Forum Energy Technologies, Inc. (NYSE:FET) today announced

second quarter 2017 revenue of $201 million, an increase of $30

million, or 18%, from the first quarter 2017. Net loss for the

quarter was $78 million, or $0.81 per diluted share, compared to a

net loss of $16 million, or $0.16 per diluted share, for the first

quarter 2017. Excluding $69 million or $0.71 per share of special

items, the adjusted net loss was $0.10 per diluted share in the

second quarter of 2017 compared to an adjusted net loss of $0.14

per diluted share in the first quarter 2017.

Special items in the second quarter of 2017 included pre-tax

charges of $68 million for goodwill impairment, $3 million for

restructuring charges, and $3 million of foreign exchange losses.

See Tables 1-5 for a reconciliation of GAAP to non-GAAP financial

information.

During the quarter, we reviewed the carrying value of the

goodwill in our Subsea product line, which represents less than 10%

of our revenues. The review was triggered by the softening of oil

prices and the developing consensus that production from low cost

oil basins would be sufficient to meet anticipated demand for a

longer period. This is expected to delay the need for production

from higher cost basins and delay the recovery in offshore

activity. As a result, we determined that the carrying value of the

goodwill in our Subsea product line was impaired.

Segment Results

Completions segment revenue was $55 million, a 29% increase

sequentially, primarily due to customer spending on pressure

pumping equipment. New inbound orders in the second quarter were

$67 million, a 31% increase from the first quarter 2017, resulting

in a book to bill ratio of 123%. The Completions segment designs

and manufactures products for the well construction, completion,

stimulation and intervention markets primarily in North

America.

Production & Infrastructure segment revenue was $83 million,

a 23% increase from the first quarter 2017, due to improved revenue

from both well site production equipment and valve products. New

inbound orders in the second quarter were $93 million, a 24%

increase from the first quarter 2017, resulting in a book to bill

ratio of 112%. During the quarter, orders for valves reached a

record level on strong demand in North America. The Production

& Infrastructure segment manufactures U.S. land well site

production equipment, desalination refinery equipment, and a wide

range of valves for energy, industrial and mining customers.

Drilling and Subsea segment revenue was $64 million, a 4%

increase from the first quarter 2017. Subsea equipment revenue was

flat with the previous quarter. New inbound orders for the Drilling

& Subsea segment in the second quarter were $54 million,

resulting in a book to bill ratio of 84%. Drilling & Subsea

operations focus primarily on manufactured equipment and consumable

products for global drilling and subsea contractors.

Review and Outlook

Prady Iyyanki, Forum’s President and Chief Executive Officer,

remarked, "We are pleased with our strong growth in orders and

revenue, especially within our Completions and Production &

Infrastructure segments, as both are highly levered to North

America activity. We generated 18% growth in revenue and returned

to positive adjusted EBITDA for the company, with improvement in

each of our three segments.

"Forum is benefiting from the recovery in the U.S. land drilling

and completions activity. Our U.S. revenue in the second quarter

increased 23% sequentially and represented 78% of total company

revenue. We expect continued strong demand for our Completions and

Production & Infrastructure products because of their exposure

to North American completions activity, even if the rig count

flattens or declines.

"Our financial liquidity remains strong. We ended the quarter

with $221 million of cash on hand and nothing drawn on our bank

credit facility. During the quarter, working capital expanded as we

ramped up our manufacturing volumes to respond to customer

demand.

"We are pleased with the acquisition of Multilift, which we

closed in July. Multilift’s innovative products extend the useful

life of an electrical submersible pump by protecting it against

sand and other solids. The acquisition fits with our strategy of

expanding our product offering in Completions.

"Forum expects diluted loss per share for the third quarter 2017

of $0.07 to $0.04 and sequential revenue growth of 8% to 12%."

Recent Events

Forum acquired Multilift for approximately $40 million. Based in

Houston, Texas, Multilift manufactures the patented SandGuardTM and

the CycloneTM completion tools.

Forum has received orders thus far in 2017 for over 480,000

horsepower of J-Mac hydraulic fracturing power ends and for eight

of its new innovative manifold trailers, the "ICBM."

Conference Call

Information

Forum's conference call is scheduled for Friday, July 28, 2017

at 9:00 AM CDT. During the call, the Company intends to discuss

second quarter 2017 results. To participate in the earnings

conference call, please call 855-757-8876 within North America, or

631-485-4851 outside of North America. The access code is 47060238.

The call will also be broadcast through the Investor Relations link

on Forum’s website at www.f-e-t.com.

Participants are encouraged to log in to the webcast or dial in to

the conference call approximately ten minutes prior to the start

time. A replay of the call will be available for two weeks after

the call and may be accessed by dialing 855-859-2056 within North

America, or 404-537-3406 outside of North America. The access code

is 47060238.

Forum Energy Technologies is a global oilfield products

company, serving the drilling, subsea, completions, production and

infrastructure sectors of the oil and natural gas

industry. The Company’s products include highly engineered

capital equipment as well as products that are consumed in the

drilling, well construction, production and transportation of oil

and natural gas. Forum is headquartered in Houston,

TX with manufacturing and distribution facilities

strategically located around the globe. For more information,

please visit www.f-e-t.com.

Forward Looking Statements and Other Legal Disclosure

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934. All statements,

other than statements of historical facts, included in this press

release that address activities, events or developments that the

company expects, believes or anticipates will or may occur in the

future are forward-looking statements. Without limiting the

generality of the foregoing, forward-looking statements contained

in this press release specifically include the expectations of

plans, strategies, objectives and anticipated financial and

operating results of the company, including any statement about the

company's future financial position, liquidity and capital

resources, operations, performance, acquisitions, returns, capital

expenditure budgets, new product development activities, costs and

other guidance included in this press release.

These statements are based on certain assumptions made by the

company based on management's experience and perception of

historical trends, current conditions, anticipated future

developments and other factors believed to be appropriate. Such

statements are subject to a number of assumptions, risks and

uncertainties, many of which are beyond the control of the company,

which may cause actual results to differ materially from those

implied or expressed by the forward-looking statements. Among other

things, these include the volatility of oil and natural gas prices,

oilfield development activity levels, the availability of raw

materials and specialized equipment, the company's ability to

deliver backlog in a timely fashion, the availability of skilled

and qualified labor, competition in the oil and gas industry,

governmental regulation and taxation of the oil and natural gas

industry, the company's ability to implement new technologies and

services, the availability and terms of capital, and uncertainties

regarding environmental regulations or litigation and other legal

or regulatory developments affecting the company's business, and

other important factors that could cause actual results to differ

materially from those projected as described in the company's

filings with the Securities and Exchange Commission.

Any forward-looking statement speaks only as of the date on

which such statement is made and the company undertakes no

obligation to correct or update any forward-looking statement,

whether as a result of new information, future events or otherwise,

except as required by applicable law.

Forum Energy Technologies, Inc. Condensed

consolidated statements of income (loss) (Unaudited)

Three months ended June 30, March

31, (in millions, except per share information)

2017 2016 2017 Revenue $ 201.1 $ 142.8

$ 171.1 Cost of sales 151.9 137.5 132.1 Gross

Profit 49.2 5.3 39.0

Other operating

items Selling, general and administrative expenses 62.0 58.3

60.7 Goodwill impairment 68.0 — — (Gain) loss on sale of assets 1.6

— (0.2 ) Transaction expenses 0.2 0.1 0.6

Total operating expenses 131.8 58.4 61.1 Earnings from equity

investment 2.6 0.2 1.5

Operating loss

(80.0 ) (52.9 ) (20.6 )

Other expense (income) Interest

expense 6.4 6.8 6.6 Loss (gain) on foreign exchange and other, net

2.6 (10.0 ) 1.6

Loss before income taxes (89.0

) (49.7 ) (28.8 ) Income tax benefit (11.1 ) (21.1 ) (13.0 )

Net

loss attributable to common stockholders (1) $ (77.9 ) $

(28.6 ) $ (15.8 )

Weighted average shares outstanding

Basic 96.2 90.7 95.9 Diluted 96.2 90.7 95.9

Loss per

share Basic $ (0.81 ) $ (0.31 ) $ (0.16 ) Diluted $ (0.81 ) $

(0.31 ) $ (0.16 ) (1) Refer to Table 1 for schedule of

adjusting items.

Forum Energy Technologies, Inc.

Condensed consolidated statements of income (loss)

(Unaudited) Six months ended June 30,

(in millions, except per share information)

2017

2016 Revenue $ 372.2 $ 302.2 Cost of sales 284.0

262.4 Gross Profit 88.2 39.8

Other

operating items Selling, general and administrative expenses

122.6 118.3 Goodwill impairment 68.0 — Loss on sale of assets 1.4 —

Transaction expenses 0.9 0.2 Total operating expenses

192.9 118.5 Earnings from equity investment 4.2 0.8

Operating loss (100.5 ) (77.9 )

Other expense

(income) Interest expense 13.0 13.9 Deferred loan costs written

off — 2.6 Loss (gain) on foreign exchange and other, net 4.1

(11.4 )

Loss before income taxes (117.6 ) (83.0 ) Income tax

benefit (24.0 ) (31.5 )

Net loss attributable to common

stockholders (1) $ (93.6 ) $ (51.5 )

Weighted

average shares outstanding Basic 96.0 90.6 Diluted 96.0 90.6

Loss per share Basic $ (0.98 ) $ (0.57 ) Diluted $

(0.98 ) $ (0.57 ) (1) Refer to Table 2 for schedule of

adjusting items.

Forum Energy Technologies, Inc.

Condensed consolidated balance sheets (Unaudited)

(in millions of dollars)

June 30,

2017 December 31, 2016 Assets

Current assets Cash and cash equivalents $ 220.5 $ 234.4 Accounts

receivable—trade, net 145.3 105.3 Inventories, net 364.8 338.6

Other current assets 36.5 71.4 Total current assets 767.1

749.7 Property and equipment, net of accumulated depreciation 149.4

152.2 Goodwill and other intangibles, net 809.1 869.2 Investment in

unconsolidated subsidiary 62.5 59.1 Other long-term assets 7.7

5.0

Total assets $ 1,795.8 $ 1,835.2

Liabilities and Equity Current liabilities Current portion

of long-term debt $ 1.1 $ 0.1 Other current liabilities 180.6

141.7 Total current liabilities 181.7 141.8 Long-term debt,

net of current portion 398.1 396.7 Other long-term liabilities 40.2

60.9

Total liabilities 620.0 599.4 Total

stockholders’ equity 1,175.8 1,235.2 Noncontrolling interest in

subsidiary — 0.6

Total equity 1,175.8 1,235.8

Total liabilities and equity $ 1,795.8 $ 1,835.2

Forum Energy Technologies, Inc. Condensed

consolidated cash flow information (Unaudited)

Six months ended June 30, (in millions of dollars)

2017 2016 Cash flows from operating

activities Net loss $ (93.6 ) $ (51.5 ) Goodwill

impairment 68.0 — Depreciation and amortization 30.2 31.6 Other,

primarily working capital 0.2 64.8

Net cash

provided by operating activities $ 4.8 $ 44.9

Cash flows from investing activities Capital expenditures

for property and equipment, net of proceeds from sale of property

and equipment $ (11.3 ) $ (6.3 ) Acquisition of businesses, net of

cash acquired (8.7 ) (2.7 ) Investment in unconsolidated subsidiary

(1.0 ) —

Net cash used in investing activities $

(21.0 ) $ (9.0 )

Cash flows from financing activities

Repayment of long-term and short-term debt (1.0 ) (0.2 ) Repurchase

of stock related to shares withheld for taxes (4.6 ) (1.1 )

Proceeds from stock issuance 2.0 1.1 Other — (0.5 )

Net

cash used in financing activities $ (3.6 ) $ (0.7 ) Effect of

exchange rate changes on cash 5.9 (7.2 )

Net increase

(decrease) in cash and cash equivalents $ (13.9 ) $ 28.0

Forum Energy Technologies, Inc. Supplemental

schedule - Segment information (Unaudited)

As Reported As Adjusted (5) Three months

ended Three months ended (in millions of dollars)

June 30, 2017 June 30, 2016

March 31, 2017 June 30, 2017

June 30, 2016 March 31,

2017 Revenue(6) Drilling & Subsea $ 64.0 $

55.2 $ 61.8 $ 64.0 $ 55.2 $ 61.8 Completions 54.5 26.3 42.4 54.5

26.3 42.4 Production & Infrastructure 83.1 61.8 67.6 83.1 61.8

67.6 Eliminations (0.5 ) (0.5 ) (0.7 ) (0.5 ) (0.5 ) (0.7 )

Total revenue $ 201.1 $ 142.8 $ 171.1 $

201.1 $ 142.8 $ 171.1

Operating

income (loss)(6) Drilling & Subsea $ (6.4 ) $ (20.9

) $ (8.4 ) $ (6.0 ) $ (12.2 ) $ (8.0 ) Operating income margin %

(10.0 )% (37.9 )% (13.6 )% (9.4 )% (22.1 )% (12.9 )% Completions

(1) 0.7 (27.6 ) (3.5 ) 0.7 (8.1 ) (3.5 ) Operating income margin %

1.3 % (104.9 )% (8.3 )% 1.3 % (30.8 )% (8.3 )% Production &

Infrastructure 3.4 2.6 (0.5 ) 3.6 3.6 (0.4 ) Operating income

margin % 4.1 % 4.2 % (0.7 )% 4.3 % 5.8 % (0.6 )% Corporate (7.8 )

(6.9 ) (7.8 ) (7.6 ) (6.7 ) (7.4 )

Total Segment operating

loss (10.1 ) (52.8 ) (20.2 ) (9.3 ) (23.4 ) (19.3 ) Other items

not in segment operating income (2) (69.9 ) (0.1 ) (0.4 ) 0.2

0.2 0.1

Total operating loss $ (80.0 )

$ (52.9 ) $ (20.6 ) $ (9.1 ) $ (23.2 ) $ (19.2 ) Operating income

margin % (39.8 )% (37.0 )% (12.0 )% (4.5 )% (16.2 )% (11.2 )%

EBITDA (3)(6) Drilling & Subsea $ (70.5 )

$ (1.7 ) $ (2.9 ) $ 0.6 $ (4.5 ) $ (1.0 ) EBITDA Margin % (110.2 )%

(3.1 )% (4.7 )% 0.9 % (8.2 )% (1.6 )% Completions 5.0 (21.2 ) 2.9

6.9 (1.6 ) 3.0 EBITDA Margin % 9.2 % (80.6 )% 6.8 % 12.7 % (6.1 )%

7.1 % Production & Infrastructure 5.7 2.3 1.8 5.9 5.2 2.0

EBITDA Margin % 6.9 % 3.7 % 2.7 % 7.1 % 8.4 % 3.0 % Corporate (7.7

) (6.6 ) (7.8 ) (7.5 ) (6.5 ) (7.4 ) Other items (4) (0.3 ) —

(0.6 ) — — —

Total EBITDA $

(67.8 ) $ (27.2 ) $ (6.6 ) $ 5.9 $ (7.4 ) $ (3.4 ) EBITDA

Margin % (33.7 )% (19.0 )% (3.9 )% 2.9 % (5.2 )% (2.0 )% (1)

Includes earnings from equity investment. (2) Includes transaction

expenses, gain/(loss) on sale of assets, and impairment of goodwill

and intangible assets. (3) The Company believes that the

presentation of EBITDA is useful to the Company's investors because

EBITDA is an appropriate measure of evaluating the company's

operating performance and liquidity that reflects the resources

available for strategic opportunities including, among others,

investing in the business, strengthening the balance sheet,

repurchasing the Company's securities and making strategic

acquisitions. In addition, EBITDA is a widely used benchmark in the

investment community. See the attached separate schedule for the

reconciliation of GAAP to non-GAAP financial information. (4)

Includes transaction expenses. (5) Refer to Table 1 for schedule of

adjusting items. (6) In order to better align with the predominant

customer base of the segment, we have moved management and

financial reporting of our fully rotational torque machine

operations, which operates under the AMC brand, from the Drilling

and Subsea segment to the Completions segment. Prior period

financial information has been revised to conform with current

period presentation with no impact to total segment operating

results.

Forum Energy Technologies, Inc.

Supplemental schedule - Segment information

(Unaudited) As Reported As

Adjusted (5) Six months ended Six months

ended (in millions of dollars)

June 30,

2017 June 30, 2016 June 30,

2017 June 30, 2016

Revenue(6) Drilling & Subsea $ 125.9 $ 119.6 $

125.9 $ 119.6 Completions 96.9 61.6 96.9 61.6 Production &

Infrastructure 150.7 122.3 150.7 122.3 Eliminations (1.3 ) (1.3 )

(1.3 ) (1.3 )

Total revenue $ 372.2 $ 302.2 $

372.2 $ 302.2

Operating income

(loss)(6) Drilling & Subsea $ (14.7 ) $ (30.6 ) $

(14.1 ) $ (21.4 ) Operating income margin % (11.7 )% (25.6 )% (11.2

)% (17.9 )% Completions (1) (2.8 ) (34.2 ) (2.7 ) (13.9 ) Operating

income margin % (2.9 )% (55.5 )% (2.8 )% (22.6 )% Production &

Infrastructure 2.8 1.2 3.3 4.4 Operating income margin % 1.9 % 1.0

% 2.2 % 3.6 % Corporate (15.6 ) (14.1 ) (15.0 ) (13.6 )

Total

Segment operating loss (30.3 ) (77.7 ) (28.5 ) (44.5 ) Other

items not in segment operating income (loss) (2) (70.2 ) (0.2 ) 0.3

0.3

Total operating loss $ (100.5 ) $ (77.9 )

$ (28.2 ) $ (44.2 ) Operating income margin % (27.0 )% (25.8 )%

(7.6 )% (14.6 )%

EBITDA (3)(6) Drilling &

Subsea $ (73.5 ) $ (2.2 ) $ (0.5 ) $ (6.0 ) EBITDA Margin % (58.4

)% (1.8 )% (0.4 )% (5.0 )% Completions 7.9 (21.4 ) 9.9 (1.0 )

EBITDA Margin % 8.2 % (34.7 )% 10.2 % (1.6 )% Production &

Infrastructure 7.5 2.6 7.8 7.7 EBITDA Margin % 5.0 % 2.1 % 5.2 %

6.3 % Corporate (15.4 ) (16.3 ) (14.7 ) (13.2 ) Other items (4)

(0.9 ) (0.2 ) — —

Total EBITDA $ (74.4 ) $

(37.5 ) $ 2.5 $ (12.5 ) EBITDA Margin % (20.0 )% (12.4 )%

0.7 % (4.1 )% (1) Includes earnings from equity investment.

(2) Includes transaction expenses, loss on sale of business,

gain/(loss) on sale of assets, and impairment of goodwill and

intangible assets. (3) The Company believes that the presentation

of EBITDA is useful to the Company's investors because EBITDA is an

appropriate measure of evaluating the company's operating

performance and liquidity that reflects the resources available for

strategic opportunities including, among others, investing in the

business, strengthening the balance sheet, repurchasing the

Company's securities and making strategic acquisitions. In

addition, EBITDA is a widely used benchmark in the investment

community. See the attached separate schedule for the

reconciliation of GAAP to non-GAAP financial information. (4)

Includes transaction expenses and loss on sale of business. (5)

Refer to Table 2 for schedule of adjusting items. (6) In order to

better align with the predominant customer base of the segment, we

have moved management and financial reporting of our fully

rotational torque machine operations, which operates under the AMC

brand, from the Drilling and Subsea segment to the Completions

segment. Prior period financial information has been revised to

conform with current period presentation with no impact to total

segment operating results.

Forum Energy Technologies,

Inc. Supplemental schedule - Orders information

(Unaudited) Three months ended (in

millions of dollars)

June 30, 2017

June 30, 2016 March 31, 2017

Orders(2) Drilling & Subsea $ 53.5 $ 48.3 $ 67.3

Completions 67.2 28.2 51.2 Production & Infrastructure 93.4

51.8 75.4

Total orders $ 214.1 $

128.3 $ 193.9

Revenue(2)

Drilling & Subsea $ 64.0 $ 55.2 $ 61.8 Completions 54.5 26.3

42.4 Production & Infrastructure 83.1 61.8 67.6 Eliminations

(0.5 ) (0.5 ) (0.7 )

Total revenue $ 201.1 $ 142.8

$ 171.1

Book to bill ratio (1)

Drilling & Subsea 0.84 0.88 1.09 Completions 1.23 1.07 1.21

Production & Infrastructure 1.12 0.84 1.12

Total book to bill ratio 1.06 0.90 1.13

(1) The book-to-bill ratio is calculated by dividing the

dollar value of orders received in a given period by the revenue

earned in that same period. We believe that this ratio is useful to

the Company’s investors because it provides an indication of

whether the demand for our products, in the markets in which we

operate, is strengthening or declining. A ratio of greater than one

is indicative of improving market demand, while a ratio of less

than one would suggest weakening demand. In addition, we believe

the book-to-bill ratio provides more meaningful insight into future

revenues for our business than other measures, such as order

backlog, because the majority of our products are activity based

consumable items or shorter cycle capital equipment, neither of

which are typically ordered by customers far in advance. (2) In

order to better align with the predominant customer base of the

segment, we have moved management and financial reporting of our

fully rotational torque machine operations, which operates under

the AMC brand, from the Drilling and Subsea segment to the

Completions segment. Prior period financial information has been

revised to conform with current period presentation with no impact

to total segment operating results.

Forum Energy

Technologies, Inc. Reconciliation of GAAP to non-GAAP

financial information (Unaudited) Table 1 -

Adjusting items Three months ended June 30, 2017

June 30, 2016 March 31, 2017 (in

millions, except per share information)

Operatingincome(loss)

EBITDA (1)

Netincome(loss)

Operatingincome(loss)

EBITDA (1)

Netincome(loss)

Operatingincome(loss)

EBITDA (1)

Netincome(loss)

As reported $ (80.0 ) $

(67.8 ) $ (77.9 ) $

(52.9 ) $ (27.2 ) $

(28.6 ) $ (20.6 ) $

(6.6 ) $ (15.8 ) % of revenue

(39.8 )% (33.7 )% (37.0 )% (19.0 )% (12.0 )% (3.9 )% Restructuring

charges and other 2.7 2.7 2.7 3.2 3.2 3.2 0.8 0.8 0.8 Transaction

expenses 0.2 0.2 0.2 0.1 0.1 0.1 0.6 0.6 0.6 Inventory and other

working capital reserve — — — 26.4 26.4 26.4 — — — Goodwill

impairment 68.0 68.0 68.0 — — — — — — Deferred loan costs written

off — — — — — — — — — Loss (gain) on foreign exchange, net (2) —

2.8 2.8 — (9.9 ) (9.9 ) — 1.8 1.8 Income tax benefit of adjustments

— — (5.2 ) — — (8.2 ) — —

(0.9 )

As adjusted (1) $ (9.1 )

$ 5.9 $ (9.4 ) $

(23.2 ) $ (7.4 ) $

(17.0 ) $ (19.2 ) $

(3.4 ) $ (13.5 ) % of revenue

(4.5 )% 2.9 % (16.2 )% (5.2 )% (11.2 )% (2.0 )%

Diluted EPS - as reported

$ (0.81 ) $ (0.31 ) $ (0.16 ) Diluted EPS - as adjusted $ (0.10 ) $

(0.19 ) $ (0.14 )

Table 2 - Adjusting items

Six months ended June 30, 2017 June 30,

2016 (in millions, except per share information)

Operatingincome(loss)

EBITDA (1)

Net income(loss)

Operatingincome(loss)

EBITDA (1)

Net income(loss)

As reported $ (100.5 ) $

(74.4 ) $ (93.6 ) $

(77.9 ) $ (37.5 ) $

(51.5 ) % of revenue (27.0 )% (20.0 )% (25.8 )% (12.4

)% Restructuring charges 3.4 3.4 3.4 7.0 7.0 7.0 Transaction

expenses 0.9 0.9 0.9 0.3 0.3 0.3 Inventory and other working

capital reserve — — — 26.4 26.4 26.4 Goodwill impairment 68.0 68.0

68.0 — — — Deferred loan costs written off — — — — 2.6 2.6 Gain on

foreign exchange, net (2) — 4.6 4.6 — (11.3 ) (11.3 ) Income tax

expense (benefit) of adjustments — — (6.1 ) — — (10.3 )

As

adjusted (1) $ (28.2 ) $

2.5 $ (22.8 ) $

(44.2 ) $ (12.5 ) $

(36.8 ) % of revenue (7.6 )% 0.7 % (14.6 )% (4.1 )%

Diluted EPS - as reported $ (0.98 ) $ (0.57 ) Diluted EPS -

as adjusted $ (0.24 ) $ (0.41 ) (1) The Company believes

that the presentation of EBITDA, adjusted EBITDA, adjusted

operating income and adjusted Diluted EPS is useful to the

Company's investors because (i) EBITDA is an appropriate measure of

evaluating the Company's operating performance and liquidity that

reflects the resources available for strategic opportunities

including, among others, investing in the business, strengthening

the balance sheet, repurchasing the Company's securities and making

strategic acquisitions and (ii) each of adjusted EBITDA, adjusted

operating income and adjusted Diluted EPS is useful to investors to

assess and understand operating performance, especially when

comparing those results with previous and subsequent periods or

forecasting performance for future periods, primarily because

management views the excluded items to be outside of the Company's

normal operating results. In addition, EBITDA is a widely used

benchmark in the investment community. See the attached separate

schedule for the reconciliation of GAAP to non-GAAP financial

information. (2) Foreign exchange, net primarily relates to cash

and receivables denominated in U.S. dollars by some of our non-U.S.

subsidiaries that report in a local currency, and therefore the

loss has no economic impact in dollar terms.

Forum Energy

Technologies, Inc. Reconciliation of GAAP to non-GAAP

financial information (Unaudited) Table 3 -

Adjusting Items Three months ended (in millions of

dollars)

June 30, 2017

June 30, 2016 March 31,

2017 EBITDA reconciliation (1) Net loss

attributable to common stockholders $ (77.9 ) $ (28.6 ) $ (15.8 )

Interest expense 6.4 6.8 6.6 Depreciation and amortization 14.8

15.7 15.6 Income tax benefit (11.1 ) (21.1 ) (13.0 )

EBITDA

$ (67.8 ) $ (27.2 )

$ (6.6 ) Table 4 - Adjusting

Items Six months ended (in millions of dollars)

June 30, 2017 June 30, 2016

EBITDA reconciliation (1) Net loss attributable to

common stockholders $ (93.6 ) $ (51.5 ) Interest expense 13.0 13.9

Depreciation and amortization 30.2 31.6 Income tax expense

(benefit) (24.0 ) (31.5 )

EBITDA $ (74.4

) $ (37.5 ) (1) The Company

believes that the presentation of EBITDA is useful to the Company's

investors because EBITDA is an appropriate measure of evaluating

the company's operating performance and liquidity that reflects the

resources available for strategic opportunities including, among

others, investing in the business, strengthening the balance sheet,

repurchasing the Company's securities and making strategic

acquisitions. In addition, EBITDA is a widely used benchmark in the

investment community.

Table 5 - Adjusting items

Six months ended (in millions of dollars)

June 30, 2017

June 30, 2016 Free cash flow, before

acquisitions, reconciliation (2) Net cash provided by

operating activities $ 4.8 $ 44.9 Capital expenditures for property

and equipment (13.0 ) (10.0 ) Proceeds from sale of property and

equipment 1.7 3.7 Free cash flow, before acquisitions

$ (6.5 ) $ 38.6

(2) The Company believes free cash flow, before acquisitions is an

important measure because it encompasses both profitability and

capital management in evaluating results.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170727006721/en/

Forum Energy Technologies, Inc.Investor ContactMark

Traylor, 281-368-1108Vice President, Investor

Relationsmark.traylor@f-e-t.comorMedia ContactDonna Smith,

281-949-2514Director, Marketing &

Communicationsdonna.smith@f-e-t.com

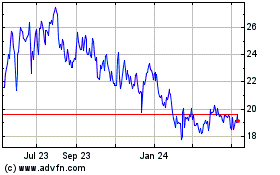

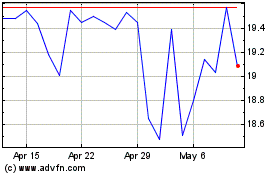

Forum Energy Technologies (NYSE:FET)

Historical Stock Chart

From Mar 2024 to Apr 2024

Forum Energy Technologies (NYSE:FET)

Historical Stock Chart

From Apr 2023 to Apr 2024