Intel Finds Room to Boost Revenue -- 2nd Update

July 27 2017 - 7:34PM

Dow Jones News

By Ted Greenwald

Intel Corp. reported a surge in quarterly profit and raised its

earnings forecast in a show of strength amid growing attacks from

rivals in its core businesses.

Revenue rose 9% from a year earlier in the three months through

July 1 to $14.8 billion, driven partly by strength in its divisions

selling chips for personal computers and industrial-strength

servers, the Santa Clara, Calif., company said Thursday.

Intel's shares were up nearly 1% in after-hours trading -- after

initially surging more sharply -- as the company increased its

estimates for full-year revenue and earnings per share.

Intel held 93% of the roughly $31 billion global market for the

calculating engines in PCs and approached 100% share of the $16.5

billion world-wide market for server processors last year,

according to Mercury Research. That leaves it almost no room to

grow.

The company has been spending heavily to spur growth in new

areas, and some of those investments are beginning to pay off.

"We are executing well to our strategy to transform from a

PC-centric company to a data-centric company that powers the cloud

and billions of smart, connected devices," Intel Chief Executive

Brian Krzanich said Thursday on a conference call.

Total profit in the latest period rose by more than 110% from

the same quarter last year, when Intel recorded a large

restructuring charge. Excluding the restructuring charge, profit

rose 23%. Intel said it expects full-year adjusted earnings of $3 a

share on $61.3 billion in revenue. It previously expected earnings

of $2.85 a share on $60 billion in revenue.

Intel's server chips face rising competition from Nvidia Corp.'s

graphics processors, which have proven especially efficient in some

artificial tasks.

Intel has said it would introduce its own AI-focused Nervana

chips later in the year.

Advanced Micro Devices Inc. in June launched a direct assault on

Intel's server chips. Its Epyc line is aimed squarely at the lower

half of Intel's data-center offerings, which accounted for roughly

80% of its 2016 server-chip sales, according to Bernstein Research.

Epyc hit the market too late to be reflected in either chip maker's

second-quarter results.

Intel fired back in July with an upgraded line of server chips

called the Xeon Scalable Platform intended to one-up AMD's

performance.

Challenging Intel's stronghold in PCs, AMD debuted its Ryzen

desktop chips in March, giving Intel its first full quarter of

serious competition in that market in years, and has said it

expects to introduce laptop units later this year.

Intel responded in late May with an upgraded line of PC

processors it calls Core X claiming superior performance but

generally maintaining higher prices. It has said it would launch a

new laptop chip later this year manufactured using a

next-generation fabrication process.

Revenue at Intel's unit responsible for PC chips rose 12% from

the prior-year quarter. Personal computer sales have been in a

persistent decline as consumer spending shifts to mobile devices,

though Intel's ability to drive sales of higher-priced chips has

compensated somewhat. That unit saw an 8% increase in average

prices and a 3% increase in volume.

Revenue in the division that sells server processors, a market

central to the chip giant's future, rose 8.6%. Intel Chief

Financial Officer Bob Swan attributed the growth to sales to cloud

providers and network providers. Sales to corporate customers

declined 11% in the quarter and will fall at a rate in the high

single digits this year, he said -- faster than the company's

previous estimate.

Intel reaffirmed its expectation that data-center revenue would

grow in high single digits for the full year, after revising its

guidance downward from double digits earlier. The company aims to

use its server-chip business to drive further revenue from related

products such as data storage.

Intel is in the process of buying Israeli car-camera pioneer

Mobileye NV for $15.3 billion. The company expects the deal to

close in the third quarter, it said on Thursday, earlier than its

previous estimates.

Opportunities in memory, automotive, mobile, and the Internet of

Things will amount to a total market of $220 billion by 2021, Intel

has said.

In all for the quarter, Intel reported profit of $2.8 billion,

compared with $1.3 billion in the same quarter last year. The

latest earnings figure translated to 58 cents a share, or 72 cents

a share on an adjusted basis, excluding restructuring charges and

certain items arising from acquisitions. Analysts surveyed by

Thomson Reuters expected adjusted earnings of 68 cents per share on

$14.4 billion in revenue.

Write to Ted Greenwald at Ted.Greenwald@wsj.com

(END) Dow Jones Newswires

July 27, 2017 19:19 ET (23:19 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

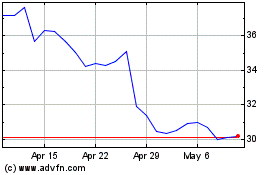

Intel (NASDAQ:INTC)

Historical Stock Chart

From Mar 2024 to Apr 2024

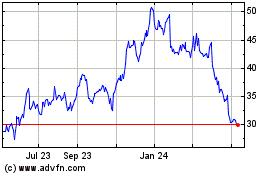

Intel (NASDAQ:INTC)

Historical Stock Chart

From Apr 2023 to Apr 2024