Subject Company: USAmeriBancorp, Inc.

July 26, 2017/10:00 a.m. EDT

VALLEY NATIONAL BANK

Host: Gerald Lipkin

July

26, 2017/10:00 a.m. EDT

Page

6

|

|

|

|

|

|

|

|

|

|

Before I turn the microphone over to Alan to discuss the quarter’s results in detail, I want to express my thanks and appreciation to Rudy, Ira, and the entire Valley team for their untiring effort to bring these events to

fruition. Alan?

|

|

|

|

|

A. Eskow

|

|

Thank you Gerry. Good morning. I’d like to start by reiterating some of Gerry’s comments. We had a very successful quarter. We were very pleased with the results that we had, and, all of this, as Gerry also indicated, is

before the acquisition and before the LIFT program, which Rudy and Ira will talk about a little later on.

|

|

|

|

|

|

|

So let me start by talking about net interest income in the margin. And we’re on Page 5, actually, of the deck that we’ve sent out to you. As we said, the margin increased six basis points from 314 to 320 and there’s

a number of things that obviously contributed to that during the quarter. First of all, we had very solid increases in net interest income both quarter-over-quarter and year-over-year. The average loans increased $389 million over the quarter,

and we’ve seen, on all new originations coming in the door, that rates have increased across the board.

|

VALLEY NATIONAL BANK

Host: Gerald Lipkin

July

26, 2017/10:00 a.m. EDT

Page

7

|

|

|

|

|

|

|

|

|

|

During the course of the quarter, as you will probably know, we saw a Fed rate hike on March 15 and then the second one that occurred on June 15. So, we have approximately $5 billion of loans that are impacted by the

movement in that rate hike. That helped a lot in this quarter to see the increase, and, obviously the June increase will help us as we move into the next quarter. We did record during the quarter, as we indicated, about $3.5 million of net swap

fee income quarter-over-quarter, which helped to increase the margin. We did slow some of our investment purchases down. We are trying to make a little room for higher loan level growth and at higher rate.

|

|

|

|

|

|

|

You’ve also noticed that our deposit rates have begun to increase, although not as dramatically yet, as we’ve held back even with the fed raising rates and other rates moving up. In order to both retain deposits and to

grow deposits, we have begun increasing those rates pretty much across the board. You can see in our time deposit category that we did have some nice growth in there, and we’re trying to move those deposits to get them in line with the loan

growth that we’ve seen so far this year.

|

VALLEY NATIONAL BANK

Host: Gerald Lipkin

July

26, 2017/10:00 a.m. EDT

Page

8

|

|

|

|

|

|

|

|

|

|

One of the things that helped the quarter was there was a slowdown in the amortization of investment and the amortization slowed to help us boost the yield little bit on the investment portfolio. As a result, some of our deposits

are being down and some of that is due to some high deposits at the end of the year that, actually, we anticipated leaving us. We have used various alternative sources of funding, mainly the Home Loan Bank and some repos, and we have utilized them

at rates we deem to be very respectable and that are helping our margin, as you can see, this quarter. And as a result of both the cash flow rate resets and new loan volume, we estimate that about 40% to 50% of our loans adjust annually. So, we do

expect to continue to see, as the market moves, rates increase.

|

|

|

|

|

|

|

If we continue on that page, on Page 5, we can talk a little bit about loan growth. The chart shows that year-over-year we showed nice growth in CRE and construction. We did have some growth in C&I, and, overall, the loans

year-over-year increased by 7%. One of the things not shown in here, and Gerry mentioned it, is we did transfer out $122 million of residential loans at the end of the quarter. We’re showing a decline in residential loans period over

period-over-period; however, we have been quite active under Kevin Chittenden’s tutelage, and we have been seeing an increase in applications, loans closed represent more of purchases than refies, especially as that refi market begins to

slowdown. During the quarter, we, actually, saw a 62% of the total closings were purchased

|

VALLEY NATIONAL BANK

Host: Gerald Lipkin

July

26, 2017/10:00 a.m. EDT

Page

9

|

|

|

|

|

|

|

|

|

|

activity with $30 million over the prior period. New apps for the quarter were about $405 million. This was an increase of about 91% over the first quarter. So, the activity has started to pick up, we’ve brought on a

lot of new lenders, and there is a lot of activity going on. We’re looking forward to this growth in pipeline.

|

|

|

|

|

|

|

We’re also seeing applications that are coming from the various states, and that’s starting to shift a little bit. New Jersey was at 61% during the quarter, New York at 28%, Pennsylvania 5% and Florida 6%. So, one of the

things we’re seeing is a little more exposure to other markets and not just the New Jersey market. New York, probably, because we put on some teams there, and that started to help build the New York volume. In addition to all of those things on

the residential side, we’re also seeing the average loan size increase. That’s going to be a benefit to us, and that’s both on the purchase loans and on the refinances. We are building teams, as I said, to help increase the flow of

loans as part of our vision is to increase the gain on sale and

non-interest

revenues.

|

VALLEY NATIONAL BANK

Host: Gerald Lipkin

July

26, 2017/10:00 a.m. EDT

Page

10

|

|

|

|

|

|

|

|

|

|

Commercial line usage, on the commercial side, is up a small amount quarter-over-quarter. The commercial loan pipeline continues to be strong going into the third quarter and is about 75% or so greater than where it was about a year

ago. And, while C&I growth doesn’t show all that much growth, a lot of those loans coming on C&I portfolio are owner-occupied loans and they get classified as CRE loans. So, all our areas in the commercial side, as well, are very

active, and volumes are increasing. The consumer business also remains robust and that’s especially in this collateralized, personal lines of credit.

|

|

|

|

|

|

|

So, if we go over to the next page, which is Page 6, there’s a discussion about operating efficiency in here. I know Gerry mentioned what that efficiency ratio is. And, by the way, on Page 17, there is a chart in the back, in

the appendix, which shows the calculations of this and what we’re showing. But, basically, what you’re seeing in this chart is that our efficiency ratio back at the second quarter of sixteen of 2016 was 63.8%. Currently, it stands at

57.6%, and that’s after removing the tax credits that Gerry mentioned as those really have no benefit to the operations; it only benefits the tax line. So, we do remove that.

|

|

|

|

|

|

|

Then, what you see in here is a reconciliation, which says that, we’re at minus 0.3% in terms of cost saves, meaning our cost went down period-over-period, and, then, we also had an increase of revenues year-over-year of

$17.9 million, which is highlighted on the right side here, which shows

|

VALLEY NATIONAL BANK

Host: Gerald Lipkin

July

26, 2017/10:00 a.m. EDT

Page

11

|

|

|

|

|

|

|

|

|

|

you a decline also of 5.9% to get you to that 57.6%. Basically, what we’re showing during, the course of the quarter, is that we had very strong operating leverage, which really is helping the numbers. Remember and keep in mind

that none of this has anything to do with Project LIFT. That will all be discussed later and is yet to come as we move forward.

|

|

|

|

|

|

|

If we move on to Page 7, Page 7 discusses the credit quality. Once again, we were very satisfied with the credit quality during the course of the quarter. Our SQs and

non-accruals

declined by

14 basis points to 0.47%. A lot of that came from the fact that we do have the taxi cab medallions, which we have been discussing, about $140 million of which $10 million are in Chicago and $130 million are in New York City. A lot of

those, during the course of the first and the second quarter, were in a past due category of 30 to 59 days, and they were matured loans that had not yet been redone. So, that occurred between the first and the second quarter, and many of them of

course did go into TDR. We only have one real relationship that’s past due at this point.

|

|

|

|

|

|

|

Non-performing

assets remain steady at 0.23%. The provision, which is discussed in the press release, was $3.6 million. We did have net charge offs of $2.7 million during the

quarter. As we indicated as well in the

|

VALLEY NATIONAL BANK

Host: Gerald Lipkin

July

26, 2017/10:00 a.m. EDT

Page

12

|

|

|

|

|

|

|

|

|

|

release, there’s about a $1.8 million relationship that caused the majority of that net charge off. You can see, by the way, some of the percentages on the right side and how we compare to our peers. I think you’ll

find that that—I don’t know, at this point, that it’s enlightening, because we’ve been showing it for a long time, but our charge offs are very, very low compared to our peer group.

|

|

|

|

|

|

|

Lastly, just the tax medallion portfolio, again we have talked about it, we have picked up a fair amount of TDRs. We have reduced the value of our taxi medallions. Last quarter, we were up at about $550,000 for medallion, and

we’re down under $400,000 right now. So, we continue to monitor that very closely. We are comfortable that almost all of those loans are currently now performing. We do have reserves in the allowance to take care of it, so we’re

comfortable with what our situation is at the moment.

|

|

|

|

|

|

|

That really covers my portion of the earnings for this morning. Obviously, we hope you’ll have read our release, which has a lot of other information in it. So, at this point, I’d like to turn it over to Rudy Schupp, who

will discuss the LIFT initiative.

|

VALLEY NATIONAL BANK

Host: Gerald Lipkin

July

26, 2017/10:00 a.m. EDT

Page

13

|

|

|

|

|

|

|

|

R. Schupp

|

|

Okay, thanks Alan. On Slide 9, we want to remind the audience, we talked about this on the road quite a bit, that we have really three crisp, major, strategic initiatives for Valley, and they include enhancing our

non-interest

income, growing our customer base, simply grow good growth, and improving our operating efficiency.

|

|

|

|

|

|

|

So, when we look at

not-interest

income, we have a series of engines that we’ve engaged to produce what we think of as sustainable income sources at the 15% to 20% level. We’re well

on our way, we’re excited about it, and we’re going to come back to that theme in a moment. With respect to growth, we seek to be a growth bank. We want you to think of us as a growth bank at the 8% to 10% loan growth level, organically.

And, we would punctuate that occasionally perhaps by acquisition.

|

|

|

|

|

|

|

When we think about efficiency, we’ve made great strides. I think back to ‘14 and ’15, and I look at it today. You saw the announcement that Alan reviewed. We’ve made great, great strides again. All of our goals

are about sustainable statistical conclusions to our goal.

|

VALLEY NATIONAL BANK

Host: Gerald Lipkin

July

26, 2017/10:00 a.m. EDT

Page

14

|

|

|

|

|

|

|

|

|

|

If we toggle to Page 10, first, let’s review the

non-interest

income revenue goal. Our resi mortgages are our single largest engine for creating a sustainable gain on sale model.

It’s in our DNA. Valley has been in the residential mortgage business for many decades. Our challenge here, candidly, was that we’ve been imbalanced historically with a refi program, but not really in the purchase mortgage business and not

with a purchase mortgage engine; that’s no longer. If you see our mix change already from 9% purchased to 62% purchased, again under the tutelage—I can’t spell tutelage, but I know its Kevin Chittenden’s tutelage. He is something

else, truly, and his team. We are recruiting in all three states. We’re building a formidable operation. You’ll see this engine drive

non-interest

income for us. But, we’re not just a

one-trick

pony for with respect to

non-interest

income. We’re building these other businesses that we highlight at the bottom of Page 10. Valley Trust in a complete

overhaul, with a team that is aggressively building investment management clients, our hallmark Capital Management Group, which is a four-star Morningstar rated business, and our commercial purpose premium finance operation under the guidance of Tom

A. Iadanza.

|

|

|

|

|

|

|

If we flip to Page 11, we’ll talk for a moment about growth, because today Valley is a growth bank, organically and acquisitively. We highlighted our major geographies here. Under Tom A. Iadanza’s direction, candidly,

we’re still very dedicated to the CRE business. We are emphasizing C&I

|

VALLEY NATIONAL BANK

Host: Gerald Lipkin

July

26, 2017/10:00 a.m. EDT

Page

15

|

|

|

|

|

|

|

|

|

|

lending across all of our geographies, and we think that’s going to be good from exchange and lots of other metrics. At the same time, again, Kevin Chittenden, is growing the resi mortgage business for the purchase team. Again,

in the end, with resi mortgage, we want a balance between refi and purchase depending on what the economy naturally delivers to America and to our geographies. Kevin is well underway, if you will, with that transition.

|

|

|

|

|

|

|

On the Florida side, we’re very excited about Florida. It’s growing from a GDP perspective at twice the rate of the rest of the country. We just needed the Florida franchise to be bigger. So, in a moment, we’re going

to celebrate together about our post-merger with USAmeriBank to do just that. That, coupled with, candidly, our existing Valley Florida teams who have been growing at a double-digit rate. So, we’re really quite excited about that. So,

we’ll come back to that theme.

|

|

|

|

|

|

|

As to our efficiency goal, I’m going to kick it over to Ira Robbins to talk with you about efficiency.

|

VALLEY NATIONAL BANK

Host: Gerald Lipkin

July

26, 2017/10:00 a.m. EDT

Page

16

|

|

|

|

|

|

|

|

I. Robbins

|

|

Thank you Rudy. The third pillar of our initiatives, really, is to improve the operating efficiency of the organization. This, really, was a multifaceted effort that we started in 2015, is to have a sustainable manner that we are

able to facilitate a change in culture and that we have perpetual improvement throughout the organization. In 2015, we announced a branch rationalization program that was about $18 million at the time and included closure of about 30 branches,

which was 30% of our overall footprint. We executed on that transaction within 12 months, and we did about 1.5 million greater than we originally announced and a quarter ahead of our original schedule.

|

|

|

|

|

|

|

Before this branch rationalization program, we had an efficiency ratio that was close to 70%. In the last 18 months, we brought that down 10% to right around 60% today. As we talk about LIFT, the goal was to get that into the mid to

low 50% range as we continue to move forward.

|

|

|

|

|

|

|

If you turn to Slide 14, we want to talk a little bit about what Project LIFT was to us, the process we went through, and then we’ll get the results of what we’ve done here.

|

|

|

|

|

|

|

I think, as we mentioned in the last couple quarters, we identified a

bottoms-up

approach in implementing Project LIFT, where we own the results, the business line leaders own the

implementation of it, and we

|

VALLEY NATIONAL BANK

Host: Gerald Lipkin

July

26, 2017/10:00 a.m. EDT

Page

17

|

|

|

|

|

|

|

|

|

|

engaged a third-party EHS to come in more as an advisory role to help us facilitate the process. It is important to us not to have an advisor come in to own the process, but an advisor to come in to help us facilitate the process

that we as an organization owned.

|

|

|

|

|

|

|

We staffed the group with 20 people internally here, high trajectory people, and had them work for six months with every single employee throughout the organization. That was a

bottoms-up

approach. Now, we’re at a point where we’re able to deliver on what those ideas were, and that will be

top-down.

We had over 1,200 ideas that came about, 300 of which plus or minus is what we’re

going to execute on. We have a dedicated implementation team to make sure that we execute upon the idea that we’re going to present to you. Similar to what we did in our branch rationalization program, it’s important to us to make sure we

deliver what we’re showing you, as well as in an appropriate time manner.

|

|

|

|

|

|

|

If you turn to the next Page, 15, this is the results of what Project LIFT has come up with.

Twenty-two

million dollars of recurring, annual, pretax, sustainable benefit to Valley National

Bank. The $22 million is comprised of $19 million in expense reduction and $3 million of revenue enhancement. The $19 million of expense reductions were based off of

|

VALLEY NATIONAL BANK

Host: Gerald Lipkin

July

26, 2017/10:00 a.m. EDT

Page

18

|

|

|

|

|

|

|

|

|

|

$480 million of consensus

non-interest

expense as we move forward. Keep in mind, that $480 million includes many items that we would believe to be not controllable, such as FDIC

insurance of about $20 million, tax credit amortization of $25 million, and other items that really are our uncontrolled by Valley at this point in time.

|

|

|

|

|

|

|

The $19 million of expense reductions are comprised largely in compensation area. The 70% of the $19 million, about $13 million, will be in that area, which reflects about 5% of the overall total compensation expense

of Valley National Bank. Now, there’s about 250 ideas that comprise that $19 million, which sounds like a lot. But, when you boil it down, there’s only 20 ideas that equate to about 65% of the total expenses, a much more manageable

number when you look at the execution as to what we have to deliver here. If we give it over to the execution—at the bottom of that page, we talked about what the

non-interest

expense projections are

going to look like. We provided what 2017 is, 2018, and 2019 and what the capture rate of each of those is going to end up being on the expense side.

|

VALLEY NATIONAL BANK

Host: Gerald Lipkin

July

26, 2017/10:00 a.m. EDT

Page

19

|

|

|

|

|

|

|

|

|

|

I would like to highlight, in 2018 our expectation is that $17 million of the $19 million, or 90% of the total expenses, will be captured, with the rest being captured in 2019. I highlight this because of the execution

component associated with it. In our mind, putting out expense reductions that really aren’t going to be captured until 2019 creates a lot of exposure as to whether we’re going to be able to actually recognize those. By having a lower

number of ideas, combined with the implementation being in the short period, in our mind we reduce a lot of the exposure when it comes to the capture risk associated with it. Rudy is going to mention what this looks like in totality for

us.

|

|

|

|

|

R. Schupp

|

|

If you look back at us in the last couple of years, and we both together—our $19.5 million that was largely branch rationalization with the $22 million which is not really branch rationalization, that equates to cost

saves that we’ve harvested, the World Harvest, to say 10% of our operating costs in the aggregate for the company, which is incredibly powerful. In fact, if we reduce our total operating debt, which is controllable, or as my friend says

impressionable, it’s an even higher statistic. So that’s why we’re so thrilled. And, I think, to punctuate the LIFT program, we’ve truly created now a culture of continuous quality improvement inside the company, with a group of

young, high-trajectory people who are going to help us year in and year out look at the company’s self-examination, so we can be better stewards of our cost of doing business. We’re thrilled about that, and we hope you are

too.

|

VALLEY NATIONAL BANK

Host: Gerald Lipkin

July

26, 2017/10:00 a.m. EDT

Page

20

|

|

|

|

|

|

|

|

|

|

Now, we’re going to transition to talk about the highlight of the day, which is the proposed acquisition of USAmeriBank. This will be a major driver, coupled with our organic growth initiative, which is again the acquisition of

USAmeriBank. Joining us today, we have Joe Chillura here again, USAmeriBank’s CEO; Al Rogers, Chief Funder; Amanda Stephens, Chief Financial; and Greg Olivier, who is Chief Credit and Chief Risk Officer. And, I’ll tell you it’s been

an absolute pleasure to work with these four leaders. They are really something else, and they’re going to make a difference, because this is a people business, front to back, and these are some kind of people. We’re excited for you to

meet them.

|

|

|

|

|

|

|

Let’s talk about the deal a bit. If you look on Slide 4 in the acquisition deck, we just highlight the growth initiative because USAmeriBank announcement points to and feeds our customer base growth call. And, it also shifts a

large segment of our balance sheet to the very, very high growth Florida market for Valley.

|

VALLEY NATIONAL BANK

Host: Gerald Lipkin

July

26, 2017/10:00 a.m. EDT

Page

21

|

|

|

|

|

|

|

|

|

|

I’m going to kick it to Ira, so you can talk about the components of USAmeriBank.

|

|

|

|

|

I. Robbins

|

|

Thank you Rudy. As Gerry mentioned earlier, USAmeriBank is evenly split in its branch distribution network with 15 branches located in Florida and another 15 located in Alabama. That being said, approximately 70% of the deposits are

actually located in Florida, compared to 86% of the loans that are located in Florida. USAB was led by a strong management team, consisting of Joe, Al, Amanda, Rick, Becky and Tina who built a tremendous franchise. You can look at the financial

highlights on the right hand side and look at the ROA number that was generated just in the second quarter of 1.19%.

|

|

|

|

|

|

|

The loan book is comprised largely of CRE, similar to what Valley is, about 54%. When combined withValley’s 52%, there really isn’t much change, going to about 53% of overall loan book on an aggregate basis. They were a

little slightly higher on the construction at 12%. With Valley’s 5%, they’re really only increasing the combined organization to 6%. The deposit franchise was a very strong franchise as well with 25% of the deposits comprised of

non-interest

bearing deposits largely of a commercial nature of compensating balance requirement.

|

VALLEY NATIONAL BANK

Host: Gerald Lipkin

July

26, 2017/10:00 a.m. EDT

Page

22

|

|

|

|

|

|

|

|

|

|

Overall, I think, maybe a little different from Valley, they haven’t really relied on the wholesale funds to the same degree that Valley has. About 90% of their total funding base comes from deposits, which is a pretty strong

measure.

|

|

|

|

|

|

|

If we turn to next slide we can talk about the historical performance of USAB and what’s really driven a lot of that ROA number. If you look at the total asset growth of the organization, about a 50% CAGR over the last four

years. When you look at the loan growth, 17% in 2015, 15% in 2016 and 13% on the

year-to-date

annualized number, when you couple that with the contraction and the

efficiency ratio from 58% in 2014 down to 52.2% where they are today, it’s easy to understand why the net income has accelerated at 29% and they’re sitting with that 1.19% return on asset number, which was obviously very attractive to

us.

|

|

|

|

|

|

|

Rudy will give a little bit overview as to the markets, and then we’ll get back into the transaction details.

|

VALLEY NATIONAL BANK

Host: Gerald Lipkin

July

26, 2017/10:00 a.m. EDT

Page

23

|

|

|

|

|

|

|

|

R. Schupp

|

|

Thanks Ira. On Page 7, if you look at that, clearly this acquisition substantially increases and expands Valley’s Florida franchise. We look at the right, the biggest boost is in the Tampa Bay area. This first cell called Tampa

fuses Valley Florida’s Tampa region numbers, if you will, with those of USAmeriBank’s. So, you can see here there will be 18 offices, a powerful loan book of $3.1 billion, deposits of $2.5 billion, and a market share

approximating 3.6%.

|

|

|

|

|

|

|

If we look at Southeast Florida and Orlando for Valley Florida, I do want you to understand that this does not include a very significant consumer loan book mortgage and direct auto, and so it’s purely commercial purpose loans.

You see the statistics for those markets. If you flip over to the bottom left, you see that for the State of Florida, post-acquisition, we’re looking at a 46 office footprint, our distribution system, and $4.8 billion in loans,

$4.9 billion in deposits, plus we would add Valley’s consumer book also.

|

|

|

|

|

|

|

If you look at the map, I think, you see here a distribution system in the high population areas, the high growth areas, of the State of Florida. So we are incredibly excited about this merger. Our Chairman, when he bought my old

bank, 1st United Bank, in late 2014, had an aspirational goal that he expressed to you and that was to see that the three states would be perhaps approximately a third, a third, a third of our businesses. With the combination with USAmeriBank, plus

organic growth, I think we will have achieved that goal. So, we’re really very, very excited about it.

|

VALLEY NATIONAL BANK

Host: Gerald Lipkin

July

26, 2017/10:00 a.m. EDT

Page

24

|

|

|

|

|

|

|

|

|

|

If we turn to Page 8, we see that USAmeriBank is a dominant bank in the Greater Tampa Bay area. Indeed, in deposits share terms, USAB is ranked eighth, with only SIFI ranked higher, only SIFI. So, they are a category killer from our

perspective in the space that they occupy and do business. Tampa Bay is the second largest MSA in the State of Florida and is eighteenth largest in the United States by population, which is very impressive, quite the area.

|

|

|

|

|

|

|

I remember when Joe sent me an article from the TampaPrinter one day in the course of our dialogue, and it was impressive to read about the millennials that are finding Tampa to be the place to be. A great encouragement

entrepreneurs and employment for millennials. Indeed if you look at the bottom of this page, you see that there’s some impressive employers in the region. And, you see it by sector as well. It’s a rich market for business banking, a rich

market for consumer banking business, and a very attractive market for employment, all important for our customers.

|

VALLEY NATIONAL BANK

Host: Gerald Lipkin

July

26, 2017/10:00 a.m. EDT

Page

25

|

|

|

|

|

|

|

|

|

|

USAmeriBank also and entered the Alabama market by acquisition in 2011. They operate in four Alabama markets with $1.1 billion in deposits, through a

15-office

network, and roughly

$486 million in loan book. If we look at this franchise, you see the four markets, of course, the very powerful Birmingham, Montgomery, Alex City and Auburn. And, we won’t take sides collegiately here in the room, so we can all be

friends.

|

|

|

|

|

|

|

And we look at the highlights for Alabama. I won’t read them to you, because you can do that, of course, yourself. I would tell you though that USAB Alabama serves largely small business and consumer bank customers. They do a

darn good job of it. We’ve had the privilege, along with a number of our directors visiting the team in Alabama visiting each of the markets, to get a measure of the team and a measure of the markets. We truly were impressed with the team;

they’re really quite something. The folks that are here in the room today built this, they reshaped the bank after they bought it.

|

|

|

|

|

|

|

So we’re very excited about supporting the Alabama team, particular with our consumer product. When we think about Kevin’s power alley of residential mortgage lending, as we met with the Alabama team, they were hungry for

the resi mortgage products, the HELOC products, card, and auto, as well, which is under the direction of Tom Iadanza. So, we think it would be a terrific fourth state for Valley.

|

VALLEY NATIONAL BANK

Host: Gerald Lipkin

July

26, 2017/10:00 a.m. EDT

Page

26

|

|

|

|

|

|

|

|

|

|

With that, I’ll turn it back to Ira.

|

|

|

|

|

I. Robbins

|

|

Thank you Rudy. As we talked earlier about the three significant pillars for Valley to improve our overall performance, and we mentioned earlier about what we’re doing on the efficiency side, Rudy gave a little bit of an

overview on the

non-interest

income fees and the residential mortgage component. Once again, just to highlight why is this strategic a fit for us? It could place more of our assets in a larger growth, in a

higher growth market. It’s what’s important to us to make sure we can deliver the growth that we think is necessary from a performance perspective. What this transaction does is it puts us, as Rudy said, about 30% of the franchise being in

the higher growth Florida market.

|

|

|

|

|

|

|

The other piece why it was a strategic fit for us, was the leadership team and culture of the organization. Far too often were provided with maps from an investment banker that would show us we should be buying this bank, we should

be buying that bank, irrespective of the culture of the

|

VALLEY NATIONAL BANK

Host: Gerald Lipkin

July

26, 2017/10:00 a.m. EDT

Page

27

|

|

|

|

|

|

|

|

|

|

employees and the customers that are associated with it. Having sat down with the leadership team of USAmeriBank, it became quite evident that the culture fit, the customer fit, and we think that’s something we can really lever

to really grow the organization.

|

|

|

|

|

|

|

Financially compelling to us, the accretion to EBS, which we’ll talk about in a little bit is really attractive. We think the dilution to a tangible book of 4.7 years is very reasonable based on where the market is today.

We’re very proactive, I think, in how we structured this specific merger, making sure that there was an appropriate credit mark and retention of key personnel throughout the transaction to make sure that there is a positive outcome.

|

|

|

|

|

|

|

If you turn to the next page, Page 11, we’ll walk through some of what the transaction highlights are. Based on our stock close of yesterday of $12.40, the transaction value is about $816 million and 100% stock. They have

a fixed exchange ratio of 6.1, which equates to about 65.8 million shares that will be issued associated with the transaction. Keep in mind, the 65.8 million includes about 3.5 million in options that are going to roll over to Valley.

So, this would be the diluted share number that would be issued as a result of the transaction.

|

VALLEY NATIONAL BANK

Host: Gerald Lipkin

July

26, 2017/10:00 a.m. EDT

Page

28

|

|

|

|

|

|

|

|

|

|

The pricing multiples, 238% times USAB’s tangible book value, which is pretty consistent with where other high-performing Florida banks have traded out recently. The real attraction to Valley, though, was on the next two

multiples, associated with price to trailing 12 months earnings, and, more importantly, priced towards that 2018 earnings plus cost saves. Valley currently trades at about 16 times earnings, and to be able to merge with a company that’s trading

at 16.4 on trailing 12 months, and 11.4 as we move forward, obviously only increases our overall performance.

|

|

|

|

|

|

|

When it comes to diligence, we spent eight weeks, at a minimum, of comprehensive diligence here. We looked at over 70% of the loans, and we engaged a team of 70 people at Valley to either to be onsite or from back office

perspective, discussing over 950 documents. We looked at 84% of the construction portfolio, and are comfortable with the market we put out there. Closing we anticipate to happen in the first quarter of 2018, associated with normal regulatory

approvals, as well as the approvals from Valley’s Board, as well as USAB’s.

|

VALLEY NATIONAL BANK

Host: Gerald Lipkin

July

26, 2017/10:00 a.m. EDT

Page

29

|

|

|

|

|

|

|

|

|

|

The assumptions that we put into the transaction on Page 12 are pretty straightforward. Expense savings were forecast at $26 million, about 28% of the overall expenses that USAmeriBank with 75%

phase-in,

in 2018.

|

|

|

|

|

|

|

I’d like to remind you when we did our 1st United transaction, we announced 28% cost saves. And when we announced C&I we announced 41% cost saves. On both of those transactions we exceeded what the announced cost saving

numbers were. Most of the cost saves that we’ve identified, 60% are going to be in salary and benefits, and 25% in the technology space.

|

|

|

|

|

|

|

Transaction expenses of $32 million equates to about 4% of the overall deal value, which is comparable to what we’ve seen in other transactions, and largely comprised of professional fees and contract terminations

agreements as well. In addition, the pro forma numbers we’re going to show you reflect a preferred equity raise of $75 million. The details of that can be found in the offering document that was released earlier today.

|

|

|

|

|

|

|

The credit marks and other purchase accounting adjustments are highlighted on Page 12, as well. We are forecasting a credit mark of $63 million, which is 1.75% of USAB’s loans, which is about $22 million greater than

what they have in their current reserve today. CDI 1.15% is

|

VALLEY NATIONAL BANK

Host: Gerald Lipkin

July

26, 2017/10:00 a.m. EDT

Page

30

|

|

|

|

|

|

|

|

|

|

about $30 million, and other purchase accounting adjustments that are consistent with what we’ve done in other transactions. I’d like to add the pro formas that we put forth when we’re looking at EPS numbers,

obviously, eliminate the impact of Durbin as, being our size, we’re not able to take the benefit.

|

|

|

|

|

|

|

Most importantly, moving to Page 13, the overall highlights of the transaction. Based on the assumptions that we just went over, we’re forecasting 2018 EPS to be accretion by about 3%, in 2019 to be about 6%. Now why is this

significant? I think when you look at this accretion, combined with what we announced earlier with our LIFT transaction, it puts us real close to that target 1% ROA number that we’ve been forecasting, which is an important number.

|

|

|

|

|

|

|

I would like to highlight that the 3% and 6% accretion numbers do not include any revenue and synergies at all associated with this transaction, which is important when you think about what we’ve done in Florida since

we’ve announced the 1st United and [indiscernible] transaction. Over 12% of our residential close loans in this quarter came from Florida, nearly 20% of our closed and direct auto came from Florida. Keep in mind, when we forecast EPS accretion,

we don’t include any of these numbers.

|

VALLEY NATIONAL BANK

Host: Gerald Lipkin

July

26, 2017/10:00 a.m. EDT

Page

31

|

|

|

|

|

|

|

|

|

|

We’ll look at the initial tangible book dilution, 5.5% with a payback of about 4.7 years. The 4.7 years is important as we discuss what really comprises that overall

4.7-year

number. If

you remember, we added about $22 million to the credit mark here. If they maintained their credit mark at $41 million, as opposed to the $63 million, the payback here would be 4.0 years as opposed to the 4.7 years. Further, had we not

included the options that are going into the diluted number, the payback here would be about 3.5 years. I think it’s important for us to communicate to you transparency, as well as up and conservative number. The 4.7 number that we’re

reflecting here is definitely all in, and we think it to be a very conservative number.

|

|

|

|

|

|

|

On a pro forma basis, the total assets would be about $29 billion and the loans and deposits of the organization about $22 billion each. One thing in the capital ratios that we’re reflecting here are inclusive of the

$75 million preferred stock raise. And, you can see Valley’s numbers, on a total risk base, go from 12% to 12.2%. The increase in capital that we’re looking at here really is to support the overall growth of Valley on an organic

basis, as well as the growth profile of USAmeriBank, not that we believe that we need more capital for any specific reason.

|

VALLEY NATIONAL BANK

Host: Gerald Lipkin

July

26, 2017/10:00 a.m. EDT

Page

32

|

|

|

|

|

|

|

|

|

|

Loan concentrations, CRE which has been standard throughout the industry, goes down from 433% to 417% for Valley, a number that we definitely feel very, very comfortable at.

|

|

|

|

|

|

|

In conclusion, I’d like to turn it over to Gerry to talk a little bit about the execution.

|

|

|

|

|

G. Lipkin

|

|

Thank you Ira. As I said earlier, all of us at Valley are very excited about this expansion of the southern portion of our franchise. USAmeriBank will represent the 29th bank acquisition in Valley’s history. We are very

confident, based upon our past experience and the strong additions to our management team coming from USAmeriBank, that the integration of this bank will be swift and successful. When Valley acquired 1st United, we stated that we were very excited

about entering the fast growing Florida marketplace. Again, at that time, we indicated it was our long-term goal to develop Valley’s franchise into what I called the three-legged stool, a third of it in New Jersey, a third in New York and a

third in Florida. With this acquisition, we will have approximately as was stated before, 30% of our assets in Florida.

|

VALLEY NATIONAL BANK

Host: Gerald Lipkin

July

26, 2017/10:00 a.m. EDT

Page

33

|

|

|

|

|

|

|

|

|

|

I thank you all for listening, and we’ll now open up for questions.

|

QUESTION AND ANSWERS

|

|

|

|

|

|

|

|

Moderator

|

|

[Operator Instructions] We do have a question from the line of Steven Alexopoulos from JPMorgan. Please go ahead.

|

|

|

|

|

S. Alexopoulos

|

|

Hey good morning everyone.

|

|

|

|

|

G. Lipkin

|

|

Good morning Steven.

|

|

|

|

|

A. Eskow

|

|

How are you?

|

|

|

|

|

S. Alexopoulos

|

|

I just want to start on the acquisition. I had a question on the tangible book earn back calculation on the 4.7 years. If I look at the tangible book dilution and the 6% accretion in 2019, I’m calculating

6.5-year

earn back. Could you walk through how you get to 4.7 years?

|

VALLEY NATIONAL BANK

Host: Gerald Lipkin

July

26, 2017/10:00 a.m. EDT

Page

34

|

|

|

|

|

|

|

|

G. Lipkin

|

|

It’s probably based on what you’re using for the out years and what the EPS is outside of the 2019 numbers. Yes, obviously the growth that we have or that we’re forecasting in USAB is around 13.5%, which is greater

than where Valley is. So, EPS contribution that will come from USAB is greater than where Valley’s numbers are, which gets us down to

4.7-year

number.

|

|

|

|

|

S. Alexopoulos

|

|

Okay. So, would you be using more than say $0.05 for the earnings from the acquisition?

|

|

|

|

|

G. Lipkin

|

|

We definitely think so yes.

|

|

|

|

|

S. Alexopoulos

|

|

Okay, got you. Then on the LIFT

|

|

|

|

|

G. Lipkin

|

|

Steven just let me add here.

|

|

|

|

|

S. Alexopoulos

|

|

Yes.

|

|

|

|

|

G. Lipkin

|

|

And, that’s really part of the overall philosophy, right, is to generate more of our assets in that higher growth market. And, that’s something that we strategically have been focusing

on.

|

VALLEY NATIONAL BANK

Host: Gerald Lipkin

July

26, 2017/10:00 a.m. EDT

Page

35

|

|

|

|

|

|

|

|

S. Alexopoulos

|

|

Right, great, okay. And just to

follow-up

actually on that, Ira, what’s the strategy to move towards the 8% to 10% long-term target for loan growth?

|

|

|

|

|

I. Robbins

|

|

I think we’re getting close to really being there as it is right now. With the organic growth we had this quarter, when you back in the loans held for sale from the residential, we were sitting at 8%. And, I don’t know if

there were any loans actually over it, at 8.8%, when you factor that back in. Again, knowing that we’re going to be involved in selling resi loans, to some extent you may be looking at it and saying well we didn’t hit that number, but I

think we are hitting it.

|

|

|

|

|

S. Alexopoulos

|

|

Got you. Then, the $3 million revenue improvement associated with LIFT, seems to me on the light side, given how senior manager was so focused on this initiative. Have you guys looked at ideas generated for improvement and were

you surprised you didn’t come up with more on the revenue front?

|

|

|

|

|

G. Lipkin

|

|

I think we tried to be conservative as to how we look at everything. I think the time line associated with it, making sure everything is executable within that

2-year

timeline, and trying to

accelerate as best as possible. I think for us what we did on the branch rationalization having a higher number than what we produced and then making sure that it was delivered within an appropriate timeline, is really important to

us.

|

VALLEY NATIONAL BANK

Host: Gerald Lipkin

July

26, 2017/10:00 a.m. EDT

Page

36

|

|

|

|

|

|

|

|

R. Schupp

|

|

Yes, and Steven we’re going to chase those other ideas, but we set a threshold, both as to time and dollars, Ira said. So, if they didn’t make that threshold, we didn’t include it. But we’re very pleased, we

certainly exceeded what most’s expectations were. That is in the aggregate.

|

|

|

|

|

S. Alexopoulos

|

|

If I could squeeze one in for Alan? The $3.5 million you called out on the derivative swap income, is that

one-time,

is that you are calling that out?

|

|

|

|

|

A. Eskow

|

|

No, no, no, no, not at all. Now we have been producing swap income for a couple of years now. The issue is, is that it’s–I’m not really pulling it out, I’m telling you it’s not necessarily recurring every

quarter with the same amount. It’s really dependent on interest rates and customers and their appetite for putting on for them fixed rate loans. So, to the extent rates stay low, they will continue to probably want to put on swaps. We actually

had, for the quarter, $4 million of swap income, as compared to $600,000 in the prior quarter. My whole point was to really indicate that that’s a little bit of a moving number. It’s not like an interest rate number that you know

you’re getting x percent every single quarter.

|

VALLEY NATIONAL BANK

Host: Gerald Lipkin

July

26, 2017/10:00 a.m. EDT

Page

37

|

|

|

|

|

|

|

|

S. Alexopoulos

|

|

Got you.

|

|

|

|

|

G. Lipkin

|

|

And, Steven that number was about $2 million in second quarter of 2016. So, a little bit of an uptick from where one year ago, but nothing that was that significant.

|

|

|

|

|

S. Alexopoulos

|

|

Got you. Okay, thanks for all the color.

|

|

|

|

|

G. Lipkin

|

|

Yes.

|

|

|

|

|

Moderator

|

|

We do have a question from the line of Matthew Breese from Piper Jaffray. Please go ahead.

|

|

|

|

|

M. Breese

|

|

Good morning everybody.

|

|

|

|

|

G. Lipkin

|

|

Good morning Matt.

|

|

|

|

|

A. Eskow

|

|

Good morning Matt.

|

VALLEY NATIONAL BANK

Host: Gerald Lipkin

July

26, 2017/10:00 a.m. EDT

Page

38

|

|

|

|

|

|

|

|

M. Breese

|

|

Maybe just going to the outlook for loan growth and realizing that we’re pretty close, but in the 8% to 10% range there is a bit of a pickup. I just want you to pick your brain a little bit. Given where we are in the economic

cycle, what stage we’re in, can you just get me comfortable with accelerating loan growth given where we are?

|

|

|

|

|

A. Eskow

|

|

Matt it’s a great question. We’re staying inside a policy, and we’ll not stretch outside of existing credit policy, assuming that even the soft items underwrite for us. Having said that, we also have very powerful

mortgage bank that’s being built, that is less than a quarter of its ultimate size. So, it’s a big driver, and, as mentioned, it’s skewed toward purchase and inside purchase is really skewed toward Freddie/Fannie qualifying

loans.

|

|

|

|

|

|

|

We feel comfortable at this stage with what we’re booking. But, we’re the first, we’ve been through multiple recession cycles as bankers. So, when we feel the market is right, we innately start to refrain. So far,

we’ve decided not to play in certain of our markets, and we feel that’s indicative of how we think both analytically and subjectively about where we want to grow loans.

|

VALLEY NATIONAL BANK

Host: Gerald Lipkin

July

26, 2017/10:00 a.m. EDT

Page

39

|

|

|

|

|

|

|

|

M. Breese

|

|

So, the acceleration is on the mortgage side.

|

|

|

|

|

G. Lipkin

|

|

No, actually, this last quarter we had good growth in CRE and C&I. We had a wonderful quarter for resi mortgage, and indirect auto contributed as well. We kind of like all the engines that we have participating in that

application in that area. Now, resi mortgage had application volume

year-to-date

of $622 million. If you look back at resi mortgage, we were pretty dead in recent

periods. So, the total fundings

year-to-date

were $345 million and again skewed toward purchase.

|

|

|

|

|

|

|

So, yes, that’s a heck of a contributor. The pipe right now it’s almost a quarter of a billion in resi at this stage. So, we’re also excited about that. ARMs represents 90% of the pipeline. So, average size, I think

Alan spoke to, and we’re actually growing the business development teams. So, the lines are crossing pretty well in that business. Again, I think, what we saw this quarter is what we want to see, which is each engine contributed to the

aggregate growth of the company.

|

|

|

|

|

M. Breese

|

|

Understood. And, then, just sticking with the mortgage, on your longer-term outlook looking to 15% to 20%

non-interest

income, should we expect more of what’s going to happen next quarter

where we see a bulk sale of 30 year fixed rate mortgages, maybe a bit more sporadic, but on an annualized basis, gets you into that range. Is that a way to think about it?

|

VALLEY NATIONAL BANK

Host: Gerald Lipkin

July

26, 2017/10:00 a.m. EDT

Page

40

|

|

|

|

|

|

|

|

G. Lipkin

|

|

I think the sustainable way to think about it is that we’re going to harvest, put into available for sale, and sell recent production versus harvesting from the

pre-existing

portfolio. I

think Q4 is a quarter that we’re thinking an awful lot about. As we look at the development that Kevin underwent with the mortgage bank, we see it becoming a big contributor in ‘18 candidly. It’s hard to answer that question other

than we expect to see production driven.

|

|

|

|

|

M. Breese

|

|

Okay. Then, thinking about the core margin outlook, Alan, excluding the swap income, could you just give me some idea of the trajectory from here if the yield curve maintained its current shape and the Fed does not lift for the

remainder of the year?

|

|

|

|

|

A. Eskow

|

|

We’ll probably—and first of all, I don’t think you want to eliminate the swap income. I mean, I think, we’ve had a quarter after quarter after quarter. It really becomes a matter of how much of that we see.

There’s going to be some continued pressure on the margin. There’s no doubt about it. You know, even though we’ve seen some rate increases on the

|

VALLEY NATIONAL BANK

Host: Gerald Lipkin

July

26, 2017/10:00 a.m. EDT

Page

41

|

|

|

|

|

|

|

|

|

|

loan side, we have to be able to continue to increase on the deposit side, as well, in order to maintain our deposit levels. So, I expect that you’re not going to see any expansion so to speak. You’ll probably see some

decline going forward.

|

|

|

|

|

M. Breese

|

|

Okay.

|

|

|

|

|

A. Eskow

|

|

And, Matt, something else just to say it, I think our commercial purpose pipe is about $1.3 billion at the moment, and there’s $570 million or so to be closed, approved and then closing. So, yes, we’re pretty,

pretty excited about what the economy is serving up to us and what we’re able to bring home.

|

|

|

|

|

M. Breese

|

|

Right, right, okay. And, then, I understand, with USAB, the Tampa element to it. What’s interesting is the Alabama effort, and that was something that I hadn’t really considered. Can you talk to me about their exposure to

Alabama and Birmingham, and why that market is something that you want to be in, and is that going to be a longer-term growth engine for Valley?

|

VALLEY NATIONAL BANK

Host: Gerald Lipkin

July

26, 2017/10:00 a.m. EDT

Page

42

|

|

|

|

|

|

|

|

G. Lipkin

|

|

Maybe say something, and then ask Joe if you might make some remarks, so you get it right from the source. As we looked at Alabama, some of us had a basic level of fluency in the market, but had not been bankers in the market. So we

did a lot of offsite kind of work. You should know that in diligence our Chief Credit officer and the team looked at 75% to 78% of the book of business at USAB, which would include the near half billion of loans derived from Alabama. And, we were

comfortable that that was inside of our credit policies. For example: The underwriting stressed you turn a cover and you can understand the loan scenario.

|

|

|

|

|

|

|

So, as we started looking at Alabama, you could take one view and say, “Well it’s a net deposit provider,” and, in a world where betas may change and deposit acquisition may get tougher if not more expensive, we

think, “Gosh, Alabama is attractive.” Then, as we looked at the loan book, small business, pretty benign, consumer business, we thought, “Gosh. If we introduced our consumer products on top of what the team has built in Alabama, this

could be a growth market for us.” We will acknowledge that Alabama doesn’t grow at the level that our other three markets do, but that doesn’t make it a market that we can’t in effect claim good growth in. So, maybe take it to

Joe, just for a moment, to make a comment or two.

|

VALLEY NATIONAL BANK

Host: Gerald Lipkin

July

26, 2017/10:00 a.m. EDT

Page

43

|

|

|

|

|

|

|

|

J. Chillura

|

|

Okay, this is Joe Chillura. Alabama is really the base of the bank, it’s a 100 year old bank that was started by the Russell family. So, they have a very stable deposit base, a great branch network, and some real distinct

markets. But, we see the opportunity there to grow really in small business and SBA lending. And SBA is a unique way to generate fee income, which is an initiative of Valley’s as well. We have a real strong management team there with Karen

Hughes and Marks Spencer, both 30 year plus bankers who are very intertwined in their communities. We feel like, with the right support, the right consumer products that Valley has, you really can see some, not only loan growth, but also big deposit

growth in the future.

|

|

|

|

|

M. Breese

|

|

Understood. That’s very helpful. Just one last one. Ira, you’d mentioned all things included, the deal and the lift initiative, gets you pretty closer to that 1% ROA target. Could you just give me an idea of timing on when

you think we get close to that, or when we achieve that? Is that an ‘18 or ‘19 event?

|

|

|

|

|

I. Robbins

|

|

I think it’s a really important metric for us, right? So, you look where we were about 2 to 2.5 years ago when we were in the

mid-60s.

And, what we’ve accomplished, Steven, to get

the 86 basis point number in such a

|

VALLEY NATIONAL BANK

Host: Gerald Lipkin

July

26, 2017/10:00 a.m. EDT

Page

44

|

|

|

|

|

|

|

|

|

|

short timeline is really the focus that we’ve all been internally working on here. I think when you just look at the actual lift numbers outlined in $17 million of expense days in 2018 and $19 million in 2019, and

just really focus on that 2018 number, as well as the revenue enhancements that come from that.

|

|

|

|

|

|

|

And, USAB was earning 1.19% on ROA. So, when you really just aggregate those together, you get really close to about 1% number without us really expanding on the mortgage piece that we’re trying to do internally. So, this

isn’t a number that we think we should be waiting to 2020 to get to by any means. It’s something that’s really important to us.

|

|

|

|

|

M. Breese

|

|

That’s great. Very helpful. Thank you everybody.

|

|

|

|

|

G. Lipkin

|

|

Thanks, Scott.

|

|

|

|

|

Moderator

|

|

We have no further questions in the question queue.

|

|

|

|

|

G. Lipkin

|

|

Thank you for joining us on our second quarter conference call. Have a good day.

|

VALLEY NATIONAL BANK

Host: Gerald Lipkin

July

26, 2017/10:00 a.m. EDT

Page

45

|

|

|

|

|

|

|

|

Moderator

|

|

Ladies and gentlemen, this conference will be available for replay after noon Central Daylight Time today through 11:59 P.M. Saturday, August 26, 2017. You may access the AT&T executive replay system at any time by dialing

1 (800)

475-6701

and entering the access code 425775. International participants dial (320)

365-3844.

Those numbers are again 1 (800)

475-6701

and (320)

365-3844

with the access code 425775. That does conclude your conference for today. Thank you for your participation and for using AT&T executive

teleconference services. You may now disconnect.

|

Additional Information and Where to Find It

This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or

approval. In connection with the proposed merger, Valley intends to file a joint proxy statement/prospectus with the Securities and Exchange Commission. INVESTORS AND SECURITY HOLDERS ARE ADVISED TO READ THE JOINT PROXY

STATEMENT/PROSPECTUS WHEN IT BECOMES AVAILABLE, BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION. Investors and security holders may obtain a free copy of the registration statement (when available) and other documents filed by Valley with the

Commission at the Commission’s web site at

www.sec.gov

. These documents may be accessed and downloaded for free at Valley’s web site at http://

www.valleynationalbank.com/filings.html

or by directing a request to Dianne

M. Grenz, Executive Vice President, Valley National Bancorp, at 1455 Valley Road, Wayne, New Jersey 07470, telephone (973)

305-3380.

Participants in the Solicitation

This communication is

not a solicitation of a proxy from any security holder of Valley or USAB. However, Valley, USAB, their respective directors and executive officers and other persons may be deemed to be participants in the solicitation of proxies from

USAB’s shareholders in respect of the proposed transaction. Information regarding the directors and executive officers of Valley may be found in its definitive proxy statement relating to its 2017 Annual Meeting of Shareholders, which was

filed with the Commission on March 17, 2017 and can be obtained free of charge from Valley’s website. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by

security holdings or otherwise, will be contained in the joint proxy statement/prospectus and other relevant materials to be filed with the SEC when they become available.

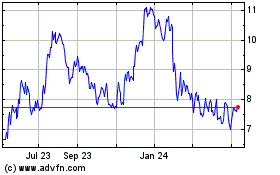

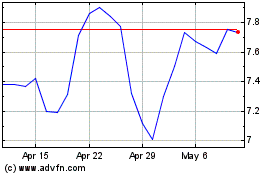

Valley National Bancorp (NASDAQ:VLY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Valley National Bancorp (NASDAQ:VLY)

Historical Stock Chart

From Apr 2023 to Apr 2024