Eversource Energy (NYSE: ES) today reported earnings of $230.7

million, or $0.72 per share, in the second quarter of 2017,

compared with earnings of $203.6 million, or $0.64 per share, in

the second quarter of 2016. In the first half of 2017, Eversource

Energy earned $490.2 million, or $1.54 per share, compared with

earnings of $447.8 million, or $1.41 per share, in the first half

of 2016.

“We experienced a very solid first half of 2017, delivering

efficient, effective and reliable service to our 3.7 million

customers and continuing to invest in New England’s clean energy

future, “ said Jim Judge, Eversource chairman, president and chief

executive officer. “We continue to project 2017 earnings of $3.05

to $3.20 per share, a level that is consistent with our 5-7 percent

long-term EPS growth rate.”

Electric Transmission

Eversource Energy’s transmission segment earned $96.4 million in

the second quarter of 2017 and $190.6 million in the first half of

2017, compared with earnings of $92.5 million in the second quarter

of 2016 and $178.2 million in the first half of 2016. The improved

results were primarily due to an increased level of investment in

Eversource Energy’s transmission system, partially offset by a

lower level of revenue in 2017 related to annual reconciliations

under Eversource’s transmission tariffs.

Electric Distribution and

Generation

Eversource Energy’s electric distribution and generation segment

earned $121.9 million in the second quarter of 2017 and $236

million in the first half of 2017, compared with earnings of $102.8

million in the second quarter of 2016 and $211.3 million in the

first half of 2016. The improved year-to-date results primarily

reflect lower operation and maintenance expense and higher

distribution revenues, partially offset by higher depreciation

expense.

Natural Gas Distribution

Eversource Energy’s natural gas distribution segment earned $4.5

million in the second quarter of 2017 and $55.3 million in the

first half of 2017, compared with earnings of $8 million in the

second quarter of 2016 and $58.9 million in the first half of 2016.

Lower second quarter results were due primarily to lower sales due

to milder early spring temperatures in 2017, as well as higher

depreciation and operation and maintenance expense.

Parent and Other Companies

Eversource Energy parent and other companies earned $7.9 million

in the second quarter of 2017 and $8.3 million in the first half of

2017, compared with earnings $0.3 million in the second quarter of

2016 and a net loss of $0.6 million in the first half of 2016.

Improved results were due largely to second-quarter 2017 gains

related to Eversource Energy’s long-time investment in a fund

holding certain renewable energy facilities. That investment

historically has had little impact on results.

The following table reconciles 2017 and 2016 second quarter and

first six months earnings per share:

Second Quarter First Six Months

2016 Reported EPS

$0.64 $1.41 Higher

transmission earnings in 2017 0.01 0.04

Higher retail electric revenues in 2017

0.02 0.04 Lower natural

gas revenues in 2017 (0.01) ---

Lower non-tracked O&M in 2017 0.04

0.04 Higher property tax,

depreciation, and

interest expense in 2017

(0.02)

(0.04)

All other, net, including higher Other Income

0.04 0.05

2017

Reported EPS $0.72

$1.54

Financial results for the second quarter and first half of 2017

and 2016 are noted below:

Three months ended:(in millions,

except EPS)

June 30, 2017

June 30, 2016

Increase/(Decrease)

2017 EPS1

Electric Distribution/Generation $121.9

$102.8 $19.1 $0.38 Natural Gas

Distribution 4.5 8.0

(3.5) 0.01 Electric Transmission 96.4

92.5 3.9 0.30 Eversource

Parent and Other Companies 7.9 0.3

7.6 0.03

Reported Earnings

$230.7 $203.6

$27.1 $0.72

Six months ended:(in millions,

except EPS)

June 30, 2017

June 30, 2016

Increase/(Decrease)

2017 EPS1

Electric Distribution/Generation $236.0

$211.3 $24.7 $0.74 Natural Gas

Distribution 55.3 58.9

(3.6) 0.17 Electric Transmission 190.6

178.2 12.4 0.60

Eversource Parent and Other Companies 8.3

(0.6) 8.9 0.03

Reported

Earnings $490.2

$447.8 $42.4 $1.54

Retail sales data:

Three months

ended: June 30, 2017 June

30, 2016 % Change Electric Distribution

(Gwh)

Traditional 6,524 6,605

(1.2%) Decoupled 5,640 5,798

(2.7%)

Total Electric Distribution

12,164 12,403

(1.9%)

Natural Gas Distribution (mmcf)

Traditional

7,778 8,315 (6.5%)

Decoupled and Special Contracts 9,238

9,521

(3.0%)

Total Natural Gas Distribution

17,016 17,836

(4.6%)

Six months ended: June 30, 2017

June 30, 2016 % Change

Electric Distribution (Gwh)

Traditional 13,495

13,601 (0.8%) Decoupled

11,840 12,022 (1.5%)

Total Electric

Distribution 25,335

25,623 (1.1%)

Natural Gas

Distribution (mmcf)

Traditional 26,683

26,300 1.5% Decoupled and Special Contracts

31,479 30,884 1.9%

Total

Natural Gas Distribution 58,162

57,184 1.7%

Eversource Energy has approximately 317 million common shares

outstanding. It operates New England’s largest energy delivery

system, serving approximately 3.7 million customers in Connecticut,

Massachusetts and New Hampshire. Eversource is recognized as the

top U.S. utility for its energy efficiency programs by the

sustainability advocacy organization Ceres.

Note: Eversource Energy will webcast a conference call with

senior management on July 28, 2017, beginning at 9 a.m. Eastern

Time. The webcast and associated slides can be accessed through

Eversource’s website at www.eversource.com.

1 All per share amounts in this news release are reported on a

diluted basis. The only common equity securities that are publicly

traded are common shares of Eversource Energy. The earnings and EPS

of each business do not represent a direct legal interest in the

assets and liabilities allocated to such business, but rather

represent a direct interest in Eversource Energy's assets and

liabilities as a whole. EPS by business is a non-GAAP (not

determined using generally accepted accounting principles) measure

that is calculated by dividing the net income or loss attributable

to controlling interests of each business by the weighted average

diluted Eversource Energy common shares outstanding for the period.

Management uses this non-GAAP financial measure to evaluate

earnings results, provide details of earnings results by business,

and more fully compare and explain our second quarter and first

half 2017 and 2016 results. Management believes that this

measurement is useful to investors to evaluate the actual and

projected financial performance and contribution of Eversource

Energy’s businesses. Non-GAAP financial measures should not be

considered as alternatives to Eversource consolidated net income

attributable to controlling interests or EPS determined in

accordance with GAAP as indicators of Eversource Energy’s operating

performance.

This news release includes statements concerning Eversource

Energy’s expectations, beliefs, plans, objectives, goals,

strategies, assumptions of future events, future financial

performance or growth and other statements that are not historical

facts. These statements are “forward-looking statements” within the

meaning of the Private Securities Litigation Reform Act of 1995. In

some cases, readers can identify these forward-looking statements

through the use of words or phrases such as “estimate, “expect,”

“anticipate,” “intend,” “plan,” “project,” “believe,” “forecast,”

“should,” “could” and other similar expressions. Forward-looking

statements involve risks and uncertainties that may cause actual

results or outcomes to differ materially from those included in the

forward-looking statements. Factors that may cause actual results

to differ materially from those included in the forward-looking

statements include, but are not limited to, cyber breaches, acts of

war or terrorism, or grid disturbances; actions or inaction of

local, state and federal regulatory, public policy and taxing

bodies; changes in business conditions, which could include

disruptive technology related to Eversource’s current or future

business model; changes in economic conditions, including impact on

interest rates, tax policies, and customer demand and payment

ability; fluctuations in weather patterns; changes in laws,

regulations or regulatory policy; changes in levels or timing of

capital expenditures; disruptions in the capital markets or other

events that make Eversource’s access to necessary capital more

difficult or costly; developments in legal or public policy

doctrines; technological developments; changes in accounting

standards and financial reporting regulations; actions of rating

agencies; and other presently unknown or unforeseen factors.

Other risk factors are detailed in Eversource’s reports filed

with the Securities and Exchange Commission (SEC) and updated as

necessary, and are available on Eversource Energy’s website at

www.eversource.com and the SEC’s website at www.sec.gov. All such

factors are difficult to predict and contain uncertainties that may

materially affect Eversource Energy’s actual results many of which

are beyond our control. You should not place undue reliance on the

forward-looking statements; each speaks only as of the date on

which such statement is made, and, except as required by federal

securities laws, Eversource Energy undertakes no obligation to

update any forward-looking statement or statements to reflect

events or circumstances after the date on which such statement is

made or to reflect the occurrence of unanticipated events.

EVERSOURCE ENERGY AND SUBSIDIARIES CONDENSED CONSOLIDATED BALANCE

SHEETS (Unaudited)

(Thousands of Dollars)

As of June 30, 2017 As of December 31,

2016

ASSETS

Current Assets: Cash and Cash Equivalents $ 24,638 $ 30,251

Receivables, Net 833,945 847,301 Unbilled Revenues 158,183 168,490

Fuel, Materials, Supplies and Inventory 286,296 328,721 Regulatory

Assets 870,393 887,625 Prepayments and Other Current Assets 157,359

215,284 Total Current Assets 2,330,814

2,477,672 Property, Plant and Equipment, Net

22,071,496 21,350,510 Deferred Debits and

Other Assets: Regulatory Assets 3,580,981 3,638,688 Goodwill

3,519,401 3,519,401 Marketable Securities 565,460 544,642 Other

Long-Term Assets 590,688 522,260 Total Deferred

Debits and Other Assets 8,256,530 8,224,991

Total Assets $ 32,658,840 $ 32,053,173

LIABILITIES AND

CAPITALIZATION

Current Liabilities: Notes Payable $ 937,500 $ 1,148,500 Long-Term

Debt – Current Portion 1,483,883 773,883 Accounts Payable 587,174

884,521 Regulatory Liabilities 185,930 146,787 Other Current

Liabilities 591,222 684,914 Total Current Liabilities

3,785,709 3,638,605 Deferred Credits and Other

Liabilities: Accumulated Deferred Income Taxes 5,900,052 5,607,207

Regulatory Liabilities 696,740 702,255 Derivative Liabilities

402,138 413,676 Accrued Pension and SERP 1,073,510 1,141,514 Other

Long-Term Liabilities 860,579 853,260 Total Deferred

Credits and Other Liabilities 8,933,019 8,717,912

Capitalization: Long-Term Debt 8,899,021 8,829,354

Noncontrolling Interest - Preferred Stock of

Subsidiaries 155,568 155,568 Equity: Common

Shareholders' Equity: Common Shares 1,669,392 1,669,392 Capital

Surplus, Paid In 6,232,501 6,250,224 Retained Earnings 3,364,336

3,175,171 Accumulated Other Comprehensive Loss (62,935 ) (65,282 )

Treasury Stock (317,771 ) (317,771 ) Common Shareholders' Equity

10,885,523 10,711,734 Total Capitalization 19,940,112

19,696,656 Total Liabilities and

Capitalization $ 32,658,840 $ 32,053,173

The data contained in this report is preliminary and is

unaudited. This report is being submitted for the sole purpose of

providing information to shareholders about Eversource Energy and

Subsidiaries and is not a representation, prospectus, or intended

for use in connection with any purchase or sale of securities.

EVERSOURCE ENERGY AND SUBSIDIARIES CONDENSED CONSOLIDATED

STATEMENTS OF INCOME (Unaudited) For

the Three Months Ended June 30, For the Six Months Ended June 30,

(Thousands of Dollars, Except Share Information) 2017

2016 2017 2016

Operating Revenues $ 1,762,811 $

1,767,184 $ 3,867,946 $ 3,822,819 Operating

Expenses: Purchased Power, Fuel and Transmission 549,704 581,260

1,303,353 1,336,119 Operations and Maintenance 302,714 320,714

632,979 640,850 Depreciation 189,881 176,507 376,686 350,492

Amortization of Regulatory (Liabilities)/Assets, Net (7,807 )

(8,716 ) 16,210 12,281 Energy Efficiency Programs 116,398 119,667

262,556 256,842 Taxes Other Than Income Taxes 156,234

154,330 311,455 314,277 Total Operating Expenses

1,307,124 1,343,762 2,903,239 2,910,861

Operating Income 455,687 423,422 964,707 911,958 Interest Expense

107,329 100,492 210,758 198,703 Other Income, Net 21,543

8,038 35,120 10,049 Income Before Income Tax Expense

369,901 330,968 789,069 723,304 Income Tax Expense 137,272

125,439 295,103 271,742 Net Income 232,629 205,529

493,966 451,562 Net Income Attributable to Noncontrolling Interests

1,880 1,880 3,759 3,759 Net Income

Attributable to Common Shareholders $ 230,749 $ 203,649

$ 490,207 $ 447,803 Basic and Diluted Earnings

Per Common Share $ 0.72 $ 0.64 $ 1.54 $ 1.41

Dividends Declared Per Common Share $ 0.48 $ 0.45

$ 0.95 $ 0.89 Weighted Average Common Shares

Outstanding: Basic 317,391,365 317,785,495

317,427,258 317,651,319 Diluted 317,947,194

318,476,699 318,035,864 318,478,876

The data contained in this report is preliminary and is

unaudited. This report is being submitted for the sole purpose of

providing information to shareholders about Eversource Energy and

Subsidiaries and is not a representation, prospectus, or intended

for use in connection with any purchase or sale of securities.

EVERSOURCE ENERGY AND SUBSIDIARIES CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS (Unaudited) For the Six

Months Ended June 30, (Thousands of Dollars) 2017

2016 Operating Activities: Net Income $

493,966 $ 451,562 Adjustments to Reconcile Net Income to Net Cash

Flows Provided by Operating Activities:

Depreciation

376,686 350,492 Deferred Income Taxes 269,505 250,851 Pension, SERP

and PBOP Expense, Net 11,242 22,659 Pension and PBOP Contributions

(91,400 ) (65,929 ) Regulatory Over/(Under) Recoveries, Net 74,224

(5,768 ) Amortization of Regulatory Assets, Net 16,210 12,281 Other

(94,666 ) (10,808 ) Changes in Current Assets and Liabilities:

Receivables and Unbilled Revenues, Net 3,908 (76,751 ) Fuel,

Materials, Supplies and Inventory 42,425 43,930 Taxes

Receivable/Accrued, Net 23,980 230,075 Accounts Payable (168,221 )

(151,996 ) Other Current Assets and Liabilities, Net (49,889 )

(72,160 ) Net Cash Flows Provided by Operating Activities 907,970

978,438 Investing Activities: Investments in

Property, Plant and Equipment (1,146,952 ) (869,168 ) Proceeds from

Sales of Marketable Securities 373,853 327,581 Purchases of

Marketable Securities (394,379 ) (322,244 ) Other Investing

Activities (11,050 ) (2,991 ) Net Cash Flows Used in Investing

Activities (1,178,528 ) (866,822 ) Financing Activities:

Cash Dividends on Common Shares (301,042 ) (282,314 ) Cash

Dividends on Preferred Stock (3,759 ) (3,759 ) Decrease in Notes

Payable (211,000 ) (393,953 ) Issuance of Long-Term Debt 950,000

800,000 Retirements of Long-Term Debt (150,000 ) (200,000 ) Other

Financing Activities (19,254 ) (16,811 ) Net Cash Flows Provided

by/(Used in) Financing Activities 264,945 (96,837 ) Net

(Decrease)/Increase in Cash and Cash Equivalents (5,613 ) 14,779

Cash and Cash Equivalents - Beginning of Period 30,251

23,947 Cash and Cash Equivalents - End of Period $ 24,638

$ 38,726

The data contained in this report is preliminary and is

unaudited. This report is being submitted for the sole purpose of

providing information to shareholders about Eversource Energy and

Subsidiaries and is not a representation, prospectus, or intended

for use in connection with any purchase or sale of securities.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170727006576/en/

Eversource EnergyJeffrey R. Kotkin, 860-665-5154

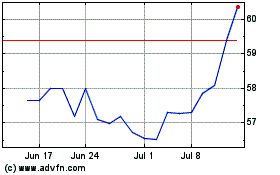

Eversource Energy (NYSE:ES)

Historical Stock Chart

From Mar 2024 to Apr 2024

Eversource Energy (NYSE:ES)

Historical Stock Chart

From Apr 2023 to Apr 2024