Net Income up 49% for First Half of 2017

Q2 2017 Highlights

- Revenue of $319 million, up 4 percent

year over year with core revenue up 7 percent year over year

- GAAP gross margin of 74 percent

- Non-GAAP gross margin of 75

percent

- Fully diluted GAAP EPS of $0.19 and

fully diluted non-GAAP EPS of $0.27

- GAAP net income of $25 million

- Non-GAAP net income of $35 million, a

record for a second quarter

- EBITDA of $46 million

- Cash and short-term investments of $368

million as of June 30, 2017

National Instruments (Nasdaq: NATI) today announced Q2 2017

revenue of $319 million, up 4 percent year over year with core

revenue up 7 percent year over year. The company’s definition of

core revenue is GAAP revenue excluding the impact of NI’s largest

customer and the impact of foreign currency exchange. A

reconciliation of the year over year change in GAAP revenue to the

year over year change in core revenue is included with this news

release.

In Q2 2017, NI received $12 million in orders from its largest

customer compared with $18 million in orders from this customer in

Q2 2016. Excluding NI’s largest customer, the value of the

company’s total orders was up 8 percent year over year for the

quarter; orders under $20,000 were flat year over year; orders

between $20,000 and $100,000 were up 1 percent year over year; and

orders above $100,000 were up 42 percent year over year.

GAAP net income for Q2 was $25 million, with fully diluted

earnings per share (EPS) of $0.19, and non-GAAP net income was $35

million, a record for a second quarter, with non-GAAP fully diluted

EPS of $0.27. Included in NI’s GAAP net income for Q2 is $4 million

related to restructuring charges. EBITDA, or Earnings Before

Interest, Taxes, Depreciation and Amortization, was $46 million for

Q2.

In Q2, GAAP gross margin was 74 percent and non-GAAP gross

margin was 75 percent. Total GAAP operating expenses were $208

million, up 3 percent year over year. Total non-GAAP operating

expenses were flat year over year at $194 million. GAAP operating

margin was 9 percent in Q2, with GAAP operating income of $29

million, up 5 percent year over year. Non-GAAP operating margin was

14 percent in Q2, with non-GAAP operating income of $44 million, up

15 percent year over year.

“I am pleased with our Q2 performance and execution as we

continue to drive toward our revenue and profitability goals with

record revenue for a second quarter and 26% year over year non-GAAP

net income growth for the first half of 2017,” said Alex Davern, NI

president and CEO. “We believe alignment of our product and channel

investments toward the growth opportunity in 5G communications,

semiconductor test, the connected vehicle, and the Industrial

Internet of Things continues to move our platform closer to our

users’ challenges, which increases our impact within these

applications.”

Karen Rapp, NI CFO, said, “We are encouraged by the strong order

growth and improved trends in the industrial economy. Our

leadership team is focused on executing to the updated leverage

model shared at our recent investor day. We are going to do this

through deliberate decision making and discipline in managing our

expenses. We believe this focus will keep us on the right path as

we strive to meet both our growth and profitability goals this year

and in 2018.”

Geographic revenue in U.S. dollar terms for Q2 2017 compared

with Q2 2016 was up 6 percent in the Americas, down 1 percent in

APAC and up 6 percent in EMEIA. Excluding the impact of foreign

currency exchange, revenue was up 6 percent in the Americas, flat

in APAC and up 10 percent in EMEIA. Historical revenue from these

three regions can be found on NI’s investor website

at www.ni.com/nati.

As of June 30, 2017, NI had $368 million in cash and short-term

investments. During the second quarter, NI paid $27 million in

dividends. The NI Board of Directors approved a quarterly dividend

of $0.21 per share payable on Sept. 5, 2017, to stockholders of

record on Aug. 14, 2017.

The company’s non-GAAP results exclude the impact of stock-based

compensation, amortization of acquisition-related intangibles,

acquisition-related transaction costs, taxes levied on the transfer

of acquired intellectual property, foreign exchange loss on

acquisitions, and restructuring charges. Reconciliations of the

company’s GAAP and non-GAAP results are included as part of this

news release.

Guidance

NI currently expects Q3 revenue to be in the range of $304

million to $334 million, which would be a new Q3 record at the

midpoint. Based on current exchange rates, the company expects that

the impact of foreign exchange on dollar revenue will be minimal in

Q3. The company currently expects that GAAP fully diluted EPS will

be in the range of $0.16 to $0.30 for Q3, with non-GAAP fully

diluted EPS expected to be in the range of $0.22 to $0.36. Included

in the company’s Q3 2017 GAAP EPS guidance is approximately $1

million of restructuring charges. For the full year, NI estimates

the restructuring charges impacting net income to be approximately

$7 million to $8 million. For 2017, NI estimates its non-GAAP

effective tax rate to be approximately 21 percent.

Non-GAAP Presentation

In addition to disclosing results determined in accordance with

GAAP, NI discloses certain non-GAAP operating results and non-GAAP

information that exclude certain charges. In this news release, the

company has presented its year over year change in core revenue,

gross profit, gross margin, operating expenses, operating income,

operating margin, income before income taxes, provision for income

taxes, net income and basic and fully diluted EPS for the

three-month and six-month periods ending June 30, 2017 and 2016, on

a GAAP and non-GAAP basis. NI is also providing guidance on its

non-GAAP fully diluted EPS and expected effective tax rate. The

company is not able to provide guidance on its GAAP tax rate or a

related reconciliation without unreasonable efforts since its

future GAAP tax rate depends on its future stock price and related

information that is not currently available.

When presenting non-GAAP information, the company includes a

reconciliation of the non-GAAP results to the GAAP results.

Management believes that including the non-GAAP results assists

investors in assessing the company’s operational performance and

its performance relative to its competitors. The company presents

these non-GAAP results as a complement to results provided in

accordance with GAAP, and these results should not be regarded as a

substitute for GAAP. Management uses these non-GAAP measures to

manage and assess the profitability and performance of its business

and does not consider stock-based compensation expense,

amortization of acquisition-related intangibles,

acquisition-related transaction costs, taxes levied on the transfer

of acquired intellectual property, foreign exchange loss on

acquisitions, and restructuring charges in managing its operations.

Specifically, management uses non-GAAP measures to plan and

forecast future periods; to establish operational goals; to compare

with its business plan and individual operating budgets; to measure

management performance for the purposes of executive compensation,

including payments to be made under bonus plans; to assist the

public in measuring the company’s performance relative to the

company’s long-term public performance goals; to allocate

resources; and, relative to the company’s historical financial

performance, to enable comparability between periods. Management

also considers such non-GAAP results to be an important

supplemental measure of its performance.

This news release discloses the company’s EBITDA for the

three-month and six-month periods ending June 30, 2017 and 2016.

The company believes that including the EBITDA results assists

investors in assessing the company’s operational performance

relative to its competitors. A reconciliation of EBITDA to GAAP net

income is included with this news release. This news release also

discloses the year over year change in the company's core revenue

for the three-month period ending June 30, 2017. The company

believes that including its year over year change in core revenue

assists investors in assessing the company’s operational

performance. A reconciliation of its year over year change in GAAP

revenue to its year over year change in core revenue is included

with this news release.

Conference Call Information and Availability of Presentation

Materials

Interested parties can listen to the Q2 2017 earnings conference

call with NI management today, July 27, at 4:00 p.m. CT at

www.ni.com/call. Replay information is available by calling (855)

859-2056, confirmation code 41457332, shortly after the call

through July 30 at 11:59 p.m. CT or by visiting the company’s

website at www.ni.com/call. Presentation materials referred to on

the conference call can be found at www.ni.com/nati.

Forward-Looking Statements

This release contains “forward-looking statements” including

statements regarding driving towards our revenue and profitability

goals, belief that alignment of our product and channel investments

will move our platform closer to our users’ challenges which

increases our impact within these applications, being encouraged by

the strong order growth and improved trends in the industrial

economy, being focused on executing to the updated leverage model,

deliberate decision making and discipline in managing our expenses,

that this focus will keep us on the right path as we strive to meet

both our growth and profitability goals this year and in 2018,

expecting Q3 revenue to be in the range of $304 million to $334

million, that the impact of foreign exchange on dollar revenue will

be minimal in Q3, expecting GAAP fully diluted EPS will be in the

range of $0.16 to $0.30 for Q3, with non-GAAP fully diluted EPS

expected to be in the range of $0.22 to $0.36, expecting about $1

million of restructuring charges in Q3, that restructuring charges

impacting net income will be approximately $7 million to $8 million

and that non-GAAP effective tax rate to be approximately 21 percent

for 2017. These statements are subject to a number of risks and

uncertainties, including the risk of adverse changes or

fluctuations in the global economy, foreign exchange fluctuations,

fluctuations in demand for NI products including orders from NI’s

largest customer, component shortages, delays in the release of new

products, the company’s ability to effectively manage its operating

expenses, manufacturing inefficiencies and the level of capacity

utilization, the impact of any recent or future acquisitions by NI,

expense overruns, adverse effects of price changes or effective tax

rates. Actual results may differ materially from the expected

results.

The company directs readers to its Form 10-K for the year ended

Dec. 31, 2016, its Form 10-Q for the quarter ended March 31, 2017

and the other documents it files with the SEC for other risks

associated with the company’s future performance.

About NI

Since 1976, NI (www.ni.com) has made it possible for engineers

and scientists to solve the world’s greatest engineering challenges

with powerful platform-based systems that accelerate productivity

and drive rapid innovation. Customers from a wide variety of

industries – from healthcare to automotive and from consumer

electronics to particle physics – use NI’s integrated hardware and

software platform to improve the world we live in. (NATI-F)

National Instruments, NI and ni.com are trademarks of National

Instruments. Other product and company names listed are trademarks

or trade names of their respective companies.

National Instruments Condensed Consolidated

Balance Sheets (in thousands)

June 30, December 31, 2017 2016

(unaudited) Assets Current assets: Cash and cash

equivalents $ 263,150 $ 285,283 Short-term investments 105,284

73,117 Accounts receivable, net 230,958 228,686 Inventories, net

186,155 193,608 Prepaid expenses and other current assets

52,568 53,953 Total current

assets 838,115 834,647 Property and equipment, net 256,761

260,456 Goodwill 261,411 253,197 Intangible assets, net 120,327

108,663 Other long-term assets 28,700

39,601 Total assets $ 1,505,314

$ 1,496,564 Liabilities and Stockholders' Equity

Current liabilities: Accounts payable $ 54,214 $ 48,800 Accrued

compensation 36,672 27,743 Deferred revenue - current 120,212

115,577 Accrued expenses and other liabilities 15,341 32,997 Other

taxes payable 28,743 34,958

Total current liabilities 255,182 260,075 Long-term

debt 25,000 25,000 Deferred income taxes 35,561 45,386 Liability

for uncertain tax positions 12,438 11,719 Deferred revenue -

long-term 31,665 29,752 Other long-term liabilities 7,420

10,413 Total liabilities

367,266 382,345

Stockholders' equity: Preferred stock - - Common stock 1,305 1,292

Additional paid-in capital 800,774 771,346 Retained earnings

359,088 376,202 Accumulated other comprehensive loss (23,119

) (34,621 ) Total stockholders' equity

1,138,048 1,114,219 Total

liabilities and stockholders' equity $ 1,505,314

$ 1,496,564

National Instruments

Condensed Consolidated Statements of Income (in

thousands, except per share data, unaudited)

Three Months Ended Six Months

Ended June 30, June 30, 2017 2016

2017 2016 Net sales: Product $

289,817 $ 278,530 $ 561,328 $ 537,963 Software maintenance

28,792 27,575 57,386

55,319 Total net sales 318,609 306,105 618,714 593,282

Cost of sales: Product 79,153 75,194 154,349 149,404

Software maintenance 3,307 2,314

4,635 4,250 Total cost of sales 82,460 77,508

158,984 153,654 Gross profit

236,149 228,597 459,730

439,628 74 % 75 % 74 % 74 % Operating expenses: Sales and

marketing 124,414 116,361 241,674 229,568 Research and development

56,913 59,839 115,175 119,179 General and administrative

26,191 25,130 51,933

49,770 Total operating expenses 207,518

201,330 408,782 398,517

Operating income 28,631 27,267 50,948 41,111 9 % 9 % 8 % 7 % Other

income (expense): Interest income 509 258 852 511 Net foreign

exchange gain (loss) 447 (1,285 ) 529 (711 ) Other (expense)

income, net (235 ) 53 197

(2,353 ) Income before income taxes 29,352 26,293 52,526

38,558 Provision for income taxes 4,197

6,493 9,223 9,460 Net

income $ 25,155 $ 19,800 $ 43,303 $ 29,098

Basic earnings per share $ 0.19 $ 0.15

$ 0.33 $ 0.23 Diluted earnings per share $ 0.19

$ 0.15 $ 0.33 $ 0.23 Weighted

average shares outstanding - basic 130,197 128,282 129,820 127,938

diluted 131,117 128,746 130,619 128,429 Dividends declared

per share $ 0.21 $ 0.20 $ 0.42 $ 0.40

National

Instruments Condensed Consolidated Statements of Cash

Flows (in thousands, unaudited) Six

Months Ended June 30, 2017 2016

Cash flow from operating activities: Net income $

43,303 $ 29,098 Adjustments to reconcile net income to net cash

provided by operating activities: Depreciation and amortization

35,915 38,217 Stock-based compensation 13,726 13,497 Tax

expense/(benefit) expense from deferred income taxes (875 ) (2,927

) Net change in operating assets and liabilities (7,284 )

2,659

Net cash provided by operating

activities 84,785 80,544

Cash flow from investing activities: Capital expenditures

(15,727 ) (20,970 ) Capitalization of internally developed software

(24,816 ) (15,406 ) Additions to other intangibles (1,124 ) (689 )

Acquisitions, net of cash received - (549 ) Purchases of short-term

investments (52,807 ) (5,008 ) Sales and maturities of short-term

investments 21,017 31,734

Net cash

used by investing activities (73,457 ) (10,888 )

Cash flow from financing activities: Proceeds from

revolving line of credit - 15,000 Principal payments on revolving

line of credit - (12,000 ) Proceeds from issuance of common stock

15,407 14,830 Repurchase of common stock - (5,635 ) Dividends paid

(54,595 ) (51,273 ) Tax benefit from stock option plans -

-

Net cash used by financing activities

(39,188 ) (39,078 ) Impact of changes in

exchange rates on cash 5,727 3,554 Net change in cash and

cash equivalents (22,133 ) 34,132 Cash and cash equivalents at

beginning of period 285,283 251,129

Cash and cash equivalents at end of period $ 263,150 $

285,261

The following tables provide details

with respect to the amount of GAAP charges related to stock-based

compensation, amortization of acquisition-related intangibles,

acquisition-related transaction costs, restructuring charges,

foreign exchange loss on acquisitions and taxes levied on the

transfer of acquired intellectual property that were recorded in

the line items indicated below (unaudited) (in thousands)

Three Months Ended Six

Months Ended June 30, June 30,

2017 2016 2017 2016

Stock-based compensation Cost of sales $ 650 $ 539 $ 1,226 $

1,087 Sales and marketing 2,884 2,851 5,509 5,787 Research and

development 2,170 2,369 4,224 4,718 General and administrative

1,620 935 2,844

1,843 Provision for income taxes (3,344 )

(2,016 ) (5,020 ) (4,110 ) Total $ 3,980 $

4,678 $ 8,783 $ 9,325

Amortization

of acquisition intangibles Cost of sales $ 1,556 $ 2,980 $

3,146 $ 6,022 Sales and marketing 486 820 964 1,639 Research and

development 267 278 531 539 Other income, net -

- - - Provision for

income taxes (556 ) 237 (1,110 )

458 Total $ 1,753 $ 4,315 $ 3,531 $

8,658

Acquisition transaction costs, restructuring

charges, and other Cost of sales $ 574 $ 74 $ 909 $ 179 Sales

and marketing 4,024 42 6,399 99 Research and development 1,182 153

1,581 411 General and administrative 419 190 596 220 Foreign

exchange gain (loss) 1 - - - 94 Other income (loss), net2 -

- - 2,475

Provision for income taxes (1,870 ) (160 )

(2,934 ) (1,202 ) Total $ 4,329 $ 299 $ 6,551

$ 2,276 (1) Foreign exchange losses on

acquisitions were $0 and $94 for the six month periods ended June

30, 2017 and 2016, respectively (2) Taxes levied on the transfer of

acquired intellectual property were $0 and $2,475 for the six month

periods ended June 30, 2017 and 2016, respectively

National Instruments Reconciliation of GAAP to Non-GAAP

Measures (in thousands, unaudited)

Three Months Ended Six

Months Ended June 30, June 30, 2017

2016 2017 2016 Reconciliation of

Gross Profit to Non-GAAP Gross Profit Gross profit, as reported

$ 236,149 $ 228,597 $ 459,730 $ 439,628 Stock-based compensation

650 539 1,226 1,087 Amortization of acquisition intangibles 1,556

2,980 3,146 6,022 Acquisition transaction costs and restructuring

charges 574 74 909

179 Non-GAAP gross profit $ 238,929 $ 232,190

$ 465,011 $ 446,916 Non-GAAP gross margin 75.0 % 75.9

% 75.2 % 75.3 %

Reconciliation of Operating Expenses to

Non-GAAP Operating Expenses Operating expenses, as reported $

207,518 $ 201,330 $ 408,782 $ 398,517 Stock-based compensation

(6,674 ) (6,155 ) (12,577 ) (12,348 ) Amortization of acquisition

intangibles (753 ) (1,098 ) (1,495 ) (2,178 ) Acquisition

transaction costs and restructuring charges (5,625 )

(385 ) (8,576 ) (730 ) Non-GAAP operating expenses $

194,466 $ 193,692 $ 386,134 $ 383,261

Reconciliation of Operating Income to Non-GAAP Operating

Income Operating income, as reported $ 28,631 $ 27,267 $ 50,948

$ 41,111 Stock-based compensation 7,324 6,694 13,803 13,435

Amortization of acquisition intangibles 2,309 4,078 4,641 8,200

Acquisition transaction costs and restructuring charges

6,199 459 9,485 909

Non-GAAP operating income $ 44,463 $ 38,498 $

78,877 $ 63,655 Non-GAAP operating margin 14.0 % 12.6

% 12.7 % 10.7 %

Reconciliation of Income before income

taxes to Non-GAAP Income before income taxes Income before

income taxes, as reported $ 29,352 $ 26,293 $ 52,526 $ 38,558

Stock-based compensation 7,324 6,694 13,803 13,435 Amortization of

acquisition intangibles 2,309 4,078 4,641 8,200 Acquisition

transaction costs and restructuring charges 6,199 459 9,485 909

Foreign exchange loss on acquisitions - - - 94 Taxes levied on

transfer of acquired intellectual property - -

- 2,474 Non-GAAP income before

income taxes $ 45,184 $ 37,524 $ 80,455 $

63,670

Reconciliation of Provision for income

taxes to Non-GAAP Provision for income taxes Provision for

income taxes, as reported $ 4,197 $ 6,493 $ 9,223 $ 9,460

Stock-based compensation 3,344 2,016 5,020 4,110 Amortization of

acquisition intangibles 556 (237 ) 1,110 (458 ) Acquisition

transaction costs, restructuring charges, and other 1,870

160 2,934 1,202

Non-GAAP provision for income taxes $ 9,967 $ 8,432 $

18,287 $ 14,314

Reconciliation of

GAAP Net Income, Basic EPS and Diluted EPS to Non-GAAP Net Income,

Non-GAAP Basic EPS and Non-GAAP Diluted EPS (in thousands,

except per share data, unaudited)

Three Months Ended Six Months

Ended June 30, June 30, 2017 2016

2017 2016 Net income, as reported $ 25,155 $

19,800 $ 43,303 $ 29,098 Adjustments to reconcile net income to

non-GAAP net income: Stock-based compensation, net of tax effect

3,980 4,678 8,783 9,325 Amortization of acquisition intangibles,

net of tax effect 1,753 4,315 3,531 8,658

Acquisition transaction costs,

restructuring, and other, net of tax effect

4,329 299 6,551 2,276 Non-GAAP net

income

$

35,217

$ 29,092 $ 62,168 $ 49,357 Basic EPS, as reported $ 0.19 $

0.15 $ 0.33 $ 0.23

Adjustment to reconcile basic EPS to

non-GAAP basic EPS:

Impact of stock-based compensation, net of tax effect 0.04 0.04

0.07 0.07 Impact of amortization of acquisition intangibles, net of

tax effect 0.01 0.03 0.03 0.07 Impact of acquisition transaction

costs, restructuring, and other, net of tax effect 0.03

0.01 0.05 0.02 Non-GAAP basic EPS $ 0.27 $

0.23 $ 0.48 $ 0.39 Diluted EPS, as reported $ 0.19 $

0.15 $ 0.33 $ 0.23 Adjustment to reconcile diluted EPS to non-GAAP

diluted EPS Impact of stock-based compensation, net of tax effect

0.04 0.04 0.07 0.07 Impact of amortization of acquisition

intangibles, net of tax effect 0.01 0.03 0.03 0.07 Impact of

acquisition transaction costs, restructuring, and other, net of tax

effect 0.03 0.01 0.05 0.01 Non-GAAP

diluted EPS $ 0.27 $ 0.23 $ 0.48 $ 0.38 Weighted average

shares outstanding - Basic 130,197 128,282

129,820 127,938 Diluted 131,117 128,746

130,619 128,429

National Instruments

Reconciliation of Net Income to EBITDA (in thousands,

unaudited)

Three Months Ended Six Months Ended June

30, June 30, 2017 2016

2017 2016 Net income, as reported $

25,155 $ 19,800 $ 43,303 $ 29,098 Adjustments to reconcile net

income to EBITDA: Interest income (313 ) (78 ) (399 ) (141 ) Tax

expense 4,197 6,493 9,223 9,460 Depreciation and amortization

17,246 18,785 35,915

38,217 EBITDA $ 46,285 $ 45,000 $

88,042 $ 76,634 Weighted average shares outstanding -

Diluted 131,117 128,746 130,619

128,429

Reconciliation of

GAAP to Non-GAAP EPS Guidance (unaudited)

Three months ended September 30, 2017

Low High GAAP Fully Diluted EPS, guidance $ 0.16 $

0.30

Adjustment to reconcile diluted EPS to

non-GAAP diluted EPS:

Impact of stock-based compensation, net of tax effect 0.04 0.04

Impact of amortization of acquisition intangibles and acquisition

accounting adjustments, net of tax effect 0.01 0.01 Impact of

acquisition transaction costs, restructuring, and other, net of tax

effect 0.01 0.01 Non-GAAP diluted EPS,

guidance

$

0.22

$ 0.36

National Instruments

Reconciliation of GAAP Revenue Growth to Core Revenue Growth

(unaudited) Three Months Ended, June

30, 2017 YoY GAAP revenue growth, as reported 4.1 %

Effect of excluding our current largest customer 1.5 % YoY GAAP

revenue growth, excluding our largest customer 5.6 % Effect of

excluding the impact of foreign currency exchange 1.4 % YoY Core

revenue growth 7.0 %

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170727006333/en/

National InstrumentsMarissa Vidaurri, 512-683-6873Investor

Relations

National Instruments (NASDAQ:NATI)

Historical Stock Chart

From Mar 2024 to Apr 2024

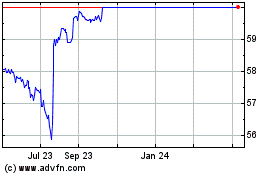

National Instruments (NASDAQ:NATI)

Historical Stock Chart

From Apr 2023 to Apr 2024