TCI Subsidiary, Southern Properties Capital, is First Dallas Company to Raise Capital on the Israeli Bond Market

July 27 2017 - 8:00AM

Business Wire

Transcontinental Realty Investors Inc. (NYSE: TCI) CEO and

President Daniel J. Moos announces that Southern Properties Capital

(SPC), a subsidiary of Transcontinental Realty Investors Inc. and

Abode Properties, both Dallas-based real estate investment

companies, recently completed a $113 million bond series on the Tel

Aviv Stock Exchange, making it the first company out of Dallas to

raise capital on the Israeli bond market. Prior to the Southern

Properties Capital issuance, the market was previously dominated by

Manhattan-based companies, and has since shown increased demand for

additional bond issuers throughout the United States.

This Smart News Release features multimedia.

View the full release here:

http://www.businesswire.com/news/home/20170727005206/en/

Transcontinental Realty Investors and

affiliates partner with Radhan to secure major bond deal in Israeli

market.

The issuance was highly sought after by Israeli institutional

investors, displaying the Israeli market’s increased comfort level

with American-based issuers, and continuing the trend that has

emerged in recent years as an increasingly viable means for

US-based real estate companies to raise unsecured corporate

debt.

The company raised 400 million shekels, approximately $113

million, in its first bond series of unsecured “investor graded”

corporate debt, due to mature in 2023. The company’s bonds have

performed well since the issuance and are consistently traded at a

premium, reflecting the market's favorability towards them.

Southern Properties Capital operates primarily in Texas and

specializes in Class A multifamily assets in emerging markets

throughout the Southern United States, corresponding with both

sustainable and viable economic growth activity. The issuing entity

is backed by over 3,000 multi-family units, (which represent only a

small portion of the total units owned by TCI) as well as over 1.5

million square feet office buildings in Texas. The company has

already used funds to acquire additional multi-family assets within

its strategic footprint, and expects significant expansion by

continuing to utilize the Israeli bond platform.

”During the past several years we’ve made major steps toward our

strategic financing goals,” said Daniel J. Moos, CEO and President.

“This historic Israeli bond deal further solidifies TCI, Abode, and

SPC as major players in the region’s real estate market.”

The deal was led by Yuval Barak and Eden Ozeri from Radhan - a

leading financial consultancy firm out of Israel who continue

to advise the company in the Israeli market.

Transcontinental Realty Investors

(www.transconrealty-invest.com) maintains a strong emphasis on

creating greater shareholder value through acquisition, financing,

operation, developing, and sale of real estate across every

geographic region in the United States. A New York Stock Exchange

company, Transcontinental is traded under the symbol "TCI".

Transcontinental produces revenue through the professional

management of apartments, office buildings, warehouses, and retail

centers that are "undervalued" or "underperforming" at the time of

acquisition. Value is added under Transcontinental ownership, and

the properties are repositioned into higher classifications through

physical improvements and improved management. Transcontinental

also develops new properties, such as luxury apartment homes

principally on land it owns or acquires.

Abode Properties is a subsidiary of Transcontinental Realty

Investors Inc., (NYSE: TCI), a Dallas-based real estate investment

company. Abode’s investment and strategic focus is to acquire,

develop, and operate a portfolio of desirable multifamily

residential properties, while capitalizing on our ability to obtain

long term and static debt structures. The portfolio stands to

benefit from historically established, proven, and successful

operational practices, seasoned on-site management, and an

experienced leadership team with forward thinking capabilities in

order to realize maximum cash flows and consistent returns, while

maintaining unequaled resident and customer service. We are

disciplined and prudent allocators of capital and we will continue

growing our geographically diverse portfolio from the Southwest to

the Southeast. These markets are geographically located in areas of

the country that correspond with both sustainable and viable

economic growth activity.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170727005206/en/

Pillar Income Asset ManagementChris Childress,

469-522-4275press@pillarincome.com

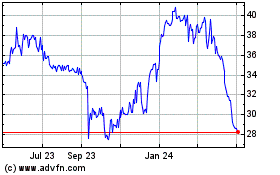

Transcontinental Realty ... (NYSE:TCI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Transcontinental Realty ... (NYSE:TCI)

Historical Stock Chart

From Apr 2023 to Apr 2024