Exceeds Q2 Earnings Guidance, Achieving GAAP

EPS of $0.41 and Adjusted EPS of $0.43

Maintains Guidance for Full-Year 2017

Gibraltar Industries, Inc. (Nasdaq: ROCK), a leading

manufacturer and distributor of building products for industrial,

infrastructure, residential, and renewable energy and conservation

markets, today reported its financial results for the three- and

six-month period ended June 30, 2017. All financial metrics in this

release reflect only the Company’s continuing operations unless

otherwise noted.

Second-quarter Consolidated Results

Gibraltar reported the following consolidated results:

Three Months Ended June 30, Dollars in

millions, except EPS

GAAP

Adjusted 2017

2016 %

Change 2017

2016 %

Change Net Sales $ 248 $ 266 (7 )% $ 248 $ 266 (7 )% Net

Income $ 13.2 $ 18.6 (29 )% $ 14.0 $ 16.4 (15 )% Diluted EPS $ 0.41

$ 0.58 (29 )% $ 0.43 $ 0.51 (16 )%

The Company reported second-quarter 2017 net sales of $248

million, essentially in line with its expectations as noted in its

first-quarter earnings release. The 7 percent year-over-year sales

decrease primarily reflects Gibraltar’s exit of the European

industrial business, U.S. bar grating product line and the European

residential solar racking business in 2016. GAAP and adjusted

earnings exceeded Company guidance due to the strong performance of

the Residential Products business.

The adjusted amounts for the second quarter 2017 and 2016 remove

special items from both periods, as described in the appended

reconciliation of adjusted financial measures.

Management Comments

“Gibraltar delivered another quarter of solid results, exceeding

our earnings guidance,” said President and CEO Frank Heard.

“Revenues were essentially in-line with our expectations as strong

sales in our Residential segment and the continued benefits of our

four-pillar value creation strategy partially offset expected

headwinds, including lower backlog in our Industrial &

Infrastructure segment as well as higher raw material costs.

“We continued to advance our four-pillar strategy, with several

notable achievements: delivering 150 basis points of operating

margin improvement through our 80/20 operational efficiency

initiatives, improving our competitive position and financial

results by effectively integrating our recent Package Concierge and

Nexus acquisitions, and advancing our innovation strategy with new

product development initiatives that are underway across all of our

segments.”

Second-quarter Segment Results

Residential Products

For the second quarter, the Residential Products segment

reported:

Three Months Ended June 30, Dollars in

millions

GAAP

Adjusted 2017

2016 %

Change 2017

2016 %

Change Net Sales $ 127 $ 120 6 % $ 127 $ 120 6 %

Operating Margin 17.7 % 17.3 % 40 bps 17.8 % 17.5 % 30 bps

The 6 percent increase in second-quarter 2017 net sales in

Gibraltar’s Residential Products segment reflects the continued

improvement in the repair and remodel and new housing construction

markets, growing demand for the Company’s commercial package

solutions, and the contribution of the Package Concierge

acquisition.

The segment’s GAAP and adjusted operating margin reflect the

benefit of increased revenues as well as operational efficiencies

stemming from 80/20 initiatives. The adjusted operating margin for

the second quarter of 2017 and 2016 removes the special charges for

restructuring initiatives under the 80/20 program from both

periods.

Industrial & Infrastructure Products

For the second quarter, the Industrial & Infrastructure

Products segment reported:

Three Months Ended June 30, Dollars in

millions

GAAP

Adjusted 2017

2016 %

Change 2017

2016 %

Change Net Sales $ 58 $ 81 (29 )% $ 58 $ 81 (29 )%

Operating Margin 5.9 % 7.6 % (170) bps 3.5 % 8.7 % (520) bps

As expected, second-quarter 2017 net sales in Gibraltar’s

Industrial & Infrastructure Products segment were down, with 80

percent of the decline driven by the 2016 divestiture of the

European industrial operations and the US bar grating product line,

with the remaining decline driven by lower activity in the

infrastructure marketplace. Backlog for the segment increased on a

sequential basis during the second quarter. The Company expects

backlog improvement to continue throughout the second half of 2017,

driven, in part, by the strengthening infrastructure market.

GAAP and adjusted operating margins were affected by higher raw

material costs and lower volumes in the infrastructure market. This

segment’s adjusted operating margin for the second quarters of 2017

and 2016 removes the special charges for portfolio management

activities and restructuring initiatives under the 80/20 program.

During the quarter, this segment continued to implement 80/20

simplification initiatives, which are expected to benefit margins

during the second half of 2017.

Renewable Energy & Conservation

For the second quarter, the Renewable Energy & Conservation

segment reported:

Three Months Ended June 30,

Dollars in millions

GAAP

Adjusted 2017

2016 %

Change 2017

2016 %

Change Net Sales $ 63 $ 65 (3 )% $ 63 $ 65 (3 )%

Operating Margin 5.6 % 15.9 % (1030) bps 8.1 % 15.9 % (780) bps

Segment revenues were down modestly year over year due to the

exit of the European solar market, and continued softness in

international markets, partially offset by the Nexus acquisition.

Segment backlog increased from the prior year and sequentially

compared with the first quarter of 2017.

The second-quarter 2017 GAAP and adjusted operating margin

decrease reflects lower volume, planned price concessions, higher

material costs and certain field installation issues. This

segment’s adjusted operating margin for the second quarter 2017

removes the special charges for portfolio management activities

related to the divestiture of the Company’s European residential

solar racking business. The Company expects better volume leverage

and improved price/material cost alignment as it moves into the

seasonally strongest half of the year.

Business Outlook

“Looking toward the second half of 2017, we continue to expect

generally favorable market conditions for each of our segments,

increased bidding activity and continued backlog growth in both our

Industrial & Infrastructure and Renewable Energy &

Conservation segments, as well as increased revenues from our new

product development initiatives,” said Heard. “As we head into our

seasonally strongest quarter, we are maintaining our full year

guidance.

“For the second half of 2017 our financial priorities will be to

accelerate sales through innovative products, seek value-added

acquisitions in attractive end markets, and continue to advance our

80/20 initiatives,” concluded Heard.

The Company is maintaining its full-year revenue guidance in the

range of $970 million and $980 million. The Company expects GAAP

EPS to be between $1.37 and $1.50 per diluted share, or $1.57 to

$1.70 on an adjusted basis. In 2016, GAAP EPS was $1.05, or $1.67

on an adjusted basis. While year-over-year adjusted earnings are

projected to be flat, the Company continues to expect increasing

ROIC and liquidity.

For the third quarter of 2017, the Company is expecting revenue

in the range of $275 million to $280 million, and GAAP EPS to be

between $0.51 and $0.58 per diluted share, or $0.58 to $0.65 per

diluted share on an adjusted basis.

FY 2017

Guidance

Gibraltar Industries Dollars in millions, except EPS

Operating Income Net

Diluted

Earnings

Income Margin Taxes

Income Per Share GAAP Measures $ 85-91 8.8-9.3

% $ 25-28 $ 44-48 $ 1.37-1.50 Restructuring Costs 10 1.0 % 4 7 0.20

Adjusted Measures $ 95-101 9.8-10.3 % $

29-32 $ 51-55 $ 1.57-1.70

Second-quarter Conference Call Details

Gibraltar has scheduled a conference call today starting at 9:00

a.m. ET to review its results for the second quarter of 2017.

Interested parties may access the call by dialing (877) 407-5790 or

(201) 689-8328. The presentation slides that will be discussed in

the conference call are expected to be available this morning,

prior to the start of the call. The slides may be downloaded from

the Gibraltar website: www.gibraltar1.com. A webcast replay of the

conference call and a copy of the transcript will be available on

the website following the call.

About Gibraltar

Gibraltar Industries is a leading manufacturer and distributor

of building products for industrial, infrastructure, residential,

and renewable energy and conservation markets. With a four-pillar

strategy focused on operational improvement, product innovation,

acquisitions and portfolio management, Gibraltar’s mission is to

drive best-in-class performance. Gibraltar serves customers

primarily throughout North America and to a lesser extent Asia.

Comprehensive information about Gibraltar can be found on its

website at www.gibraltar1.com.

Safe Harbor Statement

Information contained in this news release, other than

historical information, contains forward-looking statements and is

subject to a number of risk factors, uncertainties, and

assumptions. Risk factors that could affect these statements

include, but are not limited to, the following: the availability of

raw materials and the effects of changing raw material prices on

the Company’s results of operations; energy prices and usage;

changing demand for the Company’s products and services; changes in

the liquidity of the capital and credit markets; risks associated

with the integration and performance of acquisitions; and changes

in interest and tax rates. In addition, such forward-looking

statements could also be affected by general industry and market

conditions, as well as general economic and political conditions.

The Company undertakes no obligation to update any forward-looking

statements, whether as a result of new information, future events

or otherwise, except as may be required by applicable law or

regulation.

Non-GAAP Financial Data

To supplement Gibraltar’s consolidated financial statements

presented on a GAAP basis, Gibraltar also presented certain

adjusted financial data in this news release. Adjusted financial

data excluded special charges consisting of gains/losses on sales

of assets, restructuring primarily associated with the 80/20

simplification initiative, acquisition-related items, and other

reclassifications. These adjustments are shown in the non-GAAP

reconciliation of adjusted financial measures excluding special

charges provided in the supplemental financial schedules that

accompany this news release. The Company believes that the

presentation of results excluding special charges provides

meaningful supplemental data to investors, as well as management,

that are indicative of the Company’s core operating results and

facilitates comparison of operating results across reporting

periods as well as comparison with other companies. Special charges

are excluded since they may not be considered directly related to

the Company’s ongoing business operations. These adjusted measures

should not be viewed as a substitute for the Company’s GAAP

results, and may be different than adjusted measures used by other

companies.

Next Earnings Announcement

Gibraltar expects to release its financial results for the

three-month and nine-month periods ending September 30, 2017, on

Friday, November 3, 2017, and hold its earnings conference call

later that morning, starting at 9:00 a.m. ET.

GIBRALTAR INDUSTRIES, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except per share data)

(unaudited)

Three Months EndedJune 30, Six Months EndedJune 30, 2017

2016 2017 2016 Net Sales

$ 247,627 $ 265,738 $ 454,232 $ 503,409 Cost of sales 185,802

196,895 343,152 380,416 Gross profit 61,825

68,843 111,080 122,993 Selling, general, and administrative expense

36,895 40,267 76,471 76,656 Income from

operations 24,930 28,576 34,609 46,337 Interest expense 3,550 3,666

7,126 7,357 Other expense 353 8,195 407 8,160

Income before taxes 21,027 16,715 27,076 30,820 Provision for

(benefit of) income taxes 7,853 (1,897 ) 9,906 3,179

Income from continuing operations 13,174 18,612 17,170 27,641

Discontinued operations: Loss before taxes (644 ) — (644) — Benefit

of income taxes (239 ) — (239) — Loss from

discontinued operations (405 ) — (405) — Net income $

12,769 $ 18,612 $ 16,765 $ 27,641 Net earnings

per share – Basic: Income from continuing operations $ 0.41 $ 0.59

$ 0.54 $ 0.88 Loss from discontinued operations (0.01 ) —

(0.01 ) — Net income $ 0.40 $ 0.59 $ 0.53 $

0.88 Weighted average shares outstanding – Basic 31,709

31,475 31,698 31,447 Net earnings per share –

Diluted: Income from continuing operations $ 0.41 $ 0.58 $ 0.53 $

0.87 Loss from discontinued operations (0.01 ) — (0.01 ) —

Net income $ 0.40 $ 0.58 $ 0.52 $ 0.87

Weighted average shares outstanding – Diluted 32,183 32,007

32,219 31,916

GIBRALTAR INDUSTRIES, INC.

CONSOLIDATED BALANCE SHEETS

(in thousands, except per share data)

June 30,2017 December 31,2016 (unaudited)

Assets

Current assets: Cash and cash equivalents $ 182,379 $ 170,177

Accounts receivable, net 138,871 124,072 Inventories 86,065 89,612

Other current assets 8,351 7,336 Total current assets

415,666 391,197 Property, plant, and equipment, net 95,869 108,304

Goodwill 320,848 304,032 Acquired intangibles 110,325 110,790 Other

assets 4,750 3,922 $ 947,458 $ 918,245

Liabilities and Shareholders’ Equity Current liabilities:

Accounts payable $ 88,007 $ 69,944 Accrued expenses 69,389 70,392

Billings in excess of cost 13,963 11,352 Current maturities of

long-term debt 400 400 Total current liabilities

171,759 152,088 Long-term debt 209,229 209,237 Deferred income

taxes 38,203 38,002 Other non-current liabilities 46,364 58,038

Shareholders’ equity: Preferred stock, $0.01 par value; authorized

10,000 shares; none outstanding — — Common stock, $0.01 par value;

authorized 50,000 shares; 32,155 shares and 32,085 shares issued

and outstanding in 2017 and 2016 321 320 Additional paid-in capital

267,601 264,418 Retained earnings 228,767 211,748 Accumulated other

comprehensive loss (5,898 ) (7,721 ) Cost of 554 and 530 common

shares held in treasury in 2017 and 2016 (8,888 ) (7,885 ) Total

shareholders’ equity 481,903 460,880 $ 947,458

$ 918,245

GIBRALTAR INDUSTRIES, INC.CONSOLIDATED

STATEMENTS OF CASH FLOWS(in thousands)(unaudited)

Six Months EndedJune 30, 2017 2016

Cash Flows from Operating Activities Net income $ 16,765 $

27,641 Loss from discontinued operations (405 ) — Income

from continuing operations 17,170 27,641 Adjustments to reconcile

net income to net cash provided by operating activities:

Depreciation and amortization 11,006 11,856 Stock compensation

expense 3,191 3,218 Net gain on sale of assets (39 ) (198 ) Loss on

sale of business — 8,533 Exit activity (recoveries) costs, non-cash

(2,737 ) 1,074 Provision for deferred income taxes — 196 Other, net

628 (449 ) Changes in operating assets and liabilities, excluding

the effects of acquisitions: Accounts receivable (14,446 ) 9,145

Inventories 2,245 4,988 Other current assets and other assets

(2,174 ) (4,333 ) Accounts payable 16,962 (2,427 ) Accrued expenses

and other non-current liabilities (10,086 ) (9,803 ) Net cash

provided by operating activities 21,720 49,441

Cash Flows from Investing Activities Cash paid for

acquisitions, net of cash acquired (18,494 ) (2,314 ) Net proceeds

from sale of property and equipment 12,778 162 Purchases of

property, plant, and equipment (3,274 ) (4,035 ) Net proceeds from

sale of business — 8,479 Other, net — 1,118 Net cash

(used in) provided by investing activities (8,990 ) 3,410

Cash Flows from Financing Activities Long-term debt payments

(400 ) (400 ) Payment of debt issuance costs — (54 ) Purchase of

treasury stock at market prices (1,003 ) (462 ) Net proceeds from

issuance of common stock 247 2,057 Net cash (used in)

provided by financing activities (1,156 ) 1,141 Effect of

exchange rate changes on cash 628 1,264 Net increase

in cash and cash equivalents 12,202 55,256 Cash and cash

equivalents at beginning of year 170,177 68,858 Cash

and cash equivalents at end of period $ 182,379 $ 124,114

GIBRALTAR INDUSTRIES, INC.

Reconciliation of Adjusted Financial

Measures

(in thousands, except per share data)

(unaudited)

Three Months EndedJune 30, 2017

AsReportedIn GAAPStatements

Acquisition&RestructuringCharges

PortfolioManagement

SeniorLeadershipTransitionCosts

AdjustedFinancialMeasures

Net Sales Residential Products $ 127,252 $ — $ — $ — $ 127,252

Industrial & Infrastructure Products 57,926 — — — 57,926 Less

Inter-Segment Sales (314 ) — — — (314 ) 57,612

— — — 57,612 Renewable Energy & Conservation 62,763 —

— — 62,763 Consolidated sales 247,627 —

— — 247,627 Income from operations Residential Products

22,579 81 — — 22,660 Industrial & Infrastructure Products 3,397

— (1,379 ) — 2,018 Renewable Energy & Conservation 3,492

— 1,369 252 5,113 Segments income

29,468 81 (10 ) 252 29,791 Unallocated corporate expense (4,538 )

148 — 73 (4,317 ) Consolidated income from

operations 24,930 229 (10 ) 325 25,474 Interest expense

3,550 — — — 3,550 Other expense 353 — — —

353 Income before income taxes 21,027 229 (10 ) 325

21,571 Provision for income taxes 7,853 86 (479 ) 124

7,584 Income from continuing operations $ 13,174

$ 143 $ 469 $ 201 $ 13,987

Income from continuing operations per share – diluted $ 0.41

$ — $ 0.01 $ 0.01 $ 0.43

Operating margin Residential Products 17.7 % 0.1 % — % — % 17.8 %

Industrial & Infrastructure Products 5.9 % — % (2.4 )% — % 3.5

% Renewable Energy & Conservation 5.6 % — % 2.2 % 0.4 % 8.1 %

Segments margin 11.9 % — % — % 0.1 % 12.0 % Consolidated 10.1 % 0.1

% — % 0.1 % 10.3 %

GIBRALTAR INDUSTRIES, INC.

Reconciliation of Adjusted Financial

Measures

(in thousands, except per share data)

(unaudited)

Three Months EndedJune 30, 2016

As ReportedIn GAAPStatements

RestructuringCharges

PortfolioManagement

AdjustedFinancialMeasures

Net Sales Residential Products $ 119,965 $ — $ — $

119,965 Industrial & Infrastructure Products 81,380 — — 81,380

Less Inter-Segment Sales (373 ) — — (373 ) 81,007 — —

81,007 Renewable Energy & Conservation 64,766 — —

64,766

Consolidated sales 265,738 — — 265,738

Income from operations Residential Products 20,725 258 — 20,983

Industrial & Infrastructure Products 6,190 851 — 7,041

Renewable Energy & Conservation 10,296 — —

10,296 Segments income 37,211 1,109 — 38,320 Unallocated

corporate expense (8,635 ) — — (8,635 ) Consolidated

income from operations 28,576 1,109 — 29,685 Interest

expense 3,666 — — 3,666 Other expense (income) 8,195 —

(8,533 ) (338 ) Income before income taxes 16,715 1,109

8,533 26,357 (Benefit of) provision for income taxes (1,897 ) 424

11,414 9,941 Net income $ 18,612 $ 685

$ (2,881 ) $ 16,416 Net earnings per

share – diluted $ 0.58 $ 0.02 $ (0.09 ) $

0.51 Operating margin Residential Products

17.3 % 0.2 % — % 17.5 % Industrial & Infrastructure Products

7.6 % 1.1 % — % 8.7 % Renewable Energy & Conservation 15.9 % —

% — % 15.9 % Segments margin 14.0 % 0.4 % — % 14.4 % Consolidated

10.8 % 0.4 % — % 11.2 %

GIBRALTAR INDUSTRIES, INC.

Reconciliation of Adjusted Financial

Measures

(in thousands, except per share data)

(unaudited)

Six Months EndedJune 30, 2017

AsReported InGAAPStatements

Acquisition&RestructuringCharges

SeniorLeadershipTransitionCosts

PortfolioManagement

AdjustedFinancialMeasures

Net Sales Residential Products $ 231,803 — — — $ 231,803 Industrial

& Infrastructure Products 108,644 — — — 108,644 Less

Inter-Segment Sales (770 ) — — — (770 )

107,874 — — — 107,874 Renewable

Energy & Conservation 114,555 — — — 114,555 Consolidated sales

454,232 — — — 454,232 Income from operations Residential

Products 38,220 245 — — 38,465 Industrial & Infrastructure

Products 3,360 — — 381 3,741 Renewable Energy & Conservation

6,832 — 252 2,419 9,503 Segments

income 48,412 245 252 2,800 51,709 Unallocated corporate expense

(13,803 ) 278 420 — (13,105 ) Consolidated

income from operations 34,609 523 672 2,800 38,604 Interest

expense 7,126 — — — 7,126 Other expense 407 — —

— 407 Income before income taxes 27,076 523

672 2,800 31,071 Provision for income taxes 9,906 195

252 197 10,550 Income from continuing

operations $ 17,170 $ 328 $ 420 $ 2,603

$ 20,521 Income from continuing operations per share –

diluted $ 0.53 $ 0.01 $ 0.02 $ 0.08 $

0.64 Operating margin Residential Products 16.5 % 0.1

% — % — % 16.6 % Industrial & Infrastructure Products 3.1 % — %

— % 0.4 % 3.5 % Renewable Energy & Conservation 6.0 % — % 0.2 %

2.1 % 8.3 % Segments margin 10.7 % 0.1 % 0.1 % 0.6 % 11.4 %

Consolidated 7.6 % 0.1 % 0.1 % 0.6 % 8.5 %

GIBRALTAR INDUSTRIES, INC.

Reconciliation of Adjusted Financial

Measures

(in thousands, except per share data)

(unaudited)

Six Months EndedJune 30, 2016

As ReportedIn GAAPStatements

RestructuringCharges

PortfolioManagement

AdjustedFinancialMeasures

Net Sales Residential Products $ 220,112 — — $ 220,112 Industrial

& Infrastructure Products 161,397 — — 161,397 Less

Inter-Segment Sales (740 ) — — (740 ) 160,657

— — 160,657 Renewable Energy &

Conservation 122,640 — — 122,640 Consolidated sales 503,409 — —

503,409 Income from operations Residential Products 32,956

1,276 — 34,232 Industrial & Infrastructure Products 9,516 1,531

— 11,047 Renewable Energy & Conservation 18,603 —

— 18,603 Segments income 61,075 2,807 — 63,882

Unallocated corporate expense (14,738 ) 31 — (14,707

) Consolidated income from operations 46,337 2,838 — 49,175

Interest expense 7,357 — — 7,357 Other expense (income) 8,160

— (8,533 ) (373 ) Income before income taxes 30,820

2,838 8,533 42,191 Provision for income taxes 3,179 1,055

11,414 15,648 Net income $ 27,641 $

1,783 $ (2,881 ) $ 26,543 Net earnings per share –

diluted $ 0.87 $ 0.05 $ (0.09 ) $ 0.83

Operating margin Residential Products 15.0 % 0.6 % — % 15.6 %

Industrial & Infrastructure Products 5.9 % 1.0 % — % 6.9 %

Renewable Energy & Conservation 15.2 % — % — % 15.2 % Segments

margin 12.1 % 0.6 % — % 12.7 % Consolidated 9.2 % 0.6 % — % 9.8 %

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170727005584/en/

Gibraltar Industries, Inc.Timothy Murphy, 716-826-6500 ext.

3277Chief Financial Officertfmurphy@gibraltar1.com

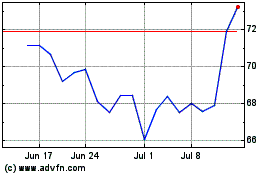

Gibraltar Industries (NASDAQ:ROCK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Gibraltar Industries (NASDAQ:ROCK)

Historical Stock Chart

From Apr 2023 to Apr 2024