- Closes Acquisition of Bally's Casino

Tunica and Resorts Casino Tunica Real Estate Assets for $82.9

million -- Establishes 2017 Third Quarter Guidance

and Revises Full Year Guidance -- Declares 2017

Third Quarter Dividend of $0.63 per Common Share -

Gaming and Leisure Properties, Inc. (NASDAQ:GLPI) (the

“Company”), the first gaming-focused real estate investment trust

(“REIT”) in North America, today announced results for

the quarter ended June 30, 2017.

Financial Highlights

| |

|

Three Months Ended June 30, |

|

(in millions, except per share data) |

|

2017Actual |

|

2017Guidance (1) |

|

2016Actual |

| Net

Revenue |

|

$ |

243.4 |

|

|

$ |

243.5 |

|

|

$ |

207.4 |

|

| Net

Income |

|

$ |

96.3 |

|

|

$ |

95.7 |

|

|

$ |

73.3 |

|

| Funds From

Operations (2) |

|

$ |

121.4 |

|

|

$ |

121.0 |

|

|

$ |

96.9 |

|

| Adjusted Funds

From Operations (3) |

|

$ |

167.8 |

|

|

$ |

166.8 |

|

|

$ |

135.1 |

|

| Adjusted EBITDA

(4) |

|

$ |

222.2 |

|

|

$ |

221.1 |

|

|

$ |

180.4 |

|

| |

|

|

|

|

|

|

| Net income, per

diluted common share |

|

$ |

0.45 |

|

|

$ |

0.45 |

|

|

$ |

0.39 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) The guidance figures in the tables above present

the guidance provided on April 27, 2017, for the three months

ended June 30, 2017.

(2) Funds from operations (“FFO”) is net income,

excluding (gains) or losses from sales of property and real estate

depreciation as defined by NAREIT.

(3) Adjusted funds from operations (“AFFO”) is FFO,

excluding stock based compensation expense, debt issuance costs

amortization, other depreciation, amortization of land rights,

straight-line rent adjustments and direct financing lease

adjustments, reduced by capital maintenance expenditures.

(4) Adjusted EBITDA is net income excluding

interest, taxes on income, depreciation, (gains) or losses from

sales of property, stock based compensation expense, straight-line

rent adjustments, direct financing lease adjustments and the

amortization of land rights.

Chief Executive Officer, Peter M. Carlino, commented, “Our

business model promotes stability through long-term master leases

with large fixed components and highly respected operators with

market-leading assets. With this structure, as demonstrated

by our second quarter results, we are able to consistently deliver

reliable cash flow for our investors. For the quarter, Adjusted

EBITDA exceeded guidance primarily as the result of solid

performance at our TRS Properties, Hollywood Casino Baton Rouge and

Hollywood Casino Perryville, as well as incremental rent from

Hollywood Casino Toledo, which is managed by Penn National Gaming,

Inc. (NASDAQ:PENN).”

Mr. Carlino continued, “On May 1, 2017, we completed the

acquisition of the Bally’s Casino Tunica and Resorts Casino Tunica

(“Tunica Properties”) for $82.9 million. These assets were

added to the master lease with PENN and will generate $9.0 million

of incremental annual rent. The accretive Tunica Properties

acquisition along with the addition of an annual $5.8 million

escalator on the Pinnacle Entertainment, Inc. (NASDAQ:PNK) master

lease resulted in our Board deciding to increase our quarterly

dividend to $0.63 per share. Our quarterly dividend has grown

at a compounded annual rate of 6.6% in the last three years, with

five dividend increases during that period.”

“Additionally during the quarter, we completed funding the

equity portion of The Meadows Casino and Tunica Properties

acquisitions through our existing ATM program. GLPI sold

3,864,872 shares of common stock with an average price of $36.22.

This equity transaction demonstrates our focus on accretive growth

while responsively managing our balance sheet for long-term

stability and potential future acquisitions.”

The Company’s second quarter 2017 net income,

AFFO and Adjusted EBIDA as compared to its guidance were primarily

impacted by the following:

- Income from rental activities had a favorable variance of $0.4

million, primarily due to incremental rent from Hollywood Casino

Toledo;

- Results from the TRS Properties were favorable to guidance by

$0.5 million due to higher performance; and

- Finalization of the Tunica Properties transaction.

Portfolio Update

GLPI owns over 4,400 acres of land and approximately 15 million

square feet of building space, which was 100% occupied as of

June 30, 2017. At the end of the second quarter of 2017, the

Company owned the real estate associated with 38 casino facilities

and leases 20 of these facilities to PENN, 15 of these facilities

to PNK and one to Casino Queen in East St. Louis, Illinois.

Two of the gaming facilities, located in Baton Rouge, Louisiana and

Perryville, Maryland, are owned and operated by a subsidiary of

GLPI, GLP Holdings, Inc., (collectively, the “TRS Properties”).

Capital maintenance expenditures at the TRS Properties were $1.2

million for the three months ended June 30, 2017.

Balance Sheet Update

The Company had $29.5 million of unrestricted cash and $4.5

billion in total debt, including $1.1 billion of debt outstanding

under its unsecured credit facility term loans and $15.0 million

outstanding under its unsecured credit facility revolver at

June 30, 2017. The Company’s debt structure as of

June 30, 2017 was as follows:

| |

|

As of June 30, 2017 |

| |

|

Interest Rate |

|

Balance |

| |

|

|

|

(in thousands) |

| Unsecured Term Loan A

(1) |

|

2.959 |

% |

|

$ |

300,000 |

|

| Unsecured Term Loan A-1

(1) |

|

2.839 |

% |

|

825,000 |

|

| Unsecured $700 Million

Revolver (1) |

|

2.976 |

% |

|

15,000 |

|

| Senior Unsecured Notes

Due 2018 |

|

4.375 |

% |

|

550,000 |

|

| Senior Unsecured Notes

Due 2020 |

|

4.875 |

% |

|

1,000,000 |

|

| Senior Unsecured Notes

Due 2021 |

|

4.375 |

% |

|

400,000 |

|

| Senior Unsecured Notes

Due 2023 |

|

5.375 |

% |

|

500,000 |

|

| Senior Unsecured Notes

Due 2026 |

|

5.375 |

% |

|

975,000 |

|

| Capital Lease |

|

4.780 |

% |

|

1,286 |

|

| Total long-term

debt |

|

|

|

$ |

4,566,286 |

|

| Less: unamortized debt

issuance costs |

|

|

|

(44,863 |

) |

| Total long-term

debt, net of unamortized debt issuance costs |

|

|

|

$ |

4,521,423 |

|

|

|

|

|

|

|

|

|

(1) The rate on the term loan facilities and

revolver is Libor plus 1.75%. The Company's revolver and $300.0

million term loan credit facility mature on October 28, 2018 and

the incremental term loan of $825.0 million matures on April 28,

2021.

As of June 30, 2017, the Company had 210,824,182 weighted

average diluted shares outstanding.

Financing

During the three months ended June 30, 2017, GLPI sold 3,864,872

shares of common stock with an average price of $36.22 per share

under its at the market (“ATM”) program, which generated gross

proceeds of $140.0 million (net proceeds of approximately $139.4

million). The Company used the net proceeds from the ATM

Program to pay down the revolver which was utilized to fund the

equity portion of The Meadows Casino acquisition and to fund the

equity portion of the Tunica Properties acquisition.

Dividends

On April 25, 2017, the Company’s Board of Directors

declared the second quarter 2017 dividend. Shareholders of

record on June 16, 2017 received $0.62 per common share, which

was paid on June 30, 2017. On July 25, 2017, the

Company declared its third quarter 2017 dividend of $0.63 per

common share, payable on September 22, 2017 to shareholders of

record on September 8, 2017.

Guidance

The table below sets forth current guidance targets for

financial results for the 2017 third quarter and full year, based

on the following assumptions:

- Reflects the real estate asset acquisition of the Tunica

Properties, which closed on May 1, 2017;

- Reported rental income of approximately $829.8 million for the

year and $209.2 million for the third quarter, consisting of:

| |

|

|

|

|

| (in millions) |

|

Third Quarter |

|

Full Year |

| Cash Rental

Receipts |

|

|

|

|

| PENN |

|

$ |

114.0 |

|

|

$ |

454.0 |

|

| PNK |

|

102.8 |

|

|

406.3 |

|

| Casino Queen |

|

3.6 |

|

|

14.4 |

|

| PENN non-assigned land

lease |

|

(0.7 |

) |

|

(2.9 |

) |

| Total Cash

Rental Receipts |

|

$ |

219.7 |

|

|

$ |

871.8 |

|

| |

|

|

|

|

| Non-Cash

Adjustments |

|

|

|

|

| Straight-line rent |

|

$ |

(16.6 |

) |

|

$ |

(66.0 |

) |

| PNK direct financing

lease |

|

(18.6 |

) |

|

(73.1 |

) |

| Property taxes paid by

tenants |

|

21.6 |

|

|

85.8 |

|

| Land leases paid by

tenants |

|

3.1 |

|

|

11.3 |

|

| Total Rent as

Reported |

|

$ |

209.2 |

|

|

$ |

829.8 |

|

| |

|

|

|

|

|

|

|

|

- Cash rent includes incremental escalator on the PENN building

rent component effective November 1, 2016, which increases 2017

annual rent by $3.8 million, no escalator assumed effective

November 1, 2017;

- Cash rent includes incremental escalator on the PNK building

rent component effective April 28, 2017, which increases 2017

annual rent by $3.9 million;

- Adjusted EBITDA from the TRS Properties of approximately $37.5

million for the year and $8.6 million for the third quarter;

- Blended income tax rate at the TRS Properties of 44%;

- LIBOR is based on the forward yield curve;

- For the purpose of the dividend calculation, AFFO is reduced by

approximately $3.2 million for the full year and $0.7 million for

the third quarter prior to calculation of the dividend to account

for dividends on shares that will be outstanding after options held

by employees are exercised;

- The basic share count is approximately 210.8 million shares for

the year and 212.5 million shares for the third quarter and the

fully diluted share count is approximately 212.7 million shares for

the year and 214.5 million shares for the third quarter; and

- 2017 year-end total long-term debt to Adjusted EBITDA ratio of

approximately 5.1 times, which includes an $80 million repayment of

debt during the remainder of 2017 (of which $60 million occurred in

July).

| |

|

|

|

|

| |

|

Three Months Ended September 30, |

|

Full Year Ending December 31, |

|

(in millions, except per share data) |

|

2017Guidance |

|

2016Actual |

|

Revised 2017 Guidance |

|

Prior 2017 Guidance

(4) |

|

2016 Actual |

| Net

Revenue |

|

$ |

243.5 |

|

|

$ |

233.3 |

|

|

$ |

971.5 |

|

|

$ |

971.3 |

|

|

$ |

828.3 |

|

| |

|

|

|

|

|

|

|

|

|

|

| Net

Income |

|

$ |

95.9 |

|

|

$ |

89.6 |

|

|

$ |

381.4 |

|

|

$ |

381.1 |

|

|

$ |

289.3 |

|

| Losses or (gains) from

dispositions of property |

|

— |

|

|

(0.4 |

) |

|

0.1 |

|

|

0.1 |

|

|

(0.5 |

) |

| Real estate

depreciation |

|

25.3 |

|

|

23.8 |

|

|

100.6 |

|

|

101.4 |

|

|

96.1 |

|

| Funds From

Operations (1) |

|

$ |

121.2 |

|

|

$ |

113.0 |

|

|

$ |

482.1 |

|

|

$ |

482.6 |

|

|

$ |

384.9 |

|

| Straight-line rent

adjustments |

|

16.6 |

|

|

14.5 |

|

|

66.0 |

|

|

65.0 |

|

|

58.7 |

|

| Direct financing lease

adjustments |

|

18.6 |

|

|

18.0 |

|

|

73.1 |

|

|

73.1 |

|

|

48.5 |

|

| Other depreciation |

|

3.4 |

|

|

3.4 |

|

|

13.0 |

|

|

13.0 |

|

|

13.5 |

|

| Amortization of land

rights |

|

2.7 |

|

|

2.3 |

|

|

10.3 |

|

|

9.3 |

|

|

6.2 |

|

| Debt issuance costs

amortization |

|

3.3 |

|

|

3.3 |

|

|

13.0 |

|

|

13.0 |

|

|

15.1 |

|

| Stock based

compensation |

|

3.7 |

|

|

4.6 |

|

|

15.6 |

|

|

15.6 |

|

|

18.3 |

|

| Maintenance CAPEX |

|

(0.9 |

) |

|

(0.5 |

) |

|

(3.6 |

) |

|

(3.6 |

) |

|

(3.1 |

) |

| Adjusted Funds

From Operations (2) |

|

$ |

168.6 |

|

|

$ |

158.6 |

|

|

$ |

669.5 |

|

|

$ |

668.0 |

|

|

$ |

542.1 |

|

| Interest, net |

|

53.9 |

|

|

52.4 |

|

|

215.6 |

|

|

216.3 |

|

|

183.8 |

|

| Income tax expense |

|

1.7 |

|

|

1.3 |

|

|

7.9 |

|

|

7.6 |

|

|

7.5 |

|

| Maintenance CAPEX |

|

0.9 |

|

|

0.5 |

|

|

3.6 |

|

|

3.6 |

|

|

3.1 |

|

| Debt issuance costs

amortization |

|

(3.3 |

) |

|

(3.3 |

) |

|

(13.0 |

) |

|

(13.0 |

) |

|

(15.1 |

) |

| Adjusted EBITDA

(3) |

|

$ |

221.8 |

|

|

$ |

209.5 |

|

|

$ |

883.6 |

|

|

$ |

882.5 |

|

|

$ |

721.4 |

|

| |

|

|

|

|

|

|

|

|

|

|

| Net income, per

diluted common share |

|

$ |

0.45 |

|

|

$ |

0.43 |

|

|

$ |

1.79 |

|

|

$ |

1.80 |

|

|

$ |

1.60 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) FFO is net income, excluding (gains) or losses from

sales of property and real estate depreciation as defined by

NAREIT.

(2) AFFO is FFO, excluding stock based compensation

expense, debt issuance costs amortization, other depreciation,

amortization of land rights, straight-line rent adjustments and

direct financing lease adjustments, reduced by capital maintenance

expenditures.

(3) Adjusted EBITDA is net income excluding interest,

taxes on income, depreciation, (gains) or losses from sales of

property, stock based compensation expense, straight-line rent

adjustments, direct financing lease adjustments and the

amortization of land rights.

(4) The guidance figures in the tables above present the

guidance provided on April 27, 2017, for the year ended

December 31, 2017.

Conference Call Details

The Company will hold a conference call on July 27, 2017 at

11:00 a.m. (Eastern Time) to discuss its financial results,

current business trends and market conditions.

Webcast

The conference call will be available in the Investor Relations

section of the Company's website at www.glpropinc.com. To listen to

a live broadcast, go to the site at least 15 minutes prior to the

scheduled start time in order to register, download and install any

necessary audio software. A replay of the call will also be

available for 90 days on the Company’s website.

To Participate in the Telephone

Conference Call:Dial in at least five minutes prior to

start time.Domestic: 1-877-407-0784International:

1-201-689-8560

Conference Call

Playback:Domestic: 1-844-512-2921International:

1-412-317-6671Passcode: 13666045The playback can be accessed

through August 3, 2017.

Disclosure Regarding Non-GAAP Financial

Measures

Funds From Operations (“FFO”), Adjusted Funds From Operations

(“AFFO”) and Adjusted EBITDA, which are detailed in the

reconciliation tables that accompany this release, are used by the

Company as performance measures for benchmarking against the

Company’s peers and as internal measures of business operating

performance, which is used for a bonus metric. The Company

believes FFO, AFFO, and Adjusted EBITDA provide a meaningful

perspective of the underlying operating performance of the

Company’s current business. This is especially true since

these measures exclude real estate depreciation, and we believe

that real estate values fluctuate based on market conditions rather

than depreciating in value ratably on a straight-line basis over

time. In addition, in order for the Company to qualify as a REIT,

it must distribute 90% of its REIT taxable income annually.

The Company adjusts AFFO accordingly to provide our investors an

estimate of taxable income for this distribution requirement.

Direct financing lease adjustments represent the portion of cash

rent we receive from tenants that is applied against our lease

receivable and thus not recorded as revenue and the amortization of

land rights represents the non-cash amortization of the value

assigned to the Company's assumed ground leases.

FFO, AFFO and Adjusted EBITDA are non-GAAP financial measures,

that are considered a supplemental measure for the real estate

industry and a supplement to GAAP measures. NAREIT defines FFO

as net income (computed in accordance with generally accepted

accounting principles), excluding (gains) or losses from sales of

property and real estate depreciation. We have defined AFFO

as FFO excluding stock based compensation expense, debt issuance

costs amortization, other depreciation, amortization of land

rights, straight-line rent adjustments and direct financing lease

adjustments, reduced by capital maintenance

expenditures. Finally, we have defined Adjusted EBITDA as net

income excluding interest, taxes on income, depreciation, (gains)

or losses from sales of property, stock based compensation expense,

straight-line rent adjustments, direct financing lease adjustments

and the amortization of land rights.

FFO, AFFO and Adjusted EBITDA are not recognized terms under

GAAP. Because certain companies do not calculate FFO, AFFO,

and Adjusted EBITDA in the same way and certain other companies may

not perform such calculation, those measures as used by other

companies may not be consistent with the way the Company calculates

such measures and should not be considered as alternative measures

of operating profit or net income. The Company’s presentation

of these measures does not replace the presentation of the

Company’s financial results in accordance with GAAP.

About Gaming and Leisure Properties

GLPI is engaged in the business of acquiring, financing, and

owning real estate property to be leased to gaming operators in

triple-net lease arrangements, pursuant to which the tenant is

responsible for all facility maintenance, insurance required in

connection with the leased properties and the business conducted on

the leased properties, taxes levied on or with respect to the

leased properties and all utilities and other services necessary or

appropriate for the leased properties and the business conducted on

the leased properties. GLPI expects to grow its portfolio by

pursuing opportunities to acquire additional gaming facilities to

lease to gaming operators. GLPI also intends to diversify its

portfolio over time, including by acquiring properties outside the

gaming industry to lease to third parties. GLPI elected to be taxed

as a REIT for United States federal income tax purposes commencing

with the 2014 taxable year and is the first gaming-focused REIT in

North America.

Forward-Looking Statements

This press release includes “forward-looking statements” within

the meaning of Section 27A of the Securities Act and

Section 21E of the Securities Exchange Act of 1934, as

amended, including statements regarding our financial outlook for

the third quarter of 2017 and the full 2017 fiscal year and our

expectations regarding future acquisitions and dividend payments.

Forward looking statements can be identified by the use of forward

looking terminology such as “expects,” “believes,” “estimates,”

“intends,” “may,” “will,” “should” or “anticipates” or the negative

or other variation of these or similar words, or by discussions of

future events, strategies or risks and uncertainties. Such

forward looking statements are inherently subject to risks,

uncertainties and assumptions about GLPI and its subsidiaries,

including risks related to the following: the ability to receive,

or delays in obtaining, the regulatory approvals required to own

and/or operate its properties, or other delays or impediments to

completing GLPI’s planned acquisitions or projects; GLPI's ability

to maintain its status as a REIT; the availability of and the

ability to identify suitable and attractive acquisition and

development opportunities and the ability to acquire and lease

those properties on favorable terms; our ability to access capital

through debt and equity markets in amounts and at rates and costs

acceptable to GLPI, including through GLPI's existing ATM program;

changes in the U.S. tax law and other state, federal or local laws,

whether or not specific to REITs or to the gaming or lodging

industries; and other factors described in GLPI’s Annual Report on

Form 10-K for the year ended December 31, 2016, Quarterly

Reports on Form 10-Q and Current Reports on Form 8-K, each as

filed with the Securities and Exchange Commission. All subsequent

written and oral forward looking statements attributable to GLPI or

persons acting on GLPI’s behalf are expressly qualified in their

entirety by the cautionary statements included in this press

release. GLPI undertakes no obligation to publicly update or revise

any forward- looking statements contained or incorporated by

reference herein, whether as a result of new information, future

events or otherwise, except as required by law. In light of these

risks, uncertainties and assumptions, the forward-looking events

discussed in this press release may not occur.

Additional Information

This communication shall not constitute an offer to sell or the

solicitation of an offer to buy any securities, nor shall there be

any sale of securities in any jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such jurisdiction.

No offering of securities shall be made except by means of a

prospectus meeting the requirements of Section 10 of the U.S.

Securities Act of 1933, as amended. In connection with the

establishment of its ATM Program, the Company filed with the SEC a

prospectus supplement dated August 9, 2016 to the prospectus

contained in its effective Registration Statement on Form S-3 (No.

333-210423), filed with the SEC on March 28, 2016. This

communication is not a substitute for the filed Registration

Statement/prospectus or any other document that the Company may

file with the SEC or send to its shareholders in connection with

the proposed transactions. INVESTORS AND SECURITY HOLDERS ARE URGED

TO READ THE REGISTRATION STATEMENT AND PROSPECTUS THAT HAVE BEEN

FILED WITH THE SEC AND OTHER RELEVANT DOCUMENTS THAT WILL BE FILED

WITH THE SEC IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY

CONTAIN, OR WILL CONTAIN, IMPORTANT INFORMATION. You may obtain

free copies of the registration statement/prospectus and other

relevant documents filed by the Company with the SEC at the SEC’s

website at www.sec.gov. Copies of the documents filed with the SEC

by the Company are available free of charge on the Company’s

investor relations website at investors.glpropinc.com or by

contacting the Company’s investor relations representative at (203)

682-8211.

Contact

Investor Relations – Gaming and Leisure

Properties, Inc.

Bill CliffordT: 610-401-2900Email:

Bclifford@glpropinc.com

Hayes CroushoreT: 610-378-8396Email:

Hcroushore@glpropinc.com

| |

| GAMING AND LEISURE PROPERTIES, INC. AND

SUBSIDIARIES |

| Consolidated Statements of

Operations |

| (in thousands, except per share data) (unaudited) |

| |

|

|

|

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| |

2017 |

|

2016 |

|

2017 |

|

2016 |

|

Revenues |

|

|

|

|

|

|

|

| Rental

income |

$ |

167,763 |

|

|

$ |

142,101 |

|

|

$ |

332,924 |

|

|

$ |

242,316 |

|

| Income

from direct financing lease |

18,516 |

|

|

12,631 |

|

|

36,340 |

|

|

12,631 |

|

| Real

estate taxes paid by tenants |

20,840 |

|

|

15,673 |

|

|

42,560 |

|

|

27,500 |

|

| Total rental revenue

and income from direct financing lease |

207,119 |

|

|

170,405 |

|

|

411,824 |

|

|

282,447 |

|

| Gaming,

food, beverage and other |

37,489 |

|

|

38,371 |

|

|

76,749 |

|

|

76,530 |

|

| Total revenues |

244,608 |

|

|

208,776 |

|

|

488,573 |

|

|

358,977 |

|

| Less

promotional allowances |

(1,217 |

) |

|

(1,415 |

) |

|

(2,469 |

) |

|

(2,796 |

) |

| Net revenues |

243,391 |

|

|

207,361 |

|

|

486,104 |

|

|

356,181 |

|

| Operating

expenses |

|

|

|

|

|

|

|

| Gaming,

food, beverage and other |

20,669 |

|

|

21,189 |

|

|

41,745 |

|

|

42,176 |

|

| Real

estate taxes |

20,912 |

|

|

16,075 |

|

|

43,055 |

|

|

28,282 |

|

| General

and administrative |

20,691 |

|

|

22,261 |

|

|

41,922 |

|

|

43,167 |

|

|

Depreciation |

28,423 |

|

|

27,019 |

|

|

56,680 |

|

|

54,102 |

|

| Total operating

expenses |

90,695 |

|

|

86,544 |

|

|

183,402 |

|

|

167,727 |

|

| Income from

operations |

152,696 |

|

|

120,817 |

|

|

302,702 |

|

|

188,454 |

|

| |

|

|

|

|

|

|

|

| Other income

(expenses) |

|

|

|

|

|

|

|

| Interest

expense |

(54,657 |

) |

|

(45,936 |

) |

|

(108,606 |

) |

|

(79,337 |

) |

| Interest

income |

487 |

|

|

654 |

|

|

951 |

|

|

1,171 |

|

| Total other

expenses |

(54,170 |

) |

|

(45,282 |

) |

|

(107,655 |

) |

|

(78,166 |

) |

| |

|

|

|

|

|

|

|

| Income from

operations before income taxes |

98,526 |

|

|

75,535 |

|

|

195,047 |

|

|

110,288 |

|

| Income tax

expense |

2,192 |

|

|

2,271 |

|

|

4,722 |

|

|

4,275 |

|

| Net

income |

$ |

96,334 |

|

|

$ |

73,264 |

|

|

$ |

190,325 |

|

|

$ |

106,013 |

|

| |

|

|

|

|

|

|

|

| Earnings per

common share: |

|

|

|

|

|

|

|

| Basic earnings per

common share |

$ |

0.46 |

|

|

$ |

0.40 |

|

|

$ |

0.91 |

|

|

$ |

0.70 |

|

| Diluted earnings per

common share |

$ |

0.45 |

|

|

$ |

0.39 |

|

|

$ |

0.90 |

|

|

$ |

0.69 |

|

| GAMING AND LEISURE PROPERTIES, INC. AND

SUBSIDIARIES |

| Operations |

| (in thousands) (unaudited) |

| |

|

|

|

| |

NET REVENUES |

|

ADJUSTED EBITDA |

| |

Three Months Ended June 30, |

|

Three Months Ended June 30, |

| |

2017 |

|

2016 |

|

2017 |

|

2016 |

| Real estate |

$ |

207,119 |

|

|

$ |

170,405 |

|

|

$ |

212,114 |

|

|

$ |

170,356 |

|

| GLP Holdings, LLC.

(TRS) |

36,272 |

|

|

36,956 |

|

|

10,081 |

|

|

10,093 |

|

|

Total |

$ |

243,391 |

|

|

$ |

207,361 |

|

|

$ |

222,195 |

|

|

$ |

180,449 |

|

| |

|

|

|

|

|

|

|

| |

NET REVENUES |

|

ADJUSTED EBITDA |

| |

Six Months Ended June 30, |

|

Six Months Ended June 30, |

| |

2017 |

|

2016 |

|

2017 |

|

2016 |

| Real estate |

$ |

411,824 |

|

|

$ |

282,447 |

|

|

$ |

420,224 |

|

|

$ |

273,866 |

|

| GLP Holdings, LLC.

(TRS) |

74,280 |

|

|

73,734 |

|

|

20,991 |

|

|

19,816 |

|

|

Total |

$ |

486,104 |

|

|

$ |

356,181 |

|

|

$ |

441,215 |

|

|

$ |

293,682 |

|

| GAMING AND LEISURE PROPERTIES, INC. AND

SUBSIDIARIES |

| General and Administrative

Expenses |

| (in thousands) (unaudited) |

| |

|

|

|

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| |

2017 |

|

2016 |

|

2017 |

|

2016 |

| Real estate general and

administrative expenses (1) (2) |

$ |

15,233 |

|

|

$ |

16,962 |

|

|

$ |

30,734 |

|

|

$ |

32,190 |

|

| GLP Holdings, LLC.

(TRS) general and administrative expenses (2) |

5,458 |

|

|

5,299 |

|

|

11,188 |

|

|

10,977 |

|

|

Total |

$ |

20,691 |

|

|

$ |

22,261 |

|

|

$ |

41,922 |

|

|

$ |

43,167 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Includes REIT expenses such as rent expense and

amortization of land rights of $6.0 million and $11.2 million for

the three and six months ended June 30, 2017, respectively,

and $3.8 million and $4.5 million for the three and six months

ended June 30, 2016, respectively.

(2) General and administrative expenses include payroll

related expenses, insurance, utilities, professional fees, rent

expense, amortization of land rights and other administrative

costs.

| Reconciliation of Net income (GAAP) to FFO, FFO to

AFFO, and AFFO to Adjusted EBITDA |

| Gaming and Leisure Properties, Inc. and

Subsidiaries |

| CONSOLIDATED |

| (in thousands) (unaudited) |

| |

|

|

|

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| |

2017 |

|

2016 |

|

2017 |

|

2016 |

| Net

income |

$ |

96,334 |

|

|

$ |

73,264 |

|

|

$ |

190,325 |

|

|

$ |

106,013 |

|

| (Gains) or losses from

dispositions of property |

(11 |

) |

|

— |

|

|

94 |

|

|

(15 |

) |

| Real estate

depreciation |

25,108 |

|

|

23,671 |

|

|

50,011 |

|

|

47,362 |

|

| Funds from

operations |

$ |

121,431 |

|

|

$ |

96,935 |

|

|

$ |

240,430 |

|

|

$ |

153,360 |

|

| Straight-line rent

adjustments |

16,493 |

|

|

13,956 |

|

|

32,738 |

|

|

27,912 |

|

| Direct financing lease

adjustments |

18,232 |

|

|

12,525 |

|

|

35,845 |

|

|

12,525 |

|

| Other depreciation

(1) |

3,315 |

|

|

3,348 |

|

|

6,669 |

|

|

6,740 |

|

| Amortization of land

rights |

2,589 |

|

|

1,541 |

|

|

4,900 |

|

|

1,541 |

|

| Debt issuance costs

amortization |

3,256 |

|

|

3,050 |

|

|

6,513 |

|

|

8,632 |

|

| Stock based

compensation |

3,773 |

|

|

4,591 |

|

|

8,256 |

|

|

9,163 |

|

| Maintenance CAPEX

(2) |

(1,245 |

) |

|

(835 |

) |

|

(1,727 |

) |

|

(1,197 |

) |

| Adjusted funds

from operations |

$ |

167,844 |

|

|

$ |

135,111 |

|

|

$ |

333,624 |

|

|

$ |

218,676 |

|

| Interest, net |

54,170 |

|

|

45,282 |

|

|

107,655 |

|

|

78,166 |

|

| Income tax expense |

2,192 |

|

|

2,271 |

|

|

4,722 |

|

|

4,275 |

|

| Maintenance CAPEX

(2) |

1,245 |

|

|

835 |

|

|

1,727 |

|

|

1,197 |

|

| Debt issuance costs

amortization |

(3,256 |

) |

|

(3,050 |

) |

|

(6,513 |

) |

|

(8,632 |

) |

| Adjusted

EBITDA |

$ |

222,195 |

|

|

$ |

180,449 |

|

|

$ |

441,215 |

|

|

$ |

293,682 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Other depreciation includes both real estate and

equipment depreciation from the Company's taxable REIT subsidiaries

as well as equipment depreciation from the REIT subsidiaries.

(2) Capital maintenance expenditures are expenditures to

replace existing fixed assets with a useful life greater than one

year that are obsolete, worn out or no longer cost effective to

repair.

| Reconciliation of Net income (GAAP) to FFO, FFO to

AFFO, and AFFO to Adjusted EBITDA |

| Gaming and Leisure Properties, Inc. and

Subsidiaries |

| REAL ESTATE and CORPORATE (REIT) |

| (in thousands) (unaudited) |

| |

|

|

|

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| |

2017 |

|

2016 |

|

2017 |

|

2016 |

| Net

income |

$ |

93,590 |

|

|

$ |

70,654 |

|

|

$ |

184,369 |

|

|

$ |

100,755 |

|

| (Gains) or losses from

dispositions of property |

— |

|

|

— |

|

|

— |

|

|

— |

|

| Real estate

depreciation |

25,108 |

|

|

23,671 |

|

|

50,011 |

|

|

47,362 |

|

| Funds from

operations |

$ |

118,698 |

|

|

$ |

94,325 |

|

|

$ |

234,380 |

|

|

$ |

148,117 |

|

| Straight-line rent

adjustments |

16,493 |

|

|

13,956 |

|

|

32,738 |

|

|

27,912 |

|

| Direct financing lease

adjustments |

18,232 |

|

|

12,525 |

|

|

35,845 |

|

|

12,525 |

|

| Other depreciation

(1) |

518 |

|

|

526 |

|

|

1,039 |

|

|

1,047 |

|

| Amortization of land

rights |

2,589 |

|

|

1,541 |

|

|

4,900 |

|

|

1,541 |

|

| Debt issuance costs

amortization |

3,256 |

|

|

3,050 |

|

|

6,513 |

|

|

8,632 |

|

| Stock based

compensation |

3,773 |

|

|

4,591 |

|

|

8,256 |

|

|

9,163 |

|

| Maintenance CAPEX |

— |

|

|

— |

|

|

— |

|

|

— |

|

| Adjusted funds

from operations |

$ |

163,559 |

|

|

$ |

130,514 |

|

|

$ |

323,671 |

|

|

$ |

208,937 |

|

| Interest, net (2) |

51,569 |

|

|

42,682 |

|

|

102,454 |

|

|

72,965 |

|

| Income tax expense |

242 |

|

|

210 |

|

|

612 |

|

|

596 |

|

| Maintenance CAPEX |

— |

|

|

— |

|

|

— |

|

|

— |

|

| Debt issuance costs

amortization |

(3,256 |

) |

|

(3,050 |

) |

|

(6,513 |

) |

|

(8,632 |

) |

| Adjusted

EBITDA |

$ |

212,114 |

|

|

$ |

170,356 |

|

|

$ |

420,224 |

|

|

$ |

273,866 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Other depreciation includes equipment depreciation

from the Company's REIT subsidiaries as well as equipment

depreciation from the REIT subsidiaries.

(2) Interest expense, net is net of intercompany

interest eliminations of $2.6 million and $5.2 million for both the

three and six months ended June 30, 2017 and 2016,

respectively.

| Reconciliation of Net income (GAAP) to FFO, FFO to

AFFO, and AFFO to Adjusted EBITDA |

| Gaming and Leisure Properties, Inc. and

Subsidiaries |

| GLP HOLDINGS, LLC (TRS) |

| (in thousands) (unaudited) |

| |

|

|

|

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| |

2017 |

|

2016 |

|

2017 |

|

2016 |

| Net

income |

$ |

2,744 |

|

|

$ |

2,610 |

|

|

$ |

5,956 |

|

|

$ |

5,258 |

|

| (Gains) or losses from

dispositions of property |

(11 |

) |

|

— |

|

|

94 |

|

|

(15 |

) |

| Real estate

depreciation |

— |

|

|

— |

|

|

— |

|

|

— |

|

| Funds from

operations |

$ |

2,733 |

|

|

$ |

2,610 |

|

|

$ |

6,050 |

|

|

$ |

5,243 |

|

| Straight-line rent

adjustments |

— |

|

|

— |

|

|

— |

|

|

— |

|

| Direct financing lease

adjustments |

— |

|

|

— |

|

|

— |

|

|

— |

|

| Other depreciation

(1) |

2,797 |

|

|

2,822 |

|

|

5,630 |

|

|

5,693 |

|

| Amortization of land

rights |

— |

|

|

— |

|

|

— |

|

|

— |

|

| Debt issuance costs

amortization |

— |

|

|

— |

|

|

— |

|

|

— |

|

| Stock based

compensation |

— |

|

|

— |

|

|

— |

|

|

— |

|

| Maintenance CAPEX

(2) |

(1,245 |

) |

|

(835 |

) |

|

(1,727 |

) |

|

(1,197 |

) |

| Adjusted funds

from operations |

$ |

4,285 |

|

|

$ |

4,597 |

|

|

$ |

9,953 |

|

|

$ |

9,739 |

|

| Interest, net |

2,601 |

|

|

2,600 |

|

|

5,201 |

|

|

5,201 |

|

| Income tax expense |

1,950 |

|

|

2,061 |

|

|

4,110 |

|

|

3,679 |

|

| Maintenance CAPEX

(2) |

1,245 |

|

|

835 |

|

|

1,727 |

|

|

1,197 |

|

| Debt issuance costs

amortization |

— |

|

|

— |

|

|

— |

|

|

— |

|

| Adjusted

EBITDA |

$ |

10,081 |

|

|

$ |

10,093 |

|

|

$ |

20,991 |

|

|

$ |

19,816 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Other depreciation includes both real estate and

equipment depreciation from the Company's taxable REIT subsidiaries

as well as equipment depreciation from the REIT subsidiaries.

(2) Capital maintenance expenditures are expenditures to

replace existing fixed assets with a useful life greater than one

year that are obsolete, worn out or no longer cost effective to

repair.

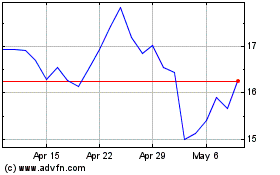

PENN Entertainment (NASDAQ:PENN)

Historical Stock Chart

From Mar 2024 to Apr 2024

PENN Entertainment (NASDAQ:PENN)

Historical Stock Chart

From Apr 2023 to Apr 2024