Report of Foreign Issuer (6-k)

July 27 2017 - 6:43AM

Edgar (US Regulatory)

Table of Contents

United States

Securities and Exchange Commission

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the

Securities Exchange Act of 1934

For the month of

July 2017

Vale S.A.

Avenida das Américas, No. 700 — Bloco 8, Sala 218

22640-100 Rio de Janeiro, RJ, Brazil

(Address of principal executive office)

(Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

(Check One) Form 20-F

x

Form 40-F

o

(Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1))

(Check One) Yes

o

No

x

(Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7))

(Check One) Yes

o

No

x

(Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.)

(Check One) Yes

o

No

x

(If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b). 82- .)

KJJN

Ricardo Teles/Vale Vale’s Performance in 2Q17

www.vale.com vale.ri@vale.com App Vale Investors & Media iOS: https://itunes.apple.com/us/app/vale-investor-media-portugues/id1087134066?ls=1&mt=8 Android: https://play.google.com/store/apps/details?id=com.theirapp.valeport Tel.: (55 21) 3485-3900 Investor Relations Department André Figueiredo André Werner Carla Albano Miller Fernando Mascarenhas Andrea Gutman Bruno Siqueira Claudia Rodrigues Denise Caruncho Mariano Szachtman Renata Capanema BM&F BOVESPA: VALE3, VALE5 NYSE: VALE, VALE.P EURONEXT PARIS: VALE3, VALE5 LATIBEX: XVALO, XVALP Except where otherwise indicated the operational and financial inform ation in this release is based on the consolidated figures in accordance with IFRS and, with the exception of inform ation on investm ents and behavior of m arkets, quarterly financial statem ents are reviewed by the com pany’s independent auditors. The m ain subsidiaries that are consolidated are the following: M ineração Corumbaense Reunida S.A., PT Vale Indonesia Tbk (form erly International Nickel Indonesia Tbk), Salobo M etais S.A, Vale Australia Pty Ltd., Vale International Holdings GM BH, Vale Canada Lim ited (form erly Vale Inco Lim ited), Vale International S.A., Vale M anganês S.A., Vale M oçam bique S.A., Vale Nouvelle-Calédonie SAS, Vale Om an Pelletizing Com pany LLC and Vale Shipping Holding PTE Ltd.

Vale’s performance in 2Q17 Strong free cash flow of US$ 2.151 billion in 2Q17, despite the sharp decrease of the Platts IODEX and the payment of SUMIC put option on Vale New Caledonia, enabling dividend distribution and net debt reduction of US$ 655 million in 2Q17. By the end of 2017, Vale will reach a comfortable leverage level. Adjusted EBITDA was US$ 2.729 billion in 2Q17, 36.7% lower than in 1Q17, mainly as a result of the 26.6% reduction of the Platts IODEX. Adjusted EBITDA for Ferrous Minerals represented 82% of total adjusted EBITDA. Costs and expenses totaled US$ 4.588 billion in 2Q17 increasing US$ 381 million vs. 1Q17, mainly as a result of non-recurrent effects. In order to consolidate a systemic and sustainable approach to cost management, Vale retained the services of Falconi consulting company to conduct a pilot project in its pelletizing business that can then be expanded to the whole company in the future. Iron ore price realization decreased by US$ 24.4/t due to the US$ 22.7/t reduction in the Platts IODEX. Vale’s significant premiums for its 65% iron ore were offset by large discounts on some low grades/high silica material, which had to be sold directly without blending. “As a response to such market conditions, Vale will from 2H17 onwards reduce its production of high silica products by an annualized rate of 19 Mt to increase price realization, keeping the long term production guidance limited to 400 Mtpa”, commented Mr. Peter Poppinga, Executive Officer for Ferrous Minerals and Coal. “Rebalancing the portfolio according to market conditions through product management and increasing offshore blending will continue to maximize our margins”. Iron ore and pellets shipments1 totaled 81.6 Mt in 2Q17 while iron ore fines sales volumes reached 69.0 Mt leading to the build-up of 5.3 Mt of offshore inventories to further support higher levels of blending activities, especially in 11 Chinese ports, in which we are already blending. Iron ore C1 cash cost increased by 6.9% to R$ 49.3/t (USD 15.2/t), as a result of a one-off railway tariff charge (MRS2), higher demurrage costs and seasonally higher maintenance costs. Costs are expected to decrease to the range of R$ 46 - 47/t in 2H17, back to the BRL levels of two years ago, due to the combination of higher production, seasonally lower maintenance costs and productivity gains. Adjusted EBITDA for Base Metals was US$ 386 million as the impact of lower nickel and copper prices (US$ 112 million) was partially offset by lower expenses (US$ 34 million), higher volumes 1 Shipm ents from Brazil and Argentina. 2 Southern system third party railway.

(US$ 29 million), favorable exchange rate variation (US$ 11 million) and higher by-product prices (US$ 10 million). Nickel production guidance for 2017 was reduced to 295 kt, 7% lower than our Vale Day guidance, as a result of actions to adjust our supply of nickel to a lower price environment including placing non-competitive mines, such as Stobie in Sudbury and Birchtree in Manitoba, on care and maintenance, and also reflecting lower than planned first half production in Manitoba, New Caledonia and Indonesia. Adjusted EBITDA for Coal was US$ 157 million in 2Q17, recording a positive result for a third consecutive quarter on higher prices, higher volumes and lower costs at the mine and processing plants, which decreased by 16% in 2Q17 vs. 1Q17, due to the successful ramp-up of Moatize II and the strong performance of both processing plants. Capital Expenditures were US$ 894 million in 2Q17, breaking through the sub US$ 1 billion mark and the lowest for a quarter since 3Q06. “With the further reduction in S11D expenditures and in other large sustaining investment programs such as the Nickel Atmospheric Emissions Reduction – AER project in Sudbury, we can aim for further CAPEX reductions in 2018. This means that Vale’s free cash flows can continue to increase even in an environment of lower prices”, highlighted Chief Financial Officer Luciano Siani Pires. “This provides breathing space while we tackle and reverse the recent increase in costs”. Chief Executive Officer Fabio Schvartsman commented on the first results partially under his oversight: “I feel there is a lot of energy in the company to take performance a step further, building on the strengths of previous efforts. A strong focus on execution will continue to boost cash flows. In the meantime, we are about to conclude our 60-day strategic diagnosis, which will guide us in our implementation of important strategic initiatives aiming at results in the short-term.” Market Overview In the 2Q17, Platts IODEX 62% Fe averaged US$ 62.90/dmt, being 26.6% lower than in 1Q17. Prices decelerated after peaking in February at US$ 95.05/dmt, as a result of the higher supply driven by higher prices in the beginning of 2017. Despite lower prices, premiums for high grade3 averaged US$ 13.61/dmt, an all-time record, while discounts for the high silica product4 deepened further to US$ 21.03/dmt, with the difference signaling the imbalance of supply between high and low Fe grades. The increase in iron ore supply was not entirely absorbed by demand, leading inventories at Chinese ports to surge. Meanwhile, demand for steel remained resilient in 1H17, supported by fixed asset investments in the infrastructure and manufacturing sectors. Steel demand from the housing sector should improve in the near future as better than expected housing sales led housing inventories to approach more regular levels in June. Coking coal prices experienced high volatility in 2Q17. The quarter started just a week after tropical Cyclone Debbie hit the world’s main coal exporting region in Australia, leading prices to peak at nearly US$ 305/t in mid-April. From then onwards, prices receded bringing the 2Q17 average to US$ 190.3/t, still 15% higher than 1Q17. 3 Difference between the 65% Fe M etal Bulletin index and the Platts IODEX 62% Fe. 4 Difference between the Platts IODEX 62% Fe and the 58% Fe M etal Bulletin index.

Coking coal demand from China drove imports to 30 Mt in the first five months of the year, on the back of lower seaborne prices and a relatively healthy steel sector in the country. The coking coal supply from Australia recovered in June to more regular loading levels with estimated losses of 12 Mt during 2Q17, mostly due to disruptions caused by Cyclone Debbie. Export losses from Queensland supported an increase in exports from the United States and Mongolia with Chinese domestic production making up for the balance. LME nickel prices retreated 10.2% during 2Q17 to an average of US$ 9,225/t. The price decline over the quarter can be attributed to two main reasons: weaker demand on account of lower Chinese stainless steel production and continued uncertainty in nickel ore export volumes from Indonesia. Following the decision of the Indonesian government to allow exports for “low-grade” ore (<1.7% Ni) from the country, the Indonesian government granted export licenses to three companies totaling 6 Mt of nickel ore for one year. The additional supply of Indonesian nickel ore into the market has caused downward pressure on ore and nickel prices. The average LME copper price dropped 3% in 2Q17 to US$ 5,662/t. Prices rebounded towards the end of the quarter as inventories on the LME and SHFE decreased -41.5kt and -130.8 kt, respectively vs. 1Q17 and demand for refined copper started to improve, particularly in China and Northeast Asia. On the supply side, global refined copper production was slightly up during 2Q17 as supply disruptions have stabilized relative to 1Q17. Despite this effect, copper concentrate imports into China increased approximately 2% in 5M17 vs. 5M16, reflecting demand associated with the ongoing expansion of smelter capacity. Meanwhile, refined copper imports declined 28% over the same period as scrap continued to displace refined material. Selected financial indicators US$ million 2Q17 1Q17 2Q16 Net operating revenues 7,235 8,515 6,162 Total costs and expenses 5,492 5,115 4,764

Operating revenues Net operating revenues in 2Q17 were US$ 7.235 billion, 15.0% lower than in 1Q17. The decrease in sales revenues was mainly due to lower prices of Ferrous Minerals (US$ 1.816 billion) and Base Metals (US$ 101 million), which were partially offset by higher realized sales volumes of Ferrous Minerals (US$ 433 million) and sales price and volumes of Coal (US$ 157 million). Net operating revenue by destination Net operating revenues by destination in 2Q17

Net operating revenue by business area

Costs and expenses COST OF GOODS SOLD (COGS) COGS5 totaled US$ 5.102 billion in 2Q17, increasing US$ 368 million from the US$ 4.734 billion recorded in 1Q17, as a result of higher sales volumes (US$ 243 million), higher freight costs in iron ore fines and pellets (US$ 33 million), higher leasing costs from the pelletizing plants (US$ 29 million) and higher services and material costs (US$ 78 million), which were partially offset by exchange rate variations (US$ 58 million). Further details regarding cost performance are provided in the “Performance of the Business Segments” section. COGS by business segment 3,142 62 2,826 60 2,579 60 Ferrous Minerals Base Metals 1,452 28 1,455 31 1,424 33 EXPENSES Total expenses amounted to US$ 390 million in 2Q17, slightly higher than the US$ 381 million in 1Q17, mainly due to higher R&D expenses (US$ 15 million), higher Other operating expenses (US$ 11 million) and higher SG&A (US$ 8 million), which were partially offset by lower Pre-operating and stoppage expenses (US$ 25 million). SG&A totaled US$ 132 million in 2Q17, US$ 8 million higher than in 1Q17. SG&A, net of depreciation, was US$ 110 million, increasing US$ 15 million in 2Q17 vs. 1Q17. R&D expenses totaled US$ 80 million in 2Q17, increasing 23.1% from the US$ 65 million recorded in 1Q17, following the usual seasonality of low disbursements in the first quarter. Pre-operating and stoppage expenses totaled US$ 90 million in 2Q17, decreasing by 21.7% from the US$ 115 million recorded in 1Q17, mainly due to the reduction of Long Harbour pre-operating expenses. The refinery is successfully ramping up and, as a result, there will be no additional pre-operating expenses charged to Long Harbour. 5 COGS currency exposure in 2Q17 was as follows: 53% BRL, 32% USD, 11% CAD, 3% EUR and 1% other currencies.

Other operating expenses were US$ 88 million in 2Q17, increasing US$ 11 million when compared to the US$ 77 million recorded in 1Q17, mainly due to higher contingencies (US$ 20 million). Personnel 62 16 54 14 54 12 Services174144164 Depreciation 22 6 29 8 32 7 Others123144164 Selling 19 5 13 3 9 2 R&D802165177216 Pre-operating and stoppage expenses¹90231153011024 Long Harbour 15 4 48 13 45 10 S11D5915501319 4 Moatize - - - - 9 2 ¹ Includes US$ 30 million of depreciation charges in 2Q17, US$ 31 million in 1Q17, and US$ 30 million in 2Q16.

Adjusted earnings before interest, taxes, depreciation and amortization Adjusted EBITDA6 was US$ 2.729 billion in 2Q17, 36.7% lower than in 1Q17 mainly as a result of the 26.6% reduction of the Platts IODEX (US$ 1.867 billion), which was partially offset by higher sales volumes of Ferrous Minerals and Coal (US$ 356 million). Adjusted EBITDA margin was 37.7% in 2Q17. Adjusted EBIT was US$ 1.743 billion in 2Q17. 6 Net revenues less costs and expenses net of depreciation plus dividends received.

Net income Net income totaled US$ 16 million in 2Q17 vs. US$ 2.490 billion in 1Q17, decreasing by US$ 2.474 billion, mainly as a result of the following impacts: (i) the 26.6% reduction of the Platts IODEX (US$ 1.867 billion); (ii) non-cash gains on monetary and exchange rate variation in 1Q17 vs. non-cash losses in 2Q17 (US$ 820 million); and (iii) gains on the sale of 50% of Vale’s stake in the Nacala Logistic Corridor, which positively impacted results in 1Q17 (US$ 504 million). z Underlying earnings were a positive US$ 949 million in 2Q17 after excluding some negative effects over net income, most importantly: (i) the negative impact of foreign exchange (US$ 610 million), related to the depreciation of the BRL against the USD, and (ii) the impairment on assets and investments from discontinued operations (US$ 414 million), which comprises mainly the mark-to-market of Mosaic shares (US$ 268 million), and the write-down of the residual value of mining assets in Canada (US$ 133 million). Net financial results showed a loss of US$ 1.339 billion in 2Q17 vs. a loss of US$ 613 million in 1Q17. The decrease of US$ 726 million was mainly a result of non-cash gains on monetary and exchange rate variation in 1Q17 vs. non-cash losses in 2Q17 (US$ 820 million). The main components of net financial results were: (i) financial expenses (US$ 773 million); (ii) financial revenues (US$ 116 million); (iii) foreign exchange and monetary losses (US$ 591 million); (iv) currency and interest rate swap losses (US$ 96 million); and (v) gains on other derivatives (US$ 5 million), despite losses on the mark-to-market of bunker oil derivatives (US$ 18 million). The end-to-end depreciation of the BRL7 contributed to generate non-cash losses of US$ 698 million with negative effects from currency and interest rate swap (US$ 96 million) and foreign exchange (US$ 602 million). 7 In 2Q17, from end-to-end, the Brazilian Real (BRL) depreciated 4.41% against the US Dollar (USD) from BRL 3.17/ USD as of March 31st, 2017 to BRL 3.31/ USD as of June 30th, 2017. On a quarterly average, the exchange rate depreciated by 2.30% , from an average BRL 3.15/ USD in 1Q17 to an average BRL 3.22/ USD in 2Q17.

The non-cash impact on financial results of the end-to-end depreciation of the BRL in 2Q17 was partially offset by the introduction of a net investment hedge in January 2017. With this instrument Vale assigned part of its USD and Euro designated debt as hedge against its net investments in its Vale International S.A. and Vale International Holding GmbH subsidiaries. The objective was to mitigate the foreign exchange risk on financial statements. On June 30th, 2017, the carrying value of the debt assigned as the net investment hedge was US$ 6.668 billion and € 750 million. The foreign exchange losses on the translation of this debt portion to BRL were US$ 392 million, and they were recognized directly in “Other comprehensive income” in the stockholders equity, not impacting Vale’s financial results. The average depreciation of the BRL against the USD had a positive impact on cash flows, as most of Vale’s revenues were denominated in USD, while COGS were 53% denominated in BRL, 32% in USD, 11% in Canadian dollars (CAD) and about 60% of capital expenditures in BRL. The depreciation of the BRL and of other currencies decreased costs and expenses in USD terms by US$ 45 million in 2Q17. Financial results US$ million 2Q17 1Q17 2Q16 ¹ The net derivatives loss of US$ 91 million in 2Q17 are comprised of settlement losses of US$ 3 million and mark -to-market loss of US$ 88 million. ² Other derivatives include mainly bunker oil derivatives losses of US$ 18 million. Equity income from affiliated companies Equity income from affiliated companies showed a loss of US$ 24 million in 2Q17 vs. a gain of US$ 73 million in 1Q17. The main negative contributor to equity income was CSP (US$ 131 million) due to the impact of the BRL depreciation on the USD denominated debt of the company, which was partially offset by the positive contributions of the leased pelletizing companies in Tubarão (US$ 61 million), MRS (US$ 22 million) and VLI (US$ 19 million).

Investments8 Capital expenditures totaled US$ 894 million in 2Q17 with US$ 388 million in project execution and US$ 507 million in sustaining capital. Capital expenditures decreased US$ 219 million vs. the US$ 1.113 billion spent in 1Q17. Project Execution and Sustaining by business area Project execution Investment in project execution totaled US$ 388 million in 2Q17, decreasing 33.9% due to the purchase of wagons and locomotives for the S11D project in 1Q17. Ferrous Minerals accounted for about 95% of the total investment in project execution in 2Q17. Project execution by business area US$ million 2Q17 % 1Q17 % 2Q16 % FERROUS MINERALS About 96% of the US$ 370 million invested in Ferrous Minerals in 2Q17 relates to the S11D project and the expansion of its associated infrastructure (US$ 357 million). 8 Does not include Fertilizers investments

S11D Mine – Truckless system in operation S11D (including mine, plant and associated logistics – CLN S11D) achieved a combined physical progress of 90% in 2Q17 with 99% progress at the mine site and 83% at the logistic infrastructure sites. The duplication of the railway reached 71% physical progress with 397 Km duplicated. S11D Logistics – Duplication of the railway Railway bridge “Estreito dos Mosquitos” – segments 02-03

Description and status of main projects ProjectDescriptionCapacity (Mtpy) Status Ferrous Minerals projects CLN S11D Duplication of 570 km railway, with construction of rail spur of 101 km, acquisition of wagons, locomotives, onshore and offshore expansions at the PDM maritime terminal. (80)1 Duplication of the railway reached 71% physical progress, totaling 397 Km delivered Onshore expansion reached 90% physical progress 1 Net additional capacity . ProjectCapacityEstimated (Mtpy)start-up Executed capexEstimated capex (US$ million)(US$ million) Physical progress 2017Total2017 Total Ferrous Minerals projects CLN S11D230 (80)a1H14 to 2H195686,230962 a Net additional capacity. b Original capex budget of US$ 11.582 billion. 7,850b83% Sustaining capex Sustaining capital totaled US$ 507 million in 2Q17, decreasing 4% when compared to 1Q17. The Ferrous Minerals and Base Metals business segments each accounted for 49% of the total sustaining capex in 2Q17. Sustaining capex in the Base Metals business segment was mainly dedicated to: (i) operational improvements (US$ 191 million); (ii) improvement in the current standards of health and safety and environmental protection (US$ 51 million); and (iii) maintenance improvements and expansion of tailings dams (US$ 4 million). Base Metals sustaining capex will be higher in 2017 due to the transition in Sudbury to a single furnace operation and the investments for the Air Emission Reduction project (AER). Sustaining capital for the Ferrous Minerals business segment included, among others: (i) enhancement and replacement in operations (US$ 153 million); (ii) improvement in the current standards of health and safety, social and environmental protection (US$ 40 million); and (iii) maintenance, improvement and expansion of tailings dams (US$ 40 million). Maintenance of railways and ports in Brazil and Malaysia accounted for US$ 64 million. 9 Pre-operating expenses were not included in the estimated capex for the year, although included in the total estimated capex column, in line with Vale’s Board of Directors approvals. Estimated capex for the year is only reviewed once a year.

Vale approved the restart of the São Luis pellet plant with its start-up planned for the first half of 2018. The project, which includes the revamp of the plant and the upgrade of its automation system, will cost US$ 105 million and will be charged to sustaining investments. Sustaining investments in iron ore fines (excluding sustaining investments in pellet plants) amounted to US$ 185 million, equivalent to US$ 2.8/dmt of iron ore fines in 2Q17, vs. the US$ 3.8/dmt in 1Q17, mainly due to the positive impact of the BRL depreciation against the USD in 2Q17, the dilution of disbursements on higher sales volumes and the carryover of payments of mining equipment acquired in 2016, which were payed only in 1Q17. The last twelve months average of sustaining capex for iron ore fines amounts to US$ 3.0/dmt. Sustaining capex by type - 2Q17 US$ millionFerrous Minerals CoalBase MetalsTOTAL Corporate social responsibility Investments in corporate social responsibility totaled US$ 127 million in 2Q17, of which US$ 103 million dedicated to environmental protection and conservation and US$ 24 million dedicated to social projects.

Free cash flow Free cash flow was US$ 2.151 billion in 2Q17. Cash generated from operations was US$ 4.085 billion in 2Q17 with a strong cash collection from the 1Q17 sales, which positively influenced accounts receivables by US$ 1.528 billion. The improvement in accounts receivables was partially offset by an increase in inventories (US$ 223 million). Free Cash Flow 2Q17 US$ million

Debt indicators Gross debt totaled US$ 27.852 billion as of June 30th, 2017, decreasing US$ 1.718 billion from the US$ 29.570 billion as of March 31st, 2017, mainly due to our liability management program. Despite the negative impact of 26.6% reduction of the Platts IODEX (US$ 1.867 billion), the payments of Sumic put option (US$ 353 million) and dividends (US$ 1.459 billion), net debt decreased by US$ 655 million compared to the end of the previous quarter, totaling US$ 22.122 billion based on a cash position of US$ 5.730 billion as of June 30th, 2017. Debt position Gross debt after currency and interest rate swaps was 92% denominated in USD, with 29% based on floating and 71% based on fixed interest rates as of June 30th, 2017.

Average debt maturity increased slightly to 8.1 years on June 30th, 2017, against 8.0 years on March 31st, 2017. Average cost of debt, after the abovementioned currency and interest rate swaps, increased slightly, to 4.88% per annum on June 30th, 2017, against 4.71% per annum on March 31st, 2017. On June 9th, 2017, Vale completed a five-year US$ 2 billion syndicated revolving credit facility, which replaced the US$ 2 billion facility signed in 2013. Vale’s current outstanding revolving credit facilities total US$ 5 billion. Interest coverage, measured by the ratio of LTM10 adjusted EBITDA to LTM gross interest, improved to 7.9x in 2Q17 vs. 7.7x in 1Q17 and vs. 4.2x in 2Q16. Leverage, measured by gross debt to LTM adjusted EBITDA decreased to 1.9x as of June 30th, 2017 from 2.1x as of March 31st, 2017 and from 4.4x as of June 30th, 2016. 10 Last twelve months.

Performance of the business segments Segment information — 2Q17, as per footnote of financial statements Expenses US$ millionNet Revenues Cost¹SG&A and others¹ R&D¹Pre operating & stoppage¹ DividendsAdjusted EBITDA Ferrous Minerals5,114(2,755)(94)(28)(42)372,232 Others 128 (125) (57) (35) (2) 45 (46) Total7,235(4,250)(198)(80)(60)822,729 ¹ Excluding depreciation and amortization. ² Including copper and by-products from our nickel operations. ³ Including by-products from our copper operations.

Ferrous Minerals Adjusted EBITDA of the Ferrous Minerals business segment was US$ 2.232 billion in 2Q17, 43.7% lower than in 1Q17, mainly as a result of the 26.6% reduction of the Platts IODEX (US$ 1.867 billion) and higher costs (US$ 148 million), which were partially offset by higher sales volumes (US$ 327 million). EBITDA variation 1Q17 vs. 2Q17 – Ferrous Minerals business segment Iron ore fines (excluding Pellets and ROM) EBITDA Adjusted EBITDA of iron ore fines was US$ 1.502 billion in 2Q17, 51.5% lower than in 1Q17, mainly as a result of lower realized prices (US$ 1.686 billion), which were impacted by the 26.6% reduction of the Platts IODEX, and higher costs and expenses (US$ 173 million), being partially offset by the positive impacts of higher sales volumes (US$ 265 million). SALES REVENUES AND VOLUME Net sales revenues of iron ore fines, excluding pellets and Run of Mine (ROM), amounted to US$ 3.544 billion in 2Q17 vs. US$ 4.826 billion in 1Q17, as a result of lower iron ore fines realized prices (US$ 1.686 billion), which were partially offset by higher sales volumes (US$ 404 million). Sales volumes of iron ore fines reached 69.0 Mt in 2Q17 vs. 63.7 Mt in 1Q17, 8.3% higher than in 1Q17, due to the usual weather related seasonality in 1Q17 and the S11D ramp-up. Offshore inventories increased 5.3 Mt in 2Q17 vs. 1Q17 to support the ongoing offshore blending

activities in Malaysia and at 11 ports in China. No further build-up of inventories is expected in 2017, as the required inventory levels have been achieved to support planned blending volumes this year. CFR sales of iron ore fines totaled 46.4 Mt in 2Q17, representing 67% of all iron ore fines sales volumes in 2Q17 and in line with the share of CFR sales in 1Q17. REALIZED PRICES Pricing system breakdown

Price realization – iron ore fines Vale’s CFR dmt reference price for iron ore fines (ex-ROM) decreased by US$ 25.9/t from US$ 86.7/t in 1Q17 to US$ 60.7/t in 2Q17, mainly as a result of the reduction in the IODEX (-US$ 22.7/t). Vale’s CFR/FOB wmt price for iron ore fines (ex-ROM) decreased 32.3% (US$ 24.4/t) from US$ 75.8/t in 1Q17 to US$ 51.3/t in 2Q17, after adjusting for moisture and the effect of FOB sales, which accounted for 33% of total sales volumes in 2Q17. The negative US$ 0.2/t in ‘Premiums/Discounts and commercial conditions’ stems from higher market discounts on high silica content. For that reason, Vale will reduce production of high silica products by an annualized rate of 19 Mt from 2H17 onwards and will limit the silica (SiO2) content of its Brazilian Blend Fines (BRBF) to 5%, reinforcing the use of the BRBF as a baseload charge for blast furnace. Vale is the player with the highest flexibility in the market to adjust its product quality output, by managing production of lower and/or higher quality ore, according to market demand. Price realization in 2Q17 was impacted by: Provisional prices set at the end of 1Q17 at US$ 77.9/t, which were later adjusted based on the price of delivery in 2Q17, and negatively impacted prices in 2Q17 by US$ 4.2/t compared to a positive impact of US$ 4.1/t in 1Q17 as a result of the lower realized prices in 2Q17.

Provisional prices set at the end of 2Q17 at US$ 62.1/t vs. the IODEX average of US$ 62.9/t in 2Q17, which negatively impacted prices in 2Q17 by US$ 0.3/t compared to a negative impact of US$ 3.2/t in 1Q17. Quarter-lagged contracts, priced at US$ 83.3/t based on the average prices for Dec-Jan-Feb, which positively impacted prices in 2Q17 by US$ 1.8/t compared to a negative impact of US$ 2.1/t in 1Q17. Iron ore sales of 25.5 Mt, or 37% of Vale’s sales mix, were recorded under the provisional pricing system, which was set at the end of 2Q17 at US$ 62.1/t. The final prices of these sales and the required adjustment to sales revenues will be determined and recorded in 3Q17. COSTS Costs for iron ore fines amounted to US$ 1.885 billion (or US$ 2.151 billion with depreciation charges) in 2Q17. Costs increased US$ 91 million when compared to 1Q17, after adjusting for the effects of higher sales volumes (US$ 139 million) and exchange rate variations (-US$ 22 million), mainly due to higher maritime freight costs, higher third party railway costs in the Southern System (MRS), demurrage and seasonally higher maintenance costs. IRON ORE COGS - 1Q17 x 2Q17 Variance drivers US$ million1Q17VolumeExchange Rate Total costs before Others Total Variation 1Q17 x 2Q17 2Q17 depreciation and amortization 1,677139(22)912081,885 Depreciation25321(6)(2)13266 Total1,930160(28)892212,151 Maritime freight costs, which are fully accrued as cost of goods sold, totaled US$ 690 million in 2Q17, increasing US$ 82 million vs. 1Q17. Unit maritime freight cost per iron ore metric ton was US$ 14.9/t in 2Q17, US$ 0.7/t higher than in 1Q17, mainly due to the negative impacts of higher freight spot prices (US$ 1.1/t), which have a lagged effect on Vale’s costs vs. the quarterly average of market spot indexes, and

partially offset by lower bunker oil prices (US$ 0.2/t) and other savings (US$ 0.2/t). Vale’s average bunker oil price decreased from US$ 314/t in 1Q17 to US$ 306/t in 2Q17. C1 CASH COST C1 cash cost FOB port per metric ton for iron ore fines ex-royalties increased by US$ 0.5/t, from the US$ 14.7 recorded in 1Q17 to US$ 15.2/t in 2Q17, as a result of higher railway tariff (MRS11) on the Southern System (US$ 0.2/t), higher demurrage costs (US$ 0.2/t) and maintenance costs (US$ 0.1/t) which were partially offset by the positive impact of the BRL depreciation against the USD of 3.4% in 2Q17 (US$ 0.2/t). C1 cash cost FOB port per metric ton of iron ore fines in BRL increased by 6.9% to R$ 49.3/t (USD 15.2/t), as a result of a one-off railway tariff charge (MRS), higher demurrage costs and seasonally higher maintenance costs. Costs are expected to decrease to the range of R$ 46 - 47/t in 2H17, back to the BRL levels of two years ago, due to the combination of higher production, seasonally lower maintenance costs and productivity gains. Evolution of C1 Cash Cost¹ per ton in BRL 11 Southern system third party railway.

EXPENSES Iron ore expenses, net of depreciation, amounted to US$ 157 million in 2Q17, 185% higher than the US$ 55 million recorded in 1Q17. SG&A and other expenses totaled US$ 94 million in 2Q17, increasing US$ 96 million mainly due to the positive effect of the recovery of the insurance associated with the destruction of the “Fábrica Nova – Timbopeba” long distance belt conveyor (US$ 85 million) in 1Q17. R&D amounted to US$ 23 million, increasing US$ 7 million vs. 1Q17, due to the usual seasonality of expenditures. Pre-operating and stoppage expenses, net of depreciation, amounted to US$ 40 million, in line with 1Q17, mainly related to S11D pre-operating expenses. Iron ore fines cash cost and freight Costs (US$ million) 2Q171Q172Q16 COGS, less depreciation and amortization1,8851,6771,652 Distribution costs332530 Maritime freight costs690608571 FOB at port costs (ex-ROM)1,1621,0441,051 FOB at port costs (ex-ROM and ex-royalties)1,051937958 % of FOB sales33%33%34% Vale's iron ore cash cost (ex-ROM, ex-royalties), FOB (US$ /t)15.214.713.2 Freight Evolution of iron ore fines cash cost, freight and expenses

Evolution of iron ore fines sustaining per ton Iron ore pellets Adjusted EBITDA for pellets in 2Q17 was US$ 640 million, 19.1% lower than the US$ 791 million recorded in 1Q17. The decrease of US$ 151 million was a result of lower sales prices (US$ 116 million) and higher costs and expenses12 (US$ 65 million), which were partially offset by higher dividends received13 (US$ 37 million). Net sales revenues for pellets amounted to US$ 1.331 billion in 2Q17, decreasing US$ 128 million from the US$ 1.459 billion recorded in 1Q17 as a result of lower realized sales prices (US$ 116 million), which decreased from an average of US$ 116.0 per ton in 1Q17 to US$ 106.7 per ton in 2Q17. Sales volumes were 12.5 Mt, in line with the 12.6 Mt sold in 1Q17. CFR pellet sales of 2.7 Mt in 2Q17 represented 21% of total pellet sales, in line with the 22% recorded in 1Q17. FOB pellet sales amounted to 9.8 Mt, in line with the 10.0 Mt in 1Q17. Pellet CFR/FOB prices decreased by US$ 9.3/t to US$ 106.7/t in 2Q17, whereas the Platts IODEX iron ore reference price (CFR China) decreased by US$ 22.7/t in the quarter, mainly as a result of the positive impact of contracts with lagged prices and higher pellet premiums. Pellet costs totaled US$ 712 million (or US$ 800 million with depreciation charges) in 2Q17. After adjusting for the effects of exchange rate variations (-US$ 9 million), costs increased by US$ 68 million vs. 1Q17 mainly due to the higher leasing costs of the pelletizing plants which are based on a predetermined formula linked to pellet premiums. 12 After adjusting for the effects of lower volumes and exchange rate variations. 13 Dividends from leased pelletizing plants, which are usually paid every 6 months (in 2Q and 4Q).

Pre-operating and stoppage expenses for pellets were US$ 1 million in 2Q17, in line with 1Q17. SG&A and other expenses totaled US$ 10 million, a decreasing of US$ 2 million when compared to 1Q17. EBITDA unit margin for pellets was US$ 51.3/t in 2Q17, 18.4% lower than in 1Q17 mainly due to higher costs and lower realized prices as mentioned above. Pellets - EBITDA ex-Samarco 2Q171Q17 US$ millionUS$/wmt US$ millionUS$/wmt Net Revenues / Realized Price 1,331 106.7 1,459 116.0 Dividends Received (Leased pelletizing plants) ex-Samarco 37 3.0 0 0.0 Cash Costs (Iron ore, leasing, freight, overhead, energy and other) (712) (57.1) (652) (51.8) Expenses (SG&A, R&D and other) (16) (1.3) (16) (1.3) EBITDA ex-Samarco 640 51.3 791 62.8 Iron ore fines and pellets cash break-even Quarterly iron ore fines and pellets EBITDA break-even, measured by unit cash costs and expenses on a landed-in-China basis (and adjusted for quality, pellets margins differential and moisture, excluding ROM), increased US$ 4.2/t when compared to 1Q17, totaling US$ 34.7/dmt in 2Q17, with the abovementioned increase in costs, expenses and freight, partially offset by the exchange rate variation. Quarterly iron ore and pellets cash break-even on a landed-in-China basis, including sustaining capex per ton of US$ 2.8/dmt, increased from US$ 34.4/dmt in 1Q17 to US$ 37.5/dmt in 2Q17.

Manganese and ferroalloys Adjusted EBITDA of manganese ore and ferroalloys was US$ 33 million in 2Q17, US$ 4 million lower than the US$ 37 million in 1Q17, mainly due to the impact of higher costs and expenses14 (US$ 35 million), which were partly offset by higher sales volumes (US$ 29 million). Net sales revenues for manganese ore increased to US$ 71 million in 2Q17 from US$ 43 million in 1Q17 mainly due to higher sales volumes (US$ 45 million), which were partially offset by lower sales prices (US$ 18 million) in 2Q17. Volumes sold of manganese ore reached 392,000 t in 2Q17 vs. 196,000 t in 1Q17. Net sales revenues for ferroalloys increased to US$ 46 million in 2Q17 from the US$ 43 million in 1Q17, mainly due to higher sales volumes (US$ 9 million), which were partially offset by lower sales prices (US$ 6 million). Volumes sold of ferroalloys increased to 36,000 t in 2Q17 from the 30,000 t recorded in 1Q17. Manganese ore and ferroalloys costs totaled US$ 81 million (or US$ 86 million with depreciation charges) in 2Q17. Costs increased 22.7% when compared to 1Q17 after adjusting for the effect of higher volumes (US$ 27 million), mainly due to higher energy tariffs and corrective maintenance. Volume sold by destination – Iron ore and pellets ‘000 metric tons 2Q17 1Q17 2Q16 14 After adjusting for the effects of lower volumes and exchange rates.

Selected financial indicators – Pellets (excluding Samarco) Selected financial indicators – Iron ore fines and Pellets

Base Metals Adjusted EBITDA was US$ 386 million in 2Q17, decreasing US$ 24 million vs. 1Q17, mainly as a result of lower nickel and copper realized prices (US$ 112 million), which were partially offset by lower expenses (US$ 34 million), favourable volume impacts (US$ 29 million), favourable exchange rate variation (US$ 11 million), higher by-product prices (US$ 10 million) and lower costs (US$ 4 million). SALES REVENUES AND VOLUMES Nickel sales revenues were US$ 686 million in 2Q17, decreasing US$ 74 million vs. 1Q17 as a result of the impact of lower realized nickel prices in 2Q17 (US$ 57 million) and lower sales volumes and mix of products (US$ 17 million). Sales volumes totaled 71 kt, 1 kt lower than in 1Q17. Copper sales revenues were US$ 535 million in 2Q17, decreasing US$ 33 million vs. 1Q17 as a result of lower realized copper prices in 2Q17 (US$ 54 million), which was partially offset by higher sales volumes (US$ 21 million). Sales volumes were 103 kt in 2Q17, 3 kt higher than in 1Q17. PGMs (platinum group metals) sales revenues totaled US$ 77 million in 2Q17, decreasing US$ 8 million vs. 1Q17. Sales volumes were 93,000 oz in 2Q17 vs. 104,000 oz in 1Q17. The PGMs sales volume decrease was mainly due to the lower production of palladium and platinum. Sales revenues from gold contained as a by-product in nickel and copper concentrates amounted to US$ 139 million in 2Q17, increasing by US$ 9 million vs. 1Q17 mainly as a result of increased Salobo deliveries in 2Q17, partially offset by lower Sudbury deliveries due to lower production. Sales volumes of gold as a by-product amounted to 117,000 oz in 2Q17, 9,000 oz higher than in 1Q17.

REALIZED NICKEL PRICES The realized nickel price was US$ 9,603/t, US$ 378/t higher than the average LME nickel price of US$ 9,225/t in 2Q17. Vale’s nickel products are divided into two categories, refined nickel (pellets, powder, cathode, FeNi, Utility Nickel™ and Tonimet™) and intermediates (concentrates, matte, NiO and NHC). Refined nickel products have higher nickel content, typically commanding a premium over the average LME nickel price, whereas nickel intermediates are less pure as they are only partially processed. Due to this difference, intermediate products are sold at a discount. The amount of the discount will vary depending on the amount of processing still required, product forms and level of impurities. The sales product mix is an important driver of nickel price realization. Refined nickel sales accounted for 84% of total nickel sales in 2Q17. Sales of intermediate products accounted for the balance. The realized nickel price differed from the average LME price in 2Q17 due to the following impacts: Premium for refined finished nickel products averaged US$ 732/t, with an impact on the aggregate realized nickel price of US$ 613/t; Discount for intermediate nickel products averaged US$ 1,444/t, with an impact on the aggregate realized nickel price of -US$ 235/t. Price realization – nickel

price of US$ 5,662/t in 2Q17. Vale’s copper products are mostly intermediate forms of copper, predominantly in the form of concentrate, which is sold at a discount to the LME price. These products are sold on a provisional pricing basis during the quarter with final prices determined in a future period, generally one to four months forward15. The realized copper price differed from the average LME price in 2Q17 due to the following impacts: Current period price adjustments: mark-to-market of invoices still open in the quarter based on the copper price forward curve16 at the end of the quarter (US$ 171/t); Prior period price adjustment: variance between the price used in final invoices (and in the mark-to-market of invoices from previous quarters still open at the end of the quarter) and the provisional prices used for sales in previous quarters (-US$ 80/t); TC/RCs, penalties, premiums and discounts for intermediate products (-US$ 553/t). Price realization – copper 15 On June 30th, 2017, Vale had provisionally priced copper sales totaling 102,198 tons valued at a LME forward price of US$ 5,934/t, subject to final pricing over the next several months. 16 Includes a small number of final invoices that were provisionally priced and settled within the quarter.

Average prices US$/ metric ton 2Q17 1Q17 2Q16 SALES VOLUME PERFORMANCE Sales volumes of nickel were 71 kt in 2Q17, 1 kt lower than in 1Q17 and 6kt lower than in 2Q16. Sales volumes were in line with 1Q17 despite lower nickel production, mainly due to a larger drawdown of finished inventories in 2Q17 as well as the sale of purchased finished nickel units. Sales volumes of copper totaled 103 kt in 2Q17, 3 kt higher than in 1Q17 and 4 kt lower than in 2Q16. The increase over 1Q17 was mainly due to the higher sales from our copper operations in Brazil. Sales volumes of gold as a by-product totaled 117,000 oz in 2Q17, 9,000 oz higher than in 1Q17, mainly due to higher by-product volumes from Salobo. Costs and expenses Costs and expenses decreased US$ 61 million in 2Q17, mainly due to lower expenses (US$ 34 million), lower volumes (US$ 13 million), the favorable impact of the exchange rate variation (US$ 11 million) and lower costs (US$ 4 million). COSTS OF GOODS SOLD (COGS) Costs totaled US$ 1.065 billion in 2Q17 (or US$ 1.452 billion including depreciation). Costs decreased by US$ 4 million vs. 1Q17 after adjusting for the effects of exchange rate variations (US$ 10 million) and lower sales volumes (US$ 13 million). The increase in depreciation primarily relates to Sudbury’s planned shutdown maintenance, amounts related to cost

normalization adjustments and the cessation of the allocation of part of Long Harbour's production costs to pre-operating expenses. BASE METALS COGS - 1Q17 x 2Q17 Variance drivers US$ million1Q17VolumeExchange Rate OthersTotal Variation 1Q17 x 2Q17 2Q17 Total costs before depreciation and amortization 1,092(13)(10)(4)(27)1,065 Depreciation363(4)(4)3224387 Total1,455(17)(14)28(3)1,452 UNIT CASH COST North Atlantic operations unit cash cost decreased from the US$ 6,699/t recorded in 1Q17 to US$ 5,388/t in 2Q17 mainly due to lower costs for purchased intermediate feed given declining metal prices and the favourable impact of by-product revenues spread over 21% fewer nickel deliveries, which was offset by planned shutdown maintenance costs in Sudbury. PTVI unit cash cost was in line with 1Q17. VNC unit cost net of by-product credits was in line with 1Q17. Onça Puma unit cash cost increased from the US$ 9,341/t recorded in 1Q17 to US$ 10,164/t in 2Q17, mainly due to the unfavorable impact of lower production volumes on unit costs. Sossego unit cost decreased primarily due to higher by-product volumes and prices, and the dilution of fixed costs caused by higher feed grades and higher mill productivity in 2Q17. Salobo unit costs decreased mainly due to the dilution of fixed costs caused by higher sales volume. Base Metals – unit cash cost of sales per operation, net of by-product credits¹ 1 North Atlantic figures includes Clydach and Acton refining costs. 2 Prior periods restated to include royalties, freight and other period costs. 3 Unit cash cost restated for periods prior to 1Q17 to exclude pre-operating and other operating expenses. 4 We realigned our unit cash cost of sales methodology in 1Q17 to include all freight, royalty and other costs reported as cost of goods sold and to exclude other operating expenses and pre-operating expenses for certain operations. Considering the previous criteria, the unit cash cost figures would be as follows: North Atlantic, US$ 3,582/t in 2Q16; PTVI, US$ 5,825/t in 2Q16, and; VNC, US$ 12,208/t in 2Q16.

EXPENSES SG&A and other expenses, excluding depreciation, totaled US$ 36 million, a decrease of US$ 10 million when compared to the US$ 46 million in 1Q17. Pre-operating and stoppage expenses, net of depreciation, decreased significantly to US$ 12 million, all related to the Long Harbour operation as the refinery is successfully ramping up. Long Harbour costs are no longer recorded as pre-operating expenses as of June 2017. Performance by operation The breakdown of the Base Metals EBITDA components per operation is detailed below. Base Metals EBITDA overview – 2Q17 Pre-operating & stoppage (12)------(12) EBITDA 123 10 (40) 61 189 (6) 49 386 EBITDA Details of Base Metals’ adjusted EBITDA by operation are as follows: (i) The North Atlantic operations EBITDA was US$ 123 million, decreasing by US$ 54 million vs. 1Q17 mainly due to lower nickel and copper realized prices (US$ 53 million), the impacts of the transition to a single furnace operation in lower volumes (US$ 39 million) and higher costs (US$ 25 million) mainly due to Sudbury’s June planned shutdown maintenance, which were partially offset by lower expenses (US$ 33 million), higher by-product prices (US$ 21 million) and the positive effect of exchange rate variations (US$ 8 million). (ii) PTVI’s EBITDA was US$ 10 million, decreasing by US$ 14 million vs. 1Q17 mainly due to lower nickel realized prices (US$ 13 million). (iii) VNC's EBITDA was negative US$ 40 million, decreasing by US$ 11 million when compared to 1Q17, mainly as a result of lower realized nickel prices (US$ 7 million) and higher expenses (US$ 4 million).

(iv) Onça Puma’s EBITDA was negative US$ 6 million, decreasing US$ 8 million vs. 1Q17, mainly as a result of higher costs (US$ 6 million) and lower realized nickel prices (US$ 4 million). (v) Sossego’s EBITDA was US$ 61 million, in line with 1Q17 despite lower realized copper prices (US$ 10 million), which were offset by higher volumes (US$ 4 million), lower costs (US$ 2 million) and the positive effect of exchange rate variations (US$ 2 million). (vi) Salobo’s EBITDA was US$ 189 million, increasing US$ 20 million vs. 1Q17, mainly as a result of higher volumes (US$ 36 million) and lower costs (US$ 14 million), partially offset by lower realized copper prices (US$ 29 million). Base Metals – EBITDA by operation 1 Includes the operations in Canada and in the United Kingdom. 2 Includes the PTVI and VNC off-takes, intercompany sales, purchase of finished nickel and corporate center allocation for Base Metals. 3 Reflecting a realignment of our reporting for the North Atlantic operations and unit cash cost methodology for Q1, the EBITDA in previous periods would change: North Atlantic would be US$ 259 million in 2Q16; Others would be -US$ 56 million in 2Q16.

Coal EBITDA Adjusted EBITDA for the Coal business segment was US$ 157 million in 2Q17, US$ 96 million higher than the US$ 61 million recorded in 1Q17, mainly due to higher sales prices (US$ 69 million) and higher sales volumes (US$ 29 million). Adjusted EBITDA from sales from the Nacala port was US$ 182 million and from sales from the Beira port was a negative US$ 24 million, with general cargo accounting for the balance. SALES REVENUES AND VOLUMES Net sales revenues of metallurgical coal increased to US$ 414 million in 2Q17 from US$ 254 million in 1Q17, as a result of higher sales prices (US$ 74 million) and higher sales volumes (US$ 85 million). Net sales revenues of thermal coal decreased to US$ 67 million in 2Q17 from US$ 70 million in 1Q17 mainly as a result of lower sales prices (US$ 5 million). Sales volumes of metallurgical coal totaled 2.057 Mt in 2Q17, increasing 33.8% vs. 1Q17, as a result of the ramp-up of Moatize Coal Handling and Preparation Plant II (CHPP2) and the improved performance of Coal Handling and Preparation Plant I (CHPP1). Sales volumes of thermal coal totaled 1.064 Mt in 2Q17, 3.2% higher than in 1Q17. The sales mix in 2Q17 was composed of 66% metallurgical coal and 34% thermal coal. Production at Moatize amounted to 3.0 Mt in 2Q17, a quarterly production record, driven by successive monthly records in the two Coal Handling and Preparation Plants (CHPP1 and CHPP2). REALIZED PRICES Metallurgical coal In 2Q17, metallurgical coal sales were priced as follows: (i) 79% based on index lagged prices; and (ii) 21% based on fixed prices (spot shipments and trial cargos). The metallurgical coal realized price increased 22%, from US$ 165.2/t in 1Q17 to US$ 201.2/t in 2Q17, following the premium low vol HCC FOB Australia spot index, which increased 13%, from US$ 168.2/t in 1Q17 to US$ 190.3/t. Metallurgical coal prices US$ / metric ton 2Q17 1Q17 2Q16 Premium Low Vol HCC index price1 190.3 168.2 170.3

Price realization in 2Q17 for metallurgical coal from Mozambique was impacted by: Quality adjustment over the index reference price due to different product characteristics as well as value in use adjustments associated with trial shipments of our new premium and temporary sale of non-premium coking coal products, which negatively impacted prices in 2Q17 by US$ 4.6/t. Sales not evenly spread across the quarter, which positively impacted prices by US$ 2.1/t. Sales using fixed price (spot shipments and trial cargos), quarterly benchmark and lagged index prices which positively impacted prices in 2Q17 by US$ 7.2/t, as index prices were higher in 1Q17 and at the beginning of 2Q17. Sales from the previous quarter with provisional prices adjusted in 2Q17, which positively impacted prices by US$ 9.3/t as prices were above the average at the beginning of 2Q17. Freight differentials which negatively impacted prices in 2Q17 by US$ 0.2/t, mainly due to differentials between Vale’s freight rates contracted from Mozambique to the delivery ports and the freight rates set in the sales contracts, which are determined considering delivery from the index reference port. Other adjustments, including penalties and trial cargos incentives associated with the new products or testing campaigns as part of the marketing development plans, which negatively impacted prices in 2Q17 by US$ 3.0/t.

Price realization – Metallurgical coal from Mozambique US$/t 2Q17 Thermal coal In 2Q17, thermal coal sales were priced as follow: (i) 95% based on index prices and (ii) 5% based on fixed prices. The realized price of thermal coal was US$ 63.4/t in 2Q17, 7.0% lower than in 1Q17, and in line with the 7.8% reduction of the index in the period. Price realization in 2Q17 for thermal coal was impacted by: Quality adjustment against the reference index given our lower calorific values and higher ash levels, which negatively impacted prices by US$ 11.1/t. Sales not evenly spread across the quarter, which negatively impacted prices by US$ 4.5/t Fixed price and lagged index pricing shipments, which positively impacted prices by US$ 2.8/t. Sales made in the previous quarter with provisional prices adjusted in 2Q17, which negatively impacted prices by US$ 0.6/t as prices decreased in 2Q17 compared to 1Q17.

Freight differentials which positively impacted prices in 2Q17 by US$ 0.2/t, mainly due to differentials between Vale’s freight rates contracted from Mozambique to the delivery ports and the freight rates set in the sales contracts, which are determined considering delivery from the index reference port Other adjustments, mainly commercial premiums/discounts that positively impacted prices by US$ 0.7/t. Price realization – Thermal coal from Mozambique US$/t, 2Q17 COSTS AND EXPENSES Coal costs and expenses totaled US$ 324 million in 2Q17 (or US$ 398 million with depreciation charges), increasing US$ 61 million against the US$ 263 million recorded in 1Q17. After adjusting for higher sales volumes (US$ 59 million), costs and expenses remained practically in line with 1Q17. Costs at the mine and processing plants decreased by 16% in 2Q17 vs. 1Q17, as a result of the successful ramp-up of Moatize CHPP2 and the strong performance of CHPP1. Production cost per ton of coal shipped through the Nacala port17 increased by 6% to US$ 89.3/t in 2Q17 from US$ 84.2/t in 1Q17, due to the impact of the logistics tariff applied after the 17 FOB cash cost at the port (mine, plant, railroad and port) ex-royalties and demurrage costs

deconsolidation of the Nacala Logistic Corridor, despite the above mentioned mine and processing plants cost reduction, which offset 67% of the tariff increase. The Nacala Logistic Corridor was deconsolidated in March 2017 as a result of the equity transaction with Mitsui. After the deconsolidation, a tariff was established to cover operation costs, investments, working capital and taxes. Excluding investments, working capital and taxes from the tariff, production cost per ton would have been US$ 74.2/t in 2Q17, 11.8% lower than in 1Q17. The tariff will be further adjusted to consider the cost of debt. Despite the increase in costs stemming from the adjustment of the tariff, Vale will receive back part of this cash outflow as interest and amortization payments on the outstanding funding instruments between Vale and the Nacala Logistic Corridor.

Financial indicators of non-consolidated companies For selected financial indicators of the main non-consolidated companies, see our quarterly financial statements on www.vale.com / investors / information to the market / financial statements. Conference call and webcast Vale will host two conference calls and webcasts on Thursday, July 27th, 2017. The first, in Portuguese (non-translated), will start at 10:00 a.m. Rio de Janeiro time. The second, in English, will start at 12:00 p.m. Rio de Janeiro time (11:00 a.m. US Eastern Daylight Time and 4:00 p.m. British Standard Time) Information on Dial-in to conference calls/webcasts: In Portuguese: Participants from Brazil: (55 11) 3193-1001 or (55 11) 2820-4001 Participants from the US: (1 888) 700-0802 Participants from other countries: (1 786) 924-6977 Access code: VALE In English: Participants from Brazil: (55 11) 3193-1001 or (55 11) 2820-4001 Participants from the U.S: (1 866) 262-4553 Participants from other countries: (1 412) 317-6029 Access code: VALE Instructions for participation will be available on the website: www.vale.com/investors. A podcast will be available on Vale’s Investor Relations website. This press release may include statements that present Vale’s expectations about future events or results. All statements, when based upon expectations about the future, involve various risks and uncertainties. Vale cannot guarantee that such statements will prove correct. These risks and uncertainties include factors related to the following: (a) the countries where we operate, especially Brazil and Canada; (b) the global economy; (c) the capital markets; (d) the mining and metals prices and their dependence on global industrial production, which is cyclical by nature; and (e) global competition in the markets in which Vale operates. To obtain further information on factors that may lead to results different from those forecast by Vale, please consult the reports Vale files with the U.S. Securities and Exchange Commission (SEC), the Brazilian Comissão de Valores Mobiliários (CVM) and the French Autorité des Marchés Financiers (AMF), and in particular the factors discussed under “Forward-Looking Statements” and “Risk Factors” in Vale’s annual report on Form 20-F.

ANNEX 1 – SIMPLIFIED FINANCIAL STATEMENTS Equity income (loss) by business segment

Total assets98,305103,008100,970 Liabilities Current liabilities10,58211,82511,546 Others1,7011,7231,840 Total liabilities56,40459,43759,487 Stockholders' equity41,90143,57141,483 Total liabilities and stockholders' equity98,305103,008100,970 US$ million6/30/20173/31/20176/30/2016 Assets Current assets19,86222,42118,274

Non-cash transactions: Additions to property, plant and equipment - interest capitalization83103213

ANNEX 2 – VOLUMES SOLD, PRICES AND MARGINS Volume sold - Minerals and metals ‘00 0 m etr ic to ns 2Q17 1Q17 2Q16 Operating margin by segment (EBIT adjusted margin) % 2Q17 1Q17 2Q16 Total¹ 24.1 39.9 22.7 ¹ Excluding non-recurring effects

Annex 3 – reconciliation of IFRS and “NON-GAAP” information (a) Adjusted EBIT¹ Adjusted EBIT 1,743 3,400 1,398 ¹ Excluding non-recurring effects. (b) Adjusted EBITDA EBITDA defines profit or loss before interest, tax, depreciation and amortization. Vale uses the term adjusted EBITDA to reflect exclusion of gains and/or losses on sale of assets, non-recurring expenses and the inclusion of dividends received from non-consolidated affiliates. However our adjusted EBITDA is not the measure defined as EBITDA under IFRS, and may possibly not be comparable with indicators with the same name reported by other companies. Adjusted EBITDA should not be considered as a substitute for operational profit or as a better measure of liquidity than operational cash flow, which are calculated in accordance with IFRS. Vale provides its adjusted EBITDA to give additional information about its capacity to pay debt, carry out investments and cover working capital needs. The following table shows the reconciliation between adjusted EBITDA and operational cash flow, in accordance with its statement of changes in financial position: Reconciliation between adjusted EBITDA and operational cash flow US$ million 2Q17 1Q17 2Q16 Net cash provided by (used in) operating activities 3,443 2,945 2,069 (c) Net debt US$ million 2Q17 1Q17 2Q16 ¹ Including financial investments (d) Total debt / LTM Adjusted EBITDA US$ million 2Q17 1Q17 2Q16 (e) LTM Adjusted EBITDA / LTM interest US$ million 2Q17 1Q17 2Q16

Table of Contents

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

Vale S.A.

|

|

|

|

(Registrant)

|

|

|

|

|

|

|

By:

|

/s/ André Figueiredo

|

|

Date: July 27, 2017

|

|

Director of Investor Relations

|

49

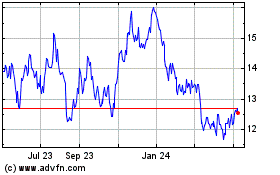

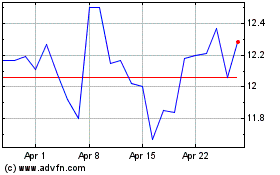

Vale (NYSE:VALE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Vale (NYSE:VALE)

Historical Stock Chart

From Apr 2023 to Apr 2024