Shell Leads Big Oil Revival Despite Crude Price Slump -- 2nd Update

July 27 2017 - 4:23AM

Dow Jones News

By Sarah Kent

LONDON -- Royal Dutch Shell PLC reported strong second-quarter

net profits on Thursday, kicking off a critical round of earnings

for big oil companies trying to show they have adapted to low crude

prices.

The British-Dutch company's equivalent of net profit rose to

$1.9 billion in the second quarter, compared with $239 million at

the same point last year and its cash flow from operations soared

to $11.3 billion. The company said it has generated $38 billion of

cash from its business over the last 12 months, enough to cover

dividend payments and bring down debt levels.

Shell's earnings were reported the same day as French oil giant

Total SA and Norway's Statoil ASA, all of them striking a confident

if cautious note. They trumpeted falling debt levels and strong

cash flow -- a metric that has become increasingly important to

investors who have been worried about oil companies' ability to

cover their spending and dividends without taking on debt.

Total's profit for the quarter was $2 billion, roughly the same

as last year, but the company also reported a significant increase

in cash flow from operations to $4.6 billion and a reduced debt

ratio.

Statoil said it earned $1.4 billion in the second quarter,

compared with a loss of $302 million last year. The company said it

generated $4 billion in free cash flow and reduced net debt by 8

percentage points since the start of the year, despite oil prices

remaining around $50 a barrel.

Though notably better than at the start of 2016 when the price

of crude plummeted to $27 a barrel, oil is still more than 50%

weaker than in 2014 when prices started to fall. The supply glut

that sparked the crash has proved stubbornly persistent despite

efforts by the Organization of the Petroleum Exporting Countries

and other major producers to limit output, prompting several large

banks to cut their oil price forecasts in recent months.

The oil-company earnings on Thursday reflect a yearslong

campaign across the industry to bring down costs and spending to a

point where the companies can operate profitably in a

lower-oil-price environment.

It's an effort that remains ongoing.

Shell said it intends to maintain tight capital discipline going

forward and will continue to focus on bringing down costs and

capital efficiency. Statoil said it expects costs to continue to

improve this year and to squeeze out an additional $1 billion in

efficiencies.

U.S. oil majors Exxon Mobil Corp. and Chevron Corp. are

scheduled report their second-quarter earnings on Friday.

Write to Sarah Kent at sarah.kent@wsj.com

(END) Dow Jones Newswires

July 27, 2017 04:08 ET (08:08 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

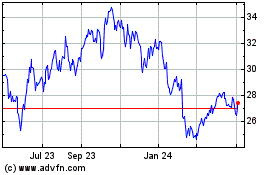

Equinor ASA (NYSE:EQNR)

Historical Stock Chart

From Mar 2024 to Apr 2024

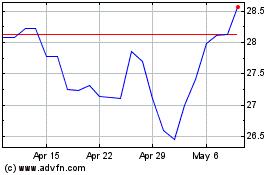

Equinor ASA (NYSE:EQNR)

Historical Stock Chart

From Apr 2023 to Apr 2024