ADRs End Mostly Higher; GlaxoSmithKline Trades Actively

July 26 2017 - 7:01PM

Dow Jones News

International stocks trading in New York closed mostly up on

Wednesday.

The BNY Mellon index of American depositary receipts improved

0.51% to 145.79. The European index increased 0.4% to 137.23. The

Asian index rose 0.85% to 167.73. And the emerging-markets index

rose 0.89% to 307.77.

Meanwhile, the Latin American index eased 0.04% to 233.77.

GlaxoSmithKline PLC (GSK, GSK.LN) was among those with ADRs that

traded actively.

GlaxoSmithKline axed more than 30 drug-research projects to

focus on four key disease areas in a push by new Chief Executive

Emma Walmsley to sharpen the company's research-and-development

operations. U.K.-based Glaxo said Wednesday it would now focus its

research on respiratory diseases, HIV and other infectious

diseases, cancer and immuno-inflammatory conditions. ADRs fell 2.7%

to $40.85.

JD.com Inc. (JD) has managed to outpace China's e-commerce

market overall by focusing on fast deliveries, and by expanding its

product line to entice affluent Chinese consumers, who are less

price-sensitive and looking for the latest gadgets and specialty

food items, said Robert Hah, a managing director at Accenture

Strategy Greater China. JD.com's continued growth is being watched

by technology-industry analysts. JD.com is now about $5 billion

below search engine Baidu Inc. (BIDU) in market value, positioning

the online retailer to possibly overtake Baidu as China's

third-largest internet company after Tencent Holding Ltd. and

Alibaba Group Holding Ltd. JD's ADRs closed up 3% at $45.87.

Three years into an oil-price slump, investors want the world's

biggest oil companies to do something they have historically

struggled with: Maintain some financial discipline. The companies

are under pressure to show they are continuing to move on from

budget-busting projects once common in the industry, as they head

into second-quarter financial disclosures that begin on Thursday

with Royal Dutch Shell PLC (RDSA, RDSA.LN, RDSB, RDSB.LN), which

closed up 0.49% at $55.53, and Total SA (TOT, FP.FR), up 1.1% at

$50.39.

Royal Bank of Scotland Group PLC (RBS, RBS.LN) will spend more

than GBP800 million on measures to increase competition in the U.K.

banking market to atone for breaking European Union rules following

its bailout during the financial crisis, the U.K. government said

Wednesday. ADRs closed up 1.1% at $6.70.

(END) Dow Jones Newswires

July 26, 2017 18:46 ET (22:46 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

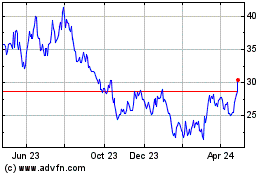

JD com (NASDAQ:JD)

Historical Stock Chart

From Mar 2024 to Apr 2024

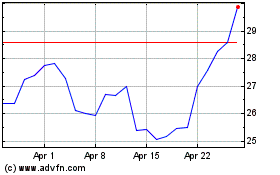

JD com (NASDAQ:JD)

Historical Stock Chart

From Apr 2023 to Apr 2024