- Second quarter net income, net income

excluding the impact of the Loss Portfolio Transfer (LPT) and

operating income of $24.8 million, $21.7 million and $19.7 million,

respectively.

- Annualized operating return on adjusted

equity of 8.1%.

- Second quarter combined ratio of 93.3%

and combined ratio excluding the impact of the LPT of 95.1%, each

an improvement year-over-year.

- Second quarter net written premiums of

$183.0 million, a decrease year-over-year related to a decline in

final audit premium.

- GAAP book value per share of $27.74,

book value per share of $32.95 and adjusted book value per share of

$30.17; increased 7.2%, 5.2% and 4.0%, respectively, in the first

half of 2017, each including dividends declared.

- In-force payroll exposure increased

1.7% overall, year-over-year.

- In-force policies increased 0.8%

overall, year-over-year.

- Net earned premiums decreased 2.9% in

the quarter, year-over-year.

- Board of Directors approved a quarterly

dividend of $0.15 per share.

Employers Holdings, Inc. (“EHI” or the “Company”)

(NYSE:EIG) today reported net income, net income excluding the

impact of the LPT and operating income of $24.8 million ($0.75 per

diluted share), $21.7 million ($0.66 per diluted share), and $19.7

million ($0.60 per diluted share), respectively, for the second

quarter of 2017.

The Company's net income for the second quarter of 2017

decreased $2.0 million year-over-year. This decrease reflects

non-routine adjustments made to LPT reserves and the LPT contingent

profit commission in the second quarter of 2016, which served to

reduce our losses and loss adjustment expense (LAE) and raise net

income by $4.9 million during that period.

The Company's net income before the impact of the LPT and

operating income increased by $2.5 million and $4.3 million,

respectively, year-over-year. These increases reflect a lower

combined ratio for the current period, driven primarily from a

reduction in the current accident year loss and LAE expense

ratio.

Chief Executive Officer Douglas Dirks commented on the

results:

“We produced another quarter of strong financial and operating

results. Excluding impacts of the LPT, our net income increased

13%, or eight cents per diluted share, and our combined ratio

improved 3.7 percentage points, demonstrating our disciplined

underwriting and sound investment strategies. Final audit premium

declined $6.2 million in the current quarter relative to the same

period last year, driving the 3% decline in top line

year-over-year. We achieved an annualized return on adjusted equity

of 8.1%, 1.2 percentage points higher than last year's second

quarter. Our balance sheet remained strong as we continued to grow

stockholders’ equity and book value per share. We again drove

strong new business growth and maintained high levels of retention

for our in-force policies, despite competitive market conditions,

while improving loss costs."

Summary of Second Quarter 2017

Results

(All comparisons vs. second quarter 2016, unless noted

otherwise).

Underwriting results

- The combined ratio before the impact of

the LPT decreased 3.7 percentage points to 95.1%, driven by a lower

current accident year loss and LAE ratio.

- The loss ratio before the LPT of 63.6%

decreased 3.8 percentage points reflecting a higher current

accident year loss ratio in last year's second quarter related to

four large losses and the continued impacts of key business

initiatives including: an emphasis on settling open claims;

diversifying our risk exposure across geographic markets; and

leveraging data-driven strategies to target, underwrite and price

profitable classes of business across all of our markets.

- The commission expense ratio of 12.5%

increased 0.1 percentage point due to an increase in partnership

and alliance business.

- The underwriting and other expense

ratio of 19.0% was flat.

Gross written premiums of $184.5 million decreased $6.1 million

due to a decline of $6.2 million in final audit premium compared

with the second quarter of 2016. Final audit pickup continued to be

positive with employers reporting higher payrolls at final audit

driven by increases in hours worked and the number of full-time

employees. We experienced strong new business growth but lower

renewal business overall, driven by one of our territories in

California.

In-force premium in states outside California grew 1.9% and

in-force premium in California increased by 0.5%. Policy count

outside of California grew 5.2% while policy count in California

declined 3.5%. Retention remained high and average renewal rates

decreased slightly by 1.8% year-to-date.

Net investment income of $18.2 million decreased $0.2 million

relative to the second quarter of last year. Net realized gains on

investments were $1.1 million versus $6.0 million in the second

quarter of last year when equity securities were sold as part of a

routine rebalancing of the equity portfolio.

In May of 2017, the Company redeemed $12.0 million of notes

payable for $9.9 million, resulting in a $2.1 million pre-tax

gain.

The Company's effective tax rate of 23.9% was slightly higher

than that of a year ago due mainly to the non-routine LPT

adjustments made in the second quarter of 2016, as previously

described.

Stockholders’ Equity including the

Deferred Gain, Second Quarter 2017 Dividend

Declaration

Stockholders’ equity including the deferred reinsurance gain was

$1,068.1 million, an increase of 4.1% year-over-year.

The Board of Directors declared a third quarter 2017 dividend of

$0.15 per share. The dividend is payable on August 23, 2017 to

stockholders of record as of August 9, 2017.

Conference Call and Web Cast; Form

10-Q; Supplemental Materials

The information in this press release should be read in

conjunction with the financial supplement that is attached to this

press release and is available on our website.

Reconciliation of Non-GAAP Financial

Measures to GAAP

Within this earnings release we present various financial

measures, some of which are a "non-GAAP financial measure" as

defined in Regulation G pursuant to Section 401 of the Sarbanes -

Oxley Act of 2002. A description of these non-GAAP financial

measures, as well as a reconciliation of such non-GAAP measures to

the Company's most directly comparable GAAP financial measures is

included in the attached Financial Supplement. Management believes

that these non-GAAP measures are meaningful to the Company's

investors, analysts and other interested parties who benefit from

having an objective and consistent basis for comparison with other

companies within our industry. These non-GAAP measures are not a

substitute for GAAP measures and investors should be careful when

comparing the Company's non-GAAP financial measures to similarly

titled measures used by other companies. Other companies may

calculate these measures differently, and, therefore, these

measures may not be comparable.

The Company will host a conference call on Thursday,

July 27, 2017, at 8:30 a.m. Pacific Daylight Time. The

conference call will be available via a live web cast on the

Company's web site at www.employers.com. An archived version will be

available several hours after the call. The conference call replay

number is (404) 537-3406 or (855) 859-2056 with a pass code of

55002602.

The Company provides a list of portfolio securities in the

Calendar of Events, “Investors” section of its website at

www.employers.com. The Company also

provides its filings with the Securities and Exchange Commission

and its investor presentations on its website.

Forward-Looking

Statements

In this press release, the Company and its management discuss

and make statements based on currently available information

regarding their intentions, beliefs, current expectations, and

projections of, among other things, the Company's future

performance, business growth, retention rates, loss costs, claim

trends and the impact of key business initiatives. Certain of these

statements may constitute "forward-looking" statements as that term

is defined in the Private Securities Litigation Reform Act of 1995.

Forward-looking statements can be identified by the fact that they

do not relate strictly to historical or current facts and are often

identified by words such as "may," "will," "could," "would,"

"should," "expect," "plan," "anticipate," "target," "project,"

"intend," "believe," "estimate," "predict," "potential," "pro

forma," "seek," "likely," or "continue," or other comparable

terminology and their negatives. EHI and its management caution

investors that such forward-looking statements are not guarantees

of future performance. Risks and uncertainties are inherent in

EHI's future performance. Factors that could cause the Company's

actual results to differ materially from those indicated by such

forward-looking statements include, among other things, those

discussed or identified from time to time in EHI's public filings

with the SEC, including the risks detailed in the Company's

Quarterly Reports on Form 10-Q and the Company's Annual Reports on

Form 10-K. Except as required by applicable securities laws, the

Company undertakes no obligation to publicly update or revise any

forward-looking statements, whether as a result of new information,

future events, or otherwise.

The SEC filings for EHI can be accessed through the “Investors”

link on the Company's website, www.employers.com, or through the SEC's EDGAR

Database at www.sec.gov (EHI EDGAR CIK

No. 0001379041).

Copyright © 2017 EMPLOYERS. All rights reserved. EMPLOYERS® and

America's small business insurance specialist. ® are registered

trademarks of Employers Insurance Company of Nevada. Employers

Holdings, Inc. is a holding company with subsidiaries that are

specialty providers of workers' compensation insurance and services

focused on select, small businesses engaged in low to medium hazard

industries. Insurance subsidiaries include Employers Insurance

Company of Nevada, Employers Compensation Insurance Company,

Employers Preferred Insurance Company, and Employers Assurance

Company, all rated A- (Excellent) by A.M. Best Company.

Additional information can be found at: http://www.employers.com.

Employers Holdings, Inc.Second Quarter

2017Financial Supplement

EMPLOYERS HOLDINGS, INC.

Table of Contents

Page

1

Consolidated Financial Highlights

2

Summary Consolidated Balance Sheets

3

Summary Consolidated Income Statements

4

Return on Equity

5

Combined Ratios

6

Roll-forward of Unpaid Losses and LAE

7

Consolidated Investment Portfolio

8

Book Value Per Share

9

Earnings Per Share

10

Non-GAAP Financial Measures

EMPLOYERS HOLDINGS, INC.

Consolidated Financial Highlights

(unaudited)

$ in millions, except per share

amounts

Three Months Ended Six Months

Ended June 30, June 30, 2017

2016* % change 2017 2016* %

change Selected financial highlights: Gross insurance

premiums written $ 184.5 $ 190.6 (3 )% $ 382.1 $ 381.3 — % Net

insurance premiums written 183.0 188.7 (3 ) 379.1 377.4 — Net

insurance premiums earned 171.7 176.9 (3 ) 347.1 349.5 (1 ) Net

investment income 18.2 18.4 (1 ) 36.9 36.2 2 Underwriting income

11.5 9.7 19 20.5 18.4 11 Net income before impact of the LPT(1)

21.7 19.2 13 42.0 37.9 11 Operating income(1) 19.7 15.4 28 38.6

33.1 17 Net income 24.8 26.8 (7 ) 48.0 48.6 (1 ) Comprehensive

income 32.5 46.2 (29 ) 63.8 87.8 (27 ) Total assets 3,824.8 3,832.4

— Stockholders' equity 899.2 845.3 6 Stockholders' equity including

deferred reinsurance gain(2) 1,068.1 1,026.0 4 Adjusted

stockholders' equity(2) 977.8 903.2 8 Annualized operating return

on adjusted stockholders' equity(3) 8.1 % 6.9 % 17 % 8.0 % 7.5 % 7

%

Amounts per share: Cash dividends declared per share $

0.15 $ 0.09 67 % $ 0.30 $ 0.18 67 % Net income per diluted share(4)

0.75 0.81 (7 ) 1.46 1.47 (1 ) Net income before impact of the LPT

per diluted share(4) 0.66 0.58 14 1.27 1.15 10 Operating income per

diluted share(4) 0.60 0.46 30 1.17 1.00 17 GAAP book value per

share(2) 27.74 26.04 7 Book value per share(2) 32.95 31.60 4

Adjusted book value per share(2) 30.17 27.82 8

Combined ratio

before impact of the LPT:(5) Loss and loss adjustment

expense ratio: Current year 63.8 % 68.6 % 63.8 % 66.4 % Prior year

(0.2 ) (1.2 ) (0.1 ) (0.7 ) Loss and loss adjustment expense ratio

63.6 % 67.4 % 63.7 % 65.7 % Commission expense ratio 12.5 12.4 12.4

12.1 Underwriting and other operating expense ratio 19.0

19.0 19.8 19.9 Combined ratio before impact of

the LPT 95.1 % 98.8 % 95.8 % 97.8 % (1) See Page 3 for

calculations and Page 10 for information regarding our use of

Non-GAAP Financial Measures.

(2) See Page 8 for calculations and Page

10 for information regarding our use of Non-GAAP Financial

Measures.

(3) See Page 4 for calculations and Page 10 for information

regarding our use of Non-GAAP Financial Measures. (4) See Page 9

for calculations and Page 10 for information regarding our use of

Non-GAAP Financial Measures. (5) See Page 5 for calculations and

Page 10 for information regarding our use of Non-GAAP Financial

Measures.

*The Company adopted ASU Number 2016-9,

Stock Compensation in the third quarter of 2016 with an effective

date of January 1, 2016. Adoption of this standard resulted in a

reduction to our income taxexpense of $0.5 million and $1.3 million

for the three and six months ended June 30, 2016, respectively.

EMPLOYERS HOLDINGS, INC.

Summary Consolidated Balance Sheets

(unaudited)

$ in millions, except per share

amounts

June 30, 2017 December 31,

2016 ASSETS Investments, cash and cash equivalents $

2,666.9 $ 2,623.4 Accrued investment income 20.5 20.6 Premiums

receivable, net 333.1 304.7 Reinsurance recoverable on paid and

unpaid losses 568.2 588.7 Deferred policy acquisition costs 49.6

44.3 Deferred income taxes, net 44.9 59.4 Contingent commission

receivable—LPT Agreement 31.1 31.1 Other assets 110.5 101.2

Total assets $ 3,824.8 $ 3,773.4

LIABILITIES Unpaid losses and LAE $ 2,284.9 $ 2,301.0

Unearned premiums 341.1 310.3 Commissions and premium taxes payable

52.0 48.8 Deferred reinsurance gain—LPT Agreement 168.9 174.9 Notes

payable 20.0 32.0 Other liabilities 58.7 65.8 Total

liabilities $ 2,925.6 $ 2,932.8

STOCKHOLDERS' EQUITY

Common stock and additional paid-in capital $ 377.2 $ 372.6

Retained earnings 815.4 777.2 Accumulated other comprehensive

income, net 90.3 74.5 Treasury stock, at cost (383.7 ) (383.7 )

Total stockholders’ equity 899.2 840.6 Total

liabilities and stockholders’ equity $ 3,824.8 $ 3,773.4

Stockholders' equity

including deferred reinsurance gain (1) $ 1,068.1 $ 1,015.5

Adjusted stockholders' equity (1) 977.8 941.0

GAAP Book Value per Share (1) $ 27.74 $ 26.16 Book value per

share (1) 32.95 31.61 Adjusted Book Value per Share (1)

30.17 29.29 (1) See Page 8 for

calculations and Page 10 for information regarding our use of

Non-GAAP Financial Measures.

EMPLOYERS HOLDINGS, INC.

Summary Consolidated Income Statements

(unaudited)

$ in millions, except per share

amounts

Three Months Ended Six Months Ended

June 30, June 30, 2017 2016*

2017 2016* Underwriting revenues: Gross

premiums written $ 184.5 $ 190.6 $ 382.1 $ 381.3 Premiums ceded

(1.5 ) (1.9 ) (3.0 ) (3.9 ) Net premiums written 183.0 188.7 379.1

377.4 Net premiums earned 171.7 176.9 347.1 349.5

Underwriting

expenses: Losses and LAE incurred (106.1 ) (111.7 ) (215.0 )

(219.0 ) Commission expense (21.5 ) (21.9 ) (43.0 ) (42.2 )

Underwriting and other operating expenses (32.6 ) (33.6 ) (68.6 )

(69.9 )

Underwriting income 11.5 9.7 20.5 18.4 Net

investment income 18.2 18.4 36.9 36.2 Gain on redemption of notes

payable 2.1 — 2.1 — Other income 0.1 0.5 0.1 0.6 Interest expense

(0.4 ) (0.4 ) (0.8 ) (0.8 ) Net realized gains on investments 1.1

6.0 3.3 7.5 Income tax expense (7.8 ) (7.4 ) (14.1 ) (13.3 )

Net

income 24.8 26.8 48.0 48.6 Net unrealized gains on investments

arising during the period, net of tax 8.4 23.3 17.9 44.1

Reclassification adj. for realized gains in net income, net of tax

(0.7 ) (3.9 ) (2.1 ) (4.9 )

Comprehensive income $

32.5 $ 46.2 $ 63.8 $ 87.8

Add (subtract) Amortization of deferred reinsurance gain -

losses $ (2.5 ) $ (2.2 ) $ (4.9 ) $ (4.8 ) Amortization of deferred

reinsurance gain - contingent commission (0.6 ) (0.5 ) (1.1 ) (1.0

) LPT reserve adjustment — (3.1 ) — (3.1 ) LPT contingent

commission adjustments — (1.8 ) — (1.8 )

Net

income before impact of the LPT Agreement (1) $

21.7 $ 19.2 $ 42.0 $ 37.9

Add (subtract) Impact of the LPT Agreement $ (3.1 ) $ (7.6 )

$ (6.0 ) $ (10.7 ) Net realized gains on investments, net of tax

(0.7 ) (3.9 ) (2.1 ) (4.9 ) Gain on redemption of notes payable,

net of tax (1.4 ) — (1.4 ) — Amortization of intangibles, net of

tax 0.1 0.1 0.1 0.1

Operating

income 1 $ 19.7 $ 15.4

$ 38.6 $ 33.1 (1) See Page 10

regarding our use of Non-GAAP Financial Measures.

*The Company adopted ASU Number 2016-9,

Stock Compensation in the third quarter of 2016 with an effective

date of January 1, 2016. Adoption of this standard resulted in a

reduction to our income taxexpense of $0.5 million and $1.3 million

for the three and six months ended June 30, 2016, respectively.

EMPLOYERS HOLDINGS, INC.

Return on Equity (unaudited)

$ in millions, except per share

amounts

Three Months Ended Six Months Ended June

30, June 30, 2017 2016* 2017

2016* Net income A $ 24.8 $ 26.8

$ 48.0 $ 48.6 Add (subtract): Impact of LPT Agreement (3.1 ) (7.6 )

(6.0 ) (10.7 ) Net realized gains on investments, net of tax (0.7 )

(3.9 ) (2.1 ) (4.9 ) Gain on redemption of notes payable, net of

tax (1.4 ) — (1.4 ) — Amortization of intangibles, net of tax 0.1

0.1 0.1 0.1

Operating income

(1) B $ 19.7 $ 15.4 $

38.6 $ 33.1 Stockholders' equity - end

of period $ 899.2 $ 845.3 $ 899.2 $ 845.3 Stockholders'

equity - beginning of period 867.5 803.7 840.6 760.8

Average stockholders' equity C $ 883.4

$ 824.5 $ 869.9 $ 803.1

Stockholders' equity - end of period $ 899.2 $ 845.3 $ 899.2 $

845.3 Add (subtract): Deferred reinsurance gain 168.9 180.7 168.9

180.7 Accumulated other comprehensive income, net of tax (90.3 )

(122.8 ) (90.3 ) (122.8 ) Adjusted stockholders' equity - end of

period 977.8 903.2 977.8 903.2 Adjusted stockholders' equity -

beginning of period 956.9 886.7 941.0 866.7

Average adjusted stockholders' equity (1)

D $ 967.4 $ 895.0 $ 959.4

$ 885.0 Return on stockholders' equity

A /

C 2.8 % 3.3 % 5.5 % 6.1 %

Annualized return on stockholders'

equity 11.2 13.0 11.0 12.1 Operating return on adjusted

stockholders' equity (1)

B / D 2.0 % 1.7 % 4.0 % 3.7 %

Annualized operating return on adjusted stockholders' equity

(1) 8.1 6.9 8.0

7.5

(1) See Page 10 for information regarding

our use of Non-GAAP Financial Measures.

*The Company adopted ASU Number 2016-9,

Stock Compensation in the third quarter of 2016 with an effective

date of January 1, 2016. Adoption of this standardresulted in a

reduction to our income tax expense of $0.5 million and $1.3

million for the three and six months ended June 30, 2016,

respectively.

EMPLOYERS HOLDINGS, INC.

Combined Ratios (unaudited)

$ in millions, except per share

amounts

Three Months Ended Six Months Ended June

30, June 30, 2017 2016 2017

2016 Net premiums earned

A $ 171.7 $ 176.9 $

347.1 $ 349.5 Losses and LAE incurred

B 106.1 111.7 215.0

219.0 Amortization of deferred reinsurance gain - losses 2.5 2.2

4.9 4.8 Amortization of deferred reinsurance gain - contingent

commission 0.6 0.5 1.1 1.0 LPT reserve adjustment — 3.1 — 3.1 LPT

contingent commission adjustments — 1.8 — 1.8

Losses and LAE before impact of the LPT (1)

C $ 109.2

$ 119.3 $ 221.0 $ 229.7 Less: favorable prior year loss reserve

development (0.3 ) (2.0 ) (0.3 ) (2.3 ) Losses and LAE before

impact of the LPT - current accident year

D $ 109.5 $

121.3 $ 221.3 $ 232.0 Commission expense

E $ 21.5 $ 21.9 $ 43.0 $ 42.2 Underwriting and other

operating expenses

F 32.6 33.6

68.6 69.9

GAAP combined ratio: Loss and

LAE ratio

B/A 61.8 % 63.1 % 61.9 % 62.7 % Commission expense

ratio

E/A 12.5 12.4 12.4 12.1 Underwriting and other

operating expense ratio

F/A 19.0 19.0 19.8

19.9 GAAP combined ratio 93.3 % 94.5 %

94.1 % 94.7 % Combined ratio before impact of the

LPT: (1) Loss and LAE ratio before impact of the LPT

C/A

63.6 % 67.4 % 63.7 % 65.7 % Commission expense ratio

E/A

12.5 12.4 12.4 12.1 Underwriting and other operating expense ratio

F/A 19.0 19.0 19.8 19.9 Combined

ratio before impact of the LPT 95.1 % 98.8 %

95.8 % 97.8 % Combined ratio before impact of the LPT:

current accident year (1) Loss and LAE ratio before impact of the

LPT

D/A 63.8 % 68.6 % 63.8 % 66.4 % Commission expense ratio

E/A 12.5 12.4 12.4 12.1 Underwriting and other operating

expense ratio

F/A 19.0 19.0 19.8 19.9

Combined ratio before impact of the LPT: current accident

year 95.3 % 99.9 % 95.9 % 98.5 %

(1) See Page 10 for information regarding our use of Non-GAAP

Financial Measures.

EMPLOYERS HOLDINGS, INC.

Roll-forward of Unpaid Losses and LAE

(unaudited)

$ in millions

Three Months Ended Six Months Ended

June 30, June 30, 2017 2016

2017 2016 Unpaid losses and LAE at

beginning of period $ 2,298.2 $ 2,341.9 $ 2,301.0 $ 2,347.5

Reinsurance recoverable on unpaid losses and LAE 572.9 621.4

580.0 628.2 Net unpaid losses and LAE at

beginning of period 1,725.3 1,720.5 1,721.0

1,719.3 Losses and LAE incurred: Current year losses 109.4

121.3 221.3 232.0 Prior year losses on voluntary business — — — —

Prior year losses on involuntary business (0.3 ) (2.0 ) (0.3 ) (2.3

) Total losses incurred 109.1 119.3 221.0

229.7 Losses and LAE paid: Current year losses 17.0 14.4

21.7 19.1 Prior year losses 92.3 91.9 195.2

196.4 Total paid losses 109.3 106.3 216.9

215.5 Net unpaid losses and LAE at end of period

1,725.1 1,733.5 1,725.1 1,733.5 Reinsurance recoverable on unpaid

losses and LAE 559.8 598.8 559.8 598.8

Unpaid losses and LAE at end of period $ 2,284.9 $ 2,332.3

$ 2,284.9 $ 2,332.3

EMPLOYERS HOLDINGS, INC.

Consolidated Investment Portfolio

(unaudited)

$ in millions

June 30, 2017 December 31, 2016

Investment Positions:

Cost

orAmortizedCost

Net UnrealizedGain

Fair Value % Fair Value

% Fixed maturities $ 2,361.3 $ 57.4 $ 2,418.7

91 % $ 2,344.4 89 % Equity securities 118.2

81.5 199.7 7 192.2 7 Short-term investments 5.5 — 5.5 — 16.0 1 Cash

and cash equivalents 42.6 — 42.6 2 67.2 3 Restricted cash and cash

equivalents 0.4 — 0.4 — 3.6

— Total investments and cash $ 2,528.0

$ 138.9 $ 2,666.9 100 % $ 2,623.4

100 %

Breakout of Fixed Maturities: U.S.

Treasuries and Agencies $ 146.1 $ 3.4 $ 149.5 6 % $ 140.2 6 %

States and Municipalities 785.9 31.2 817.1 34 851.6 36 Corporate

Securities 989.4 19.9 1,009.3 42 956.7 41 Mortgage-Backed

Securities 394.5 2.6 397.1 16 353.5 15 Asset-Backed Securities 45.4

0.3 45.7 2 42.4 2

Total fixed maturities

$ 2,361.3 $ 57.4 $ 2,418.7 100 % $

2,344.4 100 %

Weighted

average book yield 3.2% 3.1% Weighted average tax equivalent yield

3.7% 3.6% Average credit quality (S&P) AA- AA- Duration

4.1 4.3

EMPLOYERS HOLDINGS, INC.

Book Value Per Share

(unaudited)

$ in millions, except per share

amounts

June 30, 2017 December

31, 2016 June 30, 2016 December 31, 2015

Numerators: Stockholders' equity A $ 899.2 $

840.6 $ 845.3 $ 760.8 Plus: Deferred reinsurance gain 168.9

174.9 180.7 189.5

Stockholders' equity including

deferred reinsurance gain (1) B 1,068.1 1,015.5

1,026.0 950.3 Less: Accumulated other comprehensive income, net of

tax 90.3 74.5 122.8 83.6

Adjusted

stockholders' equity (1) C $ 977.8 $ 941.0

$ 903.2 $ 866.7

Denominator (shares

outstanding) D 32,412,997 32,128,922 32,463,660

32,216,480 GAAP book value per share (1)

A / D $

27.74 $ 26.16 $ 26.04 $ 23.62 Book value per share (1)

B / D

32.95 31.61 31.60 29.50 Adjusted book value per share (1)

C /

D 30.17 29.29 27.82 26.90 Cash dividends declared per

share $ 0.30 $ 0.36 $ 0.18 $ 0.24

YTD Change in:

(2) GAAP book value per share 7.2 % 11.0 % Book value per

share 5.2 7.7 Adjusted book value per share 4.0 4.1 (1) See

Page 10 for information regarding our use of Non-GAAP Financial

Measures. (2) Reflects the change in book value per share after

taking into account dividends declared in the period.

EMPLOYERS HOLDINGS, INC.

Earnings Per Share (unaudited)

$ in millions, except per share

amounts

Three Months Ended Six Months

Ended June 30, June 30, 2017

2016* 2017 2016* Numerators:

Net income A $ 24.8 $ 26.8 $ 48.0 $ 48.6 Add

(subtract): Impact of the LPT Agreement (3.1 ) (7.6 ) (6.0 ) (10.7

)

Net income before impact of

LPT (1) B $ 21.7 $ 19.2 $ 42.0

$ 37.9 Net realized gains on investments, net of tax

(0.7 ) (3.9 ) (2.1 ) (4.9 ) Gain on redemption of notes payable,

net of tax (1.4 ) — (1.4 ) — Amortization of intangibles, net of

tax 0.1 0.1 0.1 0.1

Operating

income (1) C $ 19.7 $ 15.4 $ 38.6

$ 33.1

Denominators: Average common

shares outstanding (basic)

D 32,469,137 32,629,525

32,398,858 32,521,672 Average common shares outstanding (diluted)

E 32,992,598 33,143,948 32,982,928 33,003,449

Net

income per share: Basic

A / D $ 0.76 $ 0.82 $ 1.48 $

1.49 Diluted

A / E 0.75 0.81 1.46 1.47

Net income

before impact of the LPT per share: (1) Basic

B /

D $ 0.67 $ 0.59 $ 1.30 $ 1.17 Diluted

B / E 0.66 0.58

1.27 1.15

Operating income per share: (1)

Basic

C / D $ 0.61 $ 0.47 $ 1.19 $ 1.02 Diluted

C / E

0.60 0.46 1.17 1.00 (1) See Page 10 for information

regarding our use of Non-GAAP Financial Measures.

*The Company adopted ASU Number 2016-9,

Stock Compensation in the third quarter of 2016 with an effective

date of January 1, 2016. Adoption of this standardresulted in a

reduction to our income tax expense of $0.5 million and $1.3

million for the three and six months ended June 30, 2016,

respectively.

Glossary of Financial

Measures

Within this earnings release we present the following measures,

each of which are a "non-GAAP financial measure" as defined in

Regulation G pursuant to Section 401 of the Sarbanes - Oxley Act of

2002. A reconciliation of these measures to the Company's most

directly comparable GAAP financial measures is included herein.

Management believes that these non-GAAP measures are important to

the Company's investors, analysts and other interested parties who

benefit from having an objective and consistent basis for

comparison with other companies within our industry. Management

further believes that these measures are more relevant than

comparable GAAP measures in evaluating our financial

performance.

The LPT Agreement is a non-recurring transaction that

does not result in ongoing cash benefits to the Company. Management

believes that providing non-GAAP measures that exclude the effects

of the LPT Agreement (amortization of deferred reinsurance gain,

adjustments to LPT Agreement ceded reserves and adjustments to

contingent commission receivable) is useful in providing investors,

analysts and other interested parties a meaningful understanding of

the Company's ongoing underwriting performance.

Deferred reinsurance gain reflects the unamortized gain

from the LPT Agreement. This gain has been deferred and is being

amortized using the recovery method, whereby the amortization is

determined by the proportion of actual reinsurance recoveries to

total estimated recoveries, except for the contingent profit

commission, which is being amortized through June 30, 2024.

Amortization is reflected in losses and LAE incurred.

Operating income (see Page 4 for calculations) is net

income excluding the effects of the LPT Agreement, net realized

gains (losses) on investments (net of tax), gain on redemption of

notes payable (net of tax), and amortization of intangible assets

(net of tax). Management believes that providing this non-GAAP

measures is helpful to investors, analysts and other interested

parties in identifying trends in the Company's operating

performance because such items have limited significance to its

ongoing operations or can be impacted by both discretionary and

other economic factors and may not represent operating trends.

Stockholders' equity including the deferred reinsurance

gain is stockholders' equity including the deferred reinsurance

gain. Management believes that providing this non-GAAP measure is

useful in providing investors, analysts and other interested

parties a meaningful measure of the Company's total underwriting

capital.

Adjusted stockholders' equity (see Page 8 for

calculations) is stockholders' equity including the deferred

reinsurance gain, less accumulated other comprehensive income (net

of tax). Management believes that providing this non-GAAP measure

is useful to investors, analysts and other interested parties since

it serves as the denominator to the Company's operating return on

equity metric.

Return on stockholders' equity and Operating return on

stockholders' equity (see Page 4 for calculations).

Management believes that these profitability measures are widely

used by our investors, analysts and other interested parties.

GAAP book value per share , Book value per share and Adjusted

book value per share (see Page 8 for calculations). Management

believes that these valuation measures are widely used by our

investors, analysts and other interested parties.

Net income, Combined ratio and Combined ratio before impact

of the LPT (see Pages 3 and 5 for calculations). Management

believes that these performance and underwriting measures are

widely used by our investors, analysts and other interested

parties.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170726006206/en/

Employers Holdings, Inc.Media:Ty Vukelich,

775-327-2677tvukelich@employers.com.orAnalysts:Vicki Erickson

Mills, 775-327-2794vericksonmills@employers.com.

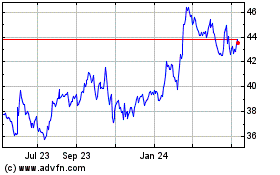

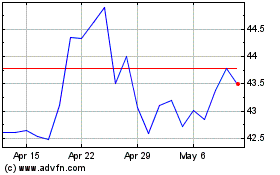

Employers (NYSE:EIG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Employers (NYSE:EIG)

Historical Stock Chart

From Apr 2023 to Apr 2024