Navios Maritime Containers Inc. ("Navios Containers " or "the

Company") (N-OTC:NMCI), a growth vehicle dedicated to the container

sector of the maritime industry, today reported financial results

for the period from April 28, 2017 (date of inception) through June

30, 2017.

Angeliki Frangou, Chairman and Chief Executive Officer, stated,

"We are pleased with the launch of Navios Containers, a vehicle

dedicated to the container sector. Navios Containers has the right

to acquire all containerships offered to the Navios Group."

Angeliki Frangou continued: "We are also pleased to have closed

on the Rickmers Maritime Trust transaction and expect all 14

vessels to be delivered to our fleet shortly. We are also

actively seeking to grow the containership fleet during this

difficult part of the cycle where we see attractive valuations for

containerships. We remain in active dialogue with industry

participants regarding possible vessel acquisitions, although the

outcome is far from certain."

HIGHLIGHTS -- RECENT DEVELOPMENTS

Initial Private Placement

On June 8, 2017, Navios Containers closed its

private placement of 10,057,645 shares at a subscription price of

$5.00 per share, resulting in gross proceeds of $50.3 million.

Navios Maritime Partners L.P. (“Navios Partners”) invested $30.0

million and received 59.7% of the equity, and Navios Maritime

Holdings Inc. (“Navios Holdings”) invested $5.0 million and

received 9.9% of the equity of Navios Containers. Each of Navios

Partners and Navios Holdings also received warrants, with a

five-year term, for 6.8% and 1.7% of the equity, respectively.

Navios Containers also registered its shares on

the Norwegian Over-The-Counter Market (N-OTC) on June 12, 2017

under the ticker NMCI.

Fleet Acquisition

Navios Containers used the proceeds of the

private placement to acquire five 4,250 TEU vessels from Navios

Partners for a total purchase price of $64.0 million. The payment

terms included a $24.0 million credit by Navios Partners for a

period of up to 90 days from the purchase date at LIBOR plus 375

bps, of which $14.0 million remained outstanding as of June 30,

2017. These vessels were previously acquired by Navios Partners

from Rickmers Maritime Trust Pte. (“Rickmers Trust”) and are

employed on charters with a net daily charter rate of $26,850 which

expire in 2018 and early 2019.

In addition, Navios Containers acquired all the

rights under the acquisition agreements entered into between Navios

Partners and Rickmers Trust to purchase the remaining nine vessels

in the original 14-vessel container fleet (the “Fleet”) for a

purchase price of $54.0 million plus certain delivery and other

operating costs. As of July 25, 2017, five of these vessels had

been delivered to Navios Containers and the remaining four are

expected to be delivered during August 2017.

Credit Facility

On June 29, 2017, Navios Containers entered into

a loan facility for an amount of $40.0 million with a commercial

bank in order to finance the acquisition of seven container vessels

of the Fleet (including the original five vessels). The facility is

repayable in six consecutive quarterly instalments of $3.8 million

each, plus a balloon payment on the last repayment date. The

facility matures in December 2018 and bears interest at LIBOR plus

385 bps per annum. As of June 30, 2017, the outstanding loan amount

under this facility was $34.3 million and an additional amount of

$3.2 million was drawn in July 2017. The Company is in advanced

discussions with the same commercial bank for the financing of the

remaining seven vessels of the Fleet.

Fleet Development

Navios Containers controls a fleet of 14 vessels, of which four

vessels are expected to be delivered during August 2017, totaling

57,100 TEU and the current average age of the fleet is 9.7 years.

As of July 25, 2017, Navios Containers has chartered-out 46.7% of

available days for the remaining six months of 2017, expecting to

generate revenues of approximately $26.0 million. The average

contractual daily charter-out rate for the fleet during this period

is expected to be $23,780.

Earnings Highlights

EBITDA is a non-U.S. GAAP financial measure and should not be

used in isolation or as a substitute for Navios Containers’ results

calculated in accordance with U.S. GAAP.

See Exhibit I under the heading, “Disclosure of Non-GAAP

Financial Measures,” for a discussion of EBITDA of Navios

Containers and a reconciliation of this measure to the most

comparable measures calculated under U.S. GAAP.

Second Quarter 2017 Results (in thousands of U.S.

dollars, except per share data and unless otherwise

stated):

The second quarter 2017 information presented below was derived

from the unaudited condensed consolidated financial statements for

the respective period.

| |

|

Period from April 28, 2017(date of

inception) to June30, 2017 |

| |

|

| |

|

| |

|

(unaudited) |

| Revenue |

|

$ |

3,102 |

|

| Net income |

|

$ |

881 |

|

| Net cash used in

operating activities |

|

$ |

(1,491 |

) |

| EBITDA |

|

$ |

2,281 |

|

| Basic Earnings per

Share |

|

$ |

0.09 |

|

| |

|

|

|

|

Fleet Summary Data:

The following table reflects certain key indicators indicative

of the performance of the Navios Containers' operations and its

fleet performance for the period from which the vessels were

delivered, June 8, 2017 through June 30, 2017.

| |

Period from June 8, 2017to June 30,

2017 |

| |

| |

| |

|

|

(Unaudited) |

| Available Days (1) |

|

|

115 |

|

| Operating Days (2) |

|

|

115 |

|

| Fleet Utilization

(3) |

|

|

100% |

|

| Vessels operating at

period end |

|

|

5 |

|

| TCE (4) |

|

$ |

26,968 |

|

|

(1 |

) |

Available

days for the fleet are total calendar days the vessels were in

Navios Containers' possession for the relevant period after

subtracting off-hire days associated with major repairs, drydocking

or special surveys. The shipping industry uses available days to

measure the number of days in a relevant period during which

vessels should be capable of generating revenues. |

|

(2 |

) |

Operating

days are the number of available days in the relevant period less

the aggregate number of days that the vessels are off-hire due to

any reason, including unforeseen circumstances. The shipping

industry uses operating days to measure the aggregate number of

days in a relevant period during which vessels actually generate

revenues. |

|

(3 |

) |

Fleet

utilization is the percentage of time that Navios Containers'

vessels were available for generating revenue, and is determined by

dividing the number of operating days during a relevant period by

the number of available days during that period. The shipping

industry uses fleet utilization to measure a company's efficiency

in finding suitable employment for its vessels. |

|

(4 |

) |

TCE is

defined as voyage and time charter revenues less voyage expenses

during a relevant period divided by the number of available days

during the period. |

About Navios Maritime Containers

Inc.

Navios Maritime Containers Inc. (N-OTC:NMCI) is a growth vehicle

dedicated to the container sector of the maritime industry. For

more information, please visit its website at

www.navios-containers.com.

About Navios Maritime Holdings Inc.

Navios Maritime Holdings Inc. (NYSE:NM) is a global, vertically

integrated seaborne shipping and logistics company focused on the

transport and transshipment of dry bulk commodities including iron

ore, coal and grain. For more information about Navios Holdings

please visit our website: www.navios.com.

About Navios Maritime Partners L.P.

Navios Partners (NYSE:NMM) is a publicly traded master limited

partnership which owns and operates container and dry bulk vessels.

For more information, please visit its website at

www.navios-mlp.com.

Forward Looking Statements - Safe Harbor

This press release contains forward-looking statements

concerning future events, including cash flow generation for the

remainder of 2017, future contracted revenues, financial

performance of the fleet, vessel deliveries, and Navios Containers'

growth strategy and measures to implement such strategy; including

expected vessel acquisitions and the ability to secured related

financing, the further growth of our containership fleet, and

entering into further time charters. Words such as “may,”

“expects,” “intends,” “plans,” “believes,” “anticipates,” “hopes,”

“estimates,” and variations of such words and similar expressions

are intended to identify forward-looking statements. These

forward-looking statements are based on the information available

to, and the expectations and assumptions deemed reasonable by

Navios Containers at the time these statements were made. Although

Navios Containers believes that the expectations reflected in such

forward-looking statements are reasonable, no assurance can be

given that such expectations will prove to have been correct. These

statements involve known and unknown risks and are based upon a

number of assumptions and estimates which are inherently subject to

significant uncertainties and contingencies, many of which are

beyond the control of Navios Containers. Actual results may differ

materially from those expressed or implied by such forward-looking

statements. Factors that could cause actual results to differ

materially include, but are not limited to, risks relating to the

completion of the fleet acquisition on the anticipated timing or at

all, the quality of the fleet and the market for the fleet vessels,

the uncertainty relating to global trade, including prices of

seaborne commodities and continuing issues related to seaborne

volume and ton miles, our continued ability to enter into long-term

time charters, our ability to maximize the use of our vessels,

expected demand in the container shipping sector in general,

fluctuations in charter rates for container carrier vessels, the

aging of our fleet and resultant increases in operations costs, the

loss of any customer or charter or vessel, the financial condition

of our customers, changes in the availability and costs of funding

due to conditions in the bank market, capital markets and other

factors, increases in costs and expenses, including but not limited

to: crew wages, insurance, provisions, port expenses, lube oil,

bunkers, repairs, maintenance, and general and administrative

expenses, the expected cost of, and our ability to comply with,

governmental regulations and maritime self-regulatory organization

standards, as well as standard regulations imposed by our

charterers applicable to our business, general domestic and

international political conditions, competitive factors in the

market in which Navios Containers operates, and risks associated

with global operations. Navios Containers expressly disclaims any

obligations or undertaking to release publicly any updates or

revisions to any forward-looking statements contained herein to

reflect any change in Navios Containers' expectations with respect

thereto or any change in events, conditions or circumstances on

which any statement is based. Navios Containers makes no prediction

or statement about the performance of its common stock.

| EXHIBIT I |

| NAVIOS MARITIME CONTAINERS INC. |

| CONDENSED CONSOLIDATED STATEMENTS OF

INCOME |

| (Expressed in thousands of U.S. dollars -

except for share and per share data) |

|

|

|

|

| |

Period from April 28,

2017(date of inception) to June

30,2017 |

| |

(unaudited) |

| |

|

|

|

| Revenue |

$ |

3,102 |

|

| Time charter and voyage

expenses |

|

|

(1 |

) |

|

| Management fees

(entirely through related parties transactions) |

|

|

(702 |

) |

|

| General and

administrative expenses |

|

|

(117 |

) |

|

| Depreciation and

amortization |

|

|

(1,320 |

) |

|

| Interest expense and

finance cost, net |

|

|

(80 |

) |

|

| Other (expense)/

income, net |

|

(1 |

) |

|

| Net

income |

$ |

881 |

|

|

| |

|

|

|

| Net income

attributable to common stockholders |

$ |

881 |

|

|

| |

|

|

|

|

| Net earnings per share,

basic and diluted |

$ |

0.09 |

|

|

| Weighted average number

of shares, basic and diluted |

|

|

10,057,645 |

|

|

|

|

| |

| NAVIOS MARITIME CONTAINERS INC. |

| CONDENSED CONSOLIDATED BALANCE

SHEETS |

| (Expressed in thousands of U.S. dollars – except for

share data) |

| |

| |

| |

|

|

June 30,2017(unaudited) |

|

ASSETS |

|

|

|

| Current

assets |

|

|

|

| Cash and cash

equivalents |

|

$ |

34,936 |

| Prepaid and other

current assets |

|

|

40 |

| Amounts due from

related companies |

|

|

3,292 |

| Total current

assets |

|

|

38,268 |

| |

|

|

|

| Vessels, net |

|

|

32,339 |

| Favorable lease

terms |

|

|

25,353 |

| Long- term receivable

from related companies |

|

|

1,373 |

| Total

non-current assets |

|

|

59,065 |

|

|

|

|

|

| Total

assets |

|

$ |

97,333 |

| |

|

|

|

| LIABILITIES AND

STOCKHOLDERS’ EQUITY |

|

|

|

| Current

liabilities |

|

|

|

| Accounts payable |

|

$ |

82 |

| Accrued expenses |

|

|

2,515 |

| Deferred income and

cash received in advance |

|

|

1,561 |

| Amounts due to related

companies |

|

|

1,723 |

| Consideration payable

to parent company |

|

|

14,000 |

| Current portion

of long-term debt, net |

|

|

12,317 |

| Total current

liabilities |

|

|

32,198 |

| |

|

|

|

| Long-term debt, net of

current portion and deferred financing fees |

|

|

21,353 |

| Total

non-current liabilities |

|

|

21,353 |

|

|

|

|

|

| Total

liabilities |

|

$ |

53,551 |

| |

|

|

|

| Commitments and

contingencies |

|

|

— |

| Stockholders’

equity |

|

|

|

|

Common stock — $0.0001 par value, 75,000,000 authorizedregistered

ordinary shares, 10,057,645 issued and outstanding as ofJune 30,

2017. |

|

|

1 |

| Additional paid-in

capital |

|

|

42,900 |

| Retained earnings |

|

|

881 |

| Total

stockholders’ equity |

|

|

43,782 |

| Total

liabilities and stockholders’ equity |

|

$ |

97,333 |

| |

|

|

|

| |

| NAVIOS MARITIME CONTAINERS INC. |

| CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS |

| (Expressed in thousands of U.S. dollars – except for

share data) |

| |

| |

| |

Period from April 28,

2017(date of inception) to June

30, 2017

(unaudited) |

| OPERATING

ACTIVITIES: |

|

|

|

| Net income |

$ |

881 |

|

| Adjustments to

reconcile net income to net cash used in

operatingactivities: |

|

|

|

| Depreciation and

amortization |

|

1,320 |

|

|

|

|

|

|

| Changes in

operating assets and liabilities: |

|

|

|

| Increase in due from

related companies |

|

(2,844 |

) |

| Decrease in prepaid and

other current assets |

|

7 |

|

| Increase in long-term

receivable from affiliate companies |

|

(1,373 |

) |

| Increase in accounts

payable |

|

35 |

|

| Increase in accrued

expenses |

|

1,123 |

|

| Increase in due to

related companies |

|

49 |

|

| Decrease in deferred

income and cash received in advance |

|

(689 |

) |

| Net cash used

in operating activities |

$ |

(1,491 |

) |

|

|

|

|

|

| INVESTING

ACTIVITIES: |

|

|

|

| Cash acquired through

asset acquisition |

|

5,433 |

|

| Acquisition of vessels

and favorable lease terms |

|

(50,000 |

) |

| Net cash used

in investing activities |

$ |

(44,567 |

) |

|

|

|

|

|

| FINANCING

ACTIVITIES: |

|

|

|

| Proceeds from long-term

borrowings |

|

34,320 |

|

| Debt issuance

costs |

|

(650 |

) |

| Proceeds from issuance

of common shares, net of offering costs |

|

47,324 |

|

| Net cash

provided by financing activities |

$ |

80,994 |

|

|

|

|

|

|

| Increase in

cash and cash equivalents |

$ |

34,936 |

|

| Cash and cash

equivalents, beginning of period |

$ |

- |

|

| Cash and cash

equivalents, end of period |

$ |

34,936 |

|

|

|

|

|

|

SUPPLEMENTAL DISCLOSURES OF CASH FLOW

INFORMATION

| Non-cash

investing and financing activities |

|

|

|

|

| Consideration payable

net of working capital acquired |

|

|

$ |

(11,273 |

) |

| Deemed distribution

payable to controlling shareholders |

|

|

$ |

(4,423 |

) |

|

|

| NAVIOS MARITIME CONTAINERS INC. |

| CONDENSED CONSOLIDATED STATEMENTS OF CHANGES

IN EQUITY |

| (Expressed in thousands of U.S. dollars — except for

share data) |

|

|

|

For the period from April 28, 2017 (date of inception) to

June 30, 2017 |

|

|

|

|

| |

|

Number

ofCommonShares |

|

|

Common Stock |

|

|

AdditionalPaid-inCapital |

|

RetainedEarnings |

|

Total Stockholders’ Equity |

| Balance April

28, 2017 (date of inception) |

|

|

- |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

$ |

- |

|

| Issuance of common

stock, net of offering expenses |

|

|

10,057,645 |

|

|

|

1 |

|

|

|

47,323 |

|

|

|

- |

|

|

47,324 |

|

| Deemed distribution to

controlling shareholders |

|

|

- |

|

|

|

- |

|

|

|

(4,423 |

) |

|

|

- |

|

|

(4,423 |

) |

| Net income |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

881 |

|

|

881 |

|

| Balance

June 30, 2017 (unaudited) |

|

|

10,057,645 |

|

|

$ |

1 |

|

|

$ |

42,900 |

|

|

$ |

881 |

|

$ |

43,782 |

|

Disclosure of Non-GAAP Financial Measures

EBITDA is a “non-U.S. GAAP financial measure” and should not be

used in isolation or considered a substitute for net income/(loss),

cash flow from operating activities and other operations or cash

flow statement data prepared in accordance with generally accepted

accounting principles in the United States.

EBITDA represents net income/(loss) before interest and finance

costs, before depreciation and amortization, before income taxes

and before stock-based compensation. We use EBITDA as liquidity

measures and reconcile EBITDA to net cash provided by/(used in)

operating activities, the most comparable U.S. GAAP liquidity

measure. EBITDA is calculated as follows: net cash provided by

operating activities adding back, when applicable and as the case

may be, the effect of (i) net increase/(decrease) in operating

assets, (ii) net (increase)/decrease in operating liabilities,

(iii) net interest cost, (iv) deferred finance charges, (v)

provision for losses on accounts receivable, and (vi) payments for

drydock and special survey costs. Navios Containers believes that

EBITDA is a basis upon which liquidity can be assessed and

represents useful information to investors regarding Navios

Containers’ ability to service and/or incur indebtedness, pay

capital expenditures, meet working capital requirements and pay

dividends. Navios Containers also believes that EBITDA is used (i)

by prospective and current lessors as well as potential lenders to

evaluate potential transactions; (ii) to evaluate and price

potential acquisition candidates; and (iii) by securities analysts,

investors and other interested parties in the evaluation of

companies in our industry.

EBITDA is presented to provide additional information with

respect to the ability of Navios Containers to satisfy its

respective obligations, including debt service, capital

expenditures, working capital requirements and pay dividends. While

EBITDA is frequently used as a measure of operating results and the

ability to meet debt service requirements, the definition of EBITDA

used here may not be comparable to those used by other companies

due to differences in methods of calculation.

EBITDA has limitations as an analytical tool, and therefore,

should not be considered in isolation or as a substitute for the

analysis of Navios Containers’ results as reported under U.S. GAAP.

Some of these limitations are: (i) EBITDA does not reflect changes

in, or cash requirements for, working capital needs; (ii) EBITDA

does not reflect the amounts necessary to service interest or

principal payments on our debt and other financing arrangements;

and (iii) although depreciation and amortization are non-cash

charges, the assets being depreciated and amortized may have to be

replaced in the future. EBITDA does not reflect any cash

requirements for such capital expenditures. Because of these

limitations, among others, EBITDA should not be considered as a

principal indicator of Navios Containers’ performance. Furthermore,

our calculation of EBITDA may not be comparable to that reported by

other companies due to differences in methods of calculation.

|

Navios Containers Reconciliation of EBITDA to Cash from

Operations |

| |

| |

| |

|

Period from April 28,2017(date of

inception) to June30, 2017 |

|

|

|

| (in thousands

of U.S. dollars) |

|

(unaudited) |

| |

|

|

|

| Net cash

used in operating activities |

|

$ |

(1,491 |

) |

| Net

increase in operating assets |

|

|

4,210 |

|

| Net

increase in operating liabilities |

|

|

(518 |

) |

| Net

interest cost |

|

|

80 |

|

|

EBITDA(1) |

|

$ |

2,281 |

|

| (1) |

|

|

Period from April 28,2017(date of

inception) to June30, 2017 |

|

|

|

|

| (in

thousands of U.S. dollars) |

|

|

(unaudited) |

| |

|

|

|

|

| Net cash used in operating activities |

|

|

$ |

(1,491 |

) |

| Net cash used in investing activities |

|

|

$ |

(44,567 |

) |

| Net cash provided by financing activities |

|

|

$ |

80,994 |

|

| EXHIBIT II |

|

Owned Vessels |

| |

|

Vessel Name |

|

TEU |

|

Year Built |

| Navios Summer |

|

3,450 |

|

2006 |

| Navios Verano |

|

3,450 |

|

2006 |

| Navios Verde |

|

4,250 |

|

2007 |

| Navios Amarillo |

|

4,250 |

|

2007 |

| Navios Azure |

|

4,250 |

|

2007 |

| MOL Dominance |

|

4,250 |

|

2008 |

| MOL Delight |

|

4,250 |

|

2008 |

| MOL Dedication |

|

4,250 |

|

2008 |

| MOL Devotion |

|

4,250 |

|

2009 |

| MOL Destiny |

|

4,250 |

|

2009 |

|

Vessels to be Delivered |

| |

|

Vessel Name |

|

TEU |

|

Year Built |

|

Delivery Date |

| Moni Rickmers |

|

3,450 |

|

2007 |

|

08/2017 |

| Erwin Rickmers |

|

4,250 |

|

2007 |

|

08/2017 |

| Sabine Rickmers |

|

4,250 |

|

2007 |

|

08/2017 |

| Vicki Rickmers |

|

4,250 |

|

2007 |

|

08/2017 |

Contact:

Navios Maritime Containers Inc.

+1.212.906.8648

investors@navios-containers.com

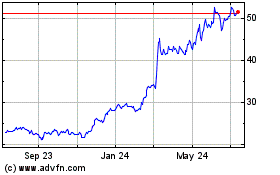

Navios Maritime Partners (NYSE:NMM)

Historical Stock Chart

From Mar 2024 to Apr 2024

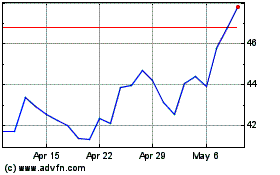

Navios Maritime Partners (NYSE:NMM)

Historical Stock Chart

From Apr 2023 to Apr 2024