As

filed with the Securities and Exchange Commission on July 26, 2017

Registration

No. 333-

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

S-1

REGISTRATION

STATEMENT UNDER

THE

SECURITIES ACT OF 1933

PetroTerra

Corp.

(Exact

name of registrant as specified in its charter)

|

Nevada

|

|

4731

|

|

26-3106763

|

|

(State

or other jurisdiction of incorporation or organization)

|

|

(Primary

Standard Industrial Classification Code Number)

|

|

(I.R.S.

Employer

Identification

Number)

|

2833

EXCHANGE COURT,

WEST

PALM BEACH, FLORIDA 33409

(561)

672-7068

(Address,

including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Steven

Yariv

Chief

Executive Officer

2833

Exchange Ct.

West

Palm Beach, Florida 33409

(561)

672-7068

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Copies

to:

|

M.

Ali Panjwani, Esq.

Pryor

Cashman LLP

7

Times Square

New

York, New York 10036

Tel:

(212) 326-0820

Fax:

(212 798-6319

|

Approximate

date of commencement of proposed sale to the public:

As soon as practicable after this registration statement becomes effective.

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under

the Securities Act, check the following box. [X]

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the

same offering. [ ]

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list

the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list

the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated

filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange

Act. (Check one):

|

Large accelerated filer [ ]

|

Accelerated filer [ ]

|

Non-accelerated filer [ ]

|

Smaller reporting company [X]

|

Emerging growth company [ ]

|

|

|

|

(Do

not check if a smaller reporting company)

|

|

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

[ ]

CALCULATION

OF REGISTRATION FEE

|

Title

of Each Class of

Securities

To Be Registered

|

|

Amount

to

be

Registered

(1)(2)

|

|

|

Proposed

Maximum

Offering

Price

Per

Share

(3)(4)

|

|

|

Proposed

Maximum

Aggregate

Offering

Price

|

|

|

Amount

of

Registration

Fee

|

|

|

Common Stock, $0.001

par value per share

|

|

|

91,108,012

|

|

|

$

|

0.0225

|

|

|

$

|

2,049,930.27

|

|

|

$

|

237.59

|

|

|

(1)

|

Consists

of (i) 48,630,136 shares of common stock issuable upon conversion of $355,000 of principal aggregate amount of convertible

notes held by a selling stockholder and convertible at an assumed conversion price of $0.0146 per share and (ii) 42,477,876

shares of common stock issuable upon conversion of $240,000 of principal aggregate amount of convertible notes held by a selling

stockholder and convertible at an assumed conversion price of $0.0113 per share.

|

|

(2)

|

Pursuant

to Rule 416 under the Securities Act, the shares offered hereby also include an indeterminate

number of additional shares of common stock as may from time to time become issuable

by reason of stock splits, stock dividends, recapitalizations or other similar transactions.

|

|

(3)

|

The

proposed maximum offering price per share will be determined from time to time in connection with, and at the time of, the

sale by the holder of such share.

|

|

(4)

|

Estimated

solely for the purpose of calculating the registration fee in accordance with Rule 457(c) under the Securities Act. The price

per share and aggregate offering price are based on the average of the high and low prices of the registrant’s common

stock on July 13, 2017, as reported on the OTC Pink.

|

The

registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until

the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become

effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this registration statement shall

become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The

information in this preliminary prospectus is not complete and may be changed. The selling stockholders may not sell these securities

until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is

not an offer to sell these securities, and the selling stockholders are not soliciting offers to buy these securities, in any

state where the offer or sale of these securities is not permitted.

SUBJECT

TO COMPLETION, DATED JULY 26, 2017

PRELIMINARY

PROSPECTUS

91,108,012

Shares of Common Stock

This

prospectus relates to the proposed resale or other disposition from time to time by the selling stockholders identified in this

prospectus of up to 91,108,012 shares of common stock, par value $0.001 per share, issuable upon (i) conversion of $355,000 of

principal amount of convertible promissory notes held by a selling stockholder and convertible at prices pursuant to the terms

of the convertible promissory notes as described herein and (ii) conversion of $240,000 of principal amount of convertible promissory

notes held by a selling stockholder and convertible at prices pursuant to the terms of the convertible promissory notes as described

herein (collectively, the “Resale Shares”). All of the shares, when sold, will be sold by the selling stockholders.

We are not selling any common stock under this prospectus and will not receive any of the proceeds from the sale or other disposition

of shares by the selling stockholders.

The

selling stockholders may sell the shares of our common stock offered by this prospectus from time to time to or through underwriters

or dealers, directly to purchasers or through agents designated from time to time. The selling stockholders will bear all commissions

and discounts, if any, attributable to the sales of shares. We will bear all other costs, expenses and fees in connection with

the registration of the shares. For additional information regarding the methods of sale, you should refer to the section entitled

“Plan of Distribution” in this Prospectus.

Our

common stock is traded on OTC Pink under the symbol “PTRA”. On July 13, 2017, the last reported sale price of our

common stock on OTC Pink was $0.0225 per share.

Investing

in our common stock and warrants involves a high degree of risk. See “Risk Factors” beginning on page 7 of this prospectus.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or

determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this prospectus is , 2017

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

You

should rely only on the information contained in this prospectus and any prospectus supplement prepared by or on behalf of us

or to which we have referred you. We have not authorized anyone to provide you with information that is different. If anyone provides

you with different or inconsistent information, you should not rely upon it. The information in this prospectus is complete and

accurate only as of the date on the front cover of this prospectus, regardless of the time of delivery of this prospectus or any

sale of any of our securities. Our business, financial condition, results of operations and prospects may have changed since these

dates.

This

prospectus does not constitute an offer to sell or the solicitation of an offer to buy any of our shares of common stock other

than the shares of our common stock covered hereby, nor does this prospectus constitute an offer to sell or the solicitation of

an offer to buy any securities in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in

such jurisdiction. Persons who come into possession of this prospectus in jurisdictions outside the United States are required

to inform themselves about, and to observe, any restrictions as to the offering and the distribution of this prospectus applicable

to those jurisdictions.

PROSPECTUS

SUMMARY

The

following summary highlights information contained elsewhere in this prospectus and is qualified in its entirety by the more detailed

information and financial statements included elsewhere in this prospectus. This summary does not contain all of the information

you should consider before investing in our securities. Before you decide to invest in our securities, you should read and carefully

consider the following summary together with the entire prospectus, including our financial statements and the related notes thereto

appearing elsewhere in this prospectus and the matters discussed in the sections in this prospectus entitled “Risk Factors”

and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Some of the statements

in this prospectus constitute forward-looking statements that involve risks and uncertainties. See the section in this prospectus

entitled “Special Note Regarding Forward-Looking Statements.” Our actual results could differ materially from those

anticipated in such forward-looking statements as a result of certain factors, including those discussed in the “Risk Factors”

and other sections of this prospectus.

Except

as otherwise indicated herein or as the context otherwise requires, references in this prospectus to “PetroTerra,”

“the company,” “we,” “us,” “our” and similar references refer to PetroTerra Corp.

Our

Company

Overview

We

are a holding company that operates as a Florida based provider of integrated transportation management solutions through our

wholly-owned subsidiary, Save on Transport. Save on Transport’s integrated transportation management solutions consist of

brokerage and logistics services such as transportation scheduling, routing and other value added services related to the transportation

of automobiles and other freight.

Corporate

History and Information

We

were originally incorporated under the laws of the State of Nevada on July 25, 2008 under the name Loran Connection Corp. We were

formed to provide a variety of services in the area of individual and group tourism and business support in Ukraine. On January

25, 2012, we filed an amendment to our articles of incorporation to, among other things, change our name to “PetroTerra

Corp.” and effect a thirty-two-for-one reverse split. We changed our name to reflect a proposed change in our business operations.

On October 2, 2013, in connection with a change of control in the management of the Company, the Company began business operations

in the oil and gas sector. Since January 2016, as a result of the decline in the oil and gas markets, we generated minimal sales

revenue and our operations were subject to all the risks inherent in the establishment of a new business enterprise.

On

March 30, 2017, we executed a Share Exchange Agreement (the “Share Exchange Agreement”) between us and Save on Transport

Inc., a Florida corporation (“Save on Transport”), pursuant to which Save on Transport became a wholly-owned subsidiary

of ours (the “Reverse Merger”). Pursuant to the Share Exchange Agreement, we acquired all of the issued and outstanding

common stock of Save on Transport from Steven Yariv, and in exchange, we issued 114,202,944 shares of our common stock, par value

$0.001 per share (the “Common Stock”) to Steven Yariv, and he was appointed Chief Executive Officer and elected as

the Chairman of our Board of Directors.

As

a result of the Reverse Merger, we are the holding company for our wholly-owned subsidiary, Save on Transport. Save on Transport

was formed under the laws of the state of Florida in July 2016. Save on Transport operates as an automobile shipping company that

provides transportation, brokerage, and logistics services relating to vehicle shipping.

Our

principal executive offices are located in the United States at 2833 Exchange Court, West Palm Beach, Florida 33409, and our telephone

number is (561) 672-7068.

Business

and Operations

Save

on Transport is a Florida based non-asset provider of integrated transportation management solutions. We provide brokerage and

logistics services such as transportation scheduling, routing and other value added services related to the transportation of

automobiles and other freight, which involve the use of independent contractor-owned trucks and equipment. We do not own the trucks

or other equipment used to transport freight. Instead we utilize our relationships with subcontracted transportation providers

– typically independent contract motor carriers. We make a profit on the difference between what we charge our customers

for the services we provide and what we pay to the transportation providers to transport our customers’ freight. Our success

depends in large part on our ability to hire and train talented salespeople and deploy them under exceptional leaders, develop

sophisticated information technology, and build relationships with the carriers in our network so that we can purchase the optimal

transportation solutions for our customers. Currently, all of our revenues are derived from domestic shipments.

Our

Strategy and Competitive Strengths

Our

growth strategy focuses on developing a full suite of automobile transportation brokerage and logistics solutions for our customers.

Our service offerings consist of non-asset based transportation supply chain management, logistics and brokerage solutions. We

facilitate cost-effective vehicle shipping for customers for a variety of reasons including:

|

|

●

|

Household

moves;

|

|

|

|

|

|

|

●

|

Seasonal

moves;

|

|

|

|

|

|

|

●

|

Military

moves;

|

|

|

|

|

|

|

●

|

College

moves;

|

|

|

|

|

|

|

●

|

Company

relocation;

|

|

|

|

|

|

|

●

|

Internet

automobile purchases;

|

|

|

|

|

|

|

●

|

Classic

car and collector shows; and

|

|

|

|

|

|

|

●

|

Transportation

for car dealerships.

|

Save

on Transport differentiates itself from the competition and grows its business by sustaining a high level of customer service,

offering expedited and time-definite services, while providing competitive pricing.

Government

Regulation

Our

operations are regulated and licensed by various governmental agencies in the United States. Such regulations impact us directly

and indirectly by regulating third-party transportation providers we use to transport freight for our customers.

Regulation

affecting Motor Carriers, Owner Operators and Transportation Brokers

.

In

the United States, our third-party providers that operate as motor carriers have licenses to operate as motor carriers from the

Federal Motor Carrier Safety Administration (“FMCSA”) of the U.S. Department of Transportation (“DOT”).

The third-party motor carriers we engage in the United States must comply with the safety and fitness regulations of DOT, including

those relating to drug- and alcohol-testing, hours-of-service, records retention, vehicle inspection, driver qualification and

minimum insurance requirements. Weight and equipment dimensions also are subject to government regulations. Other agencies, such

as the U.S. Environmental Protection Agency (“EPA”), the Food and Drug Administration, the California Air Resources

Board, and U.S. Department of Homeland Security (“DHS”), also regulate our third-party motor carriers and independent

contractor drivers. The third-party carriers we use are also subject to a variety of vehicle registration and licensing requirements

of the state or other local jurisdictions in which they operate.

In

2010, the FMCSA introduced the Compliance Safety Accountability program (“CSA”), which uses a Safety Management System

(“SMS”) to rank motor carriers on seven categories of safety-related data, known as Behavioral Analysis and Safety

Improvement Categories, or “BASICs,” which data, it is anticipated, will eventually be used for determining a carrier’s

DOT safety rating under revisions to existing Safety Fitness Determination (“SFD”) regulations. In December 2015,

the Fixing America’s Surface Transportation Act (“FAST Act”) was signed into law, which requires the FMCSA to

review the CSA program to ensure that it provides the most reliable analysis possible. During this review period, the FAST Act

requires the FMCSA to remove a property carrier’s CSA scores from public view. The FMCSA has since announced a SFD Notice

of Proposed Rulemaking (“NPRM”) that would revamp the current three-tier federal rating system for federally regulated

commercial motor carriers.

Other

Regulations.

We

are subject to a variety of other U.S. and foreign laws and regulations, including but not limited to, the Foreign Corrupt Practices

Act and other similar anti-bribery and anti-corruption statutes. Further, the transportation industry is subject to possible other

regulatory and legislative changes (such as the possibility of more stringent environmental, climate change and/or safety/security

regulations) that may affect the economics of the freight shipping industry by requiring changes in operating practices or changing

the demand for motor carrier services or the cost of providing transportation logistics services.

Employees

As

of June 1, 2017, Save on Transport has 1 full-time employee. PetroTerra Corp. has no full-time employees.

Marketing

and Significant Customers

Our

customers are primarily different and distinct individuals introduced through referrals sources. Our business serves the North

American market, with a near total concentration in the United States.

To

best serve our customers, we will need to hire and maintain a significant staff of sales representatives and related support personnel.

Our sales strategy is twofold: we seek to establish long-term relationships with new accounts and to increase the amount of business

generated from our existing customer base. We believe that these attributes are competitive advantages in the transportation and

logistics industry.

Information

Systems

We

utilize two main cloud based Information Systems: jTracker for taking customer orders and Central Dispatch for posting orders

for carrier communications.

The

transportation and logistics industry is highly competitive, with thousands of companies competing in the domestic and international

markets. Our competitors include local, regional, national and international companies with the same services that our business

provides. Due in part to the fragmented nature of the industry, our business units must strive daily to retain existing business

relationships and forge new relationships.

We

compete on service, reliability, and price. Some competitors have larger customer bases, significantly more resources and more

experience than we do. The health of the transportation and logistics industry will continue to be a function of domestic and

global economic growth.

Seasonality

Generally,

our revenues do not exhibit a significant seasonal pattern; however, revenue is affected by adverse weather conditions, holidays

and the number of business days that occur during a given period because revenue is directly related to the available work days

of our third party shipping providers.

The

Offering

|

Resale

Shares

|

91,108,012

shares of our common stock, consisting of (i) 48,630,136 shares of common stock issuable upon conversion of certain convertible

promissory notes issued pursuant to that certain Securities Purchase Agreement dated as of April 25, 2017 and (ii) 42,477,876

shares of common stock issuable upon conversion of certain convertible promissory notes dated as of June 30, 2017. See “Selling

Stockholders.”

|

|

|

|

|

Common

stock outstanding prior to this offering(1)

|

115,147,064

shares

|

|

|

|

|

Common

stock to be outstanding immediately

following

this offering

|

115,147,064

Shares

|

|

|

|

|

OTC

Pink trading symbol

|

“PTRA”.

|

|

|

|

|

Risk

factors

|

You

should carefully review the section of this prospectus entitled “Risk Factors” and all other information in this

prospectus for a discussion of factors to carefully consider before deciding to invest in shares of our common stock and warrants.

|

(1)

The number of shares of our common stock outstanding prior to this offering is based on shares outstanding as of July 13, 2017

and excludes the following:

|

●

|

45,554,006

shares of common stock reserved for issuance pursuant to certain convertible notes; and

|

|

|

|

|

●

|

48,000,000

shares of common stock issuable upon the conversion of our Series A Preferred Stock.

|

RISK

FACTORS

An

investment in our securities involves a number of risks. You should be able to bear the complete loss of your investment. There

are numerous risks affecting our business, some of which are beyond our control. An investment in our securities involves a high

degree of risk and may not be appropriate for investors who cannot afford to lose their entire investment. If any of the following

risks actually occur, our business, financial condition or operating results could be materially harmed. This could cause the

trading price of our common stock to decline, and you may lose all or part of your investment. In addition to the risks outlined

below, risks and uncertainties not presently known to us or that we currently consider immaterial may also impair our business

operations. Potential risks and uncertainties that could affect our operating results and financial condition include, without

limitation, the following:

RISKS

ASSOCIATED WITH OUR BUSINESS AND INDUSTRY

We

lack an established operating history on which to evaluate our business and determine if we will be able to execute our business

plan, and can give no assurance that operations will result in profits.

We

have only been engaged in our current and proposed business operations since July 2016. As a result, we have a limited operating

history upon which you may evaluate our proposed business and prospects. Our proposed business operations are subject to numerous

risks, uncertainties, expenses and difficulties associated with early stage enterprises. You should consider an investment in

our company in light of these risks, uncertainties, expenses and difficulties. Such risks include:

|

|

●

|

the

absence of an operating history at our current scale;

|

|

|

|

|

|

|

●

|

our

ability to raise capital to develop our business and fund our operations;

|

|

|

|

|

|

|

●

|

expected

continual losses for the foreseeable future;

|

|

|

|

|

|

|

●

|

our

ability to anticipate and adapt to a developing market(s);

|

|

|

|

|

|

|

●

|

acceptance

by customers;

|

|

|

|

|

|

|

●

|

limited

marketing experience;

|

|

|

|

|

|

|

●

|

competition

from internet-based logistics and freight companies;

|

|

|

|

|

|

|

●

|

competitors

with substantially greater financial resources and assets;

|

|

|

|

|

|

|

●

|

the

ability to identify, attract and retain qualified personnel;

|

|

|

|

|

|

|

●

|

our

ability to provide superior customer service; and

|

|

|

|

|

|

|

●

|

reliance

on key personnel.

|

Because

we are subject to these risks, you may have a difficult time evaluating our business and your investment in our company. We may

be unable to successfully overcome these risks which could harm our business.

Our

business strategy may be unsuccessful and we may be unable to address the risks we face in a cost-effective manner, if at all.

If we are unable to successfully address these risks our business will be harmed.

Economic

recessions and other factors that reduce freight volumes could have a material adverse impact on our business.

The

transportation industry historically has experienced cyclical fluctuations in financial results due to economic recession, downturns

in business cycles of our customers, increases in prices charged by third-party carriers, interest rate fluctuations and other

U.S. and global economic factors beyond our control. During economic downturns, reduced overall demand for transportation services

will likely reduce demand for our services and exert downward pressures on rates and margins. In periods of strong economic growth,

demand for limited transportation resources can result in increased network congestion and resulting operating inefficiencies.

In addition, deterioration in the economic environment subjects our business to various risks that may have a material impact

on our operating results and cause us to not reach our long-term growth goals.

These

risks may include the following:

●

A reduction in overall freight volumes in the marketplace reduces our opportunities for growth.

●

A downturn in our customers’ business cycles causes a reduction in the volume of freight shipped by those customers.

●

Some of our customers may face economic difficulties and may not be able to pay us, and some may go out of business.

●

Some of our customers may not pay us as quickly as they have in the past, causing our working capital needs to increase.

●

A significant number of our transportation providers may go out of business and we may be unable to secure sufficient equipment

or other transportation services to meet our commitments to our customers.

●

We may not be able to appropriately adjust our expenses to changing market demands.

We

have ongoing capital requirements that necessitate sufficient cash flow from operations and/or obtaining financing on favorable

terms.

We

have depended on cash from operations to expand the size of our operations and upgrade and expand the size of our revenue equipment

fleet. In the future, we could face inabilities with generating sufficient cash from operations or obtaining sufficient financing

on favorable terms. If any of these events occur, then we may face liquidity constraints or be forced to enter into less than

favorable financing arrangements. Additionally, such events could adversely impact our ability to provide services to our customers.

We

may not be profitable.

There

can be no assurance that we will be able to implement our business plan, generate sustainable revenue or ever achieve consistently

profitable operations. We cannot assure you that we can achieve or sustain profitability on a quarterly or annual basis in the

future.

Our

success is dependent on our Chief Executive Officer and other key personnel.

Our

success depends on the continuing services of our Chief Executive Officer, Mr. Steven Yariv. We believe that Mr. Yariv possesses

valuable knowledge and skills that are crucial to our success and would be very difficult to replicate.

Over

time, our success will depend on attracting and retaining qualified personnel, including a senior management team. Competition

for senior management is intense, and we may not be able to retain our management team or attract additional qualified personnel.

The loss of a member of senior management would require our remaining senior officers to divert immediate and substantial attention

to fulfilling the duties of the departing executive and to seeking a replacement. The inability to adequately fill vacancies in

our senior executive positions on a timely basis could negatively affect our ability to implement our business strategy, which

could adversely impact our results of operations and prospects.

Changes

in our relationships with our significant customers, including the loss or reduction in business from one or more of them, could

have an adverse impact on us.

No

single customer accounted for more than 5% of our revenue for 2016. We do not believe the loss of any single customer would materially

impair our overall financial condition or results of operations; however, collectively, some of our large customers might account

for a relatively significant portion of the growth in revenue and margins in a particular quarter or year. Our contractual relationships

with customers generally are terminable at will by the customers on short notice and do not require the customer to provide any

minimum commitment. Our customers could choose to divert all or a portion of their business with us to one of our competitors,

demand rate reductions for our services, require us to assume greater liability that increases our costs, or develop their own

logistics capabilities. Failure to retain our existing customers or enter into relationships with new customers could materially

impact the growth in our business and the ability to meet our current and long-term financial forecasts.

We

depend on third-parties in the operation of our business.

In

our forwarding and freight brokerage operations, we do not own or control the transportation assets that deliver our customers’

freight, and we do not employ the people directly involved in delivering the freight. In our full truckload and freight brokerage

businesses (particularly our last mile delivery logistics operations, our over-the-road expedite operations and our intermodal

drayage operations), we engage independent contractors who own and operate their own equipment. Accordingly, we are dependent

on third-parties to provide truck, rail, ocean, air and other transportation services and to report certain events to us, including

delivery information and cargo claims. This reliance could cause delays in reporting certain events, including recognizing revenue

and claims. Our inability to maintain positive relationships with independent transportation providers could significantly limit

our ability to serve our customers on competitive terms. If we are unable to secure sufficient equipment or other transportation

services to meet our commitments to our customers or provide our services on competitive terms, our operating results could be

materially and adversely affected and our customers could switch to our competitors temporarily or permanently. Many of these

risks are beyond our control, including the following:

●

equipment shortages in the transportation industry, particularly among contracted truckload carriers and railroads;

●

interruptions in service or stoppages in transportation as a result of labor disputes, network congestion, weather-related issues,

“Acts of God,” or acts of terrorism;

●

changes in regulations impacting transportation;

●

increases in operating expenses for carriers, such as fuel costs, insurance premiums and licensing expenses, that result in a

reduction in available carriers; and

●

changes in transportation rates.

Increases

in independent contractor driver compensation or other difficulties attracting and retaining qualified independent contractor

drivers could adversely affect our profitability and ability to maintain or grow our independent contractor driver fleet.

Our

business operates through fleets of vehicles that are owned and operated by independent contractors. These independent contractors

are responsible for maintaining and operating their own equipment and paying their own fuel, insurance, licenses and other operating

costs. Turnover and bankruptcy among independent contractor drivers often limit the pool of qualified independent contractor drivers

and increase competition for their services. In addition, regulations such as the FMCSA Compliance Safety Accountability program

may further reduce the pool of qualified independent contractor drivers. Thus, our continued reliance on independent contractor

drivers could limit our ability to grow our ground transportation fleet.

In

the future, we may experience difficulty in attracting and retaining sufficient numbers of qualified independent contractor drivers.

Additionally, our agreements with independent contractor drivers are terminable by either party upon short notice and without

penalty. Consequently, we regularly need to recruit qualified independent contractor drivers to replace those who have left our

fleet. If we are unable to retain our existing independent contractor drivers or recruit new independent contractor drivers, our

business and results of operations could be adversely affected.

The

compensation we offer our independent contractor drivers is subject to market conditions and we may find it necessary to continue

to increase independent contractor drivers’ compensation in future periods. If we are unable to continue to attract and

retain a sufficient number of independent contractor drivers, we could be required to increase our mileage rates and accessorial

pay or operate with fewer trucks and face difficulty meeting shipper demands, all of which would adversely affect our profitability

and ability to maintain our size or to pursue our growth strategy.

We

are dependent on computer and communications systems; and a systems failure or data breach could cause a significant disruption

to our business.

Our

business depends on the efficient and uninterrupted operation of our computer and communications hardware systems and infrastructure.

Our operations and those of our technology and communications service providers are vulnerable to interruption by fire, earthquake,

natural disasters, power loss, telecommunications failure, terrorist attacks, Internet failures, computer viruses, data breaches

(including cyber-attacks or cyber intrusions over the Internet, malware and the like) and other events generally beyond our control.

We mitigate the risk of business interruption by maintaining redundant computer systems, redundant networks, and backup systems.

In the event of a significant system failure, our business could experience significant disruption.

We

operate in a highly competitive industry and, if we are unable to adequately address factors that may adversely affect our revenue

and costs, our business could suffer.

Competition

in the transportation services industry is intense. Increased competition may lead to revenue reductions, reduced profit margins,

or a loss of market share, any one of which could harm our business. There are many factors that could impair our profitability,

including the following:

●

competition with other transportation services companies, some of which offer different services or have a broader coverage network,

more fully developed information technology systems and greater capital resources than we do;

●

reduction by our competitors of their rates to gain business, especially during times of declining economic growth, which reductions

may limit our ability to maintain or increase rates, maintain our operating margins or maintain significant growth in our business;

●

solicitation by shippers of bids from multiple transportation providers for their shipping needs and the resulting depression

of freight rates or loss of business to competitors;

●

establishment by our competitors of cooperative relationships to increase their ability to address shipper needs;

●

our current or prospective customers may decide to develop internal capabilities for some of the services that we provide; and

●

the development of new technologies or business models could result in our disintermediation in certain businesses, such as freight

brokerage.

Our

results of operations may be affected by seasonal factors.

Our

productivity may decrease during the winter season when severe winter weather impedes operations. Also, some shippers may reduce

their shipments after the winter holiday season. At the same time, operating expenses may increase and fuel efficiency may decline

due to engine idling during periods of inclement weather. Harsh weather conditions generally also result in higher accident frequency,

increased freight claims, and higher equipment repair expenditures.

Status

of independent contractors.

In

recent years, the topic of the classification of individuals as employees or independent contractors has gained increased attention

among federal and state regulators as well as the plaintiffs’ bar. Various legislative or regulatory proposals have been

introduced at the federal and state levels that may affect the classification status of individuals as independent contractors

or employees for either employment tax purposes (withholding, social security, Medicare and unemployment taxes) or other benefits

available to employees (most notably, workers’ compensation benefits). Recently, certain states (most prominently, California)

have seen significant increased activity by tax and other regulators and numerous class action lawsuits filed against transportation

companies that engage independent contractors.

The

Company classifies its third party shipping providers as independent contractors for all purposes, including employment tax and

employee benefits. There can be no assurance that legislative, judicial, administrative or regulatory (including tax) authorities

will not introduce proposals or assert interpretations of existing rules and regulations that would change the employee/independent

contractor classification of third party shipping providers doing business with the Company. Although we believe that there are

no proposals currently pending that would significantly change the employee/independent contractor classification of third party

shipping providers doing business with the Company, potential changes, if any, could have a material adverse effect on our operating

model. Further, the costs associated with any such potential changes could have a material adverse effect on the Company’s

results of operations and financial condition if we were unable to pass through to our customers an increase in price corresponding

to such increased costs. Moreover, class action litigation in this area against other transportation companies has resulted in

significant damage awards and/or monetary settlements for workers who have been allegedly misclassified as independent contractors

and the legal and other related expenses associated with litigating these cases can be substantial.

Our

business is subject to the risks of earthquakes, fire, power outages, floods and other catastrophic events, and to interruption

by man-made problems such as strikes and terrorism.

Natural

disasters such as earthquakes, tsunamis, hurricanes, tornadoes, floods or other adverse weather and climate conditions, whether

occurring in the United States or abroad, could disrupt our operations or the operations of our customers or could damage or destroy

infrastructure necessary to transport products as part of the supply chain. Specifically, these events may damage or destroy our

assets, disrupt fuel supplies, increase fuel costs, disrupt freight shipments or routes, and affect regional economies. As a result,

these events could make it difficult or impossible for us to provide logistics and transportation services; disrupt or prevent

our ability to perform functions at the corporate level; and/or otherwise impede our ability to continue business operations in

a continuous manner consistent with the level and extent of business activities prior to the occurrence of the unexpected event,

which could adversely affect our business and results of operations or make our results more volatile.

GENERAL

OPERATING RISK

We

have insufficient funds to develop our business, which may adversely affect our future growth.

We

will need to raise substantial additional capital to fund our operations and to develop and launch our services. We may need to

sell equity securities or borrow funds in order to develop these growth strategies and our inability to raise the additional capital

and/or borrow the funds needed to implement these plans may adversely affect our business and future growth.

Our

future capital requirements may be substantial and will depend on many factors including:

|

|

●

|

marketing

and developing expenses;

|

|

|

|

|

|

|

●

|

revenue

received from sales and operations, if any, in the future;

|

|

|

|

|

|

|

●

|

the

expenses needed to attract and retain skilled personnel; and

|

|

|

|

|

|

|

●

|

the

costs associated with being a public company.

|

Raising

capital in the future could cause dilution to our existing stockholders, and may restrict our operations or require us to relinquish

rights.

In

the future, we may seek additional capital through a combination of private and public equity offerings, debt financings and collaborations

and strategic and licensing arrangements. To the extent that we raise additional capital through the sale of equity or convertible

debt securities, your ownership interest will be diluted, and the terms may include liquidation or other preferences that adversely

affect your rights as a stockholder. Debt financing, if available, would result in increased fixed payment obligations and may

involve agreements that include covenants limiting or restricting our ability to take specific actions such as incurring debt,

making capital expenditures or declaring dividends. If we raise additional funds through collaboration, strategic alliance and

licensing arrangements with third parties, we may have to relinquish valuable rights to our technologies, future revenue streams

or product candidates, or grant licenses on terms that are not favorable to us.

We

will incur significant costs as a result of operating as a public company, and our management may be required to devote substantial

time to compliance initiatives.

As

a public company, we incur significant legal, accounting and other expenses, which are approximately $100,000 annually. In addition,

the Sarbanes-Oxley Act, as well as rules subsequently implemented by the SEC, have imposed various requirements on public companies,

including requiring establishment and maintenance of effective disclosure and financial controls as well as mandating certain

corporate governance practices. Our management and other personnel will devote a substantial amount of time and financial resources

to these compliance initiatives.

If

we fail to staff our accounting and finance function adequately, or maintain internal control systems adequate to meet the demands

that are placed upon us as a public company, we may be unable to report our financial results accurately or in a timely manner

and our business and stock price, assuming that a market for our stock develops, may suffer. The costs of being a public company,

as well as diversion of management’s time and attention, may have a material adverse effect on our future business, financial

condition and results of operations.

RISKS

RELATED TO THIS OFFERING AND OWNERSHIP OF OUR COMMON STOCK

There

is not now, and there may never be, an active, liquid and orderly trading market for our Common Stock, which may make it difficult

for you to sell your shares of our Common Stock.

Although

our Common Stock is quoted on the OTC Pink, trading of our Common Stock is extremely limited and sporadic and at very low volumes.

We do not now, and may not in the future, meet the initial listing standards of any national securities exchange. We presently

anticipate that our Common Stock will continue to be quoted on OTC Pink or another over-the-counter quotation system in the foreseeable

future. In those venues, our stockholders may find it difficult to obtain accurate quotations as to the market value of their

shares of our Common Stock, and may find few buyers to purchase their stock and few market makers to support its price. As a result

of these and other factors, you may be unable to resell your shares of our Common Stock at or above the price for which you purchased

them, or at all. Further, an inactive market may also impair our ability to raise capital by selling additional equity in the

future, and may impair our ability to enter into strategic partnerships or acquire companies or products by using our shares of

Common Stock as consideration.

If

a public market for our common stock develops, it may be volatile. This may affect the ability of our investors to sell their

shares as well as the price at which they sell their shares.

Our

Common Stock is subject to only limited quotation on the OTC Pink and it is not otherwise regularly quoted on any other over-the-counter

market. The market price for shares of our common stock may be significantly affected by factors such as variations in quarterly

and yearly operating results, general trends in the medical wholesaling industry, and changes in state or federal regulations

affecting us and our industry. Furthermore, in recent years the stock market has experienced extreme price and volume fluctuations

that are unrelated or disproportionate to the operating performance of the affected companies. Such broad market fluctuations

may adversely affect the market price of our common stock, if a market for it develops.

As

an “emerging growth company” under the JOBS Act, we are permitted to rely on exemptions from certain disclosure requirements.

We

qualify as an “emerging growth company” under the JOBS Act. As a result, we are permitted to and may rely on exemptions

from certain disclosure requirements. For so long as we are an emerging growth company, we will not be required to:

|

|

●

|

have

an auditor report on our internal controls over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act;

|

|

|

|

|

|

|

●

|

comply

with any requirement that may be adopted by the Public Company Accounting Oversight Board regarding mandatory audit firm rotation

or a supplement to the auditor’s report providing additional information about the audit and the financial statements

(i.e., an auditor discussion and analysis);

|

|

|

|

|

|

|

●

|

submit

certain executive compensation matters to stockholder advisory votes, such as “say-on-pay”, “say-on-frequency”

and “say-on-golden parachute;” and

|

|

|

|

|

|

|

●

|

disclose

certain executive compensation related items such as the correlation between executive compensation and performance and comparisons

of the Chief Executive’s compensation to median employee compensation.

|

In

addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition

period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words,

an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply

to private companies. We are not choosing to “opt out” of this provision. Section 107 of the JOBS Act provides that

our decision to opt out of the extended transition period for complying with new or revised accounting standards is irrevocable.

We

will remain an “emerging growth company” until the last day of our fiscal year following the fifth anniversary of

the date of our first sale of common equity securities pursuant to an effective registration under the Securities Act, or until

the earliest of (i) the last day of the first fiscal year in which our total annual gross revenues exceed $1 billion, (ii) the

date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Securities Exchange Act of 1934,

which would occur if the market value of our ordinary shares that is held by non-affiliates exceeds $700 million as of the last

business day of our most recently completed second fiscal quarter or (iii) the date on which we have issued more than $1 billion

in non-convertible debt during the preceding three year period.

Until

such time, however, we cannot predict if investors will find our common stock less attractive because we may rely on these exemptions.

If some investors find our common stock less attractive as a result, there may be a less active trading market for our common

stock and our stock price may be more volatile.

We

do not intend to pay cash dividends in the foreseeable future.

We

have never paid dividends on our common stock and do not presently intend to pay any dividends in the foreseeable future. We anticipate

that any funds available for payment of dividends will be re-invested into the Company to further its business strategy. Because

we do not anticipate paying dividends in the future, the only opportunity for our stockholders to realize the creation of value

in our common stock will likely be through a sale of those shares.

We

have the right to issue shares of preferred stock. If we were to issue preferred stock, it is likely to have rights, preferences

and privileges that may adversely affect the common stock.

We

are authorized to issue 4,000,000 shares of preferred stock, with such rights, preferences and privileges as may be determined

from time-to-time by our Board of Directors. Our Board of Directors is empowered, without stockholder approval, to issue preferred

stock in one or more series, and to fix for any series the dividend rights, dissolution or liquidation preferences, redemption

prices, conversion rights, voting rights, and other rights, preferences and privileges for the preferred stock. The issuance of

shares of preferred stock, depending on the rights, preferences and privileges attributable to the preferred stock, could adversely

reduce the voting rights and powers of the common stock and the portion of the Company’s assets allocated for distribution

to common stockholders in a liquidation event, and could also result in dilution in the book value per share of the common stock

being offered. The preferred stock could also be utilized, under certain circumstances, as a method for raising additional capital

or discouraging, delaying or preventing a change in control of the Company, to the detriment of the investors in the common stock

being offered. We cannot assure you that the Company will not, under certain circumstances, issue shares of its preferred stock.

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus contains forward-looking statements, including, without limitation, in the sections captioned “Business,”

“Risk Factors,” and “Management’s Discussion and Analysis of Financial Condition and Results of

Operations,” and elsewhere. Any and all statements contained in this prospectus that are not statements of historical fact

may be deemed forward-looking statements. Terms such as “may,” “might,” “would,” “should,”

“could,” “project,” “estimate,” “pro-forma,” “predict,” “potential,”

“strategy,” “anticipate,” “attempt,” “develop,” “plan,” “help,”

“believe,” “continue,” “intend,” “expect,” “future,” and terms of

similar import (including the negative of any of the foregoing) may be intended to identify forward-looking statements. However,

not all forward-looking statements may contain one or more of these identifying terms. Readers are cautioned not to place undue

reliance on forward-looking statements because of the risks and uncertainties related to them and to the risk factors. We will

not update the forward-looking statements contained in this prospectus to reflect any new information or future events or circumstances

or otherwise.

The

forward-looking statements are not meant to predict or guarantee actual results, performance, events or circumstances and may

not be realized because they are based upon our current projections, plans, objectives, beliefs, expectations, estimates and assumptions

and are subject to a number of risks and uncertainties and other influences, many of which we have no control over. Actual results

and the timing of certain events and circumstances may differ materially from those described by the forward-looking statements

as a result of these risks and uncertainties. Factors that may influence or contribute to the inaccuracy of the forward-looking

statements or cause actual results to differ materially from expected or desired results may include, without limitation, our

inability to obtain adequate financing, the significant length of time and resources associated with the development of our products

and services and related insufficient cash flows and resulting illiquidity, our inability to expand our business, significant

government regulation of our industry, existing or increased competition, results of arbitration and litigation, stock volatility

and illiquidity, and our failure to implement our business plans or strategies. A description of some of the risks and uncertainties

that could cause our actual results to differ materially from those described by the forward-looking statements in this prospectus

appears in the section captioned “Risk Factors,” our financial statements and the related notes thereto in this prospectus,

and other documents which we may file from time to time with the Securities and Exchange Commission (the “SEC”), and

include the following:

|

|

●

|

Our

ability to execute our business plan;

|

|

|

|

|

|

|

●

|

Our

ability to raise capital to develop our business and fund our operations;

|

|

|

|

|

|

|

●

|

Difficulties

we may experience in building and operating key elements of our technical infrastructure;

|

|

|

|

|

|

|

●

|

Changes

in tax laws, treaties or regulations, or their interpretation;

|

|

|

|

|

|

|

●

|

Share

price volatility related to, among other things, speculative trading and certain traders shorting our common shares;

|

|

|

|

|

|

|

●

|

Our

lack of an operating history on which to evaluate our new business and determine if we will be able to execute our new business

plan;

|

|

|

|

|

|

|

●

|

Our

increased risks, uncertainties, expenses and difficulties as a growing company;

|

|

|

|

|

|

|

●

|

The

need to attract and retain personnel; and

|

|

|

|

|

|

|

●

|

Our

dependence on increased penetration of existing markets

|

USE OF PROCEEDS

We

will not receive any of the proceeds from the sale of shares of our common stock in this offering. The selling stockholders will

receive all of the proceeds from this offering.

The

selling stockholders will pay any underwriting discounts and commissions and expenses incurred by the selling stockholders for

brokerage, accounting, tax or legal services or any other expenses incurred by the selling stockholders in disposing of the shares.

We will bear all other costs, fees and expenses incurred in effecting the registration of the shares covered by this prospectus,

including all registration and filing fees, and fees and expenses of our counsel and our independent registered public accountants.

MARKET

FOR OUR COMMON STOCK

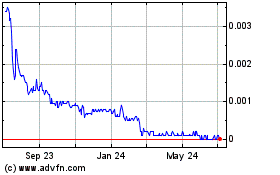

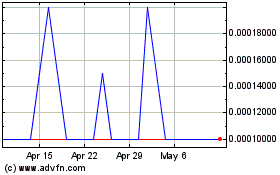

Our

Common Stock has been quoted on OTC Pink under the symbol “PTRA” since September 2016, and was quoted on the OTCQB

before that. The table below sets forth for the periods indicated the quarterly high and low bid prices as reported on OTC Pink.

These quotations reflect inter-dealer prices, without retail mark-up, mark-down, or commission and may not necessarily represent

actual transactions

|

|

|

High

|

|

|

Low

|

|

|

Fiscal year ended December 31, 2015

(1)

|

|

|

|

|

|

|

|

|

|

First Quarter

|

|

$

|

2.65

|

|

|

$

|

2.45

|

|

|

Second Quarter

|

|

$

|

3.00

|

|

|

$

|

2.3

|

|

|

Third Quarter

|

|

$

|

0.61

|

|

|

$

|

0.56

|

|

|

Fourth Quarter

|

|

$

|

1.63

|

|

|

$

|

1.23

|

|

|

|

|

|

|

|

|

|

|

|

|

Fiscal year ended December 31, 2016

(1)(2)

|

|

|

|

|

|

|

|

|

|

First Quarter

|

|

$

|

0.12

|

|

|

$

|

0.09

|

|

|

Second Quarter

|

|

$

|

0.09

|

|

|

$

|

0.08

|

|

|

Third Quarter

|

|

$

|

0.07

|

|

|

$

|

0.03

|

|

|

Fourth Quarter

|

|

$

|

0.07

|

|

|

$

|

0.02

|

|

|

|

|

|

|

|

|

|

|

|

|

Fiscal year ended December 31, 2017

|

|

|

|

|

|

|

|

|

|

First Quarter

|

|

$

|

0.04

|

|

|

$

|

0.02

|

|

|

Second Quarter

|

|

$

|

0.11

|

|

|

$

|

0.03

|

|

|

Third Quarter (through July 13, 2017)

|

|

$

|

0.03

|

|

|

$

|

0.02

|

|

(1)

Our Common Stock traded on the OTCQB from July 1, 2014 through August 31, 2016.

(2)

The Company effected a 1:2.5 reverse stock split on July 1, 2015.

Our

common stock is considered to be penny stock under rules promulgated by the Securities and Exchange Commission. Under these rules,

broker-dealers participating in transactions in these securities must first deliver a risk disclosure document which describes

risks associated with these stocks, broker-dealers’ duties, customers’ rights and remedies, market and other information,

and make suitability determinations approving the customers for these stock transactions based on financial situation, investment

experience and objectives. Broker-dealers must also disclose these restrictions in writing, provide monthly account statements

to customers, and obtain specific written consent of each customer. With these restrictions, the likely effect of designation

as a penny stock is to decrease the willingness of broker-dealers to make a market for the stock, to decrease the liquidity of

the stock and increase the transaction cost of sales and purchases of these stocks compared to other securities.

We

were a shell company from January 2016 until March 30, 2017. As a result, we are subject to the provisions of Rule 144(i) which

limit reliance on Rule 144 by stockholders owning stock in a shell company. Under current interpretations, unregistered shares

issued after we first became a shell company cannot be resold under Rule 144 until the following conditions are met:

|

|

●

|

we

cease to be a shell company;

|

|

|

|

|

|

|

●

|

we

remain subject to the Exchange Act reporting obligations;

|

|

|

|

|

|

|

●

|

we

file all required Exchange Act reports during the preceding 12 months; and

|

|

|

|

|

|

|

●

|

at

least one year has elapsed from the time we filed “Form 10 information” reflecting the fact that we had ceased

to be a shell company.

|

Holders

As

of July 13, 2017, we have 115,147,064 shares of Common Stock outstanding held by approximately 44 stockholders of record.

Dividend

Policy

We

have never paid any cash dividends on our capital stock and do not anticipate paying any cash dividends on our Common Stock in

the foreseeable future. We intend to retain future earnings to fund ongoing operations and future capital requirements. Any future

determination to pay cash dividends will be at the discretion of our Board of Directors and will be dependent upon financial condition,

results of operations, capital requirements and such other factors as the Board of Directors deems relevant.

Recent

Sales of Unregistered Securities

To

effectuate the Reverse Merger we issued to Steven Yariv 114,202,944 shares of Common Stock. This transaction is exempt from registration

pursuant to Section 4(a)(2) of the Securities Act as not involving any public offering. None of the shares were sold through an

underwriter and accordingly, there were no discounts or commissions involved.

On the closing

of the Reverse Merger, pursuant to the terms of the Share Exchange Agreement, Steven Yariv sold all of the issued and outstanding

common stock of Save on Transport to the Company, and the Company was deemed to have issued 4,000,000 shares of Series A Convertible

Preferred Stock and 944,120 shares of Common Stock to the original shareholders of the Company. These transactions

were exempt from registration pursuant to Section 4(a)(2) of the Securities Act as not involving any public offering. None of

the shares were sold through an underwriter and accordingly, there were no discounts or commissions involved.

In

April 2017, we completed a private placement pursuant to which we issued to the Lender convertible promissory notes in the aggregate

principal amount of $355,000 (the “April Notes”) for an aggregate purchase price of $350,000. On April 25, 2017, we

received the initial tranche of $95,000, which is a loan amount of $100,000, net of a $5,000 fee, recorded as convertible note

payable. The initial tranche matures on April 25, 2018 and each additional tranche will mature one year after the date of such

tranche’s funding. The second tranche of $85,000 was funded on June 2, 2017. The third tranche will be for $85,000 and is

expected to occur upon filing of this prospectus. The fourth tranche will be for $85,000 and will fund on or about July 24,

2017. The April Notes bear interest at a rate of 12% per annum and are convertible into shares of our Common Stock at the Lender’s

option at a conversion price equal to the amount which is 65% of the lowest VWAP for the ten trading days immediately preceding

the conversion.

In connection with the issuance of the April Notes the Company determined

that the terms of the April Notes included a down-round provision under which the conversion price could be affected by future

equity offerings undertaken by the Company.

On

June 30, 2017, we issued to an institutional investor (the “Lender”) a senior convertible note in the aggregate principal

amount of $240,000 (the “June Note”), for an aggregate purchase price of $30,000. The principal due under the June

Note accrues interest at a rate of 12% per annum. All principal and accrued interest under the June Note is due six months following

the issue date of the June Note, and is convertible into shares of our Common Stock at a conversion price equal to 50% of the

lowest volume-weighted average price for the previous ten trading days immediately preceding the conversion. The June Note includes

anti-dilution protection, including a

down-round provision under which the conversion price

could be affected by future equity offerings undertaken by the Company

, as well as customary events of default, including

non-payment of the principal or accrued interest due on the June Note. Upon an event of default, all obligations under the June

Note will become immediately due and payable and the Company will be required to make certain payments to the Lender.

Securities

Authorized for Issuance under Equity Compensation Plans

We

have never had any equity compensation plans. However, we may wish to issue stock options pursuant to a Stock Option Plan in the

future. Such stock options may be awarded to management, employees, members of our Board of Directors and consultants.

MANAGEMENT’S

DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION

AND

RESULTS OF OPERATIONS

The

following management’s discussion and analysis should be read in conjunction with the historical financial statements and

the related notes thereto contained in this prospectus. The management’s discussion and analysis contains forward-looking

statements, such as statements of our plans, objectives, expectations and intentions. Any statements that are not statements of

historical fact are forward-looking statements. When used, the words “believe,” “plan,” “intend,”

“anticipate,” “target,” “estimate,” “expect” and the like, and/or future tense

or conditional constructions (“will,” “may,” “could,” “should,” etc.), or similar

expressions, identify certain of these forward-looking statements. These forward-looking statements are subject to risks and uncertainties,

including those under “Risk Factors” in this prospectus that could cause actual results or events to differ materially

from those expressed or implied by the forward-looking statements. Our actual results and the timing of events could differ materially

from those anticipated in these forward-looking statements as a result of several factors. We do not undertake any obligation

to update forward-looking statements to reflect events or circumstances occurring after the date of this report.

Overview

We

were originally incorporated under the laws of the State of Nevada on July 25, 2008 under the name Loran Connection Corp. We were

formed to provide a variety of services in the area of individual and group tourism and business support in Ukraine. We subsequently

filed a resale registration statement with the SEC on May 28, 2009, which was declared effective on October 28, 2009. On January

25, 2012, we changed our name to “PetroTerra Corp.” and effected a one-for-thirty two reverse split. We changed our

name to reflect a proposed change in our business operations. On October 2, 2013, in connection with a change of control in the

management of the Company, the Company began business operations in the oil and gas sector. On December 18, 2013, we filed a certificate

of change to effect a one-for-two reverse stock split of our authorized and our outstanding shares of common stock and preferred

stock. On July 1, 2015, we filed a certificate of change to effect a one-for-two and one half reverse stock split of our authorized

and our outstanding shares of common stock. Since January 2016, as a result of the decline in the oil and gas markets, we generated

minimal sales revenue and our operations were subject to all the risks inherent in the establishment of a new business enterprise.

Since January 2016, we have not engaged in any operations and our business has been dormant. As such, we have been a “shell”

company, as defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Reverse

Merger

On

March 30, 2017, our company and Save on Transport entered into a Share Exchange Agreement, pursuant to which Save on Transport

became a wholly-owned subsidiary of ours. In the Reverse Merger, we purchased all of the issued and outstanding common stock of

Save on Transport from Steven Yariv, and in exchange, we issued 114,202,944 shares of our Common Stock to Steven Yariv. Save on

Transport operates as an automobile shipping company that provides transportation, brokerage, and logistics services relating

to vehicle shipping.

At

the closing of the Reverse Merger, Lawrence Sands, our former Chief Executive Officer, Chief Financial Officer and sole director,

resigned from all of his positions. Steven Yariv was also elected as the Chairman of our Board of Directors and appointed Chief

Executive Officer.

As

a result of the Reverse Merger and the change in business and operations of our company from a public “shell” company

to a company engaged in the business of automobile shipping, a discussion of the past financial results of our company is not

pertinent, and under generally accepted accounting principles in the United States the historical financial results of Save on

Transport, the accounting acquirer, prior to the Reverse Merger are considered the historical financial results of our company.

The Reverse Merger was accounted for as a recapitalization effected by a Reverse Merger, wherein Save on Transport is considered

the acquirer for accounting and financial reporting purposes.

The

following discussion highlights the results of operations of Save on Transport and the principal factors that have affected its

financial condition as well as its liquidity and capital resources for the periods described, and provides information that management

believes is relevant for an assessment and understanding of the financial condition and results of operations presented herein.

The following discussion and analysis is based on the audited and financial statements contained in this prospectus, which have

been prepared in accordance with generally accepted accounting principles in the United States. You should read the discussion

and analysis together with such financial statements and the related notes thereto.

Basis

of Presentation

The

audited financial statements for the period from July 12, 2016 (inception) to December 31, 2016 include a summary of our significant

accounting policies and should be read in conjunction with the discussion below. In the opinion of management, all material adjustments

necessary to present fairly the results of operations for such periods have been included in these audited financial statements.

All such adjustments are of a normal recurring nature.

For

the period from July 12, 2016 (inception) through December 31, 2016:

Results

of Operations

The

following table sets forth our revenues, expenses and net loss for the period from July 12, 2016 (inception) through December

31, 2016. The financial information below is derived from our audited financial statements included as an exhibit to this prospectus.

|

|

|

For

the period

from

July 12, 2016

through

December 31, 2016

|

|

|

Revenue

|

|

$

|

72,222

|

|

|

Cost of Sales

|

|

$

|

50,954

|

|

|

Gross Profit

|

|

$

|

21,268

|

|

|

|

|

|

|

|

|

Operating Expenses:

|

|

|

|

|

|

Legal and professional

|

|

$

|

5,871

|

|

|

Payroll and related

expenses

|

|

$

|

9,919

|

|

|

Rent - affiliate

|

|

$

|

1,500

|

|

|

General

and administrative expenses

|

|

$

|

3,952

|

|

|

Total Operating Expenses

|

|

$

|

21,242

|

|

|

|

|