FCPT Announces Acquisition of 2 Taco Bell Restaurant Properties for $3.4 million

July 26 2017 - 2:29PM

Business Wire

Four Corners Property Trust (NYSE:FCPT), a real

estate investment trust engaged in the ownership of high-quality,

net-leased restaurant properties (“FCPT” or the “Company”), is

pleased to announce the acquisition of two properties leased to

K-MAC Enterprises, LLC (“KMAC”) for $3.4 million. The properties

are located in Indiana and occupied under individual triple-net

leases with new 20-year terms, which were negotiated by FCPT prior

to closing. Both sites are scheduled to be remodeled in the next 4

years, which will include decoupling from a combination KFC / Taco

Bell to a single concept Taco Bell at one of the properties. KMAC

is one of the largest YUM! Brands franchisees, with over 280 Taco

Bell and KFC units across the Midwest and Southeast. The

transaction was priced at a 6.5% going-in cash cap rate, pro forma

for the amended terms of the lease.

Bill Lenehan, CEO of FCPT, commented “We are pleased to announce

another transaction demonstrating FCPT as an attractive landlord

partner for restaurant operators. Our team’s ability to be nimble

in lease negotiations resulted in a new long-term agreement with a

strong credit tenant.”

About FCPT

FCPT, headquartered in Mill Valley, CA, is a real estate

investment trust primarily engaged in the acquisition and leasing

of restaurant properties. The Company will seek to grow its

portfolio by acquiring additional real estate to lease, on a

triple-net basis, for use in the restaurant and related food

services industry. Additional information about FCPT can be found

on the website at http://www.fcpt.com/.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170726006143/en/

Four Corners Property Trust:Bill Lenehan, 415-965-8031CEOGerry

Morgan, 415-965-8032CFO

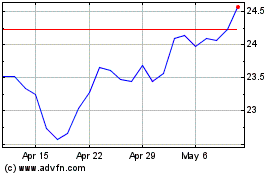

Four Corners Property (NYSE:FCPT)

Historical Stock Chart

From Mar 2024 to Apr 2024

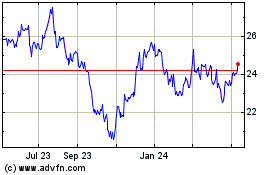

Four Corners Property (NYSE:FCPT)

Historical Stock Chart

From Apr 2023 to Apr 2024