Filed by: Valley National Bancorp

Pursuant to Rule 425 under the Securities Act of 1933

Subject Company: USAmeriBancorp, Inc.

Commission File No.:

001-11277

Key Points for Customer and Internal Conversations

The

following key points are meant to be a guide as you have conversations with your internal team, customers, business partners and people in the community about the merger with Valley National Bank.

If you are asked something that is not addressed in this document, and you are unsure of how to answer, please let the person know that you will find out more

information and get back to them. Then ask your manager for the appropriate information or for advice on how best to answer the question.

If you are

contacted by a member of the media, please refer them to B2 Communications: Kyle Parks,

(813)352-1325

or Laura Fontanills

(813)215-1271.

Key Points

|

|

•

|

|

USAmeriBank is under agreement to merge with Valley National Bank, a large regional bank headquartered in Wayne, New Jersey with approximately $23 billion in assets.

|

|

|

•

|

|

Valley National Bank was first founded in 1927. Valley National Bancorp’s stock is traded on the NY Stock Exchange under the symbol VLY.

|

|

|

•

|

|

Valley currently operates more than 200 locations in northern and central New Jersey, the New York City area, and Florida. The acquisition will bring Valley to Alabama for the first time.

|

|

|

•

|

|

Valley is a large, healthy bank and plans to keep USAmeriBank’s retail and lending teams in place.

|

|

|

•

|

|

Valley sees Florida and Alabama as significant growth markets.

|

|

|

•

|

|

Our two banks share a very similar culture and philosophy, one that puts customers first and is focused on helping customers succeed and improving the local community.

|

|

|

•

|

|

We have been very impressed with Valley’s leadership team and how they view banking, especially their customer-first approach.

|

|

|

•

|

|

Valley has been equally impressed with how USAmeriBank operates and the results we’ve delivered.

|

|

|

•

|

|

This merger will provide us even greater financial strength and therefore, the opportunity to best serve our growing and diverse customer base.

|

|

|

•

|

|

We will still provide the same exceptional, personalized service. Merging with Valley will allow us to provide more products for consumer and business lending, including auto, residential, specialty commercial, and

Trust, Insurance and Investment services.

|

|

|

•

|

|

Valley has a long tradition of being a leader in community support in the markets it serves. We will continue to provide the same meaningful investment in our Florida and Alabama communities through our community impact

work.

|

|

|

•

|

|

At the time of closing USAmeriBank’s name will change to Valley National Bank – we expect that signage will change during the integration period following the Closing.

|

|

|

•

|

|

There will be no immediate changes and the closing is expected to take place in the first quarter of 2018.

|

Q&A

|

|

•

|

|

USAmeriBank is under agreement to merge with Valley National Bank, a large regional bank headquartered in Wayne, New Jersey.

|

|

|

•

|

|

What happens next? Will the bank’s name change?

|

|

|

•

|

|

The regulatory and shareholder process is expected to take several months. We anticipate the closing to take place in the first quarter of 2018.

|

|

|

•

|

|

At the time of the closing we will be changing our name to Valley National Bank – we expect that signage will change during the integration period following the Closing.

|

|

|

•

|

|

Why is Valley National Bank making this move?

|

|

|

•

|

|

The acquisition is Valley’s third in Florida since 2014 and grows its presence in the Tampa Bay market, a high-growth market that’s Florida’s second largest by population.

|

|

|

•

|

|

It also brings Valley to Alabama for the first time in Valley’s

90-year

history.

|

|

|

•

|

|

What’s attractive to Valley National Bank about USAmeriBank?

|

|

|

•

|

|

USAB has a strong record of profitability and growth.

|

|

|

•

|

|

Valley has been complimentary of how USAB operates and has been very impressed with USAB’s team. Key leaders from USAB will stay on board to help drive growth efforts in the Florida and Alabama markets. This

includes Joe Chillura, Al Rogers and key leadership staying on board and chairwoman Jennifer Steans joining Valley’s board of directors.

|

|

|

•

|

|

What about the Tampa Bay area and Alabama is attractive to Valley National Bank?

|

|

|

•

|

|

Tampa Bay’s economy is one of the strongest in the Southeast right now.

|

|

|

•

|

|

Tampa Bay had the nation’s fourth-highest year-over-year population growth in 2016, adding 58,000 new residents.

|

|

|

•

|

|

Fortune magazine has named Tampa Bay one of the hottest cities in the U.S. for startups.

|

|

|

•

|

|

Our Alabama markets have recovered from the recession, with growth occurring for businesses of all sizes in Birmingham, Montgomery and Alexander City.

|

|

|

•

|

|

And what’s attractive to USAmeriBank about Valley National Bank?

|

|

|

•

|

|

USAB’s leadership team has been very impressed with Valley’s leadership team and its view of banking, especially its customer-first approach.

|

|

|

•

|

|

Valley is a strong regional bank focused on helping its customers succeed, so we see this as a

win-win

for our employees, customers and shareholders.

|

|

|

•

|

|

Why is this happening now?

|

|

|

•

|

|

Valley feels right. We share the same culture and customer focus, and we don’t anticipate there being a disruption for our customers.

|

|

|

•

|

|

You’ve said in the past that USAmeriBank is focused on organic growth – what changed?

|

|

|

•

|

|

Our focus has been on organic growth, not merging. But at the same time, we have always entertained conversations with interested parties, but they have never felt right until now.

|

|

|

•

|

|

After getting to know the leadership team at Valley, it was clear both teams are like-minded in our approach to banking.

|

|

|

•

|

|

You recently opened USAB’s first Polk County branch in Lakeland, touting it as one of Polk County’s only independent banks. What does this mean for your customers in Polk County?

|

|

|

•

|

|

Our customers in Polk County will continue to be served by the same local bankers they have come to know and trust.

|

|

|

•

|

|

Valley shares our same values, so customers will not see a change in the quality of service they receive.

|

|

|

•

|

|

Valley has several locations in Central Florida already, so Polk County is a natural extension of where it is already operating.

|

|

|

•

|

|

What does this mean for USAB employees? Are people going to lose their jobs?

|

|

|

•

|

|

There will be no immediate changes.

|

|

|

•

|

|

Valley intends to keep all of the retail and lending teams.

|

|

|

•

|

|

Since Valley already operates in Florida, there will be some evaluations to determine long-term staff needs in other areas of the bank.

|

|

|

•

|

|

What does this mean for customers?

|

|

|

•

|

|

Our customers will continue to be served by the same USAmeriBank team members. Valley is counting on keeping all of our branch and lending teams.

|

|

|

•

|

|

Valley has a track record of integrating mergers designed to minimize customer disruption, and of delivering profitable growth while maintaining strong credit quality and a well-capitalized balance sheet.

|

|

|

•

|

|

Customers can expect the same exceptional personal service they have always received from the same bankers they know and trust.

|

|

|

•

|

|

USAmeriBank has invested a lot in the local community and has increased its support in recent years. What does this move mean for the USAB’s community partners and community impact program?

|

|

|

•

|

|

Like USAmeriBank, Valley has a longstanding tradition of serving its communities and supporting local nonprofits.

|

|

|

•

|

|

Our commitment to local community partners will remain as strong as it has been and we have the support of Valley’s leadership team on that.

|

|

|

•

|

|

Is it sad that the largest locally owned bank in Tampa Bay is going away?

|

|

|

•

|

|

We are very proud of what we’ve built with USAmeriBank and the local businesses we’ve been able to help. And we’re all energized about this next phase of our growth. Valley National Bank provides us the

ability to continue to deliver on our mission of helping businesses grow, and providing superior service and a strong commitment to our community.

|

|

|

•

|

|

I’m confident that we’ll continue to build upon our success and continue to provide our customers with great service.

|

|

|

•

|

|

Customers in Alabama have gone through a lot of change with the sale of Aliant to USAB and now this acquisition. What are you all telling them?

|

|

|

•

|

|

It’s not about what the name of the bank is, it’s about the people. Our customers can expect to continue to work with the same bankers they have deep relationships with.

|

|

|

•

|

|

What Aliant, USAB and Valley all have had in common is their focus on personalized service delivered by experienced bankers.

|

|

|

•

|

|

USAB has significant employee ownership. What does this acquisition mean to them?

|

|

|

•

|

|

The common shareholders of USAB will receive 6.1x of a share of Valley common stock for each USAB share they own subject to the other terms in the merger agreement.

|

TRANSCRIPT OF JOE CHILLURA’S

CALL WITH ALL EMPLOYEES

OF USAMERIBANK

BEING

HELD JULY 26, 2017

Good morning, everyone. Thanks for making the effort to be on this call this morning.

We are making a major announcement today, and I wanted you to hear from me first. Effective today, we are under agreement to merge with Valley National Bank.

They are sending out a press release this morning to the public.

Valley has been around since 1927. They are a $23 billion bank and currently operate in

New York, New Jersey, and Florida. They see Florida and Alabama as significant growth markets. They have been incredibly complimentary of how we operate and the results we’ve delivered. Most of all, they’ve been impressed by our team and

our culture. We have been equally impressed with their leadership team and how they do business, especially their customer first approach. The regulatory and shareholder process is expected to take several months. We would expect the closing to take

place in early January.

Today, several Managers will be invited to meetings to be held early next week in both Alabama and Florida to meet the Valley

team. I want to make sure you know there are no plans to make any changes until after the closing. Please discuss any questions with your Manager, and they will relay those to Executive Management or HR, and we will respond as quickly as possible.

We are confident and will work to ensure that all opportunities will be explored for the best possible outcome.

We will be sending out an email with

public announcements and providing you with talking points to use in answering questions inside our organization from employees, and most importantly, for conversations with our customers.

In the meantime, if you hear from a customer about the merger, please share the following:

Valley National Bank is a solid bank, and you will continue to be served by the USAmeriBank team. Their New York Stock Exchange symbol is VLY. Valley will

provide us more products, more resources, and even greater financial strength.

While we would like to continue as we are, this merger will give us the

opportunity to be an even bigger factor in Florida and to best serve the needs of our growing, diverse customer base. It is important to note that our Executive Management team has a long-term commitment to the combined organization, and we will be

here to carry out our mission forward.

There will be, of course, more to come after this announcement, and I look forward to sharing more information

with you. During this period, I know you will continue to convey a positive message, as you always have, to our customers and your fellow team members. I am proud of each and every one of you and everything we have accomplished together.

We’ll talk again very soon. Thank you and have a great day.

Disclaimer Language to be introduced and read immediately after message

“We know you will be excited to communicate this news. However, Valley is a public company subject to many SEC requirements and while our stock is

closely held it can be traded. We need to make sure that no one at the Bank buys our stock or tells someone who buys our stock before the market has fully absorbed the news of our merger. Therefore we ask you to wait until after the end of the

conference call in which Valley will discuss the merger with the investor community (around 11:30 pm) to make any calls or take other action. The SEC will review all trades in our stock made before and shortly after the merger announcement to

see if there was trading on material non- public information.

USAB Company – Wide Email

Good Morning,

As announced on the conference call this morning

USAB is under a Definitive Agreement to Merge with Valley National Bank. Valley National Bank has been in existence since 1927 and is a highly regarded $23 billion bank operating in New York, New Jersey, and Florida. Having acquired two Florida

banks in recent years – 1

st

United Bank and CNL Bank – to operate in Southeast Florida, Central Florida, Jacksonville, and Southwest Florida, they see Florida and Alabama (?) as a

significant growth market in the years ahead. They like USAB’s business model, clients, the types of lending we do, and most importantly the team that we have built.

We are excited for the opportunity this will give USAB to expand and serve our unique customer base with more financial products for consumer and business

lending. From their Chairman, Gerry Lipkin to their Senior Managers, like Rudy Schupp, Ira Robbins and Tom Iadanza, we have been impressed with their view of banking, operating

know-how

and personable profile.

They think about banking the way we do by understanding that the customer comes first and that customers bank with bankers.

Attached is the Press Release

for you to review along with some talking points to help guide you as you field questions from customers. Besides our employees, our number one priority is our customers. Your managers are working on a plan to reach out to our clients to reassure

them that “USAB” will be here to continue to serve their banking needs with the same great people and customer service they are accustomed to.

Later today, Managers in both Florida and Alabama will receive and invitation to attend a

Meet and Greet

early next week with some members of the

Valley Team. Additionally, over the next few weeks we will visit each USAB market with some Valley bankers as they are excited to get to know each of you.

Valley’s intention is to have their Florida and Corporate support teams go to work to determine long term staffing needs and then in short order, confirm

positions. As in any transaction of this type, there will be some individual displacements in certain areas. We are confident and will work to ensure that all opportunities will be explored to have the best outcome possible for each of you. We know

you will have a lot of questions and are committed to answering them. Please help us by directing all questions to your Department Manager who will relay them to Executive Management and HR.

In the meantime, the regulatory and shareholder approval process is expected to take several months. We expect the closing will take place in the first

quarter of 2018 and it will be business as usual until then.

You know how proud we are of all of you. During this period, as professional bankers, we are

confident that you will convey a positive and upbeat message to our customers regarding this merger.

Thank you all for all that you have done to make

USAB the successful organization that it is today and all that you do to provide first class banking services to our customers.

J.C.

Important Disclaimer

“We know you will be

excited to communicate this news. However, Valley is a public company subject to many SEC requirements and while our stock is closely held it can be traded. We need to make sure that no one at the Bank buys our stock or tells someone who buys

our stock before the market has fully absorbed the news of our merger. Therefore we ask you to wait until after the end of the conference call in which Valley will discuss the merger with the investor community (around 11:30 pm) to make any calls or

take other action. The SEC will review all trades in our stock made before and shortly after the merger announcement to see if there was trading on material

non-

public information.

Additional Information and Where to Find It

This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or

approval. In connection with the proposed merger, Valley intends to file a joint proxy statement/prospectus with the Securities and Exchange Commission. INVESTORS AND SECURITY HOLDERS ARE ADVISED TO READ THE JOINT PROXY

STATEMENT/PROSPECTUS WHEN IT BECOMES AVAILABLE, BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION. Investors and security holders may obtain a free copy of the registration statement (when available) and other documents filed by Valley with the

Commission at the Commission’s web site at

www.sec.gov

. These documents may be accessed and downloaded for free at Valley’s web site at http://

www.valleynationalbank.com/filings.html

or by directing a request to Dianne

M. Grenz, Executive Vice President, Valley National Bancorp, at 1455 Valley Road, Wayne, New Jersey 07470, telephone (973)

305-3380.

Participants in the Solicitation

This communication is

not a solicitation of a proxy from any security holder of Valley or USAB. However, Valley, USAB, their respective directors and executive officers and other persons may be deemed to be participants in the solicitation of proxies from

USAB’s shareholders in respect of the proposed transaction. Information regarding the directors and executive officers of Valley may be found in its definitive proxy statement relating to its 2017 Annual Meeting of Shareholders, which was

filed with the Commission on March 17, 2017 and can be obtained free of charge from Valley’s website. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by

security holdings or otherwise, will be contained in the joint proxy statement/prospectus and other relevant materials to be filed with the SEC when they become available.

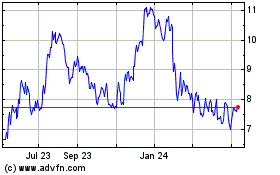

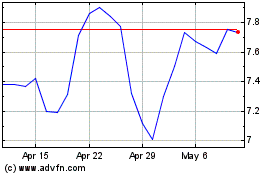

Valley National Bancorp (NASDAQ:VLY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Valley National Bancorp (NASDAQ:VLY)

Historical Stock Chart

From Apr 2023 to Apr 2024