Filing of Certain Prospectuses and Communications in Connection With Business Combination Transactions (425)

July 26 2017 - 12:20PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): July 26, 2017

VALLEY NATIONAL BANCORP

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

|

|

|

|

New Jersey

|

|

1-11277

|

|

22-2477875

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification Number)

|

|

|

|

|

|

|

|

1455 Valley Road, Wayne, New Jersey

|

|

07470

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

(973) 305-8800

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (

see

General Instruction A.2. below):

|

|

|

|

|

|

ý

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company

¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

¨

Item 7.01 Regulation FD Disclosure.

Valley National Bancorp (“Valley”) is furnishing presentation materials used in connection with an investor call held after the announcement of the Merger (as defined below). The presentation materials are included as Exhibit 99.1 to this report pursuant to Item 7.01 of Form 8-K. Valley is not undertaking to update these presentation materials. The information being furnished pursuant to Item 7.01 of this report (including Exhibit 99.1) shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section. The information in this Item 7.01 will not be deemed an admission as to the materiality of any information herein (including Exhibit 99.1).

Item 8.01 Other Events.

On July 26, 2017, Valley announced its entry into an Agreement and Plan of Merger with USAmeriBancorp, Inc. (“USAmeriBancorp”), providing for the merger of USAmeriBancorp with and into Valley, with Valley as the surviving entity, and the merger of USAmeriBank with and into Valley National Bank, with Valley National Bank as the surviving entity (the “Merger”).

Valley and USAmeriBancorp issued a joint press release in connection with the announcement, which is attached hereto as Exhibit 99.2 and is incorporated herein by reference.

Additional Information and Where to Find It

This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. In connection with the proposed Merger, Valley intends to file a Registration Statement on Form S-4 that will include a joint proxy statement/prospectus with the Securities and Exchange Commission (the “Commission”). Valley may file other documents with the Commission regarding the proposed transaction. A definitive joint proxy statement/prospectus will be mailed to the shareholders of Valley and the shareholders of USAmeriBancorp. INVESTORS AND SECURITY HOLDERS ARE ADVISED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS WHEN IT BECOMES AVAILABLE, AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE COMMISSION, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Investors and security holders may obtain a free copy of the registration statement (when available), including the joint proxy statement/prospectus and other documents containing information about Valley and USAmeriBancorp at the Commission’s web site at www.sec.gov. These documents may be accessed and downloaded for free at Valley’s web site at http://www.valleynationalbank.com/filings.html or by directing a request to Dianne M. Grenz, Executive Vice President, Valley National Bancorp, at 1455 Valley Road, Wayne, New Jersey 07470, telephone (973) 305-3380.

Participants in the Solicitation

This communication is not a solicitation of a proxy from any security holder of USAmeriBancorp or Valley. However, Valley, USAmeriBancorp, their respective directors and executive officers and other persons may be deemed to be participants in the solicitation of proxies from USAmeriBancorp’s shareholders in respect of approval of the Merger and the solicitation of proxies from Valley’s shareholders in respect of approval of the issuance of shares of common stock of Valley in connection with the Merger. Information regarding the directors and executive officers of Valley may be found in its definitive proxy statement relating to its 2017 Annual Meeting of Shareholders, which was filed with the Commission on March 17, 2017 and

in its Annual Report on Form 10-K for the year ended December 31, 2016, each of which can be obtained free of charge from Valley’s website. Information regarding the directors and executive officers of USAmeriBancorp may be found in the Registration Statement on Form S-4 when it becomes available. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the joint proxy statement/prospectus and other relevant materials to be filed with the SEC when they become available.

Forward Looking Statements

The foregoing contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including but not limited to those regarding the proposed Merger. Such statements are not historical facts and include expressions about management’s confidence and strategies and management’s expectations about new and existing programs and products, relationships, opportunities, taxation, technology and market conditions. These statements may be identified by such forward-looking terminology as “expect,” “believe,” “view,” “opportunity,” “allow,” “continues,” “reflects,” “typically,” “usually,” “anticipate,” or similar statements or variations of such terms. Such forward-looking statements involve certain risks and uncertainties. Actual results may differ materially from such forward-looking statements. Factors that may cause actual results to differ from those contemplated by such forward-looking statements include, but are not limited to, the following: failure to obtain shareholder or regulatory approval for the Merger or to satisfy other conditions to the Merger on the proposed terms and within the proposed timeframe; delays in closing the merger; the inability to realize expected cost savings and synergies from the Merger in the amounts or in the timeframe anticipated; changes in the estimate of non-recurring charges; the diversion of management’s time on issues relating to the Merger; costs or difficulties relating to integration matters might be greater than expected; material adverse changes in Valley’s or USAmeriBancorp’s operations or earnings; an increase or decrease in the stock price of Valley during the 30 day pricing period prior to the closing of the Merger which could cause an adjustment to the exchange ratio or give either Valley or USAmeriBancorp the right to terminate the merger agreement under certain circumstances; the inability to retain USAmeriBancorp’s customers and employees; or weakness or a decline in the economy, mainly in New Jersey, New York, Florida, and Alabama, as well as the risk factors set forth in Valley’s Annual Report on Form 10-K for the year ended December 31, 2016. Valley assumes no obligation for updating

any such forward-looking statement at any time.

|

|

|

|

|

|

Item 9.01

|

Financial Statements and Exhibits.

|

|

(d) Exhibits

|

|

99.1

|

Valley National Bancorp presentation materials used for investor call regarding the Merger held on July 26, 2017.

|

|

|

These presentation materials disclosed in this Item 9.01 as Exhibit 99.1 shall be considered “furnished” but not “filed” for purposes of the Exchange Act.

|

|

99.2

|

Joint press release, dated July 26, 2017, announcing the Merger.

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

Dated: July 26, 2017

|

VALLEY NATIONAL BANCORP

|

|

|

|

|

|

|

By:

|

/s/ Alan D. Eskow

|

|

|

|

Alan D. Eskow

|

|

|

|

Senior Executive Vice President

and Chief Financial Officer

|

EXHIBIT INDEX

|

|

|

|

|

|

Exhibit No.

|

Description

|

|

(d) Exhibits

|

|

99.1

|

Valley National Bancorp presentation materials used for investor call regarding the Merger held on July 26, 2017.

|

|

|

These presentation materials disclosed in this Item 9.01 as Exhibit 99.1 shall be considered “furnished” but not “filed” for purposes of the Exchange Act.

|

|

99.2

|

Joint press release, dated July 26, 2017, announcing the Merger.

|

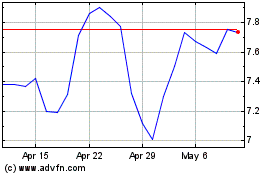

Valley National Bancorp (NASDAQ:VLY)

Historical Stock Chart

From Mar 2024 to Apr 2024

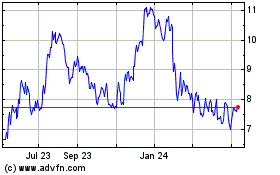

Valley National Bancorp (NASDAQ:VLY)

Historical Stock Chart

From Apr 2023 to Apr 2024