Second Quarter Highlights:

- Second quarter 2017 pre-tax loss of

$425 million reflects improved operating results compared to the

pre-tax loss of $678 million in the year-ago quarter

- Net loss was $449 million, or $1.46

per common share, compared with a net loss of $392 million, or

$1.29 per common share, in the second quarter of 2016, reflecting a

lower effective tax rate in 2017 from the required change in

deferred tax accounting

- Oil and gas production exceeded

guidance; total production was 294,000 barrels of oil

equivalent per day (boepd), excluding Libya; Bakken production was

108,000 boepd

- Sanctioned the first phase of

development for the Liza Field, one of the industry’s largest oil

discoveries of the past decade, located on the Stabroek Block

offshore Guyana (Hess 30 percent); first oil expected by

2020

- Successfully completed Liza-4 well;

the recently announced Payara-2 well confirms a second giant oil

field in Guyana and increases the Payara gross discovered

recoverable resources to approximately 500 million barrels of oil

equivalent (boe); gross discovered recoverable resources for the

Stabroek Block now estimated between 2.25 billion and 2.75 billion

boe (Hess 30 percent)

- Announced an agreement to sell our

interests in enhanced oil recovery assets in the Permian Basin for

total consideration of $600 million

- Hess Midstream Partners LP sold

common units representing limited partner interests in an initial

public offering for net proceeds of $365.5 million, of which $175

million was distributed to Hess Corporation

- E&P capital and exploratory

expenditures were $528 million for the quarter and $921 million for

the first half of 2017

- Cash and cash equivalents were $2.5

billion at June 30, 2017; $2.7 billion at December 31,

2016

2017 Revised Full Year Guidance:

- Net production guidance, excluding

Libya, increased to 305,000 to 310,000 boepd, the upper end of

previous guidance, even with the loss of 8,000 boepd of production

associated with the sale of our enhanced oil recovery assets in the

Permian Basin scheduled to close August 1st

- E&P capital and exploratory

expenditures are projected to be $2.15 billion, down from original

guidance of $2.25 billion

Hess Corporation (NYSE:HES) today reported a net loss of

$449 million, or $1.46 per common share, in the second quarter

of 2017 compared with a net loss of $392 million, or $1.29 per

common share, in the second quarter of 2016, reflecting a lower

effective tax rate in 2017 from the required change in deferred tax

accounting. Our loss before income taxes was $425 million in the

second quarter of 2017, compared with a loss before income taxes of

$678 million in the prior-year quarter. The improved second quarter

2017 pre-tax results reflect higher realized crude oil selling

prices and lower operating costs and exploration expenses that were

partially offset by lower sales volumes. On an adjusted basis,

second quarter 2016 adjusted loss was $335 million, or $1.10 per

common share.

“Our company delivered strong

operational performance and achieved a number of major strategic

milestones in the quarter,” Chief Executive Officer John Hess said.

“We continue to take steps to reinforce our outstanding

value-driven growth outlook and drive improving returns and lower

capital and operating costs across our portfolio.”

After-tax income (loss) by major

operating activity was as follows:

Three Months Ended Six Months Ended June 30,

June 30, (unaudited) (unaudited)

2017

2016

2017

2016

(In millions, except per share amounts)

Net Income (Loss)

Attributable to Hess Corporation

Exploration and Production $ (354 ) $

(328 ) $ (587 ) $ (781 ) Midstream 16 11 34 27 Corporate, Interest

and Other (111 ) (75 )

(220 ) (147 ) Net income (loss) attributable to Hess

Corporation $ (449 ) $ (392 ) $ (773 ) $

(901 ) Net income (loss) per common share (diluted)

(a) $ (1.46 ) $ (1.29 ) $ (2.53 ) $

(3.00 )

Adjusted Net Income

(Loss) Attributable to Hess Corporation (b)

Exploration and Production $ (354 ) $ (271 ) $ (587 ) $ (724 )

Midstream 16 11 34 27 Corporate, Interest and Other

(111 ) (75 ) (220 ) (147

) Adjusted net income (loss) attributable to Hess Corporation $

(449 ) $ (335 ) $ (773 ) $ (844 )

Adjusted net income (loss) per common share (diluted) (a) $

(1.46 ) $ (1.10 ) $ (2.53 ) $ (2.81 )

Weighted average number of shares (diluted)

314.4 313.2 314.2 306.5

(a)

Calculated as net income (loss)

attributable to Hess Corporation less preferred stock dividends,

divided by weighted average number of diluted shares.

(b)

Adjusted net income (loss) attributable to

Hess Corporation excludes items affecting comparability summarized

on page 5. A reconciliation of net income (loss) attributable to

Hess Corporation to adjusted net income (loss) attributable to Hess

Corporation is provided on page 6.

Exploration and Production:

The Exploration and Production net

loss in the second quarter of 2017 was $354 million, compared

to a net loss of $328 million in the second quarter of 2016.

On an adjusted basis, second quarter 2016 net loss was $271

million. The Corporation’s average realized crude oil selling

price, including the effect of hedging, was $45.95 per barrel in

the second quarter of 2017, up from $41.95 per barrel in the

year-ago quarter. The average realized natural gas liquids selling

price in the second quarter of 2017 was $14.85 per barrel, versus

$9.03 per barrel in the prior-year quarter, while the average

realized natural gas selling price was $3.19 per mcf, compared

with $3.58 per mcf in the second quarter of 2016.

Net production, excluding Libya,

was 294,000 boepd in the second quarter of 2017, compared to

313,000 boepd in the prior-year quarter. Lower volumes were due to

a reduced drilling program across our portfolio, natural field

declines, and planned shut-downs in the Gulf of Mexico. Net

production in Libya, which recommenced in the fourth quarter of

2016, was 6,000 boepd in the second quarter of 2017.

Cash operating costs, which include operating

costs and expenses, production and severance taxes, and E&P

general and administrative expenses, were $14.68 per boe in the

second quarter, down 8 percent from $15.91 per boe in the

prior-year quarter. Second quarter 2017 results included

a charge of $15 million related to crude oil hedge

ineffectiveness. The E&P effective tax rate,

excluding Libya, was a benefit of 8 percent in the second quarter

of 2017, down from a benefit of 47 percent, excluding special

items, in the second quarter of 2016. Commencing in

2017, we do not recognize deferred tax benefit or expense in the

U.S., Denmark (hydrocarbon tax only), and Malaysia until deferred

tax assets are re-established in these

jurisdictions. This financial reporting requirement has

no cash flow or economic impact.

Operational Highlights for the Second Quarter of

2017:

Bakken (Onshore U.S.): Net

production from the Bakken averaged 108,000 boepd, compared to

106,000 boepd in the prior-year quarter. The Corporation operated

an average of four rigs in the second quarter, drilling 23 wells

and bringing 13 new wells online.

Gulf of Mexico (Offshore

U.S.): Net production from the Gulf of Mexico was 51,000 boepd,

compared to 54,000 boepd in the prior-year quarter, primarily

reflecting lower production as a result of planned shut-downs,

partially offset by higher production at the Tubular Bells Field.

At the Stampede development (Hess operated - 25 percent), the

tension leg platform (TLP) was installed in the field and hook-up

activities commenced. One well has been drilled and completed, and

completion operations are underway on the second and third wells.

First production from the field is expected in the first half of

2018.

North Malay Basin Full-field

Development (Offshore Malaysia): At the North Malay Basin

project (Hess operated - 50 percent), hook-up of the topsides for

the central processing platform was completed in the quarter and

first production of natural gas commenced in mid-July with

commissioning activities ongoing. The field is expected to ramp up

net production to approximately 165 million cubic feet per day

during the third quarter.

Guyana (Offshore): At the

Stabroek Block (Hess - 30 percent), operated by Esso Exploration

and Production Guyana Limited, the partners sanctioned the first

phase of the Liza Field development. This phase is

expected to have a gross capital cost of approximately $3.2 billion

for drilling and subsea infrastructure and will develop

approximately 450 million barrels of oil, with first production

expected by 2020. The Corporation’s net share of

development costs is forecast to be approximately $955 million, of

which $110 million is already included in our 2017 capital and

exploratory budget. Of the remaining net development

costs, approximately $250 million is expected in 2018 and

approximately $330 million in 2019, with the balance expected in

2020 and 2021.

In June, the operator confirmed positive

results from the Liza-4 well that encountered more than 197 feet of

high-quality, oil-bearing sandstone reservoirs. On July

25th, the operator announced the successful Payara-2 well, which

encountered 59 feet of high-quality, oil bearing sandstone

reservoirs and confirms a second giant field containing gross

discovered recoverable resources of approximately 500 million

boe. Gross discovered recoverable resources for the

Stabroek Block are now estimated to be 2.25 billion to 2.75 billion

barrels of oil equivalent.

Midstream:

The Midstream segment, which is

comprised primarily of our 50/50 midstream joint venture, Hess

Infrastructure Partners (HIP), had net income of $16 million in the

second quarter of 2017, compared to $11 million in the prior-year

quarter.

In April, Hess Midstream Partners

LP (the “Partnership”) successfully sold common units representing

limited partner interests in an initial public offering for net

proceeds of $365.5 million, of which $175 million was distributed

to the Corporation. The Partnership owns an approximate 20 percent

controlling interest in the operating assets that comprise HIP,

while HIP retains ownership of the remaining 80 percent. The public

unit holders own a 30.5 percent limited partner interest in the

Partnership.

Capital and Exploratory Expenditures:

Exploration and Production capital

and exploratory expenditures were $528 million in the second

quarter of 2017, up from $484 million in the prior-year quarter,

primarily reflecting increased drilling activity (Bakken, Stampede

and Norway), partially offset by lower exploration activity and a

reduction in development expenditures at North Malay Basin.

Liquidity:

Net cash provided by operating

activities was $165 million in the second quarter of 2017, compared

to $197 million in the second quarter of 2016. Net cash provided by

operating activities before changes in working capital was $332

million in the second quarter of 2017, up from $257 million in the

year-ago quarter. Changes in working capital during the second

quarter of 2017 included non-recurring cash outflows totaling

approximately $130 million related to crude oil provided to Dakota

Access Pipeline as line fill, termination payments for an offshore

drilling rig, premiums on crude oil hedging contracts, and

prepayments for frac sand in North Dakota.

At June 30, 2017, the Corporation

had cash and cash equivalents of $2,492 million and total

debt, excluding the Midstream segment, of $6,035 million. The

Corporation’s debt to capitalization ratio was 30.9 percent at June

30, 2017 and 30.4 percent at December 31, 2016.

In August, the Corporation expects

to complete the sale of its enhanced oil recovery assets in the

Permian Basin for total consideration of $600 million.

Items Affecting Comparability of Earnings Between

Periods:

The following table reflects the

total after-tax income (expense) of items affecting comparability

of earnings between periods:

Three Months Ended

Six Months Ended June 30, June 30, (unaudited) (unaudited)

2017

2016

2017

2016

(In millions) Exploration and Production $ — $ (57 )

$ — $ (57 ) Midstream — — — — Corporate, Interest and

Other — — —

— Total items affecting comparability of earnings between periods $

— $ (57 ) $ — $ (57 )

Second quarter 2016 Exploration

and Production results included after-tax charges totaling $74

million ($119 million pre-tax) associated with dry-hole costs for a

well completed in the prior year and termination of a drilling rig

contract, partially offset by an after-tax gain of $17 million ($27

million pre-tax) related to the sale of undeveloped acreage,

onshore United States.

Reconciliation of U.S. GAAP to Non-GAAP measures:

The following table reconciles

reported net income (loss) attributable to Hess Corporation and

adjusted net income (loss):

Three Months Ended Six Months Ended June 30,

June 30, (unaudited) (unaudited)

2017

2016

2017

2016

(In millions) Net income (loss) attributable to Hess Corporation $

(449 ) $ (392 ) $ (773 ) $ (901 ) Less:

Total items affecting comparability of earnings between periods

— (57 ) —

(57 ) Adjusted net income (loss) attributable to Hess Corporation $

(449 ) $ (335 ) $ (773 ) $ (844 )

The following table reconciles

reported net cash provided by (used in) operating activities to

cash provided by operating activities before changes in operating

assets and liabilities:

Three Months Ended

Six Months Ended June 30, June 30, (unaudited) (unaudited)

2017

2016

2017

2016

(In millions)

Cash provided by operating activities

before changes in operatingassets and liabilities

$ 332 $ 257 $ 775 $ 405 Changes in

operating assets and liabilities (167 )

(60 ) (261 ) (268 ) Net cash provided

by (used in) operating activities $ 165 $ 197 $

514 $ 137

Hess Corporation will review second quarter financial and

operating results and other matters on a webcast at 10 a.m. today.

For details about the event, refer to the Investor Relations

section of our website at www.hess.com.

Hess Corporation is a leading global independent energy company

engaged in the exploration and production of crude oil and natural

gas. More information on Hess Corporation is available at

www.hess.com.

Forward-looking Statements

Certain statements in this release may constitute

"forward-looking statements" within the meaning of Section 21E of

the United States Securities Exchange Act of 1934, as amended, and

Section 27A of the United States Securities Act of 1933, as

amended. Forward-looking statements are subject to known and

unknown risks and uncertainties and other factors which may cause

actual results to differ materially from those expressed or implied

by such statements, including, without limitation, uncertainties

inherent in the measurement and interpretation of geological,

geophysical and other technical data. Estimates and projections

contained in this release are based on the Corporation’s current

understanding and assessment based on reasonable assumptions.

Actual results may differ materially from these estimates and

projections due to certain risk factors discussed in the

Corporation’s periodic filings with the Securities and Exchange

Commission and other factors.

Non-GAAP financial measure

The Corporation has used non-GAAP financial measures in this

earnings release. “Adjusted net income (loss)” presented in this

release is defined as reported net income (loss) attributable to

Hess Corporation excluding items identified as affecting

comparability of earnings between periods. “Net cash provided by

operating activities before changes in operating assets and

liabilities” is defined as Cash provided by operating activities

excluding changes in operating assets and liabilities. Management

uses adjusted net income (loss) to evaluate the Corporation’s

operating performance and believes that investors’ understanding of

our performance is enhanced by disclosing this measure, which

excludes certain items that management believes are not directly

related to ongoing operations and are not indicative of future

business trends and operations. Management believes that net cash

provided by operating activities before changes in operating assets

and liabilities demonstrates the Corporation’s ability to

internally fund capital expenditures, pay dividends and service

debt. These measures are not, and should not be viewed as, a

substitute for U.S. GAAP net income (loss) or net cash provided by

(used in) operating activities. A reconciliation of reported net

income (loss) attributable to Hess Corporation (U.S. GAAP) to

adjusted net income (loss) as well as a reconciliation of net cash

provided by (used in) operating activities (U.S. GAAP) to net cash

provided by operating activities before changes in operating assets

and liabilities are provided in the release.

Cautionary Note to Investors

We use certain terms in this release relating to resources other

than proved reserves, such as unproved reserves or resources.

Investors are urged to consider closely the oil and gas disclosures

in Hess’ Form 10-K, File No. 1-1204, available from Hess

Corporation, 1185 Avenue of the Americas, New York, New York 10036

c/o Corporate Secretary and on our website at www.hess.com. You can

also obtain this form from the SEC on the EDGAR system.

HESS CORPORATION AND CONSOLIDATED

SUBSIDIARIES

SUPPLEMENTAL FINANCIAL DATA

(UNAUDITED)

(IN MILLIONS)

Second Second First

Quarter

Quarter

Quarter

2017 2016 2017

Income

Statement

Revenues and

non-operating income Sales and other operating revenues $ 1,216

$ 1,224 $ 1,277 Other, net 12

45 (2 ) Total revenues and

non-operating income 1,228

1,269 1,275

Costs and

expenses Cost of products sold (excluding items shown

separately below) 272 277 219 Operating costs and expenses 375 455

359 Production and severance taxes 30 28 31 Exploration expenses,

including dry holes and lease impairment 53 199 58 General and

administrative expenses 100 106 96 Interest expense 82 85 84

Depreciation, depletion and amortization 741

797 737 Total costs and

expenses 1,653 1,947

1,584

Income (loss) before income

taxes (425 ) (678 ) (309 ) Provision (benefit) for income taxes

(8 ) (305 )

(13 )

Net income (loss) (417 ) (373 ) (296 ) Less:

Net income (loss) attributable to noncontrolling interests

32 19 28

Net income (loss) attributable to Hess Corporation (449 )

(392 ) (324 ) Less: Preferred stock dividends

11 12 12

Net

income (loss) applicable to Hess Corporation common

stockholders $ (460 ) $ (404 ) $

(336 )

HESS CORPORATION AND CONSOLIDATED

SUBSIDIARIES

SUPPLEMENTAL FINANCIAL DATA

(UNAUDITED)

(IN MILLIONS)

Six Months Ended June

30,

2017

2016

Income

Statement

Revenues and non-operating

income Sales and other operating revenues $ 2,493 $ 2,197

Other, net 10 65 Total

revenues and non-operating income 2,503

2,262

Costs and expenses Cost of

products sold (excluding items shown separately below) 491 466

Operating costs and expenses 734 891 Production and severance taxes

61 47 Exploration expenses, including dry holes and lease

impairment 111 331 General and administrative expenses 196 204

Interest expense 166 170 Depreciation, depletion and amortization

1,478 1,665 Total costs

and expenses 3,237 3,774

Income (loss) before income taxes (734 ) (1,512 )

Provision (benefit) for income taxes (21 )

(651 )

Net income (loss) (713 ) (861 )

Less: Net income (loss) attributable to noncontrolling interests

60 40

Net income

(loss) attributable to Hess Corporation (773 ) (901 )

Less: Preferred stock dividends 23

18

Net income (loss) applicable to Hess

Corporation common stockholders $ (796 ) $

(919 )

HESS CORPORATION AND CONSOLIDATED

SUBSIDIARIES

SUPPLEMENTAL FINANCIAL DATA

(UNAUDITED)

(IN MILLIONS)

June

30,

December 31,

2017 2016

Balance Sheet

Information

Cash and cash equivalents $ 2,492 $

2,732 Other current assets 1,778 1,544 Property, plant and

equipment – net 22,793 23,595 Other long-term assets

735 750

Total assets $

27,798 $ 28,621 Current maturities of long-term debt

$ 121 $ 112 Other current liabilities 1,997 2,139 Long-term debt

6,612 6,694 Other long-term liabilities 3,990 4,085 Total equity

excluding other comprehensive income (loss) 15,298 16,238

Accumulated other comprehensive income (loss) (1,518 ) (1,704 )

Noncontrolling interests 1,298

1,057

Total liabilities and equity $ 27,798 $

28,621 June 30, December 31, 2017 2016

Total

Debt

Hess $ 6,035 $ 6,073 Midstream (a) 698

733

Hess Consolidated $ 6,733 $

6,806

(a) Midstream debt is

non-recourse to Hess Corporation.

June 30, December 31, 2017 2016

Debt to

Capitalization Ratio

Hess Consolidated 30.9 % 30.4 %

HESS CORPORATION AND CONSOLIDATED

SUBSIDIARIES

SUPPLEMENTAL FINANCIAL DATA

(UNAUDITED)

(IN MILLIONS)

Second

Second First Quarter Quarter Quarter 2017 2016 2017

Cash Flow

Information

Cash Flows from Operating Activities Net income

(loss) $ (417 ) $ (373 ) $ (296 )

Adjustments to reconcile net income (loss)

to net cash provided by (used in) operatingactivities

(Gains) losses on asset sales, net — (27 ) — Depreciation,

depletion and amortization 741 797 737 Exploratory dry hole costs —

133 — Exploration lease and other impairment 8 15 7 Stock

compensation expense 22 22 22 Provision (benefit) for deferred

income taxes and other tax accruals (22

) (310 )

(27 )

Cash provided by operating activities

before changes in operating assets andliabilities

332 257 443 Changes in operating assets and liabilities

(167 ) (60 )

(94 ) Net cash provided by (used in)

operating activities 165

197 349

Cash

Flows from Investing Activities Additions to property, plant

and equipment - E&P (446 ) (547 ) (340 ) Additions to property,

plant and equipment - Midstream (34 ) (68 ) (50 ) Proceeds from

asset sales 79 80 100 Other, net —

8 — Net

cash provided by (used in) investing activities

(401 ) (527 )

(290 )

Cash Flows from Financing

Activities Net borrowings (repayments) of debt with maturities

of 90 days or less (1 ) (25 ) 5 Debt with maturities of greater

than 90 days Borrowings — — — Repayments (51 ) (18 ) (26 ) Proceeds

from issuance of Hess Midstream Partnership units 366 — — Cash

dividends paid (90 ) (89 ) (92 ) Noncontrolling interests, net (175

) — — Other, net (7 )

— 8 Net cash provided by

(used in) financing activities 42

(132 ) (105

)

Net Increase (Decrease) in Cash and Cash

Equivalents (194 ) (462 ) (46 )

Cash and Cash Equivalents at

Beginning of Period 2,686

3,557 2,732

Cash and Cash Equivalents at End of Period $

2,492 $ 3,095 $

2,686

Additions to Property, Plant and

Equipment included within Investing Activities:

Capital expenditures incurred $ (503 ) $ (501 ) $

(370 ) Increase (decrease) in related liabilities

23 (114 )

(20 ) Additions to property, plant and equipment $

(480 ) $ (615 ) $

(390 )

HESS CORPORATION AND CONSOLIDATED

SUBSIDIARIES

SUPPLEMENTAL FINANCIAL DATA

(UNAUDITED)

(IN MILLIONS)

Six Months Ended June 30, 2017 2016

Cash Flow

Information

Cash flows From Operating Activities Net income

(loss) $ (713 ) $ (861 ) Adjustments to reconcile net income (loss)

to net cash provided by (used in) operating activities (Gains)

losses on asset sales, net — (27 ) Depreciation, depletion and

amortization 1,478 1,665 Exploratory dry hole costs — 218

Exploration lease and other impairment 15 24 Stock compensation

expense 44 47 Provision (benefit) for deferred income taxes and

other tax accruals (49 ) (661 ) Cash provided by

operating activities before changes in operating assets and

liabilities 775 405 Changes in operating assets and liabilities

(261 ) (268 ) Net cash provided by (used in)

operating activities 514 137

Cash Flows

from Investing Activities Additions to property, plant and

equipment - E&P (786 ) (1,114 ) Additions to property, plant

and equipment - Midstream (84 ) (121 ) Proceeds from asset sales

179 80 Other, net — 15 Net cash provided by (used in)

investing activities (691 ) (1,140 )

Cash

Flows from Financing Activities Net borrowings (repayments) of

debt with maturities of 90 days or less 4 (20 ) Debt with

maturities of greater than 90 days Borrowings — — Repayments (77 )

(35 ) Proceeds from issuance of Hess Midstream Partnership units

366 — Proceeds from issuance of preferred stock — 557 Proceeds from

issuance of common stock — 1,087 Cash dividends paid (182 ) (169 )

Noncontrolling interests, net (175 ) — Other, net 1

(38 ) Net cash provided by (used in) financing activities

(63 ) 1,382

Net Increase (Decrease) in Cash and

Cash Equivalents (240 ) 379

Cash and Cash Equivalents at

Beginning of Year 2,732 2,716

Cash and Cash

Equivalents at End of Period $ 2,492 $ 3,095

Additions to Property, Plant and Equipment included

within Investing Activities: Capital expenditures incurred $

(873 ) $ (1,041 ) Increase (decrease) in related liabilities

3 (194 ) Additions to property, plant and equipment $ (870 )

$ (1,235 )

HESS CORPORATION AND CONSOLIDATED

SUBSIDIARIES

SUPPLEMENTAL FINANCIAL DATA

(UNAUDITED)

(IN MILLIONS)

Second Second First

Quarter

Quarter

Quarter

2017 2016 2017

Capital and

Exploratory Expenditures

E&P

Capital and exploratory expenditures United States Bakken $ 148

$ 88 $ 90 Other Onshore 9

21 8 Total Onshore 157 109 98 Offshore

191 168

158 Total United States

348 277 256 Europe 42 14

15 Africa 11 — 6 Asia and other 127

193 116 E&P Capital

and exploratory expenditures $ 528 $

484 $ 393

Total exploration expenses

charged to income included above $ 45 $

51 $ 51

Midstream Capital

expenditures $ 20 $ 68 $

28

Six Months Ended June 30,

2017

2016

Capital and

Exploratory Expenditures

E&P Capital and

exploratory expenditures United States Bakken $ 238 $ 204 Other

Onshore 17 42 Total

Onshore 255 246 Offshore 349

373 Total United States 604

619 Europe 57 62 Africa 17 3 Asia and other

243 343 E&P Capital and

exploratory expenditures $ 921 $ 1,027

Total exploration expenses charged to income included

above $ 96 $ 90

Midstream

Capital expenditures $ 48 $ 104

HESS CORPORATION AND CONSOLIDATED

SUBSIDIARIES

EXPLORATION AND PRODUCTION EARNINGS

(UNAUDITED)

(IN MILLIONS)

Second Quarter 2017

Income

Statement

United States

International

Total

Total revenues and non-operating income Sales and

other operating revenues $ 837 $ 376 $ 1,213 Other, net (5 )

11 6 Total revenues and non-operating income

832 387 1,219

Costs and expenses Cost

of products sold (excluding items shown separately below) (a) 283 8

291 Operating costs and expenses 171 146 317 Production and

severance taxes 29 1 30 Midstream tariffs 135 — 135 Exploration

expenses, including dry holes and lease impairment 29 24 53 General

and administrative expenses 50 3 53 Depreciation, depletion and

amortization 484 224 708 Total costs and

expenses 1,181 406 1,587

Results of

operations before income taxes (349 ) (19 ) (368 ) Provision

(benefit) for income taxes (9 ) (5 ) (14 )

Net income (loss) attributable to Hess Corporation $ (340 )

(b) $ (14 ) (c) $ (354 ) Second Quarter 2016

Income

Statement

United States

International

Total

Total revenues and non-operating income Sales and

other operating revenues $ 750 $ 472 $ 1,222 Other, net 22

15 37 Total revenues and non-operating income

772 487 1,259

Costs and expenses Cost

of products sold (excluding items shown separately below) (a) 238

57 295 Operating costs and expenses 221 179 400 Production and

severance taxes 27 1 28 Midstream tariffs 113 — 113 Exploration

expenses, including dry holes and lease impairment 164 35 199

General and administrative expenses 54 6 60 Depreciation, depletion

and amortization 492 273 765 Total costs and

expenses 1,309 551 1,860

Results of

operations before income taxes (537 ) (64 ) (601 ) Provision

(benefit) for income taxes (203 ) (70 ) (273 )

Net income (loss) attributable to Hess Corporation $ (334 )

$ 6 $ (328 )

(a)

Includes amounts charged from the

Midstream.

(b)

After-tax results from crude oil hedging

activities amounted to realized gains of $1 million and unrealized

losses of $7 million.

(c)

After-tax results from crude oil hedging

activities amounted to realized gains of $3 million and unrealized

losses of $8 million.

HESS CORPORATION AND CONSOLIDATED

SUBSIDIARIES

EXPLORATION AND PRODUCTION EARNINGS

(UNAUDITED)

(IN MILLIONS)

First Quarter 2017

Income

Statement

United States

International

Total

Total revenues and non-operating income Sales and

other operating revenues $ 922 $ 353 $ 1,275 Other, net (5 )

— (5 ) Total revenues and non-operating income

917 353 1,270

Costs and expenses Cost

of products sold (excluding items shown separately below) (a) 295

(53 ) 242 Operating costs and expenses 174 135 309 Production and

severance taxes 31 — 31 Midstream tariffs 124 — 124 Exploration

expenses, including dry holes and lease impairment 22 36 58 General

and administrative expenses 51 5 56 Depreciation, depletion and

amortization 445 258 703 Total costs and

expenses 1,142 381 1,523

Results of

operations before income taxes (225 ) (28 ) (253 ) Provision

(benefit) for income taxes (14 ) (6 ) (20 )

Net income (loss) attributable to Hess Corporation $ (211 )

$ (22 )

(b)

$ (233 )

(a)

Includes amounts charged from the

Midstream.

(b)

After-tax results from crude oil hedging

activities amounted to realized losses of $1 million and unrealized

gains of $1 million.

HESS CORPORATION AND CONSOLIDATED

SUBSIDIARIES

EXPLORATION AND PRODUCTION EARNINGS

(UNAUDITED)

(IN MILLIONS)

Six Months Ended June 30, 2017

Income

Statement

United States

International

Total

Total revenues and non-operating income Sales and

other operating revenues $ 1,759 $ 729 $ 2,488 Other, net

(10 ) 11 1 Total revenues and non-operating income

1,749 740 2,489

Costs and

expenses Cost of products sold (excluding items shown

separately below) (a) 578 (45 ) 533 Operating costs and expenses

345 281 626 Production and severance taxes 60 1 61 Midstream

tariffs 259 — 259 Exploration expenses, including dry holes and

lease impairment 51 60 111 General and administrative expenses 101

8 109 Depreciation, depletion and amortization 929

482 1,411 Total costs and expenses 2,323 787

3,110

Results of operations before income

taxes (574 ) (47 ) (621 ) Provision (benefit) for income taxes

(23 ) (11 ) (34 )

Net income (loss)

attributable to Hess Corporation $ (551 ) (b) $ (36 ) (c) $

(587 ) Six Months Ended June 30, 2016

Income

Statement

United States International Total

Total revenues and

non-operating income Sales and other operating revenues $ 1,347

$ 846 $ 2,193 Other, net 28 19 47 Total

revenues and non-operating income 1,375 865

2,240

Costs and expenses Cost of products sold

(excluding items shown separately below) (a) 430 69 499 Operating

costs and expenses 435 349 784 Production and severance taxes 44 3

47 Midstream tariffs 231 — 231 Exploration expenses, including dry

holes and lease impairment 272 59 331 General and administrative

expenses 104 11 115 Depreciation, depletion and amortization

1,024 578 1,602 Total costs and expenses 2,540

1,069 3,609

Results of operations before

income taxes (1,165 ) (204 ) (1,369 ) Provision (benefit) for

income taxes (445 ) (143 ) (588 )

Net

income (loss) attributable to Hess Corporation $ (720 ) $ (61 )

$ (781 )

(a)

Includes amounts charged from the

Midstream.

(b)

After-tax results from crude oil hedging

activities amounted to realized gains of $1 million and unrealized

losses of $7 million.

(c)

After-tax results from crude oil hedging

activities amounted to realized gains of $2 million and unrealized

losses of $7 million.

HESS CORPORATION AND CONSOLIDATED

SUBSIDIARIES

EXPLORATION AND PRODUCTION SUPPLEMENTAL

OPERATING DATA

Second Second First

Quarter

Quarter

Quarter

2017 2016 2017

Net Production

Per Day (in thousands)

Crude oil - barrels United States Bakken 68 69 67

Other Onshore 9 8 8 Total Onshore 77 77 75 Offshore 38 41 47 Total

United States 115 118 122 Europe 28 26 31 Africa (a) 32 33

35 Asia 2 2 2 Total 177 179 190

Natural gas liquids -

barrels United States Bakken 29 27 23 Other Onshore 8 12 10

Total Onshore 37 39 33 Offshore 4 4 6 Total United States 41 43 39

Europe 1 1 1 Total 42 44 40

Natural gas - mcf

United States Bakken 66 59 53 Other Onshore 99 134 106 Total

Onshore 165 193 159 Offshore 51 52 75 Total United States 216 245

234 Europe 33 40 38 Asia 238 254 212 Total 487 539 484

Barrels of oil equivalent 300 313 311

(a)

Production from Libya recommenced in the

fourth quarter of 2016. Production was 6,000 barrels of oil per day

(bopd) in the second quarter of 2017 and 4,000 bopd in the first

quarter of 2017.

HESS CORPORATION AND CONSOLIDATED

SUBSIDIARIES

EXPLORATION AND PRODUCTION SUPPLEMENTAL

OPERATING DATA

Six Months Ended June

30,

2017

2016

Net Production

Per Day (in thousands)

Crude oil - barrels United States Bakken 68 71 Other

Onshore 8 9 Total Onshore 76 80 Offshore 43 46 Total United States

119 126 Europe 30 30 Africa (a) 33 35 Asia 2 2 Total 184 193

Natural gas liquids - barrels United States Bakken 26

27 Other Onshore 9 12 Total Onshore 35 39 Offshore 5 5 Total United

States 40 44 Europe 1 1 Total 41 45

Natural gas -

mcf United States Bakken 59 63 Other Onshore 103 134 Total

Onshore 162 197 Offshore 63 63 Total United States 225 260

Europe 36 43 Asia 225 252 Total 486 555

Barrels of oil

equivalent 306 331

(a)

Production from Libya recommenced in the

fourth quarter of 2016. Production was 5,000 bopd in the first six

months of 2017.

HESS CORPORATION AND CONSOLIDATED

SUBSIDIARIES

EXPLORATION AND PRODUCTION SUPPLEMENTAL

OPERATING DATA

Second Second First

Quarter

Quarter

Quarter

2017 2016 2017

Sales Volumes Per

Day (in thousands)

Crude oil - barrels 174 198 175 Natural gas liquids -

barrels 42 44 40 Natural gas - mcf 487 539 484 Barrels of oil

equivalent 297 332 296

Sales Volumes (in

thousands)

Crude oil - barrels 15,757 18,053 15,744 Natural gas liquids

- barrels 3,848 3,968 3,623 Natural gas - mcf 44,390 48,998 43,544

Barrels of oil equivalent 27,003 30,187 26,624

Six Months Ended June

30,

2017

2016

Sales Volumes Per

Day (in thousands)

Crude oil - barrels 174 206 Natural gas liquids - barrels 41

45 Natural gas - mcf 486 555 Barrels of oil equivalent 296 344

Sales Volumes (in

thousands)

Crude oil - barrels 31,501 37,502 Natural gas liquids -

barrels 7,471 8,222 Natural gas - mcf 87,934 100,968 Barrels of oil

equivalent 53,628 62,552

HESS CORPORATION AND CONSOLIDATED

SUBSIDIARIES

EXPLORATION AND PRODUCTION SUPPLEMENTAL

OPERATING DATA

Second Second

First

Quarter

Quarter

Quarter

2017 2016

2017

Average Selling

Prices

Crude oil - per

barrel (including hedging) United States Onshore $ 43.83 $

39.96 $ 46.47 Offshore 44.60 40.15 47.18 Total United States 44.09

40.02 46.74 Europe 50.27 45.28 54.04 Africa 48.81 44.66 51.25 Asia

41.95 38.96 54.70 Worldwide 45.95 41.95 48.58

Crude oil -

per barrel (excluding hedging) United States Onshore $ 43.72 $

39.96 $ 46.47 Offshore 44.60 40.15 47.18 Total United States 44.01

40.02 46.74 Europe 49.72 45.28 54.18 Africa 48.40 44.66 51.37 Asia

41.95 38.96 54.70 Worldwide 45.74 41.95 48.61

Natural gas

liquids - per barrel United States Onshore $ 14.25 $ 8.34 $

18.07 Offshore 18.47 13.52 20.55 Total United States 14.64 8.84

18.43 Europe 23.95 19.23 28.06 Worldwide 14.85 9.03 18.71

Natural gas - per mcf United States Onshore $ 2.20 $ 1.30 $

2.32 Offshore 2.29 1.50 2.40 Total United States 2.22 1.34 2.35

Europe 4.22 3.74 3.99 Asia 3.93 5.70 4.01 Worldwide 3.19 3.58 3.20

The following is a summary of the

Corporation’s commodity hedging program:

Brent

West

Texas Intermediate

Outstanding

Hedging Contracts – Oil Price Collars

Q3 and Q4 average barrels of oil per day 20,000 60,000 Ceiling

price $75 $70 Floor price $55 $50 End date December 31, 2017

December 31, 2017

HESS CORPORATION AND CONSOLIDATED

SUBSIDIARIES

EXPLORATION AND PRODUCTION SUPPLEMENTAL

OPERATING DATA

Six Months Ended

June 30,

2017

2016

Average Selling

Prices

Crude oil - per barrel

(including hedging) United States Onshore $ 45.13 $ 33.22

Offshore 46.01 32.84 Total United States 45.45 33.08 Europe 52.01

37.39 Africa 49.84 38.31 Asia 52.55 39.11 Worldwide 47.25 34.97

Crude oil - per barrel (excluding hedging) United

States Onshore $ 45.07 $ 33.22 Offshore 46.01 32.84 Total United

States 45.41 33.08 Europe 51.78 37.39 Africa 49.66 38.31 Asia 52.55

39.11 Worldwide 47.16 34.97

Natural gas liquids - per

barrel United States Onshore $ 16.04 $ 7.59 Offshore 19.70

11.34 Total United States 16.47 8.00 Europe 26.19 17.40 Worldwide

16.72 8.21

Natural gas - per mcf United States

Onshore $ 2.26 $ 1.25 Offshore 2.35 1.48 Total United States 2.28

1.31 Europe 4.10 4.19 Asia 3.96 5.64 Worldwide 3.20 3.50

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170726005316/en/

For Hess CorporationInvestors:Jay Wilson, (212)

536-8940orMedia:Sard Verbinnen & CoMichael

Henson/Patrick Scanlan(212) 687-8080

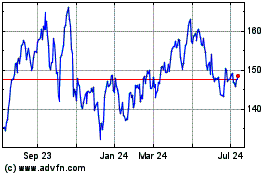

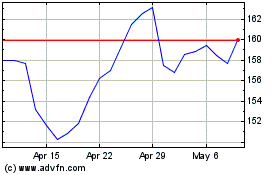

Hess (NYSE:HES)

Historical Stock Chart

From Mar 2024 to Apr 2024

Hess (NYSE:HES)

Historical Stock Chart

From Apr 2023 to Apr 2024