--Middle States Reaffirms Strayer

University’s Regional Accreditation--

--Strayer University Second Quarter New

Enrollment Up 8%, Total Enrollments Up 6%--

Strayer Education, Inc. (NASDAQ: STRA) today announced financial

results for the period ended June 30, 2017. Financial highlights

are as follows:

Three Months Ended June 30

- During the second quarter, student

enrollment at the Company’s main operating unit, Strayer

University, increased 6% to 43,411, compared to 41,029 for the same

period in 2016. New student enrollment for the period increased 8%

and continuing student enrollment increased 5%.

- Revenues increased 4% to $112.7 million

compared to $108.5 million for the same period in 2016, principally

due to higher enrollment partially offset by lower revenue per

student.

- Income from operations was $13.9

million compared to $12.9 million for the same period in 2016, an

increase of 7%. Excluding noncash adjustments, income from

operations was $11.9 million compared to $12.8 million for the same

period in 2016. The noncash adjustments are associated with a

reduction to the value of contingent consideration related to the

Company’s acquisition of the New York Code & Design Academy,

and adjustments to the Company’s reserve for leases on facilities

no longer in use. Operating margin was 12.3%, compared to 11.9% for

the same period in 2016. Excluding the noncash adjustments,

operating income margin was 10.5% compared to 11.8% for the same

period in 2016.

- Net income was $10.3 million compared

to $7.8 million for the same period in 2016, an increase of 32%.

Excluding the noncash adjustments, net income was $8.2 million

compared to $7.7 million for the same period in 2016.

- Diluted earnings per share was $0.92

compared to $0.72 for the same period in 2016, an increase of 28%.

Excluding the noncash adjustments, diluted earnings per share was

$0.73 compared to $0.71 for the same period in 2016. Diluted

weighted average shares outstanding increased 4% to 11,190,000 from

10,799,000 for the same period in 2016.

Six Months Ended June 30:

- Revenues increased 4% to $227.6 million

compared to $219.7 million for the same period in 2016, principally

due to higher enrollment partially offset by lower revenue per

student.

- Income from operations was $32.3

million compared to $33.0 million for the same period in 2016, a

decrease of 2%. Excluding the noncash adjustments, income from

operations was $30.3 million compared to $31.3 million for the same

period in 2016. Operating income margin was 14.2%, compared to

15.0% for the same period in 2016. Excluding the noncash

adjustments, operating income margin was 13.3% compared to 14.2%

for the same period in 2016.

- Net income was $20.9 million compared

to $20.2 million for the same period in 2016, an increase of 3%.

Excluding the noncash adjustments, net income was $18.8 million

compared to $19.1 million for the same period in 2016.

- Diluted earnings per share was $1.87

for 2017 and for 2016. Excluding the noncash adjustments, diluted

earnings per share was $1.68 compared to $1.77 for the same period

in 2016. Diluted weighted average shares outstanding increased 3%

to 11,155,000 from 10,790,000 for the same period in 2016.

Balance Sheet and Cash Flow

At June 30, 2017, the Company had cash and cash equivalents of

$147.9 million and no debt. The Company generated $32.8 million in

cash from operating activities in the first six months of 2017

compared to $22.4 million during the same period in 2016. Capital

expenditures for the first six months of 2017 were $8.4 million,

compared to $3.9 million for the same period in 2016.

The Company had $70.0 million of share repurchase authorization

remaining at June 30, 2017. No shares were repurchased in the

second quarter of 2017.

For the second quarter of 2017, bad debt expense as a percentage

of revenues was 4.5%, compared to 3.8% for the same period in

2016.

Q3 Enrollment Outlook

Total enrollments at Strayer University for the third quarter

2017 are anticipated to grow 7% to approximately 41,600 students

from 38,813 students for the same period in 2016. New student

enrollments are expected to increase approximately 7%, while

continuing student enrollments are expected to increase

approximately 8%. Revenue per student for the third quarter is

expected to decrease between 1% and 2%.

Accreditation

During the second quarter, the Middle States Commission on

Higher Education (Middle States) reaffirmed Strayer University’s

regional accreditation, with no required follow-up reporting.

Middle States found that Strayer is in full compliance with all

fourteen of its Standards of Excellence. The Standards of

Excellence constitute Middle States’ qualitative measures of

institutional performance. The Middle States accreditation is for

eight years, during which time the University will submit annual

reports, and the University’s next review will be in 2025-26.

Additionally during the second quarter, the Commission on

Collegiate Nursing Education (CCNE) granted accreditation to

Strayer University’s RN to BSN program. This specialized,

programmatic accreditation is for five years, through June 2022,

with the University’s next on-site evaluation in fall 2021. CCNE’s

accreditation recognizes that the program engages in effective

educational practice in nursing and effective educational

preparation of members of the nursing profession.

Stock-based Compensation Activity

In May 2017, the Company awarded 7,541 shares of restricted

stock to various non-employee members of the Company’s Board of

Directors, as part of the Company’s annual director compensation.

The Company’s stock price closed at $86.83 on the date of these

restricted stock grants.

Common Stock and Common Stock Equivalents

At June 30, 2017, the Company had 11,167,425 common shares

issued and outstanding, including 466,318 shares of restricted

stock. The Company also had 250,000 restricted stock units

outstanding and 100,000 vested stock options outstanding.

Common Stock Cash Dividend

The Company announced today that its Board of Directors had

declared a regular, quarterly cash dividend of $0.25 per share of

common stock. This dividend will be paid on September 18, 2017 to

shareholders of record as of September 5, 2017.

Conference Call with Management

Strayer Education, Inc. will host a conference call to discuss

its second quarter 2017 earnings results at 10:00 a.m. (ET) today.

To participate on the live call, investors should dial (877)

303-9047 ten minutes prior to the start time. In addition, the call

will be available via live webcast. To access the live webcast of

the conference call, please go to www.strayereducation.com 15

minutes prior to the start time of the call to register. Following

the call, the webcast will be archived and available at

www.strayereducation.com.

About Strayer Education, Inc.

Strayer Education, Inc. (NASDAQ: STRA) is educating a more

competitive and qualified workforce by solving higher education’s

most challenging problems. It includes Strayer University, a

regionally accredited institution that delivers affordable degree

programs for working adults, and a Top 25 Princeton Review-ranked

executive MBA program through the Jack Welch Management Institute.

Non-degree web and mobile application development courses are

offered through the New York Code + Design Academy. Strayer also

transforms the workforces of its corporate partners through

customized degree and professional development programs. By

deploying innovative teaching methods and technologies that enhance

student learning outcomes, Strayer makes it possible for working

adults to acquire the skills they need to succeed in today’s

rapidly changing economy.

Forward-Looking Statements

This press release contains statements that are forward-looking

and are made pursuant to the "safe-harbor" provisions of the

Private Securities Litigation Reform Act of 1995 (the “Reform

Act”). Such statements may be identified by the use of words such

as “expect,” “estimate,” “assume,” “believe,” “anticipate,” “will,”

“forecast,” “outlook,” “plan,” “project,” or similar words. The

statements are based on the Company’s current expectations and are

subject to a number of assumptions, uncertainties and risks. In

connection with the safe-harbor provisions of the Reform Act, the

Company has identified important factors that could cause the

Company’s actual results to differ materially from those expressed

in or implied by such statements. The assumptions, uncertainties

and risks include the pace of growth of student enrollment, the

Company’s continued compliance with Title IV of the Higher

Education Act, and the regulations thereunder, as well as regional

accreditation standards and state regulatory requirements,

rulemaking by the Department of Education and increased focus by

the U.S. Congress on for-profit education institutions, competitive

factors, risks associated with the opening of new campuses, risks

associated with the offering of new educational programs and

adapting to other changes, risks relating to the timing of

regulatory approvals, the Company’s ability to implement its growth

strategy, risks associated with the ability of the University’s

students to finance their education in a timely manner, and general

economic and market conditions. Further information about these and

other relevant risks and uncertainties may be found in the

Company’s Annual Report on Form 10-K for the fiscal year ended

December 31, 2016 and in its subsequent filings with the Securities

and Exchange Commission, all of which are incorporated herein by

reference and which are available from the Commission. The Company

undertakes no obligation to update or revise forward-looking

statements.

STRAYER EDUCATION, INC.

UNAUDITED CONDENSED CONSOLIDATED

STATEMENTS OF INCOME

(Amounts in thousands, except per share

data)

For the three months endedJune

30,

For the six months endedJune

30,

2016 2017 2016 2017

Revenues $ 108,487 $ 112,720 $ 219,653 $ 227,632 Costs and

expenses: Instruction and educational support 61,782 61,656 119,880

123,072 Marketing 17,748 19,226 36,046 37,944 Admissions advisory

4,131 4,779 8,480 9,495 General and administration 11,930

13,205 22,259 24,824 Total costs and expenses

95,591 98,866 186,665 195,335 Income

from operations 12,896 13,854 32,988 32,297 Investment income 112

253 212 434 Interest expense 160 160 320

319 Income before income taxes 12,848 13,947 32,880 32,412

Provision for income taxes 5,062 3,645 12,674

11,532 Net income $ 7,786 $ 10,302 $ 20,206 $ 20,880

Earnings per share: Basic $ 0.73 $ 0.96 $ 1.91 $ 1.96 Diluted $

0.72 $ 0.92 $ 1.87 $ 1.87 Weighted average shares

outstanding: Basic 10,610 10,680 10,603 10,655 Diluted 10,799

11,190 10,790 11,155

STRAYER EDUCATION, INC.

UNAUDITED CONDENSED CONSOLIDATED

BALANCE SHEETS

(Amounts in thousands, except share and

per share data)

December 31, June 30, 2016 2017

ASSETS Current assets: Cash and cash equivalents $ 129,245 $

147,867 Tuition receivable, net 20,532 20,342 Income taxes

receivable — 1,485 Other current assets 10,766 10,357

Total current assets 160,543 180,051 Property and equipment, net

73,124 72,706 Deferred income taxes 31,096 32,441 Goodwill 20,744

20,744 Other assets 13,189 12,540 Total assets $

298,696 $ 318,482

LIABILITIES & STOCKHOLDERS'

EQUITY Current liabilities: Accounts payable and accrued

expenses $ 41,132 $ 41,286 Income taxes payable 1,883 — Deferred

revenue 16,691 20,017 Other current liabilities 133 —

Total current liabilities 59,839 61,303 Other long-term liabilities

50,483 47,978 Total liabilities 110,322

109,281 Commitments and contingencies Stockholders' equity: Common

stock, par value $0.01, 20,000,000 shares authorized; 11,093,489

and 11,167,425 shares issued and outstanding at December 31, 2016

and June 30, 2017, respectively 111 112 Additional paid-in capital

35,453 41,106 Retained earnings 152,810 167,983 Total

stockholders' equity 188,374 209,201 Total

liabilities and stockholders' equity $ 298,696 $ 318,482

STRAYER EDUCATION, INC.

UNAUDITED CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(Amounts in thousands)

For the six months ended

June 30,

2016 2017 Cash flows from operating

activities: Net income $ 20,206 $ 20,880 Adjustments to reconcile

net income to net cash provided by operating activities:

Amortization of gain on sale of assets (140 ) (133 ) Amortization

of deferred rent (446 ) (859 ) Amortization of deferred financing

costs 131 131 Depreciation and amortization 8,873 8,975 Deferred

income taxes (2,158 ) (1,560 ) Stock-based compensation 4,926 5,654

Changes in assets and liabilities: Tuition receivable, net 245 (137

) Other current assets (1,466 ) 409 Other assets (2,639 ) 829

Accounts payable and accrued expenses (726 ) 559 Income taxes

payable (3,314 ) (3,153 ) Deferred revenue 3,313 4,356 Other

long-term liabilities (4,380 ) (3,187 ) Net cash

provided by operating activities 22,425 32,764

Cash flows from investing activities: Purchases of

property and equipment (3,852 ) (8,435 ) Cash used in acquisition,

net of cash acquired (7,635 ) — Net cash used

in investing activities (11,487 ) (8,435 )

Cash flows from financing activities: Payments of contingent

consideration (405 ) — Common dividends paid —

(5,707 ) Net cash used in financing activities (405 )

(5,707 ) Net increase in cash and cash equivalents 10,533 18,622

Cash and cash equivalents - beginning of period 106,889

129,245 Cash and cash equivalents - end of

period $ 117,422 $ 147,867 Non-cash

transactions: Purchases of property and equipment included in

accounts payable $ 274 $ 469

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170726005221/en/

Strayer Education Inc.Daniel Jackson,

703-713-1862Executive Vice President and Chief Financial

Officerdaniel.jackson@strayer.edu

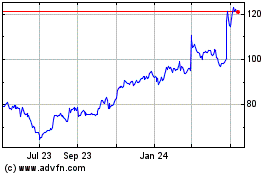

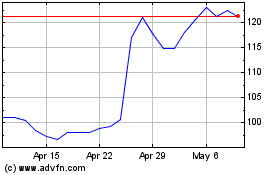

Strategic Education (NASDAQ:STRA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Strategic Education (NASDAQ:STRA)

Historical Stock Chart

From Apr 2023 to Apr 2024