PRESS

RELEASE

Clermont-Ferrand - July 25, 2017

COMPAGNIE GENERALE

DES ETABLISSEMENTS MICHELIN

Financial Information for the Six Months Ended

June 30, 2017

Net income of €863 million, up 12%

Volumes up 4.1% (3.6% at constant scope of

consolidation)

Operating income from recurring activities of €1.4

billion, stable and in line with the Group's roadmap

2017 guidance confirmed

-

Volumes up 4.1% (3.6% at

constant scope of consolidation) over the first half, dampened in

Q2 by heavy buying in Q1 ahead of price increases

-

Growth in Passenger car and

Light truck tire volumes (up 3%) and stable volumes in Truck

tires,

-

Sustained rebound in mining

tire demand and sharp upturn in OE Earthmover and Agricultural tire

sales,

-

Acquisition of Brazilian

two-wheel tiremaker Levorin in December 2016.

-

Price-mix effect positive, at

1.4% in the first half, accelerating to 2.8% in Q2, reflecting the

initial impact of price increases and resulting, as announced, in a

€186 million net negative price-mix/raw materials effect over the

period.

-

Competitiveness plan gains

offset inflation, as expected.

-

Free cash flow of a negative

€305 million, in line with annual objectives

-

Stable, excluding acquisitions

and capitalized interest on the OCEANE bonds,

-

Working capital management in

response to the unfavorable impact of higher raw materials

prices.

Jean-Dominique

Senard, Chief Executive Officer, said: ''Michelin's good

performance, compared with a strong first-half 2016, is in line

with our 2020 roadmap. The main drivers of the period include an

increase in volumes, tight pricing policy management, further

improvements in our competitiveness and the commitment of our

employees to serving customers. Today, we are confirming our

guidance for 2017, with a second half that will benefit from the

improved margins resulting from the price increases."

Over the second

half of the year, regardless of prevailing winter weather

conditions, replacement markets are expected to recover from their

decline after the surge in early buying. Demand for original

equipment tires should remain on an upward trend in the Truck,

Earthmover and Agricultural segments, with growth slowing in the

Passenger car and Light truck segment. Sales of mining tires

are expected to remain buoyant.

Given the

full-year impact of higher raw materials costs, which are currently

estimated at €800 million, Michelin will continue to agilely

manage prices, holding unit margins firm in businesses not subject

to indexation clauses and applying those clauses in businesses that

are. As a result, changes in the price mix and raw materials costs

are expected to have a net positive impact in the second half of

the year.

For the full

year, Michelin confirms its targets of volume growth in line with

global market trends, operating income from recurring activities

exceeding the 2016 figure at constant exchange rates, and

structural free cash flow of more than €900 million.

(in € millions ) |

First-Half

2017 |

First-Half

2016 |

Net sales |

11,059 |

10,292 |

Operating income from recurring activities |

1,393 |

1,405 |

Operating margin on recurring activities |

12.6% |

13.7% |

| Passenger car/Light truck tires and related distribution |

12.8% |

13.8% |

Truck tires and

related distribution |

7.5% |

9.9% |

Specialty businesses |

20.8% |

20.6% |

| Operating income/(loss) from non-recurring activities |

27 |

(51) |

Operating income |

1,420 |

1,354 |

Net income |

863 |

769 |

Earnings per share1 (in €) |

4.76 |

4.24 |

Capital expenditure |

585 |

623 |

Net debt |

1,685 |

1,719 |

Gearing |

16% |

18% |

Employee benefit obligations |

4,570 |

5,273 |

Free cash flow2 |

(305) |

8 |

Employees on payroll3 |

112,800 |

112,400 |

1 Attributable

to shareholders of the Company.

2 Free cash

flow: net cash from operating activities less net cash from

investing activities less net cash from other current financial

assets, before distributions.

3 At

period-end.

First-Half 2017

% change YoY

(in number of

tires) |

Europe

including Russia & CIS* |

Europe

excluding Russia & CIS* |

North America |

Asia

(excluding India) |

South America |

Africa/India/Middle East |

Total |

Original equipment

Replacement |

+1%

+4%

|

+1%

+2% |

+1%

+1% |

+3%

+5% |

+13%

+7% |

+8%

+2% |

+3%

+4% |

Second-Quarter 2017

% change YoY

(in number of

tires) |

Europe

including Russia & CIS* |

Europe

excluding Russia & CIS* |

North America |

Asia

(excluding India) |

South America |

Africa/India/Middle East |

Total |

Original equipment

Replacement |

-4%

+0%

|

-4%

-2%

|

-1%

-1% |

+1%

+3% |

+8%

+7% |

+4%

+3% |

-0%

+1% |

*Including Turkey.

In the first half of 2017, the

global original equipment and replacement Passenger car and Light

truck tire market grew by 3% in number of tires sold. It rose by 5%

in the first quarter, driven by purchases ahead of the price hikes

announced by most tiremakers, and by 1% in the second quarter as

demand cooled.

· Original equipment

-

In Europe, after expanding by a very brisk 6% in

the first quarter, demand fell off sharply in the second, losing

4%, with a decline in vehicle sales in the United Kingdom and

Germany. The recovery underway in Eastern Europe is gaining

momentum quarter after quarter.

-

Demand continued to show signs of slowing in

North America, with a 1% decline in the second quarter following on

from a 2% increase in the first.

-

Demand in Asia (excluding India) ended the first

half up 3% overall. The Chinese market held firm, gaining a further

3%, despite adjustments to the government's compact car purchase

incentives.

-

Markets also rose in South America, more

robustly in the first quarter thanks to the recovery in automobile

production and sales in Argentina and Brazil, but they remain

vulnerable to the region's political uncertainties.

· Replacement

-

Demand in Western Europe contracted by 2% in the

second quarter after gaining a very healthy 5% in the first due to

early buying ahead of price increases. This was against a backdrop

of slower sales to end customers and high dealer inventory levels.

Sales in the 18 inch and over and all-season segments rose sharply

over the period. Growth remained firm throughout the first half in

Eastern Europe, with a 16% increase off of favorable prior year

comparatives. Budget imports are continuing to pour into both

Western and Eastern Europe at a sustained pace.

-

In North America, the announcement of

forthcoming price hikes caused the market to swing from a 3%

increase in the first quarter to a 1% decline in the second. Note

as well that import sales rose by 5% over the full period, which

also saw strong demand for tires with high speed ratings.

-

Demand in Asia (excluding India) ended the first

half up 5% overall. In China, the announced price increases drove a

12% gain in the market in the first quarter, which slowed to 2% in

the second, leaving dealers with high inventory amid relatively

sluggish sell-out. Markets in Japan (up 6%) and South Korea rose

sharply until May, lifted by early buying ahead of the price hikes,

but fell back suddenly in June. Growth continued apace throughout

the first half in the ASEAN countries, except in Thailand, where

early buying had an impact.

-

Demand in South America rose by 7% overall, with

the Brazilian market gaining 10% on a 70% increase in imports from

Asia.

First-Half 2017

% change YoY

(in number of

tires) |

Europe

including Russia & CIS* |

Europe

excluding Russia & CIS* |

North America |

Asia

(excluding India) |

South America |

Africa/India/Middle East |

Total |

Original equipment

Replacement |

+6%

+7%

|

+6%

+6%

|

+4%

-2% |

+17%

+3% |

-3%

+3% |

-8%

-3% |

+9%

+1% |

Second-quarter 2017

% change YoY

(in number of

tires) |

Europe

including Russia & CIS* |

Europe

excluding Russia & CIS* |

North America |

Asia

(excluding India) |

South America |

Africa/India/Middle East |

Total |

Original equipment

Replacement |

+3%

+2%

|

+2%

+3%

|

+14%

-9% |

+16%

-3% |

-0%

-0% |

-14%

-3% |

+9%

-3% |

*Including Turkey.

Global demand for new original

equipment and replacement Truck tires rose by 3% in number of tires

sold in the first six months of 2017, with increases in replacement

sell-in prices spurring a 7% gain in the first quarter followed by

a 3% contraction in the second and with robust 9% growth in the OE

segment over the full period.

· Original equipment

-

The Western European market expanded by 6%,

buoyed by low interest rates, sustained demand for freight services

and renewed truck sales in the recovering construction industry. In

Eastern Europe, the rebound that began in late 2016 continued,

driving an 11% gain.

-

After dropping 19% in 2016, the North American

market enjoyed a sharp rebound in the second quarter, led by demand

for freight services.

-

Demand for radial and bias tires in Asia

(excluding India) climbed 17% overall. The Chinese market rebounded

by a very strong 22%, thanks to the legislation banning over-loaded

trucks and the government's infrastructure investment plan. Demand

rose by a robust 10% in Thailand, helping to offset the 5% slowdown

in truck production in Japan due to weakening export sales.

-

The South American market fell back 3% in a

still hesitant economic environment, both across the entire region

and in Brazil, where demand has leveled off.

· Replacement

-

In a more favorable Western European freight and

construction environment, high dealer inventory levels following

the price increases are weighing on sell-in demand, whose increase

is being partially driven by imports. In Eastern Europe, where

markets are led by the intermediate and budget segments, demand

bounced back by 7% over the first half, but with a sharp slowdown

to 1% in the second quarter.

-

In North America, the steep 9% drop in the

second quarter reflected a prior-year basis of comparison that had

been boosted by Chinese tire imports ahead of the expected

introduction of new customs duties. In addition, sales of new

trucks to replace aging models, which drove the second-quarter

rebound in the OE market, also dampened demand for replacement

tires.

-

Replacement radial and bias tire markets in Asia

(excluding India) ended the first half down by 3%. In China,

demand increased by 3% overall, but contracted by 6% in the second

quarter due to the decline in the freight market, the restructuring

of certain dealers and, in June, heavy rains in the South. In

Southeast Asia, where the market gained 3% overall, the robust 11%

rebound in Japan helped to offset the 3% decline in Thailand, where

demand was dampened by price increases.

-

Radial and bias tire markets in South America

edged up 3% over the first half, despite a slowdown at period-end

caused by price increases and high dealer inventory levels. In

Brazil, demand rose by 10% in an improving economy.

Original equipment markets have

turned upwards at a time of low inventory and rising demand for

mining machines.

Infrastructure and quarry tire

markets also rose over the period, partly in response to the

announced price increases by tiremakers.

Despite low farm commodity prices,

replacement markets expanded over the period, led by dealer

purchases ahead of announced price increases.

-

Two-wheel tires: demand for

motorcycle tires rose in the mature markets, while emerging markets

also remained on an upward trend.

-

Aircraft tires: demand in

the commercial aircraft segment continued to grow, led by the

increase in passenger traffic.

First-Half 2017 Net Sales and Earnings

Net sales for the first six months

of 2017 totaled €11,059 million, an increase of 7.5% from the year

earlier period that was attributable to the net impact of the

following factors:

-

a €372 million increase from the 3.6% growth in

volumes, along with a €52 million gain from the first time

consolidation of Brazilian two-wheel tiremaker Levorin;

-

a €145 million increase from the favorable 1.4%

price-mix effect (of which a negative 0.1% in the

first quarter and a positive 2.8% in the second). The price

effect added a net €60 million, comprising €67 million in

price increases in non-indexed businesses to offset the impact of

higher raw materials costs, less the €7 million in price

adjustments in the businesses subject to raw materials indexation

clauses. The positive mix effect added another net €85 million,

reflecting the still highly positive product mix and the favorable

impact of the rebound in the mining tire business, partially offset

by the unfavorable impact of the relative growth rates of OE and

replacement tire sales;

-

a €198 million increase from the favorable

currency effect, primarily stemming from the US dollar.

-

Results

Consolidated

operating income from recurring activities amounted to €1,393

million or 12.6% of net sales in the first six months of 2017,

compared with €1,405 million and 13.7% in first-half 2016. The €27

million in net operating income from non-recurring activities

corresponded to gains on amendments to the US post-retirement

healthcare plan and the UK pension plan, which were partially

offset by changes in the fair value of non-current assets.

Operating income from recurring

activities was first shaped by growth in volumes, which contributed

€139 million. As announced, the €145 million positive price-mix

effect partially offset the full-period €331 million negative

impact of higher raw materials costs. In line with the

implementation schedule, the competitiveness plan delivered €146

million in gains that helped to absorb the €142 million increase in

production costs and overheads. Lastly, the currency effect added

€37 million to the reported figure.

In all, net

income for the period came to €863 million, an increase of

12%.

Taking into account the negative

free cash flow, the payment of €585 million in dividends and the

€101 million in share buybacks, gearing stood at 16% at June

30, 2017, unchanged from a year earlier and corresponding to net

debt of €1,685 million, compared with gearing of 9% and net

debt of €944 million at December 31, 2016.

In € millions |

Net sales |

Operating income from recurring activities |

Operating margin on recurring activities |

| |

H1 2017 |

H1 2016 |

H1 2017 |

H1 2016 |

H1 2017 |

H1 2016 |

| Passenger car/Light truck tires and related distribution |

6,263 |

5,916 |

800 |

814 |

12.8% |

13.8% |

| Truck tires & related distribution |

3,041 |

2,907 |

229 |

288 |

7.5% |

9.9% |

| Specialty businesses |

1,755 |

1,469 |

364 |

303 |

20.8% |

20.6% |

Group

|

11,059 |

10,292 |

1,393 |

1,405 |

12.6% |

13.7% |

· Passenger car/Light truck tires and related

distribution

Net sales in the Passenger

car/Light truck tires and related distribution segment rose by 5.9%

to €6,263 million, from €5,916 million in the prior-year

period.

Operating income from recurring

activities came to €800 million or 12.8% of net sales, versus €814

million and 13.8% in first-half 2016.

The change was primarily

attributable to the 3% growth in sales volumes and the improvement

in the price mix, which offset almost all of the impact of higher

raw materials prices. The still favorable mix effect reflected the

success of the MICHELIN CrossClimate+ and MICHELIN Pilot Sport

4S lines, which drove strong growth in sales of MICHELIN brand

tires (up 4%) and 18-inch and larger tires (up 23%). Sales of

other Group brands grew 3 % over the period.

· Truck

tires & related distribution

Net sales in the Truck tires and

related distribution segment amounted to €3,041 million in the

first half of 2017, a 4.6% increase from the €2,907 million

reported a year earlier.

Operating income from recurring

activities amounted to €229 million or 7.5% of net sales, compared

with €288 million and 9.9% in first-half 2016.

The change primarily reflected the

stable volume performance, stemming from the priority focus on

raising prices to deliver higher margins in the second half. New

products and services continued to be introduced over the period,

which was shaped by the success of the MICHELIN X Multi, MICHELIN X

Works, intermediate tire lines and Tire Care services.

· Specialty businesses

Net sales by the Specialty

businesses stood at €1,755 million for the period, compared

with €1,469 million a year earlier.

Operating income from recurring

activities stood at €364 million or 20.8% of net sales, versus €303

million and 20.6% in first-half 2016.

The increase stemmed from the

robust 16% growth in volumes, led by the sustained rebound in

demand for the Group's mining tires and the sharp upturn in

Earthmover and Agricultural original equipment sales. This amply

offset the impact of higher raw materials costs and continued price

reductions over the period in application of contractual indexation

clauses.

COMPAGNIE GÉNÉRALE DES ÉTABLISSEMENTS

MICHELIN

Compagnie Générale des

Établissements Michelin ended the first half with net income of

€906 million, compared with €1,338 million in the first six

months of 2016.

The financial statements were

presented to the Supervisory Board at its meeting on July 24, 2017.

A review was performed by the statutory auditors, who issued

their related report on July 25, 2017.

First-Half 2017 Highlights

-

Successful issue of

non-dilutive, cash-settled convertible bonds (January

5, 2017)

-

MICHELIN PILOT SPORT 4S, the

new ultra high performance tire, is among the first tires in its

category to be rated A in wet grip (for the 19-inch model) (January

2017)

-

Michelin North America

announces broad price increase (January 31, 2017)

-

Michelin raises tire prices in

Europe in response to rising raw materials costs

(February 3, 2017)

-

MICHELIN X®

FORCE(TM) ZL: the new genuinely tough all-terrain tire for small

civilian and military trucks (February 14, 2017)

-

Launch of a €100 million share

buyback program (February 17, 2017)

-

MICHELIN CrossClimate+: better,

longer lasting performance in every season

(February 27, 2017)

-

Four new MICHELIN mountain bike

tire ranges (March 13, 2017)

-

The new Alpine A110 fitted with

MICHELIN Pilot Sport 4 tires (March 21, 2017)

-

Harley-Davidson selects

MICHELIN for its new Street Rod(TM) model (March 30,

2017)

-

General Motors and Michelin, a

shared vision of sustainable rubber tree farming

(May 18, 2017)

-

MICHELIN Vision concept tire:

an expression of mobility for the future (June 13, 2017)

-

Movin'On: it's time to take

action for sustainable mobility (June 13, 2017)

-

Michelin acquires NexTraq, a

telematics provider, to expand fleet management capabilities for

commercial trucks in the United States (June 14, 2017)

-

24 Hours of Le Mans: Michelin

notches up its 20th consecutive

success (June 19, 2017)

-

Michelin and Safran develop the

first connected aircraft tire (June 20, 2017)

-

A new global reorganization

project to better serve Michelin customers (June 22,

2017)

-

Acquisition of a 40% stake in

Robert Parker Wine Advocate, the world's most widely read

independent consumers' guide to fine wine (July 5, 2017)

-

Michelin and SIFCA own 89.15%

of outstanding SIPH shares (July 12, 2017)

A full

description of first-half 2017 highlights

may be found on the Michelin website:

http://www.michelin.com/eng

Presentation and

Conference call

First-half 2017 results will be reviewed with analysts and

investors during a presentation today, Tuesday July 25, at

6:30 p.m. CEST. The event will be in English, with simultaneous

interpreting in French.

Webcast

The presentation will be webcast live on www.michelin.com/eng

Conference call

Please dial-in on one of the following numbers from 6:20 p.m.

CEST:

-

In France

01 70 77 09 29 (French)

-

In France

01 70 77 09 44 (English)

-

In the United Kingdom

0203 367 9462 (English)

-

In North

America

(855) 402 7763 (English)

-

From anywhere else

+44 (0) 203 367 9462 (English)

The presentation of financial

information for the six months ended June 30, 2017 (press release,

presentation, interim financial report) may also be viewed at

http://www.michelin.com/eng, along with practical information

concerning the conference call.

Investor

calendar

Thursday, October 19, 2017 after

close of trading

Investor Relations

Valérie Magloire

+33 (0) 1 78 76 45 37

+33 (0) 6 76 21 88 12 (cell)

valerie.magloire@michelin.com

Matthieu Dewavrin

+33 (0) 4 73 32 18 02

+33 (0) 6 71 14 17 05 (cell)

matthieu.dewavrin@michelin.com

Humbert de Feydeau

+33 (0) 4 73 32 68 39

+33 (0) 6 82 22 39 78 (cell)

humbert.de-feydeau@michelin.com

|

Media Relations

Corinne Meutey

+33 (0) 1 78 76 45 27

+33 (0) 6 08 00 13 85 (cell)

corinne.meutey@michelin.com

Individual Shareholders

Jacques Engasser

+33 (0) 4 73 98 59 08

jacques.engasser@michelin.com

|

DISCLAIMER

This press release is not an offer to purchase or a

solicitation to recommend the purchase of Michelin shares. To

obtain more detailed information on Michelin, please consult the

documents filed in France with Autorité des Marchés Financiers,

which are also available from the www.michelin.com/eng

website.

This press release may contain a

number of forward-looking statements. Although the Company believes

that these statements are based on reasonable assumptions as at the

time of publishing this document, they are by nature subject to

risks and contingencies liable to translate into a difference

between actual data and the forecasts made or inferred by these

statements.

CP_2017 H1_EN

This

announcement is distributed by Nasdaq Corporate Solutions on behalf

of Nasdaq Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: Michelin via Globenewswire

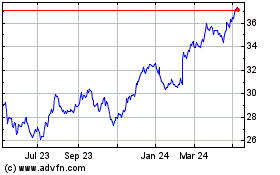

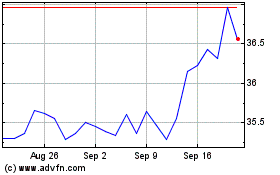

Michelin (EU:ML)

Historical Stock Chart

From Mar 2024 to Apr 2024

Michelin (EU:ML)

Historical Stock Chart

From Apr 2023 to Apr 2024