Caterpillar Boosts Outlook as Revenue Jumps -- Update

July 25 2017 - 10:04AM

Dow Jones News

By Andrew Tangel and Austen Hufford

Caterpillar Inc. boosted its revenue and outlook for the year as

sales for its bulldozers, excavators and other equipment grew in

many of its construction markets around the world.

The heavy machinery giant said Tuesday it expects revenue of $42

billion to $44 billion for all of 2017, up from a previous forecast

of as much as $41 billion. Caterpillar took in $38.5 billion in

revenue last year, its fourth-straight year of declining sales.

Caterpillar said its second-quarter revenue jumped 10% to $11.3

billion from the prior year, fueled by Chinese demand for equipment

for infrastructure projects and residential construction, as well

as the market for equipment in the North American natural gas

industry.

Shares rose about 5% in premarket trading to $113.24.

"While a number of our end markets remain challenged,

construction in China and gas compression in North America were

highlights in the quarter," Caterpillar Chief Executive Jim Umpleby

said. "Mining and oil-related activities have come off recent lows,

and we are seeing improving demand for construction in most

regions."

Demand for construction equipment in North America, its largest

market, rose 3% in the quarter, but decreased 5% in Europe, the

Middle East and Africa. Sales of construction equipment in Latin

America rose 31% as several countries' economies showed signs of

improvement.

Caterpillar cautioned, however, that it sees remaining weakness

in the Middle East and Latin America, as well as geopolitical

uncertainty and commodity-price volatility.

Caterpillar saw signs of turnaround in some of its markets in

the first quarter. That trend continued in the months since as

retail sales of Caterpillar machinery increased 7% world-wide

during the three months to the end of June.

Signs of recovery comes after four straight years of revenue

decline and waves of layoffs for Caterpillar, which is moving its

headquarters to the Chicago suburb of Deerfield from Peoria,

Ill.

The company has been working to trim its workforce and shrink

its global manufacturing footprint. Caterpillar said it now expects

restructuring costs of about $1.2 billion for the year, down from

the previously expected $1.25 billion. Caterpillar's full-time

workforce declined to 94,800 employees at the end of the second

quarter, down from 100,000 the prior year.

In recent months, public attention has focused on a federal

investigation involving Caterpillar's taxes, a Swiss subsidiary and

export filings.

The Wall Street Journal reported earlier this month

investigators believe Caterpillar failed to submit numerous

required export filings with the federal government in recent

years. Caterpillar has said it believes its tax position is

correct, and that the company was in the process of "responding to

the government's concerns."

Overall for the second quarter, Caterpillar reported a profit of

$802 million, or $1.35 a share, compared with $550 million, or 93

cents a share a year ago.

Excluding restructuring costs, the company said it earned $1.49

a share, compared with $1.09 a year ago.

Analysts polled by Thomson Reuters had expected $1.26 in

adjusted earnings per share on revenue of $10.93 billion.

Write to Andrew Tangel at Andrew.Tangel@wsj.com and Austen

Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

July 25, 2017 09:49 ET (13:49 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

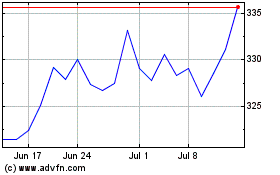

Caterpillar (NYSE:CAT)

Historical Stock Chart

From Mar 2024 to Apr 2024

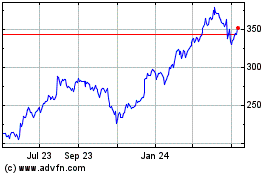

Caterpillar (NYSE:CAT)

Historical Stock Chart

From Apr 2023 to Apr 2024