Current Report Filing (8-k)

July 24 2017 - 5:31PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

July 24, 2017

Date of Report (Date of earliest event reported)

TechnipFMC plc

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

England and Wales

|

|

001-37983

|

|

98-1283037

|

|

(State or other jurisdiction of incorporation)

|

|

(Commission File Number)

|

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

|

|

|

|

|

One St. Paul’s Churchyard

London, United Kingdom

|

|

|

|

EC4M 8AP

|

|

(Address of principal executive offices)

|

|

|

|

(Zip Code)

|

+44 203-429-3950

(Registrant's telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

The information in Item 4.02 is incorporated by reference into this Item 2.02.

As of July 24, 2017, TechnipFMC plc (the “Company”) has substantially completed the preparation of its financial results for the quarter ended June 30, 2017. As previously disclosed, the Company intends to release its earnings for the quarter ended June 30, 2017 after the close of the New York Stock Exchange on Wednesday, July 26, 2017 and hold a call to discuss those earnings on Thursday, July 27, 2017 at 1 p.m. London time (8 a.m. New York time).

Item 4.02(a). Non-Reliance on Previously Issued Financial Statements or a Related Audit Report or Completed Interim Review.

On July 24, 2017, the Audit Committee of the Board of Directors of TechnipFMC plc, after consideration of relevant facts and circumstances and after consultation with management and PricewaterhouseCoopers LLP, the Company’s independent registered public accounting firm, concluded that the Company’s unaudited interim condensed consolidated U.S. GAAP financial statements as of March 31, 2017 and for the three months ended March 31, 2017 included in the Company’s Quarterly Report on Form 10-Q and prior year period prepared and included in the Company’s Quarterly Report for comparison purposes for the quarter ended March 31, 2017, as previously filed with the U.S. Securities and Exchange Commission (the “SEC”) on May 4, 2017, should be restated, and that such financial statements previously filed with the SEC should no longer be relied upon because of material errors in such financial statements.

The Company concluded that errors existed within certain rates used in the calculations of the foreign currency effects on certain of its engineering and construction projects in the Company’s unaudited Condensed Consolidated Balance Sheets and Condensed Consolidated Statements of Income for the quarter ended March 31, 2017. The net income attributable to the Company in the quarter ending March 31, 2017 was overstated by $209.5 million ($0.45 per share).

The Company will restate the unaudited interim condensed consolidated financial statements identified above as set forth in the schedules attached as Exhibit 99.1 to this Current Report on Form 8-K to recognize the non-cash, corporate charges and file such restated condensed consolidated financial statements with the SEC in an amendment to the Company’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2017 (the “10-Q Amendment”).

In connection with the 10-Q Amendment, the Company re-evaluated its conclusion regarding the effectiveness of the Company’s disclosure controls and procedures and internal control over financial reporting as of March 31, 2017 and determined that a material weakness existed as of March 31, 2017 relating to the rates used in calculations of foreign currency effects on certain of the Company’s engineering and construction projects.

Solely as a result of the material weakness described above, the Company expects to conclude that the Company’s disclosure controls and procedures and its internal control over financial reporting were not effective as of March 31, 2017. The Company has reviewed the process to calculate the foreign currency remeasurement effect and has implemented revisions and additional controls designed to ensure that similar computational errors will not recur. The Company believes that these changes provide reasonable assurance that the financial statements and other financial information for the three and six month periods ending June 30, 2017 fairly present in all material respects the Company’s financial condition, results of operations and cash flows as of, and for, such periods.

Item 7-01. Regulation FD Disclosure.

The Company’s guidance excludes the impact of foreign currency effects.

|

|

|

|

Item 9.01

|

Financial Statements and Exhibits

|

(d) Exhibits

Exhibit No

.

Description

|

|

|

|

99.1

|

Restated unaudited interim condensed consolidated financial information of TechnipFMC plc as of and for the three months ended March 31, 2017 and March 31, 2016.

|

Forward-Looking Statements

This Current Report on Form 8-K contains “forward-looking statements” as defined in Section 27A of the United States Securities Act of 1933, as amended, and Section 21E of the United States Securities Act of 1934, as amended (the “Exchange Act”). Forward-looking statements usually relate to future events and anticipated revenues, earnings, cash flows or other aspects of the Company’s operations or operating results. Forward-looking statements are often identified by the words “believe,” “expect,” “anticipate,” “plan,” “intend,” “foresee,” “should,” “would,” “could,” “may,” “estimate,” “outlook” and similar expressions, including the negative thereof. The absence of these words, however, does not mean that the statements are not forward-looking. These forward-looking statements are based on the Company’s current expectations, beliefs and assumptions concerning future developments and business conditions and their potential effect on the Company. While management believes that these forward-looking statements are reasonable as and when made, there can be no assurance that future developments affecting the Company will be those that the Company anticipates.

All of the Company’s forward-looking statements involve risks and uncertainties (some of which are significant or beyond the Company’s control) and assumptions that could cause actual results to differ materially from the Company’s historical experience and the Company’s present expectations or projections. Known material factors that could cause actual results to differ materially from those contemplated in the forward-looking statements include those set forth in Part II, Item 1A, “Risk Factors” in the Company’s Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2017 and elsewhere in the Company’s other filings with the SEC, as well as the following:

|

|

|

|

•

|

the risk that additional information may arise during the course of the Company’s review of its accounting for foreign currency effects that would require the Company to make additional adjustments or identify additional material weaknesses;

|

|

|

|

|

•

|

the time, effort and expense required to complete the restatement of the financial statements, including any pro forma corrections;

|

|

|

|

|

•

|

any legal compliance matters or internal controls review, improvement and remediation that may be necessary and resulting impact on the Company’s operations;

|

|

|

|

|

•

|

identification and ability to remediate the material weakness or material weaknesses;

|

|

|

|

|

•

|

the Company may encounter unanticipated material issues or additional adjustments that could delay the completion of the restatement of the financial statements or the filing of required periodic reports with the SEC;

|

|

|

|

|

•

|

ability to continue to be in compliance with the NYSE continued listing rules;

|

|

|

|

|

•

|

risk of governmental investigations, shareholder lawsuits, or significant fines, penalties and settlements related to the restatement of the Company’s financial statements;

|

|

|

|

|

•

|

unanticipated changes relating to competitive factors in the Company’s industry;

|

|

|

|

|

•

|

demand for the Company’s products and services, which is affected by changes in the price of, and demand for, crude oil and natural gas in domestic and international markets;

|

|

|

|

|

•

|

the Company’s ability to develop and implement new technologies and services, as well as the Company’s ability to protect and maintain critical intellectual property assets;

|

|

|

|

|

•

|

potential liabilities arising out of the installation or use of the Company’s products;

|

|

|

|

|

•

|

cost overruns related to the Company’s fixed price contracts or asset construction projects that may affect revenues;

|

|

|

|

|

•

|

disruptions in the timely delivery of the Company’s backlog and its effect on the Company’s future sales, profitability, and relationships with its customers;

|

|

|

|

|

•

|

risks related to reliance on subcontractors, suppliers and joint venture partners in the performance of the Company’s contracts;

|

|

|

|

|

•

|

ability to hire and retain key personnel;

|

|

|

|

|

•

|

piracy risks for the Company’s maritime employees and assets;

|

|

|

|

|

•

|

the cumulative loss of major contracts or alliances;

|

|

|

|

|

•

|

U.S. and international laws and regulations, including environmental regulations, that may increase the Company’s costs, limit the demand for its products and services or restrict its operations;

|

|

|

|

|

•

|

disruptions in the political, regulatory, economic and social conditions of the countries in which the Company conducts business;

|

|

|

|

|

•

|

risks associated with The Depository Trust Company and Euroclear for clearance services for shares traded on the NYSE and Euronext Paris, respectively;

|

|

|

|

|

•

|

results of the United Kingdom’s referendum on withdrawal from the European Union;

|

|

|

|

|

•

|

risks associated with being an English public limited company, including the need for court approval of “distributable profits” and stockholder approval of certain capital structure decisions;

|

|

|

|

|

•

|

compliance with covenants under the Company’s debt instruments and conditions in the credit markets;

|

|

|

|

|

•

|

downgrade in the ratings of the Company’s debt could restrict its ability to access the debt capital markets;

|

|

|

|

|

•

|

the outcome of uninsured claims and litigation against the Company;

|

|

|

|

|

•

|

the risks of currency exchange rate fluctuations associated with the Company’s international operations;

|

|

|

|

|

•

|

risks that the legacy businesses of FMC Technologies, Inc. and Technip S.A. will not be integrated successfully or that the combined company will not realize estimated cost savings, value of certain tax assets, synergies and growth or that such benefits may take longer to realize than expected;

|

|

|

|

|

•

|

unanticipated merger-related costs;

|

|

|

|

|

•

|

failure of the Company’s information technology infrastructure or any significant breach of security;

|

|

|

|

|

•

|

risks associated with tax liabilities, or changes in U.S. federal or international tax laws or interpretations to which they are subject; and

|

|

|

|

|

•

|

such other risk factors set forth in the Company’s filings with the SEC and in the Company’s filings with the Autorité des marchés financiers or the U.K. Financial Conduct Authority.

|

The forward-looking statements in this Current Report speak only as of the date hereof. The Company undertakes no obligation to publicly update or revise any forward-looking statements after the date they are made, whether as a result of new information, future events or otherwise, except to the extent

required by law.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

TechnipFMC plc

|

|

|

|

|

|

|

|

By: /s/ Maryann T. Mannen

|

|

|

Dated: July 24, 2017

|

Name: Maryann T. Mannen

|

|

|

|

Title: Executive Vice President and Chief Financial Officer

|

|

EXHIBIT INDEX

Exhibit No

.

Description

|

|

|

|

99.1

|

Restated unaudited interim condensed consolidated financial information of TechnipFMC plc as of and for the three months ended March 31, 2017 and March 31, 2016.

|

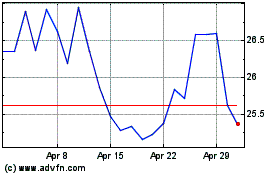

TechnipFMC (NYSE:FTI)

Historical Stock Chart

From Mar 2024 to Apr 2024

TechnipFMC (NYSE:FTI)

Historical Stock Chart

From Apr 2023 to Apr 2024