Current Report Filing (8-k)

July 24 2017 - 4:31PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES AND

EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

___________

FORM 8-K

CURRENT

REPORT

PURSUANT TO SECTION

13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of

Earliest Event Reported):

July 21,

2017

GERON

CORPORATION

(Exact name of registrant as specified in its

charter)

|

Delaware

|

0-20859

|

75-2287752

|

|

(State or other jurisdiction of

|

(Commission File Number)

|

(IRS Employer

|

|

incorporation)

|

|

Identification

No.)

|

149 COMMONWEALTH DRIVE,

SUITE 2070

MENLO PARK, CALIFORNIA 94025

(Address of principal executive offices, including

zip code)

(650)

473-7700

(Registrant's

telephone number, including area code)

N/A

(Former name or former address, if changed since

last report)

Check the appropriate box

below if the Form 8-K filing is intended to simultaneously satisfy the filing

obligation of the registrant under any of the following provisions:

|

☐

|

|

Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425)

|

|

|

|

|

|

☐

|

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act

(17 CFR 240.14a-12)

|

|

|

|

|

|

☐

|

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the

Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

|

☐

|

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the

Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether

the registrant is an emerging growth company as defined in Rule 405 of the

Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth

company ☐

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended

transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange

Act. ☐

Item 8.01 Other

Events.

As previously reported in a

Current Report on Form 8-K filed with the United States Securities and Exchange

Commission on March 3, 2017, Geron Corporation (the “Company”) entered into a

Stipulation and Agreement of Settlement (the “Stipulation”) and related

documents to resolve the consolidated class action securities lawsuit captioned

In re Geron Corporation Securities

Litigation

, Case No.

3:14-cv-01224-CRB (the “Securities Class Action”), pending in the United States

District Court for the Northern District of the State of California (the

“California District Court”).

On July 21, 2017, following

the final fairness hearing regarding the proposed settlement, the California

District Court entered an order and final judgment that: (i) dismisses with

prejudice the claims asserted in the Securities Class Action against all named

defendants in connection with the Securities Class Action, including the

Company, and releases any claims that were or could have been asserted that

arise from or relate to the facts alleged in the Securities Class Action, such

that every member of the settlement class will be barred from asserting such

claims in the future; and (ii) approves the payment of the $6.25 million cash

settlement fund, minus the payment of attorneys’ fees and costs to plaintiff’s

counsel, to members of the settlement class. The Company’s insurance providers

funded $6.0 million of the cash settlement fund and the Company paid the

remaining $250,000. The settlement does not constitute any admission of fault or

wrongdoing by the Company or any of the individual defendants.

Five stockholders opted out of

the settlement class in the Securities Class Action. The Company does not expect

to make any additional payments for and does not expect, and is not aware of,

any additional claims arising from or related to the facts alleged in the

Securities Class Action and asserted by stockholders who have opted out of the

settlement class in the Securities Class Action.

Use of Forward-Looking

Statements

Except for the historical

information contained herein, this Current Report on Form 8-K contains

forward-looking statements made pursuant to the “safe harbor” provisions of the

Private Securities Litigation Reform Act of 1995. Investors are cautioned that

statements in this Current Report on Form 8-K regarding: (i) as a result of the

settlement, members of the settlement class will be barred from asserting any

claims in the future that were or could have been asserted that arise from or

relate to the facts alleged in the Securities Class Action; (ii) the Company not

expecting any claims arising from or relating to the facts alleged in the

Securities Class Action to be asserted by any of the stockholders who have opted

out of the settlement class; (iii) the Company not expecting to make any

additional payments for any such claims; and (iv) any other statements that are

not historical facts, constitute forward-looking statements. These statements

involve risks and uncertainties that can cause actual results to differ

materially from those in such forward-looking statements. These risks and

uncertainties, include, without limitation, risks and uncertainties related to:

(i) any stockholders who have opted out of the settlement class pursuing claims

that arise from or relate to the facts alleged in the Securities Class Action

causing the Company to make additional payments, or incur additional

liabilities, related to such claims; and (ii) the settlement not having the

expected impact, including resolving the Securities Class Action. Additional

information and factors that could cause actual results to differ materially

from those in the forward-looking statements are contained in the Company’s

periodic reports filed with the United States Securities and Exchange Commission

under the heading “Risk Factors,” including in the Company’s Quarterly Report on

Form 10-Q for the quarter ended March 31, 2017. Undue reliance should not be

placed on forward-looking statements, which speak only as of the date of this

Current Report on Form 8-K, and the facts and assumptions underlying the

forward-looking statements may change. Except as required by law, the Company

disclaims any obligation to update these forward-looking statements to reflect

future information, events or circumstances.

1

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this

report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

GERON CORPORATION

|

|

|

|

Date: July 24, 2017

|

By:

|

/s/ Stephen N.

Rosenfield

|

|

|

|

Stephen N. Rosenfield

|

|

|

|

Executive Vice President, General

|

|

|

|

Counsel and Corporate Secretary

|

2

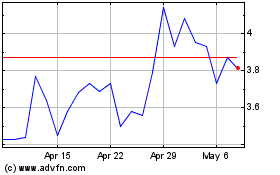

Geron (NASDAQ:GERN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Geron (NASDAQ:GERN)

Historical Stock Chart

From Apr 2023 to Apr 2024