Current Report Filing (8-k)

July 20 2017 - 5:27PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 20, 2017

APTEVO THERAPEUTICS INC.

(Exact Name of Registrant as Specified in its Charter)

|

Delaware

|

001-37746

|

81-1567056

|

|

(State or Other Juris-

diction of Incorporation)

|

(Commission

File Number)

|

(IRS Employer

Identification No.)

|

|

2401 4th Avenue, Suite 1050

Seattle, Washington

|

98121

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

Registrant’s telephone number, including area code: (206) 838-0500

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (

see

General Instruction A.2. below):

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☒

Item. 1.01

Entry into a Material Definitive Agreement

On July 20, 2017, Aptevo Research and Development LLC (the “Company”) entered into a Collaboration and Option Agreement with Alligator Bioscience AB (“Alligator”) pursuant to which the Company and Alligator will collaboratively develop a lead bispecific antibody candidate targeting 4-1BB (CD137), a costimulatory receptor found on activated T cells, and a second tumor antigen widely overexpressed in a number of different types of cancer (the “Collaboration Agreement”). Under the Collaboration Agreement, Alligator also granted to the Company a time-limited option to enter into a second agreement with Alligator for the joint development of a separate bispecific antibody product that the Company and Alligator will collaboratively select.

In accordance with the terms of the Collaboration Agreement, the parties intend to develop the lead bispecific antibody candidate targeting 4-1BB (CD137) (the “Product”) through the completion of Phase II clinical trials in accordance with an agreed upon development plan and budget. Subject to certain exceptions for the Company’s manufacturing and platform technologies, the parties will jointly own intellectual property generated in the performance of the development activities under the Collaboration Agreement.

Following the completion of the anticipated development activities under the Collaboration Agreement, the parties intend to seek a third-party commercialization partner for the Product, or, in certain circumstances, may elect to enter into a second agreement granting rights to either Aptevo or Alligator to allow such party to continue the development and commercialization of the Product. Under the terms of the Collaboration Agreement, the parties intend to share revenue received from a third-party commercialization partner equally, or, if the development costs are not equally shared under the Collaboration Agreement, in proportion to the development costs borne by each party.

The Collaboration Agreement also contains several points in development in which either party may elect to “opt-out” (i.e., terminate without cause) and, following a termination notice period, cease paying development costs for the Product, which would be borne fully by the continuing party. Following an opt-out by a party, the party that did not opt-out will be granted exclusive rights to continue the development and commercialization of the Product, subject to a requirement to pay a percentage of revenue received from any future commercialization partner for the Product, or, if the continuing party elects to self-commercialize, tiered royalties on the net sales of the Product by the continuing party ranging from the low to mid-single digits, based on the point in development during which the ‘opt-out’ occurs. The parties have also agreed on certain technical criteria or ‘stage gates’ related to the development of the Product that, if not met, will cause an automatic termination and wind-down of the Collaboration Agreement and the activities thereunder, provided that the parties do not agree to continue.

The Collaboration Agreement contains industry standard termination rights, including for material breach following a specified cure period, and in the case of a party’s insolvency.

The foregoing summary of the Collaboration Agreement does not purport to be complete and is qualified in its entirety by reference to the Collaboration Agreement, which will be filed as an exhibit to the Company’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2017.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

APTEVO THERAPEUTICS INC.

|

|

|

|

|

|

Date: July 20, 2017

|

By:

|

/s/ Shawnte Mitchell

|

|

|

|

Shawnte Mitchell,

Secretary, Vice President and General Counsel

|

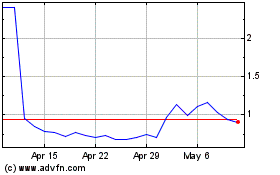

Aptevo Therapeutics (NASDAQ:APVO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Aptevo Therapeutics (NASDAQ:APVO)

Historical Stock Chart

From Apr 2023 to Apr 2024