Microsoft Profit Jumps, Fueled by Cloud Computing -- Update

July 20 2017 - 5:29PM

Dow Jones News

By Jay Greene

Once written off as a technology has-been, Microsoft Corp.

continued its rebirth as a force in cloud-computing, posting

double-digit increases in its business selling web-based services

to corporate customers.

The venerable software giant has solidified its spot as the No.

2 provider of on-demand computing processing and storage behind

market pioneer Amazon.com Inc. In its fiscal fourth quarter,

Microsoft notched gains in its Azure cloud-computing business and

Office 365, the online version of its widely used productivity

software.

Revenue from the Redmond, Wash., company's Intelligent Cloud

segment, which includes Azure, rose 11% to $7.4 billion. In the

Productivity and Business Processes segment, which includes the

Office franchise, revenue climbed 21% to $8.4 billion.

Microsoft doesn't disclose revenue figures for its Azure and

Office 365 businesses, but it said Azure revenue jumped 97% and

Office 365 revenue rose 43%.

Overall, Microsoft posted $6.51 billion in fourth-quarter net

income, or 83 cents a share, compared with a profit of $3.12

billion, or 39 cents a share, a year ago. Excluding the impact of

revenue deferrals and other items, adjusted earnings climbed to 98

cents from 69 cents a year earlier.

Revenue rose 13% to $23.32 billion and was $24.7 billion when

adjusted to reflect Windows 10 revenue deferrals.

Analysts surveyed by S&P Global Market Intelligence expected

Microsoft to report adjusted per-share earnings of 71 cents on

$24.29 billion in adjusted revenue.

Shares rose 1.5% to $75 in after-hours trading after results

beat expectations. The software giant's shares closed at a record

on Thursday, after setting its previous high a day earlier.

The strides Microsoft has made in the cloud come as its legacy

Windows operating-system business shrinks. Revenue in its More

Personal Computing segment, which includes Windows as well as the

mobile-phone and gaming businesses, slid 2% to $8.8 billion. Last

week, International Data Corp. reported world-wide PC shipments

fell 3.3% in the second quarter, while Gartner Inc. estimated the

drop at 4.3%.

Revenue for Microsoft's Surface line of computers also fell 2%.

Three months ago, that business was hit hard, registering a 26%

revenue decline, which the company attributed to older Surface

computers in the market, as well as increased price

competition.

Since then, Microsoft has introduced a new Surface laptop for

the education market and an update to its Surface Pro tablet-laptop

hybrid device, though those products made their debut with just a

few weeks left in the quarter.

LinkedIn Corp., the professional social network Microsoft

acquired last December for $27 billion, added $1.07 billion in

revenue and posted a $361 million operating loss. Microsoft is

working to connect its business products to LinkedIn, giving sales

representatives using its Dynamics software, for example, tools to

easily mine the professional social network to prospect for

leads.

Like its cloud rivals Amazon and Alphabet Inc.'s Google,

Microsoft is spending lavishly to build giant and expensive data

centers around the world to deliver its cloud services. In the

quarter, Microsoft spent $3.3 billion on capital expenses, with

much of that money going toward its data center expansion. A year

ago, Microsoft had $3.1 billion in capital expenses.

Write to Jay Greene at Jay.Greene@wsj.com

(END) Dow Jones Newswires

July 20, 2017 17:14 ET (21:14 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

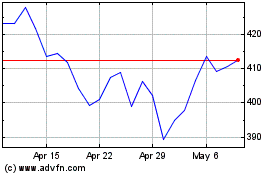

Microsoft (NASDAQ:MSFT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Microsoft (NASDAQ:MSFT)

Historical Stock Chart

From Apr 2023 to Apr 2024