Emotional anxiety overtakes financial concerns

with two-thirds of wealthy pre-retirees saying not having a set

work schedule would be a harder adjustment

Healthcare remains a top concern for wealthy

investors

Key findings:

- Two-thirds of wealthy pre-retirees are

focused on reaching a certain asset level instead of a specific age

before retiring.

- 89% of wealthy pre-retirees express

confidence in having enough money saved to be financially secure,

but most worry about the emotional adjustment of retirement.

- 84% of wealthy investors are happier

than ever in retirement, reaching peak satisfaction in their

sixties and seventies.

- 73% of wealthy retirees say getting

sick is their greatest retirement fear. Less than 50% feel secure

about long-term care planning after retirement.

UBS Wealth Management Americas (WMA) today celebrates the

twentieth issue of UBS Investor Watch with its latest report

entitled “Retiring old clichés.” The quarterly survey, which polled

over 2,000 affluent and high net worth investors, reveals that

financial security is only part of the decision-making process when

it comes to retirement. Emotional anxiety trumps financial concerns

when deciding to leave the workforce with many wealthy investors

saying that a lack of a set schedule, missing colleagues and a fear

of losing purpose keeps them from making the leap into

retirement.

Redefining retirement readiness

Wealthy pre-retirees want to reach a certain asset level before

they retire. In contrast, age is the trigger for pre-retirees with

fewer assets. Although the ideal number varies slightly, nearly

half of wealthy pre-retirees (45%) have a retirement savings target

between $1 million and $3 million.

Nearly all wealthy pre-retirees (91%) believe they have the

financial tools and knowledge necessary for a comfortable

retirement, with 89% saying they are confident they will have

enough money saved. In addition, 74% believe they know how long

their savings will last once they retire.

For wealthy pre-retirees, emotional anxiety trumps financial

concerns in assessing retirement readiness. Nearly two-thirds (64%)

expect to miss their work schedule more than their salary. Other

emotional concerns include the adjustment to retired life (59%),

leaving work colleagues behind (57%), experiencing an initial shock

(39%), losing a sense of purpose (36%) and filling the hours of

free time (34%).

“Baby Boomers have been known for 'living to work,' having been

focused on their careers for so many years. Even once they achieve

financial security, their emotional attachment to work keeps many

Boomers on the job,” said Paula Polito, Client Strategy Officer of

UBS Wealth Management Americas. "Now, as many of them look toward

retirement, they need to start 'working on living,' - figuring out

how they will fill their time and find their purpose once they

leave the workforce."

Wealthy investors reach peak happiness in retirement

In stark contrast to the fears of pre-retirees, most retired

investors adjusted quickly and easily to retired life. One wealthy

retiree compared retirement to being young again, "but with money

and no curfew."

Half of wealthy retirees took no time at all to adjust to

retired life. Another third took less than a year. A full 84% of

wealthy retirees say they are happier than at any point in their

lives. In fact, if today’s retirees had the chance to do it over

again, only 19% would have delayed their retirement.

“Based on the experience of current retirees, wealthy

pre-retirees can lay their fears to rest," said Sameer Aurora, head

of Client Insights. "Most investors are happier in retirement than

they have ever been."

Still healthy and on solid financial footing, 90% of wealthy

investors are very satisfied with life in their sixties and

seventies—higher than investors in any other age group, including

those in their thirties (68% satisfied) and forties (83%

satisfied).

Health and long-term care are top concerns for wealthy

retirees

Few wealthy retirees worry about money—only one in five worry

about outliving their assets. However, 73% say getting sick is

their top retirement concern. Nearly half (47%) are also worried

they will not have anyone to take care of them. Consistent with

UBS’s last Investor Watch report “On your mark…,” one of wealthy

investors’ top expectations of the administration is to address

healthcare.

Retirees shun traditional asset allocation guidance in

retirement

The UBS findings also showed that investors are seeking to grow

assets in retirement instead of following traditional asset

allocation guidance to reduce equities with age. For instance, 84%

of wealthy retirees plan to continue growing their assets over

time, while 74% believe equities offer the best returns regardless

of age. Most maintain or increase their equity exposure after

retirement.

Once they have achieved the liquidity that makes them feel

financially secure for retirement, many wealthy retirees focus on

longevity needs, such as healthcare expenses, and building wealth

for future generations. Contributing to this is the low interest

rate environment, with 71% citing low rates as a reason to seek

higher returns, even at an older age.

“This report confirms much of what clients have already been

sharing with us and helps to shatter some of the conventional

wisdom on how the wealthy view retirement," said Mike Ryan, Chief

Investment Officer, Wealth Management Americas.

About UBS Investor Watch

UBS Wealth Management Americas surveys U.S. investors on a

quarterly basis to keep a pulse on their needs, goals and concerns.

After identifying several emerging trends in the survey data, UBS

decided in 2012 to create the UBS Investor Watch to track, analyze

and report the sentiment of affluent and high net worth investors.

For more information on Investor Watch, visit

ubs.com/investorwatch.

Methodology

For this twentieth anniversary edition of UBS Investor Watch, we

revisited the retirement concepts first introduced in the 2013

Investor Watch report titled “80 is the new 60.” This year, 2,028

affluent and high net worth investors (with at least $1 million in

investable assets) were surveyed from June 8 – 13 2017, including

475 with at least $5 million. With 94 survey respondents, we

conducted qualitative follow-up interviews.

Notes to Editors:

About UBS Wealth Management Americas

Wealth Management Americas is one of the leading wealth managers

in the Americas in terms of Financial Advisor productivity and

invested assets. Its business includes UBS’s domestic U. S. and

Canadian wealth management businesses, as well as international

business booked in the U.S. It provides a fully integrated set of

wealth management solutions designed to address the needs of ultra

high net worth and high net worth clients.

About UBS

UBS provides financial advice and solutions to wealthy,

institutional and corporate clients worldwide, as well as private

clients in Switzerland. The operational structure of the Group is

comprised of our Corporate Center and five business divisions:

Wealth Management, Wealth Management Americas, Personal &

Corporate Banking, Asset Management and the Investment Bank. UBS's

strategy builds on the strengths of all of its businesses and

focuses its efforts on areas in which it excels, while seeking to

capitalize on the compelling growth prospects in the businesses and

regions in which it operates, in order to generate attractive and

sustainable returns for its shareholders. All of its businesses are

capital-efficient and benefit from a strong competitive position in

their targeted markets.

UBS is present in all major financial centers worldwide. It has

offices in 54 countries, with about 34% of its employees working in

the Americas, 35% in Switzerland, 18% in the rest of Europe, the

Middle East and Africa and 13% in Asia Pacific. UBS Group AG

employs approximately 60,000 people around the world. Its shares

are listed on the SIX Swiss Exchange and the New York Stock

Exchange (NYSE).

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170720005216/en/

For UBS Wealth Management AmericasMaya Dillon,

212-713-3130Mobile: 917-615-7094Maya.dillon@ubs.com

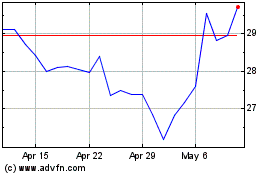

UBS (NYSE:UBS)

Historical Stock Chart

From Mar 2024 to Apr 2024

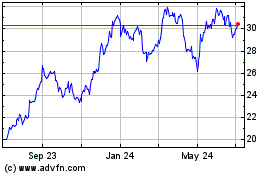

UBS (NYSE:UBS)

Historical Stock Chart

From Apr 2023 to Apr 2024