Check Point Software Technologies Reports Second Quarter 2017 Financial Results

July 20 2017 - 5:00AM

Check Point® Software Technologies Ltd. (NASDAQ:CHKP) today

announced its financial results for the second quarter ended June

30, 2017.

Second Quarter 2017:

- Total Revenue: $459 million, an 8 percent increase year over

year

- Software Blades Subscriptions Revenues: $118 million, a 27

percent increase year over year

- GAAP Operating Income: $222 million, representing 48 percent of

revenues

- Non-GAAP Operating Income: $248 million, representing 54

percent of revenues

- GAAP EPS: $1.12, an 18 percent increase year over year

- Non-GAAP EPS: $1.26, a 16 percent increase year over year

- Deferred Revenues: $1,065 million, a 19 percent increase year

over year

“We posted strong second quarter results. Revenue growth

was healthy and earnings per share growth of sixteen percent

exceeded the high-end of our projections,” said Gil Shwed, founder

and chief executive officer of Check Point Software Technologies,

“The major attacks that occurred during the last few months have

demonstrated the need for a different approach to cyber

security. We believe focusing on prevention, sharing

real-time attack information and consolidation of the security

infrastructure can stop the next attack. Check Point

Infinity, launched last quarter, provides consolidated security

architecture across networks, cloud and mobile, delivering our

highest level of threat prevention.” Financial

Highlights for the Second Quarter of 2017:

- Total Revenue: $459 million compared to $423

million in the second quarter of 2016.

- GAAP Operating Income: $222 million compared

to $202 million in the second quarter of 2016.

- Non-GAAP Operating Income: $248 million

compared to $227 million in the second quarter of 2016.

- GAAP Taxes on Income: $45 million compared to

$48 million in the second quarter of 2016.

- GAAP Net Income and Earnings per Diluted

Share: GAAP net income was $188 million compared to $166

million in the second quarter of 2016. GAAP earnings per diluted

share were $1.12 compared to $0.95 in the second quarter of

2016.

- Non-GAAP Net Income: Non-GAAP net income was

$212 million compared to $190 million in the second quarter of

2016.

- Non-GAAP Earnings per Diluted

Share: $1.26 compared to $1.09 in the second

quarter of 2016.

- Deferred Revenues: As of June 30, 2017,

deferred revenues were $1,065 million compared to $892 million as

of June 30, 2016.

- Cash Flow: Cash flow from operations of $226

million compared to $205 million in the second quarter of

2016.

- Share Repurchase Program: During the second

quarter of 2017, the company repurchased 2.3 million shares at a

total cost of $248 million.

- Cash Balances, Marketable Securities and Short Term

Deposits: $3,806 million as of June 30, 2017, compared to

$3,708 million as of June 30, 2016.

For information regarding the non-GAAP financial measures

discussed in this release, as well as a reconciliation of such

non-GAAP financial measures to the most directly comparable GAAP

financial measures, please see “Use of Non-GAAP Financial

Information” and “Reconciliation of GAAP to Non-GAAP Financial

Information.”

2017 Business Highlights

- Cyber Security Architecture of the Future:

Check Point Infinity is our fully consolidated cyber security

platform that is focused on preventing attacks across networks,

clouds, and mobile. This new architecture includes the widest

breadth of security solutions, all managed by a consolidated

security management system. As part of this architecture

introduction, the following key product and features have been

added or updated: - R80.10

security Gateway & Security

Management: The underlying software of Check Point

Infinity features dozens of new capabilities and enhancements,

including unique policy layers, security multi-zones and boosted

performance to keep organizations protected against threats,

anytime and anywhere. - Mobile

Threat Defense – SandBlast Product Family: SandBlast

Mobile provides a centralized security solution designed to

safeguard users against progressive mobile cyber-attacks. SandBlast

Mobile, the only mobile threat defense solution to detect and block

100% of tested threats in the Miercom MTD Industry Assessment

Report, March 2017, protects employees’ devices from malware

attacks via infected apps, man-in-the-middle attacks through

compromised Wi-Fi networks, operating system vulnerabilities, and

malicious links sent via SMS messages. -

Anti-Ransomware: Check Point’s

new Anti-Ransomware technology enables businesses to protect

against cyber extortion and sophisticated ransomware. Its

signature-less technology designed to detect unknown and zero-day

ransomware attacks through advanced behavioral analysis and by

detecting attempts to encrypt files illegitimately. Ransomware

infections are detected and quarantined automatically and if any

data was encrypted, it is automatically restored.

- World’s Fastest Threat Prevention

Platform: Launched an updated family of super-high

end security gateways, the 44000 & 64000 appliance series

deliver exceptionally fast threat prevention with 42 Gbps of

Real-World Production Threat Prevention throughput and 636 Gbps of

Real-World Production Firewall throughput. They also include

multi-bladed chassis to support the dynamic needs of growing

networks, while offering the high reliability and performance

needed for the future of cyber security.

We received the following industry accolades and announced the

following partnerships:

- Leader in the 2017 Gartner Magic Quadrant for

Enterprise Network Firewalls – The new report

evaluated the company’s “completeness of vision” and “ability to

execute” in areas such as security management and threat

prevention. Check Point has been positioned as a Leader in

Enterprise Network Firewalls Magic Quadrant since 1997.

- Leader in the 2016 Gartner Magic Quadrant for Unified

Threat Management – The new report evaluated the

company’s completeness of vision and ability to execute within the

small and mid-sized business market. Check Point has been

positioned as a Leader in Unified Threat Management Magic Quadrant

for six consecutive years.

- Check Point SandBlast Mobile Receives Miercom’s

Certified Secure Award: SandBlast Mobile received

Miercom’s Certified Secure Award in the first independent, mobile

threat defense test. The test measured the products ability to

identify, block, and respond to malicious malware, network attack

vulnerabilities, and mobile device vulnerabilities. This is

Miercom’s highest award of achievement in competitive, hands-on

testing.

- Check Point Infinity NGFW Earns NSS Recommended in Next

Generation Firewall Test: For the 14th consecutive time,

Check Point has achieved a recommended rating in the 2017 NSS Labs

Next Generation Firewall Group Test.

- Automotive Cyber Security: Check Point joined

forces with Valens as members of the HDBaseT Alliance to help

define the necessary specifications for a more secure connected

car. The alliance will drive the development of a safer,

better-equipped solution for in-vehicle connectivity and

safety.

Our security research organization has also continued to expose

vulnerabilities in today’s infrastructure, which included critical

vulnerabilities in mobile equipment and applications,

including:

- Watching a movie on your personal computer can infect

your computer: Hacked in Translation malware utilizes

subtitles as a new attack vector. Once the subtitles are infected

hackers may be able to execute malicious subtitles to target users

of popular media platforms and potentially gain complete control

over the device.

- Over 250 million computers worldwide were infected with

the Fireball malware: Check Point Threat Intelligence and

research teams discovered this high-volume Chinese threat

operation, which installed malware that takes over the target

computer’s browser and turns it into a “zombie.” Once infected,

hackers can run any code on the victim’s computer, and hijack and

manipulate the infected users’ web-traffic to generate

ad-revenue.

- 14 million Android devices infected with

CopyCat: Check Point researchers identified the mobile

malware that infected approximately 8 million Android devices, and

allowed the hackers behind the campaign to skim ad revenues.

“We’ve made important headway in enabling companies to prevent

cyber-attacks by introducing the Check Point Infinity cyber

security architecture. We will continue to focus on our

vision – the next attack can be prevented,” concluded Shwed.

Third Quarter Investor Conference Participation

Schedule:

- KeyBanc Capital Markets 19th Annual Global Technology

Leadership Forum August 7, 2017 – Vail, CO

- Oppenheimer 20th Annual Technology Conference

August 9, 2017 – Boston, MA

- Citi 2017 Global Technology Conference

September 7, 2017 – New York, NY

Members of Check Point's management team are expected to present

at these conferences and discuss the latest company strategies and

initiatives. Check Point’s conference presentations are expected to

be available via webcast on the company's web site. To view these

presentations and access the most updated information please visit

the company's web site at www.checkpoint.com/ir. The schedule is

subject to change.

Conference Call and Webcast Information Check

Point will host a conference call with the investment community on

July 20, 2017, at 8:30 AM ET/5:30 AM PT. To listen to the live

webcast, please visit the website at: www.checkpoint.com/ir. A

replay of the conference call will be available through July 26,

2017 on the company's website or by telephone at +1.201.612.7415,

replay ID number 13666210.

About Check Point Software Technologies

Ltd.Check Point Software Technologies Ltd.

(www.checkpoint.com) is the largest network cyber security vendor

globally, providing industry-leading solutions and protecting

customers from cyberattacks with an unmatched catch rate of malware

and other types of threats. Check Point offers a complete security

architecture defending enterprises – from networks to mobile

devices – in addition to the most comprehensive and intuitive

security management. Check Point protects over 100,000

organizations of all sizes.

©2017 Check Point Software Technologies Ltd. All rights

reserved

Legal Notice Regarding Forward-Looking

StatementsThis press release contains forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933 and Section 21E of the Securities Exchange Act of

1934. Forward-looking statements generally relate to

future events or our future financial or operating

performance. Forward-looking statements in this press release

include, but are not limited to, statements related to our

expectations regarding our products and solutions, including the

Check Point Infinity architecture, our continued focus on enabling

companies to prevent cyber-attacks by introducing the Check Point

Infinity architecture and our participation in investor conferences

during the second quarter of 2017. Our expectations and

beliefs regarding these matters may not materialize, and actual

results or events in the future are subject to risks and

uncertainties that could cause actual results or events to differ

materially from those projected. These risks include our

ability to continue to develop platform capabilities and solutions;

customer acceptance and purchase of our existing solutions and new

solutions; the market for IT security continuing to develop;

competition from other products and services; and general market,

political, economic and business conditions. The

forward-looking statements contained in this press release are also

subject to other risks and uncertainties, including those more

fully described in our filings with the Securities and

Exchange Commission, including our Annual Report on Form 20-F filed

with the Securities and Exchange Commission on April 28,

2017. The forward-looking statements in this press release

are based on information available to Check Point as of the

date hereof, and Check Point disclaims any obligation to update any

forward-looking statements, except as required by law.

Use of Non-GAAP Financial Information In

addition to reporting financial results in accordance with

generally accepted accounting principles, or GAAP, Check Point uses

non-GAAP measures of operating income, net income and earnings per

diluted share, which are adjustments from results based on GAAP to

exclude, as applicable, stock-based compensation expenses,

amortization of intangible assets and acquisition related expenses

and the related tax affects. Check Point’s management believes the

non-GAAP financial information provided in this release is useful

to investors’ understanding and assessment of Check Point’s ongoing

core operations and prospects for the future. Historically, Check

Point has also publicly presented these supplemental non-GAAP

financial measures in order to assist the investment community to

see the Company “through the eyes of management,” and thereby

enhance understanding of its operating performance. The

presentation of this non-GAAP financial information is not intended

to be considered in isolation or as a substitute for results

prepared in accordance with GAAP. A reconciliation of the non-GAAP

financial measures discussed in this press release to the most

directly comparable GAAP financial measures is included with the

financial statements contained in this press release. Management

uses both GAAP and non-GAAP information in evaluating and operating

business internally and as such has determined that it is important

to provide this information to investors.

| CHECK POINT SOFTWARE TECHNOLOGIES LTD.

CONSOLIDATED STATEMENT OF INCOME(In thousands, except per

share amounts) |

| |

|

|

Three Months Ended |

|

Six Months Ended |

|

|

June 30, |

|

June 30, |

|

|

2017 |

|

2016 |

|

2017 |

|

2016 |

|

|

(unaudited) |

|

(unaudited) |

|

(unaudited) |

|

(unaudited) |

| Revenues: |

|

|

|

|

|

|

|

| Products and

licenses |

$ |

138,288 |

|

$ |

136,248 |

|

$ |

264,614 |

|

$ |

258,978 |

| Software Blades

subscriptions |

|

117,947 |

|

|

92,700 |

|

|

230,011 |

|

|

180,828 |

| Total revenues from

products and software blades |

|

256,235 |

|

|

228,948 |

|

|

494,625 |

|

|

439,806 |

| Software updates

and maintenance |

|

202,338 |

|

|

193,801 |

|

|

399,398 |

|

|

387,214 |

| Total revenues |

|

458,573 |

|

|

422,749 |

|

|

894,023 |

|

|

827,020 |

| |

|

|

|

|

|

|

|

| Operating

expenses: |

|

|

|

|

|

|

|

| Cost of

products and licenses |

|

26,207 |

|

|

25,125 |

|

|

50,093 |

|

|

48,164 |

| Cost of

software blades subscriptions |

|

5,349 |

|

|

1,868 |

|

|

9,429 |

|

|

3,686 |

| Total cost of products

and software blades |

|

31,556 |

|

|

26,993 |

|

|

59,522 |

|

|

51,850 |

| Cost of

Software updates and maintenance |

|

21,291 |

|

|

20,559 |

|

|

42,076 |

|

|

40,165 |

| Amortization of

technology |

|

546 |

|

|

546 |

|

|

1,092 |

|

|

1,092 |

| Total cost of

revenues |

|

53,393 |

|

|

48,098 |

|

|

102,690 |

|

|

93,107 |

| |

|

|

|

|

|

|

|

| Research and

development |

|

46,368 |

|

|

43,854 |

|

|

92,460 |

|

|

86,188 |

| Selling and

marketing |

|

114,681 |

|

|

107,558 |

|

|

220,868 |

|

|

199,316 |

| General and

administrative |

|

22,489 |

|

|

21,088 |

|

|

45,533 |

|

|

44,037 |

| Total operating

expenses |

|

236,931 |

|

|

220,598 |

|

|

461,551 |

|

|

422,648 |

| |

|

|

|

|

|

|

|

| Operating income |

|

221,642 |

|

|

202,151 |

|

|

432,472 |

|

|

404,372 |

| Financial income,

net |

|

11,311 |

|

|

11,815 |

|

|

21,679 |

|

|

21,763 |

| Income before taxes on

income |

|

232,953 |

|

|

213,966 |

|

|

454,151 |

|

|

426,135 |

| Taxes on income |

|

44,591 |

|

|

48,147 |

|

|

83,238 |

|

|

92,894 |

| Net income |

$ |

188,362 |

|

$ |

165,819 |

|

$ |

370,913 |

|

$ |

333,241 |

| Basic earnings

per share |

$ |

1.15 |

|

$ |

0.97 |

|

$ |

2.26 |

|

$ |

1.94 |

| Number of shares used

in computing basic earnings per share |

|

163,328 |

|

|

170,942 |

|

|

164,197 |

|

|

172,169 |

| Diluted earnings per

share |

$ |

1.12 |

|

$ |

0.95 |

|

$ |

2.21 |

|

$ |

1.89 |

| Number of shares used

in computing diluted earnings per share |

|

167,685 |

|

|

174,816 |

|

|

168,090 |

|

|

175,898 |

| CHECK POINT SOFTWARE TECHNOLOGIES

LTD.RECONCILIATION OF GAAP TO NON GAAP FINANCIAL

INFORMATION(In thousands, except per share amounts) |

| |

|

|

|

Three Months Ended |

|

Six Months Ended |

|

|

|

June 30, |

|

June 30, |

|

|

|

2017 |

|

|

2016 |

|

|

2017 |

|

|

2016 |

|

|

|

|

(unaudited) |

|

(unaudited) |

|

(unaudited) |

|

(unaudited) |

| |

|

|

|

|

|

|

|

|

| GAAP operating

income |

|

$ |

221,642 |

|

|

$ |

202,151 |

|

|

$ |

432,472 |

|

|

$ |

404,372 |

|

| Stock-based

compensation (1) |

|

|

23,378 |

|

|

|

21,999 |

|

|

|

42,453 |

|

|

|

40,216 |

|

| Amortization of

intangible assets and acquisition related expenses (2) |

|

|

3,259 |

|

|

|

3,282 |

|

|

|

6,518 |

|

|

|

6,576 |

|

| Non-GAAP operating

income |

|

$ |

248,279 |

|

|

$ |

227,432 |

|

|

$ |

481,443 |

|

|

$ |

451,164 |

|

| |

|

|

|

|

|

|

|

|

| GAAP net income |

|

$ |

188,362 |

|

|

$ |

165,819 |

|

|

$ |

370,913 |

|

|

$ |

333,241 |

|

| Stock-based

compensation (1) |

|

|

23,378 |

|

|

|

21,999 |

|

|

|

42,453 |

|

|

|

40,216 |

|

| Amortization of

intangible assets and acquisition related expenses (2) |

|

|

3,259 |

|

|

|

3,282 |

|

|

|

6,518 |

|

|

|

6,576 |

|

| Taxes on the above

items (3) |

|

|

(2,993 |

) |

|

|

(653 |

) |

|

|

(6,378 |

) |

|

|

(2,496 |

) |

| Non-GAAP net

income |

|

$ |

212,006 |

|

|

$ |

190,447 |

|

|

$ |

413,506 |

|

|

$ |

377,537 |

|

| |

|

|

|

|

|

|

|

|

| Diluted GAAP Earnings

per share |

|

$ |

1.12 |

|

|

$ |

0.95 |

|

|

$ |

2.20 |

|

|

$ |

1.89 |

|

| Stock-based

compensation (1) |

|

|

0.14 |

|

|

|

0.12 |

|

|

|

0.25 |

|

|

|

0.23 |

|

| Amortization of

intangible assets and acquisition related expenses (2) |

|

|

0.02 |

|

|

|

0.02 |

|

|

|

0.04 |

|

|

|

0.04 |

|

| Taxes on the above

items (3) |

|

|

(0.02 |

) |

|

|

- |

|

|

|

(0.03 |

) |

|

|

(0.01 |

) |

| Diluted Non-GAAP

Earnings per share |

|

$ |

1.26 |

|

|

$ |

1.09 |

|

|

$ |

2.46 |

|

|

$ |

2.15 |

|

| |

|

|

|

|

|

|

|

|

| Number of shares used

in computing diluted Non-GAAP earnings per share |

|

|

167,685 |

|

|

|

174,816 |

|

|

|

168,090 |

|

|

|

175,898 |

|

| |

|

|

|

|

|

|

|

|

| (1) Stock-based

compensation: |

|

|

|

|

|

|

|

|

| Cost of products

and licenses |

|

$ |

23 |

|

|

$ |

17 |

|

|

$ |

39 |

|

|

$ |

34 |

|

| Cost of software

updates and maintenance |

|

|

675 |

|

|

|

554 |

|

|

|

1,232 |

|

|

|

975 |

|

| Research and

development |

|

|

3,913 |

|

|

|

3,452 |

|

|

|

7,598 |

|

|

|

6,298 |

|

| Selling and

marketing |

|

|

5,732 |

|

|

|

5,560 |

|

|

|

8,464 |

|

|

|

7,803 |

|

| General and

administrative |

|

|

13,035 |

|

|

|

12,416 |

|

|

|

25,120 |

|

|

|

25,106 |

|

| |

|

$ |

23,378 |

|

|

$ |

21,999 |

|

|

$ |

42,453 |

|

|

$ |

40,216 |

|

| |

|

|

|

|

|

|

|

|

| (2) Amortization of

intangible assets and acquisition related expenses: |

|

|

|

|

|

|

|

|

| Amortization of

technology-cost of revenues |

|

$ |

546 |

|

|

$ |

546 |

|

|

$ |

1,092 |

|

|

$ |

1,092 |

|

| Research and

development |

|

|

1,897 |

|

|

|

1,897 |

|

|

|

3,794 |

|

|

|

3,794 |

|

| Selling and

marketing |

|

|

816 |

|

|

|

839 |

|

|

|

1,632 |

|

|

|

1,690 |

|

| |

|

$ |

3,259 |

|

|

$ |

3,282 |

|

|

$ |

6,518 |

|

|

$ |

6,576 |

|

| (3) Taxes on the

above items |

|

$ |

(2,993 |

) |

|

$ |

(653 |

) |

|

$ |

(6,378 |

) |

|

$ |

(2,496 |

) |

| Total, net |

|

$ |

23,644 |

|

|

$ |

24,628 |

|

|

$ |

42,953 |

|

|

$ |

44,296 |

|

| |

| CHECK POINT SOFTWARE TECHNOLOGIES

LTD.CONDENSED CONSOLIDATED BALANCE SHEET

DATA(In thousands)ASSETS |

|

|

| |

|

|

June 30, |

|

December 31, |

| |

|

|

2017 |

|

2016 |

| |

|

|

(unaudited) |

|

(audited) |

| Current

assets: |

|

|

|

|

|

| Cash and

cash equivalents |

|

|

$ |

278,937 |

|

$ |

187,428 |

| Marketable

securities and short-term deposits |

|

|

|

1,320,018 |

|

|

1,185,499 |

| Trade

receivables, net |

|

|

|

334,049 |

|

|

478,507 |

| Prepaid expenses and

other current assets |

|

|

|

87,581 |

|

|

41,021 |

| Total

current assets |

|

|

|

2,020,585 |

|

|

1,892,455 |

| |

|

|

|

|

|

| Long-term

assets: |

|

|

|

|

|

| Marketable

securities |

|

|

|

2,207,451 |

|

|

2,296,097 |

| Property

and equipment, net |

|

|

|

69,936 |

|

|

61,859 |

| Severance

pay fund |

|

|

|

5,055 |

|

|

4,617 |

| Deferred

tax asset, net |

|

|

|

153,656 |

|

|

94,608 |

| Goodwill

and other intangible assets, net |

|

|

|

832,287 |

|

|

834,167 |

| Other

assets |

|

|

|

30,414 |

|

|

33,833 |

| Total

long-term assets |

|

|

|

3,298,799 |

|

|

3,325,181 |

| |

|

|

|

|

|

| Total

assets |

|

|

$ |

5,319,384 |

|

$ |

5,217,636 |

| LIABILITIES ANDSHAREHOLDERS’

EQUITY |

| Current

liabilities: |

|

|

|

|

|

| Deferred revenues |

|

|

$ |

792,838 |

|

|

$ |

814,418 |

|

| Trade payables and

other accrued liabilities |

|

|

|

334,759 |

|

|

|

351,440 |

|

| Total current

liabilities |

|

|

|

1,127,597 |

|

|

|

1,165,858 |

|

| |

|

|

|

|

|

| Long-term

liabilities: |

|

|

|

|

|

| Deferred revenues |

|

|

|

271,832 |

|

|

|

251,166 |

|

| Income tax accrual |

|

|

|

341,717 |

|

|

|

300,536 |

|

| Accrued severance

pay |

|

|

|

10,011 |

|

|

|

8,953 |

|

| |

|

|

|

623,560 |

|

|

|

560,655 |

|

| |

|

|

|

|

|

| Total liabilities |

|

|

|

1,751,157 |

|

|

|

1,726,513 |

|

| |

|

|

|

|

|

| Shareholders’

equity: |

|

|

|

|

|

| Share capital |

|

|

|

774 |

|

|

|

774 |

|

| Additional paid-in

capital |

|

|

|

1,214,993 |

|

|

|

1,139,642 |

|

| Treasury shares at

cost |

|

|

|

(5,414,515 |

) |

|

|

(4,956,172 |

) |

| Accumulated other

comprehensive loss |

|

|

|

(4,050 |

) |

|

|

(9,250 |

) |

| Retained earnings |

|

|

|

7,771,025 |

|

|

|

7,316,129 |

|

| Total shareholders’

equity |

|

|

|

3,568,227 |

|

|

|

3,491,123 |

|

| Total liabilities

and shareholders’ equity |

|

|

$ |

5,319,384 |

|

|

$ |

5,217,636 |

|

| Total cash and cash

equivalents, marketable securities and short-term deposits |

|

|

$ |

3,806,406 |

|

|

$ |

3,669,024 |

|

| CHECK POINT SOFTWARE TECHNOLOGIES

LTD.SELECTED CONSOLIDATED CASH FLOW

DATA(In thousands) |

|

|

| |

Three Months Ended |

|

Six Months Ended |

| |

June 30, |

|

June 30, |

| |

2017 |

|

|

2016 |

|

|

2017 |

|

|

2016 |

|

| |

(unaudited) |

|

(unaudited) |

|

(unaudited) |

|

(unaudited) |

| Cash flow from

operating activities: |

|

|

|

|

|

|

|

| Net income |

$ |

188,362 |

|

|

$ |

165,819 |

|

|

$ |

370,913 |

|

|

$ |

333,241 |

|

| Adjustments to

reconcile net income to net cash provided by operating

activities: |

|

|

|

|

|

|

|

| Depreciation of

property and equipment |

|

3,017 |

|

|

|

2,720 |

|

|

|

5,998 |

|

|

|

5,392 |

|

| Amortization of

intangible assets |

|

940 |

|

|

|

963 |

|

|

|

1,880 |

|

|

|

1,937 |

|

| Stock-based

compensation |

|

23,378 |

|

|

|

21,999 |

|

|

|

42,453 |

|

|

|

40,216 |

|

| Realized loss (gain) on

marketable securities |

|

68 |

|

|

|

(1,429 |

) |

|

|

143 |

|

|

|

(1,124 |

) |

| Decrease (increase) in

trade and other receivables, net |

|

(49,248 |

) |

|

|

(21,635 |

) |

|

|

141,934 |

|

|

|

141,218 |

|

| Increase (decrease) in

deferred revenues, trade payables and other accrued liabilities

(*) |

|

44,147 |

|

|

|

42,800 |

|

|

|

(8,606 |

) |

|

|

14,073 |

|

| Excess tax benefit from

stock-based compensation |

|

- |

|

|

|

(3,683 |

) |

|

|

- |

|

|

|

(4,814 |

) |

| Deferred income taxes,

net |

|

15,632 |

|

|

|

(2,528 |

) |

|

|

26,994 |

|

|

|

(1,214 |

) |

| Net cash

provided by operating activities |

|

226,296 |

|

|

|

205,026 |

|

|

|

581,709 |

|

|

|

528,925 |

|

|

|

|

|

|

|

|

|

|

| Cash flow from

investing activities: |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Investment in property

and equipment |

|

(6,122 |

) |

|

|

(5,942 |

) |

|

|

(14,075 |

) |

|

|

(10,650 |

) |

| Net cash used

in investing activities |

|

(6,122 |

) |

|

|

(5,942 |

) |

|

|

(14,075 |

) |

|

|

(10,650 |

) |

| |

|

|

|

|

|

|

|

| Cash flow from

financing activities: |

|

|

|

|

|

|

|

| Proceeds from issuance

of shares upon exercise of options |

|

39,324 |

|

|

|

17,379 |

|

|

|

63,706 |

|

|

|

33,529 |

|

| Purchase of treasury

shares |

|

(247,987 |

) |

|

|

(245,671 |

) |

|

|

(495,849 |

) |

|

|

(492,937 |

) |

| Excess tax benefit from

stock-based compensation |

|

- |

|

|

|

3,683 |

|

|

|

- |

|

|

|

4,814 |

|

| Payments related to

shares withheld for taxes (*) |

|

(3,855 |

) |

|

|

(2,576 |

) |

|

|

(4,064 |

) |

|

|

(2,726 |

) |

| Net cash used

in financing activities |

|

(212,518 |

) |

|

|

(227,185 |

) |

|

|

(436,207 |

) |

|

|

(457,320 |

) |

| |

|

|

|

|

|

|

|

| Unrealized gain on

marketable securities, net |

|

1,991 |

|

|

|

6,913 |

|

|

|

5,955 |

|

|

|

31,618 |

|

| |

|

|

|

|

|

|

|

| Increase (decrease) in

cash and cash equivalents, marketable securities and short term

deposits |

|

9,647 |

|

|

|

(21,188 |

) |

|

|

137,382 |

|

|

|

92,573 |

|

| |

|

|

|

|

|

|

|

| Cash and cash

equivalents, marketable securities and short term deposits at the

beginning of the period |

|

3,796,759 |

|

|

|

3,729,175 |

|

|

|

3,669,024 |

|

|

|

3,615,414 |

|

| |

|

|

|

|

|

|

|

| Cash and cash

equivalents, marketable securities and short term deposits at the

end of the period |

$ |

3,806,406 |

|

|

$ |

3,707,987 |

|

|

$ |

3,806,406 |

|

|

$ |

3,707,987 |

|

(*)Payments related to shares withheld for taxes during the

three and six month periods ending June 30, 2016 were reclassified

from operating activity to financing activity following ASU 2016-09

adoption.

INVESTOR CONTACT:

Kip E. Meintzer

Check Point Software Technologies

+1.650.628.2040

ir@checkpoint.com

MEDIA CONTACT:

Ali Donzanti

Check Point Software Technologies

+1.650.628.2030

press@checkpoint.com

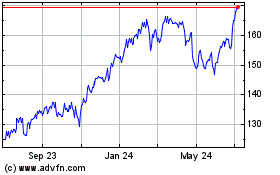

Check Point Software Tec... (NASDAQ:CHKP)

Historical Stock Chart

From Mar 2024 to Apr 2024

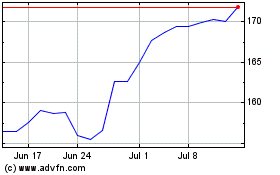

Check Point Software Tec... (NASDAQ:CHKP)

Historical Stock Chart

From Apr 2023 to Apr 2024