Current Report Filing (8-k)

July 19 2017 - 4:23PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

Current Report

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): July 19, 2017 (July 13, 2017)

DAYBREAK OIL AND GAS, INC.

(Exact Name of Registrant as Specified in its Charter)

|

|

| |

|

Washington

|

000-50107

|

91-0626366

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

|

| |

|

1101 N. Argonne Road, Suite A 211

Spokane Valley, WA

|

|

99212

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant's telephone number, including area code:

(509) 232-7674

(Former Name or Former Address if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

| |

|

Emerging growth company

|

¨

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 1.01

Entry into a Material Definitive Agreement

On July 13, 2017, Daybreak Oil and Gas, Inc. (OCT PINK:DBRM), a Washington corporation (“Daybreak” or the “Company”), received a waiver from its lender, Maximilian Resources, LLC (“Maximilian”), in which Maximilian agreed to a waiver of the interest payment due on or before July 1, 2017 under the Company’s Amended and Restated Loan and Security Agreement, dated as of August 28, 2013, as amended from time to time (as amended, the “Loan Facility”). Due to this waiver and previous waivers granted by Maximilian, the Company is not considered to be in default under the terms of the Loan Facility, even though it is currently unable to make the required monthly principal and interest payments under the terms of the Loan Facility.

In exchange for the most recent waiver, the Company agreed to a cross-collateralization of the collateral securing the Loan Facility and its working interest in its Michigan crude oil and natural gas leases (the “Michigan WI”), which previously only secured the advances made by Maximilian under a series of promissory notes separate from the Loan Facility to fund the Company’s Michigan operations (the “Michigan Promissory Note Facility”).

The Michigan Promissory Note Facility consists of (a) a promissory note dated January 17, 2017 and amended on February 10, 2017 and (b) a promissory note dated May 4, 2017, pursuant to which the Company has received $94,650 in aggregate for the development of the Company’s exploratory joint drilling project in Michigan (“Michigan Project”). As previously disclosed, advances under the Michigan Promissory Note Facility are subject to a 5% (five percent) per annum interest rate, and, if the Company elects to participate in a well that is scheduled to be spudded on or before December 31, 2017, then the advances under the Michigan Promissory Note Facility must be repaid in full upon the earlier of (a) the time that is ten days prior to the first well being spudded at the Michigan Project or (b) December 31, 2017. If there is not a well scheduled to be spudded at the project at the Michigan Project on or before December 31, 2017 that the Company elects to participate in, then the Company will assign to Maximilian the Michigan WI, in full payment and satisfaction of the advances under the promissory note. Advances under the Michigan Promissory Note Facility are secured by mortgages on the Michigan WI and may be prepaid at any time without penalty.

As amended by the terms of the most recent waiver granted by Maximilian, a default of any of the Company’s obligations under the Michigan Promissory Note Facility would constitute a default under the Loan Facility as well.

Item 2.03

Creation of a Direct Financial Obligation

See discussion in Item 1.01, which is incorporated herein by reference.

[signature page follows]

1

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

DAYBREAK OIL AND GAS, INC.

|

|

By:

/s/ JAMES F. WESTMORELAND

|

James F. Westmoreland, President and Chief Executive Officer

Date: July 19, 2017

2

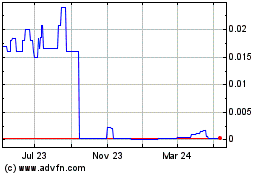

Daybreak Oil and Gas (CE) (USOTC:DBRM)

Historical Stock Chart

From Mar 2024 to Apr 2024

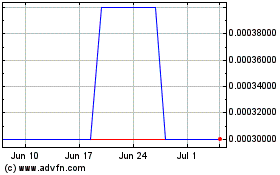

Daybreak Oil and Gas (CE) (USOTC:DBRM)

Historical Stock Chart

From Apr 2023 to Apr 2024