Trust, Investment and Other Servicing Fees

Increased 9% over the Prior-Year Quarter

Net Interest Income Increased 14% over the

Prior-Year Quarter

Northern Trust Corporation today reported second quarter net

income per diluted common share of $1.12, compared to $1.10 in the

second quarter of 2016 and $1.09 in the first quarter of 2017. Net

income was $267.9 million, compared to $263.0 million in the

prior-year quarter and $276.1 million in the prior quarter. Return

on average common equity was 11.6%.

“Our second quarter results continued to demonstrate our ability

to drive strong growth within both our wealth management and

institutional businesses. Trust, investment and other servicing

fees and net interest income grew 9% and 14%, respectively,

compared to the prior year. The growth in fees was driven by strong

growth in client assets, as assets under custody/administration and

assets under management ended the quarter up 15% and 14%,

respectively, compared to a year ago. We remain committed to

driving efficiencies in our cost base for the long term, while

continuing to invest in people, technology, and regulatory

initiatives to support our growing businesses,” said Frederick H.

Waddell, Chairman and Chief Executive Officer.

The current quarter included expense charges of $22.8 million

($14.9 million after tax, or $0.06 per diluted common share)

associated with severance and related activities. The prior-year

quarter included a net pre-tax gain in revenue of $96.6 million

($59.7 million after tax, or $0.25 per diluted common share) from

the sale of Visa Inc. Class B common shares, net of the valuation

adjustment to existing swap agreements, partially offset by

impairment charges associated with our leasing portfolio, and

expense charges of $82.6 million ($51.7 million after tax, or $0.22

per diluted common share) relating to certain securities lending

litigation, contractual modifications associated with certain

existing asset servicing clients, and severance and other personnel

related charges. Excluding these items, current quarter and

prior-year quarter net income per diluted common share, net income

and return on average common equity were $1.18, $282.8 million, and

12.2% compared to $1.07, $255.0 million, and 11.9%,

respectively.

SECOND QUARTER 2017 RESULTS

SUMMARY RESULTS & KEY METRICS

% Change vs.

($ In Millions

except per share data)

Q2 2017 Q1 2017 Q2 2016 Q1 2017 Q2 2016 Total Revenue (FTE*)

$ 1,330.1 $ 1,293.3 $ 1,323.6 3 % — % Noninterest

Expense

937.4 894.5 925.0 5 1 Provision for Credit Losses

(7.0 ) (1.0 ) (3.0 ) N/M 133 Provision for Income

Taxes

122.9 114.8 131.7 7 (7 ) Net Income

267.9 276.1

263.0 (3 ) 2 Earnings Allocated to Common and

Potential Common Shares

257.6 250.9 252.4 3 2 Diluted Earnings per Common

Share

$ 1.12 $ 1.09 $ 1.10 3 % 2 % Return on

Average Common Equity

11.6 % 11.6 % 12.3 % Return on

Average Assets

0.91 % 0.96 % 0.92 % Average

Assets

$ 118,400.7 $ 116,476.4 $ 114,913.8 2 % 3 %

(*) Total revenue presented on a fully taxable equivalent

(FTE) basis is a non-generally accepted accounting principle

financial measure that facilitates the analysis of asset yields.

Please refer to the Reconciliation to Fully Taxable Equivalent

section for further detail.

CLIENT ASSETS

Assets under custody/administration (AUC/A) and assets under

management are the primary drivers of the Corporation’s trust,

investment and other servicing fees, the largest component of

noninterest income. The following table presents the Corporation’s

AUC/A, assets under custody, a component of AUC/A, and assets under

management by reporting segment.

As of % Change vs.

($ In

Billions)

June 30,2017 March 31,2017 June 30,2016 March 31,2017

June 30,2016

Assets Under Custody/Administration

Corporate & Institutional Services (C&IS)

$

8,690.8 $ 8,338.2 $ 7,590.8 4 % 14 % Wealth Management

603.4 586.5 525.1 3 15

Total Assets Under Custody/Administration

$

9,294.2 $ 8,924.7 $ 8,115.9 4 %

15 %

Assets Under Custody Corporate & Institutional

Services

$ 6,786.3 $ 6,533.3 $ 5,838.6 4 % 16 %

Wealth Management

593.3 574.4 514.2 3

15 Total Assets Under Custody

$

7,379.6 $ 7,107.7 $ 6,352.8 4 %

16 %

Assets Under Management Corporate & Institutional

Services

$ 762.7 $ 741.1 $ 672.3 3 % 13 % Wealth

Management

266.1 260.2 233.9 2

14 Total Assets Under Management

$

1,028.8 $ 1,001.3 $ 906.2 3 % 14

%

TOTAL REVENUE (FTE)

% Change vs.

($ In Millions

except per share data)

Q2 2017 Q1 2017 Q2 2016 Q1 2017 Q2 2016 Noninterest Income

$ 979.7 $ 930.9 $ 1,017.0 5 % (4 )% Net Interest

Income (FTE*)

350.4 362.4 306.6 (3 ) 14

Total Revenue (FTE*)

$ 1,330.1 $

1,293.3 $ 1,323.6 3 % — % (*) Total revenue

and net interest income presented on an FTE basis are non-generally

accepted accounting principle financial measures that facilitate

the analysis of asset yields. Please refer to the Reconciliation to

Fully Taxable Equivalent section for further detail.

Noninterest Income

% Change vs.

($ In

Millions)

Q2 2017 Q1 2017 Q2 2016 Q1 2017 Q2 2016

Noninterest

Income Trust, Investment and Other Servicing Fees

$

848.2 $ 808.2 $ 777.2 5 % 9 % Foreign Exchange Trading

Income

49.9 48.1 64.4 4 (22 ) Treasury Management Fees

14.9 14.7 16.0 2 (7 ) Security Commissions and Trading

Income

24.1 20.5 20.6 17 17 Other Operating Income

43.0 39.7 141.2 8 (70 ) Investment Security Gains (Losses),

net

(0.4 ) (0.3 ) (2.4 ) 82 (81 ) Total

Noninterest Income

$ 979.7 $ 930.9 $

1,017.0 5 % (4 )%

Q2 2017 vs. Q1 2017

- Trust, investment and other servicing

fees increased primarily due to favorable equity markets, new

business, and the favorable impact of movements in foreign exchange

rates.

- Security commissions and trading income

increased primarily driven by higher referral, core brokerage, and

transition management revenues.

- Other operating income increased

primarily due to net gains on hedging activity.

Q2 2017 vs. Q2 2016

- Trust, investment and other servicing

fees increased primarily due to favorable equity markets and new

business, partially offset by the unfavorable impact of movements

in foreign exchange rates.

- Foreign exchange trading income

decreased primarily due to lower currency volatility.

- Security commissions and trading income

increased primarily driven by growth from the acquisition of Aviate

Global LLP, which closed during Q2 2016, and interest rate

swaps.

- Other operating income in the

prior-year quarter included the pre-tax gain on the sale of 1.1

million Visa Inc. Class B common shares, net of the valuation

adjustment to existing swap agreements, totaling $118.2 million,

partially offset by impairment charges and the loss on sale related

to the decision to exit a portion of a non-strategic loan and lease

portfolio as well as impairment charges related to the residual

value of certain aircraft and rail cars of $18.9 million. Excluding

these items, other operating income increased slightly compared to

the prior-year quarter primarily due to net gains on hedging

activity.

Trust, Investment and Other Servicing Fees by Reporting

Segment

% Change vs.

($ In

Millions)

Q2 2017 Q1 2017 Q2 2016 Q1 2017 Q2 2016

C&IS Trust,

Investment and Other Servicing Fees Custody and Fund

Administration

$ 327.5 $ 307.5 $ 293.3 7 % 12 %

Investment Management

99.3 93.5 94.2 6 5 Securities Lending

24.6 23.8 26.8 3 (8 ) Other

35.7 38.1

32.6 (6 ) 10 Total

$ 487.1 $

462.9 $ 446.9 5 % 9 %

Q2 2017 vs. Q1 2017

- C&IS custody and fund

administration fees increased primarily due to new business, the

favorable impact of movements in foreign exchange rates, favorable

equity markets, and higher transaction volumes.

- C&IS investment management fees

increased primarily due to the favorable impact of equity

markets.

- C&IS other fees decreased primarily

due to seasonally higher benefit payments fees in the prior

quarter.

Q2 2017 vs. Q2 2016

- C&IS custody and fund

administration fees increased primarily due to new business and

favorable equity markets, partially offset by the unfavorable

impact of movements in foreign exchange rates.

- C&IS investment management fees

increased primarily due to the favorable impact of equity

markets.

- C&IS securities lending fees

decreased primarily reflecting lower spreads, partially offset by

increased loan volumes in the current quarter.

- C&IS other fees increased primarily

due to new business.

% Change vs.

($ In

Millions)

Q2 2017 Q1 2017 Q2 2016 Q1 2017 Q2 2016

Wealth Management

Trust, Investment and Other Servicing Fees Central

$

143.1 $ 137.4 $ 130.2 4 % 10 % East

88.3 85.2 84.5 4

5 West

73.4 69.6 67.5 5 9 Global Family Office

56.3

53.1 48.1 6 17 Total

$ 361.1 $ 345.3 $ 330.3 5

% 9 %

Q2 2017 vs. Q1 2017

- The increase in Wealth Management fees

across all regions was primarily attributable to favorable equity

markets and new business.

Q2 2017 vs. Q2 2016

- The increase in Wealth Management fees

across all regions was primarily attributable to favorable equity

markets and new business.

Net Interest Income

% Change vs.

($ In

Millions)

Q2 2017 Q1 2017 Q2 2016 Q1 2017 Q2 2016

Net Interest

Income Interest Income (FTE*)

$ 426.1 $ 419.2 $

351.6 2 % 21 % Interest Expense

75.7 56.8 45.0

33 68 Net Interest Income (FTE*)

$

350.4 $ 362.4 $ 306.6 (3 )% 14 %

Average Earning Assets

$ 109,907 $ 108,952 $ 106,614

1 % 3 % Net Interest Margin (FTE*)

1.28 % 1.35 % 1.16

% (*) Interest income, net interest income and net interest

margin presented on an FTE basis are non-generally accepted

accounting principle financial measures that facilitate the

analysis of asset yields. Please refer to the Reconciliation to

Fully Taxable Equivalent section for further detail.

Q2 2017 vs. Q1 2017

- Net interest income on an FTE basis

decreased compared to the prior quarter, primarily attributable to

a lower net interest margin.

- The net interest margin on an FTE basis

decreased primarily due to higher premium amortization and an

unfavorable mix shift in earning assets, partially offset by an

increase in short-term interest rates. The mix shift in earning

assets was driven by a decline in U.S. Dollar deposits, which was

more than offset by increases in non-U.S. Dollar deposits.

- Average earning assets increased

compared to the prior quarter, primarily resulting from higher

levels of short-term interest bearing deposits, partially offset by

reductions in securities. Earning asset growth was funded primarily

by a higher level of interest-bearing deposits.

Q2 2017 vs. Q2 2016

- Net interest income on an FTE basis

increased compared to the prior-year quarter, primarily the result

of a higher net interest margin and an increase in earning assets.

Additionally, the prior-year quarter included a pre-tax charge of

$2.7 million related to the residual value of certain aircraft and

rail cars.

- The net interest margin on an FTE basis

increased primarily due to higher short-term interest rates and

lower premium amortization, partially offset by an unfavorable mix

shift in earning assets. The mix shift in earning assets was driven

by a decline in U.S. Dollar deposits, which was more than offset by

increases in non-U.S. Dollar deposits.

- Average earning assets increased

compared to the prior-year quarter, primarily resulting from higher

levels of securities and short-term interest bearing deposits,

partially offset by reductions in loans and leases. Earning asset

growth was funded primarily by a higher level of interest-bearing

deposits.

PROVISION FOR CREDIT LOSSES

As of and for the three-months ended, % Change vs.

($ In

Millions)

June 30,2017 March 31,2017 June 30,2016 March 31,2017

June 30,2016

Allowance for Credit Losses Beginning

Allowance for Credit Losses

$ 189.0 $ 192.0 $ 232.6

(2 )% (19 )% Provision for Credit Losses

(7.0 ) (1.0

) (3.0 ) N/M 133 Net Recoveries / (Charge-Offs)

(3.2

) (2.0 ) (2.4 ) 60 33 Effect of Foreign Exchange Rates

— — (0.1 ) — — Ending Allowance

for Credit Losses

$ 178.8 $ 189.0 $

227.1 (5 )% (21 )% Allowance assigned to: Loans and

Leases

$ 153.8 $ 162.0 $ 192.0 (5 )% (20 )% Undrawn

Commitments and

Standby Letters of Credit

25.0 27.0 35.1 (7 ) (29 ) Ending

Allowance for Credit Losses

$ 178.8 $ 189.0

$ 227.1 (5 )% (21 )%

Q2 2017

- The credit provision in the current

quarter was primarily driven by improved credit quality as well as

reductions in undrawn loan commitments and standby letters of

credit that resulted in a reduction in the inherent allowance.

Q1 2017

- The credit provision in the prior

quarter was primarily driven by reductions in outstanding loans and

undrawn loan commitments and standby letters of credit that

resulted in a reduction in the inherent allowance ascribed to the

private client, residential real estate, and commercial real estate

portfolios. The credit provision was partially offset by an

increase in specific reserves in the commercial portfolio.

Q2 2016

- The credit provision in the prior-year

quarter was driven by improved credit quality in the commercial

real estate portfolio and a reduction in outstanding loans and

improved credit quality in the residential real estate

portfolio.

NONINTEREST EXPENSE

% Change vs.

($ In

Millions)

Q2 2017 Q1 2017 Q2 2016 Q1 2017 Q2 2016

Noninterest

Expense Compensation

$ 432.5 $ 425.8 $ 389.5 2 %

11 % Employee Benefits

75.6 77.8 72.2 (3 ) 5 Outside

Services

167.0 153.1 159.0 9 5 Equipment and Software

133.7 127.3 118.0 5 13 Occupancy

46.3 45.4 45.3 2 2

Other Operating Expense

82.3 65.1 141.0

27 (42 ) Total Noninterest Expense

$ 937.4

$ 894.5 $ 925.0 5 % 1 % End of Period

Full-Time Equivalent Staff

17,600 17,300 16,600 2 % 6 %

Q2 2017 vs. Q1 2017

- Compensation expense in the current

quarter included severance and related charges of $19.5 million.

Excluding these charges, compensation expense decreased primarily

related to lower long-term performance based incentive expense,

partially offset by increases in salary expense driven by staff

growth and base pay adjustments across business units, and higher

cash-based incentive accruals. Long-term performance based

incentive expense decreased $27.6 million due to charges recorded

in the prior quarter related to a change in the vesting provisions

associated with long-term incentive grants to retirement-eligible

employees.

- Employee benefits expense in the

current quarter included severance and related charges of $2.5

million. Excluding the severance and related charges, employee

benefits expense decreased primarily due to lower medical costs and

payroll taxes.

- Expense for outside services in the

current quarter included outplacement charges associated with

severance activity of $0.8 million. Excluding these charges,

expense for outside services increased compared to the prior

quarter, primarily reflecting higher consulting, legal,

sub-custodian and technical services.

- Equipment and software expense

increased compared to the prior quarter, primarily reflecting

increased software amortization.

- Other operating expense increased

compared to the prior quarter, primarily due to higher charges

associated with account servicing activities, staff related, and

business promotion expenses.

Q2 2017 vs. Q2 2016

- Compensation expense in the current

quarter included severance and related charges of $19.5 million.

The prior-year quarter included severance and related charges of

$13.0 million. Excluding these charges, compensation expense

increased primarily related to higher salary expense driven by

staff growth and base pay adjustments across all business units,

higher long-term performance based incentive expense, and higher

cash-based incentive accruals. Long-term performance based

incentive expense increased $8.5 million due to a change in the

vesting provisions associated with long-term incentive grants to

retirement-eligible employees in the prior quarter.

- Employee benefits expense in the

current quarter included severance and related charges of $2.5

million. The prior-year quarter included severance and related

charges of $1.5 million. Excluding the severance and related

charges, employee benefits expense increased primarily due to

higher payroll taxes and retirement plan expenses, partially offset

by lower medical costs.

- Expense for outside services in the

current quarter included outplacement charges associated with

severance activity of $0.8 million. The prior-year quarter included

outplacement charges associated with severance activity of $0.7

million. Excluding these charges, expense for outside services

increased compared to the prior-year quarter, primarily due to

higher technical services, sub-custodian expenses, and third party

advisory fees, partially offset by lower consulting services.

- Equipment and software expense

increased compared to the prior-year quarter, primarily reflecting

increased software amortization, computer maintenance, and rental

costs.

- Other operating expense in the

prior-year quarter included a pre-tax charge in connection with an

agreement to settle certain securities lending litigation of $46.5

million, charges related to contractual modifications associated

with existing Corporate and Institutional Services clients of $18.6

million, and other personnel charges of $2.3 million. Excluding

these charges, other operating expense increased compared to the

prior-year quarter, primarily due to higher charges associated with

account servicing activities, business promotion, and FDIC deposit

protection expenses.

PROVISION FOR INCOME TAX

% Change vs.

($ In

Millions)

Q2 2017 Q1 2017 Q2 2016 Q1 2017 Q2 2016

Net Income

Income before Income Taxes

$ 390.8 $ 390.9 $ 394.7 —

% (1 )% Provision for Income Taxes

122.9 114.8

131.7 7 (7 ) Net Income

$ 267.9

$ 276.1 $ 263.0 (3 )% 2 % Effective Tax Rate

31.4 % 29.4 % 33.4 %

Q2 2017 vs. Q1 2017

- The increase in the provision for

income taxes was based primarily on a decrease in the income tax

benefit derived from lower vesting of restricted stock units,

partially offset by a slight increase in stock option exercises

compared to the prior quarter.

Q2 2017 vs. Q2 2016

- The decrease in the provision for

income taxes compared to the prior-year quarter was based primarily

on the increased income tax benefit derived from increased stock

option exercises in the current quarter compared to the prior-year

quarter, decreased income before income taxes, and the earnings mix

in tax jurisdictions in which the Corporation operates.

STOCKHOLDERS' EQUITY

Total stockholders’ equity averaged $10.0 billion, up $1.2

billion, or 13% from the prior-year quarter’s average of $8.8

billion. The increase was primarily attributable to the issuance of

preferred stock and earnings, partially offset by dividend

declarations and the repurchase of common stock pursuant to the

Corporation’s share repurchase program. During the third quarter

2016, the Corporation issued and sold 500,000 depositary shares,

each representing a 1/100th ownership interest in a share of Series

D Non-Cumulative Perpetual Preferred Stock for proceeds of $493.5

million, net of underwriting discounts, commissions and other

issuance costs. During the current quarter, the Corporation

declared cash dividends totaling $5.9 million to preferred

stockholders and cash dividends totaling $89.0 million to common

stockholders. During the three and six months ended June 30,

2017, the Corporation repurchased 1,760,264 shares of common stock,

including 4,342 shares withheld related to share-based

compensation, at a total cost of $157.6 million ($89.52 average

price per share) and 2,571,994 shares of common stock, including

415,211 shares withheld related to share-based compensation, at a

total cost of $227.7 million ($88.53 average price per share),

respectively.

CAPITAL RATIOS

The capital ratios of the Northern Trust Corporation and its

principal subsidiary, The Northern Trust Company, remained strong

at June 30, 2017, exceeding the minimum requirements for

classification as “well-capitalized” under applicable U.S.

regulatory requirements.

The table below provides capital ratios for Northern Trust

Corporation and The Northern Trust Company determined by Basel III

phased in requirements.

June 30, 2017 March 31, 2017 June 30, 2016

Capital Ratios -

Northern Trust Corporation

AdvancedApproach

StandardizedApproach

AdvancedApproach

StandardizedApproach

AdvancedApproach

StandardizedApproach

Common Equity Tier 1

13.2 % 12.3 % 12.9

% 12.2 % 11.5 % 10.6 % Tier 1

14.5 % 13.5

% 14.2 % 13.4 % 12.0 % 11.0 % Total

16.5 %

15.6 % 15.6 % 15.0 % 13.5 % 12.7 % Tier 1 Leverage

8.1 % 8.1 % 8.2 % 8.2 % 7.4 % 7.4 %

Supplementary Leverage

7.0 % N/A 6.9 % N/A 6.2

% N/A June 30, 2017 March 31, 2017 June

30, 2016

Capital Ratios -

The Northern Trust Company

AdvancedApproach

StandardizedApproach

AdvancedApproach

StandardizedApproach

AdvancedApproach

StandardizedApproach

Common Equity Tier 1

13.3 % 12.1 % 12.9

% 12.0 % 11.6 % 10.4 % Tier 1

13.3 % 12.1

% 12.9 % 12.0 % 11.6 % 10.4 % Total

14.9 %

13.9 % 14.6 % 13.8 % 13.3 % 12.3 % Tier 1 Leverage

7.2 % 7.2 % 7.2 % 7.2 % 7.0 % 7.0 %

Supplementary Leverage

6.2 % N/A 6.1 % N/A 5.8

% N/A

RECONCILIATION TO FULLY TAXABLE

EQUIVALENT

The following table presents a reconciliation of interest

income, net interest income, net interest margin, and total revenue

prepared in accordance generally accepted accounting principles to

such measures on an FTE basis, which are non-generally accepted

accounting financial measures. Management believes this

presentation provides a clearer indication of these financial

measures for comparative purposes. When adjusted to an FTE basis,

yields on taxable, nontaxable and partially taxable assets are

comparable; however, the adjustment to an FTE basis has no impact

on net income.

Three Months Ended

June 30, 2017

March 31, 2017

June 30, 2016

($ In

Millions)

Reported

FTE Adj.

FTE

Reported

FTE Adj.

FTE

Reported

FTE Adj.

FTE

Net Interest Income Interest Income

$

417.2 $ 8.9 $ 426.1 $ 410.3 $

8.9 $ 419.2 $ 344.7 $ 6.9 $ 351.6 Interest Expense

75.7

—

75.7

56.8

—

56.8

45.0

—

45.0 Net Interest Income

$

341.5 $ 8.9 $

350.4 $ 353.5 $ 8.9 $ 362.4 $

299.7 $ 6.9 $ 306.6 Net Interest Margin

1.25 %

1.28 %

1.32 %

1.35 %

1.13 %

1.16 % Total Revenue

$ 1,321.2 $

8.9 $ 1,330.1 $ 1,284.4 $ 8.9 $ 1,293.3 $

1,316.7 $ 6.9 $ 1,323.6

FORWARD-LOOKING STATEMENTS

This release may include statements which constitute

“forward-looking statements” within the meaning of the safe harbor

provisions of the Private Securities Litigation Reform Act of 1995.

Forward-looking statements are identified typically by words or

phrases such as “believe,” “expect,” “anticipate,” “intend,”

“estimate,” “project,” “likely,” “plan,” “goal,” “target,”

“strategy,” and similar expressions or future or conditional verbs

such as “may,” “will,” “should,” “would,” and “could.”

Forward-looking statements include statements, other than those

related to historical facts, that relate to Northern Trust’s

financial results and outlook, capital adequacy, dividend policy,

anticipated expense levels, spending related to technology and

regulatory initiatives, risk management policies, contingent

liabilities, strategic initiatives, industry trends, and

expectations regarding the impact of recent legislation. These

statements are based on Northern Trust’s current beliefs and

expectations of future events or future results, and involve risks

and uncertainties that are difficult to predict and subject to

change. These statements are also based on assumptions about

many important factors, including the factors discussed in Northern

Trust’s most recent annual report on Form 10-K and other filings

with the U.S. Securities and Exchange Commission, all of which are

available on Northern Trust’s website. We caution you not to

place undue reliance on any forward-looking statement as actual

results may differ materially from those expressed or implied by

forward-looking statements. Northern Trust assumes no

obligation to update its forward-looking statements.

WEBCAST OF SECOND QUARTER EARNINGS

CONFERENCE CALL

Northern Trust’s second quarter earnings conference call will be

webcast on July 19, 2017. The live call will be conducted at

11:00 a.m. CT and is accessible on Northern Trust’s website at:

https://www.northerntrust.com/financialreleases

The rebroadcast of the live call will be available on Northern

Trust’s website from 3:00 p.m. CT on July 19, 2017, for

approximately four weeks. Participants will need Windows Media or

Adobe Flash software. This earnings release can also be accessed at

Northern Trust’s website.

To download our investor relations mobile app, which offers

access to SEC filings, press releases, stock quotes and upcoming

events, please visit Apple’s App Store for your iPad. You may

find the app by searching Northern Trust Investor Relations or by

clicking on https://appsto.re/us/MtHH3.i from your iPad.

About Northern Trust

Northern Trust Corporation (Nasdaq: NTRS) is a leading provider

of wealth management, asset servicing, asset management and banking

to corporations, institutions, affluent families and individuals.

Founded in Chicago in 1889, Northern Trust has offices in the

United States in 19 states and Washington, D.C., and 22

international locations in Canada, Europe, the Middle East and the

Asia-Pacific region. As of June 30, 2017 Northern Trust had

assets under custody of US$7.4 trillion, and assets under

management of US$1.0 trillion. For more than 125 years, Northern

Trust has earned distinction as an industry leader for exceptional

service, financial expertise, integrity and innovation. Visit

northerntrust.com or follow us on Twitter @NorthernTrust.

Northern Trust Corporation, Head Office: 50 South La Salle

Street, Chicago, Illinois 60603 U.S.A., incorporated with limited

liability in the U.S. Global legal and regulatory information can

be found at https://www.northerntrust.com/disclosures.

NORTHERN TRUST CORPORATION

(Supplemental Consolidated Financial

Information)

STATEMENT OF

INCOME DATA

($ In Millions Except Per Share Data)

SECOND QUARTER

2017

2016

% Change (*)

Noninterest Income Trust, Investment and

Other Servicing Fees

$ 848.2 $ 777.2 9 % Foreign

Exchange Trading Income

49.9

64.4 (22 ) Treasury Management Fees

14.9

16.0 (7 ) Security Commissions and Trading Income

24.1

20.6 17 Other Operating Income

43.0

141.2 (70 ) Investment Security Gains (Losses), net

(0.4 )

(2.4 ) (81 ) Total Noninterest Income

979.7

1,017.0 (4 )

Net Interest Income Interest Income

417.2

344.7 21 Interest Expense

75.7

45.0 68 Net Interest Income

341.5

299.7 14 Total Revenue

1,321.2

1,316.7 — Provision for Credit Losses

(7.0 )

(3.0 ) 133

Noninterest Expense Compensation

432.5

389.5 11 Employee Benefits

75.6

72.2 5 Outside Services

167.0

159.0 5 Equipment and Software

133.7

118.0 13 Occupancy

46.3

45.3 2 Other Operating Expense

82.3

141.0 (42 ) Total Noninterest Expense

937.4

925.0 1 Income before Income Taxes

390.8

394.7 (1 ) Provision for Income Taxes

122.9

131.7 (7 )

NET INCOME $ 267.9 $

263.0 2 % Dividends on Preferred Stock

$

5.9 $ 5.8 — % Earnings Allocated to Participating Securities

4.4

4.8 (10 ) Earnings Allocated to Common and Potential Common Shares

257.6

252.4 2

Per Common Share Net Income Basic

$

1.12 $ 1.11 1 % Diluted

1.12

1.10 2 Average Common Equity

$ 9,094.0 $

8,404.2 8 % Return on Average Common Equity

11.6

%

12.3 % Return on Average Assets

0.91

%

0.92 % Cash Dividends Declared per Common Share

$

0.38 $ 0.36 6 % Average Common Shares Outstanding

(000s) Basic

229,197

227,536 Diluted

230,638

229,280 Common Shares Outstanding (EOP) (000s)

228,486

226,591 (*) Percentage calculations are based on actual

balances rather than the rounded amounts presented in the

Supplemental Consolidated Financial Information.

NORTHERN TRUST CORPORATION

(Supplemental Consolidated Financial Information)

STATEMENT OF

INCOME DATA

SECOND

FIRST

($ In Millions Except Per Share Data)

QUARTER

QUARTER

2017

2017

% Change (*)

Noninterest Income Trust, Investment and

Other Servicing Fees

$ 848.2 $ 808.2 5 % Foreign

Exchange Trading Income

49.9

48.1 4 Treasury Management Fees

14.9

14.7 2 Security Commissions and Trading Income

24.1

20.5 17 Other Operating Income

43.0

39.7 8 Investment Security Gains (Losses), net

(0.4 )

(0.3 ) 82 Total Noninterest Income

979.7

930.9 5

Net Interest Income Interest Income

417.2

410.3 2 Interest Expense

75.7

56.8 33 Net Interest Income

341.5

353.5 (3 ) Total Revenue

1,321.2

1,284.4 3 Provision for Credit Losses

(7.0 )

(1.0 ) N/M

Noninterest Expense Compensation

432.5

425.8 2 Employee Benefits

75.6

77.8 (3 ) Outside Services

167.0

153.1 9 Equipment and Software

133.7

127.3 5 Occupancy

46.3

45.4 2 Other Operating Expense

82.3

65.1 27 Total Noninterest Expense

937.4

894.5 5 Income before Income Taxes

390.8

390.9 — Provision for Income Taxes

122.9

114.8 7

NET INCOME $ 267.9

$ 276.1 (3 )% Dividends on Preferred Stock

$ 5.9 $ 20.7 (72 ) Earnings Allocated to

Participating Securities

4.4

4.5 (5 ) Earnings Allocated to Common and Potential Common Shares

257.6

250.9 3

Per Common Share Net Income Basic

$

1.12 $ 1.10 2 % Diluted

1.12

1.09 3 Average Common Equity

$ 9,094.0 $

8,909.4 2 % Return on Average Common Equity

11.6

%

11.6 % Return on Average Assets

0.91

%

0.96 % Cash Dividends Declared per Common Share

$

0.38 $ 0.38 — % Average Common Shares Outstanding

(000s) Basic

229,197

229,060 Diluted

230,638

230,631 Common Shares Outstanding (EOP) (000s)

228,486

229,586 (*) Percentage calculations are based on actual

balances rather than the rounded amounts presented in the

Supplemental Consolidated Financial Information.

NORTHERN TRUST CORPORATION

(Supplemental Consolidated Financial Information)

STATEMENT OF

INCOME DATA

($ In Millions Except Per Share Data)

SIX MONTHS 2017 2016 % Change (*)

Noninterest Income Trust, Investment and Other Servicing

Fees

$ 1,656.4 $ 1,525.4 9 % Foreign Exchange Trading

Income

98.0 124.9 (22 )% Treasury Management Fees

29.6 32.2 (8 )% Security Commissions and Trading Income

44.6 39.5 13 % Other Operating Income

82.7 179.3 (54

)% Investment Security Gains (Losses), net

(0.7 )

(2.1 ) (65 )% Total Noninterest Income

1,910.6

1,899.2 1 %

Net Interest Income Interest Income

827.5 696.7 19 Interest Expense

132.5 89.2

49 Net Interest Income

695.0 607.5 14

Total Revenue

2,605.6 2,506.7 4 % Provision for

Credit Losses

(8.0 ) (1.0 ) N/M

Noninterest

Expense Compensation

858.3 768.3 12 % Employee Benefits

153.4 142.8 7 % Outside Services

320.1 308.9 4 %

Equipment and Software

261.0 232.2 12 % Occupancy

91.7 86.2 6 % Other Operating Expense

147.4

215.4 (32 )% Total Noninterest Expense

1,831.9

1,753.8 4 % Income before Income Taxes

781.7

753.9 4 % Provision for Income Taxes

237.7 245.5

(3 )%

NET INCOME $ 544.0 $ 508.4

7 % Dividends on Preferred Stock

$ 26.6

$ 11.7 127 % Earnings Allocated to Participating Securities

8.9 8.9 — Earnings Allocated to Common and Potential Common

Shares

508.5 487.8 4

Per Common Share Net

Income Basic

$ 2.22 $ 2.14 4 % Diluted

2.21

2.13 4 % Average Common Equity

$ 9,002.2 $

8,353.4 8 % Return on Average Common Equity

11.6

%

12.0 % Return on Average Assets

0.93

%

0.90 % Cash Dividends Declared per Common Share

$

0.76 $ 0.72 6 % Average Common Shares Outstanding

(000s) Basic

229,128 228,077 Diluted

230,634 229,539

Common Shares Outstanding (EOP) (000s)

228,486 226,591 (*)

Percentage calculations are based on actual balances rather

than the rounded amounts presented in the Supplemental Consolidated

Financial Information.

NORTHERN TRUST CORPORATION

(Supplemental Consolidated Financial Information)

BALANCE

SHEET

($ In Millions) JUNE 30

2017 2016 % Change (*)

Assets Federal Reserve

and Other Central Bank Deposits

$ 28,968.6 $ 23,022.2

26 % Interest-Bearing Due from and Deposits with Banks (**)

7,969.6 10,311.8 (23 ) Federal Funds Sold and Securities

Purchased under Agreements to Resell

2,097.0 1,862.7 13

Securities U.S. Government

6,062.7 6,897.3 (12 ) Obligations

of States and Political Subdivisions

880.7 720.7 22

Government Sponsored Agency

17,791.7 17,445.5 2 Other (***)

19,055.3 16,397.6 16 Total Securities

43,790.4 41,461.1 6 Loans and Leases

33,499.0

34,557.1 (3 ) Total Earning Assets

116,324.6

111,214.9 5 Allowance for Credit Losses Assigned to Loans and

Leases

(153.8 ) (192.0 ) (20 ) Cash and Due from

Banks and Other Central Bank Deposits (****)

2,661.1 2,005.6

33 Buildings and Equipment

463.3 434.0 7 Client Security

Settlement Receivables

1,707.1 2,217.0 (23 ) Goodwill

523.1 527.8 (1 ) Other Assets

4,080.3 5,302.3

(23 )

Total Assets $ 125,605.7 $

121,509.6 3 %

Liabilities and Stockholders’

Equity Interest-Bearing Deposits Savings, Money Market and

Other

$ 15,210.4 $ 15,669.8 (3 )% Savings

Certificates and Other Time

1,292.9 1,403.1 (8 ) Non-U.S.

Offices - Interest-Bearing

58,720.2 50,547.5

16 Total Interest-Bearing Deposits

75,223.5 67,620.4

11 Short-Term Borrowings

4,674.2 6,909.1 (32 ) Senior Notes

1,496.9 1,496.2 — Long-Term Debt

1,671.7 1,418.8 18

Floating Rate Capital Debt

277.5 277.4 —

Total Interest-Related Funds

83,343.8 77,721.9 7

Demand and Other Noninterest-Bearing Deposits

29,088.6

31,466.5 (8 ) Other Liabilities

3,105.4 3,369.7

(8 ) Total Liabilities

115,537.8 112,558.1 3 Common

Equity

9,185.9 8,563.0 7 Preferred Equity

882.0

388.5 127 Total Equity

10,067.9

8,951.5 12

Total Liabilities and Stockholders’

Equity $ 125,605.7 $ 121,509.6 3 %

(*) Percentage calculations are based on actual balances

rather than the rounded amounts presented in the Supplemental

Consolidated Financial Information. (**) Interest-Bearing

Due from and Deposits with Banks includes the interest-bearing

component of Cash and Due from Banks and Interest-Bearing Deposits

with Banks as presented on the consolidated balance sheets in our

periodic filings with the SEC. (***) Other securities

include Federal Reserve and Federal Home Loan Bank stock and

certain community development investments for purposes of

presenting earning assets; such securities are presented in other

assets on the consolidated balance sheets in our periodic filings

with the SEC. (****) Cash and Due from Banks and Other

Central Bank Deposits includes the non-interest-bearing component

of Federal Reserve and Other Central Bank Deposits as presented on

the consolidated balance sheets in our periodic filings with the

SEC.

NORTHERN TRUST CORPORATION

(Supplemental Consolidated Financial Information)

BALANCE

SHEET

($ In Millions) JUNE 30 MARCH 31

2017 2017 % Change (*)

Assets

Federal Reserve and Other Central Bank Deposits

$

28,968.6 $ 25,943.1 12 % Interest-Bearing Due from and

Deposits with Banks (**)

7,969.6 7,320.1 9 Federal Funds

Sold and Securities Purchased under Agreements to Resell

2,097.0 1,933.8 8 Securities U.S. Government

6,062.7

6,836.2 (11 ) Obligations of States and Political Subdivisions

880.7 1,000.5 (12 ) Government Sponsored Agency

17,791.7 17,943.2 (1 ) Other (***)

19,055.3

18,525.4 3 Total Securities

43,790.4 44,305.3

(1 ) Loans and Leases

33,499.0 33,471.8 —

Total Earning Assets

116,324.6 112,974.1 3 Allowance

for Credit Losses Assigned to Loans and Leases

(153.8

) (162.0 ) (5 ) Cash and Due from Banks and Other Central

Bank Deposits (****)

2,661.1 2,593.3 3 Buildings and

Equipment

463.3 459.9 1 Client Security Settlement

Receivables

1,707.1 1,559.9 9 Goodwill

523.1 519.3 1

Other Assets

4,080.3 3,544.2 15

Total Assets $ 125,605.7 $ 121,488.7

3 %

Liabilities and Stockholders’ Equity

Interest-Bearing Deposits Savings, Money Market and Other

$

15,210.4 $ 15,878.8 (4 )% Savings Certificates and Other

Time

1,292.9 1,346.8 (4 ) Non-U.S. Offices -

Interest-Bearing

58,720.2 52,757.3 11

Total Interest-Bearing Deposits

75,223.5 69,982.9 7

Short-Term Borrowings

4,674.2 4,879.8 (4 ) Senior Notes

1,496.9 1,496.8 — Long-Term Debt

1,671.7 1,321.8 26

Floating Rate Capital Debt

277.5 277.4 —

Total Interest-Related Funds

83,343.8 77,958.7 7

Demand and Other Noninterest-Bearing Deposits

29,088.6

30,546.6 (5 ) Other Liabilities

3,105.4 3,005.7

3 Total Liabilities

115,537.8 111,511.0 4

Common Equity

9,185.9 9,095.7 1 Preferred Equity

882.0 882.0 — Total Equity

10,067.9 9,977.7 1

Total Liabilities

and Stockholders’ Equity $ 125,605.7 $

121,488.7 3 % (*) Percentage calculations are based

on actual balances rather than the rounded amounts presented in the

Supplemental Consolidated Financial Information. (**)

Interest-Bearing Due from and Deposits with Banks includes the

interest-bearing component of Cash and Due from Banks and

Interest-Bearing Deposits with Banks as presented on the

consolidated balance sheets in our periodic filings with the SEC.

(***) Other securities include Federal Reserve and Federal

Home Loan Bank stock and certain community development investments

for purposes of presenting earning assets; such securities are

presented in other assets on the consolidated balance sheets in our

periodic filings with the SEC. (****) Cash and Due from

Banks and Other Central Bank Deposits includes the

non-interest-bearing component of Federal Reserve and Other Central

Bank Deposits as presented on the consolidated balance sheets in

our periodic filings with the SEC.

NORTHERN TRUST CORPORATION

(Supplemental Consolidated Financial Information)

AVERAGE BALANCE

SHEET

($ In Millions) SECOND QUARTER

2017 2016 % Change (*)

Assets Federal

Reserve and Other Central Bank Deposits

$ 22,570.0 $

19,657.8 15 % Interest-Bearing Due from and Deposits with Banks

(**)

7,653.9 9,827.9 (22 ) Federal Funds Sold and Securities

Purchased under Agreements to Resell

2,059.4 1,915.2 8

Securities U.S. Government

6,423.8 6,875.1 (7 ) Obligations

of States and Political Subdivisions

928.8 470.2 98

Government Sponsored Agency

17,888.7 17,347.0 3 Other (***)

18,490.5 16,064.2 15 Total Securities

43,731.8 40,756.5 7 Loans and Leases

33,891.4

34,456.1 (2 ) Total Earning Assets

109,906.5

106,613.5 3 Allowance for Credit Losses Assigned to Loans and

Leases

(162.3 ) (195.4 ) (17 ) Cash and Due from

Banks and Other Central Bank Deposits (****)

2,701.1 2,093.9

29 Buildings and Equipment

465.2 439.9 6 Client Security

Settlement Receivables

829.0 1,143.0 (27 ) Goodwill

521.6 531.2 (2 ) Other Assets

4,139.6 4,287.7

(3 )

Total Assets $ 118,400.7 $

114,913.8 3 %

Liabilities and Stockholders’

Equity Interest-Bearing Deposits Savings, Money Market and

Other

$ 15,236.1 $ 15,041.3 1 % Savings Certificates

and Other Time

1,312.7 1,405.0 (7 ) Non-U.S. Offices -

Interest-Bearing

56,672.3 50,443.8 12

Total Interest-Bearing Deposits

73,221.1 66,890.1 9

Short-Term Borrowings

5,412.0 6,195.0 (13 ) Senior Notes

1,496.9 1,496.1 — Long-Term Debt

1,536.1 1,403.2 9

Floating Rate Capital Debt

277.4 277.4 —

Total Interest-Related Funds

81,943.5 76,261.8 7

Demand and Other Noninterest-Bearing Deposits

23,518.1

26,718.0 (12 ) Other Liabilities

2,963.1 3,141.3

(6 ) Total Liabilities

108,424.7 106,121.1 2 Common

Equity

9,094.0 8,404.2 8 Preferred Equity

882.0

388.5 127 Total Equity

9,976.0

8,792.7 13

Total Liabilities and Stockholders’

Equity $ 118,400.7 $ 114,913.8 3 %

(*) Percentage calculations are based on actual balances

rather than the rounded amounts presented in the Supplemental

Consolidated Financial Information. (**) Interest-Bearing

Due from and Deposits with Banks includes the interest-bearing

component of Cash and Due from Banks and Interest-Bearing Deposits

with Banks as presented on the consolidated balance sheets in our

periodic filings with the SEC. (***) Other securities

include Federal Reserve and Federal Home Loan Bank stock and

certain community development investments for purposes of

presenting earning assets; such securities are presented in other

assets on the consolidated balance sheets in our periodic filings

with the SEC. (****) Cash and Due from Banks and Other

Central Bank Deposits includes the non-interest-bearing component

of Federal Reserve and Other Central Bank Deposits as presented on

the consolidated balance sheets in our periodic filings with the

SEC.

NORTHERN TRUST CORPORATION

(Supplemental Consolidated Financial Information)

AVERAGE BALANCE

SHEET

SECOND FIRST

($ In Millions) QUARTER

QUARTER 2017 2017 % Change (*)

Assets Federal Reserve and Other Central Bank Deposits

$ 22,570.0 $ 21,806.9 3 % Interest-Bearing Due from

and Deposits with Banks (**)

7,653.9 6,684.3 15 Federal

Funds Sold and Securities Purchased under Agreements to Resell

2,059.4 2,011.7 2 Securities U.S. Government

6,423.8

7,213.8 (11 ) Obligations of States and Political Subdivisions

928.8 989.7 (6 ) Government Sponsored Agency

17,888.7

17,796.8 1 Other (***)

18,490.5 18,777.4 (2 )

Total Securities

43,731.8 44,777.7 (2 ) Loans and Leases

33,891.4 33,671.2 1 Total Earning

Assets

109,906.5 108,951.8 1 Allowance for Credit Losses

Assigned to Loans and Leases

(162.3 ) (160.8 ) 1 Cash

and Due from Banks and Other Central Bank Deposits (****)

2,701.1 2,116.6 28 Buildings and Equipment

465.2

465.9 — Client Security Settlement Receivables

829.0 829.6 —

Goodwill

521.6 519.7 — Other Assets

4,139.6

3,753.6 10

Total Assets $

118,400.7 $ 116,476.4 2 %

Liabilities and Stockholders’ Equity Interest-Bearing

Deposits Savings, Money Market and Other

$ 15,236.1 $

15,446.7 (1 )% Savings Certificates and Other Time

1,312.7

1,338.5 (2 ) Non-U.S. Offices - Interest-Bearing

56,672.3

52,435.9 8 Total Interest-Bearing Deposits

73,221.1 69,221.1 6 Short-Term Borrowings

5,412.0

5,659.1 (4 ) Senior Notes

1,496.9 1,496.7 — Long-Term Debt

1,536.1 1,324.9 16 Floating Rate Capital Debt

277.4

277.4 — Total Interest-Related Funds

81,943.5 77,979.2 5 Demand and Other Noninterest-Bearing

Deposits

23,518.1 25,712.5 (9 ) Other Liabilities

2,963.1 2,993.3 (1 ) Total Liabilities

108,424.7 106,685.0 2 Common Equity

9,094.0 8,909.4 2

Preferred Equity

882.0 882.0 — Total

Equity

9,976.0 9,791.4 2

Total

Liabilities and Stockholders’ Equity $ 118,400.7

$ 116,476.4 2 % (*) Percentage calculations

are based on actual balances rather than the rounded amounts

presented in the Supplemental Consolidated Financial Information.

(**) Interest-Bearing Due from and Deposits with Banks

includes the interest-bearing component of Cash and Due from Banks

and Interest-Bearing Deposits with Banks as presented on the

consolidated balance sheets in our periodic filings with the SEC.

(***) Other securities include Federal Reserve and Federal

Home Loan Bank stock and certain community development investments

for purposes of presenting earning assets; such securities are

presented in other assets on the consolidated balance sheets in our

periodic filings with the SEC. (****) Cash and Due from

Banks and Other Central Bank Deposits includes the

non-interest-bearing component of Federal Reserve and Other Central

Bank Deposits as presented on the consolidated balance sheets in

our periodic filings with the SEC.

NORTHERN TRUST CORPORATION

(Supplemental Consolidated Financial Information)

QUARTERLY TREND

DATA

2017 2016

($ In Millions

Except Per Share Data)

QUARTERS QUARTERS SECOND FIRST FOURTH

THIRD SECOND

Net Income

Summary

Trust, Investment and Other Servicing Fees

$ 848.2 $ 808.2 $ 794.4 $ 788.3 $ 777.2 Other

Noninterest Income

131.5 122.7 122.7 122.3 239.8 Net

Interest Income

341.5 353.5 324.3 303.1

299.7 Total Revenue

1,321.2 1,284.4 1,241.4

1,213.7 1,316.7 Provision for Credit Losses

(7.0 )

(1.0 ) (22.0 ) (3.0 ) (3.0 ) Noninterest Expense

937.4

894.5 873.9 843.0 925.0 Income

before Income Taxes

390.8 390.9 389.5 373.7 394.7 Provision

for Income Taxes

122.9 114.8 123.0

116.1 131.7 Net Income

$ 267.9 $

276.1 $ 266.5 $ 257.6 $ 263.0

Per Common

Share

Net Income - Basic

$ 1.12 $ 1.10 $ 1.12 $ 1.09 $ 1.11

- Diluted

1.12 1.09 1.11 1.08 1.10 Cash Dividends Declared

per Common Share

0.38 0.38 0.38 0.38 0.36 Book Value (EOP)

40.20 39.62 38.88 38.41 37.79 Market Value (EOP)

97.21 86.58 89.05 67.99 66.26

Financial

Ratios

Return on Average Common Equity

11.6

%

11.6 % 11.9 % 11.7 % 12.3 % Return on Average Assets

0.91

0.96 0.90 0.88 0.92 Net Interest Margin (GAAP)

1.25 1.32

1.18 1.12 1.13 Net Interest Margin (FTE*)

1.28 1.35 1.20

1.14 1.16

Assets Under

Custody / Administration ($ in Billions) - EOP

Corporate & Institutional Services

$ 8,690.8 $

8,338.2 $ 7,987.0 $ 7,951.7 $ 7,590.8 Wealth Management

603.4 586.5 554.3 544.0 525.1

Total Assets Under Custody / Administration

$

9,294.2 $ 8,924.7 $ 8,541.3 $ 8,495.7

$ 8,115.9

Assets Under

Custody ($ In Billions) - EOP

Corporate & Institutional Services

$ 6,786.3 $

6,533.3 $ 6,176.9 $ 6,173.6 $ 5,838.6 Wealth Management

593.3 574.4 543.6 533.2 514.2

Total Assets Under Custody

$ 7,379.6 $

7,107.7 $ 6,720.5 $ 6,706.8 $ 6,352.8

Assets Under

Management ($ In Billions) - EOP

Corporate & Institutional Services

$ 762.7 $

741.1 $ 694.0 $ 703.6 $ 672.3 Wealth Management

266.1

260.2 248.4 242.2 233.9 Total Assets

Under Management

$ 1,028.8 $ 1,001.3 $

942.4 $ 945.8 $ 906.2

Asset Quality ($

In Millions) - EOP

Nonperforming Loans and Leases

$ 159.0 $ 179.9 $

160.2 $ 173.3 $ 152.2 Other Real Estate Owned (OREO)

7.7

6.9 5.2 7.7 14.2 Total

Nonperforming Assets

$ 166.7 $ 186.8 $

165.4 $ 181.0 $ 166.4 Nonperforming Assets /

Loans and Leases and OREO

0.50

%

0.56 % 0.49 % 0.54 % 0.48 % Gross Charge-offs

$ 5.0 $

4.7 $ 14.1 $ 3.0 $ 4.9 Less: Gross Recoveries

1.8 2.7

3.2 3.8 2.5 Net (Recoveries) /

Charge-offs

$ 3.2 $ 2.0 $ 10.9 $

(0.8 ) $ 2.4 Net Charge-offs (Annualized) to Average Loans

and Leases

0.04

%

0.02 % 0.13 % (0.01 )% 0.03 % Allowance for Credit Losses Assigned

to Loans and Leases

$ 153.8 $ 162.0 $ 161.0 $ 191.0 $

192.0 Allowance to Nonperforming Loans and Leases

1.0

x 0.9 x 1.0 x 1.1 x 1.3 x Allowance for Other Credit-Related

Exposures

$ 25.0 $ 27.0 $ 31.0 $ 33.9 $ 35.1 (*)

Net interest margin presented on an FTE basis is a

non-generally accepted accounting principle financial measure that

facilitates the analysis of asset yields. Please refer to the

Reconciliation to Fully Taxable Equivalent section for further

detail.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170719005638/en/

Northern Trust CorporationInvestor Contact:Mark Bette(312)

444-2301Mark_Bette@ntrs.comorMedia Contact:Doug Holt(312)

557-1571Doug_Holt@ntrs.comhttps://www.northerntrust.com

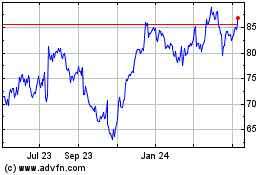

Northern (NASDAQ:NTRS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Northern (NASDAQ:NTRS)

Historical Stock Chart

From Apr 2023 to Apr 2024