BHP Billiton Forecasts Rise in FY18 Production

July 18 2017 - 7:29PM

Dow Jones News

By Robb M. Stewart

MELBOURNE, Australia--BHP Billiton Ltd. (BHP.AU) forecast a rise

in overall production over the year ahead as it continues to lift

iron-ore output and anticipates a rebound in copper and coking-coal

volumes.

Still, oil and gas production is expected to fall further in the

year through June, 2018, despite an increase in U.S. onshore shale

activity.

The quarterly production update comes as BHP faces criticism

from activist investors over its underperformance and accusations

long-serving directors stood by while billions of dollars were

misspent on acquisitions and mistimed share buybacks. New York

hedge fund Elliott Management Corp. has led a series of attacks in

recent months, calling for a sweeping overhaul of the world's

largest-listed mining company.

Iron-ore production rose by 4% to 231 million metric tons in the

just-ended fiscal year, with record volumes at BHP's mines in

Western Australia. BHP said it expected output to increase by

between 3% and 5% this year.

Production of coking coal, used alongside iron ore to produce

steel, fell by 6% to 40 million tons in fiscal 2017, in line with a

target that was cut in April due to storm damage to the rail

network serving its operations. BHP said production was expected to

climb by 10%-15% this year.

Output of thermal coal, used by power stations, was 7% higher at

29 million tons and is forecast to be steady to 3% higher this

year. Copper production is expected to jump by 25%-35% this year

after falling by 16% in fiscal 2017 to 1.33 million tons--the lower

end of revised guidance after output was held back by a 44-day

strike at the Escondida mine in Chile as well as disruptions at its

Olympic Dam mine in South Australia due to maintenance and a major

power outage.

The petroleum division's production declined by 13% in the

latest year to 208 million barrels of oil equivalent, and BHP said

it is likely to fall by 9%-13% in fiscal 2018.

"Our people have stepped up to unlock low-cost latent capacity

and achieve strong productivity gains across our tier one assets,"

Chief Executive Andrew Mackenzie said.

In copper-equivalent terms, BHP said production across its

operations was expected to increase by 7% in the 2018 fiscal

year.

Write to Robb M. Stewart at robb.stewart@wsj.com

(END) Dow Jones Newswires

July 18, 2017 19:14 ET (23:14 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

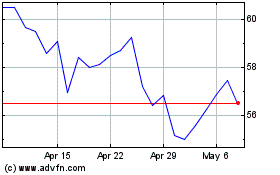

BHP (NYSE:BHP)

Historical Stock Chart

From Mar 2024 to Apr 2024

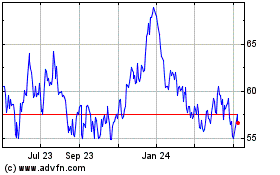

BHP (NYSE:BHP)

Historical Stock Chart

From Apr 2023 to Apr 2024