Crown Castle to buy Lightower for $7.1 Billion

July 18 2017 - 6:54PM

Dow Jones News

By Maria Armental

Crown Castle International Corp. has reached an agreement to buy

LTS Group Holdings LLC in a roughly $7.1 billion deal that would

double its fiber-optic footprint and add key Northeast metropolitan

markets.

LTS Group, the holding company of Lightower Fiber Networks, is

currently owned by private-equity firm Berkshire Partners, Pamlico

Capital and other investors.

Houston-based Crown Castle said it expects to raise its annual

dividend rate based on the acquisition's projected boost.

In the first full year of ownership, Crown Castle expects

Lightower to contribute $850 million to $870 million in site-rental

revenue; $510 million to $530 million in adjusted earnings before

interest, tax, depreciation and amortization; and $465 million to

$485 million in adjusted funds from operations before financing

costs.

The deal, first reported by Reuters, would give Crown Castle

rights to some 60,000 route miles of fiber on 23 of the top 25 most

populous domestic markets, the company said Tuesday.

Crown Castle owns portfolios of cell towers, which it then rents

to carriers.

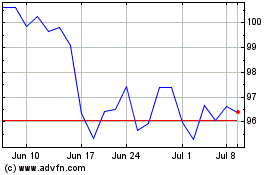

Its stock, inactive in recent extended trading, closed down

0.18% at $96.64. Through Tuesday's closing, the stock was up 11%

for the year.

Write to Maria Armental at maria.armental@wsj.com

(END) Dow Jones Newswires

July 18, 2017 18:39 ET (22:39 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

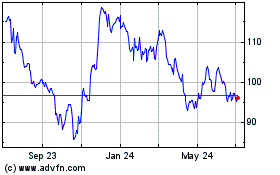

Crown Castle (NYSE:CCI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Crown Castle (NYSE:CCI)

Historical Stock Chart

From Apr 2023 to Apr 2024