Current Report Filing (8-k)

July 18 2017 - 4:58PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 12, 2017

AMERICAN INTERNATIONAL GROUP, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

1-8787

|

|

13-2592361

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

175 Water Street

New York, New York 10038

(Address of principal executive offices)

Registrant’s telephone number, including area code: (212) 770-7000

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this

chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth

company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period

for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Section 5 — Corporate Governance and Management

|

Item 5.02

|

Departure of Directors or Certain Officers; Election of Directors;

|

|

|

Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

(e) On July 12,

2017, Seraina Macia was appointed by the Board of Directors of American International Group, Inc. (“AIG”) as an executive officer and commenced employment as Executive Vice President.

In connection with Ms. Macia’s appointment, AIG and Ms. Macia entered into a letter agreement (the “Letter Agreement”) establishing

Ms. Macia’s initial compensation, which will consist of an annual base salary of $875,000, a 2017 short-term annual incentive target of $1,225,000 and a 2017 annual long-term incentive award of $650,000. Consistent with AIG’s

compensation program for other executive officers, Ms. Macia’s long-term incentive award for 2017 is 70 percent in the form of performance share units earned based on achievement of performance criteria for the three-year performance

period covering January 2017 through December 2019, and 30 percent in the form of restricted stock units earned based on continued employment through such three-year period. The Letter Agreement also provides that Ms. Macia will receive a 2018

long-term incentive award of $1,400,000, which will be granted in the first quarter of 2018 and, like her 2017 award, is subject to the terms and conditions of AIG’s Long Term Incentive Plan (the “LTI Plan”).

In addition, in consideration of compensation foregone from her prior employer, Ms. Macia was granted a one-time, sign-on award of $1,400,000 in the form

of restricted stock units (the “Sign-on RSUs”). The Sign-on RSUs were granted under the LTI Plan and vest 20 percent on each of January 1, 2018 and 2019, 40 percent on January 1, 2020 and 20 percent on January 1, 2021,

subject to Ms. Macia’s continued employment through such dates.

Any bonus, equity or equity-based award or other incentive compensation granted

to Ms. Macia is subject to the AIG Clawback Policy (and any other AIG clawback policies as may be in effect from time to time). Ms. Macia will be entitled to severance in accordance with AIG’s Executive Severance Plan. In connection

with the Letter Agreement, AIG and Ms. Macia also entered into a non-solicitation and non-disclosure agreement, under which Ms. Macia agreed to certain non-solicitation and confidentiality covenants.

The foregoing summary is qualified in its entirety by reference to the Letter Agreement and the non-solicitation and non-disclosure agreement, which are

attached as Exhibits 10.1 and 10.2 to this Current Report on Form 8-K, respectively, and which are incorporated by reference.

Section 9 —

Financial Statements and Exhibits

|

Item 9.01

|

Financial Statements and Exhibits

|

|

|

|

|

|

(d) Exhibits.

|

|

|

|

|

10.1

|

|

Letter Agreement, dated June 28, 2017, between AIG and Seraina Macia

|

|

|

|

|

10.2

|

|

Non-Solicitation and Non-Disclosure Agreement, dated July 12, 2017, between AIG and Seraina Macia

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

AMERICAN INTERNATIONAL GROUP, INC.

|

|

|

|

|

|

|

(Registrant)

|

|

|

|

|

|

|

|

|

Date: July 18, 2017

|

|

By:

|

|

/s/ James J. Killerlane III

|

|

|

|

|

|

Name: James J. Killerlane III

|

|

|

|

|

|

Title: Associate General Counsel and Assistant Secretary

|

EXHIBIT INDEX

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

10.1

|

|

Letter Agreement, dated June 28, 2017, between AIG and Seraina Macia

|

|

|

|

|

10.2

|

|

Non-Solicitation and Non-Disclosure Agreement, dated July 12, 2017, between AIG and Seraina Macia

|

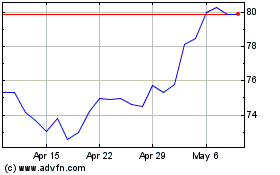

American (NYSE:AIG)

Historical Stock Chart

From Mar 2024 to Apr 2024

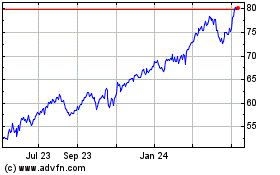

American (NYSE:AIG)

Historical Stock Chart

From Apr 2023 to Apr 2024