5 Billion Reasons Toys 'R' Us Struggles as Amazon Soars

July 18 2017 - 3:45PM

Dow Jones News

By Miriam Gottfried

Toys "R" Us Inc. will get a new website this summer as it

struggles to compete online with its cash-rich rivals. The toy

retailer, laden with $5 billion in debt, has spent $100 million

over the past several years to help boost its online sales.

That won't stop the toy chain from falling further behind its

rivals. Wal-Mart Stores Inc. bought Jet.com last August for $3.3

billion and since then has purchased three more online retailers.

Target Corp. is investing billions to lower prices and improve

online sales.

Toys "R" Us is one of many retailers fighting to keep up. High

debt loads, increasingly nervous lenders and falling sales make it

impossible to invest enough to compete online. And when companies

do generate online sales, the margins are so tight that future

investments are harder to make.

Macy's Inc. had $5.5 billion in net debt at the end of the first

quarter. A year ago, it said it would improve its performance and

use the cash to pay down debt. Instead, the retailer struggled and

had to use nearly two-thirds of its free cash flow last year to pay

off $750 million in maturing debt. It bought back more this year,

further hurting its ability to fund plans to revive sales,

including improving its mobile app and expanding its off-price

concept Backstage to more stores.

Worries that borrowing will become more expensive or won't be

there at all have prompted some relatively healthy companies to

focus on paying down their debt, which further limits the amount

they can invest.

Retailers sold just four high-yield bonds this year worth $2.8

billion, compared with seven bonds worth $5.7 billion last year.

That is down from a 20-year peak of 28 bonds totaling $10.7 billion

in 2013, according to Dealogic. The amount of retail bank and bond

debt rated by Moody's is up 65% since 2007.

Toys "R" Us and other struggling chains can likely survive for

years, but they will constantly struggle to catch up with the

competition while still turning a profit. During holiday 2015, the

toy retailer had to resort to "sales prevention" by halting some

online deals after a deluge of web orders overwhelmed its ability

to get products to customers in time for Christmas. The company had

planned to launch its new website ahead of Christmas 2016 but was

forced to delay it to fully test the new platform.

On a conference call with analysts June 15, Chief Executive

David Brandon said a clunky online registry tool and the lack of a

subscription feature for parents to receive regular shipments of

diapers and other products were holding back Toys "R" Us's baby

business.

"It's just one of a number of examples where we're limited in

terms of how we can compete until we transition over to our new

website," Mr. Brandon said.

Meanwhile, Amazon.com Inc. sold an estimated $4 billion worth of

toys last year, more than a third of what Toys "R" Us sells,

according to analytics firm One Click Retail. Amazon's toy sales

were up 24%, compared with 5% for the overall market and five years

of declines for Toys "R" Us.

For big retail chains, one of the few levers left to pull are

store closures. "We're in a period where we're going to see

indefinite top-line and gross-margin declines until there have been

enough store closures," said Jenna Giannelli, a retail credit

analyst at Citigroup. Store closures will likely continue for the

next five years or so as leases expire, she said.

Toys "R" Us, which was taken private in 2005 in a $6.6 billion

leveraged buyout by Bain Capital, KKR & Co. and Vornado Realty

Trust, has swapped debt coming due this year and next for

longer-term debt with a higher interest rate. Analysts expect it to

do the same with another $400 million bond due next year, but that

could be tough. On June 20, S&P Global Ratings lowered its

outlook for the retailer, saying that if markets are nervous or the

company's business gets worse, it might not be able to pay off that

bond when it comes due.

Toys "R" Us declined to comment.

Macy's has been forced to rethink its strategy in other ways. In

March 2015, Chief Financial Officer Karen Hoguet said the company

"liked having control of our real estate." That November, Macy's

announced it was exploring joint ventures for its four flagship

properties. In 2016, it sold its men's store in San Francisco's

Union Square, reached an agreement to sell its downtown Minneapolis

store and began work on a plan to shrink its store on Chicago's

State Street to make way for a buyer or joint-venture partner.

When Macy's laid out plans at its investor day June 6 for a

revamped marketing strategy and greater focus on exclusive

products, it warned that its 2017 gross-margin rate could be weaker

than it had expected in February. The company cited excess

inventory and bigger discounting in the beauty business. As

recently as November 2016, Macy's was touting lower inventory

levels.

Write to Miriam Gottfried at Miriam.Gottfried@wsj.com

(END) Dow Jones Newswires

July 18, 2017 15:30 ET (19:30 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

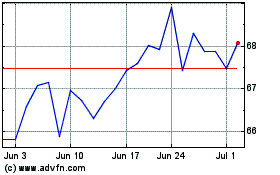

Walmart (NYSE:WMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

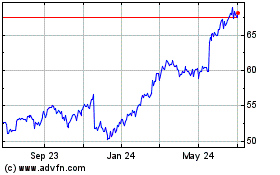

Walmart (NYSE:WMT)

Historical Stock Chart

From Apr 2023 to Apr 2024