National Public Finance Guarantee Corp. Takes Legal Action to Lift the PROMESA Stay to Seek the Appointment of a Receiver & C...

July 18 2017 - 2:42PM

Business Wire

Due to the Rejection of the RSA, Debt

Savings Are Also Lost

PREPA Payment Default Could Have Been

Avoided

National Public Finance Guarantee Corporation (“National”), an

indirect subsidiary of MBIA Inc. (NYSE:MBI), today announced that

National, along with the Ad Hoc Group of PREPA bondholders, Assured

Guaranty Corp., Assured Guaranty Municipal Corp. and Syncora

Guarantee Inc. (“the Creditor Group”), has filed a motion in the

U.S. District Court for the District of Puerto Rico to lift the

PROMESA stay to seek to enforce its right to compel the appointment

of an independent receiver in order to pursue increased rates and

to oversee certain operations of the Puerto Rico Electric Power

Authority (“PREPA”).

“As PREPA’s single largest creditor, we worked tirelessly for

several years with all stakeholders on a comprehensive

restructuring that the Oversight Board forced off the table in

violation of PROMESA. As a result of the default precipitated by

the Oversight Board’s unlawful action, we now have little option

but to enforce our legal and contractual rights, and to ensure

PREPA sets rates and charges that are sufficient to meet its

financial obligations,” said Bill Fallon, CEO of National Public

Finance Guarantee Corporation. “We cannot allow PREPA to continue

to ignore its obligations under Puerto Rico law and the terms of

our Trust Agreement. Given PREPA’s lengthy history of mismanagement

and cronyism and the inherent conflicts of interest ignored by the

Governor and the Oversight Board, an independent receiver will

provide much-needed protection for PREPA, the citizens of Puerto

Rico and its creditors. It is imperative that the rule of law is

recognized and that the political manipulation of PREPA is halted.

We continue to support the utility’s long-term viability and access

to the capital markets.”

Puerto Rico law and the PREPA Trust Agreement require PREPA to

set electricity rates at amounts sufficient to enable PREPA to pay

its debts, which include approximately $8.3 billion of outstanding

bond debt. Accordingly, today’s motion seeks to lift the stay under

the Puerto Rico Oversight, Management, and Economic Stability Act

(“PROMESA”) so that the Creditor Group can enforce their rights

under Puerto Rico law and the Trust Agreement following the payment

default by PREPA earlier this month.

Bondholders holding at least 25 percent in principal amount of

the PREPA bonds outstanding have a statutory right to the

appointment of a receiver following an event of default. National,

along with rest of the Creditor Group, represent almost 70 percent

of the outstanding bonds.

In addition, National has filed an amended complaint in its

lawsuit against the Oversight Board in the U.S. District Court for

the District of Puerto Rico, asking the court to award National

damages for the Oversight Board’s unlawful rejection of the

RSA.

Forward-Looking Statements

This release includes statements that are not historical or

current facts and are “forward-looking statements” made pursuant to

the safe harbor provisions of the Private Securities Litigation

Reform Act of 1995. The words “believe,” “anticipate,” “project,”

“plan,” “expect,” “estimate,” “intend,” “will likely result,”

“looking forward” or “will continue,” and similar expressions

identify forward-looking statements. These statements are subject

to certain risks and uncertainties that could cause actual results

to differ materially from historical earnings and those presently

anticipated or projected, including, among other factors, the

possibility that MBIA Inc. or National will experience increased

credit losses or impairments on public finance obligations issued

by state, local and territorial governments and finance authorities

that are experiencing unprecedented fiscal stress; the possibility

that loss reserve estimates are not adequate to cover potential

claims; MBIA Inc.’s or National’s ability to fully implement their

strategic plan; and changes in general economic and competitive

conditions. These and other factors that could affect financial

performance or could cause actual results to differ materially from

estimates contained in or underlying MBIA Inc.’s or National’s

forward-looking statements are discussed under the “Risk Factors”

section in MBIA Inc.’s most recent Annual Report on Form 10-K,

which may be updated or amended in MBIA Inc.’s subsequent filings

with the Securities and Exchange Commission. MBIA Inc. and National

caution readers not to place undue reliance on any such

forward-looking statements, which speak only to their respective

dates. National and MBIA Inc. undertake no obligation to publicly

correct or update any forward-looking statement if it later becomes

aware that such result is not likely to be achieved.

National Public Finance Guarantee Corporation, headquartered in

Purchase, New York is the world’s largest U.S. public finance-only

financial guarantee insurance company, with offices in New York and

San Francisco. Please visit National’s website

at www.nationalpfg.com.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170718006294/en/

National Public Finance Guarantee CorporationMedia:Greg

Diamond, 914-765-3190orFixed-Income Investor Relations:Kevin Brown,

914-765-3385orMBIA Inc.Investor and Media Relations:Greg

Diamond, 914-765-3190

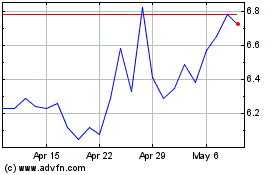

MBIA (NYSE:MBI)

Historical Stock Chart

From Mar 2024 to Apr 2024

MBIA (NYSE:MBI)

Historical Stock Chart

From Apr 2023 to Apr 2024