Current Report Filing (8-k)

July 18 2017 - 6:05AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (date of earliest event reported): July 14, 2017

EXTREME NETWORKS, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

Delaware

|

|

000-25711

|

|

77-0430270

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File No.)

|

|

(I.R.S. Employer

Identification No.)

|

6480 Via Del Oro

San Jose, California 95119

(Address of principal executive offices)

Registrant's telephone number, including area code:

(408) 579-2800

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company

☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

On July 14, 2017, Extreme Networks, Inc., a Delaware corporation (the “

Company

”) entered into the Second Amendment to Amended and Restated Credit Agreement (the “

Second Amendment

”), which amends that certain Amended and Restated Credit Agreement, dated as of October 28, 2016 (as amended, the “

Credit Agreement

”), by and among the Company, as borrower, Silicon

Valley Bank, as administrative agent and collateral agent, and the financial institutions that are a party thereto as lenders (“

Lenders

”). Among o

ther things, the Second Amendment (i) increases the amount of the available borrowing in senior secured credit facilities from $140,500,000 to $243,712,500, composed of (a) term loan facilities in a principal amount of up to $183,712,500 (the “

Term Loan Fa

cility

”) and (b) revolving loan facilities in a principal amount of up to $60,000,000 (the “

Revolving Loan Facility

”), (ii) extends the maturity date under the existing term loan facility and the termination date under the existing revolving loan facility,

(iii) makes available an additional incremental loan facility in a principal amount of up to $50,000,000 (the “

Incremental Facility

”), and (iv) joins certain additional banks, financial institutions and institutional lenders as Lenders pursuant to the ter

ms of the Credit Agreement.

On July 14, 2017, the Company borrowed $80,000,000 under the Term Loan Facility, a part of which was used to fund the purchase of the acquisition discussed below.

The above description of the Second Amendment does not purport to be complete and is qualified in its entirety by reference to the full text of the Second Amendment, a copy of which is attached hereto as Exhibit 10.1 and is incorporated by reference.

|

Item 2.01.

|

Completion of Acquisition or Disposition of Assets.

|

On July 14, 2017, the Company completed the purchase of the fabric-based secure networking solutions and network security solutions business (the “

Business

”) of Avaya Inc., a Delaware corporation (“

Avaya

”), pursuant to that certain Asset Purchase Agreement, dated as of March 7, 2017, by and between the Company and Avaya (as amended, the “

Purchase Agreement

”). Upon closing the transaction (the “

Closing

”), the Company paid a cash purchase price of $100.0 million,

subject to certain adjustments related to net working capital, deferred revenue, certain assumed lease obligations and certain assumed pension obligations for transferring employees of the Business, which was funded with a portion of the proceeds from the Company’s borrowing under the Credit Agreement described in Item 1.01 of this Current Report on Form 8-K.

Other than in respect of the transactions contemplated by the Purchase Agreement, there are no material relationships between the Company and Avaya or any of their respective affiliates.

The above description of the Purchase Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Purchase Agreement, a copy of which was included as an exhibit to the Company’s Current Report on Form 8-K previously filed on March 7, 2017.

|

Item 2.03.

|

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

|

The information set forth in Item 1.01 of this Current Report on Form 8-K is hereby

incorporated by reference into this Item 2.03.

|

|

|

|

|

Item 9.01.

|

|

Financial Statements and Exhibits.

|

|

|

|

|

|

(a)

|

|

Financial Statements of Business Acquired.

|

|

|

|

|

|

|

|

The Special Purpose Combined Statements of Assets to be Acquired and Liabilities to be Assumed and Special Purpose Combined Statements of Revenues and Direct Expenses for the fiscal years ended September 30, 2016 and 2015, (audited) and for the 6-month periods ended March 31, 2017 and 2016, (unaudited), are attached to this Current Report on Form 8-K as Exhibits 99.1 and 99.2.

|

|

|

|

|

|

(b)

|

|

Pro Forma Financial Information.

|

|

|

|

|

|

|

|

The pro forma financial information required to be filed pursuant to Item 9.01(b) of Form 8-K will be filed by amendment as soon as practicable, but in no event later than 71 days after the date of this Current Report on Form 8-K is required to be filed.

|

|

|

|

|

|

(d)

|

|

Exhibits.

|

|

|

|

|

|

Exhibit No.

|

|

Description of Exhibit

|

|

10.1*

|

|

Second Amendment to the Amended and Restated Credit Agreement, dated as of July 14, 2017, by and among the Company, as borrower, the several banks and other financial institutions or entities party thereto as lenders, and Silicon Valley Bank, as administrative agent and collateral agent.

|

|

|

|

|

|

23.1

|

|

Consent of PricewaterhouseCoopers, LLP, Independent Registered Public Accounting Firm, related to the Special Purpose Financial Statements for the Avaya Networking Business.

|

|

99.1

|

|

Special Purpose Combined Statements of Assets to be Acquired and Liabilities to be Assumed and Special Purpose Combined Statements of Revenues and Direct Expenses, for the fiscal years ended September 30, 2016 and 2015, (audited).

|

|

99.2

|

|

Special Purpose Interim Combined Statements of Assets to be Acquired and Liabilities to be Assumed and Special Purpose Interim Combined Statements of Revenues and Direct Expenses for the 6-month periods ended March 31, 2017 and 2016, (unaudited).

|

* This filing excludes schedules and exhibits pursuant to Item 601(b)(2) of Regulation S-K, which the registrant agrees to furnish supplementally to the SEC upon request by the SEC.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: July 17, 2017

|

EXTREME NETWORKS, INC.

|

|

|

|

|

|

By:

|

|

/s/ B. DREW DAVIES

|

|

|

|

B. Drew Davies

|

|

|

|

Executive Vice President, Chief Financial Officer (Principal Accounting Officer)

|

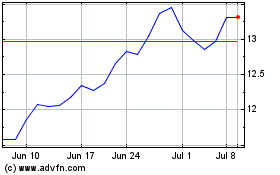

Extreme Networks (NASDAQ:EXTR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Extreme Networks (NASDAQ:EXTR)

Historical Stock Chart

From Apr 2023 to Apr 2024