BCB Bancorp, Inc., Bayonne, NJ (NASDAQ:BCBP), the holding company

for BCB Community Bank (the “Bank”), announced net income of $3.1

million for the three months ended June 30, 2017, as compared with

net income of $1.6 million for the three months ended June 30,

2016. Basic and diluted earnings per share were $0.26 for the three

months ended June 30, 2017, compared with $0.12 for the three

months ended June 30, 2016.

Net income was $6.0 million for the six months

ended June 30, 2017, compared with $3.6 million for the six months

ended June 30, 2016. Basic and diluted earnings per share were

$0.51 and $0.50, respectively, for the six months ended June 30,

2017, compared with $0.28 for the six months ended June 30,

2016.

Total assets increased by $107.2 million, or 6.3

percent, to $1.815 billion at June 30, 2017, from $1.708 billion at

December 31, 2016. The increase in total assets was primarily

as a result of increases in total cash and cash equivalents, net

loans receivable and securities available for sale. This net

increase in assets was funded primarily from a $104.1 million, or

7.5 percent, increase in deposits. Management is focused on

maintaining adequate liquidity in anticipation of funding loans

from a very healthy pipeline as demand continues to be strong.

We continue to consider all growth opportunities afforded us

but at a pace consistent with our targeted capital

levels.

Thomas Coughlin, President and Chief Executive

Officer, commented, "We are very pleased with our results for the

second quarter and year to date. Our performance is meeting the

expectations set through our strategic plan. We achieved growth in

several key indices, including net income, asset quality and

earnings per share. Net interest income increased by approximately

12.7 percent, or $1.7 million, due to our aggressive growth in

loans while adhering to strict lending parameters. This has been

enhanced by our cost-reduction initiative, which yielded a

reduction in non-interest expenses for the first six months of 2017

of 8.4 percent, or $1.0 million, as compared to the same period

last year.

"Our asset quality improvement reflects a 27

percent decrease of non-accrual loans from $21.1 million at June

30, 2016 down to $15.5 million at June 30, 2017. The allowance for

losses as a percentage of non-accrual loans is at approximately 116

percent as compared to approximately 87 percent for the same period

last year, as we remain vigilant in addressing these loans. In

addition, we enjoyed strong growth in loans across multiple

categories in both the commercial and residential sectors.

"We continue to deliver added value to our

shareholders, as our earnings per share continues to improve,"

Coughlin continued. "We continue to strategically manage our

capital position in support of our strategic plans. In 2017, after

redeeming $11.7 million of Series A and B 6.0 percent Preferred

Stock, we issued $9.5 million of Series D 4.5 percent Preferred

Stock.

"In addition, we continue to grow the Bank both

organically through the opening of new branches – five in the last

12 months – and through acquisition. Recently, we announced that we

have entered into a definitive agreement with IA Bancorp, Inc.,

pursuant to which the Company will acquire IAB and its wholly owned

subsidiary, Indus-American Bank. Upon consummation of the merger,

Indus-American Bank will merge with BCB Community Bank and will

operate as a division of BCB Community Bank. This merger will allow

us to both further develop existing markets where BCB Community

Bank and Indus-American Bank share similar footprints and expand

into new, attractive geographies. The merger will add approximately

$235 million to the Company's asset base, based on IAB's assets as

of March 31, 2017. Following completion of the merger, the Company

will have total assets of more than $2 billion, based on BCB's and

IAB's respective assets as of March 31, 2017."

Operations for the three months ended June

30, 2017, compared with the three months ended June 30,

2016

Net income increased $1.5 million, or 95.7 percent,

to $3.1 million for the three months ended June 30, 2017, compared

with $1.6 million for the three months ended June 30, 2016. The

increase in net income was primarily related to an increase in

total interest income, a decrease in total interest expense, an

increase in total non-interest income, and a decrease in total

non-interest expense, partly offset by a higher provision for loan

loss and a higher income tax provision for the three months ended

June 30, 2017 as compared to the three months ended June 30,

2016.

Net interest income increased by $1.7 million, or

12.7 percent, to $15.1 million for the three months ended June 30,

2017 from $13.4 million for the three months ended June 30, 2016.

The increase in net interest income resulted primarily from an

increase in the average balance on total interest earning assets of

$72.1 million, or 4.31 percent, to $1.747 billion for the three

months ended June 30, 2017 from $1.675 billion for the three months

ended June 30, 2016, as well as an increase in the average yield on

total interest earning assets of 15 basis points, or 3.40 percent,

to 4.37 percent for the three months ended June 30, 2017 from 4.22

percent for the three months ended June 30, 2016.

Interest income on loans receivable increased by

$763,000, or 4.4 percent, to $18.0 million for the three months

ended June 30, 2017 from $17.3 million for the three months ended

June 30, 2016. The increase was primarily attributable to an

increase in the average balance of loans receivable of $129.3

million, or 8.9 percent, to $1.578 billion for the three months

ended June 30, 2017 from $1.448 billion for the three months ended

June 30, 2016, partly offset by a decrease in the average yield on

loans receivable of 20 basis points, or 4.14 percent, to 4.57

percent for the three months ended June 30, 2017 from 4.77 percent

for the three months ended June 30, 2016. The increase in the

average balance of loans receivable was in accordance with the

Company’s growth strategy, which included growing the Bank’s

geographic footprint vis-à-vis our organic branching strategy and

the hiring of seasoned loan and business development officers. The

decrease in average yield on loans reflected the competitive price

environment prevalent in the Company’s primary market area on loan

facilities, as well as the repricing downward of certain variable

rate loans.

Interest income on investment securities increased

by $712,000, to $762,000 for the three months ended June 30, 2017

from $50,000 for the three months ended June 30, 2016. The increase

is primarily attributable to an increase in the average balance of

investment securities of $83.5 million, or 388.8 percent, to $105.0

million for the three months ended June 30, 2017 from $21.5 million

for the three months ended June 30, 2016, and an decrease in the

average yield on investment securities of 34 basis points, or 17.3

percent, to 2.30 percent, for the three months ended June 30, 2017

from 1.96 percent for the three months ended June 30, 2016.

Interest income on other interest-earning assets

decreased by $87,000, or 23.6 percent, to $281,000 for the three

months ended June 30, 2017 from $368,000 for the three months ended

June 30, 2016. The decrease is primarily attributable to a decrease

in the average balance of other interest-earning deposits of $140.8

million, or 68.8 percent, to $63.9 million for the three months

ended June 30, 2017 from $204.7 million for the three months ended

June 30, 2016, partly offset by an increase in the average yield on

other interest-earning assets of 108 basis points, or 158.0

percent, to 1.76 percent for the three months ended June 30, 2017

from 0.68 percent for the three months ended June 30, 2016. The

decrease in the average balance of other interest-earning assets

related to a decrease in cash as funds were deployed for repayment

of Federal Home Loan Bank (“FHLB”) borrowings, purchases of

investment securities and to fund loan growth, while the increase

in the average yield primarily resulted from increases in the Fed

Funds rate.

Total interest expense decreased by $312,000, or

7.2 percent, to $4.0 million for the three months ended June 30,

2017 from $4.3 million for the three months ended June 30, 2016.

Despite an increase in the average balance of interest-cost

liabilities of $49.7 million, or 3.5 percent, to $1.472 billion for

the three months ended June 30, 2017 from $1.422 billion for the

three months ended June 30, 2016, the average cost of funds

decreased 12 basis points, or 10.4 percent, to 1.09 percent for the

three months ended June 30, 2017 from 1.21 percent for the three

months ended June 30, 2016. The average balance of total deposit

liabilities increased by $94.2 million, or 7.8 percent, to $1.306

billion for the three months ended June 30, 2017 from $1.212

billion for the three months ended June 30, 2016, and the average

cost of deposits remained unchanged at .89 percent for both

three-month periods. The average balance of high-cost borrowings

decreased by $44.5 million, or 21.2 percent, to $165.5 million for

the three months ended June 30, 2017 from $210.0 million for the

three months ended June 30, 2016, and the average cost of

borrowings decreased 47 basis points, or 15.4 percent, to 2.63

percent, for the three months ended June 30, 2017 from 3.10 percent

for the three months ended June 30, 2016. The decrease in

borrowings was the result of scheduled repayments of Federal Home

Loan Bank advances.

Mr. Coughlin stated “The repayment of $55.0 million

of Federal Home Loan Bank Advances with a weighted average rate of

4.34 percent in mid-2016, and the scheduled repayments of another

$55.0 million, of which $20 million was paid in May, 2017 and $35

million is due in July 2017, having a weighted average rate of 4.45

percent, contributes positively to our net interest margin.”

Net interest margin was 3.45 percent for the

three-month period ended June 30, 2017 and 3.19 percent for the

three-month period ended June 30, 2016. The improvement in the net

interest margin was the result of the repayment of higher cost FHLB

borrowings in mid-2016, partly offset by competitive pressures in

attracting new loans and deposits, as evidenced by a decline in the

average yield on loans and an increase in the average cost of

deposits.

The provision for loan losses increased by

$739,000, to $776,000 for the three months ended June 30, 2017 from

$37,000 for the three months ended June 30, 2016. The provision for

loan losses is established based upon management’s review of the

Company’s loans and consideration of a variety of factors,

including but not limited to: (1) the risk characteristics of the

loan portfolio; (2) current economic conditions; (3) actual losses

previously experienced; (4) the dynamic activity and fluctuating

balance of loans receivable; and (5) the existing level of reserves

for loan losses that are probable and estimable. During the three

months ended June 30, 2017, the Company experienced $338,000 in net

charge-offs compared to $133,000 in net recoveries for the three

months ended June 30, 2016. The Bank had non-performing loans

totaling $15.5 million, or 0.97 percent, of gross loans at June 30,

2017 and $15.7 million, or 1.04 percent, of gross loans at December

31, 2016. The allowance for loan losses was $18.0 million, or 1.13

percent, of gross loans at June 30, 2017, $17.2 million, or 1.15

percent, of gross loans at December 31, 2016 and $18.3 million, or

1.27 percent, of gross loans at June 30, 2016. The amount of the

allowance is based on estimates and the ultimate losses may vary

from such estimates. Management assesses the allowance for loan

losses on a quarterly basis and makes provisions for loan losses as

necessary in order to maintain the adequacy of the allowance. While

management uses available information to recognize losses on loans,

future loan loss provisions may be necessary based on changes in

the aforementioned criteria. In addition various regulatory

agencies, as an integral part of their examination process,

periodically review the allowance for loan losses and may require

the Company to recognize additional provisions based on their

judgment of information available to them at the time of their

examination. Management believes that the allowance for loan losses

was adequate at June 30, 2017 and December 31, 2016.

Total non-interest income increased by $516,000, or

34.3 percent, to $2.0 million for the three months ended June 30,

2017 from $1.5 million for the three months ended June 30, 2016.

The increase was primarily attributable to income gained from sales

on other real estate owned properties of $197,000 for the three

months ended June 30, 2017 with no comparable figure for the three

months ended June 30, 2016, an increase in fees and service charges

of $102,000, or 13.9 percent, to $838,000 for the three months

ended June 30, 2017 from $736,000 for the three months ended June

30, 2016, a loss on bulk sale of impaired loans held in the

portfolio of $285,000 for the three months ended June 30, 2016 with

no comparable figure for the three months ended June 30, 2017, as

well as an increase in other non-interest income of $228,000, or

876.9 percent, to $254,000 for the three months ended June 30, 2017

from $26,000 for the three months ended June 30, 2016. The increase

in total non-interest income was partly offset by a decrease in

gains on sale of loans of $296,000, or 28.8 percent, to $733,000

for the three months ended June 30, 2017 from $1.0 million for the

three months ended June 30, 2016. The increase in other

non-interest income related to $237,000 of proceeds from a legal

settlement in the second quarter.

Total non-interest expense decreased by $1.0

million, or 8.4 percent, to $11.1 million for the three months

ended June 30, 2017 from $12.1 million for the three months ended

June 30, 2016. Salaries and employee benefits decreased by

$282,000, or 4.6 percent, to $5.9 million for the three months

ended June 30, 2017 from $6.2 million for the three months ended

June 30, 2016, primarily related to a reduction in workforce over

the last 12 months. Data processing expense decreased by $155,000,

or 18.6 percent, to $678,000 for the three months ended June 30,

2017 from $833,000 for the three months ended June 30, 2016,

primarily related to cost efficiencies achieved with the conversion

to a new core system. Professional fee expense decreased by

$100,000, or 20.7 percent, to $383,000 for the three months ended

June 30, 2017 from $483,000 for the three months ended June 30,

2016, primarily related to a reduction in the utilization of third

party providers. Advertising expense decreased by $275,000, or 70.5

percent, to $115,000 for the three months ended June 30, 2017 from

$390,000 for the three months ended June 30, 2016, partly related

to advertising efforts with the opening of several de novo branches

in 2016. Other non-interest expense consisted of occupancy and

equipment, director fees, regulatory assessments, other real estate

owned (net), and other fees/expenses.

The income tax provision increased by $982,000, or

90.5 percent, to $2.1 million for the three months ended June 30,

2017 from $1.1 million for the three months ended June 30, 2016.

The increase in income tax provision was a result of higher taxable

income during the three-month period ended June 30, 2017 as

compared with the three months ended June 30, 2016. The

consolidated effective tax rate for the three months ended June 30,

2017 was 40.1 percent compared to 40.7 percent for the three months

ended June 30, 2016.

Operations for the six months ended June

30, 2017, compared with the six months ended June 30,

2016

Net income increased $2.4 million, or 66.1 percent,

to $6.0 million for the six months ended June 30, 2017 compared

with $3.6 million for the six months ended June 30, 2016. The

increase in net income was primarily related to increases in net

interest income and non-interest income, and a decrease in

non-interest expense, partly offset by an increase in the provision

for loan loss and a higher income tax provision for the six months

ended June 30, 2017 as compared to the six months ended June 30,

2016.

Net interest income increased by $2.6 million, or

9.6 percent, to $29.7 million for the six months ended June 30,

2017 from $27.1 million for the six months ended June 30, 2016. The

increase in net interest income is primarily related to an increase

in the average balance of total interest-earning assets of $74.3

million, or 4.5 percent, to $1.724 billion for the six months ended

June 30, 2017 as compared to $1.650 billion for the six months

ended June 30, 2016 as well as an increase in the average yield in

total interest-earning assets of 4 basis points, or 1.1 percent, to

4.35 percent for the six months ended June 30, 2017 from 4.31

percent for the six months ended June 30, 2016.

Interest income on loans receivable increased by

$812,000, or 2.3 percent, to $35.6 million for the six months ended

June 30, 2017 from $34.8 million for the six months ended June 30,

2016. The increase was primarily attributable to an increase in the

average balance of loans receivable of $105.2 million, or 7.3

percent, to $1.550 billion for the six months ended June 30, 2017

from $1.445 billion for the six months ended June 30, 2016, partly

offset by a decrease in the average yield on loans receivable of 22

basis points, or 4.6 percent, to 4.59 percent for the six months

ended June 30, 2017 from 4.81 percent for the six months ended June

30, 2016. The increase in the average balance of loans receivable

was in accordance with the Company’s growth strategy, which

included the hiring of additional loan production and business

development personnel and the opening of seven additional branches

over the last 18 months. The decrease in average yield on loans

reflected the competitive price environment prevalent in the

Company’s primary market area on loan facilities, as well as the

repricing downward of certain variable rate loans.

Interest income on investment securities increased

by $1.3 million, to $1.4 million for the six months ended June 30,

2017 from $124,000 for the six months ended June 30, 2016. The

increase in interest income on investment securities is primarily

related to an increase in the average balance of investment

securities of $79.5 million, or 378.8 percent, to $100.5 million

for the six months ended June 30, 2017 from $21.0 million for the

six months ended June 30, 2016 and an increase in the average yield

of 38 basis points, or 13.1 percent, to 3.27 percent, for the six

months ended June 30, 2017 from 2.89 percent for the six months

ended June 30, 2016.

Interest income on other interest-earning assets

decreased by $71,000, or 11.2 percent, to $561,000 for the six

months ended June 30, 2017 from $632,000 for the six months ended

June 30, 2016. The decrease was primarily related to a decrease in

the average balance of other interest-earning assets of $110.5

million, or 60.1 percent, to $73.3 million for the six months ended

June 30, 2017 from $183.8 million for the six months ended June 30,

2016, partly offset by an increase in the average yield on other

interest-earning assets of 43 basis points, or 104.3 percent, to

0.85 percent, for the six months ended June 30, 2017 from 0.42

percent for the six months ended June 30, 2016. The decrease in the

average balance of other interest-earning assets related to a

decrease in cash as funds were deployed for repayment of Federal

Home Loan Bank (“FHLB”) borrowings, purchases of investment

securities, and to fund loan growth, while the increase in the

average yield resulted primarily from increases in the Fed Funds

rate.

Total interest expense decreased by $595,000, or

7.0 percent, to $7.9 million for the six months ended June 30, 2017

from $8.5 million for the six months ended June 30, 2016. Despite

an increase in the average balance of interest-cost liabilities of

$61.1 million, or 4.4 percent, to $1.460 billion for the six months

ended June 30, 2017 from $1.399 billion for the six months ended

June 30, 2016, the average cost of funds decreased 13 basis points,

or 11.0 percent, to 1.08 percent for the six months ended June 30,

2017 from 1.21 percent for the six months ended June 30, 2016. The

average balance of total deposit liabilities increased by $106.7

million, or 9.0 percent, to $1.296 billion for the six months ended

June 30, 2017 from $1.190 billion for the six months ended June 30,

2016, and the average cost of deposits increased 1 basis point to

0.88 percent for the six months ended June 30, 2017 from 0.87

percent for the six months ended June 30, 2016. The average balance

of high-cost borrowings decreased by $45.7 million, or 21.8

percent, to 163.7 million for the six months ended June 30, 2017

from $209.4 million for the six months ended June 30, 2016, and the

average cost of borrowings decreased 50 basis points, or 16.0

percent, to 2.63 percent for the six months ended June 30, 2017

from 3.13 percent for the six months ended June 30, 2016. The

decrease in borrowings was the result of scheduled repayments of

Federal Home Loan Bank advances.

The net interest margin was 3.44 percent for the

six-month period ended June 30, 2017 and 3.28 percent for the six

month period ended June 30, 2016. The improvement in the net

interest margin was partly the result of the repayment of higher

cost FHLB borrowings in mid-2016, partly offset by competitive

pressures in attracting new loans and deposits, as evidenced by a

decline in the average yield on loans and an increase in the

average cost of deposits.

The provision for loan losses increased by $1.0

million, or 463.7 percent, to $1.3 million for the six months ended

June 30, 2017 from $226,000 for the six months ended June 30, 2016.

The provision for loan losses is established based upon

management’s review of the Company’s loans and consideration of a

variety of factors, including but not limited to: (1) the risk

characteristics of the loan portfolio; (2) current economic

conditions; (3) actual losses previously experienced; (4) the

dynamic activity and fluctuating balance of loans receivable; and

(5) the existing level of reserves for loan losses that are

probable and estimable. During the six months ended June 30, 2017,

the Company experienced $519,000 in net charge-offs compared to

$70,000 in net recoveries for the six months ended June 30, 2016.

The Bank had non-performing loans totaling $15.5 million, or 0.97

percent, of gross loans at June 30, 2017 and $15.7 million, or 1.04

percent, of gross loans at December 31, 2016. The allowance for

loan losses was $18.0 million, or 1.13 percent, of gross loans at

June 30, 2017, $17.2 million, or 1.15 percent, of gross loans at

December 31, 2016 and $18.3 million, or 1.27 percent, of gross

loans at June 30, 2016. The amount of the allowance is based

on estimates and the ultimate losses may vary from such estimates.

Management assesses the allowance for loan losses on a quarterly

basis and makes provisions for loan losses as necessary in order to

maintain the adequacy of the allowance. While management uses

available information to recognize losses on loans, future loan

loss provisions may be necessary based on changes in the

aforementioned criteria. In addition various regulatory agencies,

as an integral part of their examination process, periodically

review the allowance for loan losses and may require the Company to

recognize additional provisions based on their judgment of

information available to them at the time of their examination. The

increase in the allowance for loan loss reflected growth in the

loan portfolio. Management believes that the allowance for loan

losses was adequate at June 30, 2017 and December 31, 2016.

Total non-interest income increased by $1.1

million, or 37.2 percent, to $4.3 million for the six months ended

June 30, 2017 from $3.2 million for the six months ended June 30,

2016. Total non-interest income increased primarily as a result of

increased gain on sale of other real estate owned properties

increased by $1.3 million for the six months ended June 30, 2017

with no comparable gain for the six months ended June 30, 2016, an

increase in fees and service charges of $187,000, or 12.9 percent,

to $1.6 million for the six months ended June 30, 2017 from $1.4

million for the six months ended June 30, 2016, an increase in

other non-interest income of $237,000, or 526.7 percent, to

$282,000 for the six months ended June 30, 2017 from $45,000 for

the six months ended June 30, 2017 and a loss on the bulk sale of

impaired loans held in the portfolio of $285,000 for the six months

ended June 30, 2016 with no comparable sale for the six months

ended June 30, 2017. The increase in total non-interest income was

partly offset by a decrease in gain on sale of loans of $882,000,

or 45.2 percent, to $1.1 million for the six months ended June 30,

2017 from $2.0 million for the six months ended June 30, 2016. The

sales of loans and other real estate loans is generally based on

market conditions. The increase in other non-interest income

related to $237,000 of proceeds from a legal settlement in the

second quarter.

Total non-interest expense decreased by $1.2

million, or 5.0 percent, to $22.7 million for the six months ended

June 30, 2017 from $23.9 million for the six months ended June 30,

2016. Salaries and benefits expense decreased by $216,000, or 1.8

percent, to $12.0 million for the six months ended June 30, 2017

from $12.2 million for the six months ended June 30, 2016,

primarily related to a reduction in workforce over the last 12

months. Data processing expense decreased by $564,000, or 29.8

percent, to $1.3 million for the six months ended June 30, 2017

from $1.9 million for the six months ended June 30, 2016, primarily

related to cost efficiencies achieved with the conversion to a new

core system. Professional fee expense decreased by $164,000, or

18.0 percent, to $746,000 for the six months ended June 30, 2017

from $910,000 for the six months ended June 30, 2016, primarily

related to a reduction in the utilization of third party providers.

Advertising expense decreased by $495,000, or 65.7 percent, to

$258,000 for the six months ended June 30, 2017 from $753,000 for

the six months ended June 30, 2016, partly related to advertising

efforts with the opening of several de novo branches in 2016. Other

non-interest expense consisted of occupancy and equipment, director

fees, regulatory assessments, other real estate owned (net), and

other fees/expenses.

Income tax provision increased by $1.5 million, or

62.0 percent, to $4.0 million for the six months ended June 30,

2017 from $2.5 million for the six months ended June 30, 2016. The

increase in income tax provision was a result of higher taxable

income during the six months ended June 30, 2017 as compared with

the six months ended June 30, 2016. The consolidated effective tax

rate for the six months ended June 30, 2017 was 40.0 percent

compared to 40.6 percent for the six months ended June 30,

2016.

Financial Condition

Total assets increased by $107.2 million, or 6.3

percent, to $1.815 billion at June 30, 2017 from $1.708 billion at

December 31, 2016. The increase in total assets occurred primarily

as a result of an increase in loans receivable of $92.0 million, an

increase in cash and cash equivalents of $10.0 million, and an

increase in securities available for sale of $11.0 million.

Management is concentrating on maintaining adequate liquidity in

anticipation of funding loans in the loan pipeline as well as

seeking opportunities to purchase securities in the secondary

market that provide competitive returns in a risk-mitigated

environment. It is our intention to grow our assets at a measured

pace consistent with our capital levels and as business

opportunities permit.

Loans receivable increased by $92.0 million, or 6.2

percent, to $1.577 billion at June 30, 2017 from $1.485 billion at

December 31, 2016, and is consistent with the Company’s growth

strategy for 2017. The increase resulted primarily from increases

of $18.5 million in residential real estate loans, $65.6 million in

commercial real estate and multi-family loans, $2.5 million in

construction loans, $4.1 million in commercial business loans and

$2.1 million in home equity loans and home equity lines of credit.

As of June 30, 2017, the allowance for loan losses was $18.0

million, or 116.2 percent, of non-performing loans and 0.97 percent

of gross loans.

Total cash and cash equivalents increased by $10.0

million, or 15.4 percent, to $75.0 million at June 30, 2017 from

$65.0 million at December 31, 2016 due to the Company’s strategy to

increase our deposit base and success of our 17-month promotional

CD product in the first quarter of 2017.

Securities available for sale increased by $11.0

million, or 11.6 percent, to $105.8 million at June 30, 2017 from

$94.8 million at December 31, 2016 as the Company deployed excess

cash to improve returns on earning assets and liquidity.

Deposit liabilities increased by $104.1 million, or

7.5 percent, to $1.496 billion at June 30, 2017 from $1.392 billion

at December 31, 2016. The increase resulted primarily from

increases of $69.5 million in certificates of deposit, $11.1

million in NOW deposit accounts, $10.4 million in non-interest

bearing deposit accounts, $9.3 million in money market checking

accounts and $6.5 million in savings and club accounts. In addition

to organic deposit growth resulting from the opening of seven

additional branches over the last 18 months, the Company has also

added listing service certificates of deposit and brokered

certificates of deposit to fund loan growth, which totaled $31.8

million and $17.9 million, respectively, at June 30, 2017.

Long-term debt increased by $8.0 million, or 5.2

percent, to $163.0 million at June 30, 2017 from $155.0 million at

December 31, 2016. The purpose of these borrowings reflected the

use of long-term Federal Home Loan Bank advances to augment

deposits as the Company’s funding source for originating loans and

investing in investment securities. Short-term debt decreased by

$9.0 million, or 45.0 percent, to $11.0 million at June 30, 2017

from $20.0 million at December 31, 2016. The weighted average

interest rate of borrowings was 2.26 percent at June 30, 2017.

Stockholders’ equity increased by $2.3 million, or

1.7 percent, to $133.4 million at June 30, 2017 from $131.1 million

at December 31, 2016. The increase in stockholders’ equity was

primarily attributable to proceeds received from the issuance of

$9.5 million of series D 4.5 percent non-cumulative perpetual

preferred stock, as well as an increase in retained earnings of

$2.6 million for the six months ended June 30, 2017, partly offset

by the redemption of $11.7 million of series A and B 6 percent

noncumulative perpetual preferred stock that occurred in the first

quarter of 2017. The Company accrued a dividend payable for the

second quarter on our outstanding preferred stock of $166,000 which

will be paid in the third quarter.

Mr. Coughlin added “After redeeming $11.7 million

of Series A and B 6.0 percent non-cumulative perpetual preferred

stock at the beginning of the year, we were successful in raising

$9.5 million of private placement Series D 4.5 percent

non-cumulative perpetual preferred stock in the first six months of

2017, in furtherance of our strategic capital plan.”

| BCB BANCORP INC., AND

SUBSIDIARIES |

| |

| |

Financial condition data by

quarter |

|

|

(In thousands) |

| |

Q2 2017 |

|

Q1 2017 |

|

Q4 2016 |

|

Q3 2016 |

|

Q2 2016 |

| |

|

|

|

|

|

|

|

|

|

| Total assets |

$ |

1,815,424 |

|

|

$ |

1,805,332 |

|

|

$ |

1,708,208 |

|

|

$ |

1,678,936 |

|

|

$ |

1,738,343 |

|

| Cash and cash

equivalents |

|

75,047 |

|

|

|

114,422 |

|

|

|

65,038 |

|

|

|

137,707 |

|

|

|

235,774 |

|

| Securities available

for sale |

|

105,803 |

|

|

|

106,183 |

|

|

|

94,765 |

|

|

|

52,907 |

|

|

|

18,365 |

|

| Loans receivable,

net |

|

1,577,181 |

|

|

|

1,528,756 |

|

|

|

1,485,159 |

|

|

|

1,431,211 |

|

|

|

1,424,891 |

|

| Deposits |

|

1,496,260 |

|

|

|

1,513,844 |

|

|

|

1,392,205 |

|

|

|

1,380,385 |

|

|

|

1,394,305 |

|

| Borrowings |

|

174,000 |

|

|

|

155,000 |

|

|

|

175,000 |

|

|

|

155,000 |

|

|

|

200,000 |

|

| Stockholders’

equity |

|

133,362 |

|

|

|

127,011 |

|

|

|

131,081 |

|

|

|

132,299 |

|

|

|

132,306 |

|

| |

|

|

|

|

|

|

|

|

|

| |

Operating data by quarter |

|

|

(In thousands, except for per share

amounts) |

| |

Q2 2017 |

|

Q1 2017 |

|

Q4 2016 |

|

Q3 2016 |

|

Q2 2016 |

| |

|

|

|

|

|

|

|

|

|

| Net interest

income |

$ |

15,063 |

|

|

$ |

14,605 |

|

|

$ |

14,402 |

|

|

$ |

13,597 |

|

|

$ |

13,363 |

|

| Provision for loan

losses |

|

776 |

|

|

|

498 |

|

|

|

102 |

|

|

|

(301 |

) |

|

|

37 |

|

| Non-interest

income |

|

2,022 |

|

|

|

2,313 |

|

|

|

1,433 |

|

|

|

1,530 |

|

|

|

1,506 |

|

| Non-interest

expense |

|

11,148 |

|

|

|

11,562 |

|

|

|

11,649 |

|

|

|

12,343 |

|

|

|

12,166 |

|

| Income tax expense |

|

2,067 |

|

|

|

1,945 |

|

|

|

1,611 |

|

|

|

1,171 |

|

|

|

1,085 |

|

| Net income |

$ |

3,094 |

|

|

$ |

2,913 |

|

|

$ |

2,473 |

|

|

$ |

1,914 |

|

|

$ |

1,581 |

|

| Net income per

share: |

$ |

0.26 |

|

|

$ |

0.25 |

|

|

$ |

0.20 |

|

|

$ |

0.15 |

|

|

$ |

0.12 |

|

| Common Dividends

declared per share |

$ |

0.14 |

|

|

$ |

0.14 |

|

|

$ |

0.14 |

|

|

$ |

0.14 |

|

|

$ |

0.14 |

|

| |

|

|

|

|

|

|

|

|

|

| |

Financial Ratios |

| |

Q2 2017 |

|

Q1 2017 |

|

Q4 2016 |

|

Q3 2016 |

|

Q2 2016 |

| Return on average

assets |

|

0.69 |

% |

|

|

0.68 |

% |

|

|

0.60 |

% |

|

|

0.44 |

% |

|

|

0.36 |

% |

| Return on average

stockholder’s equity |

|

9.73 |

% |

|

|

9.48 |

% |

|

|

7.64 |

% |

|

|

5.84 |

% |

|

|

4.80 |

% |

| Net interest

margin |

|

3.45 |

% |

|

|

3.43 |

% |

|

|

3.48 |

% |

|

|

3.22 |

% |

|

|

3.19 |

% |

| Stockholder’s equity to

total assets |

|

7.35 |

% |

|

|

7.04 |

% |

|

|

7.67 |

% |

|

|

7.88 |

% |

|

|

7.61 |

% |

| |

|

|

|

|

|

|

|

|

|

| |

Asset Quality Ratios |

| |

(In thousands, except for per share

amounts) |

| |

Q2 2017 |

|

Q1 2017 |

|

Q4 2016 |

|

Q3 2016 |

|

Q2 2016 |

| Non-Accrual Loans |

$ |

15,456 |

|

|

$ |

16,987 |

|

|

$ |

15,652 |

|

|

$ |

19,345 |

|

|

$ |

21,067 |

|

| Non-Accrual Loans as a

% of Total Loans |

|

0.97 |

% |

|

|

1.10 |

% |

|

|

1.04 |

% |

|

|

1.33 |

% |

|

|

1.45 |

% |

| ALLL as % of

Non-Accrual Loans |

|

116.23 |

% |

|

|

103.17 |

% |

|

|

109.95 |

% |

|

|

90.93 |

% |

|

|

87.05 |

% |

| Impaired Loans |

|

43,326 |

|

|

|

45,830 |

|

|

|

45,419 |

|

|

|

48,547 |

|

|

|

49,349 |

|

| Classified Loans |

|

42,311 |

|

|

|

44,408 |

|

|

|

48,231 |

|

|

|

59,440 |

|

|

|

51,249 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BCB Community Bank presently operates 22 branches

in Bayonne, Carteret, Colonia, Edison, Hoboken, Fairfield, Holmdel,

Jersey City, Lodi, Lyndhurst, Monroe Township, Rutherford, South

Orange, Union, and Woodbridge, New Jersey, and two branches in

Staten Island, New York.

Forward-looking Statements and Associated

Risk Factors

This release, like many written and oral

communications presented by BCB Bancorp, Inc., and our authorized

officers, may contain certain forward-looking statements regarding

our prospective performance and strategies within the meaning of

Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended. We intend

such forward-looking statements to be covered by the safe harbor

provisions for forward-looking statements contained in the Private

Securities Litigation Reform Act of 1995, and are including this

statement for purposes of said safe harbor provisions.

Forward-looking statements, which are based on

certain assumptions and describe future plans, strategies, and

expectations of the Company, are generally identified by use of

words “anticipate,” “believe,” “estimate,” “expect,” “intend,”

“plan,” “project,” “seek,” “strive,” “try,” or future or

conditional verbs such as “could,” “may,” “should,” “will,”

“would,” or similar expressions. Our ability to predict results or

the actual effects of our plans or strategies is inherently

uncertain. Accordingly, actual results may differ materially from

anticipated results.

There are a number of factors, many of which are

beyond our control, that could cause actual conditions, events, or

results to differ significantly from those described in our

forward-looking statements. These factors include, but are not

limited to: general economic conditions and trends, either

nationally or in some or all of the areas in which we and our

customers conduct our respective businesses; conditions in the

securities markets or the banking industry; changes in interest

rates, which may affect our net income, prepayment penalties and

other future cash flows, or the market value of our assets; changes

in deposit flows, and in the demand for deposit, loan, and

investment products and other financial services in the markets we

serve; changes in the financial or operating performance of our

customers’ businesses; changes in real estate values, which could

impact the quality of the assets securing the loans in our

portfolio; changes in the quality or composition of our loan or

investment portfolios; changes in competitive pressures among

financial institutions or from non-financial institutions; changes

in our customer base; potential exposure to unknown or contingent

liabilities of companies targeted for acquisition; our ability to

retain key members of management; our timely development of new

lines of business and competitive products or services in a

changing environment, and the acceptance of such products or

services by our customers; any interruption or breach of security

resulting in failures or disruptions in customer account

management, general ledger, deposit, loan or other systems; any

interruption in customer service due to circumstances beyond our

control; the outcome of pending or threatened litigation, or of

other matters before regulatory agencies, or of matters resulting

from regulatory exams, whether currently existing or commencing in

the future; environmental conditions that exist or may exist on

properties owned by, leased by, or mortgaged to the Company;

changes in estimates of future reserve requirements based upon the

periodic review thereof under relevant regulatory and accounting

requirements; changes in legislation, regulation, and policies,

including, but not limited to, those pertaining to banking,

securities, tax, environmental protection, and insurance, and the

ability to comply with such changes in a timely manner; changes in

accounting principles, policies, practices, or guidelines;

operational issues stemming from, and/or capital spending

necessitated by, the potential need to adapt to industry changes in

information technology systems, on which we are highly dependent;

the ability to keep pace with, and implement on a timely basis,

technological changes; changes in the monetary and fiscal policies

of the U.S. Government, including policies of the U.S. Treasury and

the Federal Reserve Board; war or terrorist activities; and other

economic, competitive, governmental, regulatory, and geopolitical

factors affecting our operations, pricing and services.

Readers are cautioned not to place undue reliance

on these forward-looking statements, which speak only as of the

date of this release. Except as required by applicable law or

regulation, the Company undertakes no obligation to update these

forward-looking statements to reflect events or circumstances that

occur after the date on which such statements were made.

| BCB BANCORP INC. AND SUBSIDIARIES |

| Consolidated Statements of Financial Condition |

| (In Thousands, Except Share and Per Share Data,

Unaudited) |

| |

| |

|

|

|

|

|

| |

June 30, |

|

December 31, |

| |

2017 |

|

2016 |

| |

|

|

|

|

|

|

ASSETS |

|

|

|

|

|

| Cash and amounts due

from depository institutions |

$ |

15,961 |

|

|

$ |

12,121 |

|

| Interest-earning

deposits |

|

59,086 |

|

|

|

52,917 |

|

| Total

cash and cash equivalents |

|

75,047 |

|

|

|

65,038 |

|

| |

|

|

|

|

|

| Interest-earning time

deposits |

|

980 |

|

|

|

980 |

|

| Securities available

for sale |

|

105,803 |

|

|

|

94,765 |

|

| Loans held for

sale |

|

536 |

|

|

|

4,153 |

|

| Loans receivable, net

of allowance for loan losses |

|

|

|

|

|

|

|

| of

$17,964 and $17,209 respectively |

|

1,577,181 |

|

|

|

1,485,159 |

|

| Federal Home Loan Bank

of New York stock, at cost |

|

9,913 |

|

|

|

9,306 |

|

| Premises and equipment,

net |

|

19,679 |

|

|

|

19,382 |

|

| Accrued interest

receivable |

|

5,666 |

|

|

|

5,573 |

|

| Other real estate

owned |

|

2,626 |

|

|

|

3,525 |

|

| Deferred income

taxes |

|

8,414 |

|

|

|

9,953 |

|

| Other assets |

|

9,579 |

|

|

|

10,374 |

|

|

Total Assets |

$ |

1,815,424 |

|

|

$ |

1,708,208 |

|

| |

|

|

|

|

|

| LIABILITIES AND

STOCKHOLDERS' EQUITY |

|

|

|

|

|

| |

|

|

|

|

|

|

LIABILITIES |

|

|

|

|

|

| Non-interest bearing

deposits |

$ |

168,885 |

|

|

$ |

158,523 |

|

| Interest bearing

deposits |

|

1,327,375 |

|

|

|

1,233,682 |

|

| Total

deposits |

|

1,496,260 |

|

|

|

1,392,205 |

|

| Short-term debt |

|

11,000 |

|

|

|

20,000 |

|

| Long-term debt |

|

163,000 |

|

|

|

155,000 |

|

| Subordinated

debentures |

|

4,124 |

|

|

|

4,124 |

|

| Other liabilities and

accrued interest payable |

|

7,678 |

|

|

|

5,798 |

|

|

Total Liabilities |

|

1,682,062 |

|

|

|

1,577,127 |

|

| |

|

|

|

|

|

| STOCKHOLDERS'

EQUITY |

|

|

|

|

|

| Preferred stock: $0.01

par value, 10,000,000 shares authorized, |

|

|

|

|

|

| issued

and outstanding 1,342 shares of series C 6 percent and series D 4.5

percent noncumulative |

|

|

|

|

|

| perpetual

preferred stock (liquidation value $10,000 per share) at June 30,

2017 and 1,560 shares |

|

|

|

|

|

| of series

A, B, C 6 percent noncumulative preferred stock at December 31,

2016 |

|

- |

|

|

|

- |

|

| Additional paid-in

capital preferred stock |

|

13,241 |

|

|

|

15,464 |

|

| Common stock; no par

value; 20,000,000 shares authorized, issued 13,831,203 and

13,797,088 |

|

|

|

|

|

| at June

30, 2017 and December 31, 2016, respectively, outstanding

11,300,740 shares and |

|

|

|

|

|

|

11,267,225 shares, respectively |

|

- |

|

|

|

- |

|

| Additional paid-in

capital common stock |

|

120,980 |

|

|

|

120,417 |

|

| Retained earnings |

|

30,725 |

|

|

|

28,159 |

|

| Accumulated other

comprehensive income (loss) |

|

(2,473 |

) |

|

|

(3,856 |

) |

| Treasury stock, at

cost, 2,530,463 and 2,529,863 shares, respectively, at June 30,

2017 and December 31, 2016 |

|

(29,111 |

) |

|

|

(29,103 |

) |

|

Total Stockholders' Equity |

|

133,362 |

|

|

|

131,081 |

|

| |

|

|

|

|

|

|

Total Liabilities and Stockholders' Equity |

$ |

1,815,424 |

|

|

$ |

1,708,208 |

|

| |

|

|

|

|

|

| BCB BANCORP INC. AND SUBSIDIARIES |

| Consolidated Statements of Income |

| (In Thousands, except for per share amounts,

Unaudited) |

| |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| |

|

2017 |

|

|

2016 |

|

|

|

2017 |

|

|

2016 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Interest

income: |

|

|

|

|

|

|

|

|

|

|

|

| Loans,

including fees |

$ |

18,026 |

|

$ |

17,263 |

|

|

$ |

35,568 |

|

$ |

34,756 |

|

|

Mortgage-backed securities |

|

603 |

|

|

50 |

|

|

|

1,131 |

|

|

124 |

|

| Municipal

bonds and other debt |

|

159 |

|

|

- |

|

|

|

264 |

|

|

- |

|

| FHLB

stock and other interest earning assets |

|

281 |

|

|

368 |

|

|

|

561 |

|

|

632 |

|

|

Total interest income |

|

19,069 |

|

|

17,681 |

|

|

|

37,524 |

|

|

35,512 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Interest

expense: |

|

|

|

|

|

|

|

|

|

|

|

|

Deposits: |

|

|

|

|

|

|

|

|

|

|

|

|

Demand |

|

677 |

|

|

470 |

|

|

|

1,350 |

|

|

832 |

|

| Savings

and club |

|

100 |

|

|

93 |

|

|

|

199 |

|

|

182 |

|

|

Certificates of deposit |

|

2,142 |

|

|

2,126 |

|

|

|

4,153 |

|

|

4,160 |

|

|

|

|

2,919 |

|

|

2,689 |

|

|

|

5,702 |

|

|

5,174 |

|

| Borrowed

money |

|

1,087 |

|

|

1,629 |

|

|

|

2,154 |

|

|

3,277 |

|

|

Total interest expense |

|

4,006 |

|

|

4,318 |

|

|

|

7,856 |

|

|

8,451 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Net interest

income |

|

15,063 |

|

|

13,363 |

|

|

|

29,668 |

|

|

27,061 |

|

| Provision for loan

losses |

|

776 |

|

|

37 |

|

|

|

1,274 |

|

|

226 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Net interest

income after provision for loan losses |

|

14,287 |

|

|

13,326 |

|

|

|

28,394 |

|

|

26,835 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Non-interest

income: |

|

|

|

|

|

|

|

|

|

|

|

| Fees and

service charges |

|

838 |

|

|

736 |

|

|

|

1,634 |

|

|

1,447 |

|

| Gain on

sales of loans |

|

733 |

|

|

1,029 |

|

|

|

1,071 |

|

|

1,953 |

|

| Loss on

bulk sale of impaired loans held in portfolio |

|

- |

|

|

(285 |

) |

|

|

- |

|

|

(285 |

) |

| Gain on

sales of other real estate owned |

|

197 |

|

|

- |

|

|

|

1,348 |

|

|

- |

|

|

Other |

|

254 |

|

|

26 |

|

|

|

282 |

|

|

45 |

|

|

Total non-interest income |

|

2,022 |

|

|

1,506 |

|

|

|

4,335 |

|

|

3,160 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Non-interest

expense: |

|

|

|

|

|

|

|

|

|

|

|

| Salaries

and employee benefits |

|

5,878 |

|

|

6,160 |

|

|

|

11,968 |

|

|

12,184 |

|

| Occupancy

and equipment |

|

1,989 |

|

|

2,043 |

|

|

|

4,147 |

|

|

3,915 |

|

| Data

processing and service fees |

|

678 |

|

|

833 |

|

|

|

1,331 |

|

|

1,895 |

|

|

Professional fees |

|

383 |

|

|

483 |

|

|

|

746 |

|

|

910 |

|

| Director

fees |

|

198 |

|

|

183 |

|

|

|

378 |

|

|

336 |

|

|

Regulatory assessments |

|

331 |

|

|

360 |

|

|

|

692 |

|

|

710 |

|

|

Advertising and promotional |

|

115 |

|

|

390 |

|

|

|

258 |

|

|

753 |

|

| Other

real estate owned, net |

|

13 |

|

|

94 |

|

|

|

55 |

|

|

110 |

|

|

Other |

|

1,563 |

|

|

1,620 |

|

|

|

3,135 |

|

|

3,090 |

|

|

Total non-interest expense |

|

11,148 |

|

|

12,166 |

|

|

|

22,710 |

|

|

23,903 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Income before

income tax provision |

|

5,161 |

|

|

2,666 |

|

|

|

10,019 |

|

|

6,092 |

|

| Income tax

provision |

|

2,067 |

|

|

1,085 |

|

|

|

4,012 |

|

|

2,476 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Net

Income |

$ |

3,094 |

|

$ |

1,581 |

|

|

$ |

6,007 |

|

$ |

3,616 |

|

| Preferred stock

dividends |

|

165 |

|

|

234 |

|

|

|

283 |

|

|

468 |

|

| Net Income

available to common stockholders |

$ |

2,929 |

|

$ |

1,347 |

|

|

$ |

5,724 |

|

$ |

3,148 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Net Income per

common share-basic and diluted |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

0.26 |

|

$ |

0.12 |

|

|

$ |

0.51 |

|

$ |

0.28 |

|

|

Diluted |

$ |

0.26 |

|

$ |

0.12 |

|

|

$ |

0.50 |

|

$ |

0.28 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Weighted

average number of common shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

11,295 |

|

|

11,229 |

|

|

|

11,287 |

|

|

11,223 |

|

|

Diluted |

|

11,405 |

|

|

11,233 |

|

|

|

11,383 |

|

|

11,226 |

|

Contact

Thomas Keating, Senior Vice President and Chief Financial Officer – 201.823.0700

or

Thomas Coughlin, President and Chief Executive Officer – 201.823.0700

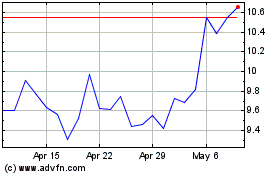

BCB Bancorp (NASDAQ:BCBP)

Historical Stock Chart

From Mar 2024 to Apr 2024

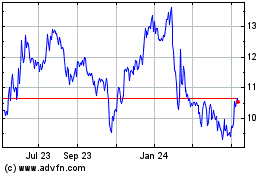

BCB Bancorp (NASDAQ:BCBP)

Historical Stock Chart

From Apr 2023 to Apr 2024