Current Report Filing (8-k)

July 14 2017 - 6:04AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported):

July 7, 2017

Legacy

Ventures International, Inc.

(Exact name of registrant as specified in its charter)

|

Nevada

|

|

333-199040

|

|

30-0826318

|

|

(State

or other jurisdiction

of

incorporation)

|

|

(Commission

File Number)

|

|

(IRS

Employer

Identification

No.)

|

|

|

1382

Valencia Ave., Suite F

Tustin,

CA 92780

|

|

|

|

(Address of Principal

Executive Offices)

|

|

(949)

260-8070

Registrant’s

telephone number, including area code

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

☐

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant

The

disclosures set forth in Item 5.01 below are incorporated by reference into this Item 2.03.

Item 5.01

Changes

in Control of Registrant.

On

June 28, 2017, Randall Letcavage entered into a stock purchase agreement for the acquisition of an aggregate of 286,720 shares

of Common Stock of the Company, representing approximately 91% of the issued and outstanding shares of Common Stock of the Company

as of such date, from Rehan Saeed, the previous majority shareholder of the Company (the “Purchase Agreement”). The

Purchase Agreements were fully executed and delivered, and the transaction consummated as of and at July 7, 2017. Consequently,

Mr. Letcavage is now able to unilaterally control the election of our board of directors, all matters upon which shareholder approval

is required and, ultimately, the direction of our Company.

In

addition, on June 28, 2017, Raheen Saeed submitted his resignation from all executive officer positions with the Company, including

Chief Executive Officer and President, effective on the 10th day following the filing of a Schedule 14f-1 with the U.S. Securities

and Exchange Commission. On June 28, 2017, Randall Letcavage was appointed as Chief Executive Officer, Chief Financial Officer,

Director, effective immediately.

Also

on June 28, 2017, the board of directors of the Company acknowledged the $20,000 of third party (unaffiliated) debt held by two

lenders which is and has been included in the Company’s filed and audited financial statements, and extended the repayment

terms of the previously demand debt obtained the waiver of potential fees and penalties and granted conversion rights. As a result,

the Company issued convertible promissory notes to the holders in the aggregate principal amount of $20,000 which in the aggregate

allow the debt to be converted into a maximum of 25% of the issued and outstanding shares of the Company. The notes are assignable

at the option of the holders. In connection with the transactions described herein, debt held by Rehan Saeed was cancelled and

waived.

Item 5.02

Departure

of Directors or Principal Officers; Election of Directors; Appointment of Principal Officers.

(a)

Resignation of Directors

The

disclosures set forth in Item 5.01 above are incorporated by reference into this Item 5.02(a).

There

were no disagreements between Mr. Saeed and us or any officer or director of the Company.

(b)

Resignation of Officers

The

disclosures set forth in Item 5.01 above are incorporated by reference into this Item 5.02(b).

(c)

Appointment of Directors

The

disclosures set forth in Item 5.01 above are incorporated by reference into this Item 5.02(c).

(d)

Appointment

of Officers

The

disclosures set forth in Item 5.01 above are incorporated by reference into this Item 5.02(d).

The

business background descriptions of the newly appointed officer and directors are as follows:

Randall

Letcavage – Chief Executive Officer, President, Chief Financial Officer and Chairman of the Board of Directors

Mr.

Letcavage was named Chairman, President, Chief Executive Officer, and Chief Financial Officer of the Company on June 28, 2017.

Mr. Letcavage is also Chairman, President, Chief Executive Officer, and Chief Financial Officer of Premier Holding Corporaiton,

since July 5, 2012. Prior to this he was employed as a consultant by Capital Finance LLC. He brings in excess of 25 years plus

of business experience specializing in the financial markets and business consulting and green energy/clean technology. For the

past 20 years Mr. Letcavage has been an investment banker widely recognized for individual achievements as well as his role of

Founder, Officer and Director of the iCapital Group that includes iCapital Finance Inc, iCapital Advisory LLC and iCap Development

LLC (A National “CDE” Community Development Entity – Certified by the U.S Treasury Department). Mr. Letcavage

has also held executive positions, invested, and/or operated numerous businesses including related companies in “Power Generation

and Power Reduction” – CEO of Ciralight Global Inc, CEO of Green Central Holdings, Consultant and second largest shareholder

of publicly traded PRHL which operates Energy Efficiency Experts (E3). Letcavage had been successful in many areas additionally

providing capital to healthcare companies. Mr. Letcavage personally acted as an advisor to municipalities leading millions in

industrial bond transAuthorized Shares Increase, while also advising the National Conference of Black Mayors (NCBM; over 800 members

all of whose cities may one day be able to offer deregulated power services). Mr. Letcavage served as the Managing Director of

NC Capital Markets and as Vice President of The National Capital Companies, Inc. (directing the daily operations of most of its

subsidiaries). Mr. Letcavage was formerly the CEO and a majority owner of Capital Access Group. Prior to Capital Access, Mr. Letcavage

founded and/or managed several asset management firms, including Valley Forge Capital Holdings and the Marshall Plan, LLC that

directed and/or co-managed over $3 billion in assets with former renowned CALPERS (California Pension & Retirement Systems)

Manager, Greta Marshall. Prior to Valley Forge, Mr. Letcavage founded Security America, Inc., an asset management firm based in

Grosse Pointe, Michigan. Mr. Letcavage worked with Prudential-Bache running a Joint Venture ―High Net Worth Group (a/k/a

Security American, Inc.).

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

Legacy Ventures International, Inc.

|

|

|

|

|

|

Date:

July 12, 2017

|

By:

|

/s/

Randall Letcavage

|

|

|

|

Name:

Randall Letcavage

|

|

|

|

Title:

Chief Executive Officer

|

4

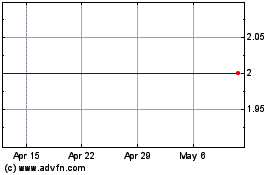

Legacy Ventures (PK) (USOTC:LGYV)

Historical Stock Chart

From Mar 2024 to Apr 2024

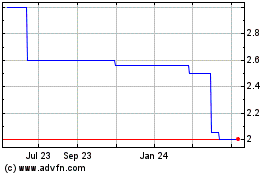

Legacy Ventures (PK) (USOTC:LGYV)

Historical Stock Chart

From Apr 2023 to Apr 2024