As filed with the Securities and Exchange

Commission on July 13, 2017

Registration No. 333-209002

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

AMENDMENT TO

POST-EFFECTIVE AMENDMENT NO. 1

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

DARIOHEALTH CORP.

(Exact Name of Registrant as Specified in

Its Charter)

|

Delaware

|

|

3670

|

|

45-2973162

|

|

(State or Other Jurisdiction of

Incorporation or Organization)

|

|

(Primary Standard Industrial

Classification Code Number)

|

|

(IR.S. Employer Identification

Number)

|

9 Halamish Street

Caesarea Industrial Park

3088900, Israel

Telephone: +(972)-(4) 770 4055

Facsimile: +(972)-(4) 770 4060

(Address, Including Zip Code, and Telephone

Number, Including Area Code, of Registrant’s Principal Executive Offices)

Mr. Erez Raphael

Chief Executive Officer

DarioHealth Corp.

9 Halamish Street

Caesarea Industrial Park

3088900, Israel

Telephone: +(972)-(4) 770 4055

Facsimile: +(972)-(4) 770 4060

(Name, Address Including Zip Code, and Telephone

Number, Including Area Code, of Agent for Service)

Copies to:

Oded Har-Even, Esq.

Robert V. Condon III, Esq.

Zysman, Aharoni, Gayer and

Sullivan & Worcester LLP

1633 Broadway

New York, New York 10019

Telephone: (212) 660-5000

Facsimile: (212) 660-3001

Approximate Date of

Commencement of Proposed Sale to the Public:

As soon as practicable after the effective date of this registration statement

If any of the securities being registered on this form are to

be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box.

☒

If this Form is filed to register additional securities for

an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same offering.

☐

If this Form is a post-effective amendment filed pursuant to

Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the

earlier effective registration statement for the same offering.

☐

If this Form is a post-effective amendment filed pursuant to

Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the

earlier effective registration statement for the same offering.

☐

Indicate by check mark whether the registrant is a large accelerated

filer, an accelerated non-accelerated filer, smaller reporting company, or an emerging growth company. See definitions of “large

accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth

company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer

☐

Accelerated filer

☐

Non-accelerated filer

☐

(Do not check if a smaller reporting company)

Smaller reporting

company

☒

Emerging growth company

☒

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act.

☐

The registrant hereby amends this registration statement

on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which

specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities

Act of 1933, as amended, or until the registration statement shall become effective on such date as the Commission, acting pursuant

to said Section 8(a), may determine.

EXPLANATORY NOTE

This amendment to Post-Effective Amendment No. 1 to

the registration statement on Form S-1 (File No. 333-209002) (the “Registration Statement”) of DarioHealth

Corp. (“our”, “we” or the “Company”) is being filed to address certain comments received

by the Company from the Securities and Exchange Commission (the “SEC”) and pursuant to the undertakings in Item

17 of the Registration Statement to update and supplement the information contained in the Registration Statement to include

the information contained in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2016 that

was filed with the SEC on March 22, 2017. The Registration Statement was originally declared effective by the SEC on March

3, 2016. The Registration Statement originally covered (i) a primary offering (the “Offering”) of 1,333,333

shares of common stock, $0.0001 par value per share and warrants to purchase 1,533,333 shares of common stock at an exercise

price of $4.34 per share, and (ii) the offering of warrants to purchase 143,333 shares of common stock at an exercise price

of $5.625 that were issued to the underwriters in the Offering. The Registration Statement now covers the sale of the shares

of our common stock issuable from time to time upon exercise of such warrants that remain unexercised.

All applicable registration fees were paid at the time of the

original filing of the Registration Statement.

The information in this prospectus is not complete and may be changed. We may not sell these securities

until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer

to sell these securities and is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is

not permitted.

|

PROSPECTUS

|

SUBJECT

TO COMPLETION

|

DATED

JULY 13, 2017

|

1,671,666 Shares of Common Stock

Issuable Upon the Exercise of Warrants

![[GRAPHIC MISSING]](http://content.edgar-online.com/edgar_conv_img/2017/07/13/0001144204-17-036717_IMAGE_001.JPG)

We are offering up to an aggregate of 1,671,666 shares of common

stock, $0.0001 par value per share, issuable upon exercise of warrants. Warrants exercisable for 1,528,333 shares were issued on

March 8, 2016 as part of a public offering of common stock and warrants and have an exercise price of $4.34 per share. Such warrants

were exercisable immediately and will expire on March 8, 2021. Warrants exercisable for 143,333 shares of Common Stock were issued

on March 8, 2016 to the underwriters in the public offering and have an exercise price of $5.625 per share. Such warrants were

immediately exercisable on September 3, 2016 and expire on March 8, 2021.

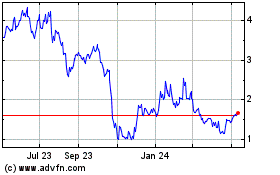

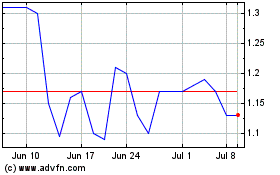

Our common stock and the warrants issued to purchasers

in the offering described above are currently listed on The NASDAQ Capital Market under the symbols “DRIO” and

“DRIOW”, respectively. On July 12, 2017, the last reported sale price for our common stock and warrants was $2.49

per share and $0.28 per warrant, respectively.

Investing in our securities involves a high degree of

risk. See “Risk Factors” beginning on page 3 of this prospectus and beginning on page 21 of our Annual Report on

Form 10-K for the fiscal year ended December 31, 2016, or our Annual Report, for a discussion of information that should be

considered in connection with an investment in our securities.

Neither the Securities and Exchange Commission nor any state

securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete.

Any representation to the contrary is a criminal offense.

The date of this prospectus is July

13, 2017

TABLE OF CONTENTS

You should rely only on the information contained in this

prospectus. We have not authorized anyone to provide you with different information. We are not making an offer of these securities

in any state where the offer is not permitted. You should not assume that the information contained in this prospectus is accurate

as of any date other than the date on the front of this prospectus.

For investors outside the United States:

We

have not done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where

action for that purpose is required, other than in the United States. You are required to inform yourselves about and to observe

any restrictions relating to this offering and the distribution of this prospectus.

We obtained statistical data, market data and other industry

data and forecasts used throughout this prospectus from market research, publicly available information and industry publications.

While we believe that the statistical data, industry data and forecasts and market research are reliable, we have not independently

verified the data, and we do not make any representation as to the accuracy of the information.

PROSPECTUS SUMMARY

This summary contains basic information

about us and this offering. Because it is a summary, it does not contain all of the information that you should consider before

investing. Before you decide to invest in our common stock, you should read this entire prospectus supplement and the accompanying

prospectus carefully, including the sections entitled “Risk Factors,” and our consolidated financial statements and

the related notes and other documents incorporated by reference herein and in the accompanying prospectus.

OUR COMPANY

This summary highlights information contained

in the documents incorporated herein by reference. Before making an investment decision, you should read the entire prospectus,

and our other filings with the Securities and Exchange Commission, or the SEC, including those filings incorporated herein by reference,

carefully, including the sections entitled “Risk Factors” and “Cautionary Statement Regarding Forward-Looking

Statements.”

We are a digital health (mHealth) company

that is developing and commercializing a patented and proprietary technology providing consumers with laboratory-testing capabilities

using smart phones and other mobile devices. Our flagship product, Dario

TM

, which we also refer to as our Dario

TM

Smart Diabetes Management Solution, is a mobile, real-time, cloud-based, diabetes management solution based on an innovative, multi-feature

software application combined with a stylish, ‘all-in-one’, pocket-sized, blood glucose monitoring device, which we

call the Dario

TM

Smart Meter.

Beyond the benefits of individual diabetes

management, we envision the Dario

TM

application becoming the centerpiece in a new era of interconnected devices and

services, providing healthier and better lives for diabetic patients worldwide. With every single measurement captured and stored

on a secure cloud data base, our software driven, comprehensive data-management technology has the potential to deliver actionable

insight and analytical tools to manage individual patients or large populations, as well as provide a complete and comprehensive

“big data” solution for healthcare providers and payers.

Our Corporate

Information

Our address is 9 Halamish Street, Caesarea

Industrial Park, 3088900, Israel and our telephone number is +(972)-(4) 770 4055. Our corporate website is: www.mydario.com. The

content of our website shall not be deemed incorporated by reference in this prospectus.

THE OFFERING

|

Securities offered by us

|

Up to 1,671,666 shares of common stock issuable upon exercise of warrants, or the Warrants, including Warrants exercisable for 1,528,333 shares issued as part of a public offering of common stock and warrants, or the Investor Warrants, and Warrants exercisable for 143,333 shares of common stock issued the underwriters in the public offering, or the Representative’s Warrants.

|

|

|

|

|

Common stock to be outstanding

after this offering

|

11,385,174 shares of common stock if all Warrants are exercised in full.

|

|

|

|

|

Description of the Investor Warrants

|

The Investor Warrants have a per share exercise price of $4.34. The Investor Warrants were exercisable immediately upon issuance and will expire on March 8, 2021.

|

|

|

|

|

Description of the Representative’s Warrants

|

The Representative’s Warrants have a per share exercise price of $5.625. The Representative’s Warrants were exercisable as of September 3, 2016 and will expire on March 8, 2021.

|

|

|

|

|

Anti-dilution

|

The exercise price and the number of shares of common stock purchasable upon the exercise of the Warrants are subject to adjustment upon the occurrence of specific events, including stock dividends, stock splits, combinations and reclassifications of our common stock.

|

|

|

|

|

Use of proceeds

|

The proceeds in this offering consist solely of the exercise price to be paid by the Warrant holders upon exercise of the Warrants. We intend to use the proceeds from the exercise of the Warrants for commercialization efforts of our products, such as increased marketing or production expenses, and for general working capital purposes.

|

|

|

|

|

NASDAQ Capital Market listing symbol for common stock and warrants

|

DRIO and DRIOW

|

|

|

|

|

Risk Factors

|

Investing in our securities involves a high degree of risk. As an investor, you should be

able to bear a complete loss of your investment. You should carefully consider the information set forth in the “Risk Factors”

section beginning on page 3 of this prospectus and page 21 of our Annual Report.

|

Unless otherwise specified, the information in this

prospectus, including the number of shares of common stock that will be outstanding after this offering set forth above, is

based on 9,713,508 shares of common stock outstanding as of July 13, 2017, and excludes the following:

|

|

•

|

1,264,424 shares of our common stock issuable upon

exercise of outstanding stock options under our Amended and Restated 2012 Equity Incentive Plan at a weighted average

exercise price of $6.19 per share, with 137,247 shares of common stock remaining available for future

grant under such plan as of July 13, 2017, and 73,522 shares of our common stock issuable upon

exercise of outstanding non-plan stock options at a weighted average exercise price of $32.34 per

share; and

|

|

|

•

|

5,750,869 shares of

our common stock issuable upon exercise of outstanding warrants at a weighted average exercise price of

$4.69 per share as of July 13, 2017.

|

RISK FACTORS

Investing in our securities involves a high degree of risk.

You should carefully consider the following risk factor, the risks described under the heading “Risk Factors” in our

Annual Report which is incorporated by reference into this prospectus, as well as the other information in this prospectus or

incorporated by reference into this prospectus (including our financial statements and the related notes), before deciding whether

to invest in our securities. Investment risks can be market-wide as well as unique to a specific industry or company. Additional

risks and uncertainties not presently known to us or that we currently deem immaterial also may impair our business operations.

The occurrence of any of the risks described below and in our Annual Report could harm our business, financial condition, results

of operations or growth prospects. In that case, the trading price of our securities could decline, and you may lose all or part

of your investment.

We may be subject to claims for rescission or damages

in connection with certain sales of shares of our securities.

In March 2016, the Securities and Exchange Commission declared

effective a registration statement of which this prospectus is a part that we filed to cover the sale of 1,333,333 shares of common

stock, 1,533,333 warrants to purchase common stock, 1,533,333 shares of common stock underlying such warrants, and underwriters’

warrants to purchase up to 153,333 shares of common stock. Sales of approximately 55,555 shares of common stock, approximately

255,555 shares of common stock underlying warrants and approximately 25,555 shares of common stock underlying underwriters’

warrants may not have been made in accordance with Section 5 of the Securities Act of 1933, as amended. Accordingly, the purchasers

of those securities may have rescission rights or be entitled to damages. The amount of such liability, if any, is uncertain.

In the event that we are required to make payments to investors as a result of these unregistered sales of securities, our liquidity

could be negatively impacted.

USE OF PROCEEDS

We received gross proceeds from the sale of the common

stock and Investor Warrants of approximately $6 million. As of July 13, 2017, we have received $22,500 from the exercise of

Warrants. In the event of full exercise for cash of all of the Warrants that remain outstanding, we will receive additional

gross proceeds of approximately $6.6 million.

The principal reason of this offering is to provide for the

registration of shares of common stock issuable upon exercise of the Warrants. We intend to use the net proceeds from this offering

for commercialization efforts of our products, such as increased marketing or production expenses, and for general working capital

purposes. Pending use of the net proceeds, we intend to invest in a combination of short-term bank deposits, interest-bearing,

investment-grade securities.

DIVIDEND POLICY

We did not declare or pay cash dividends in 2015, 2016 or through

the date of this prospectus, and currently do not plan to declare dividends on shares of our common stock in the foreseeable future.

We have no dividends policy and will consider distributing dividends on a year by year basis. We expect to retain our future earnings,

if any, for use in the operation and expansion of our business. Subject to the foregoing, the payment of cash dividends in the

future, if any, will be at the discretion of our board of directors and will depend upon such factors as earnings levels, capital

requirements, our overall financial condition and any other factors deemed relevant by our board of directors.

DILUTION

Our net tangible book value as of December 31, 2016 was approximately

($1.14) per share of common stock. Net tangible book value per share represents total tangible assets less total liabilities, divided

by the number of shares of common stock outstanding. After giving effect to the issuance of 1,671,666 shares of common stock upon

exercise of Warrants for cash in this offering, our net tangible book value as of December 31, 2016 would have been $898,000 or

$0.12 per share. This represents an immediate increase in net tangible book value of $7,439,000 per share to existing stockholders

and an immediate dilution in net tangible book value of $4.33 to holders of the Warrants, in this offering. The following

table illustrates this calculation.

|

Exercise price of the Warrants

|

|

$

|

4.45

|

|

|

Net tangible book value per share as of December 31, 2016

|

|

$

|

(1.14

|

)

|

|

Increase in net tangible book value per share attributable to this offering

|

|

$

|

1.27

|

|

|

As adjusted net tangible book value per share as of December 31, 2016, after giving effect to this offering

|

|

$

|

0.12

|

|

|

Dilution in net tangible book value per share to new investors

|

|

$

|

4.33

|

|

The number of shares of common stock outstanding

used for existing stockholders in the table and calculations above is based on 9,713,508 shares of common stock outstanding

as of July 13, 2017 and excludes the following:

|

|

•

|

1,264,424 shares of

our common stock issuable upon exercise of outstanding stock options under our Amended and Restated 2012 Equity Incentive

Plan at a weighted average exercise price of $6.19 per share, with 137,247 shares of common stock remaining available for

future grant under such plan as of July 13, 2017,

and 73,522 shares of our common stock issuable upon exercise

of outstanding non-plan stock options at a weighted average exercise price of $32.34 per

share; and

|

|

|

•

|

5,750,869

shares of

our common stock issuable upon exercise of outstanding warrants at a weighted average exercise price of

$4.69 per share as of July 13, 2017.

|

DESCRIPTION OF CAPITAL STOCK

General

As of the date of this prospectus, our authorized capital

stock consisted of 160,000,000 shares of common stock, par value $0.0001 per share and 5,000,000 shares of blank-check preferred

stock, par value $0.0001 per share. As of July 13, 2017, we had 9,713,508 shares of

common stock outstanding and no shares of preferred stock designated, issued or outstanding. No other class or series of capital

stock has been established.

Common Stock

Voting.

The holders of

our common stock are entitled to one vote for each share held of record on all matters on which the holders are entitled to vote

(or consent to).

Dividends.

The holders

of our common stock are entitled to receive, ratably, dividends only if, when and as declared by our Board of Directors in their

discretion pursuant to the Delaware General Corporation Law therefor and after provision is made for each class of capital stock

having preference over the common stock (including the preferred stock if any).

Liquidation Rights.

In

the event of our liquidation, dissolution or winding-up, the holders of our common stock are entitled to share, ratably, in all

assets remaining available for distribution after payment of all liabilities and after provision is made for each class of capital

stock having preference over the common stock (including the preferred stock if any).

Conversion Rights.

The

holders of our common stock have no conversion rights.

Preemptive and Similar Rights.

The

holders of our common stock have no preemptive or similar rights under our Certificate of Incorporation.

Redemption/Put Rights.

There

are no redemption or sinking fund provisions applicable to the common stock. All of the outstanding shares of our common stock

are fully-paid and nonassessable.

Investor Warrants

The following summary of certain terms and provisions of

the Investor Warrants offered hereby is not complete and is subject to, and qualified in its entirety by the provisions of the

form of the Investor Warrant, which is filed as an exhibit to the registration statement of which this prospectus is a part. Prospective

investors should carefully review the terms and provisions set forth in the form of warrant agreement, which is an exhibit to the

registration statement of which this prospectus forms a part.

Exercisability

. The Investor Warrants are

exercisable immediately and at any time up to the date that is five years from the closing of the original offering. The Investor

Warrants are exercisable, at the option of each holder, in whole or in part by delivering to us a duly executed exercise notice

accompanied by payment in full for the number of shares of our common stock purchased upon such exercise (except in the case of

a cashless exercise as discussed below). Unless otherwise specified in the Investor Warrant, the holder does not have the right

to exercise any portion of the Investor Warrant if the holder (together with its affiliates) would beneficially own in excess of

4.99% of the number of shares of our common stock outstanding immediately after giving effect to the exercise, as such percentage

ownership is determined in accordance with the terms of the Investor Warrants.

Cashless Exercise.

In the event that a registration

statement covering shares of common stock underlying the Investor Warrants, or an exemption from registration, is not available

for the resale of such shares of common stock underlying the Investor Warrants, the holder may, in its sole discretion, exercise

the Investor Warrant in whole or in part and, in lieu of making the cash payment otherwise contemplated to be made to us upon such

exercise in payment of the aggregate exercise price, elect instead to receive upon such exercise the net number of shares of common

stock determined according to the formula set forth in the Investor Warrant. In no event shall we be required to make any cash

payments or net cash settlement to the registered holder in lieu of issuance of common stock underlying the Investor Warrants.

Exercise Price.

The initial exercise price

per share of common stock purchasable upon exercise of the Investor Warrants is $4.50. The exercise price is subject to appropriate

adjustment in the event of certain stock dividends and distributions, stock splits, stock combinations, reclassifications or similar

events affecting our common stock and also upon any distributions of assets, including cash, stock or other property to our stockholders.

Certain Adjustments.

The exercise price and

the number of shares of common stock purchasable upon the exercise of the Investor Warrants are subject to adjustment upon the

occurrence of specific events, including stock dividends, stock splits, combinations and reclassifications of our common stock.

Transferability.

Subject to applicable laws,

the Investor Warrants may be transferred at the option of the holders upon surrender of the Investor Warrants to us together with

the appropriate instruments of transfer.

Warrant Agent and Exchange Listing.

The Investor

Warrants were issued in registered form under a warrant agency agreement between VStock Transfer, as warrant agent, and us.

Fundamental Transaction.

In the event of a

fundamental transaction, as described in the warrants and generally including any reorganization, recapitalization or reclassification

of our common stock, the sale, transfer or other disposition of all or substantially all of our properties or assets, our consolidation

or merger with or into another person, the acquisition of more than 50% of our outstanding common stock, or any person or group

becoming the beneficial owner of 50% of the voting power represented by our outstanding common stock, the holders of the warrants

will be entitled to receive upon exercise of the warrants the kind and amount of securities, cash or other property that the holders

would have received had they exercised the warrants immediately prior to such fundamental transaction.

Rights as a Stockholder.

Except as otherwise

provided in the Investor Warrants or by virtue of such holder’s ownership of shares of our common stock, the holder of a

warrant does not have the rights or privileges of a holder of our common stock, including any voting rights, until the holder exercises

the Investor Warrant.

Representative’s Warrants

The following summary of certain terms and provisions of

the Representative’s Warrants is not complete and is subject to, and qualified in its entirety by the provisions of the form

of the Representative’s Warrant, which is filed as an exhibit to the registration statement of which this prospectus is a

part. Prospective investors should carefully review the terms and provisions set forth in the form of representative’s warrant,

which is an exhibit to the registration statement of which this prospectus forms a part.

Exercisability

. The Representative’s

Warrants were exercisable as of September 3, 2016 and at any time up to the date that is five years from the closing of the offering.

The Representative’s Warrants are exercisable, at the option of the holder, in whole or in part by delivering to us a duly

executed exercise notice accompanied by payment in full for the number of shares of our common stock purchased upon such exercise

(except in the case of a cashless exercise as discussed below).

Cashless Exercise.

In the event that a registration

statement covering shares of common stock underlying the Representative’s Warrants, or an exemption from registration, is

not available for the resale of such shares of common stock underlying the Representative’s Warrants, the holder may, in

its sole discretion, exercise the Representative’s Warrant in whole or in part and, in lieu of making the cash payment otherwise

contemplated to be made to us upon such exercise in payment of the aggregate exercise price, elect instead to receive upon such

exercise the net number of shares of common stock determined according to the formula set forth in the Representative’s Warrant.

In no event shall we be required to make any cash payments or net cash settlement to the registered holder in lieu of issuance

of common stock underlying the Representative’s Warrants.

Exercise Price.

The initial exercise price

per share of common stock purchasable upon exercise of the Representative’s Warrants is $5.625. The exercise price is subject

to appropriate adjustment in the event of certain stock dividends and distributions, stock splits, stock combinations, reclassifications

or similar events affecting our common stock and also upon any distributions of assets, including cash, stock or other property

to our stockholders.

Certain Adjustments.

The exercise price and

the number of shares of common stock purchasable upon the exercise of the Representative’s Warrants are subject to adjustment

upon the occurrence of specific events, including stock dividends, stock splits, combinations and reclassifications of our common

stock.

Transferability.

Subject to applicable laws,

the Representative’s Warrants may be transferred at the option of the holder upon surrender of the Representative’s

Warrants to us together with the appropriate instruments of transfer.

Registration Rights

. The Representative’s Warrants

provide for demand and piggyback registration rights upon request, in certain cases. We will bear all fees and expenses attendant

to registering the securities issuable on exercise of the Representative’s Warrants other than underwriting commissions incurred

and payable by the holder.

Preferred Stock

Our certificate of incorporation, as amended, provides that

our board of directors is authorized to provide for the issuance of shares of preferred stock in one or more series and, by filing

a certificate of designations pursuant to the applicable law of the State of Delaware, to establish from time to time for each

such series the number of shares to be included in each such series and to fix the designations, powers, rights and preferences

of the shares of each such series, and the qualifications, limitations and restrictions thereof. The authority of the board of

directors with respect to each series of preferred stock includes, but is not limited to, determination of the following:

|

|

•

|

the distinctive designation of such class or series and the number of shares to constitute such class or series;

|

|

|

|

|

|

|

•

|

the rate at which dividends on the shares of such class or series shall be declared and paid or set aside for payment, whether dividends at the rate so determined shall be cumulative or accruing, and whether the shares of such class or series shall be entitled to any participating or other dividends in addition to dividends at the rate so determined, and if so, on what terms;

|

|

|

|

|

|

|

•

|

the right or obligation, if any, of the Company to redeem shares of the particular class or series of preferred stock and, if redeemable, the price, terms and manner of such redemption;

|

|

|

|

|

|

|

•

|

the special and relative rights and preferences, if any, and the amount or amounts per share, which the shares of such class or series of preferred stock shall be entitled to receive upon any voluntary or involuntary liquidation, dissolution or winding up of the Company;

|

|

|

|

|

|

|

•

|

the terms and conditions, if any, upon which shares of such class or series shall be convertible into, or exchangeable for, shares of capital stock of any other class or series, including the price or prices or the rate or rates of conversion or exchange and the terms of adjustment, if any;

|

|

|

|

|

|

|

•

|

the obligation, if any, of the Company to retire, redeem or purchase shares of such class or series pursuant to a sinking fund or fund of a similar nature or otherwise, and the terms and conditions of such obligations;

|

|

|

|

|

|

|

•

|

voting rights, if any, on the issuance of additional shares of such class or series or any shares of any other class or series of preferred stock;

|

|

|

|

|

|

|

•

|

limitations, if any, on the issuance of additional shares of such class or series or any shares of any other class or series of preferred stock;

|

|

|

|

|

|

|

•

|

such other preferences, powers, qualifications, special or relative rights and privileges as the board of directors may deem advisable and are not inconsistent with the law and the provisions of our certificate of incorporation, as amended.

|

Stock Options

As of July 13, 2017, we had options outstanding

pursuant to our Amended and Restated 2012 Equity Incentive Plan that are exercisable for an aggregate of 1,264,424 shares of

common stock at a weighted average exercise price of $6.19 per share and 73,522 shares of our common stock issuable upon

exercise of outstanding non-plan stock options at a weighted average exercise price of $32.34 per share.

Other Warrants

As of the date of this prospectus, other than the

Investor Warrants and the Representative’s Warrants, we have an aggregate of 5,750,869 shares of our common stock

issuable upon exercise of outstanding warrants at a weighted average exercise price of $4.69 per share

Anti-Takeover Provisions

Delaware Law

We are subject to Section 203 of the General Corporation Law

of the State of Delaware, or DGCL. This provision generally prohibits a Delaware corporation from engaging in any business combination

with any interested stockholder for a period of three years following the date the stockholder became an interested stockholder,

unless:

|

|

•

|

prior to such date, the board of directors approved either the business combination or the transaction that resulted in the stockholder becoming an interested stockholder;

|

|

|

|

|

|

|

•

|

upon consummation of the transaction that resulted in the stockholder becoming an interested stockholder, the interested stockholder owned at least 85% of the voting stock of the corporation outstanding at the time the transaction commenced, excluding for purposes of determining the number of shares outstanding those shares owned by persons who are directors and also officers and by employee stock plans in which employee participants do not have the right to determine confidentially whether shares held subject to the plan will be tendered in a tender or exchange offer; or

|

|

|

|

|

|

|

•

|

on or subsequent to such date, the business combination is approved by the board of directors and authorized at an annual meeting or special meeting of stockholders and not by written consent, by the affirmative vote of at least 66 2/3% of the outstanding voting stock that is not owned by the interested stockholder.

|

Section 203 defines a business combination to include:

|

|

•

|

any merger or consolidation involving the corporation and the interested stockholder;

|

|

|

|

|

|

|

•

|

any sale, transfer, pledge or other disposition of 10% or more of the assets of the corporation involving the interested stockholder;

|

|

|

|

|

|

|

•

|

subject to certain exceptions, any transaction that results in the issuance or transfer by the corporation of any stock of the corporation to the interested stockholder;

|

|

|

|

|

|

|

•

|

any transaction involving the corporation that has the effect of increasing the proportionate share of the stock of any class or series of the corporation beneficially owned by the interested stockholder; or

|

|

|

|

|

|

|

•

|

the receipt by the interested stockholder of the benefit of any loans, advances, guarantees, pledges or other financial benefits provided by or through the corporation.

|

In general, Section 203 defines an “interested stockholder”

as any entity or person beneficially owning 15% or more of the outstanding voting stock of a corporation, or an affiliate or associate

of the corporation and was the owner of 15% or more of the outstanding voting stock of a corporation at any time within three years

prior to the time of determination of interested stockholder status; and any entity or person affiliated with or controlling or

controlled by such entity or person.

Section 214 of the DGCL provides that stockholders are denied

the right to cumulate votes in the election of directors unless our certificate of incorporation, as amended, provides otherwise.

Our certificate of incorporation, as amended, does not provide for cumulative voting. These statutory provisions could delay or

frustrate the removal of incumbent directors or a change in control of our company. They could also discourage, impede, or prevent

a merger, tender offer, or proxy contest, even if such event would be favorable to the interests of stockholders.

Authorized but Unissued Shares

Our authorized but unissued shares of common stock will be available

for future issuance without stockholder approval. We may use additional shares of common stock for a variety of purposes, including

future offerings to raise additional capital or as compensation to third party service providers. The existence of authorized but

unissued shares of common stock could render more difficult or discourage an attempt to obtain control of us by means of a proxy

contest, tender offer, merger or otherwise.

Transfer Agent and Registrar

VStock Transfer, LLC is the transfer agent and registrar for

our common stock and the Investor Warrants.

Listing

Our common stock and the Investor Warrants are currently listed

on The NASDAQ Capital Market under the symbols “DRIO” and “DRIOW”, respectively.

PLAN OF DISTRIBUTION

We will deliver shares of our common stock upon exercise

of the Warrants. As of July 13, 2017, the Warrants were exercisable for a total of 1,671,666 shares of our common stock. The

shares of common stock will be issued in accordance with the terms of the Investor Warrants and Representative’s Warrants,

as applicable. For more information about the Investor Warrants and the Representative’s Warrants, please see the sections

above titled “Description of Capital Stock — Investor Warrants” and “Description of Capital Stock —

Representative’s Warrants,” respectively.

LEGAL MATTERS

The validity of the common stock offered hereby was passed upon

for us by Zysman, Aharoni, Gayer and Sullivan & Worcester LLP, New York, New York.

EXPERTS

The consolidated financial statements of DarioHealth Corp. at

December 31, 2016 and 2015, and for each of the two years in the period ended December 31, 2016, incorporated by reference in this

prospectus have been audited by Kost Forer Gabbay & Kasierer, a member of Ernst & Young Global, independent registered

public accounting firm, as set forth in their report thereon (which contains an explanatory paragraph describing conditions that

raise substantial doubt about our ability to continue as a going concern as described in the consolidated financial statements)

and are incorporated in reliance upon such report given on the authority of such firm as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

We have filed with the Securities and Exchange Commission, or

SEC, a registration statement on Form S-1, of which this prospectus forms a part, including exhibits and schedules, under the Securities

Act of 1933, as amended, or the Securities Act, with respect to the securities to be sold in this offering. This prospectus does

not contain all the information contained in the registration statement. For further information with respect to us and the securities

to be sold in this offering, we refer you to the registration statement and the exhibits and schedules attached to the registration

statement. Statements contained in this prospectus as to the contents of any contract, agreement or other document referred to

are not necessarily complete. When we make such statements, we refer you to the copies of the contracts or documents that are filed

as exhibits to the registration statement because those statements are qualified in all respects by reference to those exhibits.

You can read our SEC filings, including the registration statement,

at the SEC’s website at

www.sec.gov.

You may also read and copy any document we file with the SEC at its public reference

facility at 100 F Street, N.E., Washington, D.C. 20549, on official business days during the hours of 10:00 am to 3:00 pm.

You may also obtain copies of the documents at prescribed rates

by writing to the Public Reference Section of the SEC at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330

for further information on the operation of the public reference facility.

INFORMATION INCORPORATED BY REFERENCE

The SEC allows us to “incorporate

by reference” information into this document. This means that we can disclose important information to you by referring you

to another document filed separately with the SEC. The information incorporated by reference is considered to be a part of this

document, except for any information superseded by information that is included directly in this document.

This prospectus incorporates by reference

the documents listed below:

We have filed or may file the following

documents with the SEC. These documents are incorporated herein by reference as of their respective dates of filing:

|

|

(1)

|

Our Annual Report on Form 10-K for the fiscal year ended December 31, 2016, as filed with the SEC on March 22, 2017;

|

|

|

|

|

|

|

(2)

|

Our Quarterly Report on Form 10-Q for the period ended March 31, 2017, as filed with the SEC on May 15, 2017;

|

|

|

(3)

|

Our Current Reports on Form 8-K, as filed with the SEC on January 12, 2017, March 2, 2017, March 10, 2017 and March 31, 2017;

|

|

|

|

|

|

|

(4)

|

Our Registration Statement on Form S-1 filed with the SEC on January 15, 2016 (Registration No. 333-209002), as amended on February 17, 2016, February 26, 2016 and March 3, 2016 and as declared effective by the SEC on March 3, 2016; and

|

|

|

(5)

|

The description of our common stock contained in our Registration Statement on Form 8-A filed with the SEC on February 25, 2016, including any amendments and reports filed for the purpose of updating such description.

|

All documents filed by us pursuant to Section

13(a), 13(c), 14 or 15(d) of the Exchange Act (1) after the date of the filing of the registration statement of which this prospectus

forms a part and prior to its effectiveness and (2) until all of the common stock to which this prospectus relates has been sold

or the offering is otherwise terminated, except in each case for information contained in any such filing where we indicate that

such information is being furnished and is not to be considered “filed” under the Exchange Act, will be deemed to be

incorporated by reference in this prospectus and any accompanying prospectus supplement and to be a part hereof from the date of

filing of such documents.

We will provide a copy of the documents

we incorporate by reference, at no cost, to any person who receives this prospectus. To request a copy of any or all of these documents,

you should write or telephone us at 9 Halamish Street, Caesarea Industrial Park, 3088900, Israel, Attention: Controller, +(972)-(4)

770-4055.

1,671,666 Shares of Common Stock

Issuable Upon the Exercise of Warrants

![[GRAPHIC MISSING]](http://content.edgar-online.com/edgar_conv_img/2017/07/13/0001144204-17-036717_IMAGE_002.JPG)

PROSPECTUS

July 13, 2017

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 13. Other Expenses of Issuance and Distribution.

The following table sets forth the various expenses which will

be paid by the Registrant in connection with the issuance and distribution of the securities being registered.

|

|

|

Amount

|

|

|

SEC registration fee

|

|

$

|

0

|

|

|

Printing expenses

|

|

|

0

|

|

|

Legal fees and expenses

|

|

|

4,500

|

|

|

Accounting fees and expenses

|

|

|

8,000

|

|

|

Miscellaneous

|

|

|

500

|

|

|

Total

|

|

$

|

13,000

|

|

Item 14. Indemnification of Directors and Officers.

Delaware law generally permits the Registrant to indemnify its

directors, officers, employees and agents. A Delaware corporation may indemnify any person who was or is a party or

is threatened to be made a party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative

or investigative (other than an action by or in the right of the corporation) by reason of the fact that the person is or was a

director, officer, employee or agent of the corporation, or is or was serving at the request of the corporation as a director,

officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise, against expenses (including

attorneys’ fees), judgments, fines and amounts paid in settlement actually and reasonably incurred by the person in connection

with such action, suit or proceeding if the person acted in good faith and in a manner the person reasonably believed to be in

or not opposed to the best interests of the corporation, and, with respect to any criminal action or proceeding, had no reasonable

cause to believe the person’s conduct was unlawful. With respect to actions by or in the right of the corporation, no indemnification

shall be made with respect to any claim, issue or matter as to which such person shall have been adjudged to be liable to the corporation

unless and only to the extent that the Court of Chancery or the court in which such action or suit is brought shall determine upon

application that, despite the adjudication of liability but in view of all the circumstances of the case, such person is fairly

and reasonably entitled to indemnity for such expenses which such court shall deem proper. To the extent that a former

or present director or officer is successful, on the merits or otherwise, in defense of any action, suit, or proceeding subject

to the Delaware corporate statute’s indemnification provisions, or in defense of any claim, issue or matter therein, such

person shall be indemnified against expenses (including attorneys’ fees) actually and reasonably incurred by such person

in connection therewith.

Delaware law provides that expenses incurred by an officer or

director in defending any civil, criminal, administrative or investigative action, suit or proceeding may be paid by the corporation

in advance of the final disposition of the action, suit or proceeding upon receipt of an undertaking by or on behalf of the director

or officer to repay the amount if it is ultimately determined that he or she is not entitled to be indemnified by the corporation. A

Delaware corporation has the discretion to decide whether or not to advance expenses, unless provided otherwise in its certificate

of incorporation or by-laws.

The Registrant’s Amended and Restated Bylaws provide that it shall indemnify its directors and officers to the fullest extent

authorized under Delaware law, and that the Registrant will advance expenses to any officer or director in advance of the final

disposition of the proceeding upon receipt of an undertaking by or on behalf of the director or officer to repay the amount if

it is ultimately determined that he or she is not entitled to be indemnified by the Registrant.

Item 15. Recent Sales of Unregistered Securities

During the past three years, the following securities were sold

by the Company without registration under the Securities Act. All certificates representing the securities described herein and

currently outstanding have been appropriately legended. Unless otherwise set forth below, the securities described below were exempt

from registration under the Securities Act in reliance upon Section 4(a)(2), Regulation D of the Securities Act and/or pursuant

to Regulation S of the Securities Act to non-U.S. investors. There were no underwriters employed in connection with any of the

transactions set forth in this Item 15.

As of June 30, 2017, we issued an aggregate of

45,127 shares of our common stock and options to purchase up to 158,142 shares of our common stock to service providers, all

in lieu of cash payments for services rendered during the three month period ended June 30, 2017 under our 2012

Equity Incentive Plan.

On June 22, 2016, we entered into a public relation services

agreement with 5W Public Relations, LLC, or the Service Provider, which was amended on October 26, 2016, collectively referred

to as the Service Provider Agreement. Pursuant to the Service Provider Agreement, we have the right, at our sole discretion, to

issue shares of common stock in lieu of cash consideration. On January 26, 2017, we issued 6,553 shares of our common stock to

the Service Provider, in lieu of cash consideration, pursuant to our Amended and Restated 2012 Equity Incentive Plan.

On January 9, 2017, we commenced a private placement offering

of up to $5,100,000 consisting of up to 1,821,437 shares of common stock and warrants to purchase up to 1,821,437 shares of common

stock. The warrants are exercisable after the six month anniversary of each respective closing and will expire on the 5 year anniversary

of their issuance. On January 9, 2017, we held the initial closing of the offering with a lead investor and an additional investor

and issued and sold 1,113,922 shares of common stock and warrants to purchase 1,113,922 shares of common stock for aggregate gross

proceeds of approximately $3,100,000. On January 11, 2017, we entered into securities purchase agreements with 18 investors for

the future issuance and sale of 707,515 shares of common stock and warrants to purchase 707,515 shares of common stock, provided

that the issuance and sale of such securities shall only occur upon our obtaining stockholder approval, pursuant to Nasdaq rules.

On March 9, 2017, following receipt of stockholder approval, we issued and sold 707,515 shares of common stock and warrants to

purchase 707,515 shares of common stock to the 18 investors.

As of September 30, 2016, we issued an aggregate of 6,558 shares

of our common stock to our U.S. directors pursuant to our Shares for Salary Program, in lieu of cash payments due for services

rendered during the three month period ended June 30, 2016.

On August 10, 2016, we entered into an agreement (the “Agreement”)

with Dicilyon Consulting and Investment Ltd., an existing stockholder (the “Stockholder”), and David Edery, who previously

purchased certain securities from us, which were granted certain registration rights which required, among other things, the continued

effectiveness of certain registration statements. In consideration of the Stockholder waiving its registration rights with respect

to certain previously purchased securities, we agreed to issue to the Stockholder a warrant to purchase 300,000 shares of common

stock at an exercise price of $4.50 per share exercisable for a period of 4.5 years from the date of the Agreement. In addition,

we have also agreed to register the shares of common Stock underlying the warrant. The warrant is exercisable for cash or on a

cashless basis if a registration statement covering the shares issuable upon exercise of the Warrants is unavailable.

As of March 31, 2016, we issued an aggregate of 29,849 shares

of our common stock to certain officers and directors under our 2012 Equity Incentive Plan as equity compensation and we also issued

an aggregate of 5,556 shares of our common stock to a service provider in consideration for services provided to us.

In March 2016 we issued to the holders of the then currently

outstanding 1,984 shares of our Series A Convertible Preferred Stock, 623,672 shares of our common stock, reflecting an increase

of 25% in the original number of shares of common stock issuable upon conversion of the Series A Convertible Preferred Stock. The

increase of 25% in the original number of shares of common stock issued to holders of the Series A Convertible Preferred Stock

was a change in the conversion terms.

On March 3, 2016, concurrent with a public offering, we entered

into securities purchase agreements (the “Securities Purchase Agreements”) with certain existing shareholders (the

“Investors”) with respect to the sale in a private placement (the “Private Offering”) of 555,555 of our

units (the “Units”). The purchase price per Unit was $4.50 and the total consideration amounted to $2,500, net of issuance

costs. Each Unit sold in the Private Offering was comprised of (i) one share of common stock and (ii) one warrant to purchase 1.2

shares of common stock (the “2016 Series A Warrant”) which was immediately exercisable at an exercise price of $4.50

per share of Common Stock and expires 5 years from the date of issuance. In total, in the Private Offering, we issued 555,555 shares

of common stock and 2016 Series A Warrants exercisable for an aggregate of 666,666 shares of common stock. The 2016 Series A Warrants

are exercisable for cash or on a cashless basis if no registration statement covering the resale of the shares issuable upon exercise

of the 2016 Series A Warrants is available.

In connection with the Private Offering, we agreed to issue

to two non-U.S. finders an aggregate of 44,444 restricted shares of common stock, 73,333 warrants to purchase common stock at an

exercise price of $4.50 per share which expire 5 years from the date of issuance, and 38,889 non-plan stock options which have

an exercise price of $0.0001 per share and are fully vested and exercisable after the lapse of four months from the grant date.

The aforementioned public offering and Private Offering triggered

the anti-dilution mechanism of the warrants issued in a private placement conducted in 2011 and 2012 by adjusting the current exercise

price of the warrants for the investors and placement agent to $3.59 per share and an additional 415,316 and 78,662 shares became

subject to such warrants, respectively. In addition, the exercise price of the placement agent's warrants in the private placement

conducted in 2011 and 2012, was adjusted to $3.33 per share and an additional 48,054 warrants were issued.

On December 24, 2015, we consummated a private placement pursuant

to which we issued 81,122 shares of common stock and a warrant exercisable for an aggregate of 81,122 shares of common stock for

an aggregate gross consideration of approximately $0.5 million. The warrant is immediately exercisable at an exercise price of

$6.16 per share and expires 6 months from the date of the closing.

On November 19, 2015, we closed on the sale of 424,919 units

to certain existing shareholders and private investors in connection with a private placement offering pursuant to a definitive

securities purchase agreement for total gross proceeds of approximately $2.3 million. The purchase price per unit was $5.40. We

issued 424,919 shares of common stock and warrants exercisable for an aggregate of 424,919 shares of common stock, consisting of

Series A warrants and Series B warrants. The Series A warrants are immediately exercisable for 0.7 shares of common stock at an

exercise price of $6.66 per share and expire 16 months from the date of the closing. The Series B warrants are immediately exercisable

for 0.3 shares of common stock at an exercise price of $7.74 per share and expire 36 months from the date of the closing. The warrants

are exercisable for cash or on a cashless basis if no registration statement covering the resale of the shares issuable upon exercise

of the warrants is available.

In connection with the offering, we agreed to issue to certain

finders 21,304 restricted shares of common stock and 45,729 warrants to purchase shares of common stock as follows: (a) a warrant

to purchase 0.7 shares of common stock which is immediately exercisable at an exercise price of $6.66 per share and expires 16

months from the date of the closing and (b) a warrant to purchase 0.3 shares of common stock which is immediately exercisable at

an exercise price of $7.74 per share and expires 36 months from the date of the closing. In addition, the Company also issued to

a finder 24,424 non-plan stock options.

Commencing on October 27, 2015, we entered into warrant replacement

agreements with certain investors in our private placement transaction which closed in September 2014. The purpose of the warrant

replacement agreements was to induce the replacement of warrants issued in the September 2014 private placement to purchase up

to 296,775 shares of our common stock at an exercise price of $8.559 per share exercisable until September 23, 2018. The warrants

issued in the September 2014 private placement contain a net settlement cash feature and liquidated damages penalties and therefore

are accounted for as a liability in our financial statements which liability will end as a result of the replacement of the warrants.

In connection with the warrant replacement agreements, we issued replacement warrants to purchase up to 264,012 shares of common

stock at an exercise price of $8.559 per share, which replacement warrants are exercisable until September 23, 2018 and contain

a standard anti-dilution clause.

On July 23, 2015 and August 28, 2015, we closed on the sale

of 463,960 units to certain institutional and retail investors in connection with a private placement offering pursuant to a definitive

securities purchase agreement for total gross proceeds of approximately $2.5 million. The purchase price per unit was $5.40. We

issued an aggregate of 463,960 shares of common stock and warrants exercisable for an aggregate of 463,974 shares of common stock,

divided evenly between Series A Warrants and Series B Warrants.

The Series A Warrants are immediately exercisable at an exercise

price of $6.30 per share and expire 12 months from the date of the closing of the offering at which they were issued. The Series

B Warrants are immediately exercisable at an exercise price of $7.20 per share and expire 36 months from the date of the closing

of the offering at which they were issued. The warrants are exercisable for cash or on a cashless basis if a registration statement

covering the shares issuable upon exercise of the warrants is unavailable.

In total in connection with the offering, we agreed to issue

to a placement agent 2,778 restricted shares of common stock, and issue to the placement agent and to a selected dealer an aggregate

of 49,910 warrants. In addition, we agreed to issue to certain finders 13,630 restricted shares of common stock and 34,424 warrants

to purchase shares of common stock as follows: (a) a warrant to purchase 0.5 shares of common stock which is immediately exercisable

at an exercise price of $6.30 per share and expires 12 months from the date of issuance and (b) a warrant to purchase 0.5 shares

of common stock which is immediately exercisable at an exercise price of $7.20 per share and expires 36 months from the date of

issuance. In addition, the Company also issued to a finder 20,793 non-plan stock options.

We issued three types of placement agent warrants, of which

(i) the first will have an exercise price of $5.40 per share exercisable over a period of three years; (ii) the second will have

an exercise price of $6.30 per share, exercisable over a period of one year; and (iii) the third will have an exercise price of

$7.20 per share, exercisable over a period of three years. The placement agent warrants are exercisable for cash or on a cashless

basis and have similar registration rights as the shares but also include piggyback registration rights.

On May 15, 2015, we entered into warrant exercise and replacement

agreements with certain investors in our February 2015 Private Placement (as hereinafter defined). The purpose of the warrant replacement

agreements was to induce the exercise of the Series A Warrants issued in the February Private Placement, or the February 2015 Warrants,

into 106,881 shares of our common stock at an exercise price of $4.32 per share. In connection with the Exercise and Replacement

Agreements and the exercise of the February 2015 Warrants, we issued to the February 2015 Buyers additional warrants to purchase

an aggregate of 106,881 shares of our common stock at an exercise price of $4.32 per share.

On April 3, 2015 we approved the issuance of up to 22,224 shares

of common stock to a consultant, of which 22,224 shares of common stock were issued in equal 5,556 amounts on April 13, 2015, August

13, 2015, December 14, 2015 and January 27, 2016.

On February 25, 2015 and March 16, 2015, we entered into and

closed the transactions contemplated by a definitive securities purchase agreement with twenty institutional and accredited investors

memorializing a private placement offering in which we raised approximately $2 million in gross proceeds (the “February 2015

Private Placement”). In such transactions, we issued an aggregate of (i) 627,035 shares of common stock (ii) 156,769 shares

of common stock underlying Series A Warrants and (iii) 156,769 shares of common stock underlying Series B Warrants. The purchase

price per unit was $3.24.

The Series A Warrants are immediately exercisable at an exercise

price of $4.32 per share and expire 9 months from the second closing of the Offering. The Series B Warrants are immediately exercisable

at an exercise price of $5.40 per share and expire 36 months from the second closing of the February 2015 Private Placement. The

units detached immediately upon sale and are not separate securities of the company, and the warrants were aggregated into a single

Series A Warrant and Series B Warrant for each buyer based on their total investment in the February 2015 Private Placement. The

Series B Warrants will be callable by us for nominal consideration in the event that the share price of our common stock trades

over $14.40 (adjusted for splits and the like) for 20 consecutive trading days. The Series B Warrants will otherwise be identical

to the Series A Warrants.

On August 15, 2014, we entered into separate amendment and exchange

agreements with each of the investors in the a private placement we consummated on February 18, 2014 (the “February 2014

Private Placement”). The purpose of the amendment and exchange agreements was to implement an exchange of the all of the

warrants issued in the February 2014 Private Placement for a number of shares of common stock in a transaction undertaken in reliance

upon the exemption from registration provided by Section 3(a)(9) of the Securities Act, which transaction also amended and eliminated

certain terms of the securities purchase agreement and registration rights agreement related to the February 2014 Private Placement

(including cash penalties that we had accrued under the February 2014 Private Placement agreements). Pursuant to such exchange,

all of the warrants issued in the February 2014 Private Placement were exchanged (and all such warrants were terminated) effective

as of August 22, 2014 in consideration of the issuance to the warrant holders of an aggregate of 600,353 shares of common stock,

which amount was determined pursuant to a formula set forth in the amendment and exchange agreements. Pursuant to the same formula,

the warrants issuable to Roth Capital were exchange for an aggregate of 8,407 shares of common stock.

On September 23, 2014, we entered into and closed the transactions

contemplated by a definitive securities purchase agreement with fourteen institutional and accredited investors memorializing a

private placement offering in which we raised approximately $4.2 million in gross proceeds (the” September 2014 Private Placement”).

In such transaction, we issued an aggregate of (i) 2,353 shares of our newly designated Series A Convertible Preferred Stock and

(ii) warrants to purchase shares of our common stock.

Pursuant to the Certificate of Designation of Preferences, Rights

and Limitations of the Series A Preferred Stock (the “Certificate of Designation”), the shares of Series A Preferred

Stock are convertible at any time into an aggregate of 593,546 shares of common stock based on a conversion price of $7.1352 per

share. Such conversion price is not subject to any future price-based anti-dilution adjustments but does carry customary stock-based

anti-dilution protection. Upon the written election of the holders of a majority of the outstanding Series A Preferred Stock, all

shares of Series A Preferred Stock shall convert into common stock. The holders of the Series A Preferred Stock shall vote on an

as converted basis with the holders of the common stock. The Series A Preferred Stock does not carry any fixed coupon or dividend

rights but does carry a liquidation preference for each purchaser equal to the investment made by such purchaser in the September

2014 Private Placement, and such liquidation preference applies in certain deemed liquidation events such as changes in control

of the company. In addition, the holders of Series A Preferred Stock are eligible to participate in dividends and other distributions

by the company on an as converted basis.

The warrants issued in the September 2014 Private Placement

are exercisable for an aggregate of 296,775 shares of common stock (or 50% warrant coverage) at a price of $8.559 per share. Such

exercise price is also not subject to any future price-based anti-dilution adjustments but does carry customary stock-based anti-dilution

protection. The holders of the warrants have the right to participate in dividends and other distributions of the company on an

as exercised basis. The warrants expire on September 23, 2018.

Item 16. Exhibits and Financial Statements Schedules.

The exhibits filed with this registration

statement are set forth on the “Exhibit Index” set forth elsewhere herein.

Item 17. Undertakings.

The undersigned registrant hereby undertakes:

(1) To file, during any period in which offers or sales are

being made, a post-effective amendment to this registration statement:

i. To include any prospectus required by

section 10(a)(3) of the Securities Act of 1933;

ii. To reflect in the prospectus any facts or events

arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually

or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding

the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would

not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be

reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume

and price represent no more than 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration

Fee” table in the effective registration statement.

iii. To include any material information with respect

to the plan of distribution not previously disclosed in the registration statement or any material change to such information in

the registration statement.

(2) That, for the purpose of determining

any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement

relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial

bona fide offering thereof.

(3) To remove from registration by means

of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(4) Insofar as indemnification for liabilities

arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the registrant pursuant

to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the Securities and Exchange Commission

such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable. In the event that a claim

for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director,

officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such

director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the

opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the

question whether such indemnification by it is against public policy as expressed in the Act and will be governed by the final

adjudication of such issue.

(5) Each prospectus filed pursuant to Rule 424(b) as part of

a registration statement relating to an offering, other than registration statements relying on Rule 430B or other than prospectuses

filed in reliance on Rule 430A, shall be deemed to be part of and included in the registration statement as of the date it is first

used after effectiveness. Provided, however, that no statement made in a registration statement or prospectus that is part of the

registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or

prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such first

use, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration

statement or made in any such document immediately prior to such date of first use.

(6) That, for the purpose of determining liability of the registrant

under the Securities Act of 1933 to any purchaser in the initial distribution of the securities: The undersigned registrant undertakes

that in a primary offering of securities of the undersigned registrant pursuant to this registration statement, regardless of the

underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means

of any of the following communications, the undersigned registrant will be a seller to the purchaser and will be considered to

offer or sell such securities to such purchaser:

i. Any preliminary prospectus or prospectus of the

undersigned registrant relating to the offering required to be filed pursuant to Rule 424;

ii. Any free writing prospectus relating to the offering

prepared by or on behalf of the undersigned registrant or used or referred to by the undersigned registrant;

iii. The portion of any other free writing prospectus

relating to the offering containing material information about the undersigned registrant or its securities provided by or on behalf

of the undersigned registrant; and

iv. Any other communication that is an offer in the

offering made by the undersigned registrant to the purchaser.

(7) For purposes of determining any liability under the Securities

Act of 1933, the information omitted from the form of prospectus filed as part of this registration statement in reliance upon

Rule 430A and contained in a form of prospectus filed by the registrant pursuant to Rule 424(b)(1) or (4) or 497(h) under the Securities

Act shall be deemed to be part of this registration statement as of the time it was declared effective.

(8) For the purposes of determining any liability under the

Securities Act of 1933, each post-effective amendment that contains a form of prospectus shall be deemed to be a new registration

statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the

initial bona fide offering thereof.

(9) That, for purposes of determining any liability under the

Securities Act of 1933, each filing of the registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Securities

Exchange Act of 1934 that is incorporated by reference in this registration statement shall be deemed to be a new registration

statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the

initial bona fide offering thereof.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933,

the Registrant has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized,

in Caesarea, Israel on the 13th day of July 2017.

|

|

DARIOHEALTH CORP.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Erez Raphael

|

|

|

|

|

Name:

|

Erez Raphael

|

|

|

|

|

Title:

|

Chairman and Chief Executive

Officer

|

|

Pursuant to the requirements of the Securities

Act of 1933, this registration statement has been signed below by the following persons in the capacities and on the dates indicated.

|

Person

|

|

Capacity

|

|

Date

|

|

|

|

|

|

|

|

/s/ Erez Raphael

|

|

Chairman and Chief Executive Officer

|

|

July 13,

2017

|