Prospectus Filed Pursuant to Rule 424(b)(2) (424b2)

July 13 2017 - 1:48PM

Edgar (US Regulatory)

Filed Pursuant to Rule 424(b)(2)

Registration No. 333-216286

The information in this preliminary Pricing Supplement is not complete and may be changed. This preliminary Pricing Supplement and the accompanying Prospectus Supplement and Prospectus are not an offer to sell these securities and we are not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

|

Subject to Completion, Dated July 13, 2017

Preliminary Pricing Supplement dated , 2017

(To Prospectus Supplement dated March 28, 2017

and Prospectus dated March 28, 2017)

|

|

Canadian Imperial Bank of Commerce

Senior Global Medium-Term Notes (Structured Notes)

$

Floored Floating Rate Notes due July 28, 2022

We, Canadian Imperial Bank of Commerce (the “Bank” or “CIBC”), are offering $ aggregate principal amount of our Floored Floating Rate Notes due July 28, 2022 (CUSIP 13605WEG2 / ISIN US13605WEG24) (the “Notes”). The Notes are senior unsecured debt securities of CIBC and will mature on July 28, 2022. The Notes will bear interest at a floating rate (the “Coupon Rate”) equal to three-month USD LIBOR, subject to a minimum Coupon Rate of 1.75% per annum,

reset on

January 28, April 28, July 28 and October 28 of each year (each, a “Coupon Reset Date”) with the first Coupon Rate set on July 28, 2017. There is no maximum Coupon Rate. Interest on the Notes will be payable quarterly in arrears on January 28, April 28, July 28 and October 28 of each year (each, a “Coupon Payment Date”), commencing on October 28, 2017.

The Notes will be issued in the denomination of $1,000 and integral multiples of $1,000 in excess thereof.

The Notes are a new issue of securities with no established trading market. We do not intend to list the Notes on any securities exchange or automated quotation system.

The Notes are unsecured obligations of CIBC and all payments on the Notes are subject to the credit risk of CIBC. The Notes will not constitute deposits insured by the Canada Deposit Insurance Corporation, the U.S. Federal Deposit Insurance Corporation or any other government agency or instrumentality of Canada, the United States or any other jurisdiction.

Neither the Securities and Exchange Commission (the “SEC”) nor any state or provincial securities commission has approved or disapproved of these Notes or determined if this Pricing Supplement or the accompanying Prospectus Supplement and Prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Investing in the Notes involves risks. See the “Additional Risk Factors” section in this Pricing Supplement and the “Risk Factors” Sections in the accompanying Prospectus Supplement and Prospectus.

CIBC World Markets Corp. or one of our other affiliates may use this Pricing Supplement in a market-making transaction in a Note after its initial sale. Unless we or our agent informs the purchaser otherwise in the confirmation of sale, this Pricing Supplement is being used in a market-making transaction.

|

|

Initial Issue Price

|

Price to Public

|

Agent’s Commission

(1)

|

Proceeds to Issuer

(1)(2)

|

|

Per Note

|

$1,000

|

100%

|

0.75%

|

99.25%

|

|

Total

|

$

|

$

|

$

|

$

|

(1)

[Because dealers who purchase the Notes for sale to certain fee-based advisory accounts may forgo some or all selling concessions, fees or commissions, the public offering price for investors purchasing the Notes in such fee-based advisory accounts may be between $992.50 and $1,000 per Note. Investors that hold their Notes in fee-based advisory or trust accounts may be charged fees by the investment advisor or manager of such account based on the amount of assets held in those accounts, including the Notes.]

(2)

CIBC World Markets Corp. will receive commissions from the Issuer of up to 0.75% of the principal amount of the Notes, or up to $7.50 per $1,000 principal amount. CIBC World Markets Corp. will use these commissions to pay variable selling concessions or fees (including custodial or clearing fees) to other dealers. The actual commission received by CIBC World Markets Corp. will be equal to the selling concession paid to such dealers. Dealers who purchase the Notes for sale to certain fee-based advisory accounts may forgo some or all selling concessions or fees or commissions, as described above. In such circumstances, CIBC World Markets Corp. will also forgo some or all commissions paid to it by the Issuer.

We will deliver the Notes in book-entry form through the facilities of The Depository Trust Company (“DTC”) on or about , 2017 against payment in immediately available funds.

CIBC World Markets

ABOUT THIS PRICING SUPPLEMENT

You should read this Pricing Supplement together with the Prospectus dated March 28, 2017 (the “Prospectus”) and the Prospectus Supplement dated March 28, 2017 (the “Prospectus Supplement”), relating to our Senior Global Medium-Term Notes (Structured Notes), of which these Notes are a part, for additional information about the Notes. Information in this Pricing Supplement supersedes information in the Prospectus Supplement and Prospectus to the extent it is different from that information. Certain defined terms used but not defined herein have the meanings set forth in the Prospectus Supplement or the Prospectus.

You should rely only on the information contained in or incorporated by reference in this Pricing Supplement, the accompanying Prospectus Supplement and the accompanying Prospectus. This Pricing Supplement may be used only for the purpose for which it has been prepared. No one is authorized to give information other than that contained in this Pricing Supplement, the accompanying Prospectus Supplement and the accompanying Prospectus, in the documents referred to in this Pricing Supplement, the accompanying Prospectus Supplement and the accompanying Prospectus and which are made available to the public. We have not, and CIBC World Markets Corp. (“CIBCWM”) has not, authorized any other person to provide you with different or additional information. If anyone provides you with different or additional information, you should not rely on it.

We are not, and CIBCWM is not, making an offer to sell the Notes in any jurisdiction where the offer or sale is not permitted. You should not assume that the information contained in or incorporated by reference in this Pricing Supplement, the accompanying Prospectus Supplement or the accompanying Prospectus is accurate as of any date other than the date of the applicable document. Our business, financial condition, results of operations and prospects may have changed since that date. Neither this Pricing Supplement, nor the accompanying Prospectus Supplement, nor the accompanying Prospectus constitutes an offer, or an invitation on our behalf or on behalf of CIBCWM, to subscribe for and purchase any of the Notes and may not be used for or in connection with an offer or solicitation by anyone in any jurisdiction in which such an offer or solicitation is not authorized or to any person to whom it is unlawful to make such an offer or solicitation.

References to “CIBC,” “the Issuer,” “the Bank,” “we,” “us” and “our” in this Pricing Supplement are references to Canadian Imperial Bank of Commerce and not to any of our subsidiaries, unless we state otherwise or the context otherwise requires.

You may access the accompanying Prospectus Supplement and the accompanying Prospectus on the SEC website www.sec.gov as follows (or if such address has changed, by reviewing our filing for the relevant date on the SEC website):

·

Prospectus Supplement dated March 28, 2017 and Prospectus dated March 28, 2017 filed with the SEC on March 28, 2017:

https://www.sec.gov/Archives/edgar/data/1045520/000110465917019619/a17-8647_1424b3.htm

PRS-

1

The information in this “Summary” section is qualified by the more detailed information set forth in this Pricing Supplement, the accompanying Prospectus Supplement dated March 28, 2017 and the accompanying Prospectus dated March 28, 2017, each filed with the SEC. See “About This Pricing Supplement” in this Pricing Supplement.

|

Issuer:

|

Canadian Imperial Bank of Commerce (the “Issuer” or the “Bank”)

|

|

|

|

|

Type of Note:

|

Floored Floating Rate Notes due July 28, 2022

|

|

|

|

|

CUSIP/ISIN:

|

CUSIP: 13605WEG2 / ISIN: US13605WEG24

|

|

|

|

|

Minimum Investment:

|

$1,000 (one Note)

|

|

|

|

|

Denominations:

|

$1,000 and integral multiples of $1,000 in excess thereof.

|

|

|

|

|

Principal Amount:

|

$1,000 per Note

|

|

|

|

|

Aggregate Principal Amount of Notes:

|

$

|

|

|

|

|

Currency:

|

U.S. Dollars

|

|

|

|

|

Trade Date:

|

Expected to be July 25, 2017

|

|

|

|

|

Original Issue Date:

|

Expected to be July 28, 2017 (to be determined on the Trade Date and expected to be the 3rd scheduled Business Day after the Trade Date).

|

|

|

|

|

Maturity Date:

|

Expected to be July 28, 2022.

|

|

|

|

|

Business Day:

|

A Monday, Tuesday, Wednesday, Thursday or Friday that is neither a legal holiday nor a day on which banking institutions are authorized or obligated by law, regulation or order to close in New York or Toronto.

|

|

|

|

|

London Banking Day:

|

A London Banking Day is a day on which dealings in deposits in U.S. dollars are transacted in the London interbank market.

|

|

|

|

|

Coupon Payment:

|

The interest rate on the Notes for a particular Coupon Period will be a per annum rate equal to three-month USD LIBOR as determined on the applicable Coupon Determination Date subject to a minimum Coupon Rate of 1.75% per annum. There is no maximum Coupon Rate per annum. The Coupon Determination Date for a Coupon Period will be the second London Banking Day preceding the first day of such Coupon Period. The amount of accrued interest that we will pay for any Coupon Period can be calculated by multiplying the face amount of the Notes then outstanding by an accrued interest factor. This accrued interest factor is computed by adding the interest factor for each day from the Original Issue Date, or from the last date interest was paid on the Notes, to the date for which accrued interest is being calculated. The interest factor for each day is computed by dividing the interest rate applicable to that day by 360.

|

PRS-

2

|

Coupon Period:

|

Interest on the Notes will be paid to but excluding the relevant Coupon Payment Date. Interest on the Notes will accrue from and including the Original Issue Date, to but excluding the first Coupon Payment Date and then from and including the immediately preceding Coupon Payment Date to which interest has been paid or duly provided for to but excluding the next Coupon Payment Date or Maturity Date, as the case may be. We refer to each of these periods as a “Coupon Period.” If a Coupon Payment Date falls on a day that is not a Business Day, the Coupon Payment Date will be postponed to the next succeeding Business Day unless such next succeeding Business Day would be in the following month, in which case, the Coupon Payment Date will be the immediately preceding Business Day.

|

|

|

|

|

Coupon Rate:

|

3-month USD LIBOR Rate, subject to a minimum Coupon Rate of 1.75% per annum,

reset on January 28, April 28, July 28 and October 28 of each year (each, a “Coupon Reset Date”) with the first Coupon Reset Day being July 28, 2017. If a Coupon Reset Date falls on a day that is not a Business Day, the Coupon Reset Date will be postponed to the next succeeding Business Day unless such next succeeding Business Day would be in the following month, in which case, the Coupon Reset Date will be the immediately preceding Business Day. There is no maximum Coupon Rate per annum.

|

|

|

|

|

Reference Rate:

|

3 Month USD LIBOR Rate, determined as follows: o

n any Coupon Determination Date, LIBOR will be equal to the offered rate for deposits in U.S. dollars having an index maturity of three months, in amounts of at least US$1,000,000, as such rate appears on Bloomberg L.P. page “BBAM.” If no offered rate appears on Bloomberg L.P. page “BBAM” on a Coupon Determination Date at approximately 11:00 a.m., London time, then we will select four major banks in the London interbank market and will request each of their principal London offices to provide a quotation of the rate at which three-month deposits in U.S. dollars in amounts of at least US$1,000,000 are offered by it to prime banks in the London interbank market, on that date and at that time, that is representative of single transactions at that time, which such quotations we will promptly deliver to the calculation agent. If at least two quotations are provided, LIBOR will be the arithmetic average of the quotations provided. Otherwise, we will select three major banks in New York City and shall request each of them to provide a quotation of the rate offered by them at approximately 11:00 a.m., New York City time, on the Coupon Determination Date for loans in U.S. dollars to leading European banks having an index maturity of three months for the applicable Coupon Period in an amount of at least US$1,000,000 that is representative of single transactions at that time, which such quotations we will promptly deliver to the calculation agent. If three quotations are provided, LIBOR will be the arithmetic average of the quotations provided. Otherwise, the rate of LIBOR for the next Coupon Period will be set equal to the rate of LIBOR for the then current Coupon Period.

|

|

|

|

|

Coupon Payment Dates:

|

Expected to be each January 28, April 28, July 28 and October 28, commencing on October 28, 2017 and ending on the Maturity Date.

If these days are not Business Days,

the Coupon Payment Date will be postponed to the next succeeding Business Day unless such next succeeding Business Day would be in the following month, in which case, the Coupon Payment Date will be the immediately preceding business day.

|

|

|

|

|

Day Count Fraction:

|

Actual/360, adjusted, Modified Following Business Day Convention.

|

|

|

|

|

Calculation Agent:

|

Canadian Imperial Bank of Commerce. We may appoint a different calculation agent

|

PRS-

3

|

|

without your consent and without notifying you.

All determinations made by the Calculation Agent will be at its sole discretion and, in the absence of manifest error, will be conclusive for all purposes and binding on us and you. All percentages and other amounts resulting from any calculation with respect to the Notes will be rounded at the Calculation Agent’s discretion. The Calculation Agent will have no liability for its determinations.

|

|

|

|

|

Status:

|

The Notes will constitute direct, unsubordinated and unsecured obligations of the Bank ranking

pari passu

with all other direct, unsecured and unsubordinated indebtedness of the Bank from time to time outstanding (except as otherwise prescribed by law).

The Notes will not constitute deposits insured by the Canada Deposit Insurance Corporation, the U.S. Federal Deposit Insurance Corporation or any other government agency or instrumentality of Canada, the United States or any other jurisdiction.

|

|

|

|

|

Listing:

|

The Notes will not be listed on any securities exchange or quotation system.

|

|

|

|

|

Use of Proceeds:

|

General corporate purposes.

|

|

|

|

|

Certain U.S. Benefit Plan Investor Considerations:

|

For a discussion of benefit plan investor considerations, please see “Certain U.S. Benefit Plan Investor Considerations” in the accompanying Prospectus.

|

|

|

|

|

Clearance and Settlement:

|

We will issue the Notes in the form of a fully registered global note registered in the name of the nominee of DTC. Beneficial interests in the Notes will be represented through book-entry accounts of financial institutions acting on behalf of beneficial owners as direct and indirect participants in DTC. Except in the limited circumstances described in the accompanying Prospectus Supplement, owners of beneficial interests in the Notes will not be entitled to have Notes registered in their names, will not receive or be entitled to receive Notes in definitive form and will not be considered holders of Notes under the indenture.

|

|

|

|

|

Terms Incorporated:

|

All of the terms appearing under the caption “Description of the Notes We May Offer” beginning on page S-7 of the accompanying Prospectus Supplement, as modified by this Pricing Supplement.

|

ANY PAYMENT ON THE NOTES, INCLUDING ANY REPAYMENT OF PRINCIPAL, IS SUBJECT TO THE CREDITWORTHINESS OF THE BANK. IF THE BANK WERE TO DEFAULT ON ITS PAYMENT OBLIGATIONS YOU MAY NOT RECEIVE ANY AMOUNTS OWED TO YOU UNDER THE NOTES AND YOU COULD LOSE YOUR ENTIRE INVESTMENT.

PRS-

4

Historically, the Reference Rate has experienced significant fluctuations. Any historical upward or downward trend in the level of the Reference Rate during any period shown below is not an indication that the Coupon Payment payable on the Notes is more or less likely to increase or decrease at any time during the term of the Notes.

The Reference Rate was 1.30411% on July 10, 2017. The graph below sets forth the historical performance of the Reference Rate from July 10, 2007 through July 10, 2017.

PRS-

5

CERTAIN TERMS OF THE NOTES

Calculation Agent

The Bank or one of our affiliates will act as Calculation Agent for the Notes and may appoint agents to assist it in the performance of its duties. See “Additional Risk Factors—

Certain Business and Trading Activities May Create Conflicts with Your Interests and Could Potentially Adversely Affect the Value of the Notes” in this Pricing Supplement. We may appoint a different Calculation Agent without your consent and without notifying you.

All determinations made by the Calculation Agent will be at the sole discretion of the Calculation Agent and, in the absence of manifest error, will be conclusive for all purposes and binding on us and you. All percentages and other amounts resulting from any calculation with respect to the Notes will be rounded at the Calculation Agent’s sole discretion. The Calculation Agent will have no liability for its determinations.

Withholding

The Bank or the applicable paying agent will deduct or withhold from a payment on a Note any present or future tax, duty, assessment or other governmental charge that the Bank determines is required by law or the interpretation or administration thereof to be deducted or withheld. Payments on a Note will not be increased by any amount to offset such deduction or withholding.

PRS-

6

An investment in the Notes involves significant risks. In addition to the following risks included in this Pricing Supplement, we urge you to read “Risk Factors” beginning on page S-1 of the accompanying Prospectus Supplement and “Risk Factors” beginning on page 1 of the accompanying Prospectus.

You should understand the risks of investing in the Notes and should reach an investment decision only after careful consideration, with your advisers, of the suitability of the Notes in light of your particular financial circumstances and the information set forth in this Pricing Supplement and the accompanying Prospectus and the accompanying Prospectus Supplement.

Your Investment is Subject to the Credit Risk of the Bank.

The Notes are senior unsecured debt obligations of the Bank and are not, either directly or indirectly, an obligation of any third party. As further described in the accompanying Prospectus and the accompanying Prospectus Supplement, the Notes will rank on par with all of the other unsecured and unsubordinated debt obligations of the Bank, except such obligations as may be preferred by operation of law. Any payment to be made on the Notes, including the return of the Principal Amount at maturity, depends on the ability of the Bank to satisfy its obligations as they come due. As a result, the actual and perceived creditworthiness of the Bank may affect the market value of the Notes and, in the event the Bank were to default on its obligations, you may not receive the amounts owed to you under the terms of the Notes.

If we default on our obligations under the Notes, your investment would be at risk and you could lose some or all of your investment. See “Description of Senior Debt Securities – Events of Default” in the accompanying Prospectus.

The indenture does not contain any restrictions on our ability or the ability of any of our affiliates to sell, pledge or otherwise convey all or any securities. We and our affiliates will not pledge or otherwise hold any security for the benefit of holders of the Notes. Consequently, in the event of a bankruptcy, insolvency or liquidation involving us, any securities we hold as a hedge to the Notes will be subject to the claims of our creditors generally and will not be available specifically for the benefit of the holders of the Notes.

Certain Business and Trading Activities May Create Conflicts with Your Interests and Could Potentially Adversely Affect the Value of the Notes.

We, CIBCWM or one or more of our affiliates, may engage in trading and other business activities that are not for your account or on your behalf (such as holding or selling of the Notes for our proprietary account or effecting secondary market transactions in the Notes for other customers). These activities may present a conflict between your interest in the Notes and the interests we, CIBCWM or one or more of our affiliates, may have in our or their proprietary account. We, CIBCWM and our affiliates may engage in any such activities without regard to the Notes or the effect that such activities may directly or indirectly have on the value of the Notes.

In addition, the Bank will serve as calculation agent for the Notes and will have sole discretion in calculating the amounts payable in respect of the Notes. Exercising discretion in this manner could adversely affect the value of the Notes.

Increased Regulatory Oversight and Changes in the Method Pursuant to Which LIBOR is Determined May Adversely Affect the Value of the Notes.

Beginning in 2008, concerns were raised that some of the member banks surveyed by the British Bankers’ Association (the “BBA”) in connection with the calculation of LIBOR across a range of maturities and currencies may have been under-reporting or otherwise manipulating the inter-bank lending rate applicable to them. A number of BBA member banks have entered into settlements with their regulators and law enforcement agencies with respect to alleged manipulation of LIBOR, and investigations were instigated by regulators and governmental authorities in various jurisdictions. If manipulation of LIBOR or another inter-bank lending rate occurred, it may have resulted in that rate being artificially lower (or higher) than it otherwise would have been.

PRS-

7

In September 2012, the U.K. government published the results of its review of LIBOR (commonly referred to as the “Wheatley Review”). The Wheatley Review made a number of recommendations for changes with respect to LIBOR including the introduction of statutory regulation of LIBOR, the transfer of responsibility for LIBOR from the BBA to an independent administrator, changes to the method of compilation of lending rates and new regulatory oversight and enforcement mechanisms for rate-setting. Based on the Wheatley Review, final rules for the regulation and supervision of LIBOR by the Financial Conduct Authority (the “FCA”) were published and came into effect on April 2, 2013 (the “FCA Rules”). In particular, the FCA Rules include requirements that (1) an independent LIBOR administrator monitor and survey LIBOR submissions to identify breaches of practice standards and/or potentially manipulative behavior, and (2) firms submitting data to LIBOR establish and maintain a clear conflicts of interest policy and appropriate systems and controls. In addition, in response to the Wheatley Review recommendations, ICE Benchmark Administration Limited (the “ICE Administration”) has been appointed as the independent LIBOR administrator, effective February 1, 2014.

It is not possible to predict the effect of the FCA Rules, any changes in the methods pursuant to which LIBOR is determined and any other reforms to LIBOR that will be enacted in the U.K. and elsewhere, which may adversely affect the trading market for LIBOR-based securities. In addition, any changes announced by the FCA, the ICE Administration or any other successor governance or oversight body, or future changes adopted by such body, in the method pursuant to which LIBOR is determined may result in a sudden or prolonged increase or decrease in the reported LIBOR rates. If that were to occur, the level of the Coupon Rate on and the trading value of the Notes may be adversely affected. Further, uncertainty as to the extent and manner in which the Wheatley Review recommendations will continue to be adopted and implemented and the timing of such changes may adversely affect the current trading market for LIBOR-based securities and the value of the Notes.

The Notes Are Subject to Reference Rate Risk.

Because the Coupon Rate on the Notes is a floating rate, you will be exposed to risks not associated with a conventional fixed-rate debt instrument. These risks include fluctuation of the applicable Coupon Rate and the possibility that, for any given Coupon Period, you may receive a lesser Coupon Payment than for one or more prior Coupon Periods. We have no control over a number of matters that may affect interest rates, including economic, financial and political events that are important in determining the existence, magnitude and longevity of these risks and their results. In recent years, interest rates have been volatile, and volatility also could be characteristic of the future. It is possible that the Reference Rate could decline significantly, including to a rate equal to or less than zero. If the Reference Rate were to decline to a level such that the Reference Rate did not result in a rate greater than the minimum Coupon Rate for any Coupon Period, you would receive Coupon Payment based on the minimum Coupon Rate on the related Coupon Payment Date. In addition, the Coupon Rate for the Notes may be less than the floating rate payable on a similar note or other instrument of the same maturity issued by us or an issuer with the same or a comparable credit rating.

Historical Performance of the Reference Rate Should Not Be Taken As Any Indication Of The Future Performance Of the Reference Rate Over the Term Of the Notes.

The historical performance of the Reference Rate is not an indication of the future performance of the Reference Rate over the term of the Notes. Therefore, the performance of the Reference Rate over the term of the Notes may bear no relation or resemblance to the historical performance of the Reference Rate.

The Notes Will Not Be Listed On Any Securities Exchange Or Any Inter-Dealer Quotation System; There May Be No Secondary Market For The Notes; Potential Illiquidity Of The Secondary Market; Holding Of The Notes By

CIBCWM

Or Its Or Our Affiliates And Future Sales.

The Notes will be new securities for which there is no trading market. The Notes will not be listed on any organized securities exchange or any inter-dealer quotation system. We cannot assure you as to whether there will be a trading or secondary market for the Notes or, if there were to be such a trading or secondary market, that it would be liquid.

Under ordinary market conditions, CIBCWM or any of its affiliates may (but are not obligated to) make a secondary market for the Notes and may cease doing so at any time. Because we do not expect other broker-dealers to participate in the secondary market for the Notes, the price at which you may be able to trade your Notes is likely to depend on the price, if any, at which CIBCWM or any of its affiliates are willing to transact. If none of CIBCWM or

PRS-

8

any of its affiliates makes a market for the Notes, there will not be a secondary market for the Notes. Accordingly, we cannot assure you as to the development or liquidity of any secondary market for the Notes. If a secondary market in the Notes is not developed or maintained, you may not be able to sell your Notes easily or at prices that will provide you with a yield comparable to that of similar securities that have a liquid secondary market.

The Notes Are Not Insured By Any Third Parties.

The Notes will be solely our obligations. Neither the Notes nor your investment in the Notes are insured by the United States Federal Deposit Insurance Corporation, the Canada Deposit Insurance Corporation, the Bank Insurance Fund or any other government agency or instrumentality of the United States, Canada or any other jurisdiction.

PRS-

9

The net proceeds from the sale of the Notes will be used as described under “Use of Proceeds” in the accompanying Prospectus Supplement and the accompanying Prospectus.

PRS-

10

CERTAIN U.S. FEDERAL INCOME TAX CONSIDERATIONS

The following discussion supplements the discussion in the section called “Material Tax Consequences—United States Taxation” in the accompanying Prospectus, and is subject to the limitations and exceptions set forth therein. Capitalized terms used in this section without definition shall have the respective meanings given such terms in the accompanying Prospectus. This discussion is only applicable to you if you are a U.S. Holder. If you are not a U.S. Holder, please consult your own tax advisor.

The following summary describes certain U.S. federal income tax consequences relevant to the purchase, ownership, and disposition of the Notes. This discussion is based upon current provisions of the Code, existing and proposed Treasury Regulations thereunder, current administrative rulings, judicial decisions and other applicable authorities. All of the foregoing are subject to change, which change may apply retroactively and could affect the continued validity of this summary. This summary does not describe any tax consequences arising under the laws of any state, locality or taxing jurisdiction other than the U.S. federal government. This discussion also does not purport to be a complete analysis of all tax considerations relating to the Notes.

You should consult your tax advisor concerning the U.S. federal income tax and other tax consequences of your investment in the Notes in your particular circumstances, including the application of state, local or other tax laws and the possible effects of changes in federal or other tax laws.

U.S. Holders

Interest.

It is expected and this discussion assumes that either the issue price of the Notes will equal the stated principal amount of the Notes or the Notes will be issued with no more than a de minimis amount of original issue discount (“OID”). Interest paid to a U.S. Holder on a Note will be includible in the U.S. Holder’s gross income as ordinary interest income in accordance with its usual method of tax accounting. In addition, interest on the Notes will be treated as foreign source income for U.S. federal income tax purposes. Subject to certain conditions and limitations, non-U.S. taxes, if any, withheld on interest payments may be treated as non-U.S. taxes eligible for credit against a U.S. Holder’s U.S. federal income tax liability. The limitation on non-U.S. taxes eligible for the U.S. foreign tax credit is calculated separately with respect to specific “baskets” of income. Interest on the Notes generally will constitute “passive category income,” or, in the case of certain U.S. Holders, “general category income.” As an alternative to the tax credit, a U.S. Holder may elect to deduct such taxes (the election would then apply to all non-U.S. income taxes such U.S. Holder paid in that taxable year). The rules governing the U.S. foreign tax credit are complex. U.S. Holders are urged to consult their tax advisor regarding the availability of the U.S. foreign tax credit under their particular circumstances.

Sale, Exchange, Retirement or Other Disposition.

Upon the sale, exchange, retirement or other disposition of a Note, a U.S. Holder will recognize taxable gain or loss equal to the difference, if any, between the amount realized on the sale, exchange, retirement or other disposition, other than accrued but unpaid interest which will be taxable as interest, and such U.S. Holder’s adjusted tax basis in the Note. A U.S. Holder’s adjusted tax basis in a Note generally will equal the cost of the Note to such U.S. Holder, and any such gain or loss will generally be capital gain or loss. For a non-corporate U.S. Holder, under current law, the maximum marginal U.S. federal income tax rate applicable to the gain will be generally lower than the maximum marginal U.S. federal income tax rate applicable to ordinary income if the U.S. Holder’s holding period for the Notes exceeds one year (

i.e.

, such gain is long-term capital gain). Any gain or loss realized on the sale, exchange, retirement or other disposition of a Note generally will be treated as U.S. source gain or loss, as the case may be. Consequently, a U.S. Holder may not be able to claim a credit for any non-U.S. tax imposed upon a disposition of a Note. The deductibility of capital losses is subject to limitations.

A tax of 3.8% is also imposed on the “net investment income” of certain individuals, trusts and estates. Among other items, net investment income generally includes gross income from interest and net gain attributable to the disposition of certain property, including debt instruments, less certain deductions. U.S. Holders should consult their own tax advisors regarding the possible implications of this legislation in their particular circumstances.

You are urged to consult your tax advisors concerning the significance, and the potential impact, of the above considerations.

PRS-

11

Additional Information for U.S. Holders.

For the treatment regarding other aspects of interest payments and backup withholding and information reporting considerations please see the discussion under “Material Income Tax Consequences—United States Taxation” in the accompanying Prospectus.

PRS-

12

CERTAIN CANADIAN INCOME TAX CONSEQUENCES

The following is a summary of the principal Canadian federal income tax considerations generally applicable at the date hereof to a purchaser who acquires beneficial ownership of a Note pursuant to this Prospectus Supplement and who for the purposes of the

Income Tax Act

(Canada) and Regulations thereto (collectively, the “Act”) and at all relevant times: (a) is neither resident nor deemed to be resident in Canada; (b) deals at arm’s length with the Bank, and any transferee resident (or deemed to be resident) in Canada to whom the purchaser disposes of the Note; (c) does not use or hold and is not deemed to use or hold the Note in, or in the course of, carrying on a business in Canada; (d) is entitled to receive all payments (including any interest and principal) made on the Note, and (e) is not a, and deals at arm’s length with any, “specified shareholder” of the Bank for purposes of the thin capitalization rules in the Act (a “Non-Resident Holder”). A “specified shareholder” for these purposes generally includes a person who (either alone or together with persons with whom that person is not dealing at arm’s length for the purposes of the Act) owns or has the right to acquire or control or is otherwise deemed to own 25% or more of the Bank’s shares determined on a votes or fair market value basis. Special rules which apply to non-resident insurers carrying on business in Canada and elsewhere are not discussed in this summary.

This summary is based upon the current provisions of the Act and an understanding of the current administrative policies and assessing practices published in writing by the Canada Revenue Agency prior to the date hereof. This summary takes into account all specific proposals to amend the Act publicly announced by or on behalf of the Minister of Finance (Canada) prior to the date hereof (the “Proposals”) and assumes that all Proposals will be enacted in the form proposed. However, no assurance can be given that the Proposals will be enacted as proposed or at all. This summary does not otherwise take into account any changes in law or in administrative policies or assessing practices, whether by legislative, administrative or judicial action, nor does it take into account any provincial, territorial or foreign income tax considerations, which may differ from those discussed herein.

This summary is of a general nature only and is not intended to be, legal or tax advice to any particular purchaser. This summary is not exhaustive of all Canadian federal income tax considerations. Accordingly, prospective purchasers should consult their own tax advisors with respect to their particular circumstances.

No Canadian withholding tax will apply to interest or principal paid or credited to a Non-Resident Holder by the Bank or to proceeds received by a Non-Resident Holder on the disposition of a Note, including on a redemption, payment on maturity, repurchase or purchase for cancellation or on a disposition of Notes to any other person with whom such holder deals at arm’s length for purposes of the Act. Non-Resident Holders should consult their own advisors regarding the consequences to them of a disposition of Notes to a person with whom they are not dealing at arm’s length for purposes of the Act.

No other tax on income or gains will be payable by a Non-Resident Holder on interest or principal or on proceeds received by such a holder on the disposition of a Note, including on a redemption, payment on maturity, repurchase or purchase for cancellation.

PRS-

13

SUPPLEMENTAL PLAN OF DISTRIBUTION

Pursuant to the terms of a distribution agreement, CIBCWM will purchase the Notes from the Bank for distribution to other registered broker-dealers or will offer the Notes directly to investors.

Notes sold by CIBCWM to the public will initially be offered at the price to public set forth on the cover page of this pricing supplement. CIBCWM intends to purchase each of the Notes from the Bank at a purchase price equal to the price to public net of a commission of % of the Principal Amount of such Notes. Any Notes sold by CIBCWM to securities dealers may be sold at an agreed discount to the price to public. The price to public for Notes purchased by certain fee-based advisory accounts may vary between % and % of the face amount of the Notes. Any sale of a Note to a fee-based advisory account at a price to public below % of the face amount will reduce the agent’s commission specified on the cover page of this pricing supplement with respect to such Note. The price to public paid by any fee-based advisory account will be reduced by the amount of any fees assessed by the securities dealer or dealers involved in the sale of the Notes to such advisory account but not by more than % of the face amount of the Notes. If all of the offered Notes are not sold at the price to public, CIBCWM may change the offering price and the other selling terms. In addition to offers and sales at the price to public, CIBCWM may offer the Notes from time to time for sale in one or more transactions at market prices prevailing at the time of sale, at prices related to market prices or at negotiated prices.

The Bank owns, directly or indirectly, all of the outstanding equity securities of CIBCWM. In accordance with FINRA Rule 5121, CIBCWM may not make sales in this offering to any of its discretionary accounts without the prior written approval of the customer.

The Bank may use this pricing supplement in the initial sale of the Notes. In addition, CIBCWM or another of the Bank’s affiliates may use this pricing supplement in market-making transactions in any notes after their initial sale. Unless CIBCWM or we inform you otherwise in the confirmation of sale, this pricing supplement is being used by CIBCWM in a market-making transaction.

While CIBCWM may make markets in the Notes, it is under no obligation to do so and may discontinue any market-making activities at any time without notice. See the section titled “Supplemental Plan of Distribution (Conflicts of Interest)” in the accompanying Prospectus Supplement.

PRS-

14

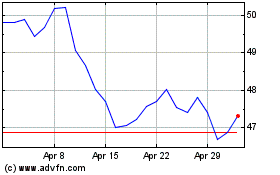

Canadian Imperial Bank o... (NYSE:CM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Canadian Imperial Bank o... (NYSE:CM)

Historical Stock Chart

From Apr 2023 to Apr 2024