UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 11-K

FOR ANNUAL REPORTS OF EMPLOYEE STOCK

PURCHASE, SAVINGS AND SIMILAR PLANS

PURSUANT TO SECTION 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

(Mark One):

|

|

|

|

|

|

ý

|

ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended

December 31, 2016

OR

|

|

|

|

|

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from

to

Commission file number 1-3157

INTERNATIONAL PAPER COMPANY

SALARIED SAVINGS PLAN

(Full title of the plan)

INTERNATIONAL PAPER COMPANY

6400 Poplar Avenue

Memphis, TN 38197

Telephone: (901) 419-9000

(Name of issuer of the securities held pursuant to the plan and

the address of its principal executive office)

INTERNATIONAL PAPER COMPANY SALARIED SAVINGS PLAN

|

|

|

|

|

|

|

Page

|

|

|

|

|

|

|

|

|

|

|

FINANCIAL STATEMENTS AS OF AND FOR THE YEARS ENDED DECEMBER 31, 2016 AND 2015:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NOTE:

|

All other schedules required by 29 CFR 2520.103-10 of the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974 have been omitted because they are not applicable.

|

EXHIBIT

|

|

|

|

|

|

|

23

|

|

Consent of Independent Registered Public Accounting Firm

|

To the Trustees and Participants of

International Paper Company Salaried Savings Plan

Memphis, Tennessee

We have audited the accompanying statements of net assets available for benefits of the International Paper Company Salaried Savings Plan (the “Plan”) as of December 31, 2016 and 2015, and the related statements of changes in net assets available for benefits for the years then ended. These financial statements are the responsibility of the Plan's management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Plan is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Plan's internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, such financial statements present fairly, in all material respects, the net assets available for benefits of the Plan as of December 31, 2016 and 2015, and the changes in net assets available for benefits for the year then ended December 31, 2016, in conformity with accounting principles generally accepted in the United States of America.

The supplemental schedule listed in the Table of Contents has been subjected to audit procedures performed in conjunction with the audit of the Plan's financial statements. The supplemental schedule is the responsibility of the Plan's management. Our audit procedures included determining whether the supplemental schedule reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental schedule. In forming our opinion on the supplemental schedule, we evaluated whether the supplemental schedule, including its form and content, is presented in compliance with the Department of Labor's Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, such schedule is fairly stated, in all material respects, in relation to the financial statements as a whole.

As discussed in Note 2 to the financial statements, in 2016 the Plan retrospectively adopted the Financial Accounting Standards Board Accounting Standards Update (“ASU”) No. 2015-07,

Fair Value Measurement (Topic 820): Disclosure for Investments in Certain Entities That Calculate Net Asset Value per Share (or Its Equivalent);

and Part II (Plan Investment Disclosures) of ASU No. 2015-12,

Plan Accounting: Defined Benefit Pension Plans (Topic 960), Defined Contribution Pension Plans (Topic 962), Health and Welfare Benefit Plans (Topic 965).

As also discussed in Note 2, the Plan also retrospectively early adopted ASU No. 2017-06,

Plan Accounting: Defined Benefit Pension Plans (Topic 960), Defined Contribution Pension Plans (Topic 962), Health and Welfare Benefit Plans (Topic 965): Employee Benefit Plan Master Trust Reporting.

Memphis, Tennessee

July 12, 2017

INTERNATIONAL PAPER COMPANY SALARIED SAVINGS PLAN

STATEMENTS OF NET ASSETS AVAILABLE FOR BENEFITS

DECEMBER 31,

2016

AND

2015

(Amounts in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2016

|

|

2015

|

|

ASSETS:

|

|

|

|

|

|

Investments, at fair value (Note 4)

|

|

|

|

|

|

Plan interest in Master Trust — Participant-directed investments

|

|

$

|

2,661,522

|

|

|

$

|

2,467,186

|

|

|

Self-directed brokerage accounts— Participant-directed investments

|

|

89,972

|

|

|

82,287

|

|

|

Investments, at contract value (Note 5)

|

|

|

|

|

|

Plan interest in Master Trust — Fully benefit-responsive investment contracts

|

|

942,745

|

|

|

897,211

|

|

|

Total investments

|

|

3,694,239

|

|

|

3,446,684

|

|

|

Receivables:

|

|

|

|

|

|

Notes receivable from participant loans

|

|

61,555

|

|

|

59,912

|

|

|

Participants’ contributions

|

|

6,694

|

|

|

5,677

|

|

|

Employer’s contributions

|

|

4,172

|

|

|

3,610

|

|

|

Total receivables

|

|

72,421

|

|

|

69,199

|

|

|

LIABILITIES:

|

|

|

|

|

|

Accrued expenses

|

|

480

|

|

|

535

|

|

|

Excess contributions payable

|

|

11

|

|

|

12

|

|

|

Total liabilities

|

|

491

|

|

|

547

|

|

|

NET ASSETS AVAILABLE FOR BENEFITS

|

|

$

|

3,766,169

|

|

|

$

|

3,515,336

|

|

See notes to financial statements.

INTERNATIONAL PAPER COMPANY SALARIED SAVINGS PLAN

STATEMENTS OF CHANGES IN NET ASSETS AVAILABLE FOR BENEFITS

YEARS ENDED DECEMBER 31,

2016

AND

2015

(Amounts in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2016

|

|

2015

|

|

ADDITIONS:

|

|

|

|

|

|

Contributions:

|

|

|

|

|

|

Participants’ contributions

|

|

$

|

141,755

|

|

|

$

|

105,268

|

|

|

Employer’s contributions

|

|

62,021

|

|

|

58,590

|

|

|

Total contributions

|

|

203,776

|

|

|

163,858

|

|

|

Investment income (loss) — Plan interest in Master Trust:

|

|

|

|

|

|

Net appreciation (depreciation)

|

|

262,241

|

|

|

(138,513

|

)

|

|

Interest

|

|

28,740

|

|

|

27,608

|

|

|

Dividends

|

|

25,304

|

|

|

23,880

|

|

|

Investment income (loss) — Plan interest in Master Trust

|

|

316,285

|

|

|

(87,025

|

)

|

|

Investment income (loss) — Self-directed brokerage accounts

|

|

8,619

|

|

|

(3,537

|

)

|

|

Total investment income (loss)

|

|

324,904

|

|

|

(90,562

|

)

|

|

Interest income on notes receivable from participant loans

|

|

2,552

|

|

|

2,539

|

|

|

Net transfers from other plans (Note 8)

|

|

11,887

|

|

|

10,620

|

|

|

Total additions

|

|

543,119

|

|

|

86,455

|

|

|

DEDUCTIONS:

|

|

|

|

|

|

Benefits paid to participants

|

|

289,670

|

|

|

287,761

|

|

|

Administrative expenses

|

|

2,616

|

|

|

2,697

|

|

|

Total deductions

|

|

292,286

|

|

|

290,458

|

|

|

NET INCREASE (DECREASE)

|

|

250,833

|

|

|

(204,003

|

)

|

|

NET ASSETS AVAILABLE FOR BENEFITS:

|

|

|

|

|

|

Beginning of year

|

|

3,515,336

|

|

|

3,719,339

|

|

|

End of year

|

|

$

|

3,766,169

|

|

|

$

|

3,515,336

|

|

See notes to financial statements.

INTERNATIONAL PAPER COMPANY SALARIED SAVINGS PLAN

NOTES TO FINANCIAL STATEMENTS

YEARS ENDED DECEMBER 31,

2016

AND

2015

The following description of the International Paper Company Salaried Savings Plan (the “Plan”) provides only general information about the provisions of the Plan. Participants should refer to the Plan document or the Plan’s summary plan description for a more complete description of the Plan’s provisions.

General

—The Plan is a defined contribution plan providing retirement benefits to the salaried employees and certain hourly employees of International Paper Company and its subsidiaries (the “Company”) who work in the United States, or who are United States citizens or residents working outside the United States. The Plan is subject to the provisions of the Employee Retirement Income Security Act of 1974, as amended (“ERISA”).

The majority of the assets of the Plan are held by State Street Bank and Trust Company (the “Trustee” or “State Street”) in the International Paper Company Defined Contribution Plans Master Trust (the “Master Trust”), a master trust established by the Company and administered by the Trustee. Self-directed brokerage accounts and participant loans are not assets of the Master Trust but are a part of the Net Assets Available for Benefits and are also held by State Street.

Empower Retirement (the “Recordkeeper”) is the recordkeeper for the Plan. J.P. Morgan Retirement Plan Services, the prior recordkeeper, was acquired by Great-West Life & Annuity Insurance Company ("Great-West") in 2014. Empower Retirement is a division of Great-West.

Eligibility to Participate

—An employee is generally eligible to participate in the Plan upon date of hire if the employee is a salaried employee, or a non-bargained hourly employee at a designated location, and is employed on a non-temporary basis. Participation in the Plan is voluntary. New employees are automatically enrolled in the Plan 45 days from the date they become eligible to participate, unless they otherwise decline participation.

Participant Contributions

—Participant contributions may be made as before-tax, after-tax or Roth 401(k) contributions, or in any combination, and are subject to certain Internal Revenue Code (the “Code”) limitations. The maximum rate of participant contributions is 85% of annual compensation as defined by the Plan. Employees who are automatically enrolled contribute at the rate of 4% of compensation, unless they elect an alternate contribution percentage.

Company Matching Contributions

—The Company matches in cash all participant contributions at 70% on the first 4% of compensation contributed to the Plan and 50% on the next 4% of compensation contributed to the Plan.

Retirement Savings Account

—The Company makes a Retirement Savings Account (“RSA”) contribution equal to 2.75% of compensation for employees hired on or after July 1, 2004. Effective January 1, 2011, employees whose age is 40 or greater as of the date that their account is credited with RSA contributions receive 4% of compensation as defined by the Salaried Savings Plan.

Rollover Contributions

—The Plan is authorized to accept rollover contributions and direct trust-to-trust transfers of amounts which participants are entitled to receive from other qualified profit-sharing, stock bonus, and savings plans or traditional individual retirement accounts.

During 2016, a lump-sum window opportunity was provided to participants of the Retirement Plan of International Paper Company who satisfied certain requirements. Participants who elected to receive a lump-sum payment were, if eligible, allowed to roll over assets into the Plan. Rollover contributions from this event totaled approximately $23.6 million and are reflected in Participant contributions in the Statement of Changes in Net Assets Available for Benefits.

On December 1, 2016, the Company acquired the Cellulose Fiber division of Weyerhaeuser. Newly acquired employees were eligible to become participants of the Plan at the date of acquisition and were allowed to roll over contributions from prior plans. Rollover contributions from this event totaled approximately $3.9 million and are reflected in Participant contributions in the Statement of Changes in Net Assets Available for Benefits.

Investments

—Participants direct the investment of all contributions into various investment options offered by the Plan. The Plan currently offers several diversified portfolios and pooled funds, a fixed income option referred to as the Stable Value Fund, an open brokerage window, and the Company’s common stock as investment options for participants. Contributions of participants who are automatically enrolled and the Company matching contributions are invested in the Tier 1 Smartmix Moderate Fund unless the participant makes alternate investment elections.

ESOP Portion of the Plan

—The Company Stock Fund, excluding contributions made in the current Plan year, is designated as an employee stock ownership plan (“ESOP”). With respect to dividends paid on shares of Company stock held in the ESOP portion of the Plan, participants are permitted to elect to receive cash payouts of the dividends or to leave the dividends in the Plan to be reinvested in shares of Company stock. Each participant has the right to direct the manner in which whole shares of

the Company stock held in the Company Stock Fund attributable to his account at valuation date will be voted at stockholders' meetings. Directions are given to the Trustee and are held in the strictest confidence and not divulged or released to any person, including officers or employees of the Company. An independent fiduciary appointed by the Company votes in person or by proxy any shares of Company stock for which voting instructions have not been received by the deadline set forth in the Company's written proxy mailed to participants.

Participant Accounts

—Individual accounts are maintained for each Plan participant. Each participant’s account is credited with the participant’s contributions, the Company matching contributions, RSA contributions and an allocation of Plan earnings, and is charged with benefit distributions, if applicable, and allocations of Plan losses and administrative expenses. The benefit to which a participant is entitled is the benefit that can be provided from the participant’s vested account.

Vesting

—Participants are immediately vested in their participant contributions and rollover contributions, plus earnings thereon. Participants become 100% vested in Company matching contributions and RSA contributions, plus earnings thereon, after three years of service.

Participants also are fully vested in amounts contributed by the Company, plus earnings thereon, upon attainment of age 65, termination of employment due to death or disability, or termination of employment due to permanent closure or sale of an employee’s work facility. Forfeited balances of terminated participants are used to reduce future Company contributions.

Notes Receivable from Participants

—Participants, including participants who are no longer employed by the Company, may borrow from their accounts an amount not to exceed (on a cumulative outstanding basis) the lesser of (1) 50% of the value of a participant’s contributions, rollover accounts, and the vested portion of a participant’s Company contributions account, less any restricted portions of such accounts or (2) $50,000 reduced by the excess of the participant’s largest outstanding balance of all loans during the 12 months preceding the date the loan is to be made over the outstanding balance of loans on the date such loan is made.

Loans are repaid through payroll deduction, beginning as soon as administratively practicable after the effective date of the loan, with a minimum loan period of one year. Participants may make payments directly to the Plan if they are on leave of absence without pay. Participants may also pay remaining balances in lump sum directly to the Plan. The maximum repayment period is five years, unless for the purchase of a principal residence, in which case the maximum repayment period is 10 years. It is permissible to have two loans outstanding at any one time, but only one principal residence loan is allowed at a time. The interest rate is determined by the Plan administrator based on the prime interest rate as published in

The Wall Street Journal

plus 1%. Interest rates on loans outstanding ranged from 4.25% to 10.50% at December 31,

2016

, and

2015

. For participants who are no longer employed by the Company, loans are repaid by direct payments to the Plan. A loan initiation fee of $50 is charged to the participant’s account for each new loan requested.

Withdrawals

—A participant may make a general withdrawal in the following order: (1) the value of the after-tax contributions made before the preceding 24-month period and the unmatched after-tax contributions made within the preceding 24-month period with no suspension penalty or contribution suspension; (2) the value of the matched after-tax contributions made during the preceding 24 months with a 3-month suspension penalty period during which no Company matching contributions are made; (3) the value of any rollover account; and (4) the value of certain prior Company matching contributions as detailed in the appendix to the Plan document.

If the total amount available to a participant for a general withdrawal is insufficient to meet his financial needs, a participant who has not attained age 59-1/2 may apply for a hardship withdrawal of vested Company matching contributions and earnings thereon, before-tax contributions and pre-1989 earnings on before-tax contributions.

To demonstrate necessity for a hardship withdrawal, a participant’s contributions to the Plan are suspended for six months. As an alternative method of demonstrating necessity, a participant may file a certification of financial hardship.

Participants who have attained age 59-1/2 may withdraw the value of before-tax contributions and the value of vested Company matching contributions, in addition to all amounts available under a general withdrawal.

Payment of Benefits

—Distributions may be made when a participant retires, terminates employment, or dies. With the exception of the Company Stock Fund, distributions are in cash for the value of the participant’s account. Distributions from the Company Stock Fund are made in shares of Company common stock, in cash, or in a combination of shares and cash, as selected by the participant.

Upon termination of employment, a participant may elect a distribution in a lump-sum payment, partial lump-sum payment or through installments over 5 to 20 years. Beginning January 1, 2011, the maximum installment period for new elections is limited to the maximum life expectancy of the participant or the joint life expectancy of the participant and their beneficiary.

The Plan requires an automatic lump-sum distribution to a terminated participant whose account balance is $5,000 or less. An automatic lump-sum distribution in excess of $1,000 is automatically distributed to a rollover Individual Retirement Account (IRA) unless the participant timely elects another form of distribution.

Death benefits to a beneficiary are paid in either a lump-sum payment within five years of the participant’s death or in installment payments commencing within one year of the participant’s death, as elected by the beneficiary. If the beneficiary is the participant’s spouse, the beneficiary may elect to defer the distribution to the date the participant would have been age 70-1/2.

Some participants that have become participants in the Plan due to plan mergers have benefits differing from the general provisions of the Plan. The appendix to the Plan’s summary plan description explains these benefits in detail by location. These participants are often allowed to continue certain benefits offered in their previous plans. The contributions available for such withdrawals are only those contributions made under their previous plans and not the contributions or earnings thereon made under the Plan’s provisions.

Administrative Expenses

—All administrative fees and expenses (except loan, self-directed brokerage account and Qualified Domestic Relations Order "QDRO" initiation fees which are charged to individual participant accounts) are charged to the Plan. The Recordkeeper nets the Master Trust administrative expenses of each plan with the investment income or loss of the Master Trust. Plan level expenses are included in administrative expenses in the accompanying statements of changes in net assets available for benefits.

Forfeited Accounts

—When certain terminations of participation in the Plan occur, the non-vested portion of the participant's account as defined by the Plan, represents a forfeiture. The plan document permits the use of forfeitures to reduce future employer contributions for the plan year. However, if a participant is reemployed and fulfills certain requirements, as defined in the plan document, the account will be reinstated. On December 31,

2016

and

2015

, forfeited non-vested accounts were valued at approximately $2,700 and $15,000, respectively. During the years ended December 31,

2016

and

2015

, employer contributions were reduced by approximately $1,346,000 and $1,378,000, respectively, from forfeited non-vested accounts.

Basis of Accounting

— The accompanying financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (GAAP).

The prior year amounts have been corrected to present Stable Value short-term investment funds within the master trust investment account rather than within other plan assets and to present the participant-directed open brokerage accounts separate from the master trust assets.

Use of Estimates

— The preparation of financial statements in conformity with GAAP requires Plan management to make estimates and assumptions that affect the reported amounts of assets, liabilities, and changes therein and disclosure of contingent assets and liabilities. Actual results could differ from those estimates.

Investment Valuation and Income Recognition

—The Plan’s investments are stated at fair value, except for fully benefit-responsive contracts or synthetic guaranteed investment contracts, which are reported at contract value. Fair value of a financial instrument is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. Contract value is the amount Plan participants would receive if they were to initiate permitted transactions under the terms of the Plan (see Note 5). See Note 4 for discussion on fair value measurements.

Purchases and sales of securities are recorded on a trade-date basis. Interest income is recorded on the accrual basis. Dividends are recorded on the ex-dividend date. Net appreciation includes the Plan's gains and losses on investments bought and sold as well as held during the year.

Management fees and operating expenses charged to the Master Trust for investments in Master Trust investment accounts are deducted from income earned on a daily basis and are not separately reflected. Consequently, management fees and operating expenses are reflected as an adjustment to net appreciation (depreciation) in fair market value for such investments.

Risks and Uncertainties

—The Plan utilizes various investment instruments. Investment securities, in general, are exposed to various risks, such as interest rate risk, credit risk, and overall market volatility. Due to the level of risk associated with certain investment securities, it is reasonably possible that changes in the values of investment securities will occur in the near term and that such changes could materially affect the amounts reported in the financial statements.

Notes Receivable from Participants

—Notes receivable from participants are measured at their unpaid principal balance plus any accrued but unpaid interest. Delinquent participant loans are recorded as distributions based on the terms of the Plan document.

Payment of Benefits

—Benefit payments to participants are recorded upon distribution. There were no participants who elected a distribution from the Plan, but had not yet been paid at December 31, 2016.

Excess Contributions Payable

—The Plan is required to return contributions to participants in the event certain nondiscrimination tests defined under the Code are not satisfied. For the year ended December 31, 2016, approximately $10,800 of contributions were refundable to Plan participants and are included in excess contributions payable in the

accompanying statements of net assets available for benefits. For the year ended December 31, 2015, approximately $12,300 of contributions were refundable to Plan participants and are included in excess contributions payable in the accompanying statements of net assets available for benefits.

Derivatives

— Investments include various derivative instruments, such as swaps, options, forwards and futures, that are employed as asset class substitutes, or for bona fide hedging or other appropriate risk management purposes, to achieve investment objectives in an efficient and cost-effective manner as follows:

|

|

|

|

•

|

Market Exposure — To gain exposure to a particular market or alter asset class exposures (e.g., tactical asset allocation) quickly and at low cost.

|

|

|

|

|

•

|

To alter the risk/return characteristics of certain investments. For example, in fixed income accounts, derivatives may be used to alter the duration of the investment portfolio. Investment managers are also permitted to use derivatives to enhance returns by selecting instruments that will perform better than underlying securities under certain scenarios.

|

|

|

|

|

•

|

Foreign Currency Exposure Management — Investment managers may use derivatives, such as currency forwards, in order to manage foreign currency exposures.

|

The extent to which investment managers are permitted to use derivatives (and the manner in which they are used) is specified within investment manager investment guidelines. Derivative exposure is monitored regularly to ensure that derivatives are used in a prudent and risk-controlled fashion.

Derivative instruments and hedging activities were immaterial for the years ended December 31,

2016

and

2015

.

Securities Lending

—The Master Trust has, via a Securities Lending Authorization Agreement with State Street, authorized State Street to lend its securities to broker-dealers and banks pursuant to a form of loan agreement.

During

2016

and

2015

, State Street lent, on behalf of the Company, certain securities held by State Street as custodian and received cash, securities issued or guaranteed by the United States government, and irrevocable letters of credit as collateral. State Street did not have the ability to pledge or sell collateral securities absent a borrower default. Borrowers were required to deliver collateral for each loan equal to (i) in the case of loaned securities denominated in United States dollars or sovereign debt issued by foreign governments, 102% of the market value of the loaned securities during 2016 and 2015; and (ii) in the case of loaned securities not denominated in United States dollars or whose primary trading market was not located in the United States, 105% of the market value of the loaned securities during 2016, and 110% in 2015.

State Street has indemnified International Paper by agreeing to purchase replacement securities, or return the cash collateral in the event a borrower failed to return a loaned security or pay distributions thereon. There were no losses during

2016

or

2015

resulting from a default of the borrowers.

The cash collateral received on loans is invested, together with the cash collateral of other qualified tax-exempt plan lenders in a collective investment pool called the Quality D Short-Term Investment Fund. As of December 31,

2016

, the Quality D Short-Term Investment Fund had an average duration of 91 days and an average weighted final maturity of 31 days. As of December 31,

2015

, such investment pool had an average duration of 74 days and an average weighted final maturity of 31 days.

Recent Accounting Pronouncements

—In May 2015, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) No. 2015-07, Disclosure for Investments in Certain Entities That Calculate Net Asset Value per Share (or Its Equivalent), Fair Value Measurement (Topic 820). ASU 2015-07 requires the categorization by level for items that are only required to be disclosed at fair value and information about transfers between Level 1 and Level 2. In addition, the ASU impacts reporting entities that measure an investment’s fair value using the net asset value per share (or an equivalent) practical expedient. The amendments in ASU No. 2015-07 eliminate the requirement to classify the investment within the fair value hierarchy. In addition, the requirement to make specific disclosures for all investments eligible to be assessed at fair value with the net asset value per share practical expedient has been removed. Instead, such disclosures are restricted only to investments that the entity has decided to measure using the practical expedient. The new guidance is effective for public entities' reporting periods beginning after December 15, 2015 and early adoption is permitted and is applied retrospectively. The Plan adopted this guidance during 2016 and applied the provisions retrospectively, as required.

In July 2015, FASB issued ASU 2015-12, Plan Accounting: Defined Benefit Pension Plans (Topic 960), Defined Contribution Pension Plans (Topic 962), Health and Welfare Benefit Plans (Topic 965): (Part I) Fully Benefit-Responsive Investment Contracts, (Part II) Plan Investment Disclosures, (Part III) Measurement Date Practical Expedient. Part I eliminates the requirement to measure the fair value of fully benefit-responsive investment contracts and provide certain disclosures. Contract value is the only required measure for fully benefit-responsive investment contracts. Part II eliminates the requirements to disclose individual investments that represent 5 percent or more of net assets available for benefits and the net appreciation or depreciation in fair value of investments by general type. Part II also simplifies the level of disaggregation of investments that are measured using fair value. Plans will continue to disaggregate investments that are measured using fair value by general type; however, plans are no longer required to also disaggregate investments by nature, characteristics and risks. Further, the disclosure of information about fair value measurements shall be provided by general type of plan asset. Part III is not

applicable to the Plan. ASU 2015-12 is effective for fiscal years beginning after December 15, 2015, with early adoption permitted. Parts I and II are to be applied retrospectively. Early adoption of only one part is also permitted. The Plan elected to early adopt ASU 2015-12, Part I as of December 31, 2015, as permitted, and has applied the provisions of ASU 2015-12

retrospectively, as required. The Plan adopted Part II of this guidance during 2016 and applied the provisions retrospectively, as required.

In February 2017, the FASB issued ASU 2017-06,

Plan Accounting: Defined Benefit Pension Plans (Topic 960), Defined Contribution Pension Plans (Topic 962), Health and Welfare Benefit Plans (Topic 965): Employee Benefit Plan Master Trust Reporting. The amendments in this Update clarify presentation requirements for a plan’s interest in a master trust and require more detailed disclosures of the plan’s interest in the master trust. ASU 2017-06 is effective for fiscal years beginning after December 15, 2018 and early adoption is permitted. The Plan elected to early adopt ASU 2017-06, as of December 31, 2016, as permitted, and has applied the provision for ASU 2017-06 retrospectively to all periods presented.

The majority of the Plan’s investment assets are held in a trust account by the Trustee and consist of an undivided interest in an investment account of the Master Trust. Use of the Master Trust permits the commingling of trust assets with the assets of other plans sponsored by the Company for investment and administrative purposes. Although assets of the plans are commingled in the Master Trust, the Recordkeeper maintains supporting records for the purpose of allocating the net gain or loss of the investment account to the participating plans. The net investment income or loss of the investment assets and administrative expenses are allocated by the Recordkeeper to each participating plan based on the relationship of the interest of each plan to the total of the interests of the participating plans.

The Master Trust is subject to master netting agreements, or netting arrangements, with certain counterparties. These agreements govern the terms of certain transactions, and reduce the counterparty risk associated with relevant transactions by specifying offsetting mechanisms and collateral posting arrangements at pre-arranged exposure levels. Since different types of transactions have different mechanics and are sometimes traded out of different legal entities of a particular counterparty organization, each type of transaction may be covered by a different master netting arrangement possibly resulting in the need for multiple agreements with a single counterparty. Master netting agreements are specific to each different asset type; therefore, they allow the Master Trust to net its total exposure to a specified counterparty and settle it through a single payment, in a single currency in the event of a default with respect to any and all the transactions governed under a single agreement with the counterparty. The total and net assets of the Master Trust at December 31,

2016

and

2015

, are summarized as follows (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Master Trust Balances

|

|

Plan's interest in Master Trust Balances

|

|

Master Trust Balances

|

|

Plan's interest in Master Trust Balances

|

|

|

|

|

|

|

|

|

|

|

|

2016

|

|

2015

|

|

Master Trust net assets:

|

|

|

|

|

|

|

|

|

Common stock of International Paper

|

$

|

411,442

|

|

|

$

|

327,047

|

|

|

$

|

371,503

|

|

|

$

|

287,246

|

|

|

Equities - domestic

|

704,239

|

|

|

558,296

|

|

|

840,108

|

|

|

662,563

|

|

|

Equities - international

|

202,577

|

|

|

160,596

|

|

|

299,947

|

|

|

236,557

|

|

|

Corporate bonds

|

136,970

|

|

|

108,605

|

|

|

129,267

|

|

|

101,976

|

|

|

Government securities

|

139,275

|

|

|

109,666

|

|

|

108,604

|

|

|

84,918

|

|

|

Mortgage backed securities

|

22,307

|

|

|

17,684

|

|

|

27,216

|

|

|

21,465

|

|

|

Other fixed income

|

12,131

|

|

|

9,617

|

|

|

15,970

|

|

|

12,595

|

|

|

Derivatives

|

(354

|

)

|

|

(254

|

)

|

|

(57

|

)

|

|

(51

|

)

|

|

Cash and cash equivalents

|

62,735

|

|

|

45,285

|

|

|

38,831

|

|

|

27,004

|

|

|

Collateral held under securities lending

|

194,374

|

|

|

141,893

|

|

|

81,341

|

|

|

59,379

|

|

|

Common collective trusts

|

1,866,587

|

|

|

1,339,924

|

|

|

1,476,007

|

|

|

1,045,936

|

|

|

Total investments at fair value

|

3,752,283

|

|

|

2,818,359

|

|

|

3,388,737

|

|

|

2,539,588

|

|

|

Stable Value fund at contract value

|

1,405,574

|

|

|

942,745

|

|

|

1,333,395

|

|

|

897,211

|

|

|

Total investments

|

5,157,857

|

|

|

3,761,104

|

|

|

4,722,132

|

|

|

3,436,799

|

|

|

Receivable for securities sold

|

35,056

|

|

|

25,591

|

|

|

34,734

|

|

|

25,356

|

|

|

Other receivables

|

15,573

|

|

|

11,368

|

|

|

12,198

|

|

|

8,905

|

|

|

Total receivables

|

50,629

|

|

|

36,959

|

|

|

46,932

|

|

|

34,261

|

|

|

Total Master Trust assets

|

5,208,486

|

|

|

3,798,063

|

|

|

4,769,064

|

|

|

3,471,060

|

|

|

Liability to return collateral held under securities lending agreements

|

194,374

|

|

|

141,893

|

|

|

81,341

|

|

|

59,379

|

|

|

Payable for securities purchased

|

55,831

|

|

|

40,757

|

|

|

52,548

|

|

|

38,360

|

|

|

Other payables

|

13,642

|

|

|

11,146

|

|

|

10,831

|

|

|

8,924

|

|

|

Total liabilities

|

263,847

|

|

|

193,796

|

|

|

144,720

|

|

|

106,663

|

|

|

Total Master Trust net assets

|

$

|

4,944,639

|

|

|

$

|

3,604,267

|

|

|

$

|

4,624,344

|

|

|

$

|

3,364,397

|

|

|

Plan interest in the Master Trust as a percentage of total

|

72.9

|

%

|

|

|

|

72.8

|

%

|

|

|

The net investment income (loss) of the Master Trust for the years ended December 31,

2016

and

2015

, is summarized below (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2016

|

|

2015

|

|

Master Trust investment income (loss)

|

|

|

|

|

|

Net appreciation (depreciation) of investments

|

|

$

|

343,852

|

|

|

$

|

(176,420

|

)

|

|

Interest

|

|

40,610

|

|

|

39,115

|

|

|

Dividends

|

|

32,009

|

|

|

30,647

|

|

|

Total Master Trust investment income (loss)

|

|

$

|

416,471

|

|

|

$

|

(106,658

|

)

|

|

Investment income (loss) — Plan interest in Master Trust

|

|

$

|

316,285

|

|

|

$

|

(87,025

|

)

|

The securities on loan under lending agreements from the Master Trust as of December 31,

2016

and

2015

, are summarized below (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

Securities on loan

|

|

2016

|

|

2015

|

|

Equities - domestic

|

|

$

|

153,536

|

|

|

$

|

49,541

|

|

|

Equities - international

|

|

8,247

|

|

|

7,942

|

|

|

Corporate bonds

|

|

15,263

|

|

|

8,330

|

|

|

Government securities

|

|

12,191

|

|

|

13,233

|

|

|

Total Securities on loan

|

|

$

|

189,237

|

|

|

$

|

79,046

|

|

ASC 820,

Fair Value Measurements and Disclosures

, provides a framework for measuring fair value. That framework provides a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value, as follows: Level 1, which refers to securities valued using unadjusted quoted prices from active markets for identical assets; Level 2, which refers to securities not traded on an active market but for which observable market inputs are readily available; and Level 3, which refers to securities valued based on significant unobservable inputs. Assets and liabilities are classified in their entirety based on the lowest level of input that is significant to the fair value measurement. The following tables set forth by level within the fair value hierarchy a summary of the Plan’s investments measured at fair value on a recurring basis at December 31,

2016

and

2015

. The Plan’s policy is to recognize significant transfers between levels at the beginning of the reporting period.

Fair Value Measurements as of December 31,

2016

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Active Markets

for Identical

Assets

(Level 1)

|

|

Other

Observable

Inputs

(Level 2)

|

|

Significant

Unobservable

Inputs

(Level 3)

|

|

Total

|

|

Common stock of International Paper

|

|

$

|

327,047

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

327,047

|

|

|

Equities - domestic

|

|

558,296

|

|

|

—

|

|

|

—

|

|

|

558,296

|

|

|

Equities - international

|

|

160,067

|

|

|

516

|

|

|

13

|

|

|

160,596

|

|

|

Corporate bonds

|

|

—

|

|

|

108,760

|

|

|

(155

|

)

|

|

108,605

|

|

|

Government securities

|

|

—

|

|

|

109,666

|

|

|

—

|

|

|

109,666

|

|

|

Mortgage backed securities

|

|

—

|

|

|

17,678

|

|

|

6

|

|

|

17,684

|

|

|

Other fixed income

|

|

—

|

|

|

9,617

|

|

|

—

|

|

|

9,617

|

|

|

Derivatives

|

|

—

|

|

|

(220

|

)

|

|

(34

|

)

|

|

(254

|

)

|

|

Cash and cash equivalents

|

|

45,285

|

|

|

—

|

|

|

—

|

|

|

45,285

|

|

|

Securities lending collateral

|

|

|

|

|

|

|

|

|

|

Cash

|

|

39,762

|

|

|

—

|

|

|

—

|

|

|

39,762

|

|

|

Non-cash

|

|

—

|

|

|

102,131

|

|

|

—

|

|

|

102,131

|

|

|

Self-directed brokerage accounts

|

|

59,541

|

|

|

30,431

|

|

|

—

|

|

|

89,972

|

|

|

Total assets in fair value hierarchy

|

|

$

|

1,189,998

|

|

|

$

|

378,579

|

|

|

$

|

(170

|

)

|

|

$

|

1,568,407

|

|

|

Investments measured at net asset value (a)

|

|

—

|

|

|

—

|

|

|

—

|

|

|

1,339,924

|

|

|

Total investments at fair value

|

|

$

|

1,189,998

|

|

|

$

|

378,579

|

|

|

$

|

(170

|

)

|

|

$

|

2,908,331

|

|

(a) In accordance with Subtopic 820-10, certain investments that were measured at net asset value per share (or its equivalent) have not been classified in the fair value hierarchy.

Fair Value Measurements as of December 31,

2015

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Active Markets

for Identical

Assets

(Level 1)

|

|

Other

Observable

Inputs

(Level 2)

|

|

Significant

Unobservable

Inputs

(Level 3)

|

|

Total

|

|

Common stock of International Paper

|

|

$

|

287,246

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

287,246

|

|

|

Equities - domestic

|

|

662,563

|

|

|

—

|

|

|

—

|

|

|

662,563

|

|

|

Equities - international

|

|

236,557

|

|

|

—

|

|

|

—

|

|

|

236,557

|

|

|

Corporate bonds

|

|

—

|

|

|

101,965

|

|

|

11

|

|

|

101,976

|

|

|

Government securities

|

|

—

|

|

|

84,918

|

|

|

—

|

|

|

84,918

|

|

|

Mortgage backed securities

|

|

—

|

|

|

21,462

|

|

|

3

|

|

|

21,465

|

|

|

Other fixed income

|

|

—

|

|

|

12,595

|

|

|

—

|

|

|

12,595

|

|

|

Derivatives

|

|

—

|

|

|

(24

|

)

|

|

(27

|

)

|

|

(51

|

)

|

|

Cash and cash equivalents

|

|

27,004

|

|

|

—

|

|

|

—

|

|

|

27,004

|

|

|

Securities lending collateral

|

|

|

|

|

|

|

|

|

|

Cash

|

|

54,723

|

|

|

—

|

|

|

—

|

|

|

54,723

|

|

|

Non-cash

|

|

—

|

|

|

4,656

|

|

|

—

|

|

|

4,656

|

|

|

Self-directed brokerage accounts

|

|

52,942

|

|

|

29,345

|

|

|

—

|

|

|

82,287

|

|

|

Total assets in fair value hierarchy

|

|

$

|

1,321,035

|

|

|

$

|

254,917

|

|

|

$

|

(13

|

)

|

|

$

|

1,575,939

|

|

|

Investments measured at net asset value (a)

|

|

—

|

|

|

—

|

|

|

—

|

|

|

1,045,936

|

|

|

Total investments at fair value

|

|

$

|

1,321,035

|

|

|

$

|

254,917

|

|

|

$

|

(13

|

)

|

|

$

|

2,621,875

|

|

(a) In accordance with Subtopic 820-10, certain investments that were measured at net asset value per share (or its equivalent) have not been classified in the fair value hierarchy.

Transfers Between Levels

—The availability of observable market data is monitored to assess the appropriate classification of financial instruments within the fair value hierarchy. Changes in economic conditions or model-based valuation techniques may require the transfer of financial instruments from one fair value level to another. In such instances, the transfer is reported at the beginning of the reporting period.

We evaluate the significance of transfers between levels based upon the nature of the financial instrument and size of the transfer relative to total net assets available for benefits. For the years ended, December 31,

2016

and

2015

, there were no significant transfers between levels.

Changes to Fair Value of Level 3 Assets and Related Gains and Losses

- During each of the years ended December 31, 2016 and 2015, the transfers into and out of Level 3 assets, along with realized and unrealized gains and losses, purchases and sales, were not material.

Asset Valuation Techniques

—Valuation technologies maximize the use of relevant observable inputs and minimize the use of unobservable inputs. The following is a description of the valuation methodologies used for assets measured at fair value.

Equity securities, including the common stock of International Paper, consist primarily of publicly traded U.S. companies and international companies. Publicly traded equities are valued at the closing prices reported in the active market in which the individual securities are traded.

Mutual funds are valued at the daily closing price as reported by the fund. Mutual funds held are open-end mutual funds that are registered with the U.S. Securities and Exchange Commission. These funds are required to publish their daily net asset value and to transact at that price. The mutual funds held are deemed to be actively traded.

Cash equivalents held are primarily short-term money market commingled funds that are valued at cost plus accrued interest which approximates fair value.

Fixed income investments consist of mortgage-backed securities, corporate bonds and government securities. Mortgage backed security holdings consist primarily of agency-rated holdings. The fair value estimates for mortgage securities are calculated by third-party pricing sources chosen by the custodian’s price matrix. Corporate bonds are valued using either the yields currently available on comparable securities of issuers with similar credit ratings or using a discounted cash flows approach that utilizes observable inputs, such as current yields of similar instruments, but includes adjustments for certain risks that may not be observable, such as credit and liquidity risks. Government securities are valued by third-party pricing sources.

Common collective funds are valued at the net asset value per share multiplied by the number of shares held as of the measurement date. The net asset value as provided by the trustee, is used as a practical expedient to estimate fair value. The net asset value is based on the fair value of the underlying investments held by the fund less its liabilities. This practical expedient is not used when it is determined to be probable that the fund will sell the investment for an amount different than the reported

net asset value. Participant transactions (purchased and sales) may occur daily. Were the Plan to initiate a full redemption of the collective trust, the investment advisor reserves the right to temporarily delay withdrawal from the trust in order to ensure that securities liquidations will be carried out in an orderly business manner.

Derivative investments such as futures, forward contracts and options are generally valued by the investment managers using model-based pricing methods, or in certain instances, by third party pricing sources.

Self-directed brokerage accounts primarily consist of common stock that is valued on the basis of readily determinable market prices. These accounts have also been invested in actively traded mutual fund vehicles which are valued at the daily closing price as reported by the fund. Investments within the self-directed brokerage accounts are up to the discretion of participants within the fund.

Quantitative Information about Significant Unobservable Inputs Used in Level 3 Fair Value Measurements

— There were no Plan Level 3 significant unobservable inputs used in 2016 or 2015.

The following table summarizes investments for which fair value is measured using the net asset value per share practical expedient as of December 31, 2016 and 2015, respectively (in thousands). There are no participant redemption restrictions for these investments; the redemption notice period is applicable only to the Plan.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2016 Fair value

|

|

Unfunded commitments

|

|

Redemption frequency

|

|

Redemption notice period

|

|

Common collective funds

|

|

$

|

1,286,815

|

|

|

N/A

|

|

Daily - Monthly

|

|

1- 5 days

|

|

Real estate fund

|

|

53,109

|

|

|

N/A

|

|

Quarterly

|

|

30 days

|

|

Total

|

|

$

|

1,339,924

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2015 Fair value

|

|

Unfunded commitments

|

|

Redemption frequency

|

|

Redemption notice period

|

|

Common collective funds

|

|

$

|

991,770

|

|

|

N/A

|

|

Daily - Monthly

|

|

1- 5 days

|

|

Real estate fund

|

|

54,166

|

|

|

N/A

|

|

Quarterly

|

|

30 days

|

|

Total

|

|

$

|

1,045,936

|

|

|

|

|

|

|

|

The Plan, via the Master Trust, has entered into various benefit-responsive investment contracts (Stable Value Contracts) which are intended to help the Stable Value Fund Master Trust Investment Account (Stable Value Fund) maintain stable principal valuation in most circumstances. Stable Value Contracts are negotiated over-the-counter contracts issued specifically to the Stable Value Fund by banks, insurance companies, and other financial institutions, and typically require the Stable Value Fund to pay periodic fees to the contract’s issuer.

The Stable Value Fund is managed by Goldman Sachs and invests in Stable Value Contracts to help offset price fluctuations. The terms of each Stable Value Contract obligate the contract’s issuer to keep a separate record for the contract’s value, which under most circumstances approximates the value of invested principal plus accrued interest, adjusted for deposits, withdrawals and fees. Participants may ordinarily direct the distribution or transfer of all or a portion of their investment at contract value as reported to the Plan by the issuers.

Stable Value Contracts are classified as either traditional guaranteed investment contracts (“TGIC”) or synthetic guaranteed investment contracts (“SGIC”). A SGIC differs from a TGIC in that the Plan owns the assets underlying the investment of a SGIC, and the bank, insurance company, or other financial institution issues a contract, referred to as a “wrapper,” that maintains the contract value of the underlying investment for the duration of the SGIC.

The following represents the disaggregation of contract value between types of investment contracts held by the Plan at December 31,

2016

and

2015

.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2016

|

|

2015

|

|

Synthetic investment contracts

|

|

$

|

871,975

|

|

|

$

|

822,855

|

|

|

Traditional investment contracts

|

|

24,488

|

|

|

42,539

|

|

|

Short-term investment fund

|

|

46,282

|

|

|

31,817

|

|

|

Total

|

|

$

|

942,745

|

|

|

$

|

897,211

|

|

The Stable Value Fund’s Net Asset Value (“NAV”) is normally expected to be calculated using the contract value of the Stable Value Contracts, regardless of the fluctuations in the market value of the underlying fixed income portfolios, which is intended to allow the fund to maintain a stable NAV. The terms of each Stable Value Contract provide for certain qualified withdrawals allowed under the Plan, such as exchanges, withdrawals, distributions and benefits to be paid at contract value, although terms

vary from contract to contract and certain withdrawals may not be permitted at contract value.

Investing in the Stable Value Fund involves certain risks, however the Stable Value Fund may be subject to additional risks other than those described below. The value of the Stable Value Fund’s investments may fluctuate, sometimes rapidly or unpredictably, due to a number of factors including changes in interest rates or inflation, adverse economic conditions, reduced market liquidity, poor manager performance, or other factors affecting the securities markets.

The creditworthiness of the contract issuer or guarantor of fixed income securities or Stable Value Contracts, may deteriorate, or the issuer may default or become unable or unwilling to make timely principal payments, interest payments, or to otherwise honor its obligations, which may impact the Stable Value Fund’s performance or cause a reduction in the Stable Value Fund’s NAV.

There are certain risks associated with investing in Stable Value Contracts. Stable Value Contracts contain terms including events of default and termination provisions, which if triggered could obligate the Stable Value Fund’s managers to alter their investment strategy and wind down the contracts over a period of several years, or could potentially cause loss of coverage under the Stable Value Contract(s). Certain events or conditions, including but not limited to, changes to the Plan’s other investment funds, changes to the rules or administration of the Plan or Stable Value Fund, employer restructuring or layoffs, corporate mergers or divestitures, employer bankruptcy, partial or complete Plan termination, changes in law, accounting procedures or regulatory changes, may result in withdrawals from the Stable Value Contracts being made at market value instead of book value, which could result in a reduction of the Stable Value Fund’s NAV. The Trustee is responsible for determining the Stable Value Fund’s NAV and the amount of any participant’s redemption from the Stable Value Fund.

Certain of the Master Trust’s investments are units of Master Trust Investment Accounts managed by the Trustee. State Street is the trustee, as defined by the Plan, and therefore, these transactions qualify as party-in-interest transactions. Fees paid by the Master Trust to the Trustee for trustee services were approximately $1.1 million and $1.2 million for the years ended December 31,

2016

and

2015

, respectively.

Also included in the Master Trust’s investments are shares of common stock of International Paper Company, the Plan’s sponsor, which qualify as party-in-interest transactions. At December 31,

2016

and

2015

, the Plan held 27.1 million and 33.5 million units, respectively, of common stock of International Paper Company, the sponsoring employer, with a cost basis of $211.7 million and $269.1 million, respectively. The Plan recorded dividend income of $12.9 million and $12.0 million for the years ended December 31,

2016

and

2015

, respectively.

Transactions with related parties were conducted on terms equivalent to those prevailing in an arm’s-length transaction.

The Internal Revenue Service (“IRS”) has determined and informed the Company, by a letter dated April 11, 2014, that the Plan and related trust were designed in accordance with the applicable requirements of the Code. The Company and the Plan administrator believe that the Plan, as amended from time to time subsequent to the receipt of the IRS determination letter, is currently designed and operated in compliance with the applicable requirements of the Code, and that the Plan and related trust continue to be tax-exempt. Therefore, no provision for income taxes has been included in the Plan’s financial statements.

GAAP requires Plan management to evaluate tax positions taken by the Plan and recognize a tax liability (or asset) if the Plan has taken an uncertain position that more likely than not would not be sustained upon examination. The Plan administrator has analyzed the tax positions taken by the Plan, and has concluded that as of December 31,

2016

, there are no uncertain positions taken or expected to be taken that would require recognition of a liability (or an asset) or disclosure in the financial statements. The Plan is subject to routine audits by taxing jurisdictions; however, there are currently no audits for any tax periods in progress. The Plan administrator believes it is no longer subject to IRS examinations for years prior to 2013.

The Company also sponsors the International Paper Company Hourly Savings Plan. If employees are transferred from hourly to salaried status or vice versa during the year, their account balances are transferred to the plan in which they are eligible to participate following transfer.

The following table summarizes the net transfers from other plans during

2016

and

2015

(in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2016

|

|

2015

|

|

International Paper Company Hourly Savings Plan—net transfers due to changes in employment status

|

|

$

|

11,887

|

|

|

$

|

10,620

|

|

|

Total net transfers from other plans

|

|

$

|

11,887

|

|

|

$

|

10,620

|

|

Although it has not expressed any intention to do so, the Company has the right under the Plan to discontinue its contributions at any time and to terminate the Plan subject to the provisions set forth in ERISA. In the event that the Plan is terminated, participants would become 100% vested in their accounts.

For the years ended December 31,

2016

and

2015

, the following is a reconciliation of participant-directed investments per the statements of net assets available for benefits to the Form 5500 (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2016

|

|

2015

|

|

Net assets available for benefits:

|

|

|

|

|

|

Total investments per the financial statements

|

|

$

|

3,694,239

|

|

|

$

|

3,446,684

|

|

|

Less self-directed brokerage accounts per the financial statements

|

|

(89,972

|

)

|

|

(82,287

|

)

|

|

Value of interest in Master Trust investment accounts per

Form 5500, Schedule H, Part I, Line 1c(11)

|

|

$

|

3,604,267

|

|

|

$

|

3,364,397

|

|

Effective July 1, 2017, the Company will increase RSA contributions for eligible RSA participants to a rate of 3% of salary up to age 40, 4% of salary for ages 40-49, 5% of salary for ages 50-54 and 6% of salary for ages above 55.

* * * * * *

SUPPLEMENTAL SCHEDULE

INTERNATIONAL PAPER COMPANY SALARIED SAVINGS PLAN

EIN: 13-0872805; PLAN 007

FORM 5500, SCHEDULE H, PART IV, LINE 4i—SCHEDULE OF ASSETS (HELD AT END OF YEAR)

DECEMBER 31,

2016

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a)

|

|

(b) Identity of Issue, Borrower,

Lessor or Similar Party

|

|

(c) Description of Investment, Including Maturity Date, Rate of Interest,

Collateral, Par or Maturity Value

|

|

(d) Cost

|

|

(e) Current

Value

|

|

*

|

|

Various participants

|

|

Participant loans at interest rates of 4.25% to 10.50%, maturing through December 2026

|

|

**

|

|

$

|

61,554,852

|

|

|

*

|

|

JP Morgan CISC

|

|

Self-directed brokerage accounts - other assets

|

|

**

|

|

89,744,030

|

|

|

*

|

|

JP Morgan CISC

|

|

Self-directed brokerage accounts - Joint venture interest

|

|

**

|

|

101,387

|

|

|

*

|

|

International Paper Company

|

|

Self-directed brokerage accounts - Bonds at interest rate of 7.95% due June 2018

|

|

**

|

|

6,513

|

|

|

*

|

|

International Paper Company

|

|

Self-directed brokerage accounts - Notes at interest rate of 7.5% due August 2021

|

|

**

|

|

120,016

|

|

|

|

|

|

|

|

**

|

Cost information is not required for participant-directed investments and, therefore, is not included.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the person who administers the Plan has duly caused this annual report to be signed by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

INTERNATIONAL PAPER COMPANY SALARIED SAVINGS PLAN

|

|

|

|

|

By:

|

|

/s/ Mark M. Azzarello

|

|

|

|

Mark M. Azzarello, Plan Administrator

|

|

|

|

|

|

|

Date:

|

July 12, 2017

Memphis, TN

|

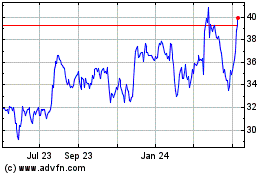

International Paper (NYSE:IP)

Historical Stock Chart

From Mar 2024 to Apr 2024

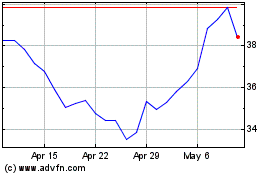

International Paper (NYSE:IP)

Historical Stock Chart

From Apr 2023 to Apr 2024