Nexstar Media Group Refinances Senior Secured Term Loans and Revolving Credit Facility

July 10 2017 - 4:05PM

Business Wire

Refinancing Reduces Annual Interest Expense

by Approximately $15 Million

Nexstar Media Group, Inc. (Nasdaq:NXST) announced today it

received commitments for a $3.1 billion refinancing of its

outstanding Senior Secured Term Loan facilities, including the

balance of the $2.75 billion Senior Secured Term Loan B due January

2024, the $51.3 million Senior Secured Term Loan A due June 2018

and the $293.9 million Senior Secured Term Loan A due January 2022.

Nexstar will also be refinancing its $175.0 million Senior Secured

revolving credit facility under which $3.0 million was drawn as of

March 31, 2017. The Company expects the refinancing transaction to

close on or about July 18, 2017, which will lower its annual

interest expense by approximately $15 million and increase free

cash flow by approximately $9 million on an annualized basis.

The new $2.125 billion Term Loan B facility was issued at par

and bears interest at a rate of LIBOR plus 2.50%, while its

maturity date remains unchanged. These new terms represent a 50

basis point interest rate reduction compared to the Company’s prior

Term Loan B facility. The new $800 million Term Loan A facility was

issued at par and initially bears interest at a rate of LIBOR plus

2.00%, with periodic adjustments thereafter according to a leverage

based grid. The maturity on the balance of the $51.3 million

tranche is unchanged and the remaining portion of the Term Loan A

will have a new 5 year maturity. The Company’s new Senior Secured

revolving credit facility has a total capacity of $175 million, of

which $3.0 million is currently drawn, and initially bears interest

at a rate of LIBOR plus 2.00%, with periodic adjustments thereafter

according to a leverage based grid. The Company’s previous Term

Loan A and revolving credit facility were priced at a rate of LIBOR

plus 2.50%, while the interest rate for the new Term Loan A and

revolving credit facilities is LIBOR plus 2.00%.

Perry A. Sook, Chairman, President and Chief Executive Officer

of Nexstar Media Group, Inc. commented, “The refinancing of our

Senior Secured Term Loan facilities and revolving credit facility

further underscores Nexstar’s ongoing focus on actively managing

our capital structure to drive free cash flow growth and provide

the financial flexibility to support our near- and long-term growth

and return of capital objectives. We thank our lenders for their

continued support and believe this refinancing will enhance

long-term shareholder value as it reduces our annual cash interest

expense thus increasing our significant and growing free cash flow.

Furthermore, we continue to expect Nexstar’s net leverage, absent

additional strategic activity, to be in the high 4x range at the

end of 2017 before declining to the mid 3x range by the end of

2018.”

About Nexstar Media Group, Inc.

Nexstar Media Group is a leading diversified media company that

leverages localism to bring new services and value to consumers and

advertisers through its traditional media, digital and mobile media

platforms. Nexstar owns, operates, programs or provides sales and

other services to 170 television stations and related digital

multicast signals reaching 100 markets or nearly 39% of all U.S.

television households. Nexstar’s portfolio includes primary

affiliates of NBC, CBS, ABC, FOX, MyNetworkTV and The CW. Nexstar’s

community portal websites offer additional hyper-local content and

verticals for consumers and advertisers, allowing audiences to

choose where, when and how they access content while creating new

revenue opportunities. For more information please visit

www.nexstar.tv.

Forward-Looking Statements

This communication includes forward-looking statements. We have

based these forward-looking statements on our current expectations

and projections about future events. Forward-looking statements

include information preceded by, followed by, or that includes the

words "guidance," "believes," "expects," "anticipates," "could," or

similar expressions. For these statements, Nexstar claims the

protection of the safe harbor for forward-looking statements

contained in the Private Securities Litigation Reform Act of 1995.

The forward-looking statements contained in this communication,

concerning, among other things, future financial performance,

including changes in net revenue, cash flow and operating expenses,

involve risks and uncertainties, and are subject to change based on

various important factors, including the impact of changes in

national and regional economies, the ability to service and

refinance our outstanding debt, successful integration of acquired

television stations and digital businesses (including achievement

of synergies and cost reductions), pricing fluctuations in local

and national advertising, future regulatory actions and conditions

in the television stations' operating areas, competition from

others in the broadcast television markets, volatility in

programming costs, the effects of governmental regulation of

broadcasting, industry consolidation, technological developments

and major world news events. Nexstar undertakes no obligation to

update or revise any forward-looking statements, whether as a

result of new information, future events or otherwise. In light of

these risks, uncertainties and assumptions, the forward-looking

events discussed in this communication might not occur. You should

not place undue reliance on these forward-looking statements, which

speak only as of the date of this release. For more details on

factors that could affect these expectations, please see Nexstar’s

other filings with the SEC.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170710006151/en/

Nexstar Media Group, Inc.Thomas E. CarterChief Financial

Officer972/373-8800orJCIRJoseph Jaffoni, Jennifer

Neuman212/835-8500 or nxst@jcir.com

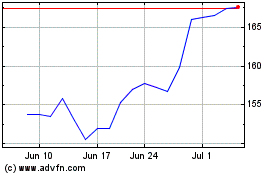

Nexstar Media (NASDAQ:NXST)

Historical Stock Chart

From Mar 2024 to Apr 2024

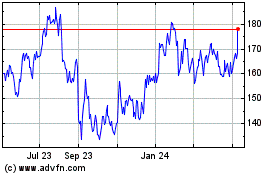

Nexstar Media (NASDAQ:NXST)

Historical Stock Chart

From Apr 2023 to Apr 2024