Current Report Filing (8-k)

July 10 2017 - 2:47PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 3, 2017

MGP Ingredients, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

KANSAS

|

0-17196

|

45-4082531

|

|

(State or other jurisdiction

of incorporation)

|

(Commission

File Number)

|

(IRS Employer

Identification No.)

|

Cray Business Plaza

100 Commercial Street

Box 130

Atchison, Kansas 66002

(Address of principal executive offices) (Zip Code)

(913) 367-1480

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 1.01 Entry into a Material Definitive Agreement.

On July 3, 2017, MGP Ingredients, Inc. ("MGP" or "Company") completed the previously-announced sale of its thirty percent equity ownership interest in Illinois Corn Processing, LLC ("ICP") to Pacific Ethanol Central, LLC ("Pacific Ethanol").

As previously disclosed, at the closing of the sale, MGP received cash of $9.0 million (before transaction expenses and taxes) and a secured promissory note ("Note") with a principal amount of $14.0 million (includes MGP's portion of a favorable working capital adjustment). ICP is the obligor on the Note. The Note is secured by, among other things, all of the limited liability company interests issued by ICP, as well as all of the property and assets of ICP following the closing. The Note bears interest at LIBOR plus an applicable margin. The margin is 5% for the first three months the Note is outstanding, 8% for the next three months, and 10% at all times thereafter. The Note matures 18 months from the closing of the merger transaction. The Note may be prepaid without penalty or premium. The Note requires mandatory prepayment in certain circumstances as a result of the receipt of cash proceeds by the maker from the sale or other disposition of the property which is collateral under the Note. The Note includes customary representations and warranties and events of default.

The Merger Agreement also contemplated a special distribution of all of ICP’s cash and cash equivalents to equity owners prior to closing. On June 28, 2017, MGP received $6.6 million (representing MGP’s 30% share of the $22.0 million dividend approved on June 26, 2017). MGP also received a smaller distribution of $0.8 million on June 30, 2017 (representing MGP’s 30% share of a $2.7 million additional distribution).

The above description of the Note is qualified in its entirety by the terms of the Note attached hereto as Exhibit 10.1 and incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

|

|

|

|

10.1

|

Secured Promissory Note dated July 3, 2017 issued to MGPI Processing, Inc.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

MGP INGREDIENTS, INC.

Date: July

10,

2017 By:

/s/ Thomas K. Pigott

Thomas K. Pigott, Vice President and Chief Financial Officer

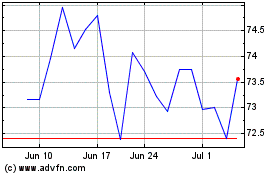

MGP Ingredients (NASDAQ:MGPI)

Historical Stock Chart

From Mar 2024 to Apr 2024

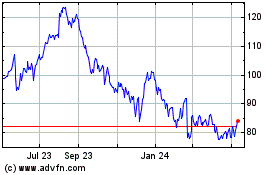

MGP Ingredients (NASDAQ:MGPI)

Historical Stock Chart

From Apr 2023 to Apr 2024