UBS Hits Milestone in Mobilizing Private Wealth for Public Good

July 10 2017 - 7:00AM

Business Wire

- The world's leading global wealth

manager raises USD 325 million for The Rise Fund – the largest

investment in the Fund.

- The sum is UBS's biggest step so far

to meeting its USD 5 billion commitment to impact investments

related to the UN Sustainable Development Goals (SDGs).

- The Rise Fund was co-founded by Bill

McGlashan, Bono, and Jeff Skoll, in collaboration with The

Bridgespan Group and the Founders Board.

UBS, the world's leading global wealth manager, has raised USD

325 million for The Rise Fund as part of a five-year plan to

mobilize private wealth for public good.

The sum raised represents the largest investment in the private

equity impact investment vehicle. The Rise Fund is committed to

achieving measurable, positive social and environmental outcomes

alongside competitive financial returns. Its objectives are aligned

with the UN SDGs.

After raising USD 471 million for its UBS Oncology Impact Fund

last year, UBS committed to raise USD 5 billion for SDG-related

impact investments over the next five years at the World Economic

Forum Annual Meeting 2017 in Davos.

The Rise Fund is an impact investing collaboration among several

parties, including:

- Co-Founders Bill McGlashan, Bono, and

Jeff Skoll. Bill McGlashan is CEO of The Rise Fund and Founder and

Managing Partner at TPG Growth.

- The Bridgespan Group, a global

non-profit advisor and resource for mission-driven organizations,

philanthropists and investors, which has worked with The Rise Fund

to design its impact assessment methodology.

- The Founders Board, a group of

influential thought leaders with a deep personal and professional

commitment to driving social and environmental progress.

- The Rise Council, which supports the

Fund and the impact investing industry more broadly, and whose

members include UBS.

Sergio Ermotti, Group CEO at UBS, said: "UBS is proud to

have raised the largest investment in The Rise Fund. Our

partnership represents a significant milestone in mobilizing

private wealth for public good. We hope it will encourage our

clients and others to support similar ventures and help make the

world a more sustainable place."

Mark Haefele, Global Chief Investment Officer at UBS Wealth

Management, said: "Our private clients care deeply about making

an impact on society as well as earning a compelling return. Impact

investing offers them the opportunity to do both, and as such the

industry is likely to grow significantly over the longer term."

Simon Smiles, Chief Investment Officer for Ultra High Net

Worth at UBS Wealth Management, said: "Our wealthiest clients

can commonly commit to longer-term investments and are therefore

well-suited to impact investing. Interest in impact investing is

especially high among millennials, but is also growing strongly

across our entire client base, particularly in Asia."

According to UBS's white paper for Davos 2017 , private wealth

could play a much bigger role in funding the SDGs, yet most

initiatives ignore it.

Private wealth investment tends to be longer-term and hence

aligned with the SDGs, and also has fewer constraints than

institutional capital. It can be incentivized by mainstreaming

SDG-related impact investing, enhancing SDG funding gap data and

measurement, standardizing investment terms and disclosures, and

connecting investors with opportunities via platforms and other

initiatives.

The Rise Fund will focus on investments in seven sectors in

which independent research has shown that impact is both achievable

and measurable in quantitative terms: education, energy, food and

agriculture, financial services, growth infrastructure, healthcare,

and technology, media & telecommunications. It will invest

predominantly in growing companies across developed and developing

markets.

Any investment opportunities in the Fund are restricted to

qualifying investors only, are not available for general

distribution to retail clients, and are not available in certain

jurisdictions.

About UBS

UBS provides financial advice and solutions to wealthy,

institutional and corporate clients worldwide, as well as private

clients in Switzerland. The operational structure of the Group is

comprised of our Corporate Center and five business divisions:

Wealth Management, Wealth Management Americas, Personal &

Corporate Banking, Asset Management and the Investment Bank. UBS's

strategy builds on the strengths of all of its businesses and

focuses its efforts on areas in which it excels, while seeking to

capitalize on the compelling growth prospects in the businesses and

regions in which it operates, in order to generate attractive and

sustainable returns for its shareholders. All of its businesses are

capital-efficient and benefit from a strong competitive position in

their targeted markets.

UBS is present in all major financial centers worldwide. It has

offices in 54 countries, with about 34% of its employees working in

the Americas, 35% in Switzerland, 18% in the rest of Europe, the

Middle East and Africa and 13% in Asia Pacific. UBS Group AG

employs approximately 60,000 people around the world. Its shares

are listed on the SIX Swiss Exchange and the New York Stock

Exchange (NYSE).

UBS media contacts Switzerland: +41-44-234 85 00 UK: +44-207-567 47

14 Americas: +1-212-882 58 57 APAC: -852-297-1 82 00 www.ubs.com

Disclaimers

This communication does not constitute an offer to sell or a

solicitation of an offer to buy any securities and may not be used

or relied upon in evaluating the merits of investing in any

investment fund or instrument. The information set forth herein

does not purport to be complete and is qualified in its entirety by

reference to the investment fund or instrument documentation.

Any investment opportunities mentioned in this press release are

restricted to specific qualifying investors (i.e. in Hong Kong to

Professional Investors only) and will not be available for general

distribution. The contents of this document have not been reviewed

by any regulatory authority in Hong Kong. You are advised to

exercise caution in relation to the offer. If you are in any doubt

about the contents of this document, you should obtain independent

professional advice. This information pays no regard to specific

investment objectives, financial or tax situations or particular

needs of any recipient. UBS does not provide legal or tax

advice.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170710005312/en/

UBSMaya Dillon, +1-212-713-3130maya.dillon@ubs.com

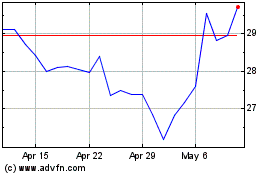

UBS (NYSE:UBS)

Historical Stock Chart

From Mar 2024 to Apr 2024

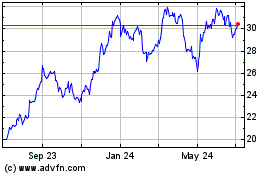

UBS (NYSE:UBS)

Historical Stock Chart

From Apr 2023 to Apr 2024