Current Report Filing (8-k)

July 07 2017 - 4:13PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of Earliest Event Reported) July 7, 2017

NEVADA

CANYON GOLD CORP.

(Exact

Name of Registrant as Specified in its Charter)

|

Nevada

|

|

000-55600

|

|

46-5152859

|

(State

or other jurisdiction

of incorporation)

|

|

(Commission

File number)

|

|

(IRS

Employer

Identification No.)

|

316

California Ave., Suite 543, Reno, NV 89509

(Address

of principal executive offices) (zip code)

Registrant’s

telephone number, including area code (888) 909-5548

(Former

name or former address, if changed since last report.)

Copies

to:

Brunson

Chandler Jones, PLLC

175

South Main Street, Suite 1410

Salt

Lake City, Utah 84111

Phone:

(801) 303-5730

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (see General Instruction A.2. below):

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

ITEM

1.01 ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT

Option

Purchase Agreement

On

July 5, 2017, the Nevada Canyon Gold Corp. (“NCG”) entered into an Option Purchase Agreement (the “Agreement”)

with Walker River Resources Corp., a Canadian public company (“Walker River” or “WRR”), on the Lapon Canyon

Project, located in Mineral County, Nevada. (the “Property”).

The

Option Purchase Agreement details whereby the Parties agreed to WRR purchasing NCG’s undivided thirty percent (30%) interest

in the Lapon Property.

Under

terms of the property purchase agreement, Walker River Resources Corp. will acquire Nevada Canyon’s 30% interest in the

Lapon Canyon Project in exchange for 9,100,000 common shares of Walker River and warrants to acquire an additional 11,900,000

common shares. Each warrant is exercisable for a period of five years without further consideration into one common share in the

capital of the Company. The terms of the warrants contain a provision that Nevada Canyon cannot exercise any warrants which would

result in it owning 10% or more of the issued and outstanding shares of the Company. Closing of the agreement with Nevada Canyon

is subject to the acceptance of the TSX Venture Exchange.

|

ITEM 9.01

|

FINANCIAL STATEMENTS AND EXHIBITS

|

(d)

Exhibits

|

Exhibit

No.

|

|

Description

|

|

|

|

|

|

10.2

|

|

Option

Purchase Agreement, dated July 5, 2017

|

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

NEVADA CANYON GOLD CORP.

|

|

|

|

|

|

|

By:

|

/s/ Jeffrey Cocks

|

|

|

|

Jeffrey Cocks

|

|

|

|

President and Chief Executive Officer

|

|

|

|

|

|

|

Date: July 7, 2017

|

|

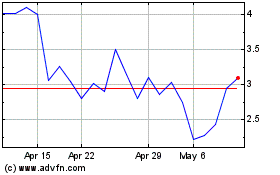

Nevada Canyon Gold (PK) (USOTC:NGLD)

Historical Stock Chart

From Mar 2024 to Apr 2024

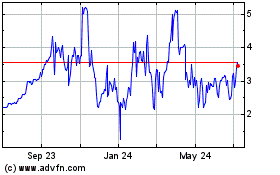

Nevada Canyon Gold (PK) (USOTC:NGLD)

Historical Stock Chart

From Apr 2023 to Apr 2024