UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form

6-K

REPORT OF

FOREIGN PRIVATE ISSUER

PURSUANT TO RULE

13a-16

OR

15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of July 2017

Commission File Number:

000-53445

KB Financial Group Inc.

(Translation of registrant’s name into English)

84,

Namdaemoon-ro, Jung-gu, Seoul 04534, Korea

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of

Form 20-F

or

Form 40-F.

Form 20-F ☒

Form 40-F ☐

Indicate by check mark if the registrant is submitting the

Form 6-K

in paper as permitted by

Regulation S-T

Rule 101(b)(1): ☐

Note

: Regulation

S-T

Rule 101(b)(1) only permits the submission in paper of a Form

6-K

if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the

registrant is submitting the

Form 6-K

in paper as permitted by

Regulation S-T

Rule 101(b)(7): ☐

Note

: Regulation

S-T

Rule 101(b)(7) only permits the submission in paper of a Form

6-K

if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or

legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required

to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form

6-K

submission or other Commission filing on EDGAR.

Report on the Results of the Stock Swap

Note:

Capitalized terms used without definitions herein have the meanings ascribed to them in the Prospectus filed with the Securities and Exchange

Commission under cover of Form CB on June 12, 2017.

The comprehensive stock swaps (the “Stock Swaps”) pursuant to which common shares of

KB Insurance Co., Ltd. (“KB Insurance”) and KB Capital Co., Ltd. (“KB Capital”) will be exchanged for common shares of KB Financial Group Inc. (“KB Financial Group”) will proceed in accordance with Article

62-2

of the Financial Holding Company Act, Article

165-4

of the Financial Investment Services and Capital Markets Act (the “FSCMA”), Article 176-5 and

176-6

of the Enforcement Decree of the FSCMA and Articles

360-2

to

360-14

of the Korean Commercial Code (the “KCC”).

KB Financial Group will become the wholly – owning parent company and KB Insurance and KB Capital will become wholly – owned subsidiaries of KB

Financial Group following the Stock Swaps.

The Stock Swaps will proceed as a small-scale stock swap for KB Financial Group. Accordingly, an approval by

the board of directors will replace an approval of the general meeting of shareholders and no appraisal rights are granted to the dissenting shareholders of KB Financial Group.

The Stock Swaps will proceed as an ordinary stock swap for KB Insurance and KB Capital and therefore require an approval by the general meeting of

shareholders. Appraisal rights are granted to the dissenting shareholders of KB Insurance and KB Capital.

|

|

|

|

|

|

|

|

|

Event

|

|

|

|

KB Financial Group

|

|

KB Insurance / KB Capital

|

|

Date of the board resolution

|

|

April 14, 2017

|

|

April 14, 2017

|

|

|

|

|

|

Date of the Stock Swap Agreements

|

|

April 14, 2017

|

|

April 14, 2017

|

|

|

|

|

|

Public announcement of the record date and the closure of the shareholder register

|

|

April 14, 2017

|

|

April 14, 2017

|

|

|

|

|

|

Record date

|

|

April 24, 2017

|

|

May 22, 2017 (May 23, 2017 00:00)

|

|

|

|

|

|

Public announcement or notice of small-scale stock swap

|

|

April 27, 2017

|

|

—

|

|

|

|

|

|

|

Closure of the shareholder register

|

|

Start date

|

|

April 25, 2017

|

|

May 23, 2017

|

|

|

End date

|

|

April 27, 2017

|

|

May 26, 2017

|

|

|

|

|

|

|

Dissent filing period (for the small-scale stock swaps)

|

|

Start date

|

|

April 27, 2017

|

|

—

|

|

|

End date

|

|

May 11, 2017

|

|

—

|

|

|

|

|

|

Notice of convening of a general meeting of shareholders

|

|

—

|

|

June 14, 2017

|

|

Dissent filing period

|

|

Start date

|

|

—

|

|

April 14, 2017

|

|

|

End date

|

|

—

|

|

June 21, 2017

|

|

|

|

|

|

Date of the board resolution / the resolution of the general meeting of shareholders for approval of the Stock Swaps

|

|

—

|

|

June 22, 2017

|

|

|

|

|

|

|

|

|

|

Appraisal right exercise period

|

|

Start date

|

|

—

|

|

June 22, 2017

|

|

|

End date

|

|

—

|

|

July 3, 2017

|

|

|

|

|

|

Date of submission of old share certificates and public announcement/notice of invalidation by the entities that will become the wholly-owned subsidiaries

|

|

—

|

|

June 29, 2017

|

|

|

|

|

|

Trading suspension period for shares of KB Insurance and KB Capital

|

|

—

|

|

July 5 – 20, 2017

|

|

|

|

|

|

Date of payment of share purchase price to dissenting shareholders exercising appraisal rights

|

|

—

|

|

July 5, 2017

|

|

|

|

|

|

End date for submission of old share certificates

|

|

—

|

|

July 6, 2017

|

|

|

|

|

|

Stock Swap Date

|

|

July 7, 2017

|

|

July 7, 2017

|

|

|

|

|

|

Expected date of delivery of new share certificates

|

|

July 20, 2017

|

|

—

|

|

|

|

|

|

Expected commencement of trading of new shares of KB Financial Group and delisting of shares of KB Insurance and KB Capital

|

|

July 21, 2017

|

|

July 21, 2017

|

|

1.

|

The schedule after the expected date of delivery of new share certificates is the expected schedule as of July 7, 2017 and may change subject to consultation with or approval by the relevant authorities or consultation

between the contracting parties.

|

|

2.

|

The schedule above is an accelerated stock swap schedule in accordance with Article

62-2

of the Financial Holding Company Act, and certain dates are accelerated compared to a

stock swap schedule in accordance with the KCC. Pursuant to paragraph (2) of Article

62-2

of the Financial Holding Company Act, the exercise of appraisal rights with respect to shares of KB Insurance and

KB Capital may occur within 10 days from the date of resolution of the general meeting of the shareholders, and the public announcement and notice regarding the submission and invalidation of old share certificates held by the shareholders of KB

Insurance and KB Capital may be accelerated to 5 days prior to the Stock Swap Date.

|

|

II.

|

Changes in Share Ownership of the Largest Shareholder

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Classification

|

|

Shares Owned Before the Stock Swaps

(As of July 4, 2017)

|

|

Shares Owned After the Stock

Swaps

|

|

|

KB Financial

Group

|

|

KB Insurance

|

|

KB Capital

|

|

KB Financial

Group

|

|

KB Insurance

|

|

KB Capital

|

|

Name of the largest shareholder

|

|

Korean National Pension Service

(Korean National Pension Fund)

|

|

KB Financial Group

|

|

KB Financial Group

|

|

Korean National Pension Service

(Korean National Pension Fund)

|

|

KB Financial Group

|

|

KB Financial Group

|

|

|

|

|

|

|

|

|

|

Total number of shares owned by the largest shareholder

|

|

40,950,453

shares

|

|

62,710,408

shares

|

|

17,129,930

shares

|

|

42,979,873

shares

|

|

66,500,000

shares

|

|

21,492,128

shares

|

|

|

|

|

|

|

|

|

|

Percentage of shareholding of the largest shareholder

|

|

9.79%

|

|

94.30%

|

|

79.70%

|

|

10.28%

|

|

100%

|

|

100%

|

|

1.

|

All of the shares of KB Financial Group, KB Insurance and KB Capital before and after the Stock Swaps are registered common shares.

|

|

2.

|

As of July 4, 2017, the numbers of shares of KB Financial Group, KB Insurance and KB Capital owned by the Korean National Pension Service are 40,950,453 shares, 2,701,659 shares and 926,096 shares, respectively.

Assuming no additional acquisition or disposal of shares by the Korea National Pension Service before the Stock Swaps, the total number of shares of KB Financial Group to be provided in respect of shares of KB Insurance and KB Capital owned by the

Korean National Pension Service is 2,029,420 shares (Calculated by applying the stock swap ratio of 1 to 0.5728700 to the number of KB Insurance shares owned, and the stock swap ratio of 1 to 0.5201639 to the number of KB Capital shares owned.) The

total number of shares of KB Financial Group owned by the Korean National Pension Service will be 42,979,873 shares following the Stock Swaps.

|

|

III.

|

Matters Relating to Appraisal Rights

|

|

1.

|

Expected Share Purchase Price

|

|

A.

|

Common Shares of KB Financial Group

|

With respect to KB Financial Group, the Stock Swaps will proceed as a small-scale stock swap pursuant to Article

360-10

of the KCC and accordingly, no appraisal rights will be granted to the dissenting shareholders of KB Financial Group.

|

B.

|

Common Shares of KB Insurance and KB Capital

|

|

|

|

|

|

|

|

Proposed share purchase price for consultation

|

|

KB Insurance

|

|

KB Capital

|

|

|

KRW27,495

|

|

KRW25,234

|

|

|

|

|

Calculation criteria

|

|

Calculated in accordance with the method prescribed by paragraph

(3)-1

of Article

62-2

of the Financial Holding Company Act and paragraph

(1) of Article

33-2

of its Enforcement Decree, as well as paragraph

(3)-1

of Article

176-7

of the Enforcement Decree of the

FSCMA.

|

|

|

|

|

If no agreement is reached on the share purchase price

|

|

(1) Pursuant to paragraph (4) Article

62-2

of the Financial Holding Company Act, if the company or shareholders holding at least 30% of the number of shares in respect of which appraisal rights have been exercised oppose the share purchase price

proposed by the company, the company or such shareholders may file an application for the adjustment of the share purchase price with the FSC 10 days prior (Monday, July 17, 2017) to the payment date of the share purchase price.

(2) Pursuant to paragraph (3) of Article

165-5

of

the FSCMA, if the company or a shareholder exercising appraisal rights opposes the share purchase price proposed by the company, it may request a court to determine the share purchase price. With respect to whether a court may be requested to

determine the share purchase price, please note that the courts may interpret paragraph (3) of Article

62-2

of the Financial Holding Company Act differently.

|

|

1.

|

In the event that shareholders opposing the above expected share purchase price apply for an adjustment of the share purchase price with the FSC or request a court to determine the share purchase price, such application

or request will not affect the Stock Swap procedures and the purchase price determined by such application or request will have effect only with respect to those shareholders who had made such application or request.

|

[Method of Determination of the Expected Share Purchase Price]

(Calculation date: April 13, 2017)

|

|

|

|

|

|

|

Item

|

|

Amount (KRW)

|

|

Calculation Period

|

|

A. Volume weighted average of the closing prices of KB Insurance

common shares for the most recent

two-month

period

|

|

27,028

|

|

February 14, 2017 — April 13, 2017

|

|

B. Volume weighted average of the closing prices of KB Insurance

common shares for the most recent

one-month

period

|

|

27,666

|

|

March 14, 2017 — April 13, 2017

|

|

C. Volume weighted average of the closing prices of KB Insurance

common shares for the most recent

one-week

period

|

|

27,790

|

|

April 7, 2017 — April 13, 2017

|

|

Share Purchase Price [(A+B+C)/3]

|

|

27,495

|

|

—

|

|

1.

|

With the date preceding the date of the board of directors’ resolution for approval of the Stock Swaps (April 14, 2017) as the calculation date (April 13, 2017), the expected share purchase price was calculated

based on the arithmetic mean of (A) the volume weighted average of the closing prices of KB Insurance common shares for the most recent two-month period; (B) the volume weighted average of the closing prices of KB Insurance common shares for the

most recent one-month period; and (C) the volume weighted average of the closing prices of KB Insurance common shares for the most recent one-week period.

|

The table below shows the closing prices and trading volumes for the

two-month

period preceding the calculation date

of April 13, 2017.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date

|

|

Closing Price (KRW)

|

|

|

Trading Volume (Shares)

|

|

|

Closing Price x Trading Volume (KRW)

|

|

|

February 14, 2017 (Tue)

|

|

|

26,400

|

|

|

|

156,423

|

|

|

|

4,129,567,200

|

|

|

February 15, 2017 (Wed)

|

|

|

26,900

|

|

|

|

222,926

|

|

|

|

5,996,709,400

|

|

|

February 16, 2017 (Thu)

|

|

|

26,000

|

|

|

|

405,706

|

|

|

|

10,548,356,000

|

|

|

February 17, 2017 (Fri)

|

|

|

25,700

|

|

|

|

238,647

|

|

|

|

6,133,227,900

|

|

|

February 20, 2017 (Mon)

|

|

|

25,550

|

|

|

|

156,706

|

|

|

|

4,003,838,300

|

|

|

February 21, 2017 (Tue)

|

|

|

25,500

|

|

|

|

175,740

|

|

|

|

4,481,370,000

|

|

|

February 22, 2017 (Wed)

|

|

|

25,400

|

|

|

|

215,901

|

|

|

|

5,483,885,400

|

|

|

February 23, 2017 (Thu)

|

|

|

25,600

|

|

|

|

316,485

|

|

|

|

8,102,016,000

|

|

|

February 24, 2017 (Fri)

|

|

|

26,000

|

|

|

|

321,138

|

|

|

|

8,349,588,000

|

|

|

February 27, 2017 (Mon)

|

|

|

26,150

|

|

|

|

176,989

|

|

|

|

4,628,262,350

|

|

|

February 28, 2017 (Tue)

|

|

|

26,350

|

|

|

|

121,953

|

|

|

|

3,213,461,550

|

|

|

March 2, 2017 (Thu)

|

|

|

26,400

|

|

|

|

294,796

|

|

|

|

7,782,614,400

|

|

|

March 3, 2017 (Fri)

|

|

|

27,100

|

|

|

|

455,832

|

|

|

|

12,353,047,200

|

|

|

March 6, 2017 (Mon)

|

|

|

27,300

|

|

|

|

229,397

|

|

|

|

6,262,538,100

|

|

|

March 7, 2017 (Tue)

|

|

|

27,450

|

|

|

|

212,116

|

|

|

|

5,822,584,200

|

|

|

March 8, 2017 (Wed)

|

|

|

27,450

|

|

|

|

179,405

|

|

|

|

4,924,667,250

|

|

|

March 9, 2017 (Thu)

|

|

|

27,250

|

|

|

|

297,584

|

|

|

|

8,109,164,000

|

|

|

March 10, 2017 (Fri)

|

|

|

27,300

|

|

|

|

162,736

|

|

|

|

4,442,692,800

|

|

|

March 13, 2017 (Mon)

|

|

|

27,150

|

|

|

|

135,482

|

|

|

|

3,678,336,300

|

|

|

March 14, 2017 (Tue)

|

|

|

27,700

|

|

|

|

248,738

|

|

|

|

6,890,042,600

|

|

|

March 15, 2017 (Wed)

|

|

|

28,100

|

|

|

|

266,148

|

|

|

|

7,478,758,800

|

|

|

March 16, 2017 (Thu)

|

|

|

28,300

|

|

|

|

174,015

|

|

|

|

4,924,624,500

|

|

|

March 17, 2017 (Fri)

|

|

|

28,150

|

|

|

|

245,186

|

|

|

|

6,901,985,900

|

|

|

March 20, 2017 (Mon)

|

|

|

27,900

|

|

|

|

143,460

|

|

|

|

4,002,534,000

|

|

|

March 21, 2017 (Tue)

|

|

|

27,900

|

|

|

|

128,241

|

|

|

|

3,577,923,900

|

|

|

March 22, 2017 (Wed)

|

|

|

27,600

|

|

|

|

113,942

|

|

|

|

3,144,799,200

|

|

|

March 23, 2017 (Thu)

|

|

|

27,650

|

|

|

|

96,531

|

|

|

|

2,669,082,150

|

|

|

March 24, 2017 (Fri)

|

|

|

27,400

|

|

|

|

143,433

|

|

|

|

3,930,064,200

|

|

|

March 27, 2017 (Mon)

|

|

|

27,400

|

|

|

|

98,662

|

|

|

|

2,703,338,800

|

|

|

March 28, 2017 (Tue)

|

|

|

27,400

|

|

|

|

118,293

|

|

|

|

3,241,228,200

|

|

|

March 29, 2017 (Wed)

|

|

|

27,550

|

|

|

|

192,846

|

|

|

|

5,312,907,300

|

|

|

March 30, 2017 (Thu)

|

|

|

27,200

|

|

|

|

221,492

|

|

|

|

6,024,582,400

|

|

|

March 31, 2017 (Fri)

|

|

|

27,000

|

|

|

|

316,445

|

|

|

|

8,544,015,000

|

|

|

April 3, 2017 (Mon)

|

|

|

27,300

|

|

|

|

260,420

|

|

|

|

7,109,466,000

|

|

|

April 4, 2017 (Tue)

|

|

|

27,750

|

|

|

|

123,060

|

|

|

|

3,414,915,000

|

|

|

April 5, 2017 (Wed)

|

|

|

27,700

|

|

|

|

114,363

|

|

|

|

3,167,855,100

|

|

|

April 6, 2017 (Thu)

|

|

|

27,650

|

|

|

|

103,327

|

|

|

|

2,856,991,550

|

|

|

April 7, 2017 (Fri)

|

|

|

27,750

|

|

|

|

148,427

|

|

|

|

4,118,849,250

|

|

|

April 10, 2017 (Mon)

|

|

|

27,500

|

|

|

|

164,978

|

|

|

|

4,536,895,000

|

|

|

April 11, 2017 (Tue)

|

|

|

27,500

|

|

|

|

101,570

|

|

|

|

2,793,175,000

|

|

|

April 12, 2017 (Wed)

|

|

|

27,400

|

|

|

|

126,492

|

|

|

|

3,465,880,800

|

|

|

April 13, 2017 (Thu)

|

|

|

28,200

|

|

|

|

322,705

|

|

|

|

9,100,281,000

|

|

|

A. Volume weighted average of the closing prices

for the most recent

two-month

period

|

|

|

|

27,028

|

|

|

B. Volume weighted average of the closing prices for the

most recent

one-month

period

|

|

|

|

27,666

|

|

|

C. Volume weighted average of the closing prices for the

most recent

one-week

period

|

|

|

|

27,790

|

|

|

D. Share purchase price based on arithmetic mean

[(A+B+C)/3]

|

|

|

|

27,495

|

|

[Method of Determination of the Expected Share Purchase Price]

(Calculation date: April 13, 2017)

|

|

|

|

|

|

|

Item

|

|

Amount (KRW)

|

|

Calculation Period

|

|

A. Volume weighted average of the closing prices of KC Capital common

shares for the most recent

two-month

period

|

|

25,442

|

|

February 14, 2017 — April 13, 2017

|

|

B. Volume weighted average of the closing prices of KB Capital common

shares for the most recent

one-month

period

|

|

25,159

|

|

March 14, 2017 — April 13, 2017

|

|

C. Volume weighted average of the closing prices of KB Capital common

shares for the most recent

one-week

period

|

|

25,100

|

|

April 7, 2017 — April 13, 2017

|

|

Share Purchase Price [(A+B+C)/3]

|

|

25,234

|

|

—

|

|

1.

|

With the date preceding the date of the board of directors’ resolution for approval of the Stock Swaps (April 14, 2017) as the calculation date (April 13, 2017), the expected share purchase price was

calculated based on the arithmetic mean of (A) the volume weighted average of the closing prices of KB Capital common shares for the most recent two-month period; (B) the volume weighted average of the closing prices of KB Capital common shares for

the most recent two-month period; and (C) the volume weighted average of the closing prices of KB Capital common shares for the most recent one-week period.

|

The table below shows the closing prices and trading volumes for the

two-month

period preceding the calculation date of April 13, 2017.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date

|

|

Closing Price (KRW)

|

|

|

Trading Volume (Shares)

|

|

|

Closing Price x Trading Volume (KRW)

|

|

|

February 14, 2017 (Tue)

|

|

|

25,500

|

|

|

|

13,762

|

|

|

|

350,931,000

|

|

|

February 15, 2017 (Wed)

|

|

|

25,800

|

|

|

|

9,178

|

|

|

|

236,792,400

|

|

|

February 16, 2017 (Thu)

|

|

|

25,800

|

|

|

|

22,051

|

|

|

|

568,915,800

|

|

|

February 17, 2017 (Fri)

|

|

|

26,200

|

|

|

|

13,226

|

|

|

|

346,521,200

|

|

|

February 20, 2017 (Mon)

|

|

|

26,000

|

|

|

|

10,891

|

|

|

|

283,166,000

|

|

|

February 21, 2017 (Tue)

|

|

|

26,000

|

|

|

|

7,058

|

|

|

|

183,508,000

|

|

|

February 22, 2017 (Wed)

|

|

|

26,000

|

|

|

|

2,967

|

|

|

|

77,142,000

|

|

|

February 23, 2017 (Thu)

|

|

|

26,150

|

|

|

|

6,030

|

|

|

|

157,684,500

|

|

|

February 24, 2017 (Fri)

|

|

|

26,150

|

|

|

|

9,774

|

|

|

|

255,590,100

|

|

|

February 27, 2017 (Mon)

|

|

|

26,000

|

|

|

|

10,010

|

|

|

|

260,260,000

|

|

|

February 28, 2017 (Tue)

|

|

|

26,800

|

|

|

|

9,755

|

|

|

|

261,434,000

|

|

|

March 2, 2017 (Thu)

|

|

|

26,000

|

|

|

|

8,471

|

|

|

|

220,246,000

|

|

|

March 3, 2017 (Fri)

|

|

|

26,000

|

|

|

|

7,688

|

|

|

|

199,888,000

|

|

|

March 6, 2017 (Mon)

|

|

|

25,600

|

|

|

|

8,507

|

|

|

|

217,779,200

|

|

|

March 7, 2017 (Tue)

|

|

|

26,250

|

|

|

|

8,227

|

|

|

|

215,958,750

|

|

|

March 8, 2017 (Wed)

|

|

|

25,700

|

|

|

|

8,661

|

|

|

|

222,587,700

|

|

|

March 9, 2017 (Thu)

|

|

|

25,850

|

|

|

|

5,204

|

|

|

|

134,523,400

|

|

|

March 10, 2017 (Fri)

|

|

|

25,750

|

|

|

|

12,870

|

|

|

|

331,402,500

|

|

|

March 13, 2017 (Mon)

|

|

|

25,900

|

|

|

|

6,824

|

|

|

|

176,741,600

|

|

|

March 14, 2017 (Tue)

|

|

|

25,850

|

|

|

|

7,459

|

|

|

|

192,815,150

|

|

|

March 15, 2017 (Wed)

|

|

|

25,850

|

|

|

|

8,511

|

|

|

|

220,009,350

|

|

|

March 16, 2017 (Thu)

|

|

|

26,150

|

|

|

|

16,296

|

|

|

|

426,140,400

|

|

|

March 17, 2017 (Fri)

|

|

|

26,100

|

|

|

|

9,549

|

|

|

|

249,228,900

|

|

|

March 20, 2017 (Mon)

|

|

|

25,900

|

|

|

|

8,282

|

|

|

|

214,503,800

|

|

|

March 21, 2017 (Tue)

|

|

|

25,600

|

|

|

|

11,340

|

|

|

|

290,304,000

|

|

|

March 22, 2017 (Wed)

|

|

|

25,000

|

|

|

|

34,732

|

|

|

|

868,300,000

|

|

|

March 23, 2017 (Thu)

|

|

|

25,250

|

|

|

|

18,827

|

|

|

|

475,381,750

|

|

|

March 24, 2017 (Fri)

|

|

|

24,950

|

|

|

|

11,850

|

|

|

|

295,657,500

|

|

|

March 27, 2017 (Mon)

|

|

|

24,750

|

|

|

|

39,277

|

|

|

|

972,105,750

|

|

|

March 28, 2017 (Tue)

|

|

|

24,750

|

|

|

|

7,180

|

|

|

|

177,705,000

|

|

|

March 29, 2017 (Wed)

|

|

|

24,200

|

|

|

|

7,795

|

|

|

|

188,639,000

|

|

|

March 30, 2017 (Thu)

|

|

|

24,900

|

|

|

|

2,758

|

|

|

|

68,674,200

|

|

|

March 31, 2017 (Fri)

|

|

|

24,600

|

|

|

|

3,175

|

|

|

|

78,105,000

|

|

|

April 3, 2017 (Mon)

|

|

|

25,000

|

|

|

|

6,183

|

|

|

|

154,575,000

|

|

|

April 4, 2017 (Tue)

|

|

|

24,900

|

|

|

|

4,848

|

|

|

|

120,715,200

|

|

|

April 5, 2017 (Wed)

|

|

|

24,850

|

|

|

|

3,961

|

|

|

|

98,430,850

|

|

|

April 6, 2017 (Thu)

|

|

|

24,900

|

|

|

|

7,383

|

|

|

|

183,836,700

|

|

|

April 7, 2017 (Fri)

|

|

|

24,950

|

|

|

|

7,013

|

|

|

|

174,974,350

|

|

|

April 10, 2017 (Mon)

|

|

|

25,000

|

|

|

|

7,954

|

|

|

|

198,850,000

|

|

|

April 11, 2017 (Tue)

|

|

|

24,850

|

|

|

|

6,426

|

|

|

|

159,686,100

|

|

|

April 12, 2017 (Wed)

|

|

|

25,100

|

|

|

|

89,112

|

|

|

|

2,236,711,200

|

|

|

April 13, 2017 (Thu)

|

|

|

25,700

|

|

|

|

5,828

|

|

|

|

149,779,600

|

|

|

A. Volume weighted average of the closing prices

for the most recent

two-month

period

|

|

|

|

25,442

|

|

|

B. Volume weighted average of the closing prices for the

most recent

one-month

period

|

|

|

|

25,159

|

|

|

C. Volume weighted average of the closing prices for the

most recent

one-week

period

|

|

|

|

25,100

|

|

|

D. Share purchase price based on arithmetic mean

[(A+B+C)/3]

|

|

|

|

25,234

|

|

|

2.

|

Exercise of Appraisal Rights

|

With respect to KB Financial Group, the Stock Swaps will proceed as a small-scale stock

swap pursuant to Article

360-10

of the KCC and accordingly, no appraisal rights will be granted to the dissenting shareholders of KB Financial Group.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Company

name

|

|

Proposed share

purchase price

|

|

Appraisal

right exercise

period

|

|

Shareholder

exercising

appraisal rights

|

|

Repurchased

shares

(common

shares)

|

|

Payment

1

(KRW)

|

|

Payment

date of share

purchase

price

|

|

Source of

payment

|

|

KB Insurance

|

|

KRW27,495 per

common share

|

|

June 22 –

July 3,

2017

|

|

4 individual

shareholders

|

|

14

|

|

384,930

|

|

July 5, 2017

|

|

Available funds

|

|

1.

|

Based on the share purchase price proposed by KB Insurance.

|

No appraisal rights were exercised during the appraisal right exercise period (June 22 – July

3, 2017).

|

3.

|

Disposal of Treasury Shares Acquired as a Result of Exercise of Appraisal Rights

|

KB Financial Group plans to

allot common shares of KB Financial Group for treasury shares acquired by KB Insurance as a result of the exercise of appraisal rights by dissenting shareholders of KB Insurance. KB Insurance must dispose of the common shares of KB Financial Group

so allotted within three years of the acquisition date in accordance with Article

62-2

of the Financial Holding Company Act, and such disposal may have an effect on the market price of the common shares of KB

Financial Group, as well as a dilutive effect on the share ownership percentages of the existing shareholders of KB Financial Group.

|

IV.

|

Matters Relating to Creditor Protection

|

Not applicable

As of the Stock Swap Date, there are no legal proceedings involving KB Financial

Group, KB Insurance or KB Capital the outcome of which may have a material adverse effect on the effectiveness of the Stock Swaps.

|

VI.

|

Matters Relating to Allotment of Shares

|

On the Stock Swap Date (expected to be 00:00 on July 7, 2017), KB Financial Group

plans to transfer to the shareholders registered in the shareholder register of KB Insurance and KB Capital (other than KB Financial Group), using treasury shares currently held by KB Financial Group, 0.5728700 and 0.5201639 common shares of KB

Financial Group (par value KRW5,000 per share, expected to be delivered on July 20, 2017) for each common share of KB Insurance (par value KRW500 per share) and KB Capital (par value KRW5,000 per share), respectively, held by such shareholders. In

connection therewith, the common shares of KB Insurance and KB Capital held by such shareholders who will be transferred common shares of KB Financial Group pursuant to the Stock Swaps are expected to be transferred to KB Financial Group on the

Stock Swap Date. In addition, KB Financial Group plans to transfer common shares of KB Financial Group in exchange for the treasury shares held by KB Insurance and KB Capital (including shares purchased as a result of the exercise of appraisal

rights by dissenting shareholders of KB Insurance and KB Capital).

The total number of common shares of KB Financial Group that are expected to be

transferred to shareholders of KB Insurance and KB Capital (other than KB Financial Group) in the Stock Swaps is 4,440,000 shares (comprising 2,170,943 and 2,269,057 shares to be transferred to shareholders of KB Insurance and KB Capital,

respectively, except that the number of shares transferred may be reduced due to fractional shares), which will be in the form of treasury shares (registered common shares) currently held by KB Financial Group.

|

2.

|

Treatment of Fractional Shares Resulting from the Transfer of Shares

|

In respect of any resulting fractional

treasury shares of KB Financial Group to be transferred to shareholders of KB Insurance and KB Capital, KB Financial Group will pay in cash to the relevant shareholders of KB Insurance and KB Capital, within one month from the Stock Swap Date, an

amount calculated based on the closing price on the Korea Exchange of the common shares of KB Financial Group on the expected date of delivery of new share certificates (expected to be July 20, 2017).

The expected date of delivery of the new share certificates is July 20, 2017, and

the expected date of commencement of trading of such shares is July 21, 2017. Such expected delivery date and trading commencement date of the shares are subject to change, including as a result of consultation with, and the approval process

of, the relevant authorities and the determination of the relevant representative directors pursuant to the authority delegated to them by their board of directors and the relevant Stock Swap Agreement.

|

4.

|

Payment of Additional Consideration

|

Other than the transfer of common shares of KB Financial Group to

shareholders of KB Insurance and KB Capital (in exchange for common shares of KB Insurance and KB Capital, respectively) in accordance with the swap ratios and the cash payment for fractional shares, no additional consideration will be paid with

respect to the Stock Swaps.

|

5.

|

Compensation for Specific Shareholders

|

There will be no direct or indirect additional compensation, such as

payment of special consideration by one party or its specially-related parties to specific shareholders of the counterparties, in connection with the Stock Swaps.

|

VII.

|

Summary of Financial Information Before and After the Stock Swaps

|

[KB Financial Group]

(

Unit: KRW millions)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Items

|

|

Before the Stock Swaps

|

|

|

After the Stock Swaps

|

|

|

Change

Increase / (Decrease)

|

|

|

I. Cash and due from financial institutions

|

|

|

1,093,526

|

|

|

|

1,093,526

|

|

|

|

—

|

|

|

II. Financial assets at fair value through profit or loss

|

|

|

247,371

|

|

|

|

247,371

|

|

|

|

—

|

|

|

III. Loans

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

IV. Investments in subsidiaries

|

|

|

21,392,745

|

|

|

|

22,703,430

|

|

|

|

1,310,685

|

|

|

V. Investment in associates

|

|

|

1,053,690

|

|

|

|

1,053,690

|

|

|

|

—

|

|

|

VI. Property and equipment

|

|

|

420

|

|

|

|

420

|

|

|

|

—

|

|

|

VII. Intangible assets

|

|

|

8,052

|

|

|

|

8,052

|

|

|

|

—

|

|

|

VIII. Deferred income tax assets

|

|

|

3,963

|

|

|

|

3,963

|

|

|

|

—

|

|

|

IX. Other assets

|

|

|

586,417

|

|

|

|

586,417

|

|

|

|

—

|

|

|

Total assets

|

|

|

24,386,184

|

|

|

|

25,696,869

|

|

|

|

1,310,685

|

|

|

I. Debts

|

|

|

470,000

|

|

|

|

470,000

|

|

|

|

—

|

|

|

II. Debentures

|

|

|

3,733,725

|

|

|

|

3,733,725

|

|

|

|

—

|

|

|

III. Net defined benefit liabilities

|

|

|

268

|

|

|

|

268

|

|

|

|

—

|

|

|

IV. Current income tax liabilities

|

|

|

419,611

|

|

|

|

419,611

|

|

|

|

—

|

|

|

V. Other liabilities

|

|

|

640,916

|

|

|

|

640,916

|

|

|

|

—

|

|

|

Total liabilities

|

|

|

5,264,520

|

|

|

|

5,264,520

|

|

|

|

—

|

|

|

I. Share capital

|

|

|

2,090,558

|

|

|

|

2,090,558

|

|

|

|

158,799

|

|

|

II. Capital surplus

|

|

|

14,656,168

|

|

|

|

14,725,942

|

|

|

|

—

|

|

|

III. Accumulated other comprehensive income

|

|

|

(4,769

|

)

|

|

|

(4,769

|

)

|

|

|

—

|

|

|

IV. Retained earnings

|

|

|

3,180,908

|

|

|

|

3,180,908

|

|

|

|

—

|

|

|

V. Treasury shares

|

|

|

(801,201

|

)

|

|

|

(636,100

|

)

|

|

|

(165,101

|

)

|

|

Total equity

|

|

|

19,121,664

|

|

|

|

19,356,539

|

|

|

|

234,875

|

|

|

1.

|

The above statement of financial position data before the Stock Swaps is derived from the separate statement of financial position of KB Financial Group as of March 31, 2017.

|

|

2.

|

The above statement of financial position data after the Stock Swaps reflects only (i) the treasury shares to be disposed of pursuant to the Stock Swaps and (ii) the increase in the number of common shares of

KB Insurance and KB Capital that KB Financial Group will own after the Stock Swaps, and does not reflect any changes that are currently difficult to predict (including the number of fractional shares).

|

|

3.

|

The above data was prepared based on estimates and may differ from the actual statement of financial position prepared in accordance with

K-IFRS.

|

[KB Insurance]

(Unit: KRW)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Items

|

|

Before the Stock Swaps

|

|

|

After the Stock Swaps

|

|

|

Change

Increase / (Decrease)

|

|

|

I. Cash and cash equivalents

|

|

|

487,661,018,420

|

|

|

|

487,660,633,490

|

|

|

|

(384,930

|

)

|

|

II. Financial assets

|

|

|

21,854,278,973,601

|

|

|

|

21,854,278,973,601

|

|

|

|

—

|

|

|

1. Financial assets at fair value through profit or loss

|

|

|

882,410,892,874

|

|

|

|

882,410,892,874

|

|

|

|

—

|

|

|

2. Available-for-sale financial assets

|

|

|

9,186,037,647,455

|

|

|

|

9,186,037,647,455

|

|

|

|

—

|

|

|

3. Held-to-maturity financial assets

|

|

|

4,619,303,190,084

|

|

|

|

4,619,303,190,084

|

|

|

|

—

|

|

|

4. Loans

|

|

|

6,554,328,030,915

|

|

|

|

6,554,328,030,915

|

|

|

|

—

|

|

|

5. Other receivables

|

|

|

612,199,212,273

|

|

|

|

612,199,212,273

|

|

|

|

—

|

|

|

III. Investments in associates and subsidiaries

|

|

|

433,091,075,611

|

|

|

|

433,091,075,611

|

|

|

|

—

|

|

|

IV. Derivative assets to hedge

|

|

|

138,707,648,827

|

|

|

|

138,707,648,827

|

|

|

|

—

|

|

|

V. Reinsurance assets

|

|

|

698,853,710,378

|

|

|

|

698,853,710,378

|

|

|

|

—

|

|

|

VI. Investment property

|

|

|

327,539,654,514

|

|

|

|

327,539,654,514

|

|

|

|

—

|

|

|

VII. Property and equipment

|

|

|

723,767,897,999

|

|

|

|

723,767,897,999

|

|

|

|

—

|

|

|

VIII. Intangible assets

|

|

|

37,351,163,774

|

|

|

|

37,351,163,774

|

|

|

|

—

|

|

|

IX. Assets held-for-sale

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

X. Deferred acquisition costs

|

|

|

1,655,774,190,931

|

|

|

|

1,655,774,190,931

|

|

|

|

—

|

|

|

XI. Other assets

|

|

|

54,299,459,972

|

|

|

|

54,299,459,972

|

|

|

|

—

|

|

|

XII. Separate account assets

|

|

|

3,258,716,128,103

|

|

|

|

3,258,716,128,103

|

|

|

|

—

|

|

|

Total assets

|

|

|

29,670,040,922,130

|

|

|

|

29,670,040,537,200

|

|

|

|

(384,930

|

)

|

|

I. Insurance liabilities

|

|

|

22,844,734,248,549

|

|

|

|

22,844,734,248,549

|

|

|

|

—

|

|

|

II. Financial liabilities

|

|

|

607,228,780,744

|

|

|

|

607,228,780,744

|

|

|

|

—

|

|

|

1. Financial liabilities at fair value through profit or loss

|

|

|

1,380,000

|

|

|

|

1,380,000

|

|

|

|

—

|

|

|

2. Other financial liabilities

|

|

|

607,227,400,744

|

|

|

|

607,227,400,744

|

|

|

|

—

|

|

|

III. Derivative liabilities to hedge

|

|

|

5,865,147,802

|

|

|

|

5,865,147,802

|

|

|

|

—

|

|

|

IV. Provisions

|

|

|

62,119,893,651

|

|

|

|

62,119,893,651

|

|

|

|

—

|

|

|

V. Net defined benefit liabilities

|

|

|

105,868,922,879

|

|

|

|

105,868,922,879

|

|

|

|

—

|

|

|

VI. Current tax liabilities

|

|

|

46,771,286,748

|

|

|

|

46,771,286,748

|

|

|

|

—

|

|

|

VII. Deferred tax liabilities

|

|

|

212,691,681,799

|

|

|

|

212,691,681,799

|

|

|

|

—

|

|

|

VIII. Other liabilities

|

|

|

33,553,876,839

|

|

|

|

33,553,876,839

|

|

|

|

—

|

|

|

IX. Separate account liabilities

|

|

|

3,263,838,771,558

|

|

|

|

3,263,838,771,558

|

|

|

|

—

|

|

|

Total liabilities

|

|

|

27,182,672,610,569

|

|

|

|

27,182,672,610,569

|

|

|

|

—

|

|

|

I. Capital stock

|

|

|

33,250,000,000

|

|

|

|

33,250,000,000

|

|

|

|

—

|

|

|

II. Capital surplus

|

|

|

348,453,891,932

|

|

|

|

348,453,891,932

|

|

|

|

—

|

|

|

III. Accumulated other comprehensive income

|

|

|

198,942,550,941

|

|

|

|

198,942,550,941

|

|

|

|

—

|

|

|

IV. Accumulated other comprehensive income from assets held for sale

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

V. Retained earnings

|

|

|

1,906,721,868,688

|

|

|

|

1,906,721,868,688

|

|

|

|

—

|

|

|

Treasury shares

|

|

|

—

|

|

|

|

(384,930

|

)

|

|

|

(384,930

|

)

|

|

Total equity

|

|

|

2,487,368,311,561

|

|

|

|

2,487,367,926,631

|

|

|

|

(384,930

|

)

|

|

Total liabilities and equity

|

|

|

29,670,040,922,130

|

|

|

|

29,670,040,537,200

|

|

|

|

(384,930

|

)

|

|

1.

|

The above statement of financial position data before the Stock Swaps is derived from the separate statement of financial position of KB Insurance as of March 31, 2017.

|

|

2.

|

The statement of financial position data after the Stock Swaps reflects the acquisition of 14 treasury shares (KRW 384,930) resulting from the exercise of appraisal rights by the dissenting shareholders of KB Insurance.

|

|

3.

|

Unlike a merger, the two parties to a comprehensive stock swap continue to exist after the stock swap. The statement of financial position of KB Insurance, which will become a wholly-owned subsidiary, is not affected by

the Stock Swaps.

|

|

4.

|

The above data was prepared based on estimates and may differ from the actual statement of financial position prepared in accordance with

K-IFRS.

|

[KB Capital]

(Unit: KRW millions)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Items

|

|

Before the Stock Swaps

|

|

|

After the Stock Swaps

|

|

|

Change

Increase / (Decrease)

|

|

|

Cash and cash equivalents

|

|

|

73,599

|

|

|

|

73,599

|

|

|

|

—

|

|

|

Available-for-sale financial assets

|

|

|

3,262

|

|

|

|

3,262

|

|

|

|

—

|

|

|

Investments in associates

|

|

|

15,767

|

|

|

|

15,767

|

|

|

|

—

|

|

|

Loans and receivables

|

|

|

7,351,227

|

|

|

|

7,351,227

|

|

|

|

—

|

|

|

Property and equipment

|

|

|

19,453

|

|

|

|

19,453

|

|

|

|

—

|

|

|

Intangible assets

|

|

|

28,253

|

|

|

|

28,253

|

|

|

|

—

|

|

|

Investment in properties

|

|

|

1,329

|

|

|

|

1,329

|

|

|

|

—

|

|

|

Other assets

|

|

|

283,690

|

|

|

|

283,690

|

|

|

|

—

|

|

|

Total assets

|

|

|

7,776,581

|

|

|

|

7,776,581

|

|

|

|

—

|

|

|

Borrowings

|

|

|

215,000

|

|

|

|

215,000

|

|

|

|

—

|

|

|

Debentures

|

|

|

6,149,015

|

|

|

|

6,149,015

|

|

|

|

—

|

|

|

Provisions

|

|

|

611

|

|

|

|

611

|

|

|

|

—

|

|

|

Net defined benefit liabilities

|

|

|

3,362

|

|

|

|

3,362

|

|

|

|

—

|

|

|

Income tax payable

|

|

|

19,531

|

|

|

|

19,531

|

|

|

|

—

|

|

|

Other financial liabilities

|

|

|

484,599

|

|

|

|

484,599

|

|

|

|

—

|

|

|

Other liabilities

|

|

|

36,843

|

|

|

|

36,843

|

|

|

|

—

|

|

|

Deferred tax liabilities

|

|

|

35,106

|

|

|

|

35,106

|

|

|

|

—

|

|

|

Total liabilities

|

|

|

6,944,068

|

|

|

|

6,944,068

|

|

|

|

—

|

|

|

Share capital

|

|

|

107,461

|

|

|

|

107,461

|

|

|

|

—

|

|

|

Hybrid equity securities

|

|

|

249,426

|

|

|

|

249,426

|

|

|

|

—

|

|

|

Capital surplus

|

|

|

83,949

|

|

|

|

83,949

|

|

|

|

—

|

|

|

Accumulated other comprehensive income

|

|

|

(5,411

|

)

|

|

|

(5,411

|

)

|

|

|

—

|

|

|

Retained earnings

|

|

|

397,087

|

|

|

|

397,087

|

|

|

|

—

|

|

|

Total equity

|

|

|

832,513

|

|

|

|

832,513

|

|

|

|

—

|

|

|

Total liabilities and equity

|

|

|

7,776,581

|

|

|

|

7,776,581

|

|

|

|

—

|

|

|

1.

|

The above statement of financial position data before the Stock Swaps is derived from the separate statement of financial position of KB Capital as of March 31, 2017.

|

|

2.

|

Unlike a merger, the two parties to a comprehensive stock swap continue to exist after the stock swap. The statement of financial position of KB Capital, which will become a wholly-owned subsidiary, is not affected by

the Stock Swaps.

|

|

3.

|

The above data was prepared based on estimates and may differ from the actual statement of financial position prepared in accordance with

K-IFRS.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

KB Financial Group Inc.

|

|

|

|

|

|

|

|

(Registrant)

|

|

|

|

|

|

|

Date: July 7, 2017

|

|

|

|

By:

|

|

/s/ Jae Keun Lee

|

|

|

|

|

|

|

|

(Signature)

|

|

|

|

|

|

|

|

|

|

|

Name:

|

|

Jae Keun Lee

|

|

|

|

|

|

Title:

|

|

Managing Director and Chief Financial Officer

|

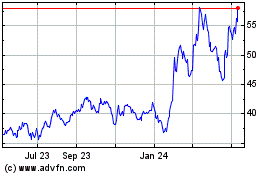

KB Financial (NYSE:KB)

Historical Stock Chart

From Mar 2024 to Apr 2024

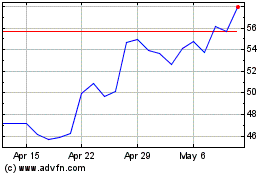

KB Financial (NYSE:KB)

Historical Stock Chart

From Apr 2023 to Apr 2024