Report of Foreign Issuer (6-k)

July 07 2017 - 6:04AM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For June 22, 2017

(Commission File No. 1-31317)

Companhia de Saneamento Básico do Estado de São Paulo - SABESP

(Exact name of registrant as specified in its charter)

Basic Sanitation Company of the State of Sao Paulo - SABESP

(Translation of Registrant's name into English)

Rua Costa Carvalho, 300

São Paulo, S.P., 05429-900

Federative Republic of Brazil

(Address of Registrant's principal executive offices)

Indicate by check mark whether the registrant files or will file

annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F ______

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1)__.

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7)__.

Indicate by check mark whether the registrant by furnishing the

information contained in this Form is also thereby furnishing the

information to the Commission pursuant to Rule 12g3-2(b) under

the Securities Exchange Act of 1934.

Yes ______ No ___X___

If "Yes" is marked, indicated below the file number assigned to the

registrant in connection with Rule 12g3-2(b):

COMPANHIA DE SANEAMENTO BÁSICO DO ESTADO DE SÃO PAULO - SABESP

Corporate Taxpayer’s ID (CNPJ): 43.776.517/0001-80

Company Registry (NIRE): 35.3000.1683-1

EXCERPT OF THE MINUTES OF THE EIGHT HUNDRED FORTIETH MEETING OF

THE BOARD OF DIRECTORS

On June 14, 2017, at 4:00 p.m., as convened by the Chairman of the Board of Directors, Benedito Pinto Ferreira Braga Junior, on an extraordinary basis, as provided for in paragraph 4 of Article 12 of the Bylaws, the members of the Board of Directors of Companhia de Saneamento Básico do Estado de São Paulo – SABESP, as named and signed below, met and resolved, via email, on the following agenda:

“Changes to the Conditions Applicable to Sabesp’s 21st Issue of Debentures”

,

based on Board Resolution No. 0147/2017 of June 14, 2017, Internal Communication FI No. 026/2017, of June 13, 2017, and in the power point presentation, documents filed in the electronic folder of this meeting, which was

unanimously approved,

in compliance with paragraph 1 of Article 59 of Law No. 6404, of December 15, 1976, as amended (“Brazilian Corporate Law”), and in accordance with items X and XIII of Article 13 of the Bylaws,

the changes in the conditions applicable to Sabesp’s 21st issue of simple debentures

, of simple unsecured non-convertible debentures, in up to 2 (two) series, for public offering, with restricted placement efforts, pursuant to CVM Instruction 476, of January 16, 2009, as amended (“Debentures”), which were approved at the Eight Hundred Thirty-Ninth Meeting of the Company's Board of Directors (“839

th

BDM”), as described below:

1. Remuneration: The Debentures will be entitled to the following remuneration:

(a) Remuneration of First Series Debentures: First Series Debentures will be entitled to remuneration corresponding to 100% (one hundred percent) of the accumulated variation of the average daily rate of one-day over extragrupo DI interbank deposits (“DI Rate”) expressed as an annual percentage, based on 252 (two hundred and fifty-two) working days, calculated and disclosed by CETIP in the daily bulletin available on its website (http://www.cetip.com.br), plus the maximum spread or surcharge to be defined in the Book Building Process, limited to 1% (one percent) per year, based on 252 (two hundred and fifty-two) working days. The First Series Remuneration will be calculated on an exponential and cumulative pro rata temporis basis, proportionally to the number of working days elapsed since the Pay-in Date or the last date of payment of the First Series Remuneration, as applicable, based on the Nominal Unit Value of First Series Debentures, and paid at the end of each Yield Period.

(b) Remuneration of Second Series Debentures: Second Series Debentures will be entitled to remuneration corresponding to 100% (one hundred percent) of the accumulated DI rate variation, expressed as an annual percentage, based on 252 (two hundred and fifty-two) working days, calculated and disclosed by the CETIP in the daily bulletin available on its website (http://www.cetip.com.br), plus the maximum spread or surcharge to be defined in the Book Building Process, limited to 1.3% (one point three percent) per year, based on 252 (two hundred and fifty-two) working days. The Second Series Remuneration will be calculated on an exponential and

cumulative basis, proportionally to the number of working days elapsed since the Pay-in Date or the last date of payment of the Second Series Remuneration, as applicable, based on the Nominal Unit Value of Second Series Debentures, and paid at the end of each Yield Period.

(c) For the purposes of calculation of the Remuneration, “Yield Period” is defined as the time interval between the Pay-in Date, inclusive, in the case of the first Yield Period, or the immediately prior date of payment of Remuneration, and the date of payment of Remuneration, exclusive, corresponding to the period in question.

2. Ratification of the other conditions applicable to the Debentures: All other conditions applicable to the issue of the Debentures approved at the 839

th

BDM are unchanged and expressly ratified.

Additionally, the Board of Directors authorized the members of the Executive Board, pursuant to the legal and statutory provisions, to perform any and all acts related to the 21

st

issue of simple unsecured non-convertible debentures, in up to 2 (two) series, including, but not limited to, negotiating and executing the Indenture and any amendments thereto, as well as the agreement for the coordination, placement and public distribution under a firm placement guarantee; signing any and all documents and performing all acts necessary for this purpose, being also able to determine whether there will be one or two series and the number of Debentures to be allocated to each Series; and establishing the Debentures’ remuneration, pursuant to item 10 above, after the completion of the Book Building Process to be conducted by the Coordinators, within the limits and parameters established herein. Finally, the Board of Directors ratified all the acts related to the 21

st

issue previously performed by the Executive Board.

(...)

The minutes, after being approved, will be signed by the attending members of the Board of Directors: Benedito Pinto Ferreira Braga Junior, Francisco Luiz Sibut Gomide, Francisco Vidal Luna, Jerônimo Antunes, Jerson Kelman, Luis Eduardo Alves de Assis e Reinaldo Guerreiro.

This is a free translation of the excerpt of the minutes that will be drawn up in the book of minutes of Board of Directors’ meetings.

São Paulo, June 14, 2017.

Benedito Pinto Ferreira Braga Junior

Chairman of the Board of Directors

Marialve de S. Martins

Secretary of the Board of Directors

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized, in the city São Paulo, Brazil.

Date: June 22, 2017

|

Companhia de Saneamento Básico do Estado de São Paulo - SABESP

|

|

|

|

|

|

By:

|

/s/

Rui de Britto Álvares Affonso

|

|

|

|

Name: Rui de Britto Álvares Affonso

Title: Chief Financial Officer and Investor Relations Officer

|

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These statements are statements that are not historical facts, and are based on management's current view and estimates of future economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

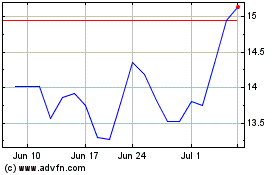

Companhia Sanea (NYSE:SBS)

Historical Stock Chart

From Mar 2024 to Apr 2024

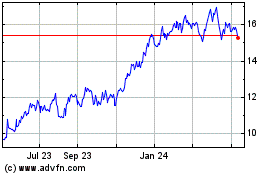

Companhia Sanea (NYSE:SBS)

Historical Stock Chart

From Apr 2023 to Apr 2024