By Shalini Ramachandran, Laura Stevens and Ryan Knutson

For years Dish Network Corp. Chief Executive Charlie Ergen has

sought out deals and partnerships with just about every major

telecom company, from Sprint Corp. to T-Mobile US Inc. to AT&T

Inc. -- so far, to no avail.

Now, the satellite-television mogul is turning his attention to

the technology world and a new -- and somewhat surprising --

potential partner has emerged: Amazon.com Inc. CEO Jeff Bezos.

The two men -- eccentric billionaires with geek tendencies and

shared interest in space and robotics -- have gotten to know each

other better over the past year and have discussed a partnership to

enter the wireless business, according to people familiar with the

matter.

Among the ideas: Amazon could help finance a network Dish is

building focused on the "Internet of Things" -- the idea that

everything from bikes to Amazon's drones can have web connectivity

everywhere. Another idea is that Amazon, as a founding partner of

Dish's new wireless network, could offer an option for Prime

members to pay a little more a month for a connectivity or phone

plan, one of the people said.

No deal is imminent and it is unclear if the companies will move

forward with a partnership. Dish has discussed versions of the

"founding partner" concept with other technology firms, one of the

people familiar with the matter said.

Amazon "is taking a walk vs. a run approach with Dish," adds one

person familiar with the talks. The two companies struck deals in

May that allow some Dish customers to control their set-top boxes

through artificial intelligence assistant Alexa on Amazon's Echo

speakers and make Dish streaming-TV apps available on Amazon Fire

devices.

An all-out acquisition of Dish by Amazon is highly unlikely, the

people say.

Amazon and Dish declined to comment.

The possibility of an Amazon-Dish tie-up comes amid a swirl of

deal and partnership talks in the wireless industry. Cable

companies, tech giants and the incumbent telecom carriers are all

trying to position themselves as smartphones and the mobile web

capture more of consumers' attention, and as Washington regulators

throw up new opportunities and obstacles.

Sprint Corp. was holding merger talks with T-Mobile before

putting those temporarily on hold to explore a deal with Comcast

Corp. and Charter Communications that could bolster those

companies' plans to offer wireless service. Some industry observers

think the Sprint-cable talks could push T-Mobile and its parent

Deutsche Telekom AG to rekindle deal discussions with Dish after an

earlier round in 2015 collapsed.

Of late, Messrs. Ergen and Bezos have been crossing paths more

often. They spent time together in March at a satellite convention,

where Mr. Bezos' rocket company Blue Origin LLC gave a presentation

to Mr. Ergen's EchoStar Corp., Dish's sister company that builds

satellite technology, people familiar with the matter said. Mr.

Ergen in March also attended Mr. Bezos' secretive, invite-only MARS

robotics and space conference. More recently, the two moguls met in

May in Seattle, other people familiar with the matter said.

The two executives are both eager disrupters: Mr. Ergen, who had

a stint as a professional blackjack player, founded Dish in 1980 to

take on cable TV and in 2015 launched Sling TV, the first online

live TV service aimed at cord-cutters created by a traditional

pay-TV provider. Mr. Bezos has upended business models from books

to media, and is venturing into food retail with Amazon's

acquisition of Whole Foods valued at $13.7 billion, including

debt.

Mr. Bezos is no stranger to uncertain terrain. "We look into the

future and we always see an intensively competitive environment, a

world that is awash in disruptive change and new technologies," he

said at Amazon's annual shareholder meeting in May.

Joining with Dish on a wireless network could potentially

advance the online retail giant's ambitions in a range of new

businesses. It could give the company quality control over

connectivity for its Amazon Dash buttons -- which allow people to

reorder household goods easily -- and its Echo speaker powered by

Alexa. And it could help improve Alexa's technology by putting the

intelligence throughout the nodes of a wireless network, said one

wireless executive who has worked with Amazon and Dish, enabling

Alexa to be faster and more human-like in its responses to searches

due to proximity to users' locations.

Amazon could also offer a one-way broadcast signal for Amazon

Prime video on a slice of Dish's airwaves, ensuring shows and

movies stream without hiccups everywhere, one person close to

Dish's plans said.

It also could help Amazon's plans to operate a network of drones

delivering packages to customers, wireless executives and people

familiar with Amazon's thinking said. The company could "command

and control" those drones and "consider real-time changes in

directions or multi-stop delivery routes through messages from the

network," wrote Citigroup analysts speculating about a

Dish-and-Amazon partnership in the wake of a May report from

Satellite Business News.

Dish has been seeking to enter the wireless business for several

years as a way to diversify away from its shrinking core satellite

TV business. Dish and its affiliated entities have spent more than

$21 billion over the course of a decade to acquire airwaves

nationwide, but Dish lacks a network to deploy the spectrum and has

been on the hunt for a partner.

To meet a March 2020 government-mandated deadline to offer

service on some of its spectrum, Dish is building a bare-bones,

so-called "fifth-generation," or 5G, network that will cost less

than $1 billion.

Citi analysts said a partnership between Dish and a technology

giant like Amazon or Google could take many forms. Amazon could

become a "preferred customer" on a new wireless network and commit

to spending a certain amount on connectivity in exchange for a

below-market rate. It could also invest cash upfront in Dish's

network to help pay for the build out, in exchange for a

significantly-discounted price upon the launch of the network.

In a private meeting with investors and J.P. Morgan analysts in

May, Mr. Ergen indicated that he believed technology companies

could be looking seriously at the wireless business, especially as

the Trump administration seeks to roll back "net neutrality" rules

that were meant to guard against carriers extracting tolls from

content companies for better service, according to an attendee.

"They're going to have to make sure that in a world of net

neutrality...being eliminated, that they're positioned so that

they're not in a situation where their connectivity is clogged,"

Mr. Ergen said earlier in May.

Write to Shalini Ramachandran at shalini.ramachandran@wsj.com,

Laura Stevens at laura.stevens@wsj.com and Ryan Knutson at

ryan.knutson@wsj.com

(END) Dow Jones Newswires

July 06, 2017 05:44 ET (09:44 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

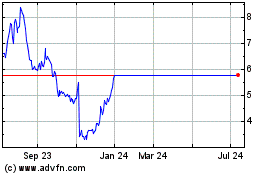

DISH Network (NASDAQ:DISH)

Historical Stock Chart

From Mar 2024 to Apr 2024

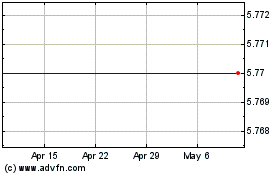

DISH Network (NASDAQ:DISH)

Historical Stock Chart

From Apr 2023 to Apr 2024