As filed with the Securities and Exchange Commission on July 3, 2017

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

HOSTESS BRANDS, INC.

(Exact Name of Registrant as Specified in Its Charter)

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

47-4168492

|

|

(State or Other Jurisdiction of

Incorporation or Organization)

|

|

(I.R.S. Employer

Identification No.)

|

1 East Armour Boulevard

Kansas City, Missouri 64111

(816) 701-4600

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Jolyn Sebree

Senior Vice President, General Counsel

Hostess Brands, Inc.

1 East Armour Boulevard

Kansas City, Missouri 64111

(816) 701-4600

(866) 672-0008 fax

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

Copies to:

Howard A. Kenny

Morgan, Lewis & Bockius LLP

101 Park Avenue

New York, New York 10178

(212) 309-6000

(212) 309-6001 fax

Approximate date of commencement of proposed sale to the public:

From time to time after the effective date of this registration statement, as determined by market conditions.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box:

o

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, please check the following box:

x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering:

o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering:

o

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box

o

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box:

o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non‑accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b‑2 of the Exchange Act.:

|

|

|

|

|

|

|

|

|

Large accelerated filer

o

|

Accelerated

filer

x

|

Non‑accelerated filer

o

(Do not check if a

smaller reporting company)

|

Smaller reporting company

o

|

Emerging growth company

x

|

☐ If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b‑2 of the Act). Yes

o

No

x

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of Each Class of

Securities to be Registered

|

|

Amount

to be

Registered(1)(2)

|

|

Proposed

Maximum

Offering Price

Per Share(3)

|

|

Proposed

Maximum

Aggregate

Offering Price(3)

|

|

Amount of

Registration Fee(4)

|

|

Warrants to purchase shares of Class A Common Stock

|

|

19,000,000

|

|

$2.71

|

|

$51,490,000

|

|

$5,967.69

|

|

Class A Common Stock, par value $0.0001 per share

|

|

9,500,000

|

|

$11.50

|

|

$109,250,000

|

|

$12,662.08

|

|

Total:

|

|

|

|

|

|

|

|

$18,629.77

|

|

|

|

|

|

|

|

|

|

|

(1)

|

The warrants, each of which is exercisable to purchase one-half share of Class A common stock, were initially issued to the Selling Warrantholders named in this registration statement and are registered for resale. The issuance by the registrant of the shares of Class A Common Stock upon exercise of the warrants by transferees of such warrants is also being registered hereunder.

|

|

(2)

|

Pursuant to Rule 416 under the Securities Act of 1933, as amended (the "Securities Act"), the registrant is also registering an indeterminate number of additional shares of Class A Common Stock issuable by reason of any stock dividend, stock split, recapitalization or other similar transaction.

|

|

(3)

|

Pursuant to Rule 457(c) under the Securities Act, and solely for the purpose of calculating the registration fee, the proposed maximum offering price of the warrants is $2.71, which is the average of the high and low prices of the warrants on June 26, 2017, on the NASDAQ Capital Market. For purposes of calculating the registration fee, the proposed maximum offering price of the Class A Common Stock is $11.50, which is the exercise price of the warrants.

|

|

(4)

|

Calculated by multiplying the estimated aggregate offering price of the securities being registered by 0.0001159.

|

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment that specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION DATED JULY 3, 2017

PRELIMINARY PROSPECTUS

HOSTESS BRANDS, INC.

19,000,000 Warrants to Purchase 9,500,000 Shares of Class A Common Stock

9,500,000 Shares of Class A Common Stock

The selling warrantholders named in this prospectus (the “Selling Warrantholders”) may offer and sell from time to time up to 19,000,000 warrants (“Private Warrants”) to purchase shares of our Class A common stock par value $0.0001 per share (“Class A Common Stock”). The Private Warrants are exercisable to purchase an aggregate of 9,500,000 shares of Class A Common Stock at an exercise price of $5.75 per half share of Class A Common Stock. Upon the sale or distribution of the Private Warrants as described herein, the Private Warrants will become fungible with our public warrants to purchase Class A Common Stock (“Public Warrants”) and we expect these transferred Private Warrants (“Transferred Warrants”) will trade under the same CUSIP and ticker symbol as the Public Warrants on the NASDAQ Capital Market (“NASDAQ”).

In addition, this prospectus relates to the issuance by us of up to 9,500,000 shares of our Class A Common Stock that are issuable upon the exercise of Transferred Warrants.

We are not selling any Private Warrants in this offering and will not receive any proceeds from the sale of Private Warrants by the Selling Warrantholders pursuant to this prospectus, but will receive $5.75 per half-share upon the exercise of any Transferred Warrants. We will pay the expenses, other than any underwriting discounts and commissions, associated with the sale of Private Warrants and shares pursuant to this prospectus.

Our registration of the securities covered by this prospectus does not mean that the Selling Warrantholders will offer or sell any of the Private Warrants. The Selling Warrantholders may sell the Private Warrants covered by this prospectus in a number of different ways and at varying prices. We provide more information about how the Selling Warrantholders may sell the Private Warrants in the section entitled “Plan of Distribution.”

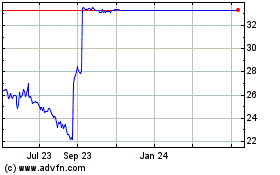

Upon sale, the Transferred Warrants will trade together with the Public Warrants on NASDAQ under the symbol “TWNKW.” On June 30, 2017, the last reported sales price of the Public Warrants was $2.91 per share. Our Class A Common Stock is traded on NASDAQ under the symbol “TWNK.” On June 30, 2017, the last reported sales price of the Class A Common Stock was $16.10 per share.

An investment in our securities involves risks. See “

Risk Factors

” on page 4 of this prospectus, and any updates to those risk factors or new risk factors contained in our subsequent Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K filed with the SEC, all of which we incorporate by reference herein.

We are an “emerging growth company” as defined in Section 2(a) of the Securities Act of 1933, as amended (the “Securities Act”) and are subject to reduced public company reporting requirements. See “Risk Factors – The JOBS Act permits “emerging growth companies” like us to take advantage of certain exemptions from various reporting requirements applicable to other public companies that are not emerging growth companies.”

Neither the SEC nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2017.

TABLE OF CONTENTS

You should rely only on the information provided in this prospectus, as well as the information incorporated by reference into this prospectus and any applicable prospectus supplement. We have not authorized anyone to provide you with different information. We are not making an offer of these securities in any jurisdiction where the offer is not permitted. You should not assume that the information in this prospectus, any applicable prospectus supplement or any documents incorporated by reference is accurate as of any date other than the date of the applicable document. Since the respective dates of this prospectus and the documents incorporated by reference into this prospectus, our business, financial condition, results of operations and prospects may have changed.

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form S-3 that we filed with the Securities and Exchange Commission (the “SEC”) using a “shelf” registration process. This prospectus generally describes Hostess Brands, Inc., the Private Warrants and our Class A Common Stock. The Selling Warrantholders may, from time to time, use the shelf registration statement to offer and sell up to an aggregate of 19,000,000 Private Warrants and we may, from time to time, use the shelf registration statement to sell up to an aggregate of 9,500,000 shares of our Class A Common Stock issuable upon exercise of Transferred Warrants, in each case from time to time as described in the section entitled “Plan of Distribution.”

We are not selling any Private Warrants in this offering and will not receive any proceeds from the sale of Private Warrants by the Selling Warrantholders pursuant to this prospectus, but will receive $5.75 per half-share upon the exercise of any Transferred Warrants. We will pay the expenses, other than any underwriting discounts and commissions, associated with the sale of the Private Warrants and shares pursuant to this prospectus. To the extent appropriate, we and the Selling Warrantholders, as applicable, will deliver a prospectus supplement with this prospectus to update the information contained in this prospectus. The prospectus supplement may also add, update or change information included in this prospectus. You should read both this prospectus and any applicable prospectus supplement, together with additional information described below under the captions “Where You Can Find More Information” and “Documents Incorporated by Reference.”

No offer of these securities will be made in any jurisdiction where the offer is not permitted.

Unless the context indicates otherwise, the terms “Hostess,” “Company,” “we,” “us” and “our” refer to Hostess Brands, Inc. (formerly known as Gores Holdings, Inc.), a Delaware corporation. References in this prospectus to the “Business Combination” refer to the consummation of the transactions contemplated by that certain Master Transaction Agreement, dated as of July 5, 2016, which transactions were consummated on November 4, 2016.

FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated by reference herein and therein contain statements reflecting our views about our future performance that constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), that involve substantial risks and uncertainties. All statements contained other than statements of historical fact, including statements regarding our future results of operations and financial position, our business strategy and plans, and our objectives for future operations, are forward-looking statements. Statements that constitute forward-looking statements are generally identified through the inclusion of words such as “believes,” “expects,” “intends,” “estimates,” “projects,” “anticipates,” “will,” “plan,” “may,” “should,” or similar language. Statements addressing our future operating performance and statements addressing events and developments that we expect or anticipate will occur are also considered as forward-looking statements. All forward-looking statements included in this prospectus, any prospectus supplement and the documents incorporated by reference herein and therein are made only as of the date thereof. It is routine for our internal projections and expectations to change throughout the year, and any forward-looking statements based upon these projections or expectations may change prior to the end of the next quarter or year. Investors are cautioned not to place undue reliance on any such forward-looking statements. As a result of a number of known and unknown risks and uncertainties, our actual results or performance may be materially different from those expressed or implied by those forward-looking statements. Risks and uncertainties are identified and discussed in “Risk Factors.” All subsequent written or oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by these risk factors. We undertake no obligation to update any forward-looking statement, whether as a result of new information, future events, or otherwise.

SUMMARY

This summary highlights selected information contained in this prospectus and does not contain all of the information that is important to you. This summary is qualified in its entirety by the more detailed information included in or incorporated by reference into this prospectus. Before making your investment decision with respect to our securities, you should carefully read this entire prospectus, any applicable prospectus supplement and the documents referred to in “Where You Can Find More Information” and “Documents Incorporated by Reference.”

When we use the words “Hostess Brands,” “Hostess,” “the Company,” “we,” “us,” or “our,” we are referring to Hostess Brands, Inc. and its consolidated subsidiaries.

The Company

Hostess

®

has been an iconic American brand for generations. We offer a variety of new and classic treats under the Hostess

®

brand including Twinkies

®

, Cupcakes, Ding Dongs

®

, Ho Hos

®

, Donettes

®

, and Zingers

®

among others. In April 2013, we acquired the Hostess

®

and Dolly Madison

®

brands out of the bankruptcy liquidation proceedings of their prior owners, free and clear of all prior liabilities, contracts, deferred taxes and other “legacy” issues. After a brief hiatus in production, we began providing Hostess products to retailer partners and consumers nationwide in July 2013. By combining Hostess’ strong reputation with innovative technology and a Direct-To-Warehouse (“DTW”) business model, we rapidly recaptured market share. In nearly four years, we have invested approximately $180 million to upgrade our manufacturing footprint, implement new IT systems and enhance production efficiency through the installation of automated baking and packaging lines. These investments, combined with our DTW distribution model, have reestablished Hostess’ leading, premium brand position in the $6.5 billion U.S. Sweet Baked Goods (“SBG”) category and have increased our distribution channels and paved new growth opportunities for the Company.

Our DTW distribution model uses centralized distribution centers and common carriers to fill orders, with products generally delivered to our customers’ warehouses. This model has eliminated the need for Direct-Store-Delivery (“DSD”) routes and drivers which has allowed us to expand our core distribution while gaining access to new channels (e.g., further penetration into convenience, drug store, dollar, foodservice, and cash & carry). We have both renewed and added relationships with trusted retailers around the country.

As a highly fragmented category in both the United States and internationally, SBG represents a significant opportunity for further consolidation. Our business model and efficient DTW route-to-market strategy, along with highly sophisticated and modern systems, provide an ideal platform for adding other branded snacks to our portfolio. We maintain a highly-disciplined outlook on acquisitions, focusing on opportunities with large addressable markets. In addition, we believe our expertise in managing brands (led by our Executive Chairman, C. Dean Metropoulos) and experience in operating packaged food businesses (under the leadership of our President and Chief Executive Officer, Bill Toler) gives us the specialized tools to position the Company as an attractive vehicle for future growth within the snacking universe.

We have been actively investing in new product development and pursuing acquisitions to further leverage our strong brand and to expand into new categories and markets to drive incremental growth. In April 2015, we launched Hostess

®

branded bread and buns to capitalize on the strength of our brand and to expand our product assortment in the small format channels, including convenience and drug store channels.

In May 2016, we purchased 100% of the stock of Superior Cake Products, Inc. (“Superior”), to expand into the in-store bakery (“ISB”) section of grocery and club retailers. Retailers are increasingly utilizing in-store bakery goods to provide a differentiated shopping experience and to showcase product offerings. Superior manufactures éclairs, madeleines, brownies, and iced cookies, and also offers preservative-free and gluten-free products. We believe there is growth potential by expanding Hostess

®

product offerings within the ISB section of grocery and club retailers.

Executive Offices

Our executive offices are located at 1 East Armour Boulevard, Kansas City, Missouri. Our telephone number is (816) 701-4600. Our website is located at

www.hostessbrands.com

. The information contained on, or that may be accessed through, our website is not part of, and is not incorporated into, this prospectus.

|

|

|

|

|

|

THE OFFERING

|

|

|

|

|

Issuer

|

Hostess Brands, Inc.

|

|

Private Warrants to purchase Class A Common Stock

|

19,000,000 warrants to purchase Class A Common Stock.

|

|

Shares of Class A Common Stock issuable upon exercise of the Private Warrants

|

9,500,000 shares issuable upon the exercise of the Private Warrants.

|

|

Shares of Class A Common Stock outstanding prior to any resale or exercise of Public Warrants or Private Warrants as of June 28, 2017

|

99,992,183 shares.

|

|

Shares of Class B Common Stock outstanding as of June 28, 2017

|

30,398,777 shares.

|

|

Public Warrants outstanding as of June 28, 2017

|

37,499,890 warrants.

|

|

Use of proceeds

|

We are not selling any Private Warrants in this offering and will not receive any of the proceeds from these sales, but we will receive $5.75 per half-share upon the exercise of the Transferred Warrants. We will bear all of the offering expenses other than the underwriting discounts and commissions.

|

|

Market for our warrants

|

Our Public Warrants are currently listed on the NASDAQ Capital Market and, after resale, our Transferred Warrants will also trade under the same CUSIP and ticker symbol.

|

|

Market for our common stock

|

Our shares of common stock are currently listed on the NASDAQ Capital Market.

|

|

NASDAQ Capital Market Symbol

|

“TWNKW” for our Public Warrants and Transferred Warrants and “TWNK” for our Class A Common Stock.

|

|

Risk Factors

|

Any investment in the securities offered hereby is speculative and involves a high degree of risk. You should carefully consider the information set forth under “Risk Factors” on page 4 of this prospectus.

|

RISK FACTORS

An investment in our Private Warrants and Class A Common Stock involves risks and uncertainties. You should consider carefully the risk factors and any updates to those risk factors or new risk factors contained in our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K as filed or subsequently filed with the SEC, all of which we incorporate by reference herein, as well as the other information included in this prospectus, and any applicable prospectus supplement, before making an investment decision. Any of the risk factors could significantly and negatively affect our business, financial condition, results of operations, cash flows, and prospects and the trading price of our securities. You could lose all or part of your investment.

USE OF PROCEEDS

All of the Private Warrants offered by the Selling Warrantholders pursuant to this prospectus will be sold by the Selling Warrantholders for their respective accounts. We will not receive any of the proceeds from these sales. However, we will receive up to an aggregate of approximately $109,250,000 from the exercise of Transferred Warrants, assuming the exercise in full of all of the Transferred Warrants for cash. There is no assurance that any of the Transferred Warrants will be exercised. We expect to use the net proceeds from the exercise of the Transferred Warrants for general corporate purposes.

The Selling Warrantholders will pay any underwriting discounts and commissions and expenses incurred by the Selling Warrantholders for brokerage, accounting, tax or legal services or any other expenses incurred by the Selling Warrantholders in disposing of the Private Warrants. We will bear all other costs, fees and expenses incurred in effecting the registration of the Private Warrants and the shares covered by this prospectus, including, without limitation, all registration and filing fees, NASDAQ listing fees and fees and expenses of our counsel and our independent registered public accountants.

DESCRIPTION OF CAPITAL STOCK

The following summary of the material terms of our securities is not intended to be a complete summary of the rights and preferences of such securities. We urge you to read our certificate of incorporation in its entirety for a complete description of the rights and preferences of our securities.

Authorized and Outstanding Stock

Our certificate of incorporation authorizes the issuance of 261,000,000 shares of capital stock, consisting of (i) 260,000,000 shares of common stock, $0.0001 par value per share (“Common Stock”), including 200,000,000 shares of Class A Common Stock, $0.0001 par value per share, 50,000,000 shares of class B common stock, $0.0001 par value per share (“Class B Common Stock”), and 10,000,000 shares of class F common stock, $0.001 par value per share (“Class F Common Stock”) and (ii) 1,000,000 shares of preferred stock, par value $0.0001 per share. The outstanding shares of our Common Stock are duly authorized, validly issued, fully paid and non-assessable. As of June 28, 2017, there were 130,390,960 shares of Common Stock outstanding, held of record by approximately 59 holders of Common Stock, including 99,992,183 shares of Class A Common Stock and 30,398,777 shares of Class B Common Stock, no shares of Class F Common Stock outstanding, no shares of preferred stock outstanding and 56,499,890 warrants outstanding held of record by approximately 3 holders of warrants, including 37,499,890 Public Warrants and 19,000,000 Private Warrants. Such numbers do not include DTC participants or beneficial owners holding shares through nominee names.

The Class B Common Stock may only be issued to and held by entities affiliated with C. Dean Metropoulos (the “CDM Holders”) and their respective permitted transferees and any other transferee of class B units (to the extent permitted by the limited partnership agreement of Hostess Holdings, L.P, a Delaware limited partnership (“Hostess Holdings”), then in effect) (collectively, the “Permitted Holders”) of Hostess Holdings (“Class B Units”). At any time Hostess Holdings issues a Class B Unit to a Permitted Holder, the Company will issue a share of Class B Common Stock to such Permitted Holder. Upon the conversion or cancellation of any Class B Units, the corresponding share of Class B Common Stock automatically will be canceled for no consideration. Shares of Class B Common Stock may only be transferred to a person other than the Company or Hostess Holdings if the transferee is a Permitted Holder and an equal number of Class B Units are simultaneously transferred to such transferee.

Voting Power

Except as otherwise required by law or as otherwise provided in any certificate of designation for any series of preferred stock, the holders of common stock possess all voting power for the election of our directors and all other matters requiring stockholder action and will at all times vote together as one class on all matters submitted to a vote of the stockholders of the Company. Holders of common stock are entitled to one vote per share on matters to be voted on by stockholders.

Dividends

Holders of Class A Common Stock will be entitled to receive such dividends and other distributions, if any, as may be declared from time to time by our Board in its discretion out of funds legally available therefor and shall share equally on a per share basis in such dividends and distributions. Holders of Class B Common Stock are not entitled to share in any such dividends or other distributions from Hostess Brands, Inc.

Liquidation, Dissolution and Winding Up

In the event of the voluntary or involuntary liquidation, dissolution, distribution of assets or winding-up of the post-combination company, the holders of the Class A Common Stock will be entitled to receive an equal amount per share of all of our assets of whatever kind available for distribution to stockholders, after the rights of the holders of the preferred stock, if any, have been satisfied. Holders of Class B Stock are not entitled to receive any portion of any such assets in respect of their shares of Class B Stock.

Preemptive or Other Rights

Our stockholders have no preemptive or other subscription rights and there are no sinking fund or redemption provisions applicable to our common stock.

Election of Directors

Our Board is currently divided into three classes, Class I, Class II and Class III, with only one class of directors being elected in each year and each class (except for those directors appointed prior to our first annual meeting of stockholders) serving a two-year term. Class I directors will serve until the 2020 annual meeting, Class II directors will serve until the 2018 annual meeting and Class III directors will serve until the 2019 annual meeting. There is no cumulative voting with respect to the election of directors, with the result that directors will be elected by a plurality of the votes cast at an annual meeting of stockholders by holders of our common stock.

Preferred Stock

Our certificate of incorporation provides that shares of preferred stock may be issued from time to time in one or more series. Our Board is authorized to fix the voting rights, if any, designations, powers, preferences, the relative, participating, optional or other special rights and any qualifications, limitations and restrictions thereof, applicable to the shares of each series. Our Board is able, without stockholder approval, to issue preferred stock with voting and other rights that could adversely affect the voting power and other rights of the holders of the common stock and could have anti-takeover effects. The ability of our Board to issue preferred stock without stockholder approval could have the effect of delaying, deferring or preventing a change of control of us or the removal of existing management. We have no preferred stock outstanding at the date hereof. Although we do not currently intend to issue any shares of preferred stock, we cannot assure you that we will not do so in the future.

Warrants

Public Warrants

Each Public Warrant entitles the registered holder to purchase one-half of one share of our Class A Common Stock at a price of $5.75 per half share, subject to adjustment as discussed below, at any time commencing on December 4, 2016 (

i.e.

, the later of 12 months from the closing of the Company’s initial public offering, consummated on August 19, 2015 (the “IPO”) or 30 days after the completion of the Business Combination). For example, if a warrant holder holds two Public Warrants, such Public Warrants will be exercisable for one share of the company’s Class A Common Stock. Public Warrants must be exercised for a whole share. The Public Warrants will expire November 4, 2021 (

i.e.

, five years after the completion of the Business Combination), at 5:00 p.m., New York City time, or earlier upon redemption or liquidation.

We are not obligated to deliver any shares of Class A Common Stock pursuant to the exercise of a Public Warrant and will have no obligation to settle such warrant exercise unless a registration statement under the Securities Act with respect to the shares of Class A Common Stock underlying the warrants is then effective and a prospectus relating thereto is current, subject to our satisfying our obligations described below with respect to registration. No Public Warrant will be exercisable for cash or on a cashless basis, and we will not be obligated to issue any shares to holders seeking to exercise their Public Warrants, unless the issuance of the shares upon such exercise is registered or qualified under the securities laws of the state of the exercising holder, or an exemption is available. In the event that the conditions in the two immediately preceding sentences are not satisfied with respect to a Public Warrant, the holder of such Public Warrant will not be entitled to exercise such Public Warrant and such Public Warrant may have no value and expire worthless. In the event that a registration statement is not effective for the exercised warrants, the purchaser of a unit containing such Public Warrant will have paid the full purchase price for the unit solely for the share of Class A Common Stock underlying such unit.

On November 2016, we filed a registration statement for the registration, under the Securities Act, of the shares of Class A Common Stock issuable upon exercise of the Public Warrants. We will use our best efforts to maintain the effectiveness of such registration statement, and a current prospectus relating thereto, until the expiration of the Public Warrants in accordance with the provisions of the warrant agreement. Notwithstanding the above, if our Class A Common Stock is at the time of any exercise of a Public Warrant not listed on a national securities exchange such that it satisfies the definition of a “covered security” under Section 18(b)(1) of the Securities Act, we may, at our option, require holders of Public Warrants who exercise their Public Warrants to do so a “cashless basis” in accordance with Section 3(a)(9) of the Securities Act and, in the event we so elect, we will not be required to file or maintain in effect a registration statement, but will use our best efforts to qualify the shares under applicable blue sky laws to the extent an exemption is not available.

Once the Public Warrants become exercisable, we may call the Public Warrants for redemption:

|

|

|

|

|

|

|

|

|

•

|

|

in whole and not in part;

|

|

|

•

|

|

at a price of $0.01 per warrant;

|

|

|

•

|

|

upon not less than 30 days’ prior written notice of redemption to each warrant holder; and

|

|

|

•

|

|

if, and only if, the last reported sale price of the Class A Common Stock equals or exceeds $24.00 per share for any 20 trading days within a 30 trading day period ending on the third trading day prior to the date we send the notice of redemption to the warrant holder.

|

If and when the Public Warrants become redeemable by us, we may exercise our redemption right even if we are unable to register or qualify the underlying securities for sale under all applicable state securities laws.

We have established the last of the redemption criterion discussed above to prevent a redemption call unless there is at the time of the call a significant premium to the Public Warrant exercise price. If the foregoing conditions are satisfied and we issue a notice of redemption of the Public Warrants, each Public Warrant holder will be entitled to exercise his, her or its Public Warrant prior to the scheduled redemption date. However, the price of the Class A Common Stock may fall below the $24.00 redemption trigger price as well as the $11.50 Public Warrant exercise price (for whole shares) after the redemption notice is issued.

If we call the Public Warrants for redemption as described above, our management will have the option to require any holder that wishes to exercise his, her or its Public Warrant to do so on a “cashless basis.” In determining whether to require all holders to exercise their Public Warrants on a “cashless basis,” our management will consider, among other factors, our cash position, the number of Public Warrants that are outstanding and the dilutive effect on our stockholders of issuing the maximum number of shares of Class A Stock issuable upon the exercise of our Public Warrant. If our management takes advantage of this option, all holders of Public Warrants would pay the exercise price by surrendering their Public Warrants for that number of shares of Class A Common Stock equal to the quotient obtained by dividing (x) the product of the number of shares of Class A Common Stock underlying the Public Warrant, multiplied by the difference between the exercise price of the Public Warrant and the “fair market value” (defined below) by (y) the fair market value. The “fair market value” shall mean the average reported last sale price of the Class A Stock for the ten trading days ending on the third trading day prior to the date on which the notice of redemption is sent to the holders of Public Warrants. If our management takes advantage of this option, the notice of redemption will contain the information necessary to calculate the number of shares of Class A Common Stock to be received upon exercise of the Public Warrants, including the “fair market value” in such case. Requiring a cashless exercise in this manner will reduce the number of shares to be issued and thereby lessen the dilutive effect of a warrant redemption. We believe this feature is an attractive option to us if we do not need the cash from the exercise of the Public Warrants. If we call our Public Warrants for redemption and our management does not take advantage of this option, Gores Sponsor LLC, a Delaware limited liability company (“Gores”), and its permitted transferees would still be entitled to exercise their Private Warrants for cash or on a cashless basis using the same formula described above that other Public Warrant holders would have been required to use had all Public Warrant holders been required to exercise their Public Warrant on a cashless basis, as described in more detail below.

A holder of a Public Warrant may notify us in writing in the event it elects to be subject to a requirement that such holder will not have the right to exercise such Public Warrant, to the extent that after giving effect to such exercise, such person (together with such person’s affiliates), to the Public Warrant agent’s actual knowledge, would beneficially own in excess of 9.8% (or such other amount as a holder may specify) of the shares of Class A Common Stock outstanding immediately after giving effect to such exercise.

If the number of outstanding shares of Class A Common Stock is increased by a stock dividend payable in shares of Class A Common Stock, or by a split-up of shares of Class A Common Stock or other similar event, then, on the effective date of such stock dividend, split-up or similar event, the number of shares of Class A Common Stock issuable on exercise of each Public Warrant will be increased in proportion to such increase in the outstanding shares of Class A Common Stock. A rights offering to holders of Class A Common Stock entitling holders to purchase shares of Class A Common Stock at a price less than the fair market value will be deemed a stock dividend of a number of shares of Class A Common Stock equal to the product of (i) the number of shares of Class A Common Stock actually sold in such rights offering (or issuable under any other equity securities sold in such rights offering that are convertible into or exercisable for Class A Common Stock) multiplied by (ii) one minus the quotient of (x) the price per share of Class A Common Stock paid in such rights offering divided by (y) the fair market value. For these purposes (i) if the rights offering is for securities convertible into or exercisable for Class A Common Stock, in determining the price payable for Class A Common Stock, there will be taken into account any consideration received for such rights, as well as any additional amount payable upon exercise or conversion and (ii) fair market value means the volume weighted average price of Class A Common Stock as reported during the ten trading day period ending on the trading day prior to the first date on which the shares of Class A Common Stock trade on the applicable exchange or in the applicable market, regular way, without the right to receive such rights.

In addition, if we, at any time while the Public Warrants are outstanding and unexpired, pay a dividend or make a distribution in cash, securities or other assets to the holders of Class A Common Stock on account of such shares of Class A Common Stock (or other shares of our capital stock into which the Public Warrants are convertible), other than (a) as described above, (b) certain ordinary cash dividends, (c) to satisfy the redemption rights of the holders of Class A Common Stock in connection with the Business Combination, or (d) as a result of the repurchase of shares of Class A Common Stock by the Company in connection with the Business Combination, is presented to the stockholders of the Company for approval, then the Public Warrant exercise price will be decreased, effective immediately after the effective date of such event, by the amount of cash and/or the fair market value of any securities or other assets paid on each share of Class A Common Stock in respect of such event.

If the number of outstanding shares of our Class A Common Stock is decreased by a consolidation, combination, reverse stock split or reclassification of shares of Class A Common Stock or other similar event, then, on the effective date of such consolidation, combination, reverse stock split, reclassification or similar event, the number of shares of Class A Common Stock issuable on exercise of each Public Warrant will be decreased in proportion to such decrease in outstanding shares of Class A Common Stock.

Whenever the number of shares of Class A Common Stock purchasable upon the exercise of the Public Warrants is adjusted, as described above, the Public Warrant exercise price will be adjusted by multiplying the Public Warrant exercise price immediately prior to such adjustment by a fraction (x) the numerator of which will be the number of shares of Class A Common Stock purchasable upon the exercise of the Public Warrants immediately prior to such adjustment, and (y) the denominator of which will be the number of shares of Class A Common Stock so purchasable immediately thereafter.

In case of any reclassification or reorganization of the outstanding shares of Class A Common Stock (other than those described above or that solely affects the par value of such shares of Class A Common Stock), or in the case of any merger or consolidation of us with or into another corporation (other than a consolidation or merger in which we are the continuing corporation and that does not result in any reclassification or reorganization of our outstanding shares of Class A Common Stock), or in the case of any sale or conveyance to another corporation or entity of the assets or other property of us as an entirety or substantially as an entirety in connection with which we are dissolved, the holders of the Public Warrants will thereafter have the right to purchase and receive, upon the basis and upon the terms and conditions specified in the Public Warrants and in lieu of the shares of our Class A Common Stock immediately theretofore purchasable and receivable upon the exercise of the rights represented thereby, the kind and amount of shares of stock or other securities or property (including cash) receivable upon such reclassification, reorganization, merger or consolidation, or upon a dissolution following any such sale or transfer, that the holder of the Public Warrants would have received if such holder had exercised its Public Warrants immediately prior to such event. However, if such holders were entitled to exercise a right of election as to the kind or amount of securities, cash or other assets receivable upon such consolidation or merger, then the kind and amount of securities, cash or other assets for which each Public

Warrant will become exercisable will be deemed to be the weighted average of the kind and amount received per share by such holders in such consolidation or merger that affirmatively make such election, and if a tender, exchange or redemption offer has been made to and accepted by such holders under circumstances in which, upon completion of such tender or exchange offer, the maker thereof, together with members of any group (within the meaning of Rule 13d-5(b)(1) under the Exchange Act) of which such maker is a part, and together with any affiliate or associate of such maker (within the meaning of Rule 12b-2 under the Exchange Act) and any members of any such group of which any such affiliate or associate is a part, own beneficially (within the meaning of Rule 13d-3 under the Exchange Act) more than fifty percent (50%) of the outstanding shares of Class A Common Stock, the holder of a Public Warrant will be entitled to receive the highest amount of cash, securities or other property to which such holder would actually have been entitled as a stockholder if such Public Warrant holder had exercised the Public Warrant prior to the expiration of such tender or exchange offer, accepted such offer and all of the Class A Common Stock held by such holder had been purchased pursuant to such tender or exchange offer, subject to adjustments (from and after the consummation of such tender or exchange offer) as nearly equivalent as possible to the adjustments provided for in the Public Warrant agreement. Additionally, if less than seventy percent (70%) of the consideration receivable by the holders of Class A Common Stock in such a transaction is payable in the form of Class A Common Stock in the successor entity that is listed for trading on a national securities exchange or is quoted in an established over-the-counter market, or is to be so listed for trading or quoted immediately following such event, and if the registered holder of the Public Warrant properly exercises the Public Warrant within 30 days following public disclosure of such transaction, the Public Warrant exercise price will be reduced as specified in the Public Warrant agreement based on the per share consideration minus Black-Scholes Warrant Value (as defined in the Public Warrant agreement) of the Public Warrant.

The Public Warrants have been issued in registered form under a warrant agreement between Continental Stock Transfer & Trust Company, as warrant agent, and us. You should review a copy of the warrant agreement, which is filed as an exhibit to the registration statement of which this prospectus is part, for a complete description of the terms and conditions applicable to the Public Warrants. The warrant agreement provides that the terms of the Public Warrants may be amended without the consent of any holder to cure any ambiguity or correct any defective provision, but requires the approval by the holders of at least 65% of the then outstanding Public Warrants to make any change that adversely affects the interests of the registered holders of Public Warrants.

The Public Warrants may be exercised upon surrender of the Public Warrant certificate on or prior to the expiration date at the offices of the Public Warrant agent, with the exercise form on the reverse side of the Public Warrant certificate completed and executed as indicated, accompanied by full payment of the exercise price (or on a cashless basis, if applicable), by certified or official bank check payable to us, for the number of Public Warrants being exercised. The Public Warrant holders do not have the rights or privileges of holders of Class A Common Stock and any voting rights until they exercise their Public Warrants and receive shares of Class A Common Stock. After the issuance of shares of Class A Common Stock upon exercise of the Public Warrants, each holder will be entitled to one vote for each share held of record on all matters to be voted on by stockholders.

Public Warrants may be exercised only for a whole number of shares of Class A Common Stock. No fractional shares will be issued upon exercise of the Public Warrants. If, upon exercise of the Public Warrants, a holder would be entitled to receive a fractional interest in a share, we will, upon exercise, round down to the nearest whole number the number of shares of Class A Common Stock to be issued to the Public Warrant holder. As a result, Public Warrant holders not purchasing an even number of Public Warrants must sell any odd number of Public Warrants in order to obtain full value from the fractional interest that will not be issued.

Private Warrants

Gores purchased 19,000,000 Private Warrants at a price of $0.50 per Private Warrant for an aggregate purchase price of $9,500,000 in a private placement (the “Private Placement”) that occurred prior to the IPO. The Private Warrants (including the Class A Common Stock issuable upon exercise of the Private Warrants) were not transferable, assignable or salable until December 4, 2016 (i.e., 30 days after the completion of the Business Combination) (except, among other limited exceptions, to our officers and directors and other persons or entities affiliated with Gores) and they will not be redeemable by us so long as they are held by Gores or its permitted transferees. Otherwise, the Private Warrants have terms and provisions that are identical to those of the Public Warrants. At the closing of the Business Combination, Gores transferred 2,000,000 Private Warrants to C. Dean Metropoulos (“Mr. Metropoulos”).

Following the sale of any Private Warrants by Gores or its permitted transferees or any other transfer thereof other than to a permitted transferee, such Private Warrants will become Transferred Warrants that will be redeemable by us and exercisable by the holders on the same basis as the Public Warrants. Accordingly, such Transferred Warrants will have the same terms and conditions as the Public Warrants described above.

Dividends

We have not paid any cash dividends on our common stock to date. The payment of cash dividends in the future will be dependent upon our revenues and earnings, if any, capital requirements and general financial condition. The payment of any cash dividends is within the discretion of our Board. In addition, our Board is not currently contemplating and does not anticipate declaring any stock dividends in the foreseeable future. Further, if we incur any indebtedness, our ability to declare dividends may be limited by restrictive covenants we may agree to in connection therewith.

Transfer Agent and Warrant Agent

The transfer agent for our common stock and warrant agent for our warrants is Continental Stock Transfer & Trust Company. We have agreed to indemnify Continental Stock Transfer & Trust Company in its roles as transfer agent and warrant agent, its agents and each of its stockholders, directors, officers and employees against all liabilities, including judgments, costs and reasonable counsel fees that may arise out of acts performed or omitted for its activities in that capacity, except for any liability due to any gross negligence, willful misconduct or bad faith of the indemnified person or entity.

Certain Anti-Takeover Provisions of Delaware Law, the Company’s Certificate of Incorporation and Bylaws

We have “opted out” of Section 203 of the Delaware General Corporation Law, which we refer to as “

Section 203

,” regulating corporate takeovers, such election becoming effective on November 3, 2017. Instead, our certificate of incorporation contains a provision that is substantially similar to Section 203, but excludes Gores, Apollo Global Management, LLC, a Delaware limited liability company (“Apollo”), and the CDM Holders, each of their successors, certain affiliates and each of their respective transferees from the definition of “interested stockholder”.

Section 203 prevents certain Delaware corporations, under certain circumstances, from engaging in a “business combination” with:

|

|

|

|

|

|

|

|

|

•

|

|

a stockholder who owns fifteen percent (15%) or more of our outstanding voting stock (otherwise known as an “interested stockholder”);

|

|

|

•

|

|

an affiliate of an interested stockholder; or

|

|

|

•

|

|

an associate of an interested stockholder, for three years following the date that the stockholder became an interested stockholder.

|

A “business combination” includes a merger or sale of more than ten percent (10%) of our assets. However, the above provisions of Section 203 do not apply if:

|

|

|

|

|

|

|

|

|

•

|

|

our Board approves the transaction that made the stockholder an “interested stockholder,” prior to the date of the transaction;

|

|

|

•

|

|

after the completion of the transaction that resulted in the stockholder becoming an interested stockholder, that stockholder owned at least eighty-five percent (85%) of our voting stock outstanding at the time the transaction commenced, other than statutorily excluded shares of common stock; or

|

|

|

•

|

|

on or subsequent to the date of the transaction, the business combination is approved by our Board and authorized at a meeting of our stockholders, and not by written consent, by an affirmative vote of at least two-thirds of the outstanding voting stock not owned by the interested stockholder.

|

Our certificate of incorporation provides that our Board is classified into three classes of directors. As a result, in most circumstances, a person can gain control of our Board only by successfully engaging in a proxy contest at three or more annual meetings.

Our certificate of incorporation requires the approval by affirmative vote of the holders of at least two-thirds of our common stock to make any amendment to key provisions of our certificate of incorporation or bylaws.

In addition, our certificate of incorporation does not provide for cumulative voting in the election of directors. Our Board is empowered to elect a director to fill a vacancy created by the expansion of the Board or the resignation, death, or removal of a director in certain circumstances; and our advance notice provisions require that stockholders must comply with certain procedures in order to nominate candidates to our Board or to propose matters to be acted upon at a stockholders’ meeting.

Our authorized but unissued common stock and preferred stock are available for future issuances without stockholder approval and could be utilized for a variety of corporate purposes, including future offerings to raise additional capital, acquisitions and employee benefit plans. The existence of authorized but unissued and unreserved common stock and preferred stock could render more difficult or discourage an attempt to obtain control of us by means of a proxy contest, tender offer, merger or otherwise.

Rule 144

Pursuant to Rule 144 of the Securities Act, which we refer to as “Rule 144”, a person who has beneficially owned restricted shares of our common stock or warrants for at least six months would be entitled to sell their securities,

provided

that (i) such person is not deemed to have been one of our affiliates at the time of, or at any time during the three months preceding, a sale and (ii) we are subject to the Exchange Act periodic reporting requirements for at least three months before the sale and have filed all required reports under Section 13 or 15(d) of the Exchange Act during the 12 months (or such shorter period as we were required to file reports) preceding the sale.

Persons who have beneficially owned restricted shares of our common stock or warrants for at least six months but who are our affiliates at the time of, or at any time during the three months preceding, a sale, would be subject to additional restrictions, by which such person would be entitled to sell within any three-month period only a number of securities that does not exceed the greater of:

|

|

|

|

|

|

|

|

|

•

|

|

one percent (1%) of the total number of shares of common stock then outstanding; or

|

|

|

•

|

|

the average weekly reported trading volume of the common stock during the four calendar weeks preceding the filing of a notice on Form 144 with respect to the sale.

|

Sales by our affiliates under Rule 144 are also limited by manner of sale provisions and notice requirements and to the availability of current public information about us.

Restrictions on the Use of Rule 144 by Shell Companies or Former Shell Companies

Rule 144 is not available for the resale of securities initially issued by shell companies (other than business combination related shell companies) or issuers that have been at any time previously a shell company. However, Rule 144 also includes an important exception to this prohibition if the following conditions are met:

|

|

|

|

|

|

|

|

|

•

|

|

the issuer of the securities that was formerly a shell company has ceased to be a shell company;

|

|

|

•

|

|

the issuer of the securities is subject to the reporting requirements of Section 13 or 15(d) of the Exchange Act;

|

|

|

•

|

|

the issuer of the securities has filed all Exchange Act reports and material required to be filed, as applicable, during the preceding 12 months (or such shorter period that the issuer was required to file such reports and materials), other than Form 8-K reports; and

|

|

|

•

|

|

at least one year has elapsed from the time that the issuer filed current Form 10 type information with the SEC reflecting its status as an entity that is not a shell company.

|

While we were formed as a shell company, since the consummation of the Business Combination, we are no longer a shell company, and so, once the conditions set forth in the exceptions listed above are satisfied, Rule 144 will become available for the resale of the above noted restricted securities.

Registration Rights

The Company is party to a certain Registration Rights Agreement with the Selling Warrantholders and certain other security holders. The security holders party to the Registration Rights Agreement and their permitted transferees are entitled to certain demand and “piggyback” registration rights described in the Registration Rights Agreement. We will bear the expenses incurred in connection with the filing of any such registration statements, other than certain underwriting discounts, selling commissions and certain other expenses. The registration statement of which this prospectus is part has been filed pursuant to the Registration Rights Agreement.

Listing of Securities

Our Class A Common Stock and Public Warrants are each listed on NASDAQ under the symbols “TWNK” and “TWNKW,” respectively. Upon registration and resale of the Private Warrants, the Transferred Warrants and Public Warrants will both be listed on NASDAQ under the symbol “TWNKW.”

SELLING WARRANTHOLDERS

This prospectus relates to the possible resale by the Selling Warrantholders of up to 19,000,000 Private Warrants to purchase shares of our Class A Common Stock. Gores acquired its Private Warrants exercisable for shares of Class A Common Stock concurrently with our IPO. Mr. Metropoulos acquired his Private Warrants from Gores in connection with the Business Combination. The Selling Warrantholders may from time to time offer and sell any or all of the Private Warrants set forth below pursuant to this prospectus. When we refer to the “Selling Warrantholders” in this prospectus, we mean the persons listed in the table below, and the pledgees, donees, transferees, assignees, successors, distributees and others who later come to hold any of the Selling Warrantholders' interest in the Private Warrants other than through a public sale, including through a distribution by such Selling Warrantholders to its members.

The following table sets forth, as of the date of this prospectus, (i) the Selling Warrantholders, (ii) the number of Private Warrants that each of the Selling Warrantholders beneficially owned as of May 31, 2017, (iii) the number of Private Warrants proposed to be sold in this offering by each of the Selling Warrantholders, and (iv) the number of Private Warrants that will be beneficially owned by each of the Selling Warrantholders following this offering.

Beneficial ownership is determined according to the rules of the SEC and generally means that a person has beneficial ownership of a security if he, she, or it possesses sole or shared voting or investment power of that security, including securities underlying warrants and options that are currently exercisable or exercisable within 60 days of May 31, 2017. Under these rules, more than one person may be deemed a beneficial owner of the same securities and a person may be deemed a beneficial owner of securities as to which he or she has no economic interest.

Except as indicated by footnote to the table below, the persons named in the table below have sole voting and investment power with respect to all Private Warrants as beneficially owned by them.

Our calculation of the percentage of beneficial ownership is based on 19,000,000 Private Warrants outstanding as of May 31, 2017.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling Warrantholder

|

Number of

Warrants

Beneficially

Owned Before

the Offering

|

Percentage Beneficially

Owned Before the

Offering

|

Number of

Warrants to be

Sold in the

Offering

|

Percentage

Beneficially

Owned to be Sold

in the Offering

|

Number of Warrants

Beneficially Owned

After the Offering

|

Percentage Beneficially

Owned After the Offering

|

|

Gores Sponsor LLC (1)

|

17,000,000

|

89.5%

|

17,000,000

|

100%

|

–

|

–

|

|

C. Dean Metropoulos (2)

|

2,000,000

|

10.5%

|

2,000,000

|

100%

|

–

|

–

|

|

|

|

|

(1)

|

The business address of Gores Sponsor LLC is 9800 Wilshire Blvd., Beverly Hills, California 90212. Gores Sponsor LLC is controlled indirectly by Alec Gores and Tom Gores and, accordingly, each of Alec and Tom Gores may be deemed to have beneficial ownership of the Private Warrants owned thereby. Each of Alec and Tom Gores disclaims beneficial ownership of these securities except to the extent of any pecuniary interest therein.

|

|

|

|

|

(2)

|

The business address of C. Dean Metropoulos is 200 Greenwich Avenue, Greenwich, CT 06830.

|

PLAN OF DISTRIBUTION

We are registering up to 19,000,000 Private Warrants to purchase shares of Class A Common Stock for possible sale by the Selling Warrantholders thereof. Following the sale of any Private Warrants as described herein, such Private Warrants will become Transferred Warrants that will be redeemable by us and exercisable by the holders thereof. We are registering the 9,500,000 shares of Class A Common Stock issuable upon exercise of such Transferred Warrants.

The Private Warrants to purchase shares of Class A Common Stock beneficially owned by the Selling Warrantholders covered by this prospectus may be offered and sold from time to time by the Selling Warrantholders. The term “Selling Warrantholders” includes donees, pledgees, transferees or other successors in interest selling Private Warrants received after the date of this prospectus from a Selling Warrantholder as a gift, pledge, partnership distribution or other non-sale related transfer. The Selling Warrantholders will act independently of us in making decisions with respect to the timing, manner and size of each sale. Such sales may be made on one or more exchanges or in the over-the-counter market or otherwise, at prices and under terms then prevailing, at fixed prices, at prices related to the then current market price, prices determined at the time of sale or in negotiated transactions. The Selling Warrantholders may offer and sell their Private Warrants by one or more of, or a combination of, the following methods:

|

|

|

|

|

|

|

|

|

•

|

|

purchases by a broker-dealer as principal and resale by such broker-dealer for its own account pursuant to this prospectus;

|

|

|

•

|

|

ordinary brokerage transactions and transactions in which the broker solicits purchasers;

|

|

|

•

|

|

block trades in which the broker-dealer so engaged will attempt to sell the warrants as agent but may position and resell a portion of the block as principal to facilitate the transaction;

|

|

|

•

|

|

an over-the-counter distribution in accordance with the rules of the Nasdaq Capital Market;

|

|

|

•

|

|

through trading plans entered into by a Selling Warrantholder pursuant to Rule 10b5-1 under the Exchange Act that are in place at the time of an offering pursuant to this prospectus and any applicable prospectus supplement hereto that provide for periodic sales of its securities on the basis of parameters described in such trading plans;

|

|

|

•

|

|

short sales;

|

|

|

•

|

|

in a rights offering;

|

|

|

•

|

|

an exchange distribution in accordance with the rules of the applicable exchange;

|

|

|

•

|

|

distribution to employees, members, limited partners or stockholders of the Selling Warrantholders;

|

|

|

•

|

|

through the writing or settlement of options or other hedging transaction, whether through an options exchange or otherwise;

|

|

|

•

|

|

by pledge to secured debts and other obligations;

|

|

|

•

|

|

delayed delivery arrangements;

|

|

|

•

|

|

to or through underwriters or agents;

|

|

|

•

|

|

in “at the market” offerings, as defined in Rule 415 under the Securities Act, at negotiated prices, at prices prevailing at the time of sale or at prices related to such prevailing market prices, including sales made directly on a national securities exchange or sales made through a market maker other than on an exchange or other similar offerings through sales agents;

|

|

|

•

|

|

in privately negotiated transactions;

|

|

|

•

|

|

in options transactions; and

|

|

|

•

|

|

through a combination of any of the above methods of sale, as described below or any other method permitted pursuant to applicable law.

|

In addition, any Private Warrants that qualify for sale pursuant to Rule 144 may be sold under Rule 144 rather than pursuant to this prospectus.

To the extent required, this prospectus may be amended or supplemented from time to time to describe a specific plan of distribution. In connection with distributions of the Private Warrants or otherwise, the Selling Warrantholders may enter into hedging transactions with broker-dealers or other financial institutions. In connection with such transactions, broker-dealers or other financial institutions may engage in short sales of the Private Warrants in the course of hedging the positions they assume with the Selling Warrantholders. The Selling Warrantholders may also sell the Private Warrants short and redeliver the Private Warrants to close out such short positions. The Selling Warrantholders may also enter into option or other transactions with broker-dealers or other financial institutions which require the delivery to such broker-dealer or other financial institution of Private Warrants offered by this prospectus, which Private Warrants such broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction). The Selling Warrantholders may also pledge Private Warrants to a broker-dealer or other financial institution, and, upon a default, such broker-dealer or other financial institution, may effect sales of the pledged Private Warrants pursuant to this prospectus (as supplemented or amended to reflect such transaction).

A Selling Warrantholder may enter into derivative transactions with third parties, or sell securities not covered by this prospectus to third parties in privately negotiated transactions. If the applicable prospectus supplement indicates, in connection with those derivatives, the third parties may sell securities covered by this prospectus and the applicable prospectus supplement, including in short sale transactions. If so, the third party may use securities pledged by any Selling Warrantholder or borrowed from any Selling Warrantholder or others to settle those sales or to close out any related open borrowings of stock, and may use securities received from any Selling Warrantholder in settlement of those derivatives to close out any related open borrowings of stock. The third party in such sale transactions will be an underwriter and will be identified in the applicable prospectus supplement (or a post-effective amendment). In addition, any Selling Warrantholder may otherwise loan or pledge securities to a financial institution or other third party that in turn may sell the securities short using this prospectus. Such financial institution or other third party may transfer its economic short position to investors in our securities or in connection with a concurrent offering of other securities.

The Selling Warrantholders may, from time to time, pledge or grant a security interest in some or all of the Private Warrants owned by them and, if they default in the performance of their secured obligations, the pledgees or secured parties may offer and sell their Private Warrants, from time to time, under this prospectus, or under an amendment to this prospectus under Rule 424(b)(3) or other applicable provision of the Securities Act amending the list of Selling Warrantholders to include the pledgee, transferee or other successors in interest as Selling Warrantholders under this prospectus. The Selling Warrantholders may also transfer or distribute their Private Warrants in other circumstances, including to their members, in which case the transferees, pledgees or other successors in interest will be the selling beneficial owners for purposes of this prospectus.

The Selling Warrantholders may sell the Private Warrants directly. In this case, no underwriters or agents would be involved.

The Selling Warrantholders may sell the Private Warrants to institutional investors or others who may be deemed to be underwriters within the meaning of the Securities Act with respect to any sale of such Private Warrants. The terms of any sales of these Private Warrants will be described in the applicable prospectus supplement.

The Private Warrants may also be offered and sold, if so indicated in the applicable prospectus supplement, in connection with a remarketing upon their purchase, in accordance with a redemption or repayment pursuant to their terms, or otherwise, by one or more marketing firms, acting as principals for their own accounts or as agents for the Selling Warrantholders. Any remarketing firm will be identified and the terms of its agreements, if any, with the Selling Warrantholders and its compensation will be described in the applicable prospectus supplement.

If indicated in the prospectus supplement, the Selling Warrantholders may authorize agents, underwriters or dealers to solicit offers from certain types of institutions to purchase Private Warrants from them at the public offering price under delayed delivery contracts. These contracts would provide for payment and delivery on a specified date in the future. The contracts would be subject only to those conditions described in the applicable prospectus supplement. The applicable prospectus supplement will describe the commission payable for solicitation of those contracts.

In effecting sales, broker-dealers or agents engaged by the Selling Warrantholders may arrange for other broker-dealers to participate. Broker-dealers or agents may receive commissions, discounts or concessions from the Selling Warrantholders in amounts to be negotiated immediately prior to the sale.

In offering the Private Warrants covered by this prospectus, the Selling Warrantholders and any broker-dealers who execute sales for the Selling Warrantholders may be deemed to be “underwriters” within the meaning of the Securities Act in connection with such sales. Any profits realized by the Selling Warrantholders and the compensation of any broker-dealer may be deemed to be underwriting discounts and commissions.

In order to comply with the securities laws of certain states, if applicable, the Private Warrants and shares of Class A Common Stock must be sold in such jurisdictions only through registered or licensed brokers or dealers. In addition, in certain states the Private Warrants and shares of Class A Common Stock may not be sold unless they have been registered or qualified for sale in the applicable state or an exemption from the registration or qualification requirement is available and is complied with.

We have advised the Selling Warrantholders that the anti-manipulation rules of Regulation M under the Exchange Act may apply to sales of Private Warrants in the market and to the activities of the Selling Warrantholders and its affiliates. In addition, we will make copies of this prospectus available to the Selling Warrantholders for the purpose of satisfying the prospectus delivery requirements of the Securities Act. The Selling Warrantholders may indemnify any broker-dealer that participates in transactions involving the sale of the Private Warrants against certain liabilities, including liabilities arising under the Securities Act.

At the time a particular offer of Private Warrants is made, if required, a prospectus supplement will be distributed that will set forth the number of Private Warrants being offered and the terms of the offering, including the name of any underwriter, dealer or agent, the purchase price paid by any underwriter, any discount, commission and other item constituting compensation, any discount, commission or concession allowed or reallowed or paid to any dealer, and the proposed selling price to the public.

We have agreed to indemnify the Selling Warrantholders against certain liabilities, including certain liabilities under the Securities Act of 1933, as amended, the Exchange Act of 1934, as amended, or other federal or state law.

We have agreed with the Selling Warrantholders to use all reasonable efforts to keep the registration statement of which this prospectus constitutes a part effective until the earlier of (i) such time as all of the Private Warrants covered by this prospectus have been disposed of pursuant to and in accordance with the registration statement, or (ii) two years after the effective date of the registration statement.

Exercise of Transferred Warrants

The Transferred Warrants may be exercised upon the surrender of the certificate evidencing such warrant on or before the expiration date at the offices of the warrant agent, Continental Stock Transfer & Trust Company, in the Borough of Manhattan, City and State of New York, with the subscription form, as set forth in the Transferred Warrants, duly executed, accompanied by full payment of the exercise price, by certified or official bank check payable to us, for the number of Transferred Warrants being exercised. The Transferred Warrants will be required to be exercised on a cashless basis in the event of a redemption of the Transferred Warrants pursuant to the warrant agreement governing the Transferred Warrants in which our board of directors has elected to require all holders of the Transferred Warrants who exercise their Transferred Warrants to do so on a cashless basis. In such event, such holder may exercise his, her or its warrants on a cashless basis by paying the exercise price by surrendering his, her or its warrants for that number of shares of Class A Common Stock equal to the quotient obtained by dividing (x) the product of the number of shares of Class A Common Stock underlying the warrants, multiplied by the difference between the exercise price of the warrants and the “fair market value” (defined below) by (y) the fair market value. The “fair market value” shall mean the average reported last sale price of the Class A Common Stock for the ten trading days ending on the third trading day prior to the date on which the notice of warrant exercise is sent to the warrant agent.

No fractional shares will be issued upon the exercise of the Transferred Warrants. If, upon the exercise of the Transferred Warrants, a holder would be entitled to receive a fractional interest in a share, we will, upon the exercise, round up to the nearest whole number the number of shares of common stock to be issued to such holder.

The prices at which the shares of Class A Common Stock underlying the Transferred Warrants covered by this prospectus may actually be disposed of may be at fixed prices, at prevailing market prices at the time of sale, at prices related to the prevailing market price, at varying prices determined at the time of sale or at negotiated prices.

LEGAL MATTERS