Additional Proxy Soliciting Materials - Non-management (definitive) (dfan14a)

July 03 2017 - 6:13AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the

Registrant ☐ Filed by a Party other than the

Registrant ☑

Check the appropriate box:

|

|

|

|

|

☐

|

|

Preliminary Proxy Statement

|

|

|

|

|

☐

|

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

|

|

☐

|

|

Definitive Proxy Statement

|

|

|

|

|

☑

|

|

Definitive Additional Materials

|

|

|

|

|

☐

|

|

Soliciting Material Pursuant to § 240.14a-12

|

CERULEAN

PHARMA INC.

(Name of Registrant as Specified In Its Charter)

DARÉ BIOSCIENCE, INC.

(Name of Person(s) Filing Proxy Statement if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box)

|

|

|

|

|

|

|

|

|

|

☑

|

|

No fee required.

|

|

|

|

|

☐

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

|

|

|

(1)

|

|

Title of each class of securities to which transaction applies:

|

|

|

|

(2)

|

|

Aggregate number of securities to which transaction applies:

|

|

|

|

(3)

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing

fee is calculated and state how it was determined):

|

|

|

|

(4)

|

|

Proposed maximum aggregate value of transaction:

|

|

|

|

(5)

|

|

Total fee paid:

|

|

|

|

|

☐

|

|

Fee paid previously with preliminary materials.

|

|

|

|

|

☐

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement

number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

|

|

(1)

|

|

Amount Previously Paid:

|

|

|

|

(2)

|

|

Form, Schedule or Registration Statement No.:

|

|

|

|

(3)

|

|

Filing Party:

|

|

|

|

(4)

|

|

Date Filed:

|

July 3, 2017

Dear

Cerulean Stockholder,

As the founder and CEO of Daré Bioscience, Inc. (“Daré”), I am excited by the prospect of Daré

combining with Cerulean Pharma Inc. (“Cerulean”). Daré is a healthcare company committed to the development and commercialization of innovative products in women’s health. We believe a segment of this market is underserved,

which gives us an opportunity to create value for stockholders.

The problem isn’t a lack of early innovation.

The global donor

community of foundations and governments has invested in early research to expand options, improve outcomes and advance global women’s health. Yet, promising candidates often fail to advance.

The problem isn’t commercialization

.

Pharmaceutical companies with established sales and marketing franchises in women’s health

exist; however, many of these companies prefer to get involved in later stages of development, e.g., in pivotal trials or following an application for regulatory approval.

The problem is the gap in mid-stage development

.

We believe there is a gap between early innovation and commercialization in women’s

health that creates an opportunity for Daré.

Our business model is to fill the gap.

We intend to license the rights to novel product

candidates (some of which have existing clinical data), advance their clinical development and, if successful, create a comprehensive global commercialization strategy in combination with established pharmaceutical partners.

Our product candidate, Ovaprene

®

, illustrates our business model.

We intend to continue

the clinical development of Ovaprene, which has completed a pilot postcoital test clinical trial with results published in the Journal of Reproductive Medicine in 2009. If the Cerulean stockholders approve the transactions proposed in the definitive

proxy statement, Daré intends to commence a PCT clinical trial of Ovaprene

®

with CONRAD, a non-profit organization that oversaw the successful development and FDA approval of the

Caya

®

diaphragm, the most recently approved barrier contraceptive device in combination with a locally-acting spermiostatic agent.

In connection with the proposed combination of Daré and Cerulean, Cerulean has filed with the SEC a definitive proxy statement that describes the

combination in detail. Stockholders may obtain a copy of the definitive proxy statement without charge at the SEC’s website (

http://www.sec.gov

) or from Cerulean’s proxy solicitor. Before making any voting decision, I urge you to

read the definitive proxy statement filed with the SEC June 19, 2017 and any other documents that may be filed with the SEC regarding the special meeting and the proposed transactions in their entirety because they contain or will contain

important information about the proposed transaction, the combined business and Ovaprene. In addition, you are strongly encouraged to read the description of the transaction with Novartis starting on page 102 of the definitive proxy statement, as

the cash from the sale of those assets will be an important source of funding for the operations of the combined company.

If Cerulean

stockholders approve the transactions in the proxy, the management of Daré looks forward to having the opportunity to work on your behalf.

If you

have any questions regarding the proposed transactions, or to obtain a copy of the definitive proxy statement free of charge, please contact Cerulean’s proxy solicitor, Morrow Sodali, at 1-800-662-5200.

Sincerely,

Sabrina Martucci Johnson

Founder and CEO

Daré Bioscience, Inc.

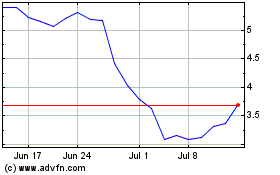

Dare Bioscience (NASDAQ:DARE)

Historical Stock Chart

From Mar 2024 to Apr 2024

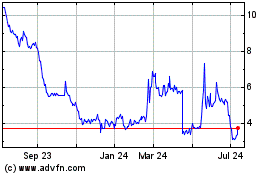

Dare Bioscience (NASDAQ:DARE)

Historical Stock Chart

From Apr 2023 to Apr 2024