Report of Foreign Issuer (6-k)

June 30 2017 - 6:31AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form

6-K

REPORT OF

FOREIGN PRIVATE ISSUER

PURSUANT TO RULE

13a-16

OR

15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of

June 2017

Commission File Number:

000-53445

KB Financial Group Inc.

(Translation of registrant’s name into English)

84,

Namdaemoon-ro,

Jung-gu,

Seoul 04534, Korea

(Address of

principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of

Form 20-F

or

Form 40-F.

Form 20-F ☒

Form 40-F ☐

Indicate by check mark if the registrant is submitting the

Form 6-K

in paper as permitted by

Regulation S-T

Rule 101(b)(1): ☐

Note

: Regulation

S-T

Rule 101(b)(1) only permits the submission in paper of a Form

6-K

if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the

registrant is submitting the

Form 6-K

in paper as permitted by

Regulation S-T

Rule 101(b)(7): ☐

Note

: Regulation

S-T

Rule 101(b)(7) only permits the submission in paper of a Form

6-K

if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or

legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required

to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form

6-K

submission or other Commission filing on EDGAR.

Decision on Disposal of Treasury Shares

On June 30, 2017, the board of directors of KB Financial Group Inc. (“KB Financial Group”) resolved to dispose of a portion of

its treasury shares by exchanging such shares for shares of KB Insurance Co., Ltd. (“KB Insurance”) and KB Capital Co., Ltd. (“KB Capital”) pursuant to their respective stock swap agreements entered into on April 14, 2017

(the “Stock Swap Agreements”).

|

|

|

|

|

|

|

|

|

1. Number of treasury shares expected to be disposed

|

|

Common shares

|

|

4,440,000

|

|

|

Preferred shares

|

|

—

|

|

2. Reference price of the treasury shares to be disposed (KRW)

|

|

Common shares

|

|

48,676

|

|

|

Preferred shares

|

|

—

|

|

3. Expected disposal amount (KRW)

|

|

Common shares

|

|

216,121,440,000

|

|

|

Preferred shares

|

|

—

|

|

4. Expected disposal period

|

|

From

|

|

July 7, 2017

|

|

|

To

|

|

July 7, 2017

|

|

5. Purpose of disposal

|

|

KB Financial Group plans to acquire a 100% equity interest in each of KB Insurance and KB Capital through comprehensive stock swaps (the “Stock Swaps”). As the Stock Swaps were approved at the shareholders’ meetings

of KB Insurance and KB Capital on June 22, 2017, thereby meeting the

pre-conditions

set forth in paragraph (1) of Article 9 of the Stock Swap Agreements, KB Financial Group plans to transfer its

treasury shares to the shareholders of KB Insurance and KB Capital as consideration for the Stock Swaps.

|

|

6. Method of disposal

|

|

Over-the-counter

|

|

7. Number of treasury shares held before disposal

|

|

Acquisitions from Profits Available for Dividend

|

|

Common Shares (percentage)

|

|

21,517,802 shares (5.1%)

|

|

|

|

Other Shares

|

|

—

|

|

|

Other Acquisitions

|

|

Common Shares (percentage)

|

|

28,511 shares (0.0%)*

* Fractional shares resulting from the allocation of new shares in a stock swap on

October 19, 2016

|

|

|

|

Other Shares

|

|

—

|

|

8. Date of resolution by the board of directors

|

|

June 30, 2017

|

|

|

|

Non-executive

directors

|

|

Present: 7

|

|

|

|

|

Absent: 0

|

|

|

|

Attendance of audit committee member who is not a

non-executive

director

|

|

—

|

9. Other matters to consider before making an investment decision

|

|

•

|

|

This decision on disposal of treasury shares is related to KB Financial Group’s Stock Swaps with KB Insurance and KB Capital. As the Stock Swaps were approved at the shareholders’ meetings of KB Insurance and

KB Capital, the

pre-conditions

set forth in the Stock Swap Agreements have been met. Accordingly, KB Financial Group resolved to dispose of the treasury shares that will be transferred to the shareholders of

KB Insurance and KB Capital in the Stock Swaps.

|

|

|

•

|

|

The above “2. Reference price of the treasury shares to be disposed” is swap value per share pursuant to the Stock Swap Agreements with KB Insurance and KB Capital.

|

|

|

•

|

|

The above “3. Expected disposal amount” is calculated by multiplying the swap value per share by the number of treasury shares to be disposed.

|

|

|

•

|

|

The above “4. Expected disposal period” is the date of the Stock Swaps. As KB Financial Group plans to distribute its treasury shares (2,170,943 shares and 2,269,057 shares, respectively) to the shareholders

of KB Insurance and KB Capital on such date, the above “6. Method of disposal” is indicated as

“over-the-counter”.

|

|

|

•

|

|

As cash will be paid for the fractional shares resulting from the Stock Swaps instead of treasury shares, the actual number of treasury shares disposed may be different from the above “1. Number of treasury shares

expected to be disposed”.

|

|

|

•

|

|

For further details regarding the Stock Swaps, please see the Prospectus filed with the Securities and Exchange Commission under cover of Form CB on June 12, 2017.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

KB Financial Group Inc.

|

|

|

|

|

|

(Registrant)

|

|

|

|

|

|

|

Date: June 30, 2017

|

|

|

|

By:

|

|

/s/ Jae Keun Lee

|

|

|

|

|

|

(Signature)

|

|

|

|

|

|

|

|

|

|

|

Name:

|

|

Jae Keun Lee

|

|

|

|

|

|

|

|

|

|

|

Title:

|

|

Managing Director and Chief Financial Officer

|

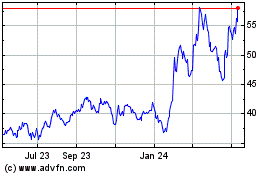

KB Financial (NYSE:KB)

Historical Stock Chart

From Mar 2024 to Apr 2024

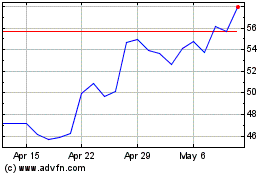

KB Financial (NYSE:KB)

Historical Stock Chart

From Apr 2023 to Apr 2024